How to Evaluate Crypto Exchanges - What to Look For

In the ever-evolving world of cryptocurrency, choosing the right exchange can feel like navigating a maze. With countless platforms available, each boasting unique features, how do you determine which one is the right fit for you? This article provides essential tips and criteria for assessing cryptocurrency exchanges, ensuring you choose a platform that prioritizes security, usability, and compliance with regulations. Whether you're a seasoned trader or a newcomer, understanding what to look for can save you time, money, and stress.

When it comes to crypto exchanges, security should be your number one priority. Imagine your digital assets as precious jewels; you wouldn’t leave them lying around unguarded, right? Most exchanges implement a variety of security measures to protect users' assets and personal information. Key features to look for include:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring not just your password but also a second form of identification.

- Cold Storage: Many exchanges store the majority of their funds offline, which minimizes the risk of hacking.

- Regular Security Audits: Look for exchanges that undergo frequent security assessments to identify and rectify vulnerabilities.

By ensuring that the exchange you choose employs these security features, you can trade with greater peace of mind.

A user-friendly interface can significantly enhance your trading experience. Picture yourself trying to navigate a complex website; it can be frustrating and time-consuming. A well-designed platform should be intuitive, allowing you to execute trades quickly and efficiently. Look for:

- Clear Navigation: Menus and options should be easily accessible and logically organized.

- Responsive Design: The platform should perform well on both mobile and desktop devices.

- Customizable Dashboard: A good exchange allows you to tailor your trading view according to your preferences.

Many exchanges offer both mobile and desktop platforms. Each has its perks and drawbacks, depending on your trading style. For instance, mobile apps provide the convenience of trading on-the-go, while desktop platforms often feature more advanced tools. It’s essential to evaluate which environment suits you best.

The functionality of mobile apps can vary widely. A well-designed app should offer essential features such as real-time price tracking, easy order placement, and secure wallet integration. Always check reviews and ratings to see how other users feel about the app's performance.

Web-based platforms often provide advanced features that enhance trading on desktop. Look for tools like charting software, market analysis, and customizable alerts that can give you a competitive edge. A robust web platform can make a significant difference in your trading outcomes.

Reliable customer support is crucial for resolving issues quickly. Imagine trying to solve a problem without any assistance; it can be maddening! Look for exchanges that offer multiple support channels, such as:

- Email Support

- Live Chat

- Phone Support

Additionally, check the response times. A good exchange should respond promptly to inquiries, ensuring that you’re never left in the dark.

