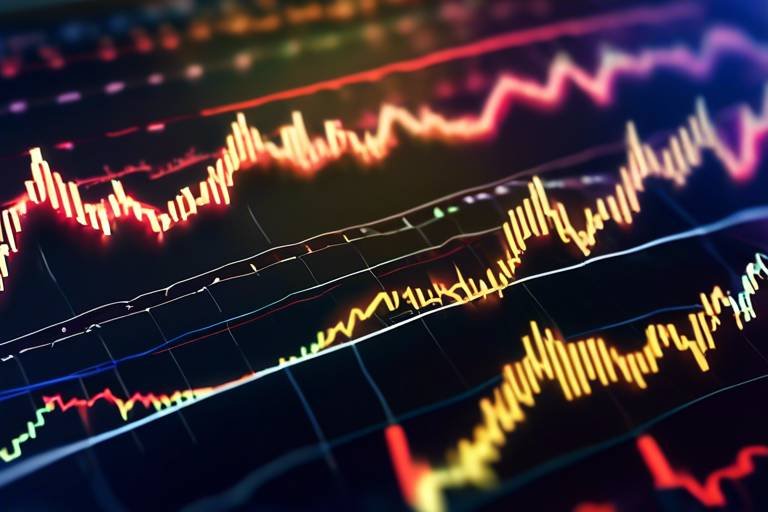

The Role of Candlestick Patterns in Day Trading

In the fast-paced world of day trading, understanding market trends and making quick decisions are crucial for success. One of the most effective tools in a trader's arsenal is the use of candlestick patterns. These visual indicators not only help traders analyze past price movements but also provide insights into future market behavior. Imagine walking into a bustling marketplace, where every stall represents a different stock; candlestick patterns are like signs that guide you to the best deals, helping you navigate through the chaos. By recognizing these patterns, traders can enhance their strategies and make informed decisions that could lead to significant profits.

So, what exactly are candlestick patterns? They are graphical representations that depict price movements over a specific time frame, typically formed by the open, high, low, and close prices of a security. Each candlestick provides a snapshot of market sentiment during that period, allowing traders to gauge whether buyers or sellers are in control. This is particularly important in day trading, where every second counts, and the ability to read the market effectively can mean the difference between a winning trade and a losing one. It's like having a weather forecast for trading—knowing when to expect a storm or a sunny day can significantly impact your decisions.

The significance of candlestick patterns lies in their ability to signal potential market reversals and continuations. Day traders often rely on these patterns to identify entry and exit points, helping them capitalize on short-term price movements. For instance, spotting a bullish reversal pattern could prompt a trader to enter a position, while a bearish signal might indicate it's time to exit. The ability to interpret these signals with precision is what sets successful traders apart from the rest. Just as a chef uses specific ingredients to create a masterpiece, traders use candlestick patterns to craft their trading strategies.

Understanding the psychology behind candlestick patterns is equally important. Each pattern reflects the emotions of market participants—fear, greed, uncertainty, and confidence. By analyzing these emotions, traders can better predict future price movements. For example, a Doji candlestick, which indicates indecision, may suggest that a trend is about to change. Recognizing these subtle cues can provide traders with a competitive edge, much like a detective piecing together clues to solve a mystery.

In conclusion, candlestick patterns play a vital role in day trading by offering insights into market sentiment and potential price movements. By mastering these patterns, traders can enhance their decision-making processes and develop more effective trading strategies. As you delve deeper into the world of candlestick patterns, remember that practice and experience are key. The more you familiarize yourself with these visual indicators, the better equipped you'll be to navigate the complexities of day trading. So, are you ready to unlock the secrets of the market and elevate your trading game?

Understanding Candlestick Patterns

Candlestick patterns are not just pretty visuals; they are a powerful tool in the arsenal of any day trader. Imagine walking into a bustling marketplace, where every stall represents a different stock. Each stall has its own story to tell through the way it displays its goods, and that’s exactly what candlestick patterns do for traders. They provide a snapshot of price movements over a specific time frame, revealing the underlying emotions of buyers and sellers. Understanding these patterns is crucial because they give traders insights into market sentiment and potential price reversals.

At the core of candlestick analysis is the relationship between the opening and closing prices of a given time period, along with the high and low prices. Each candlestick consists of a body and wicks (or shadows) that extend from the top and bottom. The body represents the range between the opening and closing prices, while the wicks indicate the highest and lowest prices during that period. When a candlestick closes higher than it opens, it’s typically colored green (or white), indicating bullish sentiment. Conversely, a candlestick that closes lower than it opens is often colored red (or black), signaling bearish sentiment.

