Developing a Scalping Strategy - Tips and Tricks

When it comes to trading, speed and precision are the names of the game, and scalping epitomizes this approach. Scalping is not just another trading strategy; it's an art form that allows traders to capitalize on minor price movements in the market. Imagine being a sprinter in a race, where every second counts and every small gain can lead to victory. That’s the essence of scalping. In this article, we will explore effective tips and tricks for creating a successful scalping strategy, emphasizing the importance of market analysis, tools, and mindset for optimal results.

At its core, scalping is a trading strategy focused on making small profits from numerous trades throughout the day. Think of it as fishing with a net instead of a rod; you're casting out to catch as many small fish as possible rather than waiting for a big catch. Scalpers aim to exploit inefficiencies in the market, and they often make dozens, if not hundreds, of trades in a single day. This method requires a unique mindset that combines quick decision-making with a keen understanding of market movements.

The advantages of scalping are manifold. First, it allows traders to generate consistent profits, albeit small ones, which can accumulate over time. Second, scalpers are less exposed to market risk since trades are held for a very short duration. However, it’s essential to remember that this strategy is not for everyone. Scalping demands a high level of concentration and the ability to make rapid decisions under pressure. Are you ready to embrace the fast-paced world of scalping?

To navigate the world of scalping effectively, you need the right tools at your disposal. Just as a chef requires quality knives and utensils, a scalper needs robust trading platforms, charting tools, and indicators to enhance performance. The choice of trading platform can significantly impact your ability to execute trades swiftly and efficiently.

Selecting a broker that supports scalping is crucial for any aspiring scalper. Not all brokers are created equal, and various factors can influence your trading success. Here are some key considerations:

- Spreads: Look for brokers with tight spreads, as this can significantly affect your profit margins.

- Commissions: Understand the commission structure, as high fees can eat into your profits.

- Execution Speed: A broker with fast execution speeds can make all the difference in a scalping strategy.

In scalping, every second counts. Low latency execution is vital because it ensures that your trades are executed as quickly as possible. Imagine trying to catch a bus that leaves every minute; if you miss it, you have to wait. The same applies to trading—if your order is delayed, you might miss the perfect entry point. Low latency can significantly impact your trading outcomes and ultimately your profitability.

Understanding commission structures is vital for scalpers. Different brokers have various fee models, and knowing how these affect your profitability is crucial. For instance, a broker might charge a flat fee per trade, while another might have a tiered structure based on trading volume. It’s essential to choose a broker with favorable terms that align with your trading frequency and strategy.

Using the right indicators can significantly improve your scalping strategy. Scalpers often rely on technical indicators to make quick decisions. Some of the most effective indicators include:

- Moving Averages: Help identify trends and potential reversal points.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions.

- Bollinger Bands: Show volatility and price levels.

These indicators can serve as your compass in the fast-paced world of scalping, guiding your trades and helping you make informed decisions.

Effective risk management is essential for long-term success in scalping. Without it, even the best strategies can lead to significant losses. One of the most critical aspects of risk management is setting stop-loss orders. These orders are crucial in scalping to limit potential losses. By determining your stop-loss levels based on market conditions, you can protect your capital and ensure that one bad trade doesn’t derail your entire strategy.

Setting effective stop-loss levels is an art in itself. It requires an understanding of market volatility and price action. A good rule of thumb is to set your stop-loss at a level that allows for normal market fluctuations, yet protects your capital. This way, you can avoid being stopped out by minor price movements while still safeguarding your investments.

Proper position sizing can help manage risk effectively. It’s essential to determine how much capital to allocate per trade in scalping. A common technique is the fixed fractional method, where you risk a small percentage of your trading capital on each trade. This approach helps ensure that a series of losing trades won’t deplete your account.

The psychological component of trading is often overlooked. Scalping requires mental discipline and focus. The fast-paced nature of this strategy can lead to emotional trading, which can be detrimental. It's essential to maintain a clear mind and stick to your trading plan. Remember, trading is not just about numbers; it’s about mindset.

Managing emotions is crucial for scalpers. Fear and greed can cloud judgment and lead to impulsive decisions. Developing strategies to cope with these emotions, such as taking breaks or practicing mindfulness, can help maintain focus during trades. Think of your mind as a garden; you need to weed out negative thoughts to allow positive ones to flourish.

Discipline is key in scalping. It’s vital to stick to your trading plan and avoid impulsive decisions. Create a checklist of your trading rules and follow it diligently. Just as a pilot relies on checklists to ensure safety, you should do the same to enhance your trading performance.

1. What is scalping in trading?

Scalping is a trading strategy focused on making small profits from numerous trades throughout the day, aiming to capitalize on minor price movements.

2. What tools do I need for scalping?

Successful scalping requires a reliable trading platform, charting tools, and technical indicators to make quick decisions.