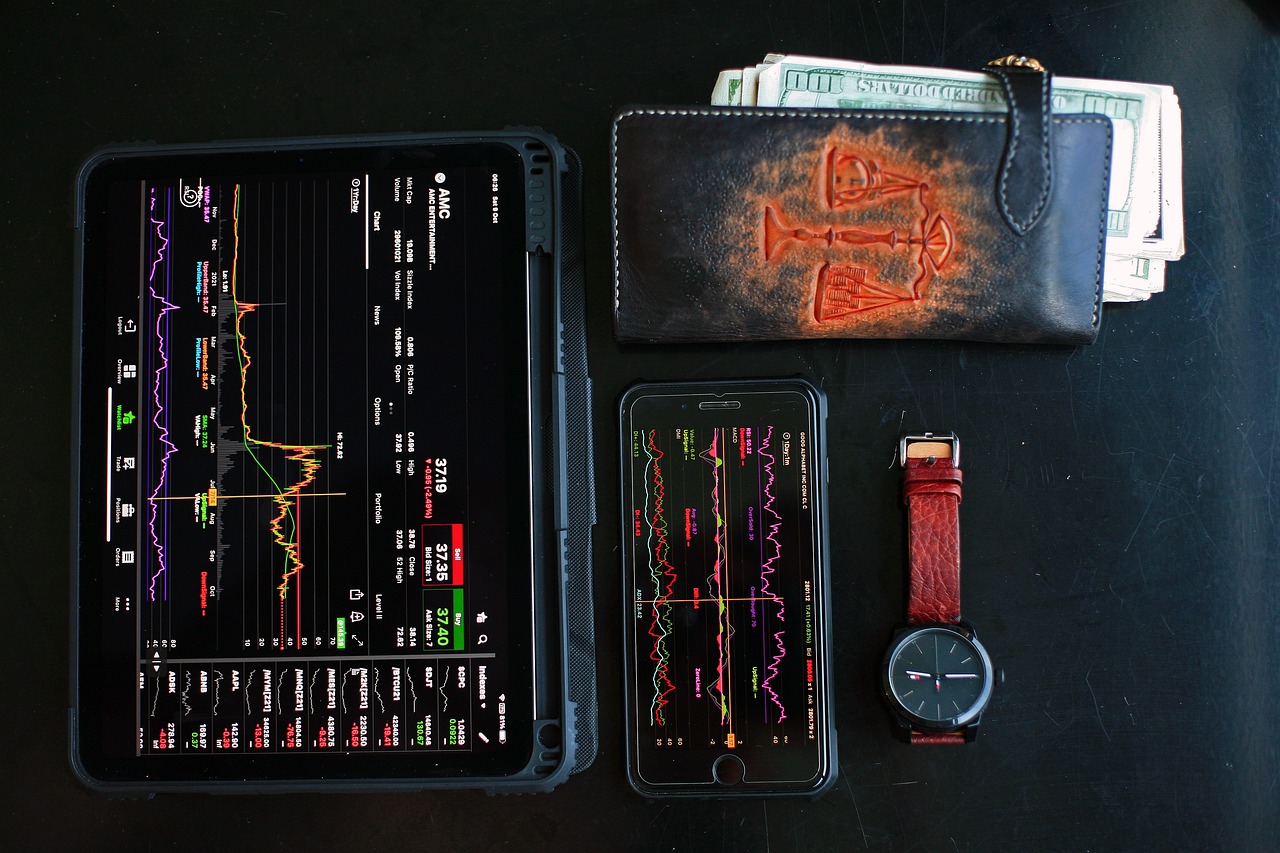

Understanding the fee structure of an exchange is vital for cost-effective trading. Just like shopping, you want to know what you’re paying upfront. Common fees to consider include trading fees, withdrawal fees, and deposit fees. Make sure to read the fine print, as these can significantly impact your profits.

Different exchanges have different fee structures. Some may charge a flat fee, while others might take a percentage of your trades. Here’s a quick comparison of common fee types:

| Exchange Type | Trading Fee | Withdrawal Fee |

|---|---|---|

| Centralized Exchange | 0.1% - 0.5% | $0.01 - $5.00 |

| Decentralized Exchange | Varies | Varies |

Some exchanges may have hidden costs that can catch you off guard. These could include inactivity fees, deposit fees for certain payment methods, or even inflated exchange rates. Always do your homework and read user reviews to uncover any potential pitfalls.

Regulatory compliance is essential for trust and safety. Think of it as a security blanket for your investments. This section discusses the importance of choosing exchanges that adhere to local laws and possess valid licenses. Always check if the exchange is registered with relevant authorities in your jurisdiction, as this can protect you from fraud and ensure a higher level of operational integrity.

1. What is the most important factor when choosing a crypto exchange?

Security features are paramount. Ensure the platform has robust security measures in place.

2. Are all exchanges regulated?

No, not all exchanges are regulated. Always check for licensing and compliance with local laws.

3. How can I minimize trading fees?

Look for exchanges with lower fees, and consider using limit orders to reduce costs.

4. Is it safe to use mobile trading apps?

Yes, as long as the app has strong security features like 2FA and encryption.

Understanding Security Features

When it comes to cryptocurrency exchanges, security is not just a feature; it's the backbone of the entire platform. Imagine walking into a bank without any security measures in place. It would be chaos, right? The same principle applies to crypto exchanges. Before you dive into trading, you need to ensure that the exchange you choose has robust security protocols to safeguard your assets and personal information.

Most reputable exchanges implement a variety of security measures. Here are some of the key features you should look for:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring not only your password but also a second form of identification, such as a text message or authentication app. Think of it as needing both a key and a fingerprint to access a vault.

- Cold Storage: Many exchanges store the majority of their digital assets in offline wallets, often referred to as cold storage. This practice minimizes the risk of hacks, as these wallets are not connected to the internet. It's like keeping your valuables in a safe instead of leaving them out in the open.

- Encryption: Look for exchanges that utilize strong encryption protocols to protect your data. This is akin to locking your sensitive documents in a secure cabinet.

- Regular Security Audits: A trustworthy exchange should undergo regular security audits by third-party firms. This transparency is crucial as it demonstrates their commitment to maintaining a secure environment.

