Tips for Trading Different Crypto Assets

In the ever-evolving world of cryptocurrency, making informed trading decisions can feel like navigating a maze. With thousands of cryptocurrencies at your fingertips, each with its own unique characteristics and market behaviors, how do you ensure that you’re not just throwing darts in the dark? Well, fear not! This article provides essential strategies and insights for effectively trading various cryptocurrencies, helping traders navigate the complexities of the crypto market and maximize their investment potential. Whether you're a seasoned trader or just dipping your toes into the crypto waters, there's something here for everyone.

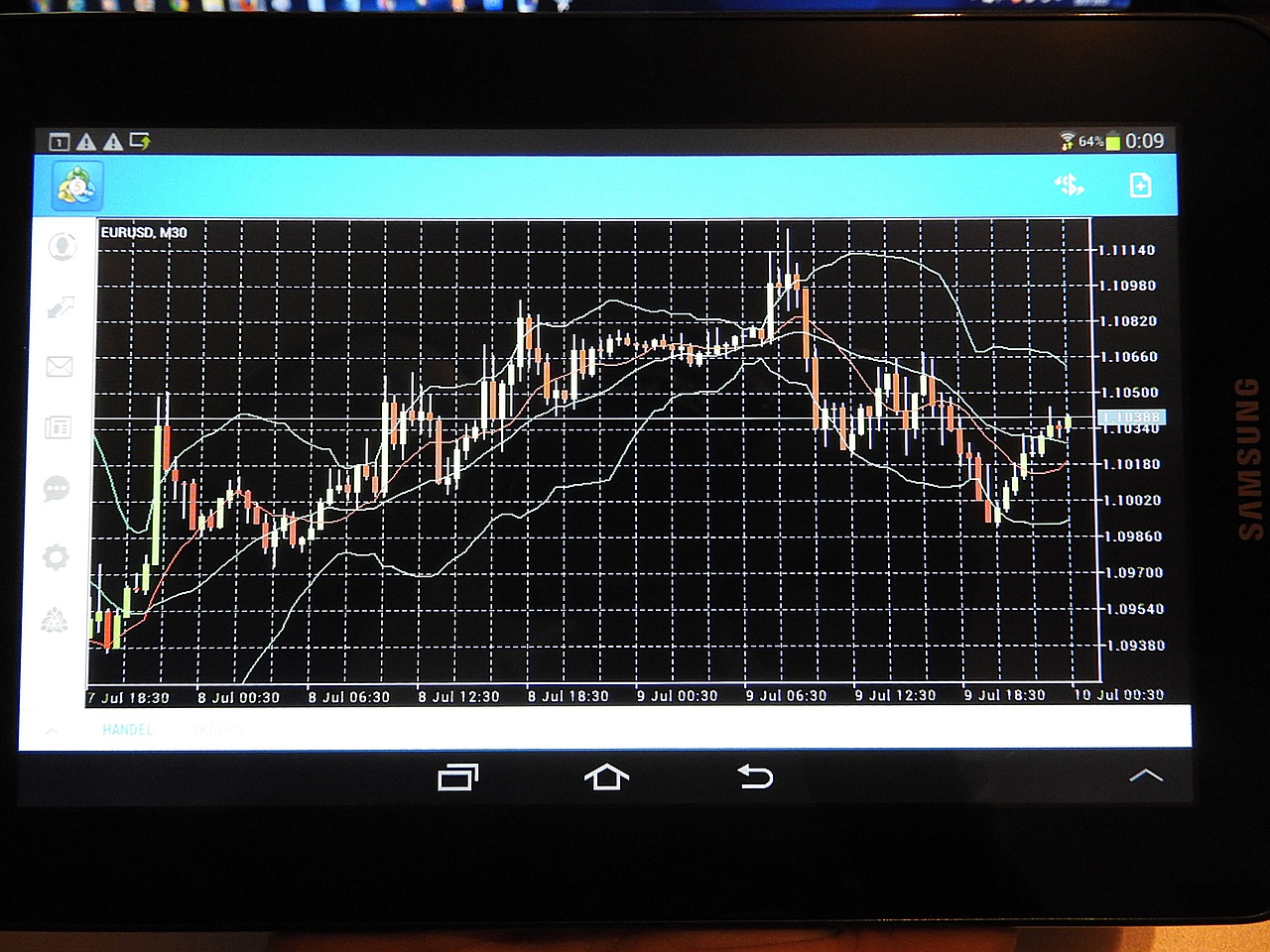

Recognizing market trends is crucial for successful trading. Think of it like riding a wave; you want to catch the momentum at just the right moment to ride it all the way to the shore. Analyzing price movements can help you identify whether the market is bullish (on the rise) or bearish (on the decline). One effective way to gauge market sentiment is by using technical analysis tools like moving averages and Relative Strength Index (RSI). These tools can offer insights into price patterns that may not be immediately obvious. So, keep your eyes peeled and your analytical skills sharp!

