Using Analytics Tools for Better Trading Insights

In the fast-paced world of trading, having the right information at your fingertips can be the difference between a successful trade and a costly mistake. Analytics tools have emerged as essential companions for traders, offering insights that can significantly enhance trading strategies. Imagine navigating through a stormy sea without a compass—this is what trading without analytics feels like. By leveraging data-driven insights, traders can make more informed decisions, minimize risks, and ultimately improve their investment outcomes.

These tools provide a window into the market's behavior, allowing traders to identify trends, spot opportunities, and react quickly to changes. Whether you're a seasoned trader or just starting, understanding how to utilize analytics tools can elevate your trading game to new heights. In this article, we’ll explore the importance of data in trading, the various types of analytics tools available, and how to integrate these tools into your trading strategies for maximum effectiveness.

Data is the lifeblood of trading. In an environment where every second counts, having access to accurate and timely information can make or break a trade. By analyzing data, traders can uncover patterns and correlations that inform their decision-making process. Think of data as a treasure map; without it, you’re wandering aimlessly, but with it, you can pinpoint the best opportunities. Accurate data analysis minimizes risks by allowing traders to make decisions based on historical performance and market conditions, rather than gut feelings or speculation.

Moreover, the ability to analyze data effectively can lead to maximizing returns. Traders who embrace analytics tools can identify entry and exit points with greater precision, aligning their trades with market trends. This proactive approach not only increases the chances of successful trades but also builds confidence in trading strategies. In essence, understanding data is not just an advantage; it’s a necessity in today’s trading landscape.

There’s a plethora of analytics tools available for traders, each serving unique functions that can enhance trading strategies. These tools can be broadly categorized into two main types: Technical Analysis Tools and Fundamental Analysis Tools. Each category offers distinct functionalities that cater to different trading styles and objectives.

Technical analysis tools are designed to help traders analyze price movements and market trends. They provide insights into market behavior, enabling traders to make predictions about future price movements. Some of the most popular technical analysis tools include:

- Charting Software: This software provides visual representations of market data, allowing traders to see price movements over time. The ability to visualize data makes it easier to spot trends and patterns that may not be apparent in raw data.

- Indicators and Oscillators: These are mathematical calculations based on price and volume that help traders identify market signals. They play a vital role in technical analysis, guiding traders in making informed decisions.

