How to Assess the Potential of New Crypto Projects

In today's fast-paced digital landscape, the world of cryptocurrency is evolving at an astonishing rate. With new projects emerging almost daily, how do you sift through the noise and identify the gems worth your investment? It's no secret that the crypto space can be both exciting and overwhelming, much like trying to find a needle in a haystack. However, with the right approach, you can assess the potential of new crypto projects effectively. This article will guide you through various methods and criteria to evaluate these projects, ensuring you make informed decisions that align with your investment goals.

First and foremost, understanding the project's whitepaper is crucial. Think of the whitepaper as the blueprint of the project—it outlines the purpose, technology, and roadmap for the future. A well-crafted whitepaper not only explains what the project aims to achieve but also details how it plans to reach those goals. So, when diving into a new crypto project, make sure to analyze this document thoroughly. Look for clarity in its objectives and the feasibility of its proposed solutions. If the whitepaper leaves you scratching your head, it might be a red flag.

Next, let’s talk about the team behind the project. The success of any venture often hinges on the expertise and experience of its founders and developers. Imagine trying to build a house without a skilled architect; the results would likely be disastrous. Similarly, a strong team can significantly elevate a project's chances of success. Therefore, researching the backgrounds of the team members is essential. Check their credentials, previous projects, and achievements to gauge their capability. A team with a solid track record in the crypto space is often a good indicator of potential success.

Moreover, community involvement and reputation play a vital role in assessing a project's credibility. A team that engages actively with its community and receives positive feedback is usually trustworthy. Think of it this way: if a group of friends consistently supports and praises a particular restaurant, you’re more likely to give it a try, right? The same principle applies to crypto projects. Engaging with the community not only builds trust but also fosters a loyal user base that can drive adoption.

Now, let’s shift gears and analyze the market demand for the project’s solution. Understanding whether there is a genuine need for what the project offers is essential. A strong demand can drive adoption and significantly increase the project's potential for success in a competitive landscape. Ask yourself: does this project solve a real problem? If the answer is yes, you’re already on the right track.

Another crucial aspect to explore is the technology and innovation behind the project. The underlying technology is vital for functionality and scalability. Evaluating the technical aspects can help determine long-term viability and competitive edge. Reviewing the technical documentation can provide valuable insights into the project's architecture and functionality. A well-documented project often indicates a thoughtful approach to development and implementation.

Furthermore, comparing the new project with existing solutions can reveal its unique value proposition. If it offers significant improvements or innovative features that set it apart from competitors, it’s likely to attract more attention and investment. Think of this as shopping for a new phone; if one model has features that others lack, it naturally becomes more appealing.

Lastly, let's delve into the concept of tokenomics. Tokenomics refers to the economic model governing a cryptocurrency, encompassing supply, demand, and distribution. Understanding these factors is crucial for evaluating a project's growth potential. Analyzing the total supply and distribution strategy of tokens can give insights into potential price movements. Scarcity and demand are key components that influence a token's value. Additionally, examining the incentives offered to token holders and users can help assess the project's attractiveness. Strong incentives can drive user engagement and foster a loyal community.

- What is a whitepaper, and why is it important?

A whitepaper is a foundational document that outlines a cryptocurrency project's purpose, technology, and roadmap. It's important because it provides insights into the project's viability and potential for success.

- How can I evaluate the team behind a crypto project?

Research the backgrounds of the founders and developers, check their previous projects and achievements, and assess their community involvement and reputation.

- What role does market demand play in a project's success?

Market demand is crucial as it drives adoption. A project that addresses a genuine need is more likely to succeed in a competitive landscape.

- What is tokenomics?

Tokenomics refers to the economic model governing a cryptocurrency, including factors like supply, demand, and distribution, which are essential for assessing growth potential.

Understanding the Project's Whitepaper

The whitepaper serves as the foundational document for any crypto project, detailing its purpose, technology, and roadmap. Think of it as the project's blueprint; without it, you’re essentially building a house without a plan. Analyzing this document is crucial for assessing its viability and potential success. A well-crafted whitepaper not only outlines the project’s goals but also provides insights into how those goals will be achieved. It’s your first glimpse into the project's soul, so to speak.

When diving into a whitepaper, here are some key components you should focus on:

- Problem Statement: What issue is the project aiming to solve? A clear, compelling problem statement is often a strong indicator of the project’s relevance.

- Solution Offered: Does the project provide a unique solution? Look for innovative approaches that set it apart from existing projects.

- Token Utility: Understand how the token will be used within the ecosystem. A token with real utility is more likely to attract users and investors.

- Roadmap: A well-defined roadmap outlines the project’s timeline and milestones. It helps you gauge whether the project is on track and has a clear plan for the future.

In addition to these components, it's essential to assess the technical feasibility of the project. Does the whitepaper provide enough technical detail to convince you that the team can deliver on their promises? If the technical aspects are vague or overly complicated, it might be a red flag. You want to see clarity and confidence in their technological approach.

