How to Use Wallets for Cryptocurrency-backed Mortgages

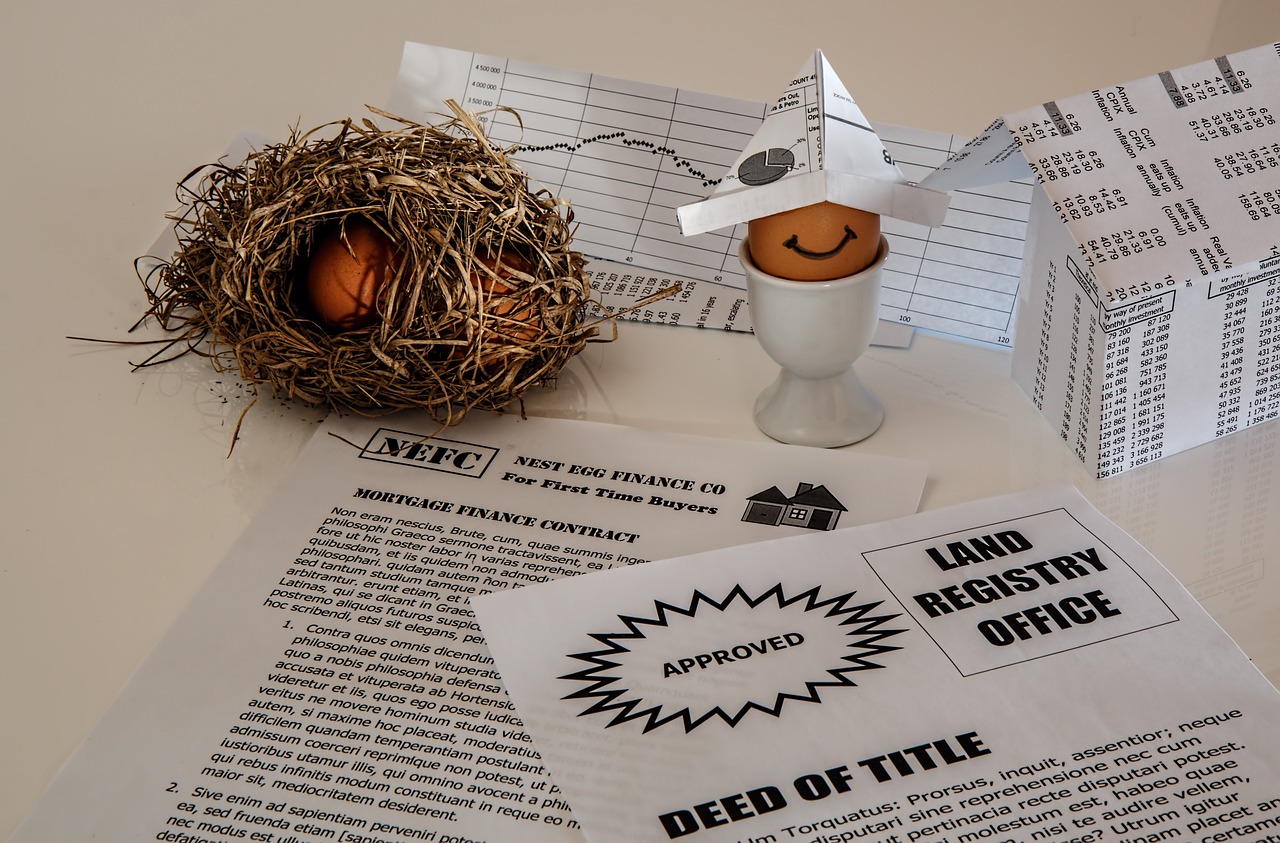

In recent years, the financial landscape has witnessed a dramatic shift, with cryptocurrency emerging as a formidable player in various sectors, including real estate. This article delves into the innovative approach of utilizing cryptocurrency wallets for securing mortgages, which not only revolutionizes the way we perceive home financing but also opens up a myriad of opportunities for both borrowers and lenders. Imagine being able to use your digital assets to purchase your dream home—sounds enticing, right? By the end of this article, you will understand how these wallets function, the benefits they offer, and the considerations you need to keep in mind as you navigate this evolving financial landscape.