3. How can I manage risk in scalping?

Effective risk management involves setting stop-loss orders, proper position sizing, and sticking to a disciplined trading plan.

4. Is scalping suitable for beginners?

While scalping can be profitable, it requires a high level of concentration and quick decision-making, making it more suitable for experienced traders.

Understanding Scalping

Scalping is a trading strategy that focuses on making small profits from numerous trades throughout the day. Imagine a chef who prepares bite-sized hors d'oeuvres for a banquet; each dish may not be grand, but when combined, they create a feast. Similarly, scalpers aim to capitalize on minor price movements, executing multiple trades in a single day to accumulate profits. This approach requires a keen understanding of market dynamics and a quick decision-making ability.

The core principle of scalping is to enter and exit trades swiftly. Scalpers typically hold positions for just a few seconds to minutes, which means they need to be constantly alert and ready to act. This fast-paced environment can be thrilling, but it also demands a specific mindset. Traders must be able to handle the pressures of rapid decision-making and remain focused, even when the market is volatile.

So, why do traders choose scalping over other strategies? Here are a few advantages:

- High Frequency of Trades: Scalpers can execute dozens or even hundreds of trades in a single day, which can lead to significant cumulative profits.

- Reduced Exposure: By holding positions for a short time, scalpers limit their exposure to market fluctuations.

- Market Efficiency: Scalping allows traders to take advantage of inefficiencies in the market, often capitalizing on discrepancies between the bid and ask prices.

However, successful scalping is not just about speed; it also requires a thorough understanding of market analysis. Traders must be able to read charts, spot trends, and identify key levels of support and resistance. This analytical approach is akin to a detective piecing together clues to solve a mystery. The more information a scalper has, the better equipped they are to make informed decisions.

In summary, scalping is a dynamic trading strategy that emphasizes speed, precision, and a deep understanding of market conditions. It is not for the faint of heart, as it requires intense focus and a willingness to adapt quickly to changing circumstances. For those who thrive in fast-paced environments and have the discipline to manage their emotions, scalping can be a rewarding venture.

Essential Tools for Scalping

When it comes to scalping, having the right tools at your disposal can mean the difference between success and failure. Think of it like a chef in a kitchen; the best ingredients and equipment can elevate a dish from mediocre to extraordinary. In the fast-paced world of trading, speed and precision are paramount, and the tools you choose can either enhance your performance or hinder it. So, what are the essential tools for scalping? Let’s dive into the must-haves that every aspiring scalper should consider.