Moreover, the whitepaper should include a section on market analysis. This part should address the potential market size, target audience, and competitive landscape. If the team has done their homework, they will provide data-backed insights that can help you understand the project’s potential for success in the crowded crypto market.

Lastly, don’t overlook the importance of transparency. A good whitepaper should not only provide information but also be open about risks and challenges. If the project glosses over potential pitfalls or presents overly optimistic projections, it’s a sign that you should proceed with caution.

In summary, the whitepaper is your first line of defense when evaluating a new crypto project. It’s where you can uncover the project’s vision, its roadmap, and the team’s credibility. By taking the time to thoroughly analyze this document, you position yourself to make informed investment decisions in a rapidly evolving market.

| Question | Answer |

|---|---|

| What is a whitepaper? | A whitepaper is a detailed document that outlines a cryptocurrency project's purpose, technology, and roadmap. |

| Why is the whitepaper important? | It serves as a blueprint for the project, helping investors assess its viability and potential for success. |

| What should I look for in a whitepaper? | Focus on the problem statement, solution offered, token utility, roadmap, and transparency regarding risks. |

Evaluating the Team Behind the Project

When diving into the world of cryptocurrency, one of the most critical factors to consider is the team behind the project. Think of it like assembling a sports team; you wouldn't want to back a team with inexperienced players, right? The same principle applies here. A project's success often hinges on the expertise and experience of its team members. If the founders and developers have a strong track record, they're more likely to steer the project toward success. So, how do you go about evaluating this vital component?

First, you should start by researching the backgrounds of the founders and developers. Look for their previous work experience, educational qualifications, and any notable achievements. This can help you gauge their capability and whether they have the necessary skills to execute the project effectively. A strong team with relevant experience is a positive indicator of a project's potential. For instance, if a team member has previously led successful blockchain projects or has a background in finance, it bodes well for the new venture.

Next, it’s essential to check the team members' credentials. You can do this through platforms like LinkedIn or GitHub, where many professionals showcase their work. Pay attention to:

- Educational background

- Previous job roles and responsibilities

- Involvement in other successful crypto projects

Investigating these aspects can give you a clearer picture of their expertise. For example, if a developer has contributed to well-known projects in the crypto space, it’s a good sign that they understand the intricacies of blockchain technology.

Moreover, examining past projects and achievements of team members can reveal their track record in the crypto space. Successful previous ventures often indicate a higher likelihood of future success. If a founding member was instrumental in launching a popular dApp or protocol, that’s a strong testament to their ability. Think of it as looking at a resume; the more impressive the accomplishments, the more confident you can be in their capabilities.

Lastly, don’t overlook the importance of community involvement and reputation. The team's engagement with the community and their standing within it can significantly affect a project's credibility. A team that actively participates in discussions, responds to community feedback, and maintains transparency is generally viewed as trustworthy. Look for positive feedback on forums, social media, and other platforms. If the community is buzzing with excitement about the team, it’s usually a good sign!

In summary, evaluating the team behind a crypto project is crucial for making informed investment decisions. By looking into their credentials, past achievements, and community reputation, you can get a clearer understanding of their potential for success. Remember, a project is only as strong as its team!

- How important is the team behind a crypto project? The team is critical as their expertise and experience can greatly influence the project's success.

- Where can I find information about the team? You can check platforms like LinkedIn, GitHub, and the project's official website for team member profiles and backgrounds.

- What should I look for in a team's background? Look for relevant experience in crypto, successful previous projects, and educational qualifications.

- How can community involvement affect a project's credibility? A team that engages positively with the community is often seen as more trustworthy, which can bolster the project's reputation.

Checking Team Members' Credentials

When diving into the world of cryptocurrency projects, one of the most critical steps you can take is checking the credentials of the team members. Why is this so important? Well, the success of any project often hinges on the expertise and experience of its founders and developers. Think of it like building a house; if you hire a team of skilled architects and builders, you’re more likely to end up with a sturdy home. Similarly, a project led by a capable team is more likely to navigate the turbulent waters of the crypto market successfully.

To start with, it's essential to investigate the educational backgrounds of the team members. Are they graduates of reputable institutions? Do they hold degrees in fields relevant to the project, such as computer science, finance, or blockchain technology? A solid educational foundation can indicate a strong theoretical understanding of the challenges they may face. However, education alone doesn't tell the whole story; practical experience is equally, if not more, important.

Next, delve into their professional histories. Have they worked for well-known companies in the tech or finance sectors? Have they been involved in successful projects before? This kind of information can be a significant indicator of their capabilities. For instance, if a team member previously contributed to a successful ICO or a groundbreaking blockchain project, that’s a positive sign. It shows they have firsthand experience in overcoming obstacles and navigating the complexities of the crypto world.