Selecting a reliable cryptocurrency exchange is vital for trading success. Imagine trying to trade on a platform that’s constantly crashing or has hidden fees; it would be like trying to run a race with a pebble in your shoe! Here are some factors to consider when choosing an exchange:

- Security: Look for exchanges that prioritize security, offering features like two-factor authentication and cold storage.

- Fees: Be aware of trading and withdrawal fees, as these can eat into your profits.

- Available Trading Pairs: Ensure the exchange offers the cryptocurrencies you want to trade.

Security is paramount when trading crypto. The last thing you want is to wake up one morning and find your assets vanished into thin air! To protect your investments, implement essential security practices:

- Two-Factor Authentication: Always enable 2FA for an added layer of security.

- Cold Storage: Consider storing your assets in a cold wallet, which is not connected to the internet, to minimize hacking risks.

Different wallets serve various purposes in crypto trading. Understanding the differences can help you choose the right one for your needs. Hot wallets are connected to the internet and are convenient for trading, but they come with higher risks. On the other hand, cold wallets, like hardware wallets, are offline and much safer. Here’s a quick comparison:

| Wallet Type | Advantages | Disadvantages |

|---|---|---|

| Hot Wallet | Convenient for trading | Higher risk of hacking |

| Cold Wallet | Secure from online threats | Less convenient for frequent trading |

The crypto space can be rife with scams. From Ponzi schemes to phishing attacks, knowing how to spot these traps is crucial. Always be skeptical of offers that seem too good to be true and do thorough research before investing. If you ever feel pressured to make a quick decision, take a step back and evaluate the situation. Remember, in the world of crypto, patience is often rewarded!

Implementing effective trading strategies can enhance profitability. Think of trading strategies as your roadmap in the chaotic world of crypto. Popular strategies include:

- Day Trading: Buying and selling within the same day to capitalize on short-term price movements.

- Swing Trading: Holding onto assets for several days or weeks to benefit from expected price changes.

- Long-Term Investing: Buying and holding assets for an extended period, betting on their long-term growth.

Managing risk is essential for sustaining trading success. It's like having a safety net that catches you when you fall. Here are some techniques to safeguard your investments:

Diversification can reduce risk exposure. By spreading your investments across different assets, you can protect yourself against market volatility. Think of it like not putting all your eggs in one basket; if one basket falls, you still have others to rely on.

Stop-loss orders are crucial for managing potential losses. Setting effective stop-loss levels can protect your investments during market downturns. This tool allows you to automatically sell an asset when it reaches a certain price, helping to minimize losses and keep your emotions in check.

Keeping abreast of news and developments in the crypto world is vital. The market is highly sensitive to news, and a single tweet can send prices soaring or plummeting. Follow credible sources for timely information that can impact your trading decisions. Being informed is your best defense against market volatility!

Q: What is the best strategy for trading cryptocurrencies?

A: There’s no one-size-fits-all answer. It depends on your risk tolerance, investment goals, and market conditions. Experiment with different strategies to find what works best for you.

Q: How can I protect my crypto assets?

A: Use secure wallets, enable two-factor authentication, and be cautious of scams. Always keep your private keys safe!

Q: Is it too late to invest in cryptocurrencies?

A: It’s never too late, but always do your research and consider the risks involved. The crypto market is volatile, and prices can fluctuate dramatically.

Understanding Market Trends

Recognizing market trends is crucial for successful trading in the ever-evolving world of cryptocurrencies. Just like a surfer reads the waves before paddling out, traders must analyze price movements to catch the right trends. A solid grasp of market trends can be the difference between riding the wave to profit or wiping out in losses. But how do you identify these trends? It all starts with understanding the basic concepts of bullish and bearish trends.