Cryptocurrency-backed mortgages represent a groundbreaking financing option that allows borrowers to leverage their digital assets, such as Bitcoin or Ethereum, to secure a mortgage. Unlike traditional mortgage systems, where your credit score and income play pivotal roles, these innovative mortgages focus on the value of your cryptocurrency holdings. Imagine trading in your digital coins for a home; it’s like turning your virtual treasure into tangible assets! The potential advantages are numerous, including the ability to bypass some traditional banking hurdles, which can often feel like navigating a maze. With fewer barriers, tech-savvy borrowers can seize opportunities faster than ever before.

Selecting the appropriate wallet is crucial for managing your cryptocurrency assets effectively. There are several types of wallets available, each with its own set of features and implications for mortgage transactions. For instance, hardware wallets are physical devices that store your cryptocurrency offline, providing a high level of security. On the other hand, software wallets are applications that can be accessed via your computer or smartphone, offering convenience but potentially exposing you to security risks. Finally, custodial wallets are managed by third parties, which can simplify the process but may compromise your control over your assets. Understanding these options is essential to ensure that your mortgage transaction goes smoothly.

The advantages of using cryptocurrency wallets for mortgages are compelling. One of the most significant benefits is the potential for reduced transaction fees. Traditional mortgage processes often involve numerous intermediaries, each taking a cut of the transaction. In contrast, cryptocurrency transactions can be processed with lower fees, allowing you to save money in the long run. Additionally, the speed of transactions is another major advantage. While traditional mortgages can take weeks or even months to finalize, cryptocurrency transactions can often be completed in a matter of hours. This efficiency is particularly appealing for tech-savvy borrowers who value quick results.

However, it’s essential to acknowledge that using wallets for cryptocurrency-backed mortgages does come with its own set of risks. Market volatility is a significant concern; the value of cryptocurrencies can fluctuate wildly in a short period, potentially impacting your mortgage amount. Furthermore, regulatory concerns are also on the rise as governments around the world grapple with how to handle digital currencies. Borrowers should stay informed about the legal landscape and be prepared for potential changes that could affect their mortgage agreements. It’s a bit like walking a tightrope; you need to balance the rewards with the risks involved.

The process of applying for a cryptocurrency-backed mortgage can differ significantly from traditional methods. Generally, it involves a few key steps:

- Initial Consultation: Discuss your options with a lender familiar with cryptocurrency.

- Asset Evaluation: Provide documentation of your digital assets and their current value.

- Application Submission: Complete the necessary paperwork, which may include disclosures about the risks of cryptocurrency.

- Approval Process: The lender will review your application and assess the value of your assets.

- Closing: Once approved, you’ll finalize the mortgage agreement and receive the funds.

Understanding the legal landscape surrounding cryptocurrency-backed mortgages is essential for both borrowers and lenders. Regulations can vary significantly by jurisdiction, and it’s crucial to be aware of compliance issues that may arise. For instance, some regions may have strict rules governing the use of digital currencies in real estate transactions. Engaging with legal professionals who specialize in cryptocurrency can help navigate these complexities. It’s like having a map in uncharted territory; it guides you through potential pitfalls and ensures you stay on the right path.

When dealing with significant assets, ensuring the security of your cryptocurrency wallets is paramount. Best practices include employing encryption to protect your data and utilizing two-factor authentication for an added layer of security. Regularly updating your software and being cautious of phishing attempts can also safeguard your assets. Think of it as fortifying your castle; the more secure your defenses, the less likely you are to face unwanted intrusions.

As the financial landscape continues to evolve, cryptocurrency-backed mortgages are poised to gain traction. Emerging trends suggest that more lenders will begin to accept digital assets as collateral, making it easier for borrowers to access financing. Additionally, advancements in technology may streamline the mortgage application process even further, allowing for quicker approvals and reduced fees. It’s an exciting time for digital asset financing, and staying informed about these trends can help you navigate the future with confidence.

Q: Can I use any cryptocurrency for a mortgage?