Another aspect worth considering is the team's previous projects and achievements. A track record of success can be a strong predictor of future performance. If you discover that the team has launched projects that gained traction and delivered on their promises, it can instill confidence in their current venture. On the flip side, if their previous projects failed or were mired in controversy, it might raise red flags.

Don’t forget to check for community involvement and reputation. A credible team will often be engaged with their community, responding to questions and feedback, and actively participating in discussions. Platforms like Twitter, Reddit, and Telegram can provide valuable insights into how the team interacts with potential users and investors. Positive feedback from the community can be a strong endorsement of the team's credibility. Conversely, a lack of engagement or negative comments could indicate trouble ahead.

In summary, checking team members' credentials is not just about looking at resumes; it's about painting a complete picture of their capabilities and reliability. By understanding their educational backgrounds, professional experiences, previous successes, and community engagement, you can better assess whether a project is worth your investment. Remember, in the fast-paced world of crypto, knowledge is power, and due diligence can save you from costly mistakes.

- What should I look for in a crypto project's team? Look for relevant education, experience in successful projects, and positive community engagement.

- How important is the whitepaper? The whitepaper is crucial as it outlines the project's purpose, technology, and roadmap.

- What does tokenomics involve? Tokenomics covers the economic model of a cryptocurrency, including supply, demand, and distribution strategies.

Previous Projects and Achievements

When diving into the world of cryptocurrency, one of the key indicators of a project's potential success lies in the of its team members. Think of it like a resume for a job applicant; just as you would want to see a history of relevant experience and accomplishments, the same principle applies here. A team with a proven track record in the crypto space can signal to investors that they possess the necessary skills and knowledge to navigate the complexities of this rapidly evolving market.

For instance, consider a team that has successfully launched multiple blockchain projects in the past. If those projects have not only survived but thrived, it suggests that the team knows how to execute their vision effectively. On the flip side, if a team has a history of failed projects, it could raise red flags about their ability to deliver on their current undertaking. Therefore, it’s essential to conduct thorough research into the backgrounds of the team members.

Moreover, examining the achievements of previous projects can provide insights into the team's capability to innovate and solve real-world problems. Here are some aspects to consider when evaluating past projects:

- Successful Funding Rounds: Did the team manage to secure funding through Initial Coin Offerings (ICOs) or venture capital? Successful fundraising often indicates market confidence.

- Community Growth: Did the previous projects build a strong community? A loyal and engaged community can be a significant asset for any new project.

- Partnerships and Collaborations: Look for partnerships with reputable companies or organizations. Such alliances often enhance credibility and market reach.

- Market Performance: How did previous tokens perform in the market? A history of consistent price growth can be a good sign for future projects.

In summary, the previous projects and achievements of a crypto team's members can serve as a powerful indicator of their potential for success in new ventures. By digging into their past, you can gain valuable insights that will inform your investment decisions. Remember, investing in cryptocurrency is not just about the technology; it's also about the people behind it and their ability to execute their vision effectively.

Q1: How important is the team's previous experience in crypto?

A1: The team's previous experience is crucial as it often reflects their ability to navigate challenges and execute projects successfully.

Q2: What should I look for in a team's past projects?

A2: Look for successful funding, community growth, partnerships, and overall market performance to gauge their effectiveness.

Q3: Can a team with failed projects still be credible?

A3: Yes, but it's essential to investigate the reasons behind past failures. Learning from mistakes can lead to future success.

Community Involvement and Reputation

When diving into the world of cryptocurrency projects, one cannot overlook the significance of community involvement and the reputation of the team behind the initiative. Think of a crypto project as a ship sailing through the turbulent waters of the market; without a strong crew (the community), it risks capsizing. A project that actively engages with its community not only fosters trust but also enhances its credibility. This engagement can take many forms, from regular updates on social media platforms to interactive sessions on forums like Reddit or Discord, where team members answer questions and gather feedback.

Moreover, a positive reputation within the community can serve as a powerful endorsement. Investors often look for signals that indicate a project is not just a flash in the pan but has the potential for longevity. Here are some aspects to consider when evaluating community involvement and reputation:

- Social Media Presence: Check how active the project is on platforms like Twitter, Telegram, and Facebook. Frequent interactions and updates can indicate a committed team.

- Community Feedback: Look for reviews and comments from users. Positive testimonials can be a good sign, while negative feedback, especially if persistent, should raise red flags.

- Engagement in Discussions: A team that participates in discussions and responds to queries shows that they value their community's input and are willing to adapt based on feedback.

In addition to these factors, it’s also crucial to assess the overall sentiment of the community. Are the discussions filled with enthusiasm, or is there a sense of skepticism? Tools like sentiment analysis can help gauge the mood of the community towards a project. A thriving, engaged community often translates to higher adoption rates and, ultimately, a better chance of success. On the flip side, a project with a disengaged or negative community could struggle to gain traction.