A **bullish trend** indicates that prices are on the rise, creating a sense of optimism and encouraging traders to buy. On the other hand, a **bearish trend** signals that prices are falling, often leading to panic selling. But here’s the kicker: trends don’t last forever. They can shift rapidly, influenced by market sentiment, news events, and economic indicators. So, how can you stay ahead of these changes?

One effective way to analyze price movements is through the use of technical analysis. This involves studying historical price charts and using various indicators to predict future price movements. Here are some popular indicators that traders often rely on:

- Moving Averages: These help smooth out price data to identify the direction of the trend over a specific period.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

- Bollinger Bands: These are volatility indicators that can help traders identify potential price breakouts or reversals.

Understanding these indicators is like having a map in a foreign city. They guide you through the complex landscape of crypto trading, helping you make informed decisions. But remember, no indicator is foolproof. It's essential to combine these tools with a good understanding of market sentiment. Observing social media trends, news articles, and community discussions can provide insights that technical indicators alone might miss.

In addition to technical analysis, it's wise to keep an eye on fundamental analysis. This involves evaluating the underlying factors that could affect a cryptocurrency's value, such as its technology, use case, and the team behind it. Just like a company’s performance in the stock market can be influenced by its earnings reports, cryptocurrencies can be affected by developments in their ecosystem. For example, a major partnership announcement or a technological upgrade can lead to a bullish trend.

To sum it up, understanding market trends is about being proactive rather than reactive. By combining technical and fundamental analysis, you can better anticipate market movements and position yourself for success. It’s like being a chess player; you need to think several moves ahead to outsmart your opponent. So, the next time you dive into trading, remember to keep your eyes peeled for those trends, and always be ready to adapt your strategy!

Choosing the Right Exchange

When it comes to trading cryptocurrencies, selecting the right exchange can make all the difference between a smooth trading experience and a frustrating one. Just like choosing a reliable bank for your finances, picking the right exchange is crucial for your crypto journey. With the plethora of options available, how do you narrow it down? Let’s dive into some key factors that you should consider.

First and foremost, security should be your top priority. The crypto market is notorious for its vulnerabilities, and you want to ensure your assets are safe from hackers. Look for exchanges that offer robust security features such as two-factor authentication (2FA), which adds an extra layer of protection by requiring a second form of verification. Additionally, consider whether the exchange holds the majority of its assets in cold storage, which is not connected to the internet and significantly reduces the risk of theft.

Next up, let’s talk about trading fees. Every exchange has its own fee structure, and these can eat into your profits if you’re not careful. Some exchanges charge a flat fee per transaction, while others take a percentage of the trade value. It’s essential to read the fine print and understand what you’ll be paying. You might be tempted to go for the exchange with the lowest fees, but keep in mind that sometimes, you get what you pay for. An exchange that seems cheap might compromise on security or customer service.

Another important factor is the variety of trading pairs available. If you’re looking to trade not just Bitcoin but also altcoins like Ethereum, Litecoin, or even lesser-known tokens, ensure that the exchange supports a wide range of cryptocurrencies. The more trading pairs available, the more flexibility you have in diversifying your portfolio. It’s like having a toolbox with various tools; the more tools you have, the more jobs you can tackle!

Don’t forget about the user experience. A user-friendly interface can significantly enhance your trading experience. Look for exchanges that offer intuitive designs, easy navigation, and helpful resources. Some exchanges even provide demo accounts where you can practice trading without risking real money. This feature can be invaluable, especially for beginners who are still learning the ropes.

Lastly, it’s wise to check the customer support offered by the exchange. When you encounter issues or have questions, you want to ensure that help is readily available. Look for exchanges that provide multiple channels of support, such as live chat, email, or phone support. Reading user reviews can also give you insight into the quality of customer service offered.

In summary, choosing the right exchange is a multifaceted decision that requires careful consideration of security, fees, trading pairs, user experience, and customer support. It’s like finding the perfect partner for a dance; you want someone who complements your moves and makes the experience enjoyable. Take your time, do your research, and you’ll be well on your way to a successful trading journey.

Security Measures

When it comes to trading cryptocurrencies, security isn't just a precaution—it's a necessity. Imagine walking into a bank with a bag full of cash and leaving the door wide open; that’s what trading without proper security feels like. To safeguard your investments, it's essential to adopt a multi-layered approach to security. One of the first steps is enabling two-factor authentication (2FA) on your exchange accounts. This adds an extra layer of protection by requiring not just your password but also a second piece of information, typically a code sent to your mobile device. It’s like having a double lock on your front door.