A: Not all lenders accept every type of cryptocurrency. It's crucial to check with your lender about which digital assets they accept.

Q: What happens if the value of my cryptocurrency drops after I secure a mortgage?

A: Market volatility can impact your mortgage, so it's essential to understand the risks involved and discuss them with your lender.

Q: Are cryptocurrency-backed mortgages available worldwide?

A: Availability varies by region. Some countries have embraced cryptocurrency in real estate, while others remain cautious.

Understanding Cryptocurrency-backed Mortgages

Cryptocurrency-backed mortgages are revolutionizing the way we think about financing real estate. Imagine being able to use your digital assets, like Bitcoin or Ethereum, to secure a mortgage for your dream home. Sounds futuristic, right? But this innovative approach is becoming increasingly popular as more people recognize the potential of their cryptocurrencies. Essentially, these mortgages allow borrowers to leverage their digital currencies as collateral, providing a unique alternative to traditional mortgage systems that rely solely on fiat currency and credit scores.

So, what exactly does that mean for you? Well, for starters, it opens up a whole new world of possibilities for tech-savvy individuals who have invested in cryptocurrencies. Rather than liquidating your assets and facing potential tax implications, you can use them to secure a loan. This not only preserves your investment but also allows you to take advantage of rising property values while maintaining your position in the crypto market.

One of the biggest advantages of cryptocurrency-backed mortgages is the potential for faster approval times. Traditional mortgage processes can be lengthy and cumbersome, often taking weeks or even months to finalize. In contrast, many lenders offering crypto mortgages can streamline the process significantly, thanks to the digital nature of the assets involved. This means you could potentially close on a property much quicker than you would with a conventional loan.

Additionally, the transaction fees associated with cryptocurrency transactions can be lower than those tied to traditional banking systems. This can save you money in the long run, making it an appealing option for those looking to minimize costs. However, it's essential to do your homework and understand the specific terms and conditions of any mortgage agreement, as they can vary widely between lenders.

Of course, like any financial product, cryptocurrency-backed mortgages come with their own set of challenges and risks. Market volatility is a significant concern; the value of cryptocurrencies can fluctuate dramatically within short periods, which could impact the collateral value of your assets. Moreover, the regulatory landscape surrounding cryptocurrencies is still evolving, and potential changes in laws could affect your mortgage agreement.

In summary, cryptocurrency-backed mortgages represent a fascinating intersection of digital finance and real estate. They offer unique benefits that traditional mortgages simply can't match, but they also require careful consideration and understanding of the risks involved. As this innovative financing option continues to gain traction, it’s crucial for both borrowers and lenders to stay informed and navigate this exciting new terrain wisely.

Choosing the Right Wallet

When it comes to leveraging your digital assets for a cryptocurrency-backed mortgage, choosing the right wallet is a crucial step that can significantly impact your experience. Just like you wouldn't store your cash in an unsafe place, the same principle applies to your cryptocurrency. With various options available, understanding the differences between wallets can help you make an informed decision that aligns with your financial goals.

There are primarily three types of wallets to consider: hardware wallets, software wallets, and custodial wallets. Each type has its own unique features, benefits, and potential drawbacks. Let’s break these down to give you a clearer picture:

| Wallet Type | Description | Pros | Cons |

|---|---|---|---|

| Hardware Wallet | A physical device that securely stores your cryptocurrency offline. |

|

Costly and less convenient for frequent transactions. |

| Software Wallet | A digital application that can be installed on your computer or smartphone. |

|

More vulnerable to cyber attacks compared to hardware wallets. |

| Custodial Wallet | A wallet managed by a third party, such as an exchange. |

|

Less control over your private keys and potential regulatory issues. |

As you can see, each wallet type serves different needs. If you’re looking for maximum security and don’t mind a bit of extra effort, a hardware wallet might be the way to go. On the other hand, if you prefer convenience and ease of access, a software or custodial wallet could be more suitable. Think about how you plan to use your cryptocurrency. Will you be making frequent transactions, or are you more focused on long-term storage? This consideration can guide your choice.

Another essential factor to consider is the security features of the wallet. Look for wallets that offer two-factor authentication, encryption, and regular software updates. These features can significantly enhance the security of your assets. After all, in the world of cryptocurrency, it’s better to be safe than sorry!