Finally, don’t underestimate the power of community-driven initiatives. Projects that involve their users in decision-making processes, such as governance votes or development suggestions, tend to foster a sense of ownership among their community members. This sense of belonging can significantly enhance loyalty and retention, which are vital for the long-term success of any crypto project.

Q1: Why is community involvement important for a crypto project?

A1: Community involvement is crucial because it builds trust, enhances credibility, and encourages user engagement, all of which are essential for a project's success.

Q2: How can I assess a project's reputation?

A2: You can assess a project's reputation by checking social media interactions, community feedback, and the team's engagement in discussions. Positive sentiment and active participation are good indicators.

Q3: What role does social media play in a crypto project's success?

A3: Social media serves as a platform for communication, updates, and community engagement. An active social media presence can enhance visibility and foster a loyal community.

Q4: How can I gauge the sentiment of a crypto community?

A4: Sentiment analysis tools can be used to evaluate the mood of the community based on discussions, comments, and feedback across various platforms.

Analyzing the Market Demand

When diving into the world of cryptocurrencies, one of the first questions that should pop into your mind is: Is there a real need for this project? Understanding the market demand for a cryptocurrency project’s solution is not just a good idea; it's essential! Think of it like fishing—if you’re casting your line into a pond with no fish, you’re not going to catch anything. The same goes for crypto investments; without demand, even the most innovative project can flop.

To assess the market demand, start by identifying the problem the project aims to solve. Is it addressing a significant pain point for users? Projects that tackle real-world issues, like enhancing security in online transactions or providing faster payment solutions, often have a higher chance of gaining traction. For example, consider the rise of decentralized finance (DeFi) platforms. They emerged to solve the limitations of traditional banking, and as a result, they’ve attracted a massive user base.

Next, you’ll want to look at the target audience. Who are they? Are they tech-savvy millennials, traditional investors, or perhaps businesses looking for efficiency? Knowing the audience helps gauge the potential adoption rate. If a project targets a niche market with a growing user base, it might just be a goldmine. On the flip side, if it’s too broad or saturated, it may struggle to stand out. Here’s a quick breakdown of factors to consider:

- Target Audience: Understand who will use the product and their needs.

- Market Size: Is the market growing? A growing market often indicates strong demand.

- Competitive Landscape: Analyze existing competitors and their market share.

Another crucial aspect is to evaluate the project's marketing strategy. A well-thought-out marketing plan can create buzz and attract users even before the project launches. Look for projects that have a clear roadmap, including marketing initiatives aimed at building a community and educating potential users. The more engaged the community, the higher the likelihood of adoption.

Lastly, don't forget to check social media and discussion forums. Platforms like Reddit and Twitter can provide real-time feedback on public sentiment. Are people excited? Are they discussing it? Or is the chatter more about skepticism? Engaging with community opinions can offer insights that numbers alone cannot provide.

In summary, analyzing market demand is about piecing together a puzzle. You need to look at the problem being solved, the target audience, the competitive landscape, and the marketing strategies in place. By doing so, you can form a clearer picture of whether a new crypto project is worth your investment. Remember, in the fast-paced world of cryptocurrency, understanding demand is your best weapon against the unpredictable waves of the market.

Q: How do I determine if there is market demand for a cryptocurrency project?

A: Start by identifying the problem the project solves, analyzing the target audience, and evaluating the competitive landscape. Community engagement and marketing strategies also provide valuable insights.

Q: What role does community feedback play in assessing market demand?

A: Community feedback is crucial as it reflects public sentiment and can indicate the potential for adoption. Engaging with discussions on platforms like Reddit and Twitter can offer real-time insights.

Q: Is it necessary to analyze market demand for every crypto project?

A: Yes, analyzing market demand is essential for making informed investment decisions. It helps you understand the project's viability and potential for success in a competitive landscape.