In addition to 2FA, consider utilizing cold storage for your assets. Cold wallets, which are not connected to the internet, provide a safe haven for your cryptocurrencies, protecting them from online threats. Think of it as storing your valuables in a safe rather than leaving them out on a countertop. While hot wallets are convenient for quick trades, they come with higher risks. Here’s a quick comparison of the two:

| Wallet Type | Advantages | Disadvantages |

|---|---|---|

| Hot Wallets | Easy to access; ideal for frequent trading. | Vulnerable to hacks; online risks. |

| Cold Wallets | High security; protects against online threats. | Less convenient for quick trades; requires more steps to access. |

Another crucial aspect of security is being vigilant against scams. The crypto space is notorious for its share of fraudulent schemes, from phishing attacks to Ponzi schemes. Always verify the legitimacy of any platform or offer before sharing your personal information or funds. If something seems too good to be true, it probably is. To help you stay informed, here are some common types of scams to watch out for:

- Phishing Scams: Fake emails or websites that mimic legitimate exchanges.

- Pyramid Schemes: Promises of high returns for recruiting others.

- Fake ICOs: Non-existent tokens that lure investors with unrealistic promises.

Lastly, always keep your software updated. Whether it’s your trading app or your operating system, updates often include critical security patches. Think of it as maintaining your car—regular tune-ups can prevent bigger problems down the road. By following these security measures, you can significantly reduce your risk and trade with greater peace of mind.

Q: What is two-factor authentication (2FA)?

A: Two-factor authentication is a security process that requires two different forms of identification before granting access to an account. It typically involves something you know (like a password) and something you have (like a mobile device).

Q: What are hot and cold wallets?

A: Hot wallets are online wallets that are connected to the internet, making them convenient for trading but vulnerable to hacks. Cold wallets, on the other hand, are offline and provide enhanced security for storing cryptocurrencies long-term.

Q: How can I recognize a scam?

A: Look out for unrealistic promises of high returns, pressure to invest quickly, and requests for personal information. Always do your research before investing in any project.

Types of Wallets

When diving into the world of cryptocurrency, one of the first things you need to grasp is the concept of wallets. Just like you wouldn't carry all your cash in your pockets without a wallet, the same goes for your digital assets. In the crypto universe, wallets are essential for storing, managing, and securing your cryptocurrencies. There are two primary types of wallets you should be aware of: hot wallets and cold wallets. Each has its own set of advantages and disadvantages, and understanding these differences can help you make informed decisions about how to safeguard your investments.

Hot wallets are connected to the internet, making them incredibly convenient for frequent trading and transactions. Imagine them as your everyday wallet—easy to access but potentially vulnerable to theft. While hot wallets allow you to quickly buy, sell, or transfer your cryptocurrencies, they also expose you to risks such as hacking. Examples of hot wallets include web wallets, mobile wallets, and desktop wallets.

On the other hand, cold wallets are offline storage solutions that provide enhanced security for your digital assets. Think of them as a safety deposit box—secure and protected, but not as easily accessible for day-to-day transactions. Cold wallets include hardware wallets and paper wallets. They are ideal for long-term storage of cryptocurrencies since they are less susceptible to online threats.

Here's a quick comparison of the two types of wallets:

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Accessibility | High | Low |

| Security | Moderate | High |

| Best for | Frequent transactions | Long-term storage |

| Examples | Web wallets, mobile wallets | Hardware wallets, paper wallets |

Ultimately, the choice between a hot wallet and a cold wallet boils down to your trading habits and security preferences. If you’re a trader who likes to make quick moves, a hot wallet might suit you better. However, if you’re holding onto your assets for the long haul, investing in a cold wallet could provide the peace of mind you need. Remember, the crypto market is as volatile as a roller coaster ride, and securing your investments is paramount.

In conclusion, understanding the types of wallets available and their respective benefits is crucial for anyone venturing into cryptocurrency trading. By choosing the right wallet, you can enhance both the security of your assets and your overall trading experience.

- What is the safest type of wallet for cryptocurrency? Cold wallets are generally considered the safest option for storing cryptocurrencies.

- Can I use both hot and cold wallets? Yes, many traders use a combination of both to balance accessibility and security.