In addition to these features, it’s important to consider the exchange's insurance policies. Some exchanges offer insurance coverage for user funds in case of a security breach. While this is not a foolproof solution, it can provide an extra layer of peace of mind. Always check the terms of such policies carefully.

Furthermore, take a moment to read through user reviews and feedback regarding the exchange's security history. Have they experienced breaches in the past? How did they handle those situations? This can give you insights into their reliability and responsiveness to security threats.

Ultimately, the goal is to select a platform that prioritizes security as much as you do. Your hard-earned money deserves to be protected, and understanding these security features is the first step in making an informed choice.

User Experience and Interface

When diving into the world of cryptocurrency trading, the user experience (UX) and interface of an exchange can make or break your trading journey. Imagine stepping into a bustling marketplace where every stall is filled with unique treasures, but if the paths are confusing and the signs are unclear, you might miss out on the best deals. Similarly, a well-designed interface can guide you through the complexities of trading, making it feel intuitive and engaging.

One of the first things to consider is the design aesthetic of the platform. A clean, modern look not only feels more professional but also helps users navigate more efficiently. Look for exchanges that incorporate visual hierarchies—where important information stands out. For instance, key metrics like your portfolio balance or current market prices should be easily visible. A cluttered interface can lead to frustration, making it essential to choose a platform that prioritizes simplicity and clarity.

Another critical aspect is navigation. Think about how easy it is to find what you need. Can you quickly access trading pairs, your account settings, or educational resources? A good exchange will have a well-organized menu that allows you to move from one section to another without feeling lost. Additionally, features like search bars can be incredibly helpful, especially when you’re looking for specific cryptocurrencies or trading pairs.

Accessibility is also a significant factor. Many traders prefer to use their mobile devices for trading on the go. Therefore, a responsive design that works seamlessly across both desktop and mobile platforms is essential. Some exchanges even offer dedicated apps, which can enhance the trading experience by providing notifications and quick access to market changes. But remember, not all mobile apps are created equal. Some may have limited functionalities compared to their desktop counterparts, which can hinder your trading efficiency.

When weighing your options between mobile and desktop platforms, consider your trading habits. If you’re someone who trades frequently and values having all the tools at your fingertips, a desktop platform might be more suitable. It often offers advanced charting tools and a broader range of features. However, if you prefer the flexibility of trading from anywhere, a mobile app could be the way to go. Just ensure that it doesn't compromise on essential functionalities.

Now, let’s talk about what makes a mobile trading app effective. Key features to look for include:

- Real-time updates: Market prices should refresh quickly to give you the latest information.

- Push notifications: Alerts for price changes or significant market movements can help you make timely decisions.

- Easy order placement: The ability to buy or sell with just a few taps is crucial for fast-paced trading.

These features can significantly enhance your trading experience, allowing you to react swiftly to market changes.

On the other hand, web-based platforms often come with their own set of powerful tools. Advanced charting capabilities, for instance, can provide deeper insights into market trends. You might find features like technical analysis tools, which can help you predict future price movements based on historical data. Additionally, many desktop platforms offer integration with other financial tools, allowing for a more comprehensive trading strategy.

Ultimately, whether you choose a mobile app or a desktop platform, the key is to find a balance that suits your trading style. Remember, the goal is to create a trading environment that feels comfortable and efficient, allowing you to focus on what really matters—making informed trading decisions.

Reliable customer support is crucial for resolving issues quickly. This section highlights the different support channels and response times you should expect from exchanges.

Mobile vs. Desktop Platforms

When diving into the world of cryptocurrency trading, one of the crucial decisions you'll face is whether to use a mobile or desktop platform. Each option has its unique advantages and disadvantages, and understanding these can significantly impact your trading experience. Imagine you're a bird in the sky; the mobile platform gives you the freedom to soar wherever you go, while the desktop platform offers a sturdy nest with all the tools you need at your fingertips.

Mobile platforms are designed for on-the-go trading. They allow you to manage your investments from anywhere—whether you're commuting, waiting in line, or just lounging at a café. With just a few taps on your smartphone, you can buy, sell, and monitor your portfolio. However, the compact nature of mobile apps can sometimes mean fewer features. Some traders find that they miss out on advanced trading tools that are typically available on desktop versions. It's like trying to paint a masterpiece on a small canvas; while you can still create something beautiful, the limitations can be frustrating.