Ultimately, the right wallet for your cryptocurrency-backed mortgage is one that aligns with your personal needs, risk tolerance, and how actively you plan to use your digital assets. Take your time to research and perhaps even test a few options before making a decision. Remember, this isn’t just about storing digital currency; it’s about securing your financial future.

Benefits of Using Wallets for Mortgages

In the world of finance, innovation often leads to new opportunities, and when it comes to mortgages, using cryptocurrency wallets is paving the way for a revolutionary approach. Imagine being able to secure a mortgage using digital assets, which not only streamlines the process but also offers a plethora of benefits. One of the standout advantages is reduced transaction fees. Traditional mortgage processes can be riddled with various fees, from application to closing costs. However, with cryptocurrency transactions, these fees can be significantly lower, allowing borrowers to save money that can be better utilized elsewhere.

Another compelling benefit is the speed of transactions. In a typical mortgage scenario, waiting for approvals and processing can feel like watching paint dry. But with cryptocurrency wallets, transactions can be executed almost instantly. This rapid processing time is particularly appealing for tech-savvy borrowers who value efficiency and want to avoid the drawn-out timelines often associated with traditional banks.

Moreover, cryptocurrency-backed mortgages open up opportunities for greater accessibility. Many potential homeowners face barriers when trying to secure traditional loans, such as credit history or income verification issues. However, using digital assets as collateral can bypass some of these hurdles, making homeownership more attainable for a wider audience. For instance, if you have substantial cryptocurrency holdings, you can leverage them to secure a mortgage without the typical scrutiny of your financial history.

Additionally, the transparency offered by blockchain technology is a game-changer. With every transaction recorded on a public ledger, both lenders and borrowers can enjoy a level of trust and security that is often lacking in traditional finance. This transparency helps in reducing fraud and ensures that all parties are on the same page regarding the terms of the mortgage.

It's also worth mentioning that the potential for investment growth is an enticing factor for many borrowers. By using cryptocurrency to secure a mortgage, homeowners can hold onto their digital assets while simultaneously investing in real estate. This dual investment strategy can lead to significant financial gains, as both the real estate market and cryptocurrency markets have the potential for appreciation.

Lastly, let’s not overlook the flexibility that comes with cryptocurrency wallets. Many wallets allow for easy management and movement of funds, giving borrowers the ability to adjust their investments or make payments quickly. This flexibility is particularly beneficial in a fluctuating market where timing can significantly impact financial decisions.

In summary, the benefits of using wallets for mortgages are numerous and varied. From reduced fees and faster processing times to greater accessibility and enhanced transparency, this innovative approach is transforming how we think about home financing. As more people become aware of these advantages, the adoption of cryptocurrency-backed mortgages is likely to rise, making it an exciting space to watch in the coming years.

- What is a cryptocurrency-backed mortgage? A cryptocurrency-backed mortgage allows borrowers to use their digital assets as collateral to secure a loan for purchasing real estate.

- How do transaction fees compare between traditional and cryptocurrency mortgages? Typically, transaction fees for cryptocurrency mortgages are lower than those associated with traditional mortgages, which can include various fees throughout the process.

- Can anyone apply for a cryptocurrency-backed mortgage? Yes, but eligibility may vary based on the lender's requirements and the type of digital assets you hold.

- What are the risks involved? Risks include market volatility of cryptocurrencies and regulatory uncertainties that could impact the mortgage process.

Risks and Challenges

When diving into the world of cryptocurrency-backed mortgages, it’s essential to understand that while the opportunities are exciting, there are also significant involved. Just like navigating a boat through stormy waters, you need to be prepared for the waves that might come your way. One of the most pressing concerns is market volatility. Cryptocurrencies are notorious for their price fluctuations. Imagine buying a house today, only to find that the value of your digital assets has plummeted by the time you finish the mortgage process. This volatility can lead to situations where borrowers find themselves owing more than their collateral is worth, making it a risky endeavor.