Why should you care about these patterns? Well, they can help you anticipate market movements. For instance, if you notice a series of green candlesticks, it might signal a strong bullish trend, while a series of red candlesticks could indicate a bearish trend. But it’s not just about the colors; it’s about the shapes and formations that emerge. Recognizing these formations can be the difference between a successful trade and a costly mistake.

Moreover, candlestick patterns can be categorized into two main types: single candlestick patterns and multiple candlestick patterns. Single candlestick patterns, like the Doji or Hammer, provide insights with minimal complexity. On the other hand, multiple candlestick patterns, which involve two or more candles, can indicate stronger market signals, helping traders make more informed decisions. Understanding these nuances is essential for anyone looking to navigate the fast-paced world of day trading.

In summary, mastering candlestick patterns is akin to learning the language of the market. The more fluent you become, the better equipped you will be to interpret price movements and make decisions that align with your trading goals. Whether you are a seasoned trader or just starting, investing time in understanding these patterns can significantly enhance your trading strategies.

Types of Candlestick Patterns

Candlestick patterns are essential tools for day traders, providing a visual representation of price movements that can significantly influence trading decisions. Understanding the different types of candlestick patterns is vital for traders aiming to anticipate market behavior and make informed choices. There are two primary categories of candlestick patterns: single candlestick patterns and multiple candlestick patterns. Each type serves a unique purpose and can signal various market conditions.

Single candlestick patterns are the simplest forms of candlestick formations, often indicating potential market reversals with minimal complexity. These patterns are crucial for traders who need quick insights into market sentiment. For instance, when observing a single candlestick, traders can quickly gauge whether the market is leaning towards bullish or bearish sentiment. Examples of single candlestick patterns include:

- Doji Candlestick: This pattern signifies indecision in the market, where the opening and closing prices are nearly identical. A Doji can indicate potential reversals, making it a vital pattern for day traders to watch.

- Hammer Candlestick: Characterized by a small body and a long lower shadow, the Hammer suggests a potential bullish reversal. Recognizing this pattern can be advantageous for traders seeking entry points in an upward trend.

On the other hand, multiple candlestick patterns involve two or more candles and provide deeper insights into market trends. These patterns often indicate stronger signals for potential price movements, allowing traders to make more calculated decisions. For example, a bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle that completely engulfs the previous one. This pattern suggests a potential reversal from a downtrend to an uptrend.

Another critical multiple candlestick pattern is the evening star, which consists of three candles: a large bullish candle, a small-bodied candle, and a large bearish candle. This formation signals a potential reversal from an uptrend to a downtrend, alerting traders to the possibility of a market shift.

In summary, recognizing and understanding these candlestick patterns can significantly enhance a trader's ability to predict market movements. By incorporating both single and multiple candlestick patterns into their analysis, traders can develop more effective strategies and improve their chances of success in the fast-paced world of day trading.

Single Candlestick Patterns

Single candlestick patterns are the building blocks of candlestick analysis, serving as quick indicators of potential market reversals or continuations. These patterns are incredibly useful for day traders who thrive on short-term price movements. When you see a single candlestick on your chart, it can tell you a story about the market's mood, whether it's feeling bullish, bearish, or downright confused. Understanding these patterns can give you a significant edge in making timely trading decisions.

Among the most notable single candlestick patterns are the Doji and the Hammer. Each of these patterns conveys unique information about market sentiment. For instance, a Doji candlestick appears when the opening and closing prices are nearly identical, creating a small body with long wicks on either side. This pattern indicates indecision in the market, suggesting that neither buyers nor sellers are in control. As a day trader, spotting a Doji can be your cue to prepare for a possible reversal, especially if it appears at a significant support or resistance level.

On the other hand, the Hammer candlestick is a powerful bullish reversal signal. It features a small body at the upper end of the trading range and a long lower shadow, resembling a hammer. This pattern suggests that sellers drove prices down during the session, but buyers stepped in to push the price back up before the close. The presence of a Hammer can indicate that the market is ready to turn around, making it an ideal entry point for traders looking to capitalize on potential upward momentum.