On the flip side, desktop platforms provide a more robust trading environment. With larger screens and advanced functionalities, they are ideal for serious traders who rely on extensive data analysis and multiple charts. The user interface is often more comprehensive, allowing for easier navigation through various tools and features. You can have multiple tabs open, analyze market trends, and execute trades with a few clicks. However, the downside is that you're anchored to your desk, which can limit your trading flexibility. It's akin to being a lion in a zoo; you have all the space to roam within your enclosure, but you can't venture out into the wild.

To help you understand the differences better, here’s a quick comparison:

| Feature | Mobile Platform | Desktop Platform |

|---|---|---|

| Accessibility | Available anytime, anywhere | Limited to where your computer is |

| Screen Size | Smaller, may limit data visibility | Larger, better for detailed analysis |

| Functionality | Basic features, user-friendly | Advanced tools, complex features |

| Performance | Can be slower due to mobile limits | Faster, especially with high-speed internet |

Ultimately, the choice between mobile and desktop platforms boils down to your personal trading style and needs. If you value flexibility and the ability to trade on the fly, a mobile app is likely your best bet. On the other hand, if you prefer a comprehensive trading experience with all the bells and whistles, a desktop platform will serve you better. Many traders opt for a hybrid approach, utilizing both platforms to maximize their trading potential. This way, they can enjoy the best of both worlds—trading seamlessly on the go while having the option to dive deep into analytics when they’re at their desk.

- Can I use both mobile and desktop platforms for trading? Yes, many traders use both to take advantage of their unique benefits.

- Are mobile trading apps secure? Most reputable exchanges implement robust security measures, but it's essential to choose a trusted platform.

- What should I look for in a mobile trading app? Look for features like ease of use, security, and access to essential trading tools.

App Functionality

When diving into the world of cryptocurrency trading, the functionality of the mobile app you choose can make or break your experience. Think of it like having a trusty toolbox; if the tools are well-designed and easy to use, you can tackle any project that comes your way. Similarly, a robust mobile trading app should offer a range of features that cater to both novice and experienced traders alike.

One of the most critical aspects to consider is the user interface (UI). A clean and intuitive UI allows you to navigate through the app effortlessly. Imagine trying to find a specific tool in a cluttered toolbox; it can be frustrating and time-consuming. The same goes for a trading app. Look for apps that prioritize simplicity and efficiency in their design, making it easy to execute trades quickly without getting lost in a maze of menus.

Moreover, the real-time data feature is essential for any trading app. Cryptocurrency markets are notoriously volatile, and having access to live price updates can be the difference between a profitable trade and a missed opportunity. A good app should provide real-time charts, price alerts, and comprehensive market analysis tools. This way, you can react swiftly to market changes, just like a chef who knows when to flip a pancake at the perfect moment!

Another feature to consider is the security measures integrated into the app. As a trader, you want to feel secure about your assets. Look for apps that offer two-factor authentication (2FA), biometric logins, and end-to-end encryption for transactions. These features act like a heavy-duty lock on your toolbox, ensuring that your valuable tools (or in this case, your crypto assets) are safe from prying eyes.

Finally, consider the customer support options available through the app. In the fast-paced world of cryptocurrency trading, issues can arise at any moment. Whether it's a transaction that didn’t go through or questions about fees, having access to reliable customer support, ideally via live chat or a dedicated support line, can be a lifesaver. It’s like having a buddy who’s always there to help you out when you hit a snag.

In summary, when evaluating a mobile trading app, keep an eye out for:

- User Interface: Clean, intuitive design for easy navigation.

- Real-Time Data: Live updates and alerts to stay ahead of the market.

- Security Features: Robust security measures to protect your assets.

- Customer Support: Accessible support options for quick resolutions.

By paying attention to these aspects, you can ensure that your mobile trading experience is not only effective but also enjoyable. After all, trading should be more than just numbers; it should be about empowerment and making informed decisions in the ever-evolving crypto landscape.

1. What features should I look for in a crypto trading app?

You should prioritize a user-friendly interface, real-time data updates, strong security measures, and reliable customer support.

2. Are mobile trading apps secure?

Yes, but it's essential to choose apps that offer features like two-factor authentication and encryption to protect your assets.

3. Can I trade on both mobile and desktop platforms?

Absolutely! Many exchanges offer both options, allowing you to choose based on your trading style and convenience.