Another challenge is the regulatory landscape. The laws governing cryptocurrency are still evolving, and this can create uncertainty for both borrowers and lenders. For instance, some jurisdictions may impose strict regulations on how cryptocurrencies can be used in financial transactions, including mortgages. This can complicate the process and may even lead to legal hurdles that could delay or derail the mortgage application.

Additionally, the security of digital wallets cannot be overlooked. While cryptocurrencies offer a modern approach to finance, they also come with unique security challenges. Cybersecurity threats, such as hacking and phishing attacks, are real dangers that can result in the loss of significant assets. Borrowers must take extensive measures to secure their wallets, which can be an added burden in an already complicated process.

Moreover, there is the issue of liquidity. Unlike traditional assets, cryptocurrencies can sometimes be challenging to convert into cash quickly. This can pose a problem if a borrower needs to access funds for mortgage payments or other expenses. If the market is down, they may find themselves in a tight spot, unable to liquidate their assets without incurring substantial losses.

Lastly, it’s crucial to consider the educational gap that exists in the market. Many potential borrowers may not fully understand how cryptocurrency mortgages work, leading to poor decision-making. This lack of knowledge can result in individuals entering into agreements that are not in their best interest, further complicating the landscape.

In summary, while cryptocurrency-backed mortgages offer an innovative financing option, they come with their own set of risks and challenges. From market volatility and regulatory uncertainties to security concerns and liquidity issues, borrowers must tread carefully. Being informed and prepared can make all the difference in successfully navigating this new financial frontier.

- What is a cryptocurrency-backed mortgage? A mortgage that uses digital assets as collateral instead of traditional forms of collateral like cash or real estate.

- What are the main risks associated with cryptocurrency mortgages? Risks include market volatility, regulatory issues, security threats, liquidity challenges, and a general lack of understanding among borrowers.

- How can I secure my cryptocurrency wallet? Utilize strong passwords, enable two-factor authentication, and consider using hardware wallets for added security.

- Are cryptocurrency-backed mortgages legal? Yes, but the legality varies by jurisdiction, and it’s essential to understand the regulations in your area.

The Mortgage Application Process

Applying for a cryptocurrency-backed mortgage can feel like stepping into a new world, especially if you're used to traditional financing methods. The process is not only different but also offers a unique set of opportunities and challenges. So, how do you navigate this innovative landscape? Let’s break it down step by step.

First and foremost, it's essential to understand that the mortgage application process for cryptocurrency-backed loans typically begins with a thorough assessment of your digital assets. Lenders will want to know the value of your cryptocurrency holdings, as these will be used as collateral. This is where your choice of a wallet becomes crucial. A secure and reliable wallet not only protects your assets but also facilitates easier valuation and verification. You'll need to provide documentation that proves ownership and value, which can often be done through your wallet's transaction history.

Once you have your digital assets in order, the next step is to find a lender that specializes in cryptocurrency-backed mortgages. Not all lenders are on board with this innovative financing method, so doing your homework is vital. Look for institutions that have experience in handling digital currencies and understand the nuances of the market. After you’ve identified potential lenders, you can initiate the application process. This typically involves filling out an application form, which may ask for personal information, financial history, and details about the property you wish to purchase.

After submitting your application, the lender will conduct a due diligence process. This is where they evaluate your financial health and the value of the cryptocurrency assets you’re using as collateral. Unlike traditional mortgages, where extensive paperwork can bog down the process, cryptocurrency-backed mortgages often streamline this phase. Many lenders utilize advanced technology to quickly assess the value of your digital assets, which can expedite the approval process significantly.

Once your application is approved, the lender will provide you with a loan offer. This is where you can review the terms and conditions, including interest rates and repayment schedules. Be sure to read the fine print, as the terms for cryptocurrency-backed mortgages can differ from traditional loans. If everything looks good, you can proceed to finalize the loan agreement.

Finally, after signing the agreement, the funds will be transferred, and the mortgage will be secured against your cryptocurrency assets. This might involve transferring a portion of your digital assets to a custodial wallet controlled by the lender, which acts as collateral for the loan. It's crucial to understand the implications of this step, as it ties up your assets until the mortgage is paid off.