Assessing the Technology and Innovation

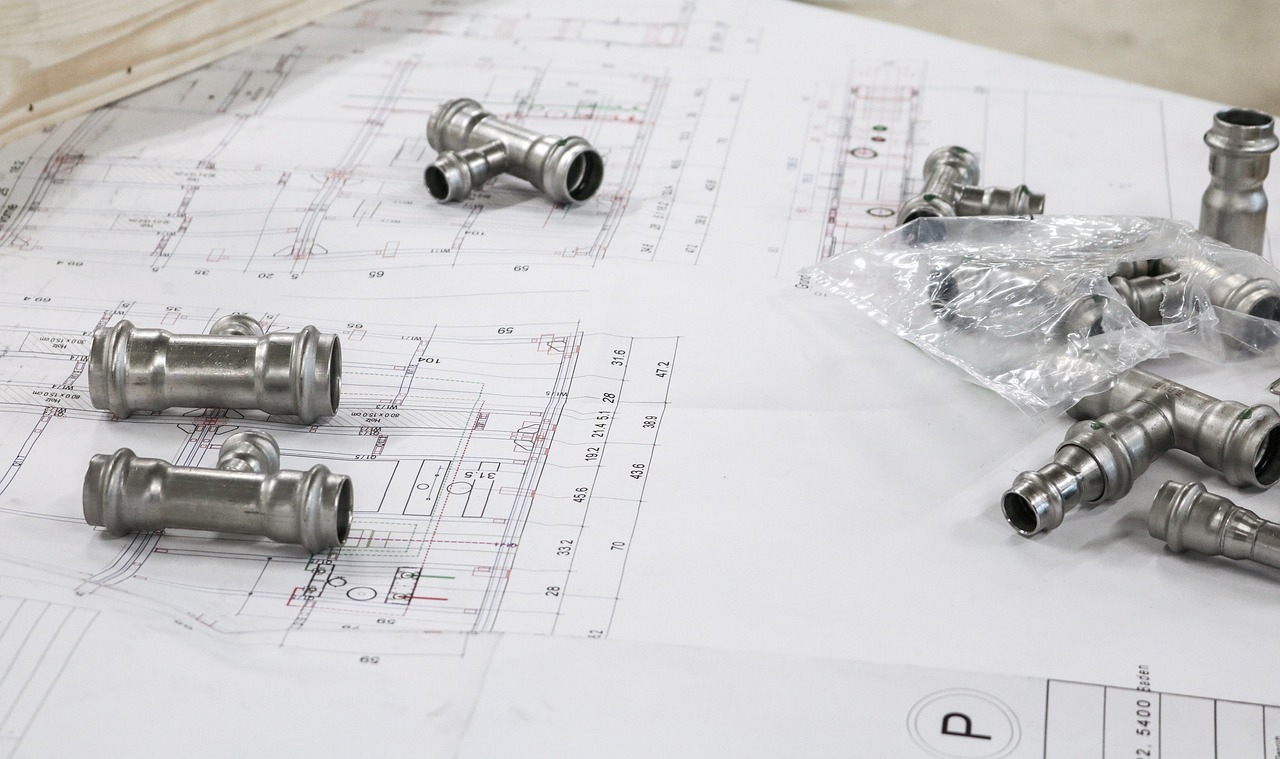

When diving into the world of cryptocurrency, one of the most critical aspects to evaluate is the technology and innovation behind a project. This isn’t just about flashy graphics or trendy buzzwords; it’s about understanding the core technology that powers the project. Think of it like the engine of a car; if the engine is poorly designed, no matter how sleek the exterior looks, it won’t perform well on the road. So, how do we assess this technology?

First and foremost, reviewing the technical documentation is essential. This documentation acts as a blueprint, providing insights into the project's architecture, functionality, and even its scalability. A well-documented project often indicates that the team has put thought and effort into their development process. It’s like reading the manual before assembling furniture; it can save you a lot of headaches down the line. If the technical documentation is clear, comprehensive, and accessible, it’s a good sign that the team is serious about their work.

Next, we should consider how the project compares with existing solutions. In a saturated market, it’s vital to identify the unique value proposition of the new project. This means asking questions like: What problems does it solve that others don’t? Is it more efficient, faster, or cheaper than the competition? A project that offers significant improvements or innovations over existing solutions is more likely to grab attention and succeed. For instance, if a new blockchain technology can process transactions in seconds compared to others that take minutes, it’s bound to attract users looking for efficiency.

Moreover, examining the scalability of the technology is crucial. Scalability refers to the system's ability to handle a growing amount of work or its potential to accommodate growth. A project that can scale effectively is more likely to succeed as user demand increases. For example, if a blockchain can only support a limited number of transactions per second, it might struggle to keep up as its user base expands. This is why it's essential to understand the limits of the technology and whether the team has a plan to address potential scalability issues.

Lastly, it’s important to consider the innovation aspect. Is the project leveraging cutting-edge technologies like artificial intelligence, machine learning, or Internet of Things (IoT)? Projects that incorporate innovative technologies can often create new markets or disrupt existing ones. For example, a cryptocurrency that utilizes AI for predictive analytics could provide investors with insights that traditional methods cannot offer. This kind of innovation can set a project apart and make it more attractive to potential investors.

In summary, assessing the technology and innovation of a cryptocurrency project involves a thorough analysis of its technical documentation, comparison with existing solutions, evaluation of scalability, and consideration of innovative technologies. By taking the time to understand these components, investors can make more informed decisions and increase their chances of backing a successful project.

- What is the importance of technical documentation? Technical documentation provides crucial insights into a project's architecture and functionality, indicating the team's commitment to development.

- How can I assess a project's scalability? Look for information on transaction speeds and the team's plans for accommodating future growth.

- Why is innovation important in cryptocurrency projects? Innovative projects can create new markets or disrupt existing ones, making them more attractive to investors.

