How to Use ATR (Average True Range) in Trading

The world of trading can often feel like navigating through a stormy sea. With price fluctuations and market volatility, traders need a reliable compass to guide them through the chaos. This is where the Average True Range (ATR) indicator comes into play. Understanding how to use ATR effectively can be the difference between weathering the storm and capsizing your trading account. In this article, we will delve into what ATR is, how to calculate it, and practical applications that can enhance your trading strategies and risk management. Get ready to unlock the secrets of ATR!

The Average True Range (ATR) is more than just a buzzword in trading; it’s a powerful volatility indicator that measures the degree of price movement in a market. Think of it as a thermometer for the market's temperature—when it’s hot, you know prices are swinging wildly; when it’s cool, things are relatively calm. Understanding ATR is crucial for traders who want to gauge market conditions effectively. By analyzing ATR, traders can make informed decisions on when to enter or exit trades, and how to set their stop-loss orders appropriately.

Calculating ATR might sound daunting, but it's as easy as pie once you break it down into manageable steps. ATR is derived from the True Range, which is calculated using price movements over a specified period. To compute ATR, follow these steps:

- Identify the current high and low prices for the period.

- Find the previous closing price.

- Calculate the True Range using the formula: True Range max(Current High - Current Low, |Current High - Previous Close|, |Current Low - Previous Close|).

- Average the True Ranges over a set number of periods, typically 14 days.

This method not only provides a clear picture of market volatility but also smooths out the fluctuations, allowing traders to identify trends more easily.

To fully grasp ATR, it’s essential to understand its three key components:

- Current High: The highest price reached during the period.

- Current Low: The lowest price during the same period.

- Previous Close: The closing price from the previous period.

Each of these components plays a vital role in determining market volatility. By analyzing them, traders can better anticipate market movements and adjust their strategies accordingly.

The True Range is essentially the greatest of three values: the difference between the current high and low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close. This comprehensive approach ensures that traders are accounting for all potential price movements, giving a more accurate picture of volatility.

Once the True Range is calculated, the Average True Range is derived by averaging these values over a specified number of periods. This smoothing process helps traders identify trends and volatility levels without being overly sensitive to short-term price spikes.

Interpreting ATR values is crucial for making informed trading decisions. Generally, higher ATR values indicate increased volatility, while lower values suggest a calmer market. For instance, if the ATR value suddenly spikes, it could signal that a significant price movement is on the horizon, prompting traders to adjust their strategies accordingly. Understanding these implications can dramatically influence your trading decisions and overall success.

One of the most practical applications of ATR is in setting stop-loss orders. By using ATR to determine appropriate stop-loss levels based on market volatility, traders can protect their investments without being too conservative. For example, a trader might set a stop-loss order at a multiple of the ATR value below the entry price. This way, the stop-loss adjusts to the market's temperament, providing a buffer against normal price fluctuations.

Dynamic stop-loss strategies are like a safety net that adapts to changing market conditions. By incorporating ATR into your strategy, you can adjust your stop-loss levels to protect profits while minimizing risk. This flexibility can be the key to staying afloat during turbulent market conditions.

When comparing fixed stop-loss orders with ATR-based stops, the advantages of using ATR become clear. Fixed stops may leave traders vulnerable during periods of high volatility, while ATR-based stops adjust to the market's behavior. This adaptability not only helps in managing risk but also allows traders to capture more significant gains when trends are favorable.

Position sizing is another critical aspect of risk management that can be enhanced by using ATR. By calculating risk per trade using ATR, traders can allocate capital wisely, ensuring that trades align with their overall risk tolerance and market conditions. This method is akin to having a tailored suit—your trading strategy fits perfectly with your risk appetite.

Calculating risk per trade using ATR allows traders to make informed decisions about how much capital to allocate to each trade. For instance, if a trader determines that their risk tolerance per trade is 1% of their account balance, they can use the ATR to adjust their position size accordingly. This method ensures that traders are not overexposed during volatile market conditions.

Adjusting position sizes based on ATR values can significantly enhance trading performance. When volatility is high, traders can reduce their position sizes to mitigate risk. Conversely, during calmer periods, they can increase their position sizes to capitalize on favorable market conditions. This dynamic approach to position sizing can help traders navigate the unpredictable waters of the trading world.

ATR is not just a measure of volatility; it can also serve as a trend indicator. Understanding how ATR relates to market trends can provide traders with valuable insights for their strategies. For example, higher ATR values during an uptrend signal strong momentum, while lower values may indicate a potential reversal. This information can be crucial for making timely trading decisions.

Using ATR to identify the strength of a trend can be a game-changer for traders. When you see rising ATR values during an uptrend, it’s a clear signal that momentum is strong, and it might be a good time to enter a position. On the flip side, if ATR values start to decline, it could be a warning sign that the trend is losing steam, prompting traders to consider exiting their positions.