Recognizing these single candlestick patterns is not just about spotting them; it's about understanding their implications in the broader context of market dynamics. For example, if a Doji appears after a strong downtrend, it might signal that the bearish momentum is waning, and a reversal could be on the horizon. Conversely, if a Hammer shows up after a downtrend, it’s often a strong indication that buyers are starting to gain control. Therefore, integrating these patterns into your trading strategy is essential for making informed decisions.

In summary, mastering single candlestick patterns can significantly enhance your trading prowess. By keeping an eye out for these visual cues, you can better gauge market sentiment and make more strategic trades. Remember, the key to successful day trading is not just about recognizing patterns but also about understanding the story they tell in the context of the market.

- What is a candlestick pattern? A candlestick pattern is a visual representation of price movements in the market, providing insights into market sentiment and potential reversals.

- Why are single candlestick patterns important? They help traders quickly identify market sentiment and potential price reversals, enabling more informed trading decisions.

- How can I use single candlestick patterns in my trading strategy? By recognizing these patterns, you can anticipate potential market movements and make timely trades, especially when combined with other indicators.

Doji Candlestick

The is a fascinating and essential pattern in the realm of day trading. It signifies a moment of indecision in the market, where the opening and closing prices are nearly identical, leading to a small body with long wicks on either side. This unique formation can be visually captivating, but more importantly, it serves as a powerful indicator of potential market reversals. Imagine standing at a crossroads where one path leads to bullish momentum and the other to bearish trends; the Doji is that pivotal moment of uncertainty.

Traders often interpret the Doji as a signal that the current trend may be losing strength. When you spot a Doji after a strong uptrend, it could be a sign that buyers are losing their grip, and a reversal might be on the horizon. Conversely, if a Doji appears after a downtrend, it may indicate that sellers are losing control. This makes the Doji an invaluable tool for traders looking to make informed decisions in real-time.

It's important to note that the Doji candlestick's effectiveness increases when combined with other technical indicators or patterns. For instance, if a Doji forms at a significant resistance level, it could be an even stronger signal of a potential reversal. The context in which the Doji appears is crucial; it’s not just about the pattern itself but also about what it signifies in relation to the broader market environment.

To further illustrate the significance of the Doji, consider the following table that outlines key characteristics and implications:

| Characteristic | Implication |

|---|---|

| Small body | Indicates indecision in the market |

| Long wicks | Shows volatility and price rejection |

| Occurs after a strong trend | Potential reversal signal |

| Context matters | Best used with other indicators for confirmation |

In summary, the Doji candlestick is not just another pattern; it’s a window into the market's psyche. Understanding its nuances can provide traders with a significant edge in their decision-making process. So next time you see a Doji forming on your charts, take a moment to consider what it might mean for your trading strategy. Are you ready to act on that uncertainty?

- What does a Doji candlestick indicate? A Doji indicates indecision in the market, suggesting a potential reversal in the current trend.

- How can I use a Doji in my trading strategy? Combine the Doji with other technical indicators to confirm potential trade signals and improve your success rate.

- Is a Doji always a reversal signal? Not necessarily; it’s important to consider the context and other market indicators before making a decision.

- Where is the best place to spot a Doji? Look for Dojis at key support and resistance levels for stronger signals.

Hammer Candlestick

The is a fascinating pattern that often suggests a potential bullish reversal in the market. It typically appears at the bottom of a downtrend, signaling that buyers are starting to gain momentum. This pattern is characterized by a small body at the upper end of the trading range and a long lower shadow, which indicates that sellers pushed prices down during the trading session, but buyers stepped in and drove the price back up before the close. Essentially, it’s like a phoenix rising from the ashes, showcasing the resilience of buyers in a seemingly bearish environment.

Identifying a Hammer candlestick can be a game changer for day traders. When you spot this pattern, it's crucial to consider the context in which it appears. For instance, if the Hammer forms after a significant downtrend, it could be a strong indication that the market sentiment is shifting. However, traders should not rely solely on this pattern. Instead, it’s advisable to look for confirmation from subsequent price action or other technical indicators.

To further illustrate the Hammer candlestick, here’s a simple table summarizing its key characteristics:

| Characteristic | Description |

|---|---|

| Body Size | Small, located at the upper end of the trading range |

| Lower Shadow | Long, at least twice the length of the body |

| Upper Shadow | Very small or nonexistent |

| Market Context | Typically appears after a downtrend |

When trading with the Hammer pattern, consider the following tips to enhance your strategy:

- Look for confirmation in the next candlestick. A bullish candle following the Hammer can strengthen the signal.