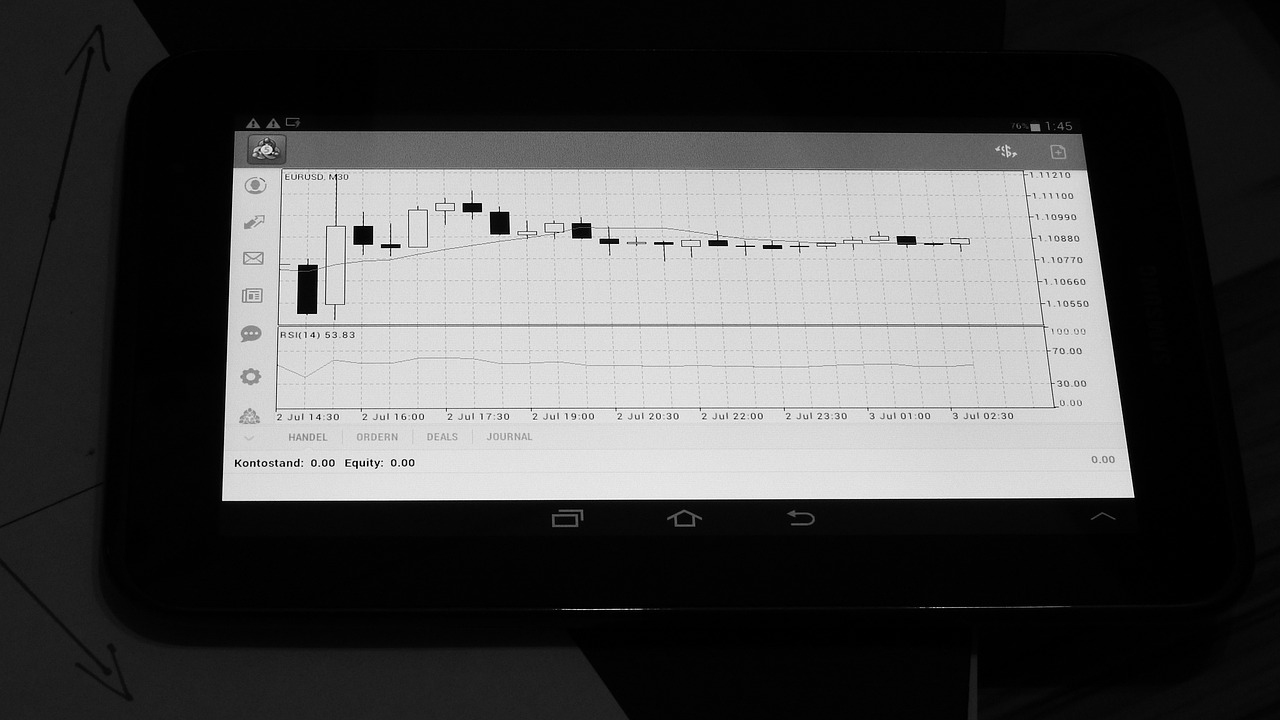

First and foremost, you need a reliable trading platform. This is your command center where all the action happens. Look for platforms that offer a user-friendly interface, quick execution times, and advanced features like one-click trading. Popular choices among scalpers include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which provide robust charting tools and a wide array of indicators. Additionally, ensure that the platform supports automated trading strategies if you plan to use algorithms to enhance your scalping efforts.

Next up, let’s talk about charting tools. High-quality charts are vital for making informed decisions in real-time. You’ll want to utilize platforms that provide customizable charts with various time frames, as scalpers often rely on minute or even second-based charts to spot trends quickly. Look for features such as candlestick patterns, volume indicators, and customizable moving averages. These elements will allow you to analyze price movements effectively and identify potential entry and exit points in the market.

Now, let’s not forget about technical indicators. These are your navigational tools in the trading waters. Some of the most effective indicators for scalping include:

- Moving Averages: These help smooth out price action and identify trends.

- Relative Strength Index (RSI): This momentum oscillator can indicate overbought or oversold conditions.

- Bollinger Bands: These can help identify volatility and potential price breakouts.

Using these indicators in conjunction with your charting tools can significantly enhance your decision-making process.

Another critical aspect of scalping is market news and analysis tools. Staying updated with the latest market news can give you an edge over other traders. Platforms like Bloomberg or Reuters provide real-time news feeds that can impact market movements. Additionally, consider subscribing to economic calendars to keep track of important announcements, such as interest rate changes or employment reports, which can create volatility in the markets.

In summary, equipping yourself with the right tools can dramatically improve your scalping strategy. A reliable trading platform, effective charting tools, essential technical indicators, and timely market news are all integral to navigating the fast-paced world of scalping. Remember, the goal is to make informed, quick decisions, and having the right tools at your fingertips is the first step toward achieving that.

Q1: What is the best trading platform for scalping?

A1: The best trading platform for scalping often depends on personal preference, but popular choices include MetaTrader 4 and MetaTrader 5 due to their speed and extensive features.

Q2: How important are technical indicators in scalping?

A2: Technical indicators are crucial in scalping as they help traders make quick decisions based on market trends and price movements.

Q3: Can I use automated trading strategies for scalping?

A3: Yes, many scalpers use automated trading strategies to take advantage of market opportunities without the need for constant monitoring.

Q4: What is the ideal time frame for scalping?

A4: Scalpers typically use very short time frames, such as 1-minute or 5-minute charts, to capture small price movements throughout the day.

Choosing the Right Broker

When it comes to scalping, selecting the right broker is akin to choosing the right vehicle for a high-speed race. You need a broker that not only supports your trading style but also enhances your performance on the trading floor. Scalping requires precision, speed, and efficiency, and your broker plays a pivotal role in this equation. So, what should you look for?

First and foremost, consider the spreads. In scalping, the goal is to make small profits from numerous trades, and high spreads can eat into your profits faster than you can say “market volatility.” Look for brokers that offer tight spreads—this means the difference between the buying and selling price is minimal, allowing you to maximize your gains.

Next up is commissions. Some brokers charge a flat fee per trade, while others might have a percentage-based commission structure. As a scalper, you want to ensure that your broker's commission structure is favorable for your trading frequency. A broker with lower commissions can make a significant difference in your overall profitability, especially when you’re executing multiple trades in a day.

Another critical factor is execution speed. In the fast-paced world of scalping, every second counts. Delays in order execution can result in missed opportunities or worse—trades that go against you. Therefore, opt for brokers that boast low latency execution. This ensures that your trades are executed at lightning speed, keeping you ahead of the market.

Additionally, it’s essential to check if the broker offers a demo account. This allows you to test their platform and trading conditions without risking real money. A demo account can be a fantastic way to familiarize yourself with the broker's interface and ensure it suits your scalping needs. You can practice your strategies and get a feel for how the broker operates in real-time market conditions.

Lastly, don't overlook the importance of customer support. In a world where market conditions can change in an instant, having access to responsive customer service can be a game-changer. Whether you have questions about your account or need assistance during a critical trading moment, reliable support can provide peace of mind.

In summary, when you're on the hunt for the right broker for your scalping strategy, keep these factors in mind:

- Tight Spreads: Minimize costs to maximize profits.