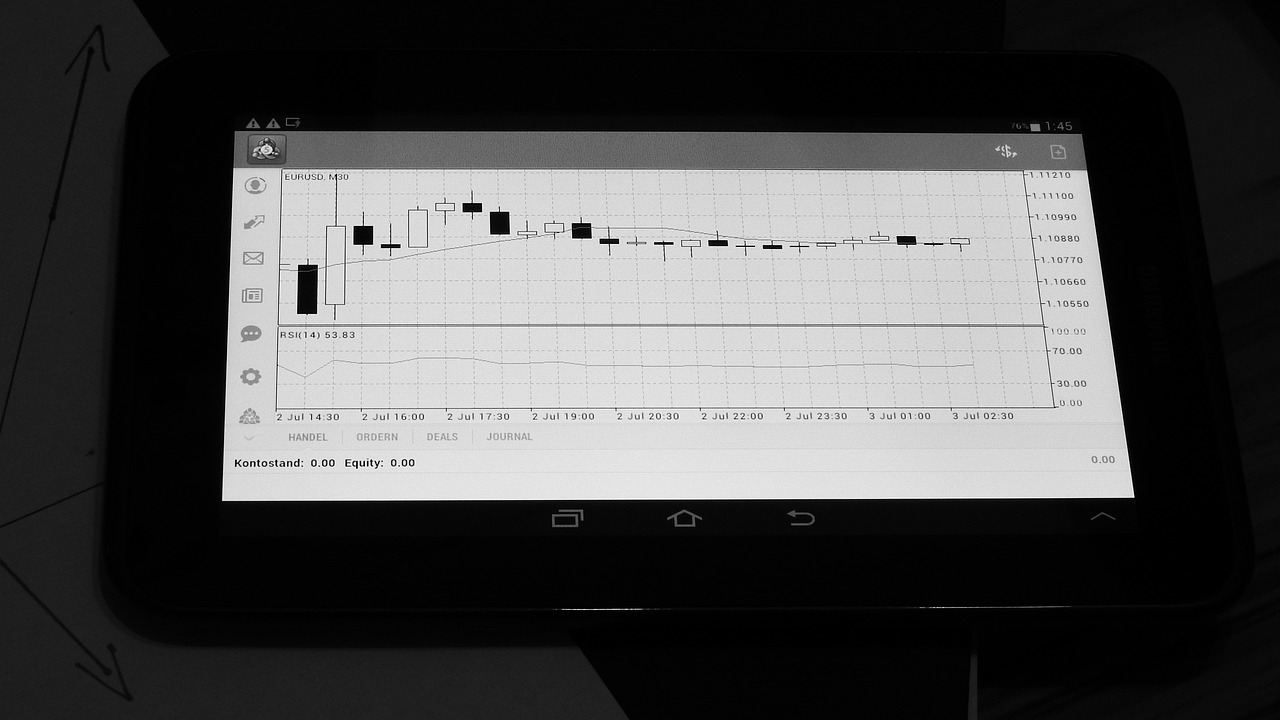

Combining ATR with other technical indicators can enhance your analysis and lead to better trading decisions. For instance, integrating ATR with moving averages or the Relative Strength Index (RSI) can provide a more comprehensive view of market conditions. This multifaceted approach allows traders to confirm signals and make more informed choices, ultimately improving their chances of success.

1. What is the Average True Range (ATR)?

ATR is a volatility indicator that measures market movement by analyzing price fluctuations over a specified period.

2. How do I calculate ATR?

ATR is calculated by averaging the True Range over a set number of periods, typically 14 days. The True Range considers the current high, current low, and previous close.

3. How can I use ATR in my trading strategy?

ATR can be used to set stop-loss orders, determine position sizes, and identify market trends. By incorporating ATR, traders can enhance their risk management and trading strategies.

4. What do high and low ATR values indicate?

High ATR values indicate increased market volatility, while low ATR values suggest a calmer market. Understanding these implications can help traders make informed decisions.

Understanding ATR

The Average True Range (ATR) is a powerful volatility indicator that every trader should have in their toolkit. It’s not just a fancy term thrown around in trading circles; it’s a critical measure that can help you understand how much a market is moving, which is essential for making informed trading decisions. At its core, ATR quantifies the degree of price movement over a specific period, giving traders insight into market volatility. Think of it as a weather forecast for the financial markets—just as you wouldn't venture out in a storm without checking the weather, you shouldn't enter a trade without understanding the volatility at play.

Understanding ATR is about grasping its calculation and purpose. It’s calculated based on the price movements of an asset, specifically looking at the highs, lows, and closes of the price over a set time frame. This means that ATR can adapt to changing market conditions, reflecting the current volatility level. For traders, this adaptability is crucial; it allows for real-time adjustments to trading strategies, ensuring that you are not just reacting to the market but proactively managing your trades.

To break it down further, ATR is particularly useful in identifying whether the market is in a volatile phase or a calm phase. A high ATR indicates a significant price movement, while a low ATR suggests that the market is relatively stable. This information can be invaluable when deciding when to enter or exit trades. If you think of trading like surfing, a high ATR is akin to big waves that can either carry you to success or wipe you out if you’re not careful. Conversely, a low ATR is like a calm sea—great for paddling around but not ideal for catching those big rides.

In summary, understanding ATR is not just about knowing what it is; it’s about leveraging this knowledge to enhance your trading strategies. By incorporating ATR into your analysis, you can better gauge market conditions and make more informed decisions. This understanding will not only improve your trading outcomes but also help you manage risk more effectively. So, the next time you look at a chart, remember that ATR is your ally in navigating the often tumultuous waters of trading.

Calculating ATR

Calculating the Average True Range (ATR) is a straightforward process, but it requires a solid understanding of price movements over a specified period. By analyzing these movements, traders can gauge market volatility effectively. The ATR is not just a number; it’s a powerful tool that can inform your trading decisions and risk management strategies.

To calculate the ATR, you need to follow a series of steps that involve the price data of the asset you are trading. First, you will need to gather the necessary data points: the current high, the current low, and the previous close. These components are essential for determining the True Range, which is the cornerstone of the ATR calculation.

As mentioned, the ATR calculation hinges on three key components:

- Current High: The highest price reached during the current trading period.

- Current Low: The lowest price reached during the current trading period.

- Previous Close: The closing price of the asset from the previous trading period.

Each of these components plays a vital role in determining market volatility. By understanding how they interact, traders can better interpret the True Range and, subsequently, the ATR.