- Check for volume; higher volume during the formation of the Hammer can indicate stronger buying interest.

- Combine with other technical indicators like moving averages or RSI to validate your trading decision.

In conclusion, the Hammer candlestick is a powerful tool in a trader’s arsenal. By recognizing this pattern and understanding its implications, traders can position themselves to capitalize on potential market reversals. Just remember, while the Hammer can provide valuable insights, it’s essential to use it in conjunction with other analysis techniques to make informed trading decisions.

Multiple Candlestick Patterns

When it comes to day trading, are like a treasure map guiding traders through the often unpredictable market terrain. These patterns, formed by two or more candlesticks, offer a wealth of information that single patterns simply can't provide. Just as a seasoned explorer knows to look for landmarks, traders must learn to recognize these intricate formations to anticipate market movements more accurately.

One of the most common multiple candlestick patterns is the Engulfing Pattern. This occurs when a small candlestick is followed by a larger candlestick that completely engulfs the previous one. A bullish engulfing pattern, for instance, suggests that buyers have taken control, signaling a potential upward price movement. Conversely, a bearish engulfing pattern indicates that sellers are overpowering buyers, which could lead to a downward trend. Understanding these patterns can be pivotal for traders looking to enter or exit positions at the right time.

Another significant pattern is the Morning Star and Evening Star. The Morning Star is a three-candle pattern that typically appears at the bottom of a downtrend, indicating a potential reversal. It consists of a long bearish candle, followed by a small-bodied candle, and then a long bullish candle. This formation symbolizes a shift in momentum, suggesting that buyers are starting to gain strength. On the flip side, the Evening Star appears at the top of an uptrend and suggests a reversal to the downside, with a similar structure but in the opposite direction. Recognizing these patterns can help traders make informed decisions about when to enter or exit trades.

To make it even clearer, here's a quick comparison of these patterns:

| Pattern | Description | Market Implication |

|---|---|---|

| Engulfing Pattern | A small candle followed by a larger candle that completely engulfs it. | Indicates a potential reversal in market direction. |

| Morning Star | A bullish reversal pattern consisting of three candles. | Signals a potential upward price movement. |

| Evening Star | A bearish reversal pattern consisting of three candles. | Signals a potential downward price movement. |

Understanding these multiple candlestick patterns is essential for traders looking to gain an edge in the market. They serve as critical indicators of market sentiment, allowing traders to align their strategies with current trends. By combining these patterns with other technical analysis tools, traders can develop a more comprehensive trading strategy.

In addition to the patterns mentioned, traders should also pay attention to the Harami Pattern. This pattern consists of a large candle followed by a smaller candle that is contained within the body of the first candle. A bullish harami pattern suggests a potential reversal from bearish to bullish, while a bearish harami indicates a potential reversal from bullish to bearish. The key here is the size and position of the candles, which can reveal a lot about market sentiment.

In summary, mastering multiple candlestick patterns can significantly enhance a trader's ability to make informed decisions. These patterns not only provide insights into potential price movements but also help in understanding market psychology. Remember, trading is not just about numbers; it's about interpreting the story that those numbers tell.

- What are candlestick patterns? Candlestick patterns are visual representations of price movements in the market, used to identify potential reversals and trends.

- How do multiple candlestick patterns differ from single candlestick patterns? Multiple candlestick patterns involve two or more candles and provide deeper insights into market trends, while single patterns are simpler and indicate potential reversals.

- Can I use candlestick patterns alone for trading decisions? While candlestick patterns are powerful tools, it's advisable to combine them with other technical indicators for more robust trading strategies.

Using Candlestick Patterns in Trading Strategies

In the fast-paced world of day trading, having a solid strategy is essential for success. Candlestick patterns serve as a valuable tool in this arsenal, enabling traders to make informed decisions based on visual cues from the market. By integrating these patterns into their trading strategies, traders can gain a deeper understanding of market sentiment and potential price movements. But how exactly do these patterns fit into a broader trading strategy? Let’s dive in!

First and foremost, it's crucial to recognize that candlestick patterns are not standalone indicators. They shine brightest when combined with other technical indicators. For instance, traders might pair candlestick patterns with moving averages, which smooth out price data to identify trends. This combination allows traders to confirm potential trades; when a candlestick pattern aligns with a moving average crossover, it could signal a strong entry point. Imagine it like having a compass and a map; while the compass points to true north, the map provides context for where you are headed.