- Low Commissions: Ensure your trading frequency doesn’t eat into your profits.

- Fast Execution: Every second counts in scalping.

- Demo Accounts: Test the waters before diving in.

- Responsive Customer Support: Get help when you need it.

Choosing the right broker is not just a step in your trading journey; it’s a crucial foundation for your scalping strategy. Take your time to evaluate your options, and remember that the right broker can elevate your trading experience from mundane to extraordinary.

Low Latency Execution

When it comes to scalping, every millisecond matters. In the fast-paced world of trading, low latency execution can be the difference between capturing a profit and missing out entirely. Imagine you're a sprinter at the starting line; the moment the gun goes off, you need to be off the blocks and running. In trading, that "gun" is the market signal, and low latency execution ensures you're the first to respond.

Low latency refers to the minimal delay in processing trades. In scalping, where traders aim to make numerous small profits throughout the day, even a slight delay can lead to missed opportunities. Therefore, choosing a broker with low latency execution is crucial. This means that when you hit that buy or sell button, your order is processed almost instantaneously, allowing you to react to market movements without hesitation.

To put it simply, think of low latency execution as having a high-speed internet connection. Just as a faster connection allows you to stream videos without buffering, low latency execution enables you to execute trades quickly and efficiently. But how do you determine if a broker offers low latency? Here are some factors to consider:

- Server Location: Brokers with servers located close to major exchanges typically offer lower latency.

- Technology: Look for brokers using advanced technology and infrastructure designed for speed.

- Reputation: Research broker reviews and testimonials regarding their execution speed.

Additionally, many brokers provide tools such as demo accounts where you can test their execution speeds. This is a fantastic way to gauge how well they perform under real market conditions without risking your capital. Remember, the less time it takes for your orders to be executed, the better your chances of capitalizing on fleeting market opportunities.

In conclusion, low latency execution is not just a technical feature; it's a critical component of a successful scalping strategy. By ensuring that your broker can deliver orders with minimal delay, you position yourself to seize every possible advantage in the market. So, before you dive into the world of scalping, make sure your execution is as fast as your trading strategy demands!

Commission Structures

When it comes to scalping, understanding is not just important; it’s absolutely crucial. Why? Because every cent counts in this fast-paced trading strategy. Scalpers aim to make small profits from numerous trades, and high commissions can eat away at those profits faster than you can say "market volatility." So, let’s break down what you need to know about commission structures and how they can impact your bottom line.

First off, there are generally two types of commission structures you’ll encounter: fixed commissions and variable commissions. Fixed commissions remain the same regardless of the trade size, which can be beneficial for scalpers who make frequent trades. On the other hand, variable commissions can fluctuate based on trade volume or the type of asset being traded. This means that if you’re trading high volumes, a variable commission structure could either work in your favor or against you, depending on the broker's terms.

To illustrate this further, let’s take a look at a simple comparison of how different commission structures can affect your trading:

| Commission Structure | Example Trade Size | Commission Rate | Total Commission Paid |

|---|---|---|---|

| Fixed Commission | 100 shares | $5 per trade | $5 |

| Variable Commission | 100 shares | 0.1% of trade value | $1 (assuming a $1,000 trade) |

As you can see, the commission structure can significantly impact your costs. In scalping, where margins are razor-thin, even a small difference in commission can affect your overall profitability. Therefore, it’s essential to choose a broker that offers a commission structure that aligns with your trading style.

Moreover, it’s not just about the rates; execution speed and spreads also play a vital role in your trading success. A broker with tight spreads and low commissions will give you a better chance of making those quick profits that scalpers rely on. So, don’t just rush into signing up with the first broker you find. Take your time to compare different options and see which one offers the best overall package for your scalping needs.

In conclusion, understanding commission structures is a key component of developing a successful scalping strategy. By keeping an eye on your costs and choosing the right broker, you can maximize your profits and make the most out of every trade. Remember, in scalping, it’s not just about making money; it’s about keeping as much of it as possible!

- What is the best commission structure for scalping? The best structure depends on your trading volume and style. Fixed commissions can be beneficial for frequent trades, while variable commissions may work better for larger trades.

- How do commissions affect my overall profitability? High commissions can quickly eat into your profits from small trades, making it essential to choose a broker with low fees.

- Can I negotiate commission rates with my broker? Some brokers may be open to negotiation, especially if you are a high-volume trader. It's worth asking!

Key Indicators for Scalping

When it comes to scalping, the right indicators can be your best friends. These tools help you make quick decisions in the fast-paced world of trading. Think of them as your trusty GPS guiding you through the maze of market movements. But what exactly should you be looking at? Let's dive into some of the most effective technical indicators that can elevate your scalping game.

First up is the Moving Average (MA). This indicator smooths out price data by creating a constantly updated average price. Scalpers often use short-term moving averages, like the 5-period or 10-period, to spot immediate trends. When the price crosses above the moving average, it might indicate a buying opportunity, while a cross below could signal a sell. It's like having a crystal ball that shows you where the market might be heading next!