The True Range is calculated as the greatest of the following three values:

- The difference between the current high and the current low (Current High - Current Low).

- The absolute value of the current high minus the previous close (|Current High - Previous Close|).

- The absolute value of the current low minus the previous close (|Current Low - Previous Close|).

This calculation ensures that you capture the full extent of price movement, accounting for gaps and volatility spikes that might occur between trading sessions.

Once you have the True Range values for a specific period, the next step is to calculate the Average True Range. This is done by averaging the True Range over a set number of periods, typically 14 days. The formula looks like this:

ATR (TR1 + TR2 + TR3 + ... + TRn) / n

Where TR represents the True Range for each period and n is the number of periods used for the calculation. This smoothing process helps traders identify trends and volatility levels more clearly, making it easier to make informed trading decisions.

In summary, calculating the ATR involves understanding the components that contribute to market volatility and applying them correctly. By mastering this calculation, traders can harness the power of the ATR to enhance their trading strategies and improve risk management.

Components of ATR Calculation

The Average True Range (ATR) calculation hinges on three essential components: the current high, the current low, and the previous close. Each of these elements is crucial in determining the market's volatility and understanding how much the price is likely to move. Let’s break these components down further to see how they work together in the ATR formula.

The current high represents the highest price level reached during a specified period. This value is significant because it indicates the peak of market sentiment at any given moment. Conversely, the current low reflects the lowest price point of that same period, showcasing the market's lowest sentiment. Together, these two components create a range that illustrates the price movement during that timeframe.

In addition to these, the previous close is also vital. It refers to the closing price of the last trading session before the current period. This value serves as a benchmark for measuring the price movement relative to where it was previously. By comparing the current high and low to the previous close, traders can gain insights into potential price fluctuations.

To better visualize how these components interact, consider the following table:

| Component | Description |

|---|---|

| Current High | The highest price during the current period. |

| Current Low | The lowest price during the current period. |

| Previous Close | The closing price of the last trading session. |

By using these three components, traders can calculate the True Range, which is the greatest of the following:

- Current High - Current Low

- Absolute value of (Current High - Previous Close)

- Absolute value of (Current Low - Previous Close)

Once the True Range is established, the ATR is calculated by averaging these True Range values over a specified number of periods. This averaging process smooths out the volatility readings and provides a clearer picture of market conditions. Understanding these components not only helps in calculating the ATR but also enhances a trader's ability to make informed decisions based on market volatility.

- What is the Average True Range (ATR)? The ATR is a volatility indicator that measures market movement by calculating the average of price ranges over a specified period.

- How is ATR calculated? ATR is calculated using the current high, current low, and previous close to determine the True Range, which is then averaged over a set number of periods.

- Why is ATR important in trading? ATR helps traders assess market volatility, set stop-loss orders, and determine position sizes, making it a crucial tool for risk management.

- Can ATR be used in any market? Yes, ATR can be applied to any financial market, including stocks, forex, and commodities, to gauge volatility.

True Range Explained

The concept of True Range is fundamental to understanding the Average True Range (ATR) indicator. In simple terms, True Range measures the volatility of a security by considering the greatest price movements over a specific period. It’s like taking a snapshot of the market's heartbeat, showing how much the price fluctuates within a given timeframe. To grasp this concept fully, let's break it down into three essential components:

- Current High minus Current Low: This is the most straightforward calculation, reflecting the range of price movement in one trading session.

- Absolute Value of Current High minus Previous Close: This aspect captures how far the current high has moved from the last closing price, indicating any significant upward movements.

- Absolute Value of Current Low minus Previous Close: Conversely, this measures how far the current low has dropped from the previous close, highlighting any notable downward shifts.

By taking the greatest value from these three calculations, traders can determine the True Range, which serves as a crucial input for calculating the ATR. Think of it as a safety net – it helps traders understand the potential price swings they might face. For example, if the True Range is significantly high, it signals that the market is experiencing substantial volatility, which can be both an opportunity and a risk.

To illustrate this further, consider the following hypothetical scenario:

| Day | Current High | Current Low | Previous Close | True Range Calculation |

|---|---|---|---|---|

| 1 | $50 | $45 | $48 | Max(50-45, |50-48|, |45-48|) $5 |

| 2 | $52 | $46 | $50 | Max(52-46, |52-50|, |46-50|) $6 |

| 3 | $49 | $44 | $52 | Max(49-44, |49-52|, |44-52|) $8 |

In this example, the True Range for each day is calculated based on the greatest value derived from the three components. As you can see, the True Range fluctuates, reflecting the market's volatility. A high True Range indicates that traders should be prepared for larger price swings, while a lower True Range suggests a more stable market environment.

Understanding True Range is vital for traders as it lays the groundwork for calculating the Average True Range (ATR), which further smoothens these values over a specified number of periods. This smoothing effect allows traders to identify trends and make informed decisions based on the market's volatility patterns.

Average of True Ranges

The Average True Range (ATR) is not just a single value but a dynamic measure that reflects market volatility over time. To calculate the ATR, traders take the True Range values over a specified number of periods and compute their average. This averaging process is crucial because it smooths out the fluctuations in price, providing a clearer picture of the market's volatility. Typically, traders use a period of 14 days for this calculation, but depending on trading strategies, this can vary.