- How do I choose the right wallet for my needs? Consider factors such as how frequently you trade, the amount of cryptocurrency you hold, and your security preferences.

Recognizing Scams

In the fast-paced world of cryptocurrency, scams can lurk around every corner, waiting to ensnare unsuspecting traders. The allure of quick profits can often cloud judgment, leading even seasoned investors to fall prey to fraudulent schemes. So, how can you protect yourself from becoming a victim? Recognizing the signs of scams is your first line of defense.

One of the most common types of scams is the Ponzi scheme. In this scenario, returns for older investors are paid using the capital from new investors, rather than from profit earned by the operation of a legitimate business. These schemes often promise unrealistically high returns in a short period of time. If something sounds too good to be true, it probably is! Always conduct thorough research before investing.

Another prevalent scam involves phishing attacks. Scammers may send emails or messages that appear to be from legitimate exchanges or wallet providers, asking you to verify your account information. These communications often include links that lead to fake websites designed to capture your sensitive data. Always double-check the URL and never provide personal information through unsolicited messages.

Additionally, be wary of pump and dump schemes, where a group of investors artificially inflate the price of a low-volume cryptocurrency through hype and false information. Once the price peaks, these scammers sell off their holdings, leaving other investors with worthless assets. To avoid such traps, it’s crucial to stay informed and skeptical of sudden price spikes accompanied by excessive promotion.

To help you navigate the murky waters of cryptocurrency trading, here are some red flags to watch out for:

- Unrealistic promises of high returns with little to no risk.

- Pressure to invest quickly or to keep your investment secret.

- Lack of transparency regarding the team behind the project or the technology used.

- Unverified endorsements from social media influencers or celebrities.

By staying vigilant and informed, you can significantly reduce the risk of falling victim to these scams. Always remember the golden rule: if it sounds too good to be true, it probably is.

Q: How can I identify a legitimate cryptocurrency project?

A: Look for transparency in team members, a clear roadmap, and a working product. Always research the project's whitepaper and community feedback.

Q: What should I do if I think I've been scammed?

A: Report the scam to relevant authorities, such as your local consumer protection agency or the police. Additionally, inform the platform where the scam occurred.

Q: Are there any resources to help me stay updated on scams?

A: Yes, websites like CoinDesk and CoinTelegraph often report on scams and fraudulent activities in the crypto space.

Trading Strategies

When it comes to trading cryptocurrencies, having a solid strategy is like having a map in uncharted territory—it guides you through the chaos and helps you make informed decisions. There are several popular trading strategies that traders use to navigate the volatile waters of the crypto market. Each strategy comes with its own set of advantages and potential pitfalls, so it’s essential to find one that aligns with your risk tolerance and investment goals.

One of the most common strategies is day trading. This approach involves buying and selling cryptocurrencies within the same trading day, capitalizing on short-term price movements. Day traders often rely on technical analysis to identify trends and make quick decisions. However, this strategy requires a significant time commitment and the ability to react swiftly to market changes. Think of it like a high-speed car race; you need to be alert and ready to take action at any moment.

Another popular method is swing trading, which aims to capture gains in a stock (or in this case, a cryptocurrency) over a period of days to weeks. Swing traders typically use a mix of technical and fundamental analysis to identify potential price swings. This strategy is less time-intensive than day trading, allowing traders to hold positions longer and reduce the stress of constant monitoring. It’s akin to fishing; you cast your line and wait patiently for the right moment to reel in your catch.

For those who prefer a more hands-off approach, long-term investing can be a viable option. This strategy involves buying cryptocurrencies and holding them for an extended period, often years, regardless of short-term market fluctuations. Long-term investors typically focus on the underlying technology and potential future value of the assets they purchase. This method requires a strong belief in the cryptocurrency's potential and the patience to ride out market volatility, much like planting a tree and waiting for it to bear fruit.

Moreover, it’s crucial to combine these strategies with effective risk management techniques. Traders often use stop-loss orders to limit potential losses. By setting a predetermined price at which they will sell an asset, traders can protect themselves from significant downturns. It’s like having a safety net; it won't prevent you from falling, but it can soften the blow.

In summary, whether you choose day trading, swing trading, or long-term investing, the key is to find a strategy that suits your personal style and risk appetite. Always remember that the crypto market is unpredictable, and staying informed and adaptable is essential for success.

- What is the best trading strategy for beginners? For beginners, swing trading can be a good starting point as it doesn't require constant monitoring of the market.