Reviewing Technical Documentation

When diving into the world of cryptocurrencies, one of the most essential steps is reviewing the technical documentation of a project. This documentation acts like a blueprint, outlining the project's architecture, functionality, and the technologies employed. It’s like peeking under the hood of a fancy car—you want to know what makes it tick before you decide to take it for a spin. A well-crafted technical document not only showcases the project's vision but also reflects the team’s commitment to transparency and quality.

First and foremost, you should look for clarity and detail in the documentation. Does it explain the technology in a way that is understandable, even for those who might not be tech-savvy? A project that can break down complex concepts into digestible information is often a sign of a team that values its community. Moreover, the documentation should cover several key areas:

- System Architecture: This section should provide a clear overview of how different components of the project interact with each other. Look for diagrams or flowcharts that illustrate the relationships between various parts of the system.

- Consensus Mechanism: Understanding how the project achieves consensus is crucial. Is it using Proof of Work, Proof of Stake, or another method? Each mechanism has its pros and cons, and knowing which one the project employs can give you insight into its scalability and security.

- Smart Contracts: If the project utilizes smart contracts, the documentation should explain how they function and what programming language is used. This is vital for assessing the potential vulnerabilities and capabilities of the project.

Additionally, it’s essential to check the roadmap included in the documentation. A well-defined roadmap outlines the project's milestones and timelines, giving you an idea of what to expect in the future. It’s like a treasure map—if the path is clear, you’re more likely to find the treasure, which in this case is the project's success.

Another critical aspect to consider is the development activity surrounding the project. Is the code open-source? Are there regular updates and contributions from developers? Platforms like GitHub can be a treasure trove of information. A vibrant repository with frequent commits and active discussions can indicate a healthy project that is continually evolving.

Lastly, don’t forget to look for any audits that have been conducted on the project’s code. Audits are like a health check-up for the project; they assess the security and functionality of the codebase. If a reputable third-party firm has audited the project and provided a clean bill of health, that’s a significant plus in your evaluation.

In summary, reviewing technical documentation is a critical step for anyone looking to invest in a new cryptocurrency project. By paying attention to clarity, detail, and the various technical elements outlined, you can gain valuable insights into the project's viability and long-term potential. Remember, the more you know about the technology behind a project, the better equipped you'll be to make informed investment decisions.

- What is technical documentation in the context of crypto projects?

Technical documentation provides detailed information about a cryptocurrency project’s architecture, functionality, and technologies used. - Why is reviewing technical documentation important?

It helps investors understand the project's viability, transparency, and potential for success. - What should I look for in technical documentation?

Key areas include system architecture, consensus mechanism, smart contracts, roadmap, development activity, and security audits.

Comparing with Existing Solutions

When diving into the world of new cryptocurrency projects, one of the most enlightening exercises is to compare them with existing solutions. This comparison is not just about identifying what makes each project unique; it's about understanding the competitive landscape and determining whether the new project can carve out a niche for itself. Think of it like shopping for a new smartphone. You wouldn’t just buy the latest model without checking how it stacks up against the competition, right? Similarly, assessing a crypto project requires a keen eye on how it measures up to its predecessors and contemporaries.

First off, it’s essential to identify the key features that differentiate the new project from established players. For instance, does it offer faster transaction speeds, lower fees, or enhanced security features? Understanding these aspects can provide a clearer picture of its potential adoption. Moreover, if a project claims to solve a specific problem, you need to ask yourself: Is this problem already being addressed effectively by existing solutions? If so, what makes this new project a better choice?

To illustrate this, let’s consider a hypothetical new project, CryptoX, which aims to improve upon the transaction speed of popular cryptocurrencies like Bitcoin and Ethereum. Here’s a quick comparison table:

| Feature | Bitcoin | Ethereum | CryptoX |

|---|---|---|---|

| Transaction Speed | 10 minutes | 15 seconds | 3 seconds |

| Transaction Fee | $2.50 | $0.20 | $0.05 |

| Smart Contract Capability | No | Yes | Yes |

This table highlights how CryptoX could potentially disrupt the market by offering superior transaction speeds and lower fees. However, it’s not just about numbers; you also need to consider the user experience. Does the project provide an intuitive interface? Is it easy for users to navigate? These factors can significantly influence adoption rates and overall success.

Another critical element in this comparison is the community support. A project with a strong, engaged community can often outperform those that lack this backing, even if the technology is superior. Communities can drive adoption through word-of-mouth, social media buzz, and grassroots marketing efforts. So, when you’re evaluating a new project, take a moment to explore forums, social media platforms, and other community channels to gauge the sentiment around it.

In conclusion, comparing a new crypto project with existing solutions is a multifaceted approach that requires careful consideration of various factors. Look beyond the surface details and dive deep into the technology, user experience, and community involvement. This comprehensive analysis will not only help you understand the project's potential but also equip you with the knowledge needed to make informed investment decisions.

- What should I look for when comparing crypto projects? Focus on key features, technology, user experience, and community support.

- How can I assess the credibility of a crypto project? Research the team behind the project, their previous achievements, and the project's whitepaper.