The formula for calculating the ATR is straightforward, yet its implications can be profound. The ATR is calculated as follows:

| Period | True Range |

|---|---|

| 1 | 5 |

| 2 | 7 |

| 3 | 6 |

| 4 | 8 |

| 5 | 4 |

In this example, the True Range values for a series of periods are displayed. To find the ATR, you would sum these True Range values and divide by the number of periods. For instance, if we take the values from the table above, the ATR would be calculated as:

ATR (5 + 7 + 6 + 8 + 4) / 5 6

This result indicates an average volatility of 6 units over the specified periods. The significance of this average cannot be overstated. It helps traders gauge the current market conditions and adjust their strategies accordingly. A higher ATR suggests a more volatile market, which might be suitable for aggressive trading strategies, while a lower ATR indicates stability and potentially less trading opportunity.

Moreover, understanding the average of True Ranges can also assist in setting realistic profit targets. If the ATR is high, traders might expect larger price swings, allowing for wider stop-loss placements and profit targets. Conversely, in a low ATR environment, tighter stops and targets may be more appropriate.

In summary, the Average True Range is a powerful tool in a trader's arsenal. By averaging True Range values over time, traders can gain insights into market volatility and make informed decisions that align with their trading objectives.

Interpreting ATR Values

Understanding how to interpret ATR values is crucial for traders who want to make informed decisions in a fluctuating market. The Average True Range (ATR) serves as a powerful tool to gauge market volatility, and recognizing what these values mean can significantly influence your trading strategies. When you see a high ATR value, it indicates that the market is experiencing increased volatility. This could mean larger price swings, which could lead to more significant trading opportunities, but it also implies a higher risk. Conversely, a low ATR value suggests a calmer, more stable market, which might be less appealing for traders looking for big moves.

So, how do you interpret these values in a practical sense? Here’s a quick breakdown:

- High ATR Value: A value above 1.0 (or the specific threshold you set based on your trading strategy) usually indicates that the market is volatile. Traders might consider this a signal to either enter trades that capitalize on volatility or to tighten their risk management strategies.

- Low ATR Value: A value below 0.5 often suggests a market in consolidation or a lack of strong directional movement. This can be a signal for traders to wait for more favorable conditions before entering a trade.

To put it into a real-world context, think of the ATR as a weather forecast for trading. Just as you would check the weather to decide whether to carry an umbrella, you would check the ATR to determine your trading approach. If the forecast shows a storm (high ATR), you might want to prepare for bumpy rides in your trades. On the other hand, if the forecast is clear (low ATR), you might choose to hold off on taking risks until conditions improve.

Moreover, comparing ATR values across different assets can provide additional insights. For example, if you notice that Stock A has an ATR of 2.5 while Stock B has an ATR of 0.7, it’s clear that Stock A is experiencing much more volatility. This comparative analysis can help you decide where to allocate your trading resources. You might prefer to trade Stock A if you’re looking for higher risk and potentially higher reward, or Stock B if you’re aiming for stability.

| ATR Value Range | Market Condition | Trading Implication |

|---|---|---|

| 0.0 - 0.5 | Low Volatility | Consider waiting for better opportunities |

| 0.5 - 1.0 | Moderate Volatility | Possible trading opportunities; monitor closely |

| 1.0 - 2.0 | High Volatility | Potential for significant trades; manage risk |

| Above 2.0 | Extreme Volatility | High risk; consider protective measures |

In summary, interpreting ATR values is not just about looking at numbers; it’s about understanding the story behind those numbers. By keeping an eye on ATR, traders can better navigate the complexities of the market, make more informed decisions, and ultimately enhance their trading performance.

Q: What is a good ATR value for trading?

A: There’s no one-size-fits-all answer, as a good ATR value depends on the asset being traded and the trader's strategy. Generally, higher ATR values indicate more volatility, which can be suitable for aggressive traders, while lower values might appeal to conservative traders.

Q: How often should I check ATR values?

A: It’s wise to check ATR values regularly, especially when entering or exiting trades. Monitoring ATR can help you adjust your strategies based on current market conditions.

Q: Can ATR be used for any trading style?

A: Yes! ATR is versatile and can be applied to various trading styles, including day trading, swing trading, and long-term investing. It helps traders of all levels assess market volatility and adjust their strategies accordingly.

Using ATR to Set Stop Losses

When it comes to trading, setting stop-loss orders is like having a safety net. It’s your way of saying, "I want to protect my investment from unexpected market moves." The Average True Range (ATR) can be an invaluable tool in determining where to place these stop-loss orders. By understanding the volatility of the market through ATR, traders can set their stop-loss levels in a way that makes sense for the current market conditions, rather than relying solely on arbitrary price levels.

Imagine you’re on a roller coaster. If the ride is smooth, you might feel comfortable letting go of the safety bar, but if it’s a wild ride, you'd want to hold on tight! Similarly, ATR helps traders gauge the “smoothness” or volatility of the market. A higher ATR indicates a more volatile market, which suggests that wider stop-loss levels may be necessary. Conversely, a lower ATR suggests a calmer market, allowing for tighter stop-loss placements.

To effectively use ATR for setting stop-loss orders, you can follow these steps:

- Determine the ATR Value: First, calculate the ATR over a specific period, such as 14 days. This will give you a sense of the average volatility during that timeframe.

- Adjust for Market Conditions: If the ATR is high, consider setting your stop-loss further away from your entry point to avoid being stopped out by normal price fluctuations.

- Calculate the Stop-Loss Level: Use the formula: Stop-Loss Level Entry Price - (ATR x Multiplier). A common multiplier is 1.5 to 2, depending on your risk tolerance.

This method allows you to create a dynamic stop-loss that adapts to the market’s volatility. For example, if you enter a trade at $100 and the ATR is $3, you might set your stop-loss at:

| ATR | Multiplier | Stop-Loss Level |

|---|---|---|

| $3 | 1.5 | $100 - ($3 x 1.5) $95.50 |

| $3 | 2 | $100 - ($3 x 2) $94.00 |

As you can see, the stop-loss level varies based on the multiplier you choose. This flexibility allows you to adjust your risk based on how volatile the market is at any given moment. It's crucial to remember that a stop-loss is not a guarantee against loss; rather, it’s a strategy to manage risk. The goal is to give your trades enough room to breathe while still protecting your capital.