In summary, while the mortgage application process for cryptocurrency-backed loans may seem daunting at first, it offers an exciting opportunity to leverage your digital assets. By understanding the steps involved and choosing the right lender, you can navigate this process smoothly. Remember, the key is to stay informed and proactive throughout your journey.

- What types of cryptocurrencies can be used for a mortgage? Most lenders will accept popular cryptocurrencies like Bitcoin and Ethereum, but it's essential to check with your lender for specific requirements.

- How is the value of my cryptocurrency determined? Lenders typically use real-time market data to assess the value of your digital assets at the time of the application.

- What happens if the value of my cryptocurrency drops? If your collateral value significantly decreases, lenders may require additional collateral or even liquidate your assets to cover the loan.

Legal Considerations

When diving into the world of cryptocurrency-backed mortgages, it's crucial to understand the legal landscape that surrounds this innovative financing option. Unlike traditional mortgages, which are well-established within the legal framework, cryptocurrency-backed mortgages are still navigating uncharted waters. This means that both borrowers and lenders need to be particularly vigilant about the laws and regulations that apply to digital assets.

One of the primary legal considerations involves regulatory compliance. Different jurisdictions have varying rules regarding the use of cryptocurrencies, and these can affect how mortgages are structured and executed. For instance, some countries may classify cryptocurrency as an asset, while others might treat it as currency. This classification can significantly impact taxation, reporting requirements, and the overall legality of using digital assets in mortgage transactions. It's essential for both parties to consult with legal experts who specialize in cryptocurrency to ensure they are compliant with local laws.

Additionally, contractual agreements play a vital role in cryptocurrency-backed mortgages. The terms of the mortgage must be clearly defined, including how the digital assets will be valued, the process for liquidation if necessary, and the rights and responsibilities of both the borrower and lender. In many cases, traditional mortgage contracts may not adequately address the unique aspects of cryptocurrency, necessitating the creation of customized agreements that cater to the specifics of the transaction.

Another critical aspect to consider is consumer protection laws. Borrowers should be aware of their rights and protections under the law when dealing with cryptocurrency-backed mortgages. Given the volatile nature of digital assets, there may be additional risks involved, and understanding these risks is paramount. For example, if the value of the cryptocurrency falls significantly after securing the mortgage, borrowers need to know what recourse they have. It's advisable to include clauses in the mortgage agreement that outline how such scenarios will be handled.

Moreover, dispute resolution mechanisms should be clearly outlined in the mortgage contracts. In the event of a disagreement, having a predefined process can save both parties time and money. Whether it involves mediation, arbitration, or going through the courts, understanding how disputes will be resolved is essential for a smooth transaction.

In summary, navigating the legal considerations of cryptocurrency-backed mortgages requires thorough research and professional guidance. As this sector continues to evolve, staying informed about changes in regulations and best practices will be crucial for both borrowers and lenders who wish to leverage the benefits of digital assets in their mortgage agreements.

- What are the main legal risks associated with cryptocurrency-backed mortgages? Legal risks include regulatory compliance issues, potential disputes over contract terms, and consumer protection concerns.

- Do I need a lawyer for a cryptocurrency-backed mortgage? Yes, it's highly recommended to consult a legal expert familiar with cryptocurrency laws to ensure compliance and protect your interests.

- How can I ensure my rights are protected when using cryptocurrency for a mortgage? Make sure to have a well-drafted contract that outlines your rights, obligations, and dispute resolution processes.

Security Measures for Wallets

When it comes to managing your cryptocurrency assets, security should be your top priority. Just like you wouldn't leave your house unlocked, you shouldn't leave your digital wallet vulnerable to potential threats. The world of cryptocurrency is full of opportunities, but it also comes with its fair share of risks. So, how can you ensure that your assets remain safe and sound? Let's dive into some essential security measures that every cryptocurrency wallet user should consider.

First and foremost, encryption is a fundamental aspect of wallet security. Most reputable wallets employ encryption techniques to protect your private keys, which are crucial for accessing your funds. Think of your private key as the key to your treasure chest; if someone gets hold of it, they can access everything inside. Therefore, always choose wallets that offer strong encryption standards, and never share your private key with anyone.