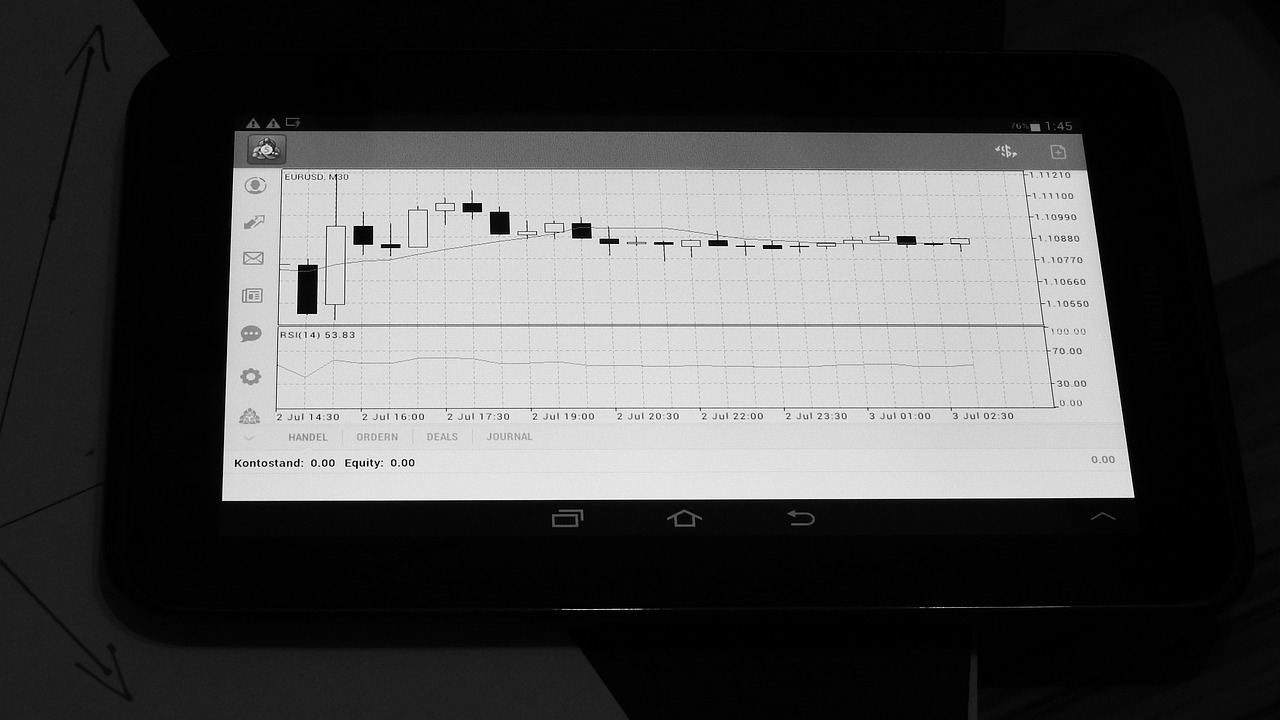

Charting software is an invaluable tool for traders, offering a graphical representation of historical price data. By utilizing various chart types—such as line charts, bar charts, and candlestick charts—traders can analyze price movements, identify support and resistance levels, and spot potential reversal points. The features of charting software often include:

- Customizable time frames

- Technical indicators integration

- Drawing tools for trend lines and patterns

Using charting software effectively can lead to more strategic trading decisions, as it allows traders to visualize their strategies in action.

Indicators and oscillators are essential components of technical analysis. They assist traders in interpreting market conditions and making informed decisions based on market signals. Some common indicators include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). These tools help traders understand whether a market is overbought or oversold, indicating potential entry or exit points.

On the other hand, fundamental analysis tools focus on economic data and company performance. These tools are crucial for traders who prefer a long-term trading strategy. By analyzing factors such as earnings reports, economic indicators, and market news, traders can gain a deeper understanding of a company's potential and the overall market landscape. This comprehensive approach helps in making informed decisions that align with long-term investment goals.

Integrating analytics tools into your trading strategies can significantly enhance performance. It’s like adding a turbocharger to your car; it doesn’t just improve speed but also makes your journey smoother. One effective method for combining data analysis with trading plans is through real-time data monitoring. This allows traders to react swiftly to market changes and capitalize on emerging opportunities.

Real-time data monitoring is essential for traders who want to stay ahead of the game. With tools that provide live updates on market conditions, traders can make quick decisions based on the latest information. This capability is crucial in volatile markets where prices can change rapidly. Imagine trying to catch a wave; if you’re not paying attention, you’ll miss the perfect moment. Real-time data ensures you’re always ready to ride the wave of opportunity.

Backtesting allows traders to evaluate their strategies against historical data. This process is vital for refining and validating trading approaches. By simulating trades based on past market conditions, traders can assess the effectiveness of their strategies and make necessary adjustments. It’s like rehearsing for a performance; the more you practice, the better you get. Backtesting not only builds confidence in your trading strategy but also helps identify potential pitfalls before they become costly mistakes.

1. What are analytics tools in trading?

Analytics tools in trading are software applications that help traders analyze market data to make informed decisions. They include technical analysis tools, fundamental analysis tools, and real-time data monitoring systems.

2. How do I choose the right analytics tool?

Choosing the right analytics tool depends on your trading style and objectives. Consider factors such as ease of use, the type of analysis you want to perform, and the specific features that align with your trading strategy.

3. Can I use analytics tools for day trading?

Absolutely! Many analytics tools are specifically designed for day trading, providing real-time data and technical indicators that are crucial for making quick trading decisions.

4. Is backtesting necessary for all traders?

While not mandatory, backtesting is highly recommended for traders looking to refine their strategies. It helps identify strengths and weaknesses in your approach based on historical data.