Moreover, understanding the context in which a candlestick pattern appears is vital. Patterns can have different meanings depending on the preceding price action and the overall trend. For example, a Hammer pattern appearing after a downtrend suggests a potential bullish reversal. However, if this same pattern appears during an uptrend, it might indicate a temporary pullback rather than a reversal. This nuanced understanding helps traders avoid misinterpretations, akin to reading the weather before planning a picnic.

Effective risk management is another crucial aspect of utilizing candlestick patterns in trading. Traders can use these patterns to set stop-loss orders—a predetermined price level where a trade will be exited to prevent further losses. For example, if a trader identifies a bullish engulfing pattern, they might place a stop-loss just below the low of the engulfing candle. This strategy not only protects their capital but also maximizes potential gains by allowing trades to run when they are in profit.

To illustrate how candlestick patterns can be integrated into trading strategies, consider the following table:

| Candlestick Pattern | Market Signal | Recommended Action |

|---|---|---|

| Doji | Indecision | Wait for confirmation before entering a trade |

| Hammer | Potential bullish reversal | Consider entering a long position |

| Engulfing | Reversal signal | Enter trade in the direction of the engulfing candle |

In addition to market signals, traders should also pay attention to the volume accompanying these patterns. Higher volume during the formation of a candlestick pattern can indicate stronger conviction in the price movement, providing further confidence in the decision to trade. Think of it like a crowd cheering at a concert; the louder the applause, the more you know the performance is resonating with the audience.

Ultimately, the key to successfully using candlestick patterns in trading strategies lies in practice and experience. As traders become more familiar with these patterns, they can develop a keen eye for spotting them in real-time. This skill, combined with a solid understanding of market dynamics and risk management, can significantly enhance a trader's ability to make profitable trades.

- What are candlestick patterns? Candlestick patterns are graphical representations of price movements in financial markets, illustrating the opening, closing, high, and low prices over a specific time frame.

- How do I identify a candlestick pattern? Look for specific formations of candlesticks on your trading chart, such as Doji, Hammer, or Engulfing patterns, which can signal potential market reversals or continuations.

- Can I rely solely on candlestick patterns for trading? While candlestick patterns provide valuable insights, they should be used in conjunction with other technical indicators and market analysis for more reliable trading decisions.

- How can I improve my candlestick pattern recognition? Practice is key! Spend time analyzing historical charts and observing how different patterns behave in various market conditions.

Combining with Technical Indicators

When it comes to day trading, the real magic happens when you start to combine candlestick patterns with other technical indicators. Think of candlestick patterns as the canvas, and technical indicators as the paint that brings your trading strategy to life. By integrating these two elements, traders can create a more comprehensive view of the market, allowing for more informed decision-making.

For instance, using moving averages alongside candlestick patterns can significantly enhance your trading insights. Moving averages smooth out price data to identify trends over a specific period, and when combined with candlestick patterns, they can confirm potential entry and exit points. Imagine you spot a Hammer candlestick forming at a support level; if the price is also above a moving average, it strengthens the case for a potential bullish reversal. This synergy can help filter out the noise and improve your chances of success.

Moreover, indicators like the Relative Strength Index (RSI) or MACD (Moving Average Convergence Divergence) can also be used in conjunction with candlestick patterns. For example, if you see a Doji candlestick appearing at the peak of an uptrend, and the RSI is showing overbought conditions, it could signal a possible trend reversal. This kind of analysis allows traders to make more calculated decisions rather than relying solely on one type of indicator.

It's crucial, however, to remember that no strategy is foolproof. The market can be unpredictable, and even the best combinations can lead to losses. Therefore, always incorporate a solid risk management strategy alongside your technical analysis. This could involve setting stop-loss orders based on the candlestick patterns you observe or using trailing stops to lock in profits as the market moves in your favor.

In summary, combining candlestick patterns with technical indicators is like having a roadmap in a new city. It gives you direction and helps you navigate through the complexities of day trading. By leveraging these tools together, you can enhance your trading strategy, making it more robust and potentially more profitable.

- What are candlestick patterns? - Candlestick patterns are visual representations of price movements that help traders identify market trends and potential reversals.

- How do I combine candlestick patterns with technical indicators? - You can combine them by using indicators like moving averages, RSI, or MACD to confirm signals given by candlestick patterns.

- Why is risk management important in day trading? - Effective risk management helps traders minimize losses and protect their capital, allowing for more sustainable trading practices.