- How do I manage risk in crypto trading? Utilizing stop-loss orders and diversifying your portfolio are effective ways to manage risk.

- Can I combine different trading strategies? Absolutely! Many traders use a combination of strategies to adapt to changing market conditions.

- What tools can help me with trading? Tools like trading platforms, market analysis software, and news aggregators can greatly enhance your trading experience.

Risk Management Techniques

Managing risk is an essential component of successful trading in the volatile world of cryptocurrencies. Just like a sailor navigating through stormy seas, you need to have a solid plan to keep your ship afloat. Risk management techniques can help you safeguard your investments and minimize potential losses, allowing you to trade with confidence. In this section, we’ll explore various strategies that can help you manage your risk effectively.

One of the most important techniques is diversification. Imagine you have a basket filled with different fruits; if one fruit goes bad, the others can still be enjoyed. The same principle applies to trading. By spreading your investments across various cryptocurrencies, you can reduce your exposure to any single asset's volatility. This way, if one coin experiences a downturn, your overall portfolio won’t suffer as much.

To illustrate the power of diversification, consider the following table:

| Asset Type | Potential Risk | Example Cryptocurrencies |

|---|---|---|

| High Risk | Price fluctuations can be significant | Shiba Inu, Dogecoin |

| Medium Risk | Moderate price volatility | Ethereum, Binance Coin |

| Low Risk | Stable with slow growth | Bitcoin, Litecoin |

Another crucial aspect of risk management is setting stop-loss orders. Think of a stop-loss order as a safety net that catches you before you fall too far. By setting a predetermined price at which your asset will be sold, you can limit your losses and protect your investment. It’s essential to analyze market conditions and set your stop-loss levels wisely. For instance, if you buy Bitcoin at $50,000, you might set a stop-loss order at $48,000 to ensure that you exit the position before your losses escalate.

Additionally, it's essential to remain vigilant and stay informed about market trends and news. Keeping an eye on significant developments can help you make timely decisions that can mitigate risks. For example, regulatory changes or technological advancements can impact the market dramatically. By following credible news sources and engaging with the crypto community, you can stay ahead of potential threats.

Lastly, it’s crucial to assess your risk tolerance. Everyone has a different comfort level when it comes to investing. Understanding your own financial situation and emotional response to losses can help you create a personalized risk management strategy. Ask yourself questions like: “How much can I afford to lose?” or “What level of risk am I comfortable with?” This self-awareness can guide your trading decisions and help you avoid impulsive actions driven by fear or greed.

In conclusion, effective risk management techniques are vital for anyone looking to thrive in the crypto trading landscape. By diversifying your investments, setting stop-loss orders, staying informed, and understanding your risk tolerance, you can navigate the unpredictable waters of cryptocurrency trading with greater confidence and security.

- What is the best way to manage risk in cryptocurrency trading? Diversification, setting stop-loss orders, and staying informed about market trends are effective ways to manage risk.

- How can diversification help reduce risk? By spreading your investments across various assets, you minimize the impact of a downturn in any single cryptocurrency.

- What are stop-loss orders and how do they work? Stop-loss orders automatically sell your asset when it reaches a specified price, helping to limit your losses.

- How do I determine my risk tolerance? Assess your financial situation and emotional response to losses to gauge how much risk you are comfortable taking.

Diversification

When it comes to trading cryptocurrencies, is like having a safety net in a circus act—it's essential for keeping you balanced and secure. Just as a tightrope walker wouldn’t perform without a safety harness, you shouldn’t dive into the volatile crypto market without spreading your investments across various assets. Why? Because the crypto landscape can be as unpredictable as a roller coaster ride, and one wrong turn can lead to significant losses. By diversifying your portfolio, you can reduce the risk of being heavily impacted by the poor performance of a single asset.

Imagine your investment portfolio as a fruit basket. If you only have apples, a bad harvest could leave you with nothing. But if you mix in bananas, oranges, and berries, you’re less likely to suffer from a single crop failure. Similarly, investing in a range of cryptocurrencies—such as Bitcoin, Ethereum, and altcoins—can help cushion your investments against market volatility. This strategy allows you to capture gains from various sources while minimizing the impact of a downturn in any one asset.

Moreover, diversification isn’t just about having multiple assets; it’s about understanding the different types of cryptocurrencies available. For instance, you might want to consider:

- Established Coins: These are your big players like Bitcoin and Ethereum, which typically have more stability.