4. How do I know if a trading app is user-friendly?

Look for reviews and user feedback, and consider trying out the app yourself to see how intuitive the navigation feels.

Web-Based Features

When diving into the world of cryptocurrency trading, the web-based platform of an exchange can often be the heart of your trading experience. Unlike mobile apps, which are designed for convenience, web platforms typically offer a richer array of features that can cater to both novice and experienced traders. Imagine stepping into a vast library where every book is a tool to help you navigate the complex world of crypto. That’s what a robust web-based platform should feel like.

One of the standout features of many web-based exchanges is their advanced charting tools. These tools allow traders to analyze market trends, identify potential price movements, and make informed decisions. With features like technical indicators, customizable chart types, and real-time data feeds, traders can gain insights that are crucial for success. Think of it like having a personal navigator on a stormy sea, guiding you through the waves of volatility.

Additionally, web platforms often provide order types that go beyond the standard buy and sell options. Traders can utilize limit orders, stop-loss orders, and even more complex strategies like conditional orders. This flexibility can be the difference between making a profit and facing losses in a fast-moving market. It’s akin to having multiple gears in a car; each gear allows you to adjust your speed and performance based on the terrain.

Furthermore, security features on web platforms are typically more robust. Most exchanges implement two-factor authentication (2FA) and encryption protocols to safeguard your assets. This is essential in a digital landscape where threats are ever-present. Just like locking your front door at night, these measures add an extra layer of protection for your investments.

Another critical aspect of web-based features is the user interface. A clean, intuitive design can make a significant difference in your trading experience. If you’ve ever used a complicated website that left you feeling lost, you know how frustrating it can be. A well-designed interface should allow you to navigate effortlessly, making it easy to execute trades and access your account information. This is especially important during high-stress trading situations when every second counts.

Lastly, many web platforms offer educational resources, such as tutorials, webinars, and articles, to help users understand the intricacies of trading. These resources can be invaluable for beginners looking to build their knowledge and confidence. Imagine having a mentor available at any time, ready to share insights and strategies tailored to your learning pace.

In conclusion, when evaluating a crypto exchange's web-based features, consider the following key aspects:

- Advanced charting tools for market analysis

- Diverse order types for strategic trading

- Robust security measures, including 2FA

- User-friendly interface for seamless navigation

- Educational resources to enhance trading skills

By focusing on these elements, you can ensure that your trading platform not only meets your needs but also empowers you to make informed decisions in the dynamic world of cryptocurrency.

Q: What should I prioritize when choosing a crypto exchange?

A: Focus on security features, user experience, fees, and regulatory compliance to ensure a safe and efficient trading environment.

Q: Are web-based platforms better than mobile apps for trading?

A: It depends on your trading style. Web platforms generally offer more advanced features, while mobile apps provide convenience for on-the-go trading.

Q: How can I ensure the security of my funds on an exchange?

A: Look for exchanges that implement strong security measures, such as two-factor authentication, encryption, and cold storage for funds.

Q: What types of fees should I be aware of?

A: Be mindful of trading fees, withdrawal fees, and any potential hidden costs that may arise during transactions.

Q: Why is regulatory compliance important for crypto exchanges?

A: Regulatory compliance ensures that the exchange operates within legal frameworks, providing a level of trust and safety for users.

Customer Support Services

When it comes to navigating the often-turbulent waters of cryptocurrency trading, having reliable customer support can make all the difference. Imagine you're in the middle of a trade, and suddenly, your transaction fails or your account gets locked. Panic sets in, and you need immediate assistance. This is where the quality of customer support from your chosen exchange comes into play. It’s not just about having a contact number or an email address; it's about the responsiveness and effectiveness of that support.

First off, consider the different channels through which support is offered. Many exchanges provide a variety of options, including:

- Live Chat: This is often the fastest way to get help, allowing you to communicate in real-time with a support representative.

- Email Support: While this method can take longer, it's useful for more complex issues that require detailed explanations.

- Phone Support: Some users prefer speaking to someone directly, and exchanges that offer this option can provide a sense of reassurance.

- Help Center/FAQ: A well-organized help center can be a lifesaver, offering answers to common questions without the need to contact support.

But it’s not just about the channels available; the quality of the support matters too. A good exchange should have knowledgeable staff who can address your issues efficiently. Look for reviews or testimonials that speak to the responsiveness and helpfulness of the support team. Some exchanges even offer 24/7 support, which is crucial for traders operating in different time zones or those who trade at odd hours.