- Is it important to consider existing solutions when evaluating a new project? Yes, understanding how a new project compares to existing solutions can provide insights into its potential success.

Investigating Tokenomics

When diving into the world of cryptocurrency, one cannot overlook the importance of tokenomics. This term refers to the economic model that governs a cryptocurrency, encompassing aspects such as supply, demand, and distribution mechanisms. Understanding tokenomics is crucial, as it provides insights into how a project is designed to grow and sustain itself in a highly competitive market. A well-structured tokenomics model can be the difference between a project that flourishes and one that flounders.

One of the first things to analyze is the total supply of tokens. This figure indicates how many tokens will ever be created, and it plays a significant role in determining the asset's scarcity. For instance, Bitcoin has a capped supply of 21 million coins, which has contributed to its value over time. In contrast, projects with unlimited supply might struggle to maintain value as more tokens are released into circulation. Therefore, it’s essential to look at how the total supply is structured and whether it aligns with the project's vision.

Another critical component of tokenomics is the distribution strategy. How are the tokens allocated? Are they distributed fairly among early investors, developers, and the community? A transparent distribution model can foster trust and encourage broader participation. For example, if a large percentage of tokens is reserved for the founding team, it may raise red flags about potential market manipulation or lack of commitment to the project's success.

Moreover, understanding the dynamics of supply and demand is vital. A project with a limited supply but high demand is likely to see its token value increase. Conversely, if the demand is low, even a limited supply may not prevent the token's price from plummeting. Therefore, analyzing market trends and community interest can provide a clearer picture of the potential success of a cryptocurrency.

Incentives also play a crucial role in tokenomics. Projects often offer various incentives for holders and users to encourage engagement and loyalty. These incentives can come in many forms, such as staking rewards, governance participation, or exclusive access to features. A strong incentive structure can lead to a vibrant community and increase the likelihood of long-term success. For instance, if users are rewarded for holding their tokens instead of selling them, this can create a more stable price environment and foster a sense of belonging within the community.

To summarize, investigating tokenomics is not just about numbers; it's about understanding the ecosystem that supports a cryptocurrency. A well-thought-out tokenomics model can provide investors with the confidence they need to invest in a project. As you navigate through the myriad of new cryptocurrency projects, keep an eye on these factors, and you'll be better equipped to make informed decisions.

- What is tokenomics? Tokenomics refers to the economic model that governs a cryptocurrency, including its supply, demand, and distribution.

- Why is tokenomics important? Understanding tokenomics helps investors assess a project's potential for growth and sustainability.

- How can I analyze a project's tokenomics? Look at the total supply, distribution strategy, supply and demand dynamics, and incentives for holders and users.

- What should I be wary of in tokenomics? Be cautious of projects with unclear distribution models or excessive allocations to the founding team, as these can indicate potential issues.

Supply and Demand Dynamics

When diving into the world of cryptocurrency, understanding the is akin to peering through a window into the future of a project. Just like any other market, the value of a cryptocurrency is fundamentally influenced by how many tokens are available (supply) versus how many people want to buy them (demand). This relationship can create a rollercoaster of price movements that can either make or break an investor's portfolio.

To grasp this concept, let’s think of it in terms of a classic scenario: imagine a new smartphone release. If the company produces a limited number of units (low supply) but there’s a huge buzz and excitement surrounding the launch (high demand), the prices will likely skyrocket. Conversely, if a company produces too many smartphones and there’s little interest from consumers, the prices will plummet. The same principle applies to cryptocurrencies.

In the crypto world, scarcity plays a crucial role. For instance, Bitcoin has a capped supply of 21 million coins, which creates a sense of urgency and desirability. If a project has a well-thought-out supply strategy, it can lead to increased demand, as investors may perceive the asset as a valuable commodity. On the other hand, if a project has an excessive supply without a clear plan for distribution, it could lead to a dilution of value, causing potential investors to tread carefully.

To better illustrate the impact of supply and demand, consider the following table which highlights key factors:

| Factor | High Demand | Low Demand |

|---|---|---|

| Low Supply | Price Increases | Price Stabilizes or Decreases |

| High Supply | Price Stabilizes | Price Decreases |

Moreover, it’s essential to analyze the distribution strategy of the tokens. How are they being released into the market? Is there a vesting period for early investors? Are tokens being distributed through a fair launch or an initial coin offering (ICO)? These strategies can significantly affect the perceived value of the token and its long-term sustainability. For example, if too many tokens are released too quickly, it may flood the market and lead to a decrease in value.

Additionally, the incentives for holders are another aspect to consider. Many projects implement mechanisms such as staking rewards or yield farming to encourage users to hold onto their tokens rather than sell them immediately. This can create a more stable demand and help maintain or increase the token's value over time. If a project is offering attractive incentives, it can lead to a loyal community and a more robust market presence.