Another essential tool is the Relative Strength Index (RSI). This momentum oscillator measures the speed and change of price movements, helping traders identify overbought or oversold conditions. An RSI above 70 can indicate that a stock is overbought, while below 30 suggests it’s oversold. For scalpers, these signals can be crucial for timing entries and exits. Imagine being able to predict when a stock is about to take a breather or when it’s ready to sprint again!

Next, we have the Stochastic Oscillator. This indicator compares a particular closing price of a security to a range of its prices over a specific period. It produces values between 0 and 100, with readings above 80 indicating overbought conditions and below 20 indicating oversold conditions. Scalpers can use this information to make swift trades, capitalizing on short-term price movements. Think of it as a radar that helps you spot opportunities before they vanish!

Don’t forget about Volume! Monitoring trading volume can provide insights into the strength of a price move. A price increase accompanied by high volume is generally more reliable than one with low volume. As a scalper, you want to be in tune with the market's pulse. High volume can indicate strong interest and momentum, making it an excellent time to execute your trades.

| Indicator | Description | Use in Scalping |

|---|---|---|

| Moving Average (MA) | Smooths out price data to identify trends | Helps spot buying/selling opportunities |

| Relative Strength Index (RSI) | Measures speed and change of price movements | Indicates overbought/oversold conditions |

| Stochastic Oscillator | Compares closing price to a range of prices | Identifies potential entry/exit points |

| Volume | Tracks the number of shares traded | Confirms the strength of price movements |

By incorporating these indicators into your scalping strategy, you can enhance your ability to make informed decisions quickly. However, remember that no single indicator is foolproof. It's essential to use a combination of them to get a clearer picture of the market. Just like a chef needs various spices to create a delicious dish, a trader needs multiple indicators to craft a winning strategy!

- What is scalping in trading? Scalping is a trading strategy that focuses on making small profits from numerous trades throughout the day.

- How do I choose the right indicators for scalping? Look for indicators that provide quick signals and can be easily interpreted, such as Moving Averages, RSI, and Volume.

- Can I use scalping on any trading platform? Not all platforms support scalping. Choose one that offers fast execution and low spreads.

- What is the best time frame for scalping? Many scalpers use 1-minute or 5-minute charts to make quick trades based on short-term movements.

Risk Management in Scalping

When it comes to scalping, one of the most vital aspects that traders often overlook is risk management. Imagine you’re in a bustling market, trying to grab the best deals while avoiding the chaos around you. That’s exactly what scalping feels like! It’s fast-paced and thrilling, but without a solid risk management strategy, you could easily find yourself overwhelmed and facing significant losses. So, how do you protect your capital while engaging in this high-speed trading style? Let’s dive into some practical strategies that can help you minimize losses and safeguard your profits.

First and foremost, setting stop-loss orders is crucial. These orders act like a safety net, automatically closing your position when it hits a predetermined loss level. Think of it as having an emergency exit in a crowded theater; it ensures you can escape before things get too chaotic. To set effective stop-loss levels, consider the market's volatility and your trading strategy. For example, if you’re scalping a currency pair that’s known for rapid fluctuations, you might want to set your stop-loss a bit further away to avoid being stopped out too early. However, if the market is relatively stable, a tighter stop-loss may be appropriate. The key is to find a balance that aligns with your trading style.

Next up is position sizing. This is all about determining how much capital you allocate to each trade. Think of your trading account as a pie, and each slice represents a different trade. You wouldn’t want to take a massive slice for one trade and leave yourself with little for others, right? A good rule of thumb is to risk only a small percentage of your total capital on a single trade. Many traders recommend risking no more than 1-2% of your account balance on each trade. This way, even if you hit a string of losses, your account can withstand the blows without being completely wiped out.

Moreover, it’s essential to have a risk-reward ratio in mind. This ratio compares the potential profit of a trade to its potential loss. For example, if you’re risking $1 to potentially gain $3, your risk-reward ratio is 1:3. This means that even if you only win one out of four trades, you could still come out ahead. Many scalpers aim for a risk-reward ratio of at least 1:2 or higher, ensuring that their wins outweigh their losses over time.

Lastly, maintaining a trading journal can be a game-changer for your risk management strategy. By documenting each trade, including your reasoning, outcomes, and emotional state, you can identify patterns in your trading behavior. This self-awareness can lead to improved decision-making and help you spot potential pitfalls before they become costly mistakes. Over time, you’ll develop a clearer understanding of what works for you and what doesn’t, allowing you to refine your strategy and enhance your profitability.

In summary, effective risk management in scalping involves setting stop-loss orders, practicing proper position sizing, maintaining a favorable risk-reward ratio, and keeping a detailed trading journal. By incorporating these strategies into your trading routine, you can navigate the fast-paced world of scalping with greater confidence and resilience.