In addition to encryption, enabling two-factor authentication (2FA) adds an extra layer of security. This feature requires you to provide two forms of identification before accessing your wallet. For instance, after entering your password, you might also need to input a code sent to your phone. This way, even if someone manages to steal your password, they won't be able to access your wallet without that second factor. It's like having a double lock on your door—one lock alone isn't enough.

Another important aspect is to keep your software up to date. Just as you would update your phone or computer to protect against vulnerabilities, regularly updating your wallet software ensures that you have the latest security patches. Cybercriminals are constantly evolving their tactics, so staying ahead by keeping your software current is crucial. Additionally, always download wallets from official sources to avoid malicious software.

For those holding significant amounts of cryptocurrency, considering a hardware wallet can be a wise choice. Unlike software wallets, hardware wallets store your private keys offline, making them less susceptible to hacking attempts. These devices are like a safe deposit box for your digital assets, providing a high level of security while allowing you to access your funds when needed.

Lastly, always be aware of phishing attempts. Cybercriminals often try to trick users into providing their sensitive information through fake websites or emails. Be cautious of unsolicited communications and double-check URLs before entering any personal information. It's essential to stay vigilant, as a moment of carelessness can lead to significant losses.

To summarize, here are some key security measures to keep your cryptocurrency wallet safe:

- Use strong encryption for your wallet.

- Enable two-factor authentication to add an extra layer of protection.

- Keep your wallet software up to date.

- Consider using a hardware wallet for enhanced security.

- Be vigilant against phishing attempts and suspicious communications.

By implementing these security measures, you can significantly reduce the risks associated with cryptocurrency wallets. Remember, in the digital world, being proactive about security is the best defense against potential threats.

Q1: What is the safest type of wallet for cryptocurrency?

A1: Hardware wallets are generally considered the safest option because they store your private keys offline, making them less vulnerable to hacking.

Q2: How often should I update my wallet software?

A2: You should update your wallet software as soon as updates are available to ensure you have the latest security features and patches.

Q3: What should I do if I suspect my wallet has been compromised?

A3: If you suspect a breach, immediately transfer your assets to a new wallet and change your passwords. Contact your wallet provider for further assistance.

Q4: Is two-factor authentication necessary?

A4: Yes, two-factor authentication adds an essential layer of security and is highly recommended for all cryptocurrency wallets.

Q5: Can I recover my funds if I lose access to my wallet?

A5: Recovery depends on the type of wallet you are using. Many wallets provide recovery phrases that can help you regain access, but if you lose this phrase, you may permanently lose your funds.

Future Trends in Cryptocurrency Mortgages

The world of cryptocurrency-backed mortgages is evolving at lightning speed, and if you're not paying attention, you might just miss the next big wave. As digital currencies become more mainstream, the way we think about financing homes is also changing. Imagine a future where securing a mortgage could be as simple as sending a text message. This isn't just a dream; it's on the horizon. So, what are the trends that are shaping this innovative landscape? Let's dive in!

First off, one of the most exciting trends is the increasing acceptance of decentralized finance (DeFi) platforms. These platforms allow borrowers to bypass traditional banks, cutting out the middleman and reducing costs significantly. Instead of dealing with a lengthy approval process, borrowers can get instant access to funds by leveraging their crypto assets directly. This shift is not just about convenience; it's about empowerment. Borrowers can take control of their financial futures without being tied to the rigid structures of conventional banking.

Another trend that’s gaining traction is the integration of smart contracts in mortgage agreements. These self-executing contracts with the terms of the agreement directly written into code could revolutionize how we think about property transactions. Imagine a scenario where once the conditions are met (like a payment being made), the contract executes automatically, transferring ownership without the need for extensive paperwork or legal fees. This technology not only speeds up the process but also enhances transparency and reduces the risk of fraud.

Moreover, as the regulatory landscape continues to evolve, we can expect more clarity around cryptocurrency mortgages. Governments and financial institutions are starting to recognize the potential of digital assets, and with that recognition comes the need for regulation. This could lead to more robust frameworks that protect both borrowers and lenders, making the market more stable and trustworthy. A clear regulatory environment could also encourage traditional banks to offer crypto-backed mortgage products, further integrating digital currencies into mainstream finance.