In addition, using ATR for stop-loss placement can help you avoid the common pitfall of getting stopped out prematurely. Many traders set their stop-loss levels too tight, leading to frequent losses even in a normal market fluctuation. By incorporating ATR into your strategy, you can find a balance that aligns with the current volatility, allowing you to stay in trades longer and potentially increase your chances of success.

Dynamic Stop Loss Strategies

When it comes to trading, one of the most critical aspects is managing risk, and that's where come into play. Unlike traditional fixed stop-loss orders that remain static regardless of market conditions, dynamic stop-loss strategies adapt to the ever-changing landscape of the market. By leveraging the Average True Range (ATR), traders can establish stop-loss levels that are not only reactive but also proactive, enhancing their ability to protect profits and minimize losses.

Imagine you're sailing a ship in unpredictable waters. A fixed anchor might keep you in one spot, but it can also leave you vulnerable to sudden waves. On the other hand, a dynamic anchor adjusts to the tides, allowing you to navigate through rough seas while maintaining your course. This analogy perfectly illustrates the essence of dynamic stop-loss strategies in trading.

To implement a dynamic stop-loss strategy using ATR, traders typically set their stop-loss levels at a multiple of the ATR value. For instance, if the ATR is calculated to be 1.5, a trader might set their stop-loss at 1.5 times the ATR below their entry price. This method allows the stop-loss to expand or contract based on market volatility, providing a buffer during periods of heightened price movement.

Here’s a simple formula to illustrate this concept:

| Trade Entry Price | ATR Value | Dynamic Stop Loss (1.5 x ATR) |

|---|---|---|

| $100 | $1.5 | $96.50 |

| $100 | $2.0 | $93.00 |

In the table above, you can see how the stop-loss level changes based on the ATR value. The greater the ATR, the further away the stop-loss is set, allowing for more room to breathe in volatile markets. This flexibility is crucial because it helps traders avoid getting stopped out prematurely during normal market fluctuations.

Another significant advantage of dynamic stop-loss strategies is that they can be adjusted as the trade progresses. For instance, as the price moves in favor of the trader, they can tighten the stop-loss to lock in profits while still allowing for some fluctuation. This technique is often referred to as a trailing stop-loss, and it can be a game-changer for maximizing profitability.

However, it’s essential to remember that while dynamic stop-loss strategies can significantly enhance your trading approach, they also require careful consideration and discipline. Traders should regularly review their ATR calculations and be mindful of market conditions. A sudden spike in volatility could necessitate a reevaluation of stop-loss levels to ensure they remain effective.

In summary, dynamic stop-loss strategies powered by ATR not only provide a more flexible approach to risk management but also help traders navigate the unpredictable waters of the market with greater confidence. By adjusting stop-loss levels based on real-time volatility, traders can protect their investments and enhance their overall trading performance.

- What is the Average True Range (ATR)?

ATR is a volatility indicator that measures market movement by calculating the average of true ranges over a specified period. - How do I calculate ATR?

ATR is calculated using the current high, current low, and previous close to determine the true range, which is then averaged over a set number of periods. - Why should I use dynamic stop-loss strategies?

Dynamic stop-loss strategies adapt to market volatility, helping traders protect profits and reduce the risk of being stopped out during normal price fluctuations. - What is a trailing stop-loss?

A trailing stop-loss is a type of dynamic stop-loss that adjusts as the price moves in favor of the trader, locking in profits while allowing for potential further gains.

Fixed vs. ATR-Based Stops

When it comes to managing risk in trading, the choice between using fixed stop-loss orders and ATR-based stops can significantly influence your trading outcomes. Fixed stops are predetermined points where you exit a trade, regardless of market conditions. This method offers simplicity and consistency, making it appealing for many traders. However, it can also lead to premature exits, especially in volatile markets where price fluctuations might trigger your stop-loss unnecessarily.

On the other hand, ATR-based stops adapt to the current market volatility. By using the Average True Range, traders can set their stop-loss levels based on the prevailing market conditions. For instance, if the ATR indicates high volatility, a trader might widen their stop-loss to avoid being stopped out by normal price swings. Conversely, in a calmer market, the stop-loss can be tightened, allowing for a more aggressive risk management approach.

To illustrate this difference, consider the following example:

| Market Condition | ATR Value | Fixed Stop-Loss (pips) | ATR-Based Stop-Loss (pips) |

|---|---|---|---|

| High Volatility | 50 | 20 | 40 |

| Low Volatility | 10 | 20 | 15 |

In this table, you can see how the ATR-based stop-loss adjusts according to market volatility. In a high-volatility scenario, the ATR suggests a wider stop-loss to accommodate larger price movements, while in a low-volatility environment, the stop-loss can be much tighter. This flexibility can help traders stay in winning trades longer and avoid unnecessary losses.

Ultimately, the choice between fixed and ATR-based stops should be guided by your trading style, risk tolerance, and market conditions. While fixed stops are straightforward and easy to implement, ATR-based stops provide a dynamic approach that can enhance your trading strategy, particularly in fluctuating markets. So, why not experiment with both methods to see which one resonates more with your trading philosophy?

- What is the main advantage of using ATR-based stops?

ATR-based stops adjust according to market volatility, helping traders avoid being stopped out during normal price fluctuations. - Can I use fixed stops in conjunction with ATR?