- Emerging Altcoins: These are newer cryptocurrencies that could provide high returns but come with higher risks.

- Stablecoins: Coins like USDT or USDC that are pegged to fiat currencies can help stabilize your portfolio.

It's also crucial to keep an eye on market trends and adjust your diversification strategy accordingly. The crypto market is always evolving, and what works today might not be as effective tomorrow. Regularly reviewing your portfolio and reallocating your investments can help you stay ahead of the curve. Remember, the goal of diversification is not just to spread your investments, but to do so strategically, ensuring you’re not overexposed to any single asset class or market trend.

In conclusion, diversification is not merely a strategy; it's a mindset. Embrace it, and you'll find that navigating the crypto market becomes a lot less daunting. So, take a step back, assess your investments, and make sure your portfolio is as diverse as the crypto landscape itself. After all, in the world of trading, having a variety of options can be your best friend.

Here are some common questions traders have about diversification in crypto trading:

- What is diversification in crypto trading? Diversification in crypto trading refers to the strategy of spreading investments across various cryptocurrencies to minimize risk.

- Why is diversification important? It helps protect your portfolio from significant losses due to the volatility of individual assets.

- How can I diversify my crypto portfolio? By investing in a mix of established coins, emerging altcoins, and stablecoins, you can create a balanced portfolio.

- Should I constantly change my diversified portfolio? Regularly reviewing and adjusting your portfolio based on market trends and performance is recommended.

Setting Stop-Loss Orders

Setting stop-loss orders is a fundamental practice that every trader should incorporate into their strategy. Imagine you're in a boat on a vast ocean, and the waves start to get choppy. What do you do? You either steer your boat carefully or drop anchor to prevent it from drifting too far off course. Similarly, a stop-loss order acts as your anchor in the turbulent waters of cryptocurrency trading. By defining a specific price point at which your assets will automatically be sold, you can protect yourself from significant losses in a volatile market.

So, how do you set an effective stop-loss order? First, you need to determine the right percentage to set your stop-loss at. This often depends on your risk tolerance and the volatility of the asset you're trading. For instance, if you're trading a particularly volatile cryptocurrency, you might want to set a wider stop-loss to avoid being stopped out too early. Conversely, if the asset is more stable, a tighter stop-loss can help you lock in profits without taking on too much risk.

Here’s a quick breakdown of the types of stop-loss orders you can set:

- Standard Stop-Loss: This is the most common type, where you specify a price at which your asset will be sold if it drops to that level.

- Trailing Stop-Loss: This dynamic order moves with the market price. If the asset increases in value, the stop-loss price rises, but if it falls, it remains at the last set level.

- Guaranteed Stop-Loss: Some exchanges offer this feature, ensuring that your order will be executed at the specified price, regardless of market conditions.

To set a stop-loss order, follow these steps:

- Choose a trading platform that supports stop-loss orders.

- Decide on the percentage or price level at which you want to set the stop-loss.

- Enter the stop-loss order on the trading platform, ensuring all details are correct.

It's also crucial to regularly review and adjust your stop-loss levels as market conditions change. Just like a sailor checks the weather before setting sail, you should keep an eye on market trends and price movements. This practice helps ensure that your stop-loss orders remain relevant and effective. Remember, the goal is to protect your investments while still allowing for potential growth.

In conclusion, setting stop-loss orders is not just about minimizing losses; it's about creating a disciplined trading strategy that allows you to navigate the unpredictable nature of the crypto market with confidence. By implementing these orders, you can safeguard your investments and make more informed trading decisions.

1. What is a stop-loss order?

A stop-loss order is an instruction to sell a cryptocurrency when it reaches a specific price, helping to limit potential losses.

2. How do I determine the right stop-loss level?

The right stop-loss level depends on your risk tolerance, market volatility, and trading strategy. It's often a percentage below the current market price.

3. Can I change my stop-loss order after it's set?

Yes, most trading platforms allow you to modify or cancel your stop-loss orders at any time.

4. Are stop-loss orders guaranteed?

Not all stop-loss orders are guaranteed. Some may be executed at a different price during volatile market conditions, unless you use a guaranteed stop-loss feature offered by some exchanges.