Another factor to consider is the average response time. Some exchanges pride themselves on resolving issues within minutes, while others may take hours or even days. You can often find this information in user reviews or on the exchange's website. A quick response can alleviate stress and help you get back to trading without losing momentum.

Lastly, don't underestimate the importance of a community. Many exchanges have active forums or social media channels where users can share their experiences and get help from fellow traders. This can be an invaluable resource when you're facing a problem or just looking for tips on how to navigate the platform.

In summary, when evaluating a cryptocurrency exchange, take the time to assess their customer support services. Look for multiple contact options, check response times, and read user reviews to gauge the quality of support. After all, in the fast-paced world of crypto trading, having a reliable support system can turn a potential crisis into a minor hiccup.

Fees and Transaction Costs

Understanding the fee structure of a cryptocurrency exchange is vital for anyone looking to trade effectively. Just like when you’re shopping for a new gadget, you want to ensure you’re getting the best deal possible. In the world of crypto, this means being aware of various fees that can eat into your profits. From trading fees to withdrawal costs, each exchange has its own pricing model that can significantly impact your overall trading experience.

When evaluating an exchange, it's crucial to look at three main types of fees:

- Trading Fees: These are the fees charged for executing buy or sell orders. They can be either a flat fee per trade or a percentage of the transaction amount. Some exchanges offer tiered pricing based on your trading volume, which means the more you trade, the lower your fees.

- Withdrawal Fees: Whenever you transfer your funds out of the exchange, you may incur a withdrawal fee. This fee can vary based on the cryptocurrency you are withdrawing. For example, Bitcoin withdrawals often come with higher fees compared to lesser-known altcoins.

- Deposit Fees: While many exchanges offer free deposits, some may charge fees for specific payment methods. Always check if there are fees associated with depositing funds into your account.

To give you a clearer picture, here’s a comparison table of common fee structures among popular exchanges:

| Exchange | Trading Fee | Withdrawal Fee (BTC) | Deposit Fee |

|---|---|---|---|

| Exchange A | 0.1% | 0.0005 BTC | Free |

| Exchange B | 0.2% | 0.0003 BTC | 1% (Credit Card) |

| Exchange C | 0.15% | 0.0004 BTC | Free (Bank Transfer) |

As you can see from the table, the differences in fees among exchanges can be quite pronounced. This is why it’s essential to do your homework. You wouldn’t buy a car without checking the price and features first, right? The same logic applies to choosing a crypto exchange.

Additionally, it's essential to be aware of hidden costs that some exchanges may not explicitly advertise. For instance, some platforms might have slippage, which is the difference between the expected price of a trade and the actual price. This can occur during periods of high volatility and can lead to unexpected costs. Therefore, always read the fine print and understand the total cost of trading before you dive in.

In summary, being informed about the various fees and transaction costs associated with crypto exchanges can save you a lot of money in the long run. Make sure to compare different platforms and find one that aligns with your trading style and budget. After all, the goal is to maximize your profits while minimizing unnecessary expenses!

Comparing Fee Structures

When it comes to trading cryptocurrencies, understanding the fee structures of different exchanges is crucial. Not only can fees eat into your profits, but they can also affect your overall trading strategy. Each exchange has its own unique fee model, which can include trading fees, withdrawal fees, deposit fees, and sometimes even inactivity fees. It’s essential to compare these structures to find the platform that aligns with your trading habits.

To make an informed decision, let's break down the common types of fees you might encounter:

- Trading Fees: These are fees charged for executing trades. They can be either a flat fee per trade or a percentage of the trade amount. Some exchanges offer tiered pricing, where fees decrease as your trading volume increases.

- Withdrawal Fees: When you decide to transfer your crypto to another wallet, exchanges typically charge a fee for this service. This fee can vary significantly between platforms and can sometimes be a fixed amount or a percentage of the withdrawal amount.

- Deposit Fees: Some exchanges may charge fees for depositing funds, especially if you’re using certain payment methods like credit cards or wire transfers. Always check if the exchange offers free deposits for specific methods.

- Inactivity Fees: If you’re not actively trading, some exchanges impose inactivity fees after a certain period. It’s a way for them to encourage users to keep trading.

