How to Stay Informed About Exchange Updates

In today's fast-paced financial world, staying updated on exchange rates is more crucial than ever. Whether you’re a seasoned investor, a business owner dealing with international clients, or just someone planning a trip abroad, understanding currency fluctuations can significantly impact your financial decisions. But how do you keep track of these ever-changing rates? In this article, we will explore various methods and resources to ensure you are always in the loop regarding exchange updates.

To effectively stay informed about exchange updates, it's essential to grasp what exchange rates actually are. In simple terms, an exchange rate is the price of one currency in terms of another. For example, if the exchange rate between the US dollar (USD) and the Euro (EUR) is 1.20, it means that 1 USD is equivalent to 1.20 EUR. Exchange rates fluctuate due to a variety of factors including economic indicators, market demand, and geopolitical events. Understanding these dynamics is foundational for anyone looking to make informed financial decisions.

Imagine trying to catch a wave while surfing without knowing when the next big wave is coming. That’s what it feels like to trade currencies without real-time updates. The financial market can change in an instant, and having access to immediate information can mean the difference between profit and loss. Real-time updates allow you to react swiftly to market changes, ensuring that your financial decisions are timely and effective. This is especially critical for traders and businesses that deal in foreign currencies on a daily basis.

One of the most effective ways to stay informed is by leveraging financial news platforms. Websites like Bloomberg, Reuters, and CNBC offer comprehensive coverage of exchange rates, economic news, and market trends. These platforms provide not just the latest figures, but also expert analysis and insights that can help you understand the bigger picture. Subscribing to alerts from these sites can keep you updated on significant changes and trends, ensuring you never miss crucial information.

In our mobile-driven world, having the right apps at your fingertips can be a game changer. Applications like XE Currency, OANDA, and Currency Converter Plus provide real-time exchange rates and notifications straight to your phone. These apps often come with features like historical data analysis, which can help you spot trends over time. Whether you’re at home or on the go, these tools make it easy to track currency movements and make informed decisions.