- What is the best stop-loss strategy for scalping?

The best stop-loss strategy varies based on market conditions and your trading style. A common approach is to set stop-loss orders just beyond key support or resistance levels. - How much capital should I allocate for each scalping trade?

Many traders recommend risking no more than 1-2% of your total trading capital on any single trade to manage risk effectively. - What is a good risk-reward ratio for scalping?

A risk-reward ratio of at least 1:2 is often recommended, meaning you should aim to gain at least twice what you risk on a trade. - Why is a trading journal important for scalpers?

A trading journal helps you track your trades, analyze your performance, and learn from your mistakes, ultimately leading to improved trading decisions.

Setting Stop-Loss Orders

When it comes to scalping, setting effective stop-loss orders is not just a good practice; it's a necessity. Imagine you're a sprinter at the starting line, ready to dash forward, but you need to have a safety net in place in case you trip. That's exactly what stop-loss orders do for scalpers—they act as that safety net, helping you minimize potential losses while allowing you to focus on making quick profits.

So, how do you set these critical stop-loss levels? First, it's essential to understand the market conditions. For instance, during high volatility, you might want to set your stop-loss a bit wider to avoid getting stopped out too early. Conversely, in a stable market, tighter stop-loss levels can be more effective. A good rule of thumb is to place your stop-loss just beyond a recent support or resistance level, as this gives the trade some breathing room while still protecting your capital.

Another factor to consider is your risk-reward ratio. A common strategy is to aim for a risk-reward ratio of at least 1:2 or even 1:3. This means that for every dollar you're willing to risk, you're aiming to make two or three dollars in profit. To achieve this, you must carefully calculate your stop-loss level based on your entry point and your target. For example, if you enter a trade at $100 and set a stop-loss at $98, you're risking $2. If your target is $104, you're looking at a potential profit of $4, giving you a 1:2 risk-reward ratio.

Here's a simple example to illustrate:

| Trade Entry | Stop-Loss Level | Target Price | Risk-Reward Ratio |

|---|---|---|---|

| $100 | $98 | $104 | 1:2 |

Remember, the key to effective stop-loss orders is not just about where you place them, but also about adjusting them as the market moves. As your trade becomes profitable, consider using a trailing stop-loss to lock in profits while still allowing for some upward movement. This way, if the market reverses, your stop-loss will automatically adjust, helping you secure gains without constantly monitoring the market.

In summary, setting stop-loss orders is a crucial component of a successful scalping strategy. By understanding market conditions, calculating risk-reward ratios, and adjusting your stop-loss levels as needed, you can protect your capital and enhance your trading performance. Remember, in the fast-paced world of scalping, having a solid plan for your stop-loss orders can make all the difference between a winning trade and a costly mistake.

- What is a stop-loss order? A stop-loss order is a predetermined price level at which a trader will exit a losing position to prevent further losses.

- How do I determine where to set my stop-loss? You can set your stop-loss based on recent support and resistance levels or use a percentage of your entry price.

- Can I adjust my stop-loss after placing it? Yes, you can adjust your stop-loss as the trade progresses to lock in profits or reduce potential losses.

- What is a trailing stop-loss? A trailing stop-loss is a dynamic stop-loss order that moves with the market price, allowing you to lock in profits as the price increases.

Position Sizing Techniques

When it comes to scalping, mastering position sizing is akin to having a well-tuned engine in a high-speed race car. It’s not just about how fast you can drive; it’s about how efficiently you can manage your resources. Position sizing determines how much of your capital you allocate to a single trade, and getting this right is crucial for your overall success in the fast-paced world of scalping. But how do you figure out the ideal position size? Let’s dive into some techniques that can help you navigate this critical aspect of trading.

One of the most popular methods for determining position size is the fixed fractional method. This technique involves risking a specific percentage of your trading capital on each trade. For instance, if you decide to risk 1% of your $10,000 trading account, you would allocate $100 to that particular trade. This approach not only helps in managing risk but also ensures that you don’t overexpose yourself to any single trade, which is vital in scalping where trades are frequent and often volatile.

Another method is the Kelly Criterion, a formula that calculates the optimal size of a series of bets. In trading, this translates to determining the right amount to risk based on your win rate and the ratio of your average win to your average loss. The formula might seem complex, but it essentially helps you find a balance between risk and reward, ensuring that you maximize growth while minimizing the risk of ruin. Here’s a simplified version of the formula:

Kelly % W - [(1 - W) / R]

Where:

- W Win rate (percentage of winning trades)

- R Win/Loss ratio (average win divided by average loss)

Now, while these methods are effective, it's essential to consider your own risk tolerance and trading style. For example, if you’re a more conservative trader, you might prefer to risk only a fraction of your capital, while aggressive scalpers might opt for higher percentages. Therefore, it's crucial to assess your own comfort level and adjust your position sizing accordingly.