Staying Updated with News

In the fast-paced world of cryptocurrency trading, staying updated with the latest news is not just a good practice; it's a necessity. Imagine trying to navigate a bustling city without a map—confusing, right? The same goes for trading without being informed. Market sentiment can change on a dime based on news events, regulatory changes, or technological advancements. Thus, keeping your finger on the pulse of the crypto world can significantly influence your trading decisions.

To make informed decisions, you need to follow credible sources that provide timely and accurate information. Relying on social media or random blogs can lead to misinformation, which could cost you dearly. Instead, consider subscribing to reputable news outlets and platforms dedicated to cryptocurrency. Here are some types of sources you should keep an eye on:

- Crypto News Websites: Websites like CoinDesk, CoinTelegraph, and The Block offer in-depth articles and analyses.

- Social Media: Follow influential figures in the crypto space on Twitter and LinkedIn for real-time updates.

- Podcasts and YouTube Channels: Engaging content can provide insights and opinions that traditional media might miss.

- News Aggregators: Services like Feedly or CryptoPanic compile news from various sources, giving you a comprehensive view.

Moreover, consider setting up alerts for significant events like hard forks, regulatory announcements, or major partnerships. This proactive approach will ensure that you are not caught off guard. For instance, if a major exchange announces a new listing, it could lead to a price surge for that asset. Being among the first to know can give you an edge over other traders.

Another effective way to stay updated is by joining online communities and forums. Platforms like Reddit, Discord, and Telegram host vibrant discussions where traders share insights and news. Engaging with these communities can provide a wealth of information and different perspectives that you might not find elsewhere. Just remember to verify any information you gather, as rumors can spread quickly in these spaces.

Lastly, don't underestimate the power of analytics and market research tools. Websites like Glassnode or Santiment provide on-chain data that can help you understand market trends and investor behavior. By combining news with analytics, you can make more informed trading decisions that align with market movements.

In conclusion, staying updated with news is like having a compass in the unpredictable landscape of cryptocurrency trading. It guides your decisions, helps you anticipate market shifts, and ultimately enhances your trading strategy. So, make it a habit to consume quality information daily, and you'll be better equipped to navigate the thrilling yet challenging world of crypto.

Q: Why is staying updated with news important for crypto trading?

A: Staying updated helps you understand market sentiment, anticipate price movements, and make informed trading decisions.

Q: What are some credible sources for crypto news?

A: Reputable sources include CoinDesk, CoinTelegraph, and various dedicated crypto news platforms. Social media, podcasts, and news aggregators can also provide valuable insights.

Q: How can I set up alerts for significant crypto events?

A: Many news websites and trading platforms allow you to set up alerts for specific events. You can also use tools like Google Alerts for broader news coverage.

Q: Should I trust information from social media?

A: While social media can provide real-time updates, it's essential to verify the information from credible sources before acting on it.

Frequently Asked Questions

- What are the key factors to consider when choosing a cryptocurrency exchange?

When selecting a crypto exchange, it's essential to evaluate factors such as security, transaction fees, available trading pairs, and user experience. A reliable exchange should prioritize user safety, offer competitive fees, and provide a wide range of cryptocurrencies for trading.

- How can I protect my cryptocurrency investments from scams?

To safeguard your investments, always conduct thorough research before engaging with any platform. Look for reviews, verify licensing, and be wary of offers that seem too good to be true. Additionally, using two-factor authentication and keeping your assets in a secure cold wallet can significantly reduce the risk of falling victim to scams.

- What is the importance of market trends in crypto trading?

Understanding market trends is crucial because it helps traders make informed decisions. By analyzing price movements, traders can identify whether the market is in a bullish or bearish phase, allowing them to adjust their strategies accordingly and maximize potential profits.

- How does diversification help in managing risk?

Diversification involves spreading investments across different cryptocurrencies or asset classes. This strategy can minimize the impact of market volatility on your overall portfolio, as losses in one asset may be offset by gains in another, ultimately leading to a more stable investment experience.

- What are stop-loss orders and how do they work?

A stop-loss order is a tool that allows traders to set a predetermined price at which their assets will be sold to prevent further losses. By using stop-loss orders, you can effectively manage risk and protect your investments during market downturns, ensuring that you don't lose more than you're willing to risk.

- Why is it important to stay updated with crypto news?

Staying informed about the latest news and developments in the crypto space is vital because external factors can greatly influence market conditions. Following credible sources for timely information can help you make better trading decisions and seize opportunities as they arise.