The Importance of Data in Trading

In the fast-paced world of trading, data is king. Without accurate and timely information, traders are like ships lost at sea, navigating through uncertainty. The role of data in trading is not just important; it’s absolutely crucial. Traders who leverage data effectively can make informed decisions that minimize risks and maximize returns. It’s as if they have a secret map guiding them through the tumultuous waters of the financial markets.

When we talk about data in trading, we’re referring to a vast ocean of information, including market trends, economic indicators, and company performance metrics. The ability to analyze this data can be the difference between a successful trade and a costly mistake. For instance, consider two traders: one relies solely on gut feelings and hearsay, while the other meticulously analyzes data from various sources. Who do you think is more likely to succeed? The answer is clear.

Moreover, the importance of data extends beyond just making trades. It involves understanding the market dynamics and the underlying factors that drive price movements. This knowledge allows traders to anticipate changes and react accordingly. For example, a sudden shift in economic policy can send shockwaves through the market, and those equipped with the right data can capitalize on such events. Here’s a quick breakdown of how data impacts trading decisions:

- Risk Management: Accurate data helps traders identify potential risks and set appropriate stop-loss orders.

- Trend Analysis: By analyzing historical data, traders can identify patterns and trends that inform their strategies.

- Performance Evaluation: Data allows traders to review their past trades, helping them learn from mistakes and successes.

Furthermore, in an age where information is readily available, the challenge lies in distinguishing between valuable insights and noise. Traders must develop a keen eye for what data is relevant to their strategies. This is where analytics tools come into play, providing the means to sift through vast amounts of information and extract actionable insights. Think of these tools as your personal data assistants, helping you navigate the complex landscape of trading.

In conclusion, the importance of data in trading cannot be overstated. It is the backbone of informed decision-making and strategic planning. Traders who harness the power of data are not just surviving; they are thriving in a competitive environment. So, if you’re serious about trading, start treating data with the respect it deserves—it could very well be your ticket to success.

Types of Analytics Tools

When it comes to trading, having the right analytics tools at your disposal can make all the difference. These tools are designed to help traders analyze vast amounts of data, identify trends, and make informed decisions that can significantly impact their investment outcomes. The world of trading is complex, and without the right tools, navigating through it can feel like trying to find your way through a maze blindfolded. So, let’s dive into the various types of analytics tools available to traders and how they can be leveraged for better trading strategies.

Analytics tools can generally be categorized into two main types: technical analysis tools and fundamental analysis tools. Each category serves a unique purpose and offers distinct functionalities that cater to different trading styles. Understanding these tools is crucial for any trader looking to enhance their performance.

Technical analysis tools are primarily focused on price movements and market trends. They provide traders with the necessary insights to predict future market behavior based on historical data. Imagine trying to forecast the weather without any data; it would be nearly impossible! Similarly, technical analysis tools equip traders with the data they need to make educated guesses about where the market might head next.

One of the most popular types of technical analysis tools is charting software. This software allows traders to visualize market data in various formats, such as line charts, bar charts, and candlestick charts. Each of these formats has its unique advantages, helping traders to identify patterns and trends more easily. For instance, candlestick charts can reveal crucial information about market sentiment at specific price points, making them invaluable for short-term traders. The benefits of using charting tools include:

- Enhanced visualization of data

- Ability to spot trends quickly

- Customizable indicators for personal trading strategies

Indicators and oscillators are another essential component of technical analysis. These tools help traders analyze market signals and make decisions based on quantitative data. Popular indicators like the Moving Average and the Relative Strength Index (RSI) provide insights into market momentum and potential reversals. Think of these indicators as your trading compass, guiding you through the often turbulent waters of market fluctuations. By utilizing these tools, traders can:

- Identify overbought or oversold conditions

- Determine entry and exit points

- Assess market momentum

On the flip side, we have fundamental analysis tools that focus on economic data and company performance. These tools are particularly useful for traders who prefer a long-term approach to investing. By analyzing financial statements, economic indicators, and news releases, traders can gain a deeper understanding of the factors driving market movements. For instance, a sudden change in interest rates can significantly impact stock prices, and having the right tools to analyze such data can lead to more informed trading decisions.