Yes, many traders find success by combining both methods, using fixed stops for certain trades while employing ATR-based stops for others. - How often should I recalculate my ATR-based stop-loss?

It's advisable to recalculate your ATR-based stop-loss regularly, especially after significant price movements or changes in volatility.

ATR in Position Sizing

When it comes to trading, understanding how much to invest in a position is crucial for managing risk effectively. This is where the Average True Range (ATR) comes into play. By using ATR, traders can determine the appropriate size of their trades based on the current market volatility. Think of ATR as your personal guide through the unpredictable waters of trading; it helps you navigate the highs and lows without capsizing your portfolio.

So, how does ATR assist in position sizing? The concept revolves around the relationship between volatility and risk. When volatility is high, you might want to reduce your position size to avoid significant losses. Conversely, when the market is calm, you can afford to increase your position size, capitalizing on the stability. This dynamic approach to position sizing ensures that your trading strategy remains adaptable and responsive to market conditions.

To calculate the risk per trade using ATR, you can follow a simple formula:

| Step | Formula | Description |

|---|---|---|

| 1 | ATR Value | Identify the current ATR value for the asset you are trading. |

| 2 | Risk Percentage | Determine the percentage of your total capital you are willing to risk on a single trade (e.g., 1-2%). |

| 3 | Position Size | Use the formula: (Account Size * Risk Percentage) / ATR Value. |

For example, if you have a trading account of $10,000 and decide to risk 1% on a trade, your total risk would be $100. If the ATR of the asset is $2, the calculation would be:

Position Size (10,000 * 0.01) / 2 Position Size 100 / 2 50 shares

This means you would purchase 50 shares of the asset, aligning your position size with the current market volatility. By doing this, you ensure that your risk is proportional to the market's behavior, enhancing your chances of long-term success.

Additionally, adjusting your position sizes based on ATR values can significantly improve your trading performance. For instance, during periods of high volatility, you might find that the ATR value increases, prompting you to reduce your position size. This way, you can protect your capital and avoid overexposure to sudden market movements. On the flip side, when ATR values decrease, indicating a more stable market, you can increase your position size to take advantage of favorable conditions.

In summary, utilizing ATR for position sizing is not just about numbers; it's about creating a strategy that adapts to the market's rhythm. By incorporating ATR into your trading plan, you can enhance your risk management approach and make more informed decisions. Remember, in trading, it's not only about how much you make but also about how well you protect what you have. So, next time you’re about to place a trade, consider how ATR can guide your position sizing for a more balanced and strategic approach.

- What is ATR? ATR stands for Average True Range, a volatility indicator that measures market movement.

- How is ATR calculated? ATR is calculated using the current high, current low, and previous close to determine the True Range, which is then averaged over a specified period.

- Can ATR be used for setting stop-loss orders? Yes, ATR can help determine appropriate stop-loss levels based on market volatility.

- Is ATR suitable for all trading styles? While ATR is beneficial for many trading strategies, its effectiveness may vary depending on individual trading styles and market conditions.

Risk Per Trade Calculation

Calculating the risk per trade is a fundamental aspect of successful trading, particularly when utilizing the Average True Range (ATR) as a guide. Understanding how much of your capital you are willing to risk on a single trade is essential for maintaining a sustainable trading strategy. The key to this calculation lies in determining your account size, the percentage of your account you are willing to risk, and the ATR value corresponding to the asset you are trading.

To start, let’s break this down into manageable steps. First, you need to decide what percentage of your trading account you are comfortable risking on a single trade. A common recommendation is to risk no more than 1% to 2% of your total trading capital. This approach helps ensure that a series of losses won’t deplete your account quickly.

Next, the formula for calculating risk per trade is:

Risk per Trade Account Size x Risk Percentage

For example, if you have a trading account of $10,000 and you decide to risk 1% per trade, your risk per trade would be:

Risk per Trade $10,000 x 0.01 $100

Once you have established your risk per trade, you can incorporate ATR to determine your position size. This is where the ATR comes into play, as it provides a measure of market volatility, which can help you adjust your trade size accordingly. The calculation for position size based on ATR is as follows:

Position Size Risk per Trade / ATR

Let’s say the ATR for the asset you’re trading is $2. Using our previous example, your position size would be:

Position Size $100 / $2 50 shares

This means you can buy 50 shares of the asset while keeping your risk within the predetermined limits. By using ATR, you are adapting your position size to the current market conditions, which can enhance your overall trading performance.

In conclusion, calculating risk per trade using ATR is not just about crunching numbers; it's about developing a risk management strategy that aligns with your trading goals. This method allows you to navigate the turbulent waters of trading with confidence and poise, ensuring that you stay in the game even when the market throws curveballs your way.

- What is ATR? ATR stands for Average True Range, a volatility indicator that measures market movement.

- How do I calculate ATR? ATR is calculated by averaging the True Range over a specified number of periods.

- Why is risk management important in trading? Effective risk management helps protect your capital and ensures long-term trading success.

- Can I use ATR for different trading styles? Yes, ATR can be beneficial for day traders, swing traders, and long-term investors alike.

Adjusting Position Sizes

When it comes to trading, one size certainly does not fit all. Adjusting position sizes based on the Average True Range (ATR) is a smart strategy that can significantly enhance your trading performance. Think of it this way: if you were to walk on a tightrope, would you take the same size steps regardless of how wobbly the rope is? Of course not! The same logic applies to trading. The more volatile the market, the smaller your steps—or in this case, your position size—should be.

By using ATR to inform your position sizing, you can tailor your trades to match the current market environment. For instance, if the ATR indicates high volatility, it might be wise to reduce your position size to mitigate risk. Conversely, during periods of low volatility, you might feel more comfortable increasing your position size. This dynamic approach allows traders to respond to changing market conditions, which can be the difference between a successful trade and a costly mistake.