Moreover, using a position sizing calculator can simplify this process significantly. These calculators allow you to input your account size, risk percentage, and the stop-loss distance, and they will automatically calculate the appropriate position size for you. This tool can be invaluable, especially when you’re juggling multiple trades at once and need to make quick decisions.

In conclusion, understanding and implementing effective position sizing techniques can be the difference between success and failure in scalping. By adopting methods like the fixed fractional approach or the Kelly Criterion, along with utilizing position sizing calculators, you can enhance your trading strategy and safeguard your capital. Remember, in the world of scalping, precision and discipline are your best friends!

Q1: What is the best position sizing technique for scalping?

A1: The best technique depends on your trading style and risk tolerance. Fixed fractional and Kelly Criterion are popular methods, but you should choose one that suits your personal comfort level.

Q2: How can I calculate my position size quickly?

A2: Using a position sizing calculator can help you quickly determine the appropriate size based on your account size, risk percentage, and stop-loss distance.

Q3: Is it necessary to adjust position sizes for different trades?

A3: Yes, adjusting position sizes based on the volatility of the asset and your confidence in the trade can help manage risk effectively.

Psychological Aspects of Scalping

When it comes to scalping, the psychological aspects are just as crucial as the technical skills involved. Imagine you’re a tightrope walker, balancing high above the ground. One misstep can lead to a fall, and in trading, that misstep could mean losing money. Scalpers must maintain a razor-sharp focus, as the fast-paced nature of this strategy can stir up a whirlwind of emotions. Fear, greed, and stress can creep in, jeopardizing your carefully crafted trading plan.

One of the primary challenges scalpers face is handling emotions. When you’re making rapid trades, it’s easy to get swept up in the moment. For instance, after a series of wins, you might feel invincible and take on larger positions, risking your profits. Conversely, after a loss, fear can paralyze you, leading to missed opportunities. To combat this, it’s essential to develop a set of strategies that help you manage these emotions effectively. Here are some tips:

- Practice mindfulness: Take a moment to breathe and refocus when you feel overwhelmed.

- Stick to your plan: Always refer back to your trading plan, regardless of how you feel.

- Keep a journal: Document your trades and emotions to identify patterns that affect your decision-making.

Moreover, staying disciplined is the cornerstone of successful scalping. It’s all too easy to deviate from your strategy when emotions run high. Picture a marathon runner who suddenly decides to sprint just because they feel good; they might burn out before reaching the finish line. Similarly, in trading, sticking to your plan is vital. This means following your entry and exit strategies diligently, regardless of market noise. Here are some key components to maintaining discipline:

- Set clear goals: Know what you want to achieve with each trade.

- Limit distractions: Create a trading environment that minimizes interruptions.

- Review your performance: Regularly assess your trading decisions to ensure you’re adhering to your strategy.

Finally, it’s important to recognize that psychological resilience is built over time. Just like a muscle, it requires consistent practice and reinforcement. You may encounter setbacks along the way, but learning from these experiences will only make you stronger. Embrace the journey of scalping not just as a way to make money, but as a path to personal growth and self-discovery.

Q: How can I improve my emotional control while scalping?

A: Emotional control can be improved through mindfulness techniques, maintaining a trading journal, and by sticking to a well-defined trading plan.

Q: What should I do if I start feeling overwhelmed during trading?

A: Take a short break, step away from your screen, and practice some deep breathing. This can help clear your mind and restore your focus.

Q: Is it normal to feel anxious when scalping?

A: Yes, feeling anxious is common among traders, especially in a fast-paced environment like scalping. The key is to develop strategies to manage that anxiety effectively.

Handling Emotions

When it comes to scalping, emotions can be your best friend or your worst enemy. Imagine you're in a high-speed car race, where every second counts. Just like a driver needs to stay calm and focused to navigate tight turns, you too need to manage your emotions to make quick, informed trading decisions. So, how do you keep your cool when the market feels like it's on fire? Here are some strategies to help you cope with the emotional rollercoaster of scalping.

First off, it’s crucial to recognize that fear and greed are two of the most common emotions that can sabotage your trading efforts. Fear can make you hesitate, preventing you from entering a trade when you should, while greed can push you to overtrade or hold onto losing positions longer than you should. The key is to develop a mindset that allows you to acknowledge these feelings without letting them control your actions.

One effective way to manage these emotions is by creating a trading plan. Your trading plan should outline your entry and exit strategies, risk management techniques, and criteria for evaluating trades. By having a clear plan, you’ll be less likely to react impulsively to market fluctuations. Think of your trading plan as a roadmap; it helps you stay on course even when the road gets bumpy.

Another powerful tool for emotional management is journaling. Keeping a trading journal allows you to document your trades, thoughts, and feelings during each session. Over time, you can identify patterns in your emotional responses and learn how to manage them more effectively. For instance, if you notice that you tend to panic after a few losses, you can develop strategies to counteract that fear before it influences your decisions.