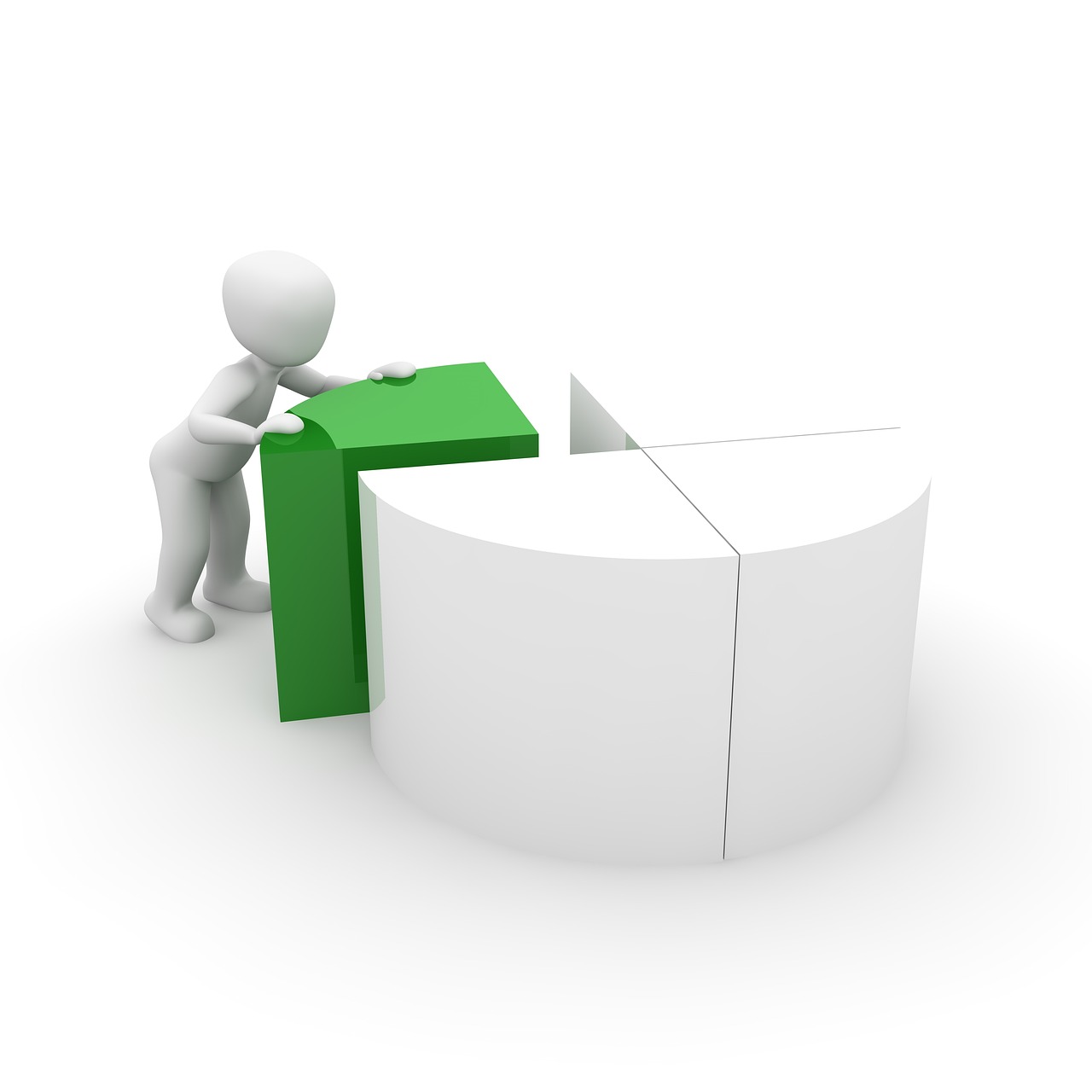

Understanding the key economic indicators that influence exchange rates is vital. Factors such as interest rates, inflation, and employment data can all affect currency value. For example, when a country raises its interest rates, it often leads to a stronger currency as investors seek higher returns. By keeping an eye on these indicators, you can gain insights into potential market movements and adjust your strategies accordingly. Here’s a quick overview of some key indicators:

| Indicator | Impact on Currency |

|---|---|

| Interest Rates | Higher rates typically strengthen a currency. |

| Inflation | High inflation can weaken a currency. |

| Employment Data | Strong employment figures can boost currency value. |

Another great way to stay informed is by engaging with online communities. Platforms like Reddit, Facebook groups, and specialized forums allow you to connect with other individuals interested in currency exchange. Members often share valuable insights, tips, and real-time updates that can enhance your understanding of the market. It’s like having a personal network of financial advisors at your fingertips, ready to share their knowledge and experiences.

To ensure you never miss important updates, setting up alerts for specific currency pairs or market changes is a smart move. Many financial news platforms and mobile apps allow you to customize notifications based on your preferences. By doing this, you can receive instant alerts for significant fluctuations, helping you to act quickly when it matters most. It’s like having a personal assistant dedicated to keeping you informed about your financial interests.

Expert analysis can provide deeper insights into potential exchange rate movements. Financial analysts and economists often publish forecasts and reports that can help you understand the underlying factors affecting currency values. Subscribing to these insights can be incredibly beneficial, especially for those who want to make informed decisions rather than relying solely on market trends.

Finally, consider subscribing to financial newsletters that offer curated content about exchange rates and economic developments. These newsletters often provide a summary of the latest trends, expert opinions, and actionable insights directly to your inbox. This way, you can stay informed without having to scour multiple sources for information.

- What are exchange rates? Exchange rates are the value of one currency compared to another, determining how much of one currency you need to spend to purchase another.

- Why do exchange rates fluctuate? They fluctuate due to various factors including economic indicators, market demand, and geopolitical events.

- How can I track exchange rates? You can track exchange rates through financial news platforms, mobile apps, and by following economic indicators.

- What are economic indicators? Economic indicators are statistics about economic activities that can influence currency value, such as interest rates and inflation.

Understanding Exchange Rates

Exchange rates are the prices at which one currency can be exchanged for another. Imagine you’re traveling to Europe and you need to convert your US dollars into euros. The rate at which this conversion happens is the exchange rate. But what determines these rates? Well, it’s a complex interplay of various factors, including supply and demand, economic stability, interest rates, and even geopolitical events. Just like the weather, exchange rates can change rapidly, and understanding this fluctuation is crucial for anyone involved in international transactions or investments.

At the core of exchange rates lies the concept of currency pairs. For example, in the USD/EUR pair, the first currency (USD) is the base currency, and the second (EUR) is the quote currency. If the exchange rate is 0.85, it means one US dollar can be exchanged for 0.85 euros. This relationship is influenced by numerous factors:

- Economic Indicators: These include GDP growth, unemployment rates, and inflation. Strong economic performance generally boosts a country's currency.

- Interest Rates: Higher interest rates offer lenders a higher return relative to other countries, attracting foreign capital and causing the exchange rate to rise.

- Political Stability: Countries with less risk for political turmoil are more attractive to foreign investors, which can strengthen their currency.

Another way to think about it is to consider exchange rates as a reflection of a country's economic health. If a country is doing well economically, its currency will likely strengthen against others. Conversely, if a country is facing economic challenges, its currency may weaken. This is why investors and businesses closely monitor exchange rates—they can significantly impact profit margins and investment returns.

Additionally, exchange rates can be categorized into two types: floating and fixed. A floating exchange rate is determined by the market forces of supply and demand, while a fixed exchange rate is pegged to another major currency, like the US dollar or gold. Understanding these types can help you navigate the currency market more effectively.

In conclusion, having a solid grasp of what exchange rates are and how they function is essential for anyone looking to make informed financial decisions. Whether you're an investor, a traveler, or a business owner, staying updated on currency fluctuations can save you money and help you capitalize on favorable exchange rates.

Importance of Real-Time Updates

In today's fast-paced financial landscape, staying informed about exchange rates is crucial for anyone involved in trading, investing, or even traveling. The importance of receiving real-time updates cannot be overstated. Imagine trying to catch a wave while surfing; if you're not aware of the changing tides, you might miss the best swells. Similarly, in the world of finance, timely information can mean the difference between making a profit or incurring a loss.

Exchange rates are influenced by a plethora of factors, including economic indicators, geopolitical events, and market sentiment. These factors can change rapidly, leading to fluctuations in currency values. Without real-time updates, you might find yourself relying on outdated information, which can lead to poor financial decisions. For instance, if you were to buy a foreign currency without knowing that its value has dropped significantly, you could end up paying much more than necessary. This is where the power of real-time updates comes into play.

Receiving updates in real time allows you to:

- React Quickly: When you have access to live data, you can make swift decisions. Whether it’s executing a trade or making a purchase, timing is everything.

- Stay Ahead of Trends: Understanding market trends as they happen can give you a competitive edge. By monitoring real-time updates, you can identify emerging patterns before they become mainstream.

- Mitigate Risks: The financial market is inherently volatile. Real-time updates help you manage risks by allowing you to adjust your strategies based on the latest information.

Moreover, the ability to track changes as they happen means you can better plan your investments. For example, if you're looking to invest in a currency that is experiencing a surge, having real-time access to that information allows you to jump in before the prices stabilize. This is akin to watching a stock that’s about to take off; the earlier you get in, the better your potential returns.

In conclusion, the importance of real-time updates in the realm of exchange rates cannot be ignored. They empower you to make informed decisions, seize opportunities, and navigate the complexities of the financial market with confidence. Remember, in the world of finance, knowledge is power, and staying informed is your best strategy for success.

1. Why are real-time updates important for exchange rates?

Real-time updates are crucial because they allow you to respond quickly to market changes, helping you make informed financial decisions that can significantly impact your investments.

2. How can I receive real-time updates on exchange rates?

You can receive real-time updates through financial news platforms, mobile apps, and by setting up alerts on various trading platforms.

3. What are some key factors that influence exchange rates?

Exchange rates are influenced by economic indicators, interest rates, inflation, and geopolitical events, among other factors.

4. Can I trust online communities for exchange rate information?

While online communities can provide valuable insights and real-time updates, it’s essential to verify information with trusted financial sources to ensure accuracy.

5. What tools can I use to set up alerts for exchange rate changes?

Many financial platforms offer alert features, and you can also use dedicated currency tracking apps to set notifications for specific currency pairs.

Utilizing Financial News Platforms

In today’s fast-paced world, staying updated on exchange rates and market trends is more crucial than ever. With the constant ebb and flow of currency values, having the right information at your fingertips can make all the difference in your financial decisions. So, how can you harness the power of financial news platforms to keep yourself informed? Let’s dive into this topic and explore the various resources available.

Financial news platforms serve as your go-to source for real-time updates on exchange rates, economic indicators, and global market trends. Think of these platforms as your personal financial news reporters, delivering the latest headlines straight to your screen. Websites like Bloomberg, Reuters, and CNBC are excellent starting points. They offer comprehensive coverage of financial news, including dedicated sections for currency exchange rates and economic reports. By regularly visiting these sites, you can gain insights into the factors driving currency fluctuations, such as geopolitical events, trade agreements, and economic policies.

Moreover, many of these platforms provide live updates and interactive charts that allow you to visualize trends over time. For instance, if you’re interested in the Euro to Dollar exchange rate, you can easily track its performance over days, weeks, or even months. This visual representation can help you identify patterns and make informed predictions about future movements. Here’s a quick overview of some popular financial news platforms and their unique features:

| Platform | Features | Best For |

|---|---|---|

| Bloomberg | Live updates, in-depth analysis, and expert opinions | Comprehensive market coverage |

| Reuters | Real-time news, economic indicators, and currency analysis | Global news and insights |

| CNBC | Live streaming, expert interviews, and market analysis | Real-time updates and expert advice |

In addition to these platforms, consider subscribing to their newsletters. Most financial news websites offer daily or weekly newsletters that summarize key market events and trends. This way, you can receive curated content directly in your inbox, saving you the hassle of searching for updates. Imagine waking up to a neatly organized email highlighting the most significant currency movements and economic news. It’s like having a financial advisor at your service!

Furthermore, many financial news platforms have mobile applications that allow you to stay connected on the go. Whether you’re commuting, traveling, or simply enjoying a coffee break, these apps provide instant notifications about significant market changes. You can set alerts for specific currency pairs and receive updates straight to your phone, ensuring you never miss an important development.

So, whether you’re a seasoned investor or just starting your journey into the world of currency exchange, utilizing financial news platforms can empower you to make informed decisions. By keeping abreast of the latest developments and leveraging the tools these platforms offer, you can navigate the complex landscape of currency exchange with confidence.

- What are the best financial news platforms for currency updates?

Some of the top platforms include Bloomberg, Reuters, and CNBC, each offering unique features and insights. - How can I set up alerts for currency movements?

Most financial news apps allow users to set up custom alerts for specific currency pairs, ensuring you stay informed. - Are there any free resources for tracking exchange rates?

Yes, many websites and apps offer free access to exchange rate data and news updates.

Mobile Apps for Currency Tracking

In today's fast-paced world, staying updated on currency fluctuations is more important than ever. With the global economy constantly shifting, having the right tools at your fingertips can make all the difference. Enter mobile apps for currency tracking! These nifty applications are designed to provide you with real-time data, allowing you to monitor exchange rates on the go. Imagine being able to check the latest rates while sipping your morning coffee or during a lunch break—it's convenience at its finest!

So, what makes these apps so essential? For starters, they often offer instant notifications on significant changes in exchange rates. This means you can react quickly to market movements, ensuring you never miss a lucrative opportunity. Whether you're a seasoned investor or just someone who travels frequently, these alerts can help you make informed decisions that could save or earn you money.

Some popular mobile apps that have gained traction among users include:

- XE Currency: Known for its user-friendly interface, XE provides live exchange rates and historical charts. Plus, it offers a handy currency converter.

- OANDA: This app is favored by traders for its advanced features, including customizable alerts and a comprehensive market analysis tool.

- Currency Converter Plus: Perfect for travelers, this app not only tracks rates but also allows you to calculate costs in different currencies.

These apps are not just about tracking numbers; they also offer valuable insights. Many of them include features like news updates and economic indicators that can help you understand the factors driving currency movements. For instance, if you notice a sudden spike in the value of the Euro against the Dollar, you can quickly check the news to see if there’s been an economic announcement or political event influencing this change.

Moreover, the best currency tracking apps are designed with user experience in mind. They often feature intuitive layouts and easy navigation, making it simple for anyone—regardless of their tech-savviness—to stay informed. You can customize your dashboard to display the currencies you care about most, ensuring that your most relevant information is always just a tap away.

Another fantastic aspect of these mobile applications is their ability to work offline. Many currency tracking apps allow you to download the latest rates so you can access them even without an internet connection. This is particularly useful for travelers who might find themselves in areas with limited connectivity. With your app ready to go, you can confidently make purchases or exchange money without worrying about fluctuating rates.

In conclusion, mobile apps for currency tracking are indispensable tools for anyone looking to navigate the complexities of currency exchange. They empower users with real-time data, personalized notifications, and insightful analysis, all while being incredibly convenient. So why not download one today and take control of your financial decisions? With the right app, you’ll be well-equipped to handle the ever-changing landscape of currency exchange!

1. What are the best mobile apps for tracking currency?

There are several popular options, including XE Currency, OANDA, and Currency Converter Plus, each offering unique features tailored to different needs.

2. Do these apps require an internet connection?

Most apps provide real-time data but often allow you to download the latest rates for offline access, which is great for travelers.

3. Can I set alerts for specific currency pairs?

Yes! Most currency tracking apps allow users to set customizable alerts for specific currency pairs, helping you stay updated on significant changes.

4. Are these apps free to use?

Many currency tracking apps are free, though some may offer premium features or subscriptions for advanced functionalities.

Following Economic Indicators

When it comes to understanding exchange rates, keeping an eye on economic indicators is crucial. These indicators act like a compass, guiding you through the often turbulent waters of currency fluctuations. They provide insights into the overall health of a country's economy, which directly impacts its currency's value. But what exactly should you be looking for?

First off, let's talk about interest rates. Central banks, like the Federal Reserve in the U.S. or the European Central Bank in Europe, set these rates, and they can have a profound effect on exchange rates. For instance, when a country raises its interest rates, it typically strengthens its currency because higher rates offer better returns on investments denominated in that currency. Imagine it as a magnet pulling in foreign capital, making the currency more attractive to investors.

Another key indicator is inflation. Inflation measures how much prices for goods and services rise over time. A country with low inflation rates usually sees an appreciation in the value of its currency. Why? Because low inflation means that purchasing power is preserved, making the currency more desirable. Conversely, high inflation can erode a currency's value, leading to a depreciation. Think of inflation as a slow leak in a balloon; the more it leaks, the less air it has, and eventually, it deflates.

Next up is employment data. Employment rates are a reflection of economic stability. High employment levels often indicate a robust economy, which can lead to a stronger currency. On the other hand, rising unemployment can signal economic trouble, causing the currency to weaken. It's like watching a sports team—when they’re winning, their fans are more enthusiastic, and the value of their merchandise goes up. But if they start losing, interest wanes, and so does the value.

To give you a clearer picture, here’s a simple table summarizing these key indicators and their effects on exchange rates:

| Economic Indicator | Effect on Currency |

|---|---|

| Interest Rates | Higher rates strengthen the currency; lower rates weaken it. |

| Inflation | Low inflation strengthens the currency; high inflation weakens it. |

| Employment Data | High employment strengthens the currency; rising unemployment weakens it. |

By following these indicators, you can gain a better understanding of the economic landscape and how it affects currency movements. But don’t just stop here! Make sure to combine this knowledge with real-time updates to stay ahead in the game. After all, in the world of currency exchange, knowledge is power, and being informed can make all the difference in your financial decisions.

Engaging with Online Communities

In today's digital age, has become an essential part of staying informed about exchange rates and currency trends. Imagine walking into a bustling marketplace where everyone is sharing the latest gossip, tips, and insights; that’s what these online communities feel like! They offer a vibrant platform where individuals come together to discuss everything from market fluctuations to investment strategies. By participating in these communities, you can tap into a wealth of knowledge that might not be readily available in traditional financial news outlets.

Online forums and social media groups dedicated to currency exchange provide a unique opportunity for real-time interaction. Members often share their personal experiences, which can be invaluable when trying to navigate the complexities of foreign exchange. For instance, you might come across a thread discussing the impact of a recent economic report on the Euro, complete with opinions from seasoned traders and analysts. This kind of exchange of ideas can sharpen your understanding and help you make better financial decisions.

Moreover, these communities are not just about sharing information; they also foster a sense of camaraderie. You can connect with like-minded individuals who share your passion for finance and trading. This support network can be incredibly motivating, especially when you're facing the inevitable ups and downs of the market. It’s like having a group of friends cheering you on as you navigate the sometimes tumultuous waters of currency trading.

Another significant advantage of engaging with online communities is the ability to ask questions and seek advice. Whether you’re a novice just starting out or an experienced trader looking to refine your strategy, these platforms provide a space to pose your queries and receive feedback from others who have been in your shoes. You might ask, “What strategies do you use to track exchange rates?” and receive a host of suggestions, ranging from specific tools to general approaches that can enhance your tracking efforts.

However, it’s essential to approach these communities with a critical eye. While many members share valuable insights, not all information is created equal. Always verify the advice you receive and consider the source. Engaging with reputable members who have a track record of success can help you filter out the noise and focus on what truly matters.

Ultimately, the key to maximizing your experience in online communities lies in active participation. Don’t just lurk in the shadows; contribute your thoughts, share your experiences, and ask questions. The more you engage, the more you’ll learn and grow. Think of it as a collaborative learning environment where everyone benefits from each other's knowledge and insights.

In summary, online communities are a treasure trove of information and support for anyone looking to stay informed about exchange rates. They provide a platform for real-time discussions, foster connections with fellow enthusiasts, and offer a space to ask questions and share insights. So, dive in, participate actively, and watch your understanding of the currency market flourish!

- How can I find reliable online communities for currency exchange? Look for forums with active discussions and a good reputation. Websites like Reddit, specialized financial forums, and social media groups can be great places to start.

- What should I be cautious about when engaging in online communities? Always verify the information you receive and be wary of advice from unverified sources. It's essential to cross-reference any strategies or tips with reputable financial advice.

- Can I learn trading strategies from these communities? Absolutely! Many experienced traders share their strategies and insights, making these communities a valuable resource for learning.

Setting Up Alerts and Notifications

In today's fast-paced financial environment, staying updated on exchange rates is crucial, and one of the most effective ways to do this is by . Imagine you're a trader who needs to make a quick decision based on a sudden change in currency value. Without real-time alerts, you might miss an opportunity or face a loss. So, how do you ensure you're always in the loop?

First, many financial platforms and mobile applications offer customizable alert systems. These tools allow you to set specific thresholds for currency pairs, notifying you when rates hit your desired levels. For example, if you're watching the Euro to Dollar exchange rate, you can set an alert to notify you when it reaches a certain value, such as 1.20. This way, you can act swiftly, just like a hawk swooping in on its prey!

To get started, you can follow these steps:

- Choose Your Platform: Select a financial news platform or mobile app that suits your needs. Popular options include XE, OANDA, and Investing.com, which offer user-friendly interfaces and robust alert systems.

- Create an Account: Most platforms require you to set up an account. This process is usually quick and straightforward.

- Set Your Alerts: Once you're logged in, navigate to the alerts section. Here, you can specify which currency pairs you want to track and set your desired price levels.

- Choose Notification Methods: Decide how you want to receive alerts—via email, SMS, or push notifications on your mobile device. This flexibility ensures that you never miss a beat!