In summary, both technical and fundamental analysis tools play a vital role in enhancing trading strategies. By utilizing a combination of these tools, traders can gain a comprehensive view of the market, enabling them to make decisions that are not just based on gut feelings but are backed by solid data. As we move forward in this article, we'll explore how to integrate these analytics tools into your trading strategies for optimal performance.

Q1: What are the best analytics tools for beginners?

A1: Beginners may find tools like TradingView for charting and Yahoo Finance for fundamental analysis to be user-friendly and effective.

Q2: How can I determine which analytics tool is right for me?

A2: It depends on your trading style; if you prefer short-term trading, technical analysis tools may be more beneficial, while long-term investors should focus on fundamental analysis tools.

Q3: Are there free analytics tools available?

A3: Yes, many platforms offer free versions of their analytics tools, although premium features may require a subscription.

Technical Analysis Tools

When it comes to trading, are like a compass for a sailor navigating through turbulent waters. These tools empower traders to analyze historical price movements, identify trends, and make predictions about future market behavior. By using various indicators and charting software, traders can gain insights that are crucial for making informed decisions. Imagine trying to find your way in a dense fog without a map; that's what trading without these tools feels like!

Among the most popular technical analysis tools are charting software and various indicators. Charting software allows traders to visualize price movements over different time frames. This visual representation helps in spotting patterns and trends that might not be immediately obvious through raw data. For instance, a trader might notice a head and shoulders pattern on a chart, signaling a potential reversal in the market. This kind of insight can be pivotal in deciding when to enter or exit a trade.

In addition to charting software, traders often rely on indicators and oscillators. These tools analyze price data and provide signals that can indicate whether a market is overbought or oversold. Common indicators include the Relative Strength Index (RSI), Moving Averages, and Bollinger Bands. Each of these tools serves a distinct purpose:

- Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions.

- Moving Averages: Smooth out price data to identify the direction of the trend over a specific period.

- Bollinger Bands: Use standard deviations to show volatility and potential price levels of support or resistance.

By combining these tools, traders can create a robust trading strategy. For example, a trader might use moving averages to identify the overall trend and then apply the RSI to time their entries and exits more effectively. This synergy between different technical analysis tools can significantly enhance a trader's ability to make sound decisions.

However, it's essential to remember that no tool is foolproof. The market can be unpredictable, and relying solely on technical indicators without considering broader market conditions can lead to poor decisions. Thus, successful traders often blend technical analysis with other forms of analysis, such as fundamental analysis, to create a more comprehensive trading strategy.

In conclusion, technical analysis tools are invaluable for traders looking to navigate the complexities of the market. By leveraging charting software and indicators, traders can gain deeper insights into price movements, identify trends, and make more informed trading decisions.

Q1: What is the best technical analysis tool for beginners?

A1: For beginners, starting with basic charting software and familiarizing themselves with simple indicators like Moving Averages and RSI can be beneficial. These tools provide a solid foundation for understanding market trends.

Q2: Can technical analysis guarantee profits?

A2: No, while technical analysis can enhance decision-making, it does not guarantee profits. Markets can be volatile and influenced by various factors, including economic news and geopolitical events.

Q3: How often should I analyze charts?

A3: The frequency of chart analysis depends on your trading style. Day traders may analyze charts multiple times a day, while swing traders might do so on a daily or weekly basis.

Charting Software

Charting software is an essential tool for traders, providing visual representations of market data that can significantly enhance decision-making processes. Imagine trying to navigate a vast ocean without a map; that's what trading without proper charting tools feels like. These software applications allow traders to visualize price movements, trends, and patterns over time, making it easier to identify potential trading opportunities. With the right charting software, you can turn complex data into understandable visuals that tell a story about market behavior.

One of the standout features of charting software is its ability to offer a variety of chart types, including line charts, bar charts, and candlestick charts. Each type serves a different purpose and can provide unique insights. For instance, a candlestick chart is particularly popular among traders because it not only shows the opening and closing prices but also reveals the high and low prices within a specific time frame. This level of detail can be crucial for making informed trading decisions.