Additionally, consider implementing mindfulness techniques. Practices such as meditation or deep-breathing exercises can help ground you and reduce anxiety. Just a few minutes of focused breathing before you start trading can clear your mind and prepare you to face the challenges ahead. It’s like taking a pit stop to refuel your mental energy before hitting the track again.

Lastly, it’s important to remember that no one is perfect. Even the most seasoned traders experience losses and emotional turmoil. The difference lies in how they respond to these challenges. By employing the strategies mentioned above, you can cultivate a resilient mindset that not only improves your trading performance but also enhances your overall well-being.

- What is the best way to control emotions while trading?

Creating a solid trading plan and maintaining a trading journal can help you manage your emotions effectively. - How can mindfulness techniques improve my trading?

Mindfulness techniques can help reduce anxiety and improve focus, allowing for better decision-making during trades. - Is it normal to feel fear and greed while trading?

Yes, these emotions are common among traders, but it's important to learn how to manage them to avoid impulsive decisions.

Staying Disciplined

Staying disciplined in the fast-paced world of scalping can feel like trying to keep a tightrope walker's balance while juggling flaming torches. It’s exhilarating, but one wrong move can lead to disaster. The market moves quickly, and emotions can run high, making it all too easy to stray from your carefully crafted trading plan. So, how do you maintain that razor-sharp focus and avoid the pitfalls of impulsive trading?

First and foremost, having a well-defined trading plan is essential. This plan should outline your entry and exit strategies, risk management techniques, and the specific conditions under which you will trade. Think of it as your roadmap; without it, you might find yourself lost in the chaotic landscape of the market. But it’s not just about having a plan; it’s about sticking to it, no matter how tempting it is to deviate. This discipline can be your safety net, preventing you from making decisions based on fleeting emotions rather than sound analysis.

Another key aspect of discipline is setting clear goals. What do you want to achieve with your scalping strategy? Is it a specific percentage return, a certain number of trades per day, or perhaps a target profit in dollars? Whatever your goals may be, write them down and refer back to them regularly. This practice not only keeps your objectives in mind but also serves as a reminder of why you started trading in the first place. When the market gets volatile, having these goals can help anchor you, providing a sense of purpose amidst the chaos.

Moreover, it’s vital to review your trades regularly. This means analyzing both your successful trades and your losses. By understanding what worked and what didn’t, you can refine your strategy and improve your discipline over time. Keeping a trading journal can be an invaluable tool in this process. Record your thoughts, emotions, and the rationale behind each trade. Over time, you’ll start to see patterns in your behavior that can inform your future decisions.

Finally, consider the role of accountability. Whether it’s a trading buddy or a mentor, having someone to share your trading journey with can make a significant difference. This person can help keep you accountable, ensuring you stay true to your trading plan and goals. Plus, they can provide valuable feedback and insights that you might not see on your own. Remember, trading doesn’t have to be a solitary endeavor; collaboration can enhance your discipline and improve your overall performance.

In conclusion, staying disciplined in scalping is not just about rigidly following rules; it’s about cultivating a mindset that prioritizes consistency, reflection, and accountability. By developing a robust trading plan, setting clear goals, reviewing your trades, and seeking accountability, you can navigate the exhilarating world of scalping with confidence and poise. So, the next time you find yourself tempted to chase after a quick profit, take a deep breath, refer back to your plan, and remind yourself of the importance of discipline. After all, in the world of trading, patience and discipline often lead to the greatest rewards.

- What is scalping in trading? Scalping is a trading strategy that involves making numerous trades throughout the day to capture small price movements.

- How can I improve my scalping discipline? By having a solid trading plan, setting clear goals, reviewing your trades, and seeking accountability.

- What tools are essential for scalping? Key tools include a reliable trading platform, charting tools, and technical indicators.

- Why is risk management important in scalping? Effective risk management helps minimize losses and protects your profits, ensuring long-term success.

Frequently Asked Questions

- What is scalping in trading?

Scalping is a trading strategy that focuses on making small profits from numerous trades throughout the day. Traders, known as scalpers, aim to capitalize on minor price fluctuations, often executing dozens or even hundreds of trades in a single day.

- What tools do I need for scalping?

To effectively scalp, you'll need specific tools including a reliable trading platform, advanced charting tools, and technical indicators. These tools help you analyze market trends and make quick trading decisions to maximize your profits.

- How do I choose the right broker for scalping?

When selecting a broker for scalping, consider factors such as tight spreads, low commissions, and fast execution speeds. A broker that supports scalping will provide the necessary environment for executing quick trades without excessive costs.

- Why is low latency execution important in scalping?

In scalping, every second counts. Low latency execution ensures that your trades are processed quickly, minimizing the risk of slippