How to Track Your Cryptocurrency Transactions

In today's digital age, cryptocurrency has revolutionized the way we think about money. With the rise of Bitcoin, Ethereum, and countless altcoins, managing your digital assets effectively has become more crucial than ever. But how do you keep track of all those transactions? This article explores effective methods and tools for tracking cryptocurrency transactions, ensuring transparency and accountability in your digital assets management. Whether you're a seasoned investor or just starting your crypto journey, understanding how to track your transactions is key to maximizing your investments and ensuring compliance with regulations.

At the heart of cryptocurrency lies blockchain technology. Imagine a digital ledger that's not only secure but also transparent and decentralized. This technology enables each transaction to be recorded in a way that everyone can see, but no one can alter. Each block in the chain contains a list of transactions, and once a block is filled, it gets added to the chain in a linear, chronological order. This makes tracking transactions incredibly straightforward. You can verify the authenticity of your transactions and ensure that your digital assets are secure. Understanding this technology is essential for anyone looking to manage their cryptocurrency effectively.

When it comes to tracking your cryptocurrency transactions, the type of wallet you choose plays a significant role. There are various types of wallets available, each with its unique transaction tracking features. Choosing the right wallet can simplify your tracking process and enhance your overall experience. Some wallets provide real-time transaction updates, while others focus on long-term security. Here’s a breakdown of the two main types of wallets:

Hot wallets are connected to the internet, making them incredibly convenient for frequent transactions. However, this convenience comes with a trade-off in security. On the other hand, cold wallets, which are offline storage options, offer enhanced security but may require more effort to access your funds. Here's a quick comparison:

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Security | Lower | Higher |

| Accessibility | Immediate | Delayed |

| Best For | Frequent transactions | Long-term storage |

Hot wallets are like your everyday wallet—always within reach. They allow you to send and receive cryptocurrencies quickly, making them ideal for trading or everyday purchases. However, this constant connection to the internet means they are more susceptible to hacks. Therefore, it’s essential to monitor your transactions closely and utilize any built-in tracking features they offer. Regularly checking your transaction history can help you catch any unauthorized activities early.

Cold wallets, on the other hand, are akin to a safe deposit box. They’re perfect for storing large amounts of cryptocurrency securely over time. While accessing your funds may take a bit longer, the peace of mind that comes with enhanced security is worth it. Many cold wallets also provide tracking capabilities, allowing you to review your transaction history without compromising security. This makes them an excellent choice for long-term investors.

In addition to wallets, numerous third-party tools can help you track your cryptocurrency transactions. These tools come with various features, such as portfolio management, real-time price updates, and transaction history analysis. Utilizing these tools can simplify your tracking process and provide valuable insights into your investment performance. Some popular options include:

- CoinTracking

- Blockfolio

- CoinStats

Tracking your cryptocurrency transactions isn't just about managing your portfolio; it's also crucial for understanding the tax implications. Many countries consider cryptocurrencies as taxable assets, meaning that every transaction could have tax consequences. By maintaining accurate records of your transactions, you can better prepare for tax season and avoid potential penalties.

Depending on where you live, reporting requirements for cryptocurrency transactions can vary significantly. It’s essential to familiarize yourself with your local regulations to ensure compliance. Keeping detailed records of your transactions, including dates, amounts, and parties involved, will make it easier to report your gains or losses accurately.

Fortunately, many tax software solutions now integrate with transaction tracking tools. This integration can significantly simplify your tax reporting process, allowing you to import your transaction history directly into your tax software. This not only saves time but also reduces the risk of errors, making tax season less stressful.

To ensure accuracy and security in your cryptocurrency tracking, consider implementing the following best practices:

Conducting regular audits of your cryptocurrency transactions is crucial for maintaining accurate records. This practice helps you detect discrepancies early and ensures that your financial records are up to date. Just like balancing your checkbook, regular audits can prevent potential issues down the line.

Finally, it’s vital to secure your transaction records. Use encrypted storage solutions and consider keeping backups in multiple locations. Protecting your sensitive information is just as important as tracking your transactions. After all, in the world of cryptocurrency, security is paramount.

Q: How can I track my cryptocurrency transactions?

A: You can track your cryptocurrency transactions using wallets with built-in tracking features, third-party tracking tools, and by maintaining detailed records of all your transactions.

Q: Are there tax implications for cryptocurrency transactions?

A: Yes, many countries consider cryptocurrencies as taxable assets, so it's essential to keep accurate records of your transactions for tax reporting purposes.

Q: What is the difference between hot wallets and cold wallets?

A: Hot wallets are connected to the internet and are convenient for frequent transactions, while cold wallets are offline and provide enhanced security for long-term storage.

Q: How often should I audit my cryptocurrency transactions?

A: It's a good practice to conduct audits regularly, such as monthly or quarterly, to ensure your records are accurate and up to date.

Understanding Blockchain Technology

Blockchain technology is the backbone of all cryptocurrencies, acting as a digital ledger that records transactions across many computers in a way that the registered transactions cannot be altered retroactively. This means that once a transaction is recorded, it is securely stored and becomes part of a permanent record. Imagine a library where every book represents a block filled with information. When someone reads a book (or a block), they can see all the previous books that were added to the library, but they cannot change the content of those books. This is how blockchain ensures transparency and security.