In conclusion, understanding supply and demand dynamics is not just an academic exercise; it’s a practical necessity for anyone looking to invest in cryptocurrency. By analyzing these factors, you can make more informed decisions and potentially identify projects that have a solid foundation for growth and sustainability. After all, in the fast-paced world of crypto, knowledge is power!

- What is the significance of supply and demand in cryptocurrency? Supply and demand dynamics determine the price and value of a cryptocurrency based on how many tokens are available versus how many people want to buy them.

- How does scarcity affect cryptocurrency value? Scarcity can drive demand and increase value. Projects with limited supply often attract more investors due to the perception of value.

- What role do incentives play in tokenomics? Incentives such as staking rewards encourage users to hold onto their tokens, stabilizing demand and potentially increasing value.

Incentives for Holders and Users

When diving into the world of cryptocurrency, one of the most crucial aspects to consider is the incentives offered to both holders and users of a project’s token. Why does this matter? Well, incentives act as the backbone of a project’s ecosystem, driving engagement, loyalty, and ultimately, the long-term success of the cryptocurrency. Imagine you’re part of a club that rewards you for simply being a member; that’s the essence of what strong incentives can do for a crypto project.

Incentives can come in various forms, and understanding these can help you gauge the attractiveness of a project. For instance, many projects implement staking rewards, where users can lock up their tokens for a specific period and earn additional tokens as a reward. This not only encourages users to hold onto their tokens rather than selling them off at the first opportunity but also contributes to the overall stability of the token’s price.

Moreover, some projects offer transaction fee discounts for users who pay fees using the project’s native token. This creates a win-win situation where users save money while simultaneously increasing the utility and demand for the token itself. It’s like getting a discount at your favorite store for using their loyalty card; the more you use it, the more benefits you reap.

Additionally, many projects incorporate governance tokens, which allow holders to participate in decision-making processes regarding the future of the project. This not only empowers users but also fosters a sense of community and belonging, as they feel their voices matter in shaping the project’s direction. Imagine being able to vote on the next big feature or upgrade—this level of involvement can significantly enhance user engagement.

Let’s take a closer look at some common types of incentives in the crypto space:

| Type of Incentive | Description |

|---|---|

| Staking Rewards | Users earn additional tokens by locking up their tokens for a certain period. |

| Transaction Fee Discounts | Discounts on transaction fees when using the native token for payments. |

| Governance Tokens | Tokens that grant holders voting rights on project decisions. |

| Referral Programs | Rewards for bringing new users to the platform, enhancing community growth. |

In conclusion, the incentives for holders and users are not just about financial gain; they are about creating an ecosystem where users feel valued and engaged. A project that prioritizes its community by offering attractive incentives is likely to foster loyalty and encourage long-term participation. As an investor, keeping an eye on these incentives can provide you with valuable insights into the project’s potential for growth and sustainability.

- What are staking rewards? Staking rewards are additional tokens earned by users who lock up their tokens for a certain period, contributing to network security and stability.

- How do transaction fee discounts work? Users can receive discounts on transaction fees by using the project's native token for payments, promoting the use of the token.

- What are governance tokens? Governance tokens allow holders to participate in decision-making processes, giving them a say in the project's future direction.

- Why are incentives important in crypto projects? Incentives encourage user engagement, loyalty, and help stabilize the token's value, contributing to the project's overall success.

Frequently Asked Questions

- What is a whitepaper and why is it important?

A whitepaper is a detailed document that outlines the purpose, technology, and roadmap of a cryptocurrency project. It serves as a foundational resource for potential investors, helping them understand the project's goals and plans. Analyzing the whitepaper is crucial for assessing the viability and potential success of the project.

- How can I evaluate the team behind a crypto project?

Evaluating the team involves researching the backgrounds of the founders and developers. Look into their educational qualifications, professional experience, and previous projects. A strong team with a proven track record in the crypto space can be a positive indicator of a project's potential for success.

- What should I look for in a project's technology?

When assessing a project's technology, review its technical documentation to understand its architecture and functionality. Compare it with existing solutions to identify its unique value proposition. Projects that demonstrate innovation and scalability are more likely to thrive in the competitive crypto landscape.

- What is tokenomics and why is it significant?

Tokenomics refers to the economic model that governs a cryptocurrency, including its supply, demand, and distribution. Understanding tokenomics is vital for evaluating a project's potential for growth and sustainability. Factors like scarcity, distribution strategy, and incentives for holders can significantly influence a token's value.

- How can I assess market demand for a crypto project?

To assess market demand, research the problem the project aims to solve and the audience it targets. Look for indicators of interest, such as community engagement and discussions in forums. A strong demand for the project's solution can drive adoption and enhance its chances of success.

- What are the signs of a trustworthy crypto team?

Trustworthy teams often have a strong online presence, positive community feedback, and active participation in discussions. Look for transparency in their communications and a willingness to engage with their audience. A reputable team is more likely to deliver on their project's promises.