Moreover, most charting software comes equipped with a suite of technical indicators and tools that traders can use to enhance their analysis. These indicators can help traders identify trends, gauge momentum, and spot potential reversal points. Some popular indicators include:

- Moving Averages: These help smooth out price data to identify the direction of the trend.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements.

- Bollinger Bands: These provide insights into volatility and overbought or oversold conditions.

In addition to indicators, many charting platforms offer customizable features that allow traders to tailor their charts to their specific needs. This customization can include adjusting time frames, changing colors, and adding or removing indicators based on personal trading strategies. For instance, day traders might prefer shorter time frames, while long-term investors might focus on daily or weekly charts. This flexibility ensures that traders can analyze the data in a way that aligns with their individual trading styles.

Furthermore, some advanced charting software also integrates social trading features, enabling traders to share their charts and insights with a community of peers. This collaborative aspect can be incredibly beneficial, as it allows traders to learn from one another, gain new perspectives, and refine their strategies based on collective knowledge. In a world where information is power, having access to a community of like-minded traders can be a game-changer.

Ultimately, investing in quality charting software is akin to equipping yourself with a powerful telescope when exploring the vast universe of trading. It enhances your ability to see beyond the immediate data and understand the broader market trends. By leveraging these tools effectively, traders can not only improve their analysis but also make more confident and informed trading decisions that can lead to better investment outcomes.

Indicators and Oscillators

When it comes to trading, understanding indicators and oscillators is like having a compass in uncharted waters. These tools are essential for traders who want to navigate the complex seas of financial markets. They help in identifying potential price movements, signaling when to enter or exit trades, and providing a clearer picture of market trends. Essentially, indicators are mathematical calculations based on the price, volume, or open interest of a security, while oscillators are a type of indicator that fluctuates between a set range. This dual functionality makes them invaluable for traders looking to make informed decisions.

One of the most popular indicators is the Moving Average (MA). It smooths out price data to identify the direction of the trend. Think of it as a moving window that helps filter out the noise from random price fluctuations. For example, a trader might use a 50-day moving average to determine if the market is in an uptrend or downtrend. If the price is above the moving average, it indicates a bullish trend, while being below suggests a bearish trend.

Another crucial tool in the trader's arsenal is the Relative Strength Index (RSI). This oscillator measures the speed and change of price movements, providing insights into overbought or oversold conditions. It operates on a scale from 0 to 100, with levels above 70 typically indicating that a security is overbought, and levels below 30 suggesting it is oversold. By using the RSI, traders can spot potential reversal points in the market. Imagine it as a traffic light—green means go, while red signals caution.

Additionally, the Moving Average Convergence Divergence (MACD) is another powerful tool. It consists of two moving averages and helps traders identify potential buy and sell signals. When the MACD line crosses above the signal line, it may indicate a buy opportunity, whereas a cross below could suggest a sell signal. This dynamic interplay between the two lines can provide insights into momentum shifts in the market.

While indicators and oscillators are incredibly useful, they should not be used in isolation. Combining these tools with other forms of analysis, such as fundamental analysis, can lead to more robust trading strategies. For instance, a trader might confirm a buy signal from the MACD with positive news about the company or sector they are trading in. This holistic approach enhances decision-making and reduces the risks associated with trading.

In summary, indicators and oscillators serve as vital navigational aids for traders. They provide essential insights into market conditions and help in making informed trading decisions. However, it’s important to remember that no tool is foolproof. The market is influenced by a myriad of factors, and it's crucial to stay adaptable and informed. As you dive deeper into trading, consider these tools as your trusty sidekicks, guiding you through the tumultuous waters of the financial markets.

- What are indicators and oscillators?

Indicators are mathematical calculations based on price, volume, or open interest, while oscillators are a type of indicator that fluctuates within a certain range.

- How do I use the RSI in trading?

The RSI helps identify overbought or oversold conditions, guiding traders on when to buy or sell based on its readings.

- Can I rely solely on indicators for trading decisions?

No, it's best to combine indicators with other analyses, such as fundamental analysis, to make well-rounded trading decisions.