At its core, the blockchain operates on a decentralized network, meaning that no single entity has control over the entire chain. This decentralization is what makes it so revolutionary. Each transaction is verified by a network of computers, known as nodes, that work together to ensure that the information is accurate and trustworthy. This verification process is crucial because it prevents fraud and ensures that everyone in the network has access to the same information. Think of it like a group of friends who all have a shared diary; every time someone writes in it, everyone else can see the new entry, and no one can erase what has already been written.

One of the most significant advantages of blockchain technology is its immutability. Once data is added to the blockchain, it becomes nearly impossible to alter. This characteristic is essential for maintaining the integrity of transaction records, especially in the world of finance where trust is paramount. In fact, this immutability is achieved through cryptographic hashing, where each block contains a unique hash of the previous block, creating a chain that is incredibly difficult to break. If a hacker attempted to change a single block, they would have to change every subsequent block, which is virtually impossible due to the immense computational power required.

Moreover, blockchain technology allows for smart contracts. These are self-executing contracts with the terms of the agreement directly written into lines of code. They automatically execute actions when certain conditions are met, eliminating the need for intermediaries. For instance, imagine a vending machine; you insert money, select your item, and the machine automatically delivers it without needing a cashier. Smart contracts function similarly, streamlining processes and reducing costs.

In summary, understanding blockchain technology is crucial for anyone involved in cryptocurrency. Its decentralized nature, immutability, and ability to facilitate smart contracts make it a powerful tool for ensuring the security and transparency of transactions. As we delve deeper into the world of cryptocurrencies, grasping the fundamentals of blockchain will empower you to manage your digital assets more effectively.

Using Cryptocurrency Wallets

When it comes to managing your digital assets, cryptocurrency wallets are your best friends. Just like you wouldn't keep your cash stuffed in a sock drawer, you shouldn't leave your cryptocurrencies unprotected. Wallets come in various forms, each offering unique features that cater to different user needs. Whether you’re a casual investor or a seasoned trader, understanding these wallets is crucial for effective transaction tracking and overall asset management.

There are primarily two types of wallets you should be aware of: hot wallets and cold wallets. Each serves a different purpose and has its own set of advantages and disadvantages. Hot wallets are connected to the internet, making them incredibly convenient for transactions. However, this connectivity can expose them to potential security risks. On the other hand, cold wallets are offline, providing a higher level of security, which is essential for long-term storage. Let’s dive deeper into what each type offers.

Hot wallets are like the trendy coffee shop on the corner; they’re convenient and easily accessible. They allow you to make transactions quickly, which is perfect for those who trade frequently. Most hot wallets come with user-friendly interfaces and mobile apps, enabling you to track your transactions in real-time. However, with great convenience comes great responsibility. Since they are always online, it’s vital to monitor your transactions closely and implement security measures like two-factor authentication and strong passwords.

In contrast, cold wallets are akin to a safety deposit box at a bank. They’re designed to keep your cryptocurrencies safe from online threats. Cold wallets store your private keys offline, making them less vulnerable to hacking attempts. They are ideal for long-term investors who don’t need to make frequent transactions. However, tracking transactions can be less straightforward since you may not have instant access to your wallet. Many cold wallets come with their own software to help you monitor your holdings and transactions over time.

To help you choose the right wallet, consider the following table that compares hot and cold wallets based on key features:

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Accessibility | High (always online) | Low (offline) |

| Security | Moderate (vulnerable to hacks) | High (offline storage) |

| Transaction Speed | Fast (instant transactions) | Slow (requires manual access) |

| Best For | Frequent traders | Long-term investors |

Choosing the right wallet is crucial for tracking your cryptocurrency transactions effectively. Always evaluate your trading habits, security needs, and how often you plan to access your funds. Remember, the right wallet will not only help you manage your assets but also keep your transactions secure and organized.

Hot Wallets vs. Cold Wallets

When it comes to managing your cryptocurrency, understanding the difference between hot wallets and cold wallets is crucial. Each type of wallet has its own unique features, benefits, and drawbacks that cater to different user needs. Think of hot wallets as your everyday wallet that you carry around, easily accessible for quick transactions, while cold wallets are like a safe deposit box—secure and perfect for storing your valuable assets over the long term.

Hot wallets are connected to the internet, making them incredibly convenient for frequent transactions. They allow users to send and receive cryptocurrencies with just a few clicks. However, this convenience comes with a trade-off; because they are online, hot wallets are more vulnerable to hacking and cyber attacks. It's like leaving your wallet on the kitchen counter—easy for you to grab, but also easy for someone else to take. Therefore, if you're someone who actively trades or uses cryptocurrency regularly, a hot wallet may be the best option for you, but it's essential to stay vigilant and monitor your transactions closely.