To effectively adjust your position sizes, consider the following factors:

- Current ATR Value: Monitor the current ATR value closely. If it's rising, the market is becoming more volatile, and you may want to decrease your position size.

- Your Risk Tolerance: Everyone has a different appetite for risk. Make sure your position sizes align with your personal risk tolerance and trading strategy.

- Overall Market Conditions: Economic news, earnings reports, or geopolitical events can all impact market volatility. Stay informed to make better decisions.

Here's a simple formula to determine your position size based on ATR:

| Variable | Description |

|---|---|

| Account Balance | Your total trading capital. |

| Risk Percentage | The percentage of your account you are willing to risk on a single trade (e.g., 1%). |

| ATR Value | The current Average True Range value for the asset you are trading. |

| Position Size | Calculated as: (Account Balance * Risk Percentage) / ATR Value |

This formula helps you determine how many units of an asset you should trade based on your risk tolerance and the market's volatility. Remember, the goal is to stay flexible and responsive to the market while ensuring that you are not overexposed to risk.

In conclusion, adjusting your position sizes using ATR is like having a personalized trading strategy that adapts to the market's rhythm. By keeping an eye on volatility and adjusting your trades accordingly, you can protect your capital while maximizing your potential for profit. After all, in the world of trading, adaptability is key!

1. What is the Average True Range (ATR)?

ATR is a volatility indicator that measures the degree of price movement in an asset, helping traders assess market conditions.

2. How do I calculate ATR?

ATR is calculated by averaging the True Range over a specific number of periods, which includes the current high, current low, and previous close.

3. Why should I adjust my position size based on ATR?

Adjusting your position size based on ATR allows you to tailor your trades to current market volatility, helping to manage risk effectively.

4. Can ATR be used for all types of trading?

Yes, ATR can be applied in various trading styles, including day trading, swing trading, and long-term investing, to help manage risk and optimize position sizes.

ATR and Market Trends

The Average True Range (ATR) is not just a measure of market volatility; it also serves as a valuable indicator of market trends. Understanding how ATR correlates with market movements can empower traders to make informed decisions. Think of ATR as your trading compass, guiding you through the often turbulent waters of the financial markets. When you grasp how ATR interacts with trends, you can better navigate your trading strategies.

One of the fundamental aspects of ATR is its ability to signal the strength of a trend. For instance, during an uptrend, if the ATR values are high, this indicates strong momentum. It’s like a speeding train—when it’s moving fast, you can bet it’s going to continue on that track for a while. Conversely, if the ATR begins to decline during an uptrend, it may suggest that the momentum is waning, hinting at a potential reversal. This is akin to a train slowing down as it approaches a station; it’s a sign that the journey might be coming to an end.

Moreover, ATR can be particularly useful when combined with other technical indicators to strengthen your analysis. For example, when you overlay ATR with moving averages or the Relative Strength Index (RSI), you create a more comprehensive trading strategy. This combination allows you to assess not only the volatility of the market but also the direction and strength of the trend. Imagine using a magnifying glass to examine a map; you can see the details more clearly, which in turn helps you make better decisions.

To illustrate how ATR can help in identifying trend strength, consider the following table that summarizes ATR values and their implications:

| ATR Value Range | Market Condition | Implication |

|---|---|---|

| High (e.g., >1.5) | Strong Trend | Indicates strong momentum; potential for continuation |

| Medium (e.g., 0.5 - 1.5) | Moderate Trend | Trend may continue but watch for signs of reversal |

| Low (e.g., <0.5) | Weak Trend | Market may be consolidating; potential for reversal |

In summary, ATR is a powerful tool that provides insights into market trends. By understanding how ATR relates to trend strength and incorporating it with other indicators, traders can enhance their strategies significantly. It’s like having a toolkit full of specialized instruments; each one has its purpose, but together, they create a more effective approach to trading.

- What is the Average True Range (ATR)?

ATR is a volatility indicator that measures the degree of price movement in a market. - How can I use ATR in my trading strategy?

You can use ATR to set stop-loss orders, determine position sizes, and analyze market trends. - Is a higher ATR always better?

A higher ATR indicates more volatility, which can mean greater potential for profit, but also increased risk. - Can ATR be used for all types of trading?

Yes, ATR can be applied to various trading styles, including day trading, swing trading, and long-term investing.

Identifying Trend Strength

When it comes to trading, understanding the strength of a trend can be the difference between making a profit and taking a loss. The Average True Range (ATR) is a powerful tool that can help traders gauge this strength effectively. By analyzing ATR values in conjunction with price movements, traders can gain insights into whether a trend is gaining momentum or losing steam. Think of ATR as a weather vane for market volatility; it tells you how turbulent the market is, which can help you make informed decisions.

Higher ATR values during an uptrend indicate that the market is experiencing strong momentum. This means that traders are actively buying, and the price is likely to continue climbing. Conversely, if you notice lower ATR values while the price is rising, it can signal a weakening trend. Imagine you’re driving a car: if the engine roars and the speedometer climbs rapidly, you’re likely on a strong road. However, if the engine sputters and the speedometer barely moves, it’s time to reconsider your route.