Fundamental Analysis Tools

When it comes to trading, understanding the underlying factors that drive market movements is just as crucial as analyzing price charts. This is where come into play. These tools focus on examining economic data, financial statements, and overall market conditions to provide traders with a comprehensive view of an asset's true value. By leveraging these tools, traders can make informed decisions that align with long-term market trends, rather than just reacting to short-term price fluctuations.

One of the primary aspects of fundamental analysis is evaluating a company's performance through its financial metrics. Tools that provide access to key financial ratios, such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE), can significantly assist traders in assessing whether a stock is undervalued or overvalued. For instance, a low P/E ratio might suggest that a stock is undervalued compared to its earnings, prompting traders to consider buying. On the other hand, a high P/E ratio could indicate overvaluation, signaling a potential sell-off.

Additionally, fundamental analysis tools often include economic indicators that reflect the overall health of the economy. These indicators, such as GDP growth rates, unemployment rates, and inflation rates, can provide insights into market trends and investor sentiment. Analyzing these metrics allows traders to anticipate potential market movements and adjust their strategies accordingly. For example, if a country is experiencing robust GDP growth, it may lead to increased consumer spending, which can positively impact stock prices.

Moreover, staying updated with news and events that affect the financial markets is vital. Many fundamental analysis tools aggregate news feeds, economic calendars, and earnings reports, allowing traders to stay informed about upcoming events that could impact their trading decisions. The ability to react quickly to news, such as earnings releases or economic data announcements, can be the difference between a profitable trade and a missed opportunity.

To sum it up, fundamental analysis tools are indispensable for traders looking to understand the bigger picture of market dynamics. By combining financial metrics with economic indicators and real-time news updates, traders can develop a more nuanced view of the market, leading to better-informed trading decisions. The integration of these insights into trading strategies can enhance overall performance and help traders navigate the complexities of the financial landscape.

In conclusion, while technical analysis focuses on price movements, fundamental analysis digs deeper into the reasons behind those movements. Utilizing both approaches can provide traders with a well-rounded strategy that not only considers the present market conditions but also anticipates future trends based on economic fundamentals.

Integrating Analytics with Trading Strategies

Integrating analytics tools into your trading strategies is like adding a turbocharger to a car; it can significantly enhance performance and speed. In today’s fast-paced trading environment, where every second counts, relying solely on gut feelings or outdated methods can lead to missed opportunities and costly mistakes. By incorporating data-driven insights, traders can make more informed decisions that not only minimize risks but also maximize potential returns. So, how can you effectively combine analytics with your trading plans?

First, it's essential to understand that analytics tools provide a wealth of information that can be tailored to suit various trading styles. Whether you're a day trader looking for quick gains or a long-term investor focused on fundamental shifts, the right tools can help you navigate the complex landscape of financial markets. For instance, using historical data to identify trends can offer invaluable insights into future price movements. This approach allows traders to anticipate market changes and react accordingly, rather than being caught off guard.

One of the most effective methods for integrating analytics into your trading strategy is through real-time data monitoring. This involves using live feeds and alerts to stay updated on market conditions and price fluctuations. Imagine being in a race where you have a live GPS tracker showing your competitors' positions; this gives you the edge to make timely decisions. With real-time data, traders can swiftly act on emerging opportunities or mitigate potential losses. For example, if a stock suddenly spikes due to breaking news, having the right analytics tools can help you decide whether to buy, sell, or hold before it’s too late.

Another critical aspect of integrating analytics is backtesting trading strategies. This process involves applying your trading strategies to historical data to see how they would have performed in the past. Think of it as a rehearsal before the big performance; it allows you to identify strengths and weaknesses in your approach. By analyzing past market conditions, you can refine your strategies, ensuring that they are robust and adaptable to changing circumstances. Backtesting not only builds confidence in your trading plan but also provides a clearer picture of potential risks and rewards.