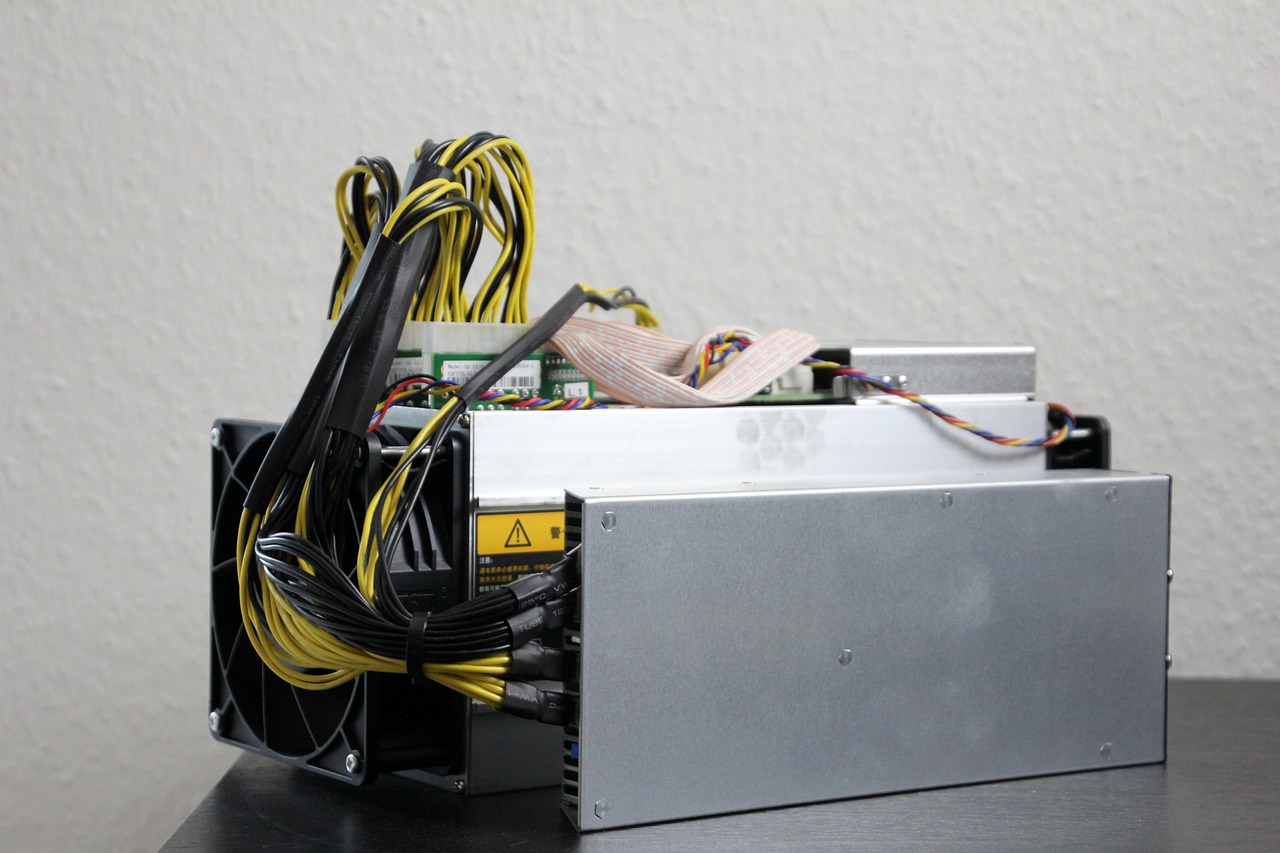

On the other hand, cold wallets are offline storage solutions, which means they are far less susceptible to hacking. These wallets are ideal for long-term storage of your cryptocurrency assets, similar to stashing cash away in a safe. Cold wallets can take the form of hardware wallets or paper wallets, and while they provide enhanced security, they aren't as user-friendly for everyday transactions. If you’re planning to hold onto your cryptocurrency for a while, a cold wallet is a great choice to keep your assets secure.

To help you understand the differences better, here’s a quick comparison of hot and cold wallets:

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Accessibility | High - Always online | Low - Offline storage |

| Security | Vulnerable to hacks | Highly secure |

| Best For | Frequent transactions | Long-term storage |

| Examples | Mobile wallets, web wallets | Hardware wallets, paper wallets |

Ultimately, the choice between hot and cold wallets depends on your specific needs. If you’re an active trader, a hot wallet may be more suitable for you, but always remember to keep an eye on your security practices. Conversely, if you’re looking to store your cryptocurrency safely for the long haul, consider investing in a cold wallet. By understanding these two types of wallets, you can make informed decisions that align with your cryptocurrency management strategy.

- What is a hot wallet? A hot wallet is a cryptocurrency wallet that is connected to the internet, allowing for easy and quick transactions.

- What is a cold wallet? A cold wallet is an offline storage solution for cryptocurrencies, providing enhanced security for long-term asset storage.

- Which wallet is safer? Cold wallets are generally considered safer due to their offline nature, reducing the risk of hacking.

- Can I use both wallets? Yes! Many users choose to use both hot and cold wallets for different purposes, balancing convenience and security.

Hot Wallets

Hot wallets are a popular choice among cryptocurrency enthusiasts due to their convenience and accessibility. These wallets are connected to the internet, allowing users to manage their digital assets on-the-go. Imagine having a digital bank account that you can access anytime, anywhere—this is essentially what hot wallets offer. They are ideal for those who engage in frequent transactions, whether it's buying, selling, or trading cryptocurrencies. However, with great convenience comes certain risks, and understanding these is crucial for any crypto user.