To further illustrate this, let’s look at a simple table that summarizes how ATR values correlate with trend strength:

| ATR Value | Trend Strength | Market Implication |

|---|---|---|

| High (e.g., >1.5) | Strong Trend | Potential for continued movement |

| Moderate (e.g., 0.5 - 1.5) | Moderate Trend | Possible consolidation or reversal |

| Low (e.g., <0.5) | Weak Trend | Market may be range-bound |

In addition to analyzing ATR values, it’s also beneficial to combine ATR with other technical indicators. For instance, using ATR alongside moving averages can provide a more comprehensive view of market conditions. When the price is above a moving average and ATR is increasing, it’s a solid indication of a strong uptrend. On the flip side, if the price is below the moving average and ATR is rising, it may suggest a robust downtrend. Combining these indicators can create a more robust trading strategy, allowing traders to capitalize on market movements effectively.

Ultimately, identifying trend strength using ATR is not just about numbers; it’s about reading the market’s pulse. Just as a doctor checks vital signs to assess a patient’s health, traders can use ATR to monitor the vitality of market trends. By staying attuned to these signals, traders can make more informed decisions, increasing their chances of success in the ever-changing landscape of trading.

- What is the Average True Range (ATR)? ATR is a volatility indicator that measures market movement by calculating the average of true ranges over a specified period.

- How can ATR help in setting stop-loss orders? By using ATR, traders can set dynamic stop-loss levels based on current market volatility, allowing for more flexible risk management.

- Can ATR be used for all trading styles? Yes, ATR can be beneficial for various trading styles, including day trading, swing trading, and long-term investing.

- Is a higher ATR always better? Not necessarily. A higher ATR indicates more volatility, which can lead to larger price swings but also increased risk.

Combining ATR with Other Indicators

When it comes to trading, using the Average True Range (ATR) in isolation can only take you so far. To truly enhance your trading strategies, it’s essential to combine ATR with other technical indicators. Think of ATR as a compass that tells you how turbulent the waters are, while other indicators help you navigate through those waters. By integrating ATR with tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands, traders can achieve a more comprehensive view of market conditions.

One effective strategy is to use ATR alongside moving averages. For instance, when the price is above a moving average and the ATR is increasing, it signals a strong uptrend with significant volatility. Conversely, if the price is below the moving average and the ATR is rising, it indicates a strong downtrend. This combination helps traders confirm the strength of a trend before entering a position.

Another powerful pairing is ATR with RSI. The RSI measures the speed and change of price movements, while ATR provides insights into volatility. When the RSI indicates that an asset is overbought or oversold but the ATR is low, it might suggest that the market is not ready for a reversal yet. However, if the ATR spikes while the RSI is in these extreme zones, it could signal that a reversal is imminent, providing traders with a timely opportunity to act.

Furthermore, integrating ATR with Bollinger Bands can also yield insightful results. Bollinger Bands consist of a moving average and two standard deviation lines that expand and contract based on market volatility. When the price approaches the upper band and the ATR is high, it indicates that the market is experiencing strong volatility, which could lead to a price reversal. On the other hand, if the price is near the lower band and the ATR is increasing, it might suggest a potential breakout to the upside.

In summary, combining ATR with other indicators not only enhances your trading strategy but also provides a multi-faceted approach to market analysis. By considering the interplay between volatility and momentum, traders can make more informed decisions. Remember, the key is to not rely solely on one indicator but to create a robust trading system that takes into account various market signals.

- What is the Average True Range (ATR)? ATR is a volatility indicator that measures market movement by calculating the average of true ranges over a specified period.

- How can I use ATR in my trading strategy? ATR can be used to set stop-loss orders, determine position sizes, and gauge market volatility to enhance your overall trading strategy.

- Is ATR useful for all types of trading? Yes, ATR is beneficial for day trading, swing trading, and long-term investing as it provides insights into market volatility regardless of the trading style.

- Can ATR be used in combination with other indicators? Absolutely! Combining ATR with indicators like moving averages, RSI, or Bollinger Bands can provide a more comprehensive analysis of market conditions.

Frequently Asked Questions

- What is the Average True Range (ATR) and why is it important in trading?

The Average True Range (ATR) is a volatility indicator that measures market movement. It helps traders assess how much an asset's price can change over a certain period, allowing for better decision-making regarding entry and exit points. Understanding ATR is crucial for managing risk and optimizing trading strategies.

- How is ATR calculated?

ATR is calculated by analyzing price movements over a specified period. It involves three key components: the current high, the current low, and the previous close. The True Range is determined by taking the greatest of these values, and the Average True Range is derived by averaging the True Range over a set number of periods.

- How can I use ATR to set stop-loss orders?

ATR can be effectively used to set stop-loss orders by determining appropriate levels based on market volatility. Traders can calculate a stop-loss level by taking the ATR value and adjusting it according to their risk tolerance. This dynamic approach helps protect profits while minimizing risks during volatile market conditions.

- What is the difference between fixed stop-loss orders and ATR-based stops?

Fixed stop-loss orders remain constant regardless of market conditions, while ATR-based stops adjust according to the market's volatility. Using ATR allows traders to be more flexible and responsive to changes in market dynamics, potentially leading to better risk management and improved trading outcomes.

- How does ATR assist in position sizing?

ATR plays a vital role in position sizing by helping traders determine the appropriate size of their trades based on market volatility. By calculating risk per trade using ATR, traders can allocate their capital wisely, ensuring their trades align with their overall risk tolerance and current market conditions.

- Can ATR indicate market trends?

Yes, ATR not only measures volatility but can also indicate market trends. Higher ATR values during an uptrend suggest strong momentum, while lower values may signal a potential reversal. This insight allows traders to make informed decisions about entering or exiting trades based on trend strength.

- How can I combine ATR with other technical indicators?

Combining ATR with other technical indicators, such as moving averages or the Relative Strength Index (RSI), can enhance your trading analysis. This integrated approach allows traders to confirm signals and improve their decision-making process, leading to more effective trading strategies.