To illustrate the importance of these integrations, consider the following table that compares traditional trading methods with data-driven strategies:

| Aspect | Traditional Trading | Data-Driven Trading |

|---|---|---|

| Decision Making | Based on intuition | Based on data analysis |

| Risk Management | Reactive | Proactive |

| Market Insights | Limited | Comprehensive |

| Adaptability | Slow | Fast |

In conclusion, integrating analytics with trading strategies is not just a trend; it's a necessity for anyone serious about investing in today's markets. By leveraging real-time data monitoring and backtesting, traders can enhance their decision-making processes, minimize risks, and ultimately increase their chances of success. So, are you ready to take your trading game to the next level? The tools are at your disposal; it’s time to embrace them!

- What are analytics tools in trading? Analytics tools are software and applications that analyze market data to help traders make informed decisions.

- How does real-time data monitoring help traders? It allows traders to respond quickly to market changes, optimizing their chances for profit.

- What is backtesting? Backtesting is the process of testing a trading strategy using historical data to assess its effectiveness.

- Can analytics tools guarantee profits? While they can significantly improve decision-making, no tool can guarantee profits due to the unpredictable nature of markets.

Real-Time Data Monitoring

In the fast-paced world of trading, is not just a luxury; it’s a necessity. Imagine trying to catch a wave while surfing—if you’re not paying attention to the ocean's movements, you might miss the perfect moment to ride. Similarly, in trading, having access to real-time data allows traders to make swift, informed decisions that can lead to significant gains or prevent substantial losses.

Real-time data monitoring provides traders with up-to-the-minute information about market conditions, price movements, and emerging trends. This immediacy is crucial because the financial markets can change in the blink of an eye. For instance, a sudden economic announcement or geopolitical event can cause stocks to skyrocket or plummet. By utilizing real-time data, traders can react promptly to these changes, positioning themselves advantageously in the market.

There are various tools available for real-time data monitoring, each offering unique features that can enhance a trader's performance. Some of the essential features to look for in these tools include:

- Live Price Updates: Instantaneous updates on stock prices, enabling traders to track their investments continuously.

- Market News Feeds: Access to breaking news that could impact market conditions, allowing traders to stay ahead of the curve.

- Custom Alerts: Setting up notifications for specific price levels or market events ensures that traders never miss a critical opportunity.

Moreover, integrating real-time data with trading strategies can significantly improve decision-making. For example, traders can use this data to identify patterns and trends that may not be apparent through historical analysis alone. By combining real-time insights with technical and fundamental analysis, traders can create a more comprehensive view of the market, leading to better predictions and outcomes.

However, while real-time data monitoring is powerful, it’s essential to approach it with a clear strategy. Traders should avoid the trap of information overload, which can lead to indecision and anxiety. Instead, focusing on the most relevant data points and using them to inform specific trading actions can lead to more successful outcomes. Ultimately, the goal is to create a seamless flow of information that enhances trading performance without overwhelming the trader.

In conclusion, real-time data monitoring serves as a vital component in the toolkit of any trader looking to excel in today’s dynamic markets. By leveraging the power of immediate insights, traders can seize opportunities, mitigate risks, and make informed decisions that drive their trading success.

Q1: What is real-time data monitoring in trading?

A1: Real-time data monitoring refers to the continuous tracking of market data, including price movements, news, and trends, allowing traders to make informed decisions quickly.

Q2: Why is real-time data important for traders?

A2: It is crucial because the financial markets can change rapidly. Access to real-time data enables traders to respond swiftly to market shifts and capitalize on opportunities.

Q3: What features should I look for in real-time data monitoring tools?

A3: Look for live price updates, market news feeds, and custom alerts to stay informed and make timely decisions.

Q4: Can real-time data monitoring help in developing trading strategies?

A4: Yes, integrating real-time data with trading strategies can enhance decision-making and improve overall trading performance by providing immediate insights into market conditions.

Backtesting Trading Strategies

Backtesting is like a time machine for traders, allowing them to step back into the past and see how their trading strategies would have performed under various market conditions. Imagine being able to test your ideas against historical data before risking your hard-earned money in the real world! This powerful tool not only helps in refining strategies but also boosts confidence in decision-making. By simulating trades based on past data, traders can assess the viability of their approaches without any financial risk.