Now, let’s look at a sample comparison table of fee structures from a few popular exchanges:

| Exchange | Trading Fee | Withdrawal Fee | Deposit Fee | Inactivity Fee |

|---|---|---|---|---|

| Exchange A | 0.1% | $1.00 | Free | $10/month after 12 months |

| Exchange B | 0.2% | $0.50 | 3% for credit card | No inactivity fee |

| Exchange C | 0.15% | $2.00 | Free for bank transfers | $5/month after 6 months |

As you can see from the table, the fee structures can vary widely between exchanges. This variance highlights the importance of doing your homework before committing to a platform. Not only should you consider the fees themselves, but also how these fees align with your trading style. Are you a frequent trader who benefits from lower trading fees, or do you prefer to hold your assets long-term and want to avoid withdrawal and inactivity fees?

In conclusion, comparing fee structures is not just about finding the lowest fees; it’s about understanding how these fees fit into your overall trading strategy. Take the time to analyze each exchange’s fee model, and don’t hesitate to reach out to their customer support if you have questions about specific fees. After all, being informed is the first step to becoming a successful trader!

Q1: What is the average trading fee on crypto exchanges?

A1: Most exchanges charge between 0.1% and 0.25% for trading fees. However, this can vary based on your trading volume and the specific exchange's fee structure.

Q2: Are withdrawal fees negotiable?

A2: Generally, withdrawal fees are set by the exchange and are not negotiable. However, some exchanges may offer promotions or fee waivers under certain conditions.

Q3: How can I avoid inactivity fees?

A3: To avoid inactivity fees, ensure you log in and make trades at least once within the specified time frame set by the exchange.

Q4: Do all exchanges have deposit fees?

A4: No, not all exchanges charge deposit fees. Many platforms offer free deposits, especially for bank transfers, but fees may apply for credit card transactions.

Hidden Costs to Watch For

When diving into the world of cryptocurrency exchanges, many traders often overlook the hidden costs that can sneak up on them. These costs can significantly impact your overall trading profitability, so it’s essential to keep your eyes peeled. Imagine you’re at a restaurant; you order a delicious meal, but when the bill arrives, you find a hefty service charge added on without any prior notice. This is similar to what can happen with crypto exchanges, where fees might not be immediately apparent.

One common hidden cost is the spread. The spread is the difference between the buying price and the selling price of a cryptocurrency. While some exchanges advertise zero trading fees, they may compensate for this by widening the spread. For instance, if you buy Bitcoin at $50,000 and the selling price is $49,500, that $500 difference is effectively a cost to you, even if the exchange claims no trading fees. It’s crucial to consider this spread when calculating your potential profits.

Another area to be wary of is deposit and withdrawal fees. Some exchanges may offer free deposits but charge substantial fees for withdrawals, particularly if you’re using a specific payment method like credit cards or certain cryptocurrencies. This can be especially frustrating if you're trying to cash out your profits quickly. Always check the fee schedule on the exchange’s website before committing your funds.

Additionally, watch out for inactivity fees. Some exchanges impose charges if your account remains inactive for a certain period, which can catch you off guard if you’re a long-term holder. It’s like paying for a gym membership you never use—money wasted! Make sure to read the fine print regarding account maintenance and inactivity fees.

Lastly, consider the conversion fees when trading between different cryptocurrencies. If you’re swapping Bitcoin for Ethereum, the exchange might charge a fee for the conversion, which can vary widely between platforms. These fees can add up, especially if you frequently trade between multiple crypto assets.

To summarize, here are some hidden costs to keep in mind:

- Spread: The difference between buying and selling prices.

- Deposit and Withdrawal Fees: Charges associated with moving funds in and out of your account.

- Inactivity Fees: Costs incurred for not trading over a specified period.

- Conversion Fees: Fees for trading one cryptocurrency for another.

Being aware of these hidden costs can help you make informed decisions and avoid unexpected expenses. Always do your due diligence before choosing an exchange, and don’t hesitate to ask questions or seek clarification on any fees that seem unclear. After all, in the world of crypto, knowledge is power!

Q: What are the most common hidden fees on crypto exchanges?

A: Common hidden fees include spreads, deposit and withdrawal fees, inactivity fees, and conversion fees.

Q: How can I avoid hidden fees when trading?

A: Always read the fee structure on the exchange's website, and consider using exchanges that are transparent about their fees.

Q: Are all exchanges transparent about their fees?