- Can candlestick patterns guarantee success in trading? - No, while they can provide valuable insights, they do not guarantee outcomes. It's essential to use them as part of a broader trading strategy.

Risk Management with Candlestick Patterns

When it comes to day trading, risk management is not just a strategy; it's a necessity. Utilizing candlestick patterns effectively can significantly enhance your risk management approach, allowing you to navigate the volatile waters of the market with greater confidence. Imagine sailing a ship through a storm; without a sturdy compass, you’re likely to get lost. Candlestick patterns serve as that compass, guiding you through the tumultuous price movements.

One of the key benefits of candlestick patterns is their ability to highlight potential reversals and continuations in price trends. For instance, when you spot a Doji after a strong uptrend, it can indicate indecision among traders, signaling that a reversal might be on the horizon. This crucial insight allows you to set appropriate stop-loss orders to protect your capital. By placing a stop-loss just below the low of the Doji, you can limit your potential losses if the market moves against you.

Moreover, integrating candlestick patterns with other technical indicators can bolster your risk management strategy. For example, consider using the Moving Average alongside candlestick patterns. If a bullish Hammer appears near a rising moving average, it strengthens the case for a potential upward move. In this scenario, you can confidently set your stop-loss below the Hammer's low, knowing that the moving average provides additional support. This layered approach not only protects your investments but also maximizes your chances of capitalizing on profitable trades.

Another important aspect of risk management is understanding your risk-reward ratio. Candlestick patterns can help you define this ratio effectively. For instance, if you identify a Bullish Engulfing pattern, you might set your target price based on the height of the engulfing candle. By calculating your potential profit against your stop-loss distance, you can ensure that your trades are skewed in your favor. A common rule of thumb is to aim for a risk-reward ratio of at least 1:2, meaning that for every dollar you risk, you aim to make two dollars.

To summarize, incorporating candlestick patterns into your risk management strategy can lead to more informed decision-making and better overall performance in day trading. By identifying key patterns, setting strategic stop-loss orders, and calculating your risk-reward ratios, you can navigate the trading landscape with a clearer vision. Remember, the goal is not just to make profits but to protect your capital as well. After all, in the world of trading, it's not just about how much you make, but how much you keep.

- What are candlestick patterns?

Candlestick patterns are visual representations of price movements in the market, showing the open, high, low, and close prices over a specific time frame. - How can I use candlestick patterns for risk management?

You can use candlestick patterns to identify potential reversals and set stop-loss orders, helping you to limit potential losses in your trades. - What is a good risk-reward ratio in trading?

A commonly recommended risk-reward ratio is 1:2, meaning for every dollar you risk, you aim to make at least two dollars. - Can I rely solely on candlestick patterns for trading decisions?

While candlestick patterns are valuable, it's best to combine them with other technical indicators and fundamental analysis for more robust trading decisions.

Frequently Asked Questions

- What are candlestick patterns?

Candlestick patterns are visual tools used in trading that represent price movements over a specific period. They consist of a body and wicks, helping traders gauge market sentiment and potential price reversals.

- Why are candlestick patterns important in day trading?

Candlestick patterns are crucial because they provide insights into market behavior, allowing traders to make informed decisions. By recognizing these patterns, traders can anticipate potential price movements and enhance their overall trading strategies.

- What is a Doji candlestick, and what does it indicate?

A Doji candlestick occurs when the opening and closing prices are nearly the same, indicating market indecision. This pattern can signal potential reversals, making it essential for traders to monitor.

- How can I use candlestick patterns with other technical indicators?

Integrating candlestick patterns with technical indicators, such as moving averages, can provide stronger confirmation for trades. This combination helps traders filter out false signals and improves the likelihood of successful trades.

- What is risk management in the context of candlestick patterns?

Risk management involves using candlestick patterns to set stop-loss orders and manage exposure effectively. By analyzing these patterns, traders can maximize potential gains while minimizing losses.

- Can candlestick patterns predict future price movements?

While candlestick patterns can indicate potential price movements, they are not foolproof. Traders should use them in conjunction with other analysis methods for more reliable predictions.

- Are there any specific candlestick patterns I should focus on?

Some key patterns to watch include the Hammer, Doji, Engulfing, and Shooting Star. Each of these patterns provides unique insights into market conditions and potential reversals.

- How can I practice recognizing candlestick patterns?

Practice can be done by analyzing historical price charts and identifying patterns. Many trading platforms offer demo accounts where you can experiment without risking real money.