Additionally, we are likely to see an increase in cross-border mortgage options. With cryptocurrency, geographical boundaries become less significant. Borrowers could potentially secure a mortgage in one country while living in another, making it easier for expatriates and international investors to navigate the property market. This trend could open up new opportunities for investors looking to diversify their portfolios globally.

Finally, the rise of digital wallets is set to revolutionize how we manage our assets. As more people become crypto-savvy, the demand for user-friendly wallets that can handle mortgage transactions securely will increase. Wallets equipped with advanced security features, such as biometric authentication and multi-signature capabilities, will become the norm, providing peace of mind for borrowers. The future of cryptocurrency mortgages may very well hinge on how effectively these wallets can integrate with lending platforms.

In conclusion, the future of cryptocurrency-backed mortgages is not just about technology; it's about creating a new financial ecosystem that is more accessible, efficient, and transparent. As we stand on the brink of this transformation, it’s essential for both borrowers and lenders to stay informed and adapt to these trends. The opportunities are vast, and those who embrace them early on could find themselves at the forefront of a financial revolution.

- What are cryptocurrency-backed mortgages? These are mortgages where the borrower leverages their digital assets as collateral to secure a loan.

- How do smart contracts work in mortgages? Smart contracts automate the execution of mortgage agreements, ensuring that terms are fulfilled without the need for intermediaries.

- Are cryptocurrency mortgages safe? While they offer unique benefits, borrowers should be aware of market volatility and regulatory risks.

- Can I use cryptocurrency to buy a house directly? Yes, some sellers accept cryptocurrencies as payment, but this varies by location and seller preference.

Frequently Asked Questions

- What is a cryptocurrency-backed mortgage?

A cryptocurrency-backed mortgage allows borrowers to use their digital assets as collateral to secure a loan for purchasing property. This innovative financing option provides an alternative to traditional mortgages, enabling tech-savvy individuals to leverage their cryptocurrency holdings.

- How do I choose the right wallet for my cryptocurrency?

Selecting the right wallet is crucial for managing your digital assets. You can choose from various types, including hardware wallets for offline storage, software wallets for ease of access, or custodial wallets where a third party manages your assets. Consider factors like security, convenience, and compatibility with your cryptocurrency when making your choice.

- What are the benefits of using cryptocurrency wallets for mortgages?

Using cryptocurrency wallets for mortgages can significantly reduce transaction fees and processing times. This streamlined approach appeals to borrowers who want to avoid the lengthy and often costly processes associated with traditional mortgage systems. Plus, it offers greater flexibility and control over your assets.

- What risks should I be aware of when using cryptocurrency-backed mortgages?

While there are many advantages, using cryptocurrency-backed mortgages comes with risks, including market volatility and regulatory uncertainties. The value of cryptocurrencies can fluctuate dramatically, which might impact your collateral. It's essential to stay informed about these factors before proceeding.

- What does the mortgage application process look like for cryptocurrency-backed loans?

The application process for a cryptocurrency-backed mortgage differs from traditional methods. Generally, it involves submitting your digital asset information, undergoing a valuation process, and completing the necessary documentation. Being prepared and understanding the specific requirements can make this process smoother.

- Are there legal considerations I need to know about?

Yes, understanding the legal landscape surrounding cryptocurrency-backed mortgages is vital. Regulations can vary by region, and compliance with local laws is essential for both lenders and borrowers. Consulting with a legal expert in cryptocurrency can help you navigate these complexities.

- How can I ensure the security of my cryptocurrency wallet?

To secure your cryptocurrency wallet, implement best practices such as using strong passwords, enabling two-factor authentication, and keeping your private keys confidential. Regularly updating your wallet software and being cautious of phishing attempts can also help protect your assets.

- What are the future trends in cryptocurrency mortgages?

The future of cryptocurrency-backed mortgages looks promising, with more lenders entering the market and technology evolving. As digital asset financing becomes more mainstream, we can expect innovations in loan products and greater acceptance of cryptocurrencies in the real estate sector.