One of the standout features of hot wallets is their ability to provide real-time transaction tracking. Users can monitor their balances and transaction history instantly, which is a game-changer in the fast-paced world of cryptocurrency. This feature not only enhances user experience but also helps in making informed decisions quickly. For example, if you notice a sudden drop in your balance, you can act swiftly to secure your assets. However, because hot wallets are always online, they are more vulnerable to hacking and cyber threats compared to their cold wallet counterparts.

When choosing a hot wallet, it's essential to consider a few key factors:

- User Interface: A simple and intuitive interface can make managing your assets much easier, especially for beginners.

- Security Features: Look for wallets that offer two-factor authentication (2FA) and encryption to safeguard your funds.

- Supported Cryptocurrencies: Ensure that the wallet supports the specific cryptocurrencies you plan to use.

While hot wallets are excellent for daily transactions, they are not recommended for storing large amounts of cryptocurrency over extended periods. Think of hot wallets as your everyday wallet—great for carrying cash and cards for daily use, but not the safest place to store your life savings. For long-term storage, many users opt to transfer their assets to cold wallets, which are offline and provide enhanced security.

In conclusion, hot wallets serve as an essential tool for anyone looking to actively manage their cryptocurrency transactions. They offer unparalleled convenience and real-time tracking, making them suitable for frequent traders. However, it's vital to remain vigilant about security practices to protect your assets from potential threats. By understanding both the advantages and limitations of hot wallets, users can make informed choices that align with their cryptocurrency management strategies.

Cold Wallets

When it comes to safeguarding your cryptocurrency, are often considered the gold standard. Unlike hot wallets, which are connected to the internet, cold wallets are offline storage solutions that provide an extra layer of security. Think of a cold wallet as a safe deposit box for your digital assets—it's not just about locking things away; it’s about locking them away in a place that’s virtually inaccessible to hackers and cyber threats.

Cold wallets come in various forms, including hardware wallets and paper wallets. Hardware wallets are physical devices that store your private keys offline, while paper wallets involve printing your keys on a piece of paper. Both methods ensure that your cryptocurrencies are stored securely, away from the prying eyes of the internet. However, this security comes with its own set of responsibilities. If you lose your hardware wallet or misplace your paper wallet, retrieving your assets can become a daunting task.

One of the standout features of cold wallets is their ability to track transactions over longer periods. When you conduct a transaction using a cold wallet, you usually need to connect it to a computer or device temporarily. During this time, you can view your transaction history, check balances, and even make transfers. However, it’s crucial to ensure that you’re using a secure device to connect your cold wallet to the internet. Always double-check that your computer is free from malware before plugging in your hardware wallet.

In addition to their security benefits, cold wallets also offer a sense of peace of mind. Many cryptocurrency investors prefer cold storage for their long-term holdings, akin to setting aside savings in a traditional bank account. This method of storage allows users to hold onto their assets without the constant worry of market fluctuations or cyber threats. However, it’s essential to remember that while cold wallets are secure, they are not entirely foolproof. Users must remain diligent in maintaining their wallets and keeping backup copies of their keys.

To further illustrate the differences between cold and hot wallets, consider the following comparison:

| Feature | Cold Wallets | Hot Wallets |

|---|---|---|

| Security | High (offline storage) | Moderate (online storage) |

| Accessibility | Less convenient for frequent transactions | Very convenient for frequent transactions |

| Transaction Tracking | Can track through temporary connections | Real-time tracking |

| Best Use Case | Long-term storage | Active trading |

Ultimately, the choice between a cold wallet and a hot wallet depends on your individual needs and how you plan to manage your cryptocurrency. If you’re in it for the long haul and want to minimize risks, a cold wallet is your best bet. On the other hand, if you’re actively trading and need quick access to your funds, consider using a hot wallet for those transactions. Remember, the most important aspect of managing your cryptocurrency is to stay informed and make decisions based on your unique investment strategy.

- What is a cold wallet? A cold wallet is an offline storage solution for cryptocurrencies, providing enhanced security against online threats.

- Are cold wallets completely secure? While cold wallets offer high security, they are not infallible. Users must take precautions to safeguard their devices and keys.

- How do I access my cold wallet? To access a cold wallet, you typically need to connect it to a secure device temporarily to view balances or make transactions.

- Can I use a cold wallet for daily transactions? Cold wallets are not ideal for daily transactions due to their offline nature, but they are perfect for long-term storage.

Third-Party Tracking Tools

In the ever-evolving world of cryptocurrency, keeping track of your transactions can feel like trying to catch smoke with your bare hands. Fortunately, third-party tracking tools have emerged as a beacon of hope, providing users with the ability to monitor their digital assets effectively. These tools not only simplify the process of tracking transactions but also enhance transparency and accountability in your cryptocurrency dealings.

There are several popular third-party tools available, each offering unique features tailored to different user needs. For instance, platforms like Blockfolio and CoinTracking allow you to import transactions from various wallets and exchanges, making it easier to manage your portfolio in one place. With real-time updates and comprehensive analytics, these tools can transform the daunting task of transaction tracking into a seamless experience.

Using third-party tracking tools can also significantly reduce the chances of errors in record-keeping. Many of these tools offer automated tracking capabilities, which means you won’t have to manually enter every transaction. This not only saves time but also minimizes the risk of human error. Imagine trying to keep track of hundreds of transactions manually—it's like trying to find a needle in a haystack! With automated tracking, the needle is right in front of you, clearly visible and organized.

Moreover, these tools often come equipped with advanced features such as tax reporting, portfolio analysis, and even alerts for significant market movements. For instance, if you’re using CoinTracking, you can generate tax reports that comply with local regulations, ensuring you’re always on the right side of the law. This is particularly important as the regulatory landscape surrounding cryptocurrencies continues to shift, and staying compliant can save you from potential headaches down the line.

When choosing a third-party tracking tool, consider the following factors:

- User Interface: Is the tool easy to navigate? A user-friendly interface can make a world of difference, especially for beginners.

- Integration: Does it support integration with your existing wallets and exchanges? Seamless integration can save you a lot of time and hassle.

- Security: How does the tool protect your data? Always prioritize tools that offer robust security measures to safeguard your sensitive information.

- Cost: Is there a subscription fee? Some tools are free, while others may require a monthly or annual fee. Weigh the costs against the features offered.

To illustrate the differences among various tracking tools, here’s a quick comparison:

| Tool Name | Key Features | Price |

|---|---|---|

| Blockfolio | Portfolio tracking, alerts, news updates | Free |

| CoinTracking | Tax reporting, portfolio analysis, automated tracking | Starts at $10/month |

| Cryptocompare | Portfolio management, price alerts, news | Free |

In conclusion, leveraging third-party tracking tools is essential for anyone serious about managing their cryptocurrency investments. They provide not only a means to track transactions but also a way to gain insights into your portfolio's performance. As you navigate the complex world of digital currencies, these tools can serve as your trusty compass, guiding you through the intricacies of tracking your transactions with ease and accuracy.

Q: Are third-party tracking tools safe to use?

A: Most reputable tools implement strong security measures, but always do your research and choose tools with good reviews and security protocols.

Q: Can I use multiple tracking tools at the same time?

A: Yes, many users opt to use multiple tools to take advantage of different features offered by each.

Q: How do these tools help with tax reporting?

A: Many tracking tools can generate tax reports based on your transaction history, making it easier to comply with tax regulations.

Tax Implications of Cryptocurrency Transactions

When it comes to managing your cryptocurrency, understanding the tax implications of your transactions is crucial. As digital currencies continue to gain popularity, governments around the world are tightening regulations and ensuring that investors comply with tax laws. This means that every time you buy, sell, or trade cryptocurrencies, you might be triggering a taxable event. So, what does this mean for you?

Firstly, it’s essential to recognize that the IRS (Internal Revenue Service) treats cryptocurrencies as property, not currency. This classification means that capital gains tax applies to your transactions. If you sell your crypto for more than you paid for it, you’ll owe taxes on that profit. Conversely, if you sell at a loss, you may be able to offset other capital gains or even deduct a portion of that loss from your taxable income. Keeping track of these transactions is not just a good idea; it's a legal requirement!

To help you navigate this complex landscape, let’s break down the key tax considerations you need to be aware of:

- Capital Gains Tax: This tax applies when you sell or trade your cryptocurrency. The rate can vary depending on how long you've held the asset.

- Income Tax: If you receive cryptocurrency as payment for goods or services, it is considered ordinary income and must be reported as such.

- Record Keeping: Maintaining accurate records of all transactions is essential for calculating your tax obligations accurately.

Many investors underestimate the importance of record keeping. Without proper documentation, you could face difficulties during tax season. Imagine being unable to prove your purchase price or transaction dates—this could lead to overpaying on taxes or even penalties for underreporting income. Therefore, it’s crucial to track every transaction meticulously.

To assist with this, many cryptocurrency wallets and exchanges provide transaction history features, but relying solely on them might not be enough. You might want to consider using specialized tax software that integrates with your wallets and exchanges. These tools can automatically calculate your gains and losses, making your tax reporting much simpler and less stressful.

Now, let’s talk about the reporting requirements. Depending on your country, you may need to report your cryptocurrency transactions on your annual tax return. In the United States, for example, you must answer a question about cryptocurrency on your Form 1040. Failing to report can lead to severe penalties, including fines and interest on unpaid taxes.

Q: Do I need to report every single transaction?

A: Yes, the IRS requires you to report every sale, trade, or exchange of cryptocurrency, even if you made a loss.

Q: What happens if I don’t report my cryptocurrency transactions?

A: Not reporting can lead to penalties, fines, and potential audits from tax authorities.

Q: Can I deduct losses from my cryptocurrency investments?

A: Yes, you can offset your capital losses against capital gains and potentially reduce your taxable income.

In conclusion, understanding the tax implications of your cryptocurrency transactions is vital for compliance and financial health. By keeping detailed records and using the right tools, you can navigate the complexities of cryptocurrency taxation with confidence, ensuring that you’re not caught off guard when tax season rolls around.

Reporting Requirements

When it comes to cryptocurrency, understanding is crucial for staying compliant with tax regulations. The IRS treats cryptocurrencies as property, which means that each transaction can potentially trigger tax implications. This complexity can be overwhelming, especially for those new to the crypto world. So, what exactly do you need to report? Well, it all boils down to three main categories: sales, exchanges, and income.

First off, if you sell your cryptocurrency for a profit, you must report that gain on your tax return. The gain is calculated as the difference between the sale price and your cost basis (what you paid for it). This is similar to how you would report gains from selling stocks. On the flip side, if you incur a loss, you can report that as well, which might help reduce your overall tax burden.

Next up is exchanges. If you trade one cryptocurrency for another, this is also considered a taxable event. Even if you don't cash out to fiat currency, the IRS requires you to report the fair market value of the crypto you received in exchange. For instance, if you trade Bitcoin for Ethereum, you need to calculate the value of the Bitcoin at the time of the trade and report any gains or losses accordingly.

Lastly, if you earn cryptocurrency through mining, staking, or as payment for goods and services, this is considered income and must be reported as well. The fair market value of the cryptocurrency at the time you receive it determines your income amount. It’s like receiving a paycheck but in digital coins!

To help you keep track of your reporting requirements, consider maintaining a detailed log of all your transactions. This log should include:

- Date of transaction

- Type of transaction (buy, sell, exchange, income)

- Amount of cryptocurrency involved

- Fair market value at the time of the transaction

- Cost basis

Moreover, many cryptocurrency exchanges provide annual tax reports that can simplify this process. However, it’s always wise to double-check their accuracy. You don’t want any surprises come tax season!

In summary, keeping meticulous records of your cryptocurrency transactions is essential not only for compliance but also for ensuring you pay the right amount of taxes. The landscape of cryptocurrency can feel like a wild west, but with the right tools and knowledge, you can navigate it successfully.

Q: Do I need to report cryptocurrency transactions if I didn't make a profit?

A: Yes, any transaction that involves the sale or exchange of cryptocurrency must be reported, even if it results in a loss.

Q: How can I track my cryptocurrency transactions for tax purposes?

A: You can use various tracking tools and software that integrate with exchanges to maintain accurate records of your transactions.

Q: What happens if I fail to report my cryptocurrency transactions?

A: Failing to report can lead to penalties, interest on unpaid taxes, and potential audits, so it's crucial to stay compliant.

Tax Software Integration

Integrating tax software with your cryptocurrency transaction tracking tools can be a game-changer for investors. Imagine having all your financial data in one place, making tax season feel less like a daunting task and more like a walk in the park. By syncing your crypto transactions with tax software, you can streamline the process of calculating gains and losses, ensuring that you’re not only compliant but also maximizing your potential deductions.

Many tax software solutions today offer features specifically designed for cryptocurrency investors. These tools can import transaction data directly from your wallets or exchanges, eliminating the need for manual entry, which is often prone to errors. For example, platforms like TurboTax and H&R Block have integrated features that allow users to seamlessly import their cryptocurrency transaction history. This means no more late-night spreadsheet sessions or worrying about missing a transaction that could lead to an audit.

When choosing a tax software, consider the following integration features:

- Automatic Data Import: Look for software that can automatically pull transaction data from popular wallets and exchanges.

- Real-Time Updates: Ensure the software can provide real-time updates on your portfolio, helping you keep track of your gains and losses throughout the year.

- Tax Reporting Forms: The software should generate the necessary tax forms, such as Schedule D and Form 8949, which are essential for reporting capital gains.

Moreover, integrating tax software can help you maintain a clear audit trail. If you ever face an audit, having organized records can save you a lot of headaches. You’ll be able to provide clear, concise reports of your transactions, making it easier for tax authorities to verify your claims. Remember, the IRS has been increasing its scrutiny of cryptocurrency transactions, so being proactive in your record-keeping is crucial.

In summary, integrating tax software with your cryptocurrency tracking tools not only simplifies tax reporting but also enhances your overall financial management strategy. By automating data import, ensuring real-time updates, and generating necessary tax forms, you can focus more on your investments and less on paperwork. So, if you haven’t considered it yet, now might be the perfect time to explore the options available in the market!

- What is tax software integration? Tax software integration refers to the process of connecting your cryptocurrency transaction tracking tools with tax software to streamline tax reporting and compliance.

- Why is it important to integrate tax software with crypto tracking? It simplifies the tax reporting process, reduces the risk of errors, and helps maintain organized records, which is crucial during audits.

- Can I use any tax software for cryptocurrency? Not all tax software supports cryptocurrency transactions, so it's essential to choose one that has specific features for crypto investors.

Best Practices for Tracking Transactions

When it comes to tracking your cryptocurrency transactions, adopting best practices is essential for maintaining accuracy and security. The world of digital currencies is ever-evolving, and with it comes the need for a robust tracking system that can keep pace with your investments. Imagine trying to navigate a bustling city without a map; that’s what tracking cryptocurrency transactions can feel like without a proper strategy. Here are some effective practices to ensure your records are not just accurate, but also secure.

First and foremost, conducting regular audits of your cryptocurrency transactions cannot be overstated. Just like a regular health check-up can catch potential issues before they become serious, periodic reviews of your transaction history can help you identify discrepancies early on. Make it a habit to compare your records with those provided by your wallet or exchange. This practice not only helps in maintaining accurate records but also builds a habit of vigilance, which is crucial in the volatile world of cryptocurrency.

Next, it’s vital to keep your records secure. In the digital age, where data breaches are unfortunately common, safeguarding your sensitive information is paramount. Utilize strong passwords and enable two-factor authentication where possible. Consider storing your transaction records in encrypted formats or using reputable password managers. Additionally, avoid keeping all your information on a single device. Instead, back up your data in multiple secure locations. Think of it as diversifying your investments; spreading your data out can help protect against loss.

Another effective practice is to leverage transaction tracking tools. These tools can automate much of the tracking process, reducing human error and saving you time. Many wallets and exchanges offer built-in tracking features, but there are also dedicated third-party applications designed specifically for tracking cryptocurrency transactions. These tools often provide insightful analytics, which can help you understand your spending habits and investment performance better.

Moreover, keeping a detailed transaction log can be incredibly beneficial. Document not just the amounts and dates of transactions, but also the purpose of each transaction. This level of detail will come in handy during tax season, as it helps clarify the context of your trades. A simple table format can be useful for this:

| Date | Transaction Type | Amount | Purpose |

|---|---|---|---|

| 2023-01-15 | Buy | 0.5 BTC | Investment |

| 2023-02-10 | Sell | 0.2 BTC | Profit-taking |

Lastly, staying informed about the latest regulatory changes and tax implications related to cryptocurrency is crucial. The landscape is constantly changing, and being proactive about understanding your obligations can save you from potential headaches down the line. Following reliable news sources and joining online communities can provide you with valuable insights and updates.

In summary, tracking cryptocurrency transactions effectively requires a combination of regular audits, secure record-keeping, the use of tracking tools, detailed documentation, and staying informed about regulations. By implementing these best practices, you can navigate the complexities of cryptocurrency with confidence and clarity.

- What is the best way to track my cryptocurrency transactions? Regular audits, using tracking tools, and maintaining detailed logs are among the best methods.

- How often should I audit my transactions? It's recommended to conduct audits at least quarterly, or more frequently if you're an active trader.

- Are there specific tools you recommend for tracking transactions? Tools like CoinTracking, Blockfolio, and CryptoTrader.Tax are popular options that many users find helpful.

- What should I do if I find discrepancies in my transaction records? Investigate the discrepancies immediately by cross-referencing with your wallet and exchange records, and consider seeking professional advice if needed.

Regular Audits

When it comes to managing your cryptocurrency, are not just a good idea; they are essential for maintaining the integrity of your digital assets. Think of it as a health check-up for your crypto portfolio. Just as you would visit a doctor to ensure your physical health is in top shape, conducting audits helps you ensure your financial health is robust and transparent. By regularly reviewing your transactions, you can catch discrepancies early, identify potential errors, and make informed decisions about your investments.

So, what exactly does a regular audit involve? It’s more than just glancing at your wallet balance. You need to dive deep into your transaction history and verify that every entry matches your records. This includes checking the amounts, transaction IDs, and the addresses involved. You might be surprised at how easy it is to overlook small details that can lead to significant issues down the line. To help you stay organized, consider creating a simple checklist for your audits. Here’s a quick overview of what to include:

- Transaction Dates: Ensure each transaction date is recorded accurately.

- Transaction Amounts: Cross-check the amounts with your wallet records.

- Transaction IDs: Verify that the transaction IDs match what is displayed in your wallet.

- Receiving Addresses: Confirm that the addresses are correct and belong to the intended recipients.

To make this process even smoother, consider utilizing tracking tools that can automate parts of the audit. Many cryptocurrency wallets and third-party tools offer features that allow you to export your transaction history into a spreadsheet format. This can save you a considerable amount of time and effort. With your data in a spreadsheet, you can easily analyze trends, spot inconsistencies, and prepare for tax reporting.

Additionally, keeping a well-organized record of your audits can be invaluable. Not only does it help you stay on top of your transactions, but it also provides you with a clear history should you need to reference it in the future. You could set up a simple table to log your findings each time you conduct an audit:

| Date | Transaction ID | Amount | Receiving Address | Notes |

|---|---|---|---|---|

| 2023-10-01 | abc123xyz | 0.5 BTC | 1A2B3C4D5E | Verified |

| 2023-10-02 | def456uvw | 1.0 ETH | 6F7G8H9I0J | Pending confirmation |

In conclusion, regular audits are a crucial part of managing your cryptocurrency effectively. They not only help you catch errors and discrepancies but also enhance your understanding of your investments. By making audits a regular practice, you’ll be better equipped to navigate the ever-changing landscape of cryptocurrency and ensure your assets remain secure.

Q1: How often should I conduct an audit of my cryptocurrency transactions?

A1: It's recommended to conduct audits at least once a month. However, if you are a frequent trader, consider doing it weekly to keep track of your transactions more effectively.

Q2: What tools can I use for auditing my cryptocurrency transactions?