So, how does backtesting work? Essentially, it involves applying your trading strategy to historical market data and analyzing the results. Traders can utilize software that allows them to input their specific rules, such as entry and exit points, stop-loss levels, and take-profit targets. The software will then run simulations, providing valuable insights into potential performance. The results can reveal critical metrics such as the percentage of winning trades, average profit per trade, and maximum drawdown—all vital statistics that can make or break a trading strategy.

To truly understand the effectiveness of a backtested strategy, traders should consider several key factors:

- Data Quality: The accuracy of historical data is paramount. Using unreliable data can lead to misleading results, so always ensure that the data source is credible.

- Market Conditions: Different market environments can yield varying results. A strategy that works well in a bullish market may falter in a bearish one. Therefore, it’s essential to test across different market conditions.

- Overfitting: While it might be tempting to tweak your strategy to achieve perfect results in backtesting, beware of overfitting. This occurs when a strategy is tailored too closely to historical data, making it less effective in live trading.

Moreover, backtesting can also help traders identify the optimal parameters for their strategies. For instance, by adjusting variables such as time frames or indicators, traders can discover what works best for their specific trading style. It’s like fine-tuning an instrument to make beautiful music—finding that perfect balance can lead to a harmonious trading experience.

However, while backtesting is an invaluable tool, it should not be the sole basis for trading decisions. It’s essential to combine backtesting results with forward testing in a demo account, which allows traders to see how their strategies perform in real-time under current market conditions. This dual approach helps bridge the gap between theory and practice, ensuring that traders are well-prepared for the unpredictable nature of the markets.

In conclusion, backtesting trading strategies is a crucial step in the trading process. It offers insights into potential performance, helps refine strategies, and boosts trader confidence. By understanding its mechanics and limitations, traders can better prepare themselves for the challenges of real-world trading, ultimately leading to improved investment outcomes.

- What is backtesting? Backtesting is the process of testing a trading strategy using historical market data to evaluate its effectiveness.

- Why is backtesting important? It allows traders to assess the viability of their strategies without risking real money, helping them make more informed decisions.

- What are the key factors to consider when backtesting? Key factors include data quality, market conditions, and the risk of overfitting.

- Can backtesting guarantee future success? While it can provide insights, backtesting cannot guarantee future performance due to the unpredictable nature of the markets.

Frequently Asked Questions

- What are analytics tools in trading?

Analytics tools in trading are software or platforms that help traders analyze market data, identify trends, and make informed decisions. They can range from simple charting tools to complex algorithms that analyze vast amounts of data.

- How can data analysis improve my trading strategy?

Data analysis can significantly enhance your trading strategy by providing insights into market behavior. By understanding historical price movements and market trends, you can make more informed decisions, reduce risks, and potentially increase your returns.

- What types of analytics tools should I consider?

There are two main categories of analytics tools: technical analysis tools, which focus on price movements and trends, and fundamental analysis tools, which examine economic data and company performance. Depending on your trading style, you may find one type more beneficial than the other.

- What are some popular technical analysis tools?

Popular technical analysis tools include charting software like MetaTrader, indicators like Moving Averages and RSI, and oscillators such as MACD. These tools help traders visualize data and identify potential buy or sell signals.

- Why is real-time data monitoring important?

Real-time data monitoring allows traders to react swiftly to market changes. By having up-to-the-minute insights, you can capitalize on opportunities and make quick decisions that can significantly impact your trading outcomes.

- What is backtesting, and why should I use it?

Backtesting is the process of testing a trading strategy against historical data to evaluate its effectiveness. By backtesting, you can refine your strategies and gain confidence before applying them in live trading scenarios.

- Can I use analytics tools for long-term trading?

Absolutely! Analytics tools are not just for short-term trading. Fundamental analysis tools, in particular, can help you assess the long-term viability of investments by analyzing economic indicators and company performance over time.

- Are there any free analytics tools available?

Yes, there are several free analytics tools available, such as TradingView and Yahoo Finance. While they may not have all the advanced features of paid tools, they can still provide valuable insights for both novice and experienced traders.