A: Unfortunately, not all exchanges are transparent. It's crucial to research and choose exchanges with a good reputation for honesty and clarity regarding their fees.

Q: What should I do if I encounter unexpected fees?

A: If you encounter unexpected fees, contact the exchange's customer support for clarification and consider switching to a more transparent platform if necessary.

Regulatory Compliance and Licensing

When navigating the ever-evolving world of cryptocurrency, one of the most critical factors to consider is . This isn’t just a box to check off; it’s a fundamental aspect that can significantly impact your trading experience and the safety of your investments. Think of it as the backbone of a trustworthy exchange. Just as you wouldn’t drive a car without a valid license, you shouldn’t engage with an exchange that isn’t compliant with local laws and regulations.

Regulatory compliance serves as a protective shield for users, ensuring that exchanges operate within the legal frameworks established by financial authorities. This means that the exchange adheres to strict guidelines regarding anti-money laundering (AML) and know your customer (KYC) policies. These measures are in place to prevent illegal activities and to protect users from fraud and scams. When an exchange is compliant, it not only boosts its credibility but also fosters a sense of trust among its users.

Moreover, a licensed exchange is typically required to undergo regular audits and inspections, which adds another layer of assurance. You can think of this like a restaurant that has passed health inspections; it gives you confidence that the food (or in this case, your funds) is safe. To help you understand the importance of licensing, here’s a quick rundown of what to look for:

| Aspect | Importance |

|---|---|

| Licensing Authority | Ensures the exchange is regulated and adheres to local laws. |

| Compliance with AML/KYC | Helps prevent fraud and ensures user safety. |

| Regular Audits | Provides transparency and builds trust with users. |

In addition to these factors, it’s also wise to consider the jurisdiction in which the exchange operates. Different countries have varying degrees of regulation. For instance, exchanges based in jurisdictions with stringent regulations, such as the United States or the European Union, are often more reliable than those in less regulated areas. This is because they are held to higher standards and are more likely to prioritize user protection.

Another crucial point is to stay informed about any changes in regulations that may affect your chosen exchange. The crypto landscape is notoriously volatile, not just in terms of market prices but also in regulatory frameworks. An exchange that is compliant today may face new regulations tomorrow, which could impact its operations. Therefore, keeping an eye on news related to cryptocurrency regulations can save you from potential pitfalls.

In summary, when evaluating a cryptocurrency exchange, always prioritize those that demonstrate strong regulatory compliance and possess valid licenses. This will not only enhance your trading experience but also provide peace of mind knowing that you’re engaging with a platform that values safety and legality. Remember, in the world of crypto, being informed is your best defense.

- What is regulatory compliance in cryptocurrency?

Regulatory compliance refers to the adherence of cryptocurrency exchanges to laws and regulations set by financial authorities, ensuring safe and legal operations. - Why is licensing important for crypto exchanges?

A licensed exchange is subject to regular audits and must follow strict guidelines, providing users with a safer trading environment. - How can I verify if an exchange is compliant?

You can check the exchange's website for licensing information, look for regulatory authority logos, and read user reviews regarding their compliance.

Frequently Asked Questions

- What security features should I look for in a crypto exchange?

When evaluating a crypto exchange, prioritize features like two-factor authentication (2FA), cold storage for funds, and encryption protocols. These measures significantly enhance the security of your assets and personal information.

- How important is user experience when choosing an exchange?

User experience is crucial! A well-designed interface makes trading smoother and more enjoyable. Look for exchanges that offer easy navigation, clear layouts, and responsive customer support to enhance your overall trading experience.

- Should I use a mobile app or a desktop platform for trading?

It really depends on your trading style! Mobile apps offer convenience for on-the-go trading, while desktop platforms often provide more advanced tools and features. Consider your preferences and trading habits when making your choice.

- What types of fees should I be aware of?

Be sure to check for trading fees, withdrawal fees, and deposit fees. Understanding these costs will help you avoid surprises and choose the most economical option for your trading needs.

- Are there hidden costs associated with crypto exchanges?

Yes, some exchanges may have hidden costs like inactivity fees or charges for certain payment methods. Always read the fine print to ensure you're fully informed and avoid any unexpected expenses.

- Why is regulatory compliance important for crypto exchanges?

Regulatory compliance ensures that exchanges adhere to local laws, which enhances trust and safety for users. Choosing a licensed exchange gives you peace of mind that your assets are protected under legal frameworks.