A2: You can use various tools such as cryptocurrency wallets with built-in tracking features, or third-party software like CoinTracking, CryptoCompare, or Blockfolio to help streamline the auditing process.

Q3: What should I do if I find discrepancies during my audit?

A3: If you find discrepancies, investigate them immediately. Check your records, contact the involved parties if necessary, and consider reaching out to customer support for your wallet or exchange for assistance.

Keeping Records Secure

In the world of cryptocurrency, where the digital landscape is as volatile as it is exciting, keeping your transaction records secure is not just a good practice—it's a necessity. Imagine your cryptocurrency holdings as a treasure chest; if the chest is left unguarded, it's only a matter of time before someone else finds it. Therefore, safeguarding your transaction records is crucial for protecting your assets and ensuring that you can track your financial history accurately.

One of the first steps in securing your records is to utilize encrypted storage solutions. Whether you choose to store your records on a physical device or in the cloud, ensuring that they are encrypted adds an essential layer of security. Encryption acts like a lock on your treasure chest, making it nearly impossible for anyone without the key to access your sensitive information. Popular options for encrypted storage include hardware wallets and secure cloud services that offer end-to-end encryption.

Moreover, it’s vital to keep your private keys and passwords confidential. Think of your private key as the key to your treasure chest; if someone gets hold of it, they can access everything inside. Use strong, unique passwords and consider enabling two-factor authentication (2FA) where possible. This extra step can significantly enhance your security by requiring a second form of verification before access is granted. Here’s a quick rundown of tips for keeping your records secure:

- Use encrypted storage solutions for your records.

- Keep your private keys and passwords confidential.

- Enable two-factor authentication on your accounts.

- Regularly back up your records in a secure manner.

Another important aspect of keeping records secure is to conduct regular backups. Just like you would keep a spare key hidden away in a safe place, having backups of your transaction records ensures that you won't lose vital information due to accidental deletion or hardware failure. Store these backups in multiple locations, such as an external hard drive and a secure cloud service. This way, even if one storage method fails, you still have access to your records.

It's also worth considering the use of transaction tracking software that offers built-in security features. These tools not only help you monitor your transactions but also provide additional layers of security by encrypting your data and offering secure access options. This can save you time and effort while ensuring that your records remain safe from prying eyes.

Lastly, always stay informed about the latest security practices and threats. The cryptocurrency landscape is continuously evolving, and new vulnerabilities can emerge. By staying updated, you can adapt your security measures accordingly, ensuring that your records remain protected against the latest threats. Remember, in the realm of cryptocurrency, knowledge is power, and being proactive is the best defense.

Q: Why is it important to keep cryptocurrency records secure?

A: Keeping your records secure protects your assets from theft and ensures you have accurate information for tracking your financial history.

Q: What are the best methods for securing my cryptocurrency records?

A: Use encrypted storage solutions, keep your private keys confidential, enable two-factor authentication, and regularly back up your records.

Q: How often should I back up my transaction records?

A: It's advisable to back up your records regularly, ideally after every significant transaction or at least once a month.

Q: Can transaction tracking software help with security?

A: Yes, many transaction tracking tools offer encryption and secure access, making it easier to keep your records safe while monitoring your transactions.

Frequently Asked Questions

- What is the best way to track my cryptocurrency transactions?

The best way to track your cryptocurrency transactions is by using a combination of a reliable cryptocurrency wallet and third-party tracking tools. Wallets like hot wallets allow for real-time tracking, while cold wallets provide enhanced security for long-term storage. Third-party tools can offer additional features like portfolio management and tax reporting integration.

- How does blockchain technology help in tracking transactions?

Blockchain technology is the backbone of cryptocurrency, providing a decentralized and transparent ledger of all transactions. Each transaction is recorded in a block and linked to previous blocks, making it nearly impossible to alter. This ensures that every transaction is traceable and verifiable, promoting transparency and accountability in your digital assets.

- What are the differences between hot wallets and cold wallets?

Hot wallets are connected to the internet, making them convenient for frequent transactions, but they are more vulnerable to hacks. Cold wallets, on the other hand, are offline storage options that provide enhanced security, making them ideal for long-term storage. Tracking transactions in cold wallets may require additional steps, but their security benefits often outweigh the inconvenience.

- Do I need to report my cryptocurrency transactions for tax purposes?

Yes, it is essential to report your cryptocurrency transactions for tax purposes. Many countries require individuals to declare their gains and losses from cryptocurrency trading. Keeping accurate records of your transactions can help simplify this process and ensure compliance with tax regulations.

- How can tax software help with cryptocurrency transaction tracking?

Tax software can integrate with your transaction tracking tools to automatically import data, calculate gains and losses, and generate reports for tax filing. This integration simplifies the tax reporting process, reducing the risk of errors and ensuring you don’t miss any important details.

- What are some best practices for tracking cryptocurrency transactions?

Some best practices include conducting regular audits of your transactions, maintaining secure records, and using multiple tracking tools for accuracy. It's also important to back up your wallet and keep sensitive information protected to avoid potential losses.

- How can I secure my transaction records?

To secure your transaction records, consider using encrypted storage solutions, keeping backups in multiple locations, and utilizing password managers for sensitive information. Regularly updating your security measures can also help protect against potential breaches.