Additionally, some platforms offer advanced features, such as news alerts that notify you of significant economic events that may impact exchange rates. For instance, if a central bank announces a change in interest rates, receiving a notification can help you anticipate market movements and make informed decisions.

Remember, the key to effective alert management is to avoid overwhelming yourself. Setting too many alerts can lead to notification fatigue, causing you to overlook critical updates. Instead, focus on the currency pairs that matter most to your financial goals and set alerts accordingly.

In conclusion, by leveraging alerts and notifications, you can stay ahead in the ever-changing world of currency exchange. This proactive approach not only enhances your ability to respond to market fluctuations but also empowers you to make informed financial decisions that align with your investment strategy. So, take the plunge and set up your alerts today—you'll thank yourself later!

Q: Can I set alerts for multiple currency pairs?

A: Yes, most platforms allow you to set alerts for multiple currency pairs simultaneously. Just ensure you manage them effectively to avoid notification overload.

Q: Are there any costs associated with setting up alerts?

A: Generally, setting up alerts on financial platforms is free, but some premium features may require a subscription.

Q: How quickly will I receive notifications?

A: Notification speed can vary by platform, but most provide real-time alerts as soon as the specified conditions are met.

Q: Can I customize the type of alerts I receive?

A: Absolutely! Many platforms allow you to customize alerts based on price changes, economic news, and more.

Leveraging Expert Analysis

When it comes to navigating the unpredictable waters of currency exchange, expert analysis serves as a lighthouse guiding you through the fog. Financial analysts and economists dedicate their careers to understanding the complex factors that influence exchange rates, and tapping into their insights can be invaluable for anyone looking to make informed decisions. But how exactly can you leverage this expert knowledge to your advantage?

First off, it’s essential to understand that expert analysis is not just about crunching numbers; it’s about interpreting data within the broader context of economic trends. Analysts take into account various factors, including geopolitical events, economic indicators, and market sentiment, to forecast potential movements in exchange rates. For instance, if an analyst predicts that the U.S. Federal Reserve will raise interest rates, this could lead to a strengthening of the U.S. dollar. Recognizing such trends can help you adjust your investment strategies accordingly.

Moreover, many financial institutions and online platforms offer regular reports and forecasts from seasoned analysts. These reports often include detailed breakdowns of currency pairs, highlighting not just current rates but also anticipated movements based on recent developments. Subscribing to these reports can keep you ahead of the curve, allowing you to make timely decisions based on expert opinions.

Here’s a quick look at some of the key benefits of leveraging expert analysis:

- Informed Decision-Making: Accessing expert insights helps you make choices based on data rather than gut feelings.

- Risk Management: Understanding potential market shifts can assist in minimizing risks associated with currency trading.

- Trend Identification: Experts often spot trends before they become mainstream, giving you an edge in the market.

Additionally, many analysts share their thoughts on social media platforms and financial news websites, making it easier than ever to stay updated. Engaging with these platforms not only provides access to expert opinions but also allows you to participate in discussions that can deepen your understanding of market dynamics.

In conclusion, leveraging expert analysis is about more than just reading reports; it’s about integrating that knowledge into your financial strategy. By staying informed through expert insights, you can navigate the complexities of currency exchange with confidence and make decisions that align with your financial goals.

Q: How can I find reliable expert analysis on exchange rates?

A: You can find reliable expert analysis through financial news websites, dedicated currency exchange platforms, and by subscribing to newsletters from reputable financial institutions.

Q: Are expert analyses always accurate?

A: While expert analyses are based on thorough research and data interpretation, they are not foolproof. Market conditions can change rapidly, so it's wise to consider multiple sources and analyses before making decisions.

Q: How often should I check for expert analysis?

A: It’s advisable to check for updates regularly, especially during periods of high market volatility or when significant economic news is expected.

Staying Informed Through Newsletters

In today's fast-paced financial world, staying informed about exchange rates and economic developments can feel like trying to catch smoke with your bare hands. However, one effective solution to this dilemma is subscribing to financial newsletters. These newsletters are like having a personal financial advisor in your inbox, delivering curated content that keeps you updated on the latest trends and insights. Imagine waking up each morning to a neatly packaged summary of essential market movements, analysis, and forecasts—all tailored to your interests. Sounds great, right?

So, what exactly makes newsletters such a powerful tool for staying informed? For starters, they often provide expert insights that you might not find elsewhere. Financial analysts and economists spend countless hours researching and analyzing data, and they condense this information into digestible formats just for you. This means you can access valuable knowledge without having to sift through mountains of data yourself. Think of it as having a cheat sheet for the complex world of finance!

Moreover, newsletters can cover a wide range of topics, from specific currency trends to broader economic indicators that influence exchange rates. By subscribing to multiple newsletters, you can create a comprehensive view of the market. Here’s a quick breakdown of the benefits:

- Timeliness: Newsletters often deliver updates in real-time or near-real-time, ensuring you are always in the loop.

- Customization: Many platforms allow you to tailor the content based on your interests, so you only receive information relevant to you.

- Accessibility: You can read newsletters on various devices, making it easy to stay informed on the go.

But how do you choose the right newsletters? With so many options out there, it can be overwhelming. Here are a few tips to help you navigate:

- Research: Look for newsletters that are well-regarded in the financial community. Check reviews and testimonials to gauge their credibility.

- Sample Content: Many newsletters offer free trial periods or sample issues. Take advantage of these to see if the content resonates with you.

- Frequency: Consider how often you want to receive updates. Some newsletters are daily, while others might be weekly or monthly.

In summary, subscribing to financial newsletters is a fantastic way to stay informed about exchange rates and economic changes. By leveraging expert analysis, timely updates, and customizable content, you can make better financial decisions. So, why not take a few minutes to sign up for a couple of newsletters today? You might just find that they become an indispensable part of your financial toolkit!

Q: How do I find reputable financial newsletters?

A: Look for recommendations from trusted financial websites, forums, or social media. Reviews and testimonials can also guide you in the right direction.

Q: Are financial newsletters free?

A: Many newsletters offer free subscriptions, while some may charge for premium content. It's wise to explore both options to see what fits your needs.

Q: How often should I read financial newsletters?

A: It depends on your personal preference and how much information you want to consume. Daily updates can keep you informed, while weekly summaries might be sufficient for some.

Frequently Asked Questions

- What are exchange rates and why do they fluctuate?

Exchange rates are the values at which one currency can be exchanged for another. They fluctuate due to various factors such as economic indicators, market sentiment, interest rates, and geopolitical events. Understanding these fluctuations is crucial for making informed financial decisions.

- How can I receive real-time updates on exchange rates?

You can receive real-time updates through financial news platforms, mobile apps, and setting up alerts on currency tracking websites. These resources provide timely information that can help you react quickly to market changes.

- What are some recommended mobile apps for tracking currency?

Popular mobile apps for currency tracking include XE Currency, OANDA, and Currency Converter Plus. These apps offer features like real-time notifications and historical data, making it easy to stay updated on the go.

- What economic indicators should I follow to understand exchange rates?

Key economic indicators include interest rates, inflation rates, employment data, and GDP growth. Monitoring these indicators can provide insights into currency strength and potential fluctuations in exchange rates.

- How can online communities help me stay informed about currency exchange?

Engaging with online communities, such as forums and social media groups, allows you to share insights and receive real-time updates from other members. This collaborative environment can enhance your understanding of market trends and currency movements.

- What tools can I use to set up alerts for currency changes?

Many financial websites and apps allow you to set up alerts for specific currency pairs. Tools like Google Alerts, Forex platforms, and dedicated mobile apps can notify you of significant market changes, ensuring you never miss important updates.

- Why should I leverage expert analysis for exchange rate predictions?

Expert analysis from financial analysts and economists can provide deeper insights into potential exchange rate movements. Their forecasts are based on extensive research and data, helping you make more informed decisions regarding your investments.

- What are the benefits of subscribing to financial newsletters?

Subscribing to financial newsletters delivers curated content, insights, and updates directly to your inbox. This way, you can stay informed about exchange rates and economic developments without having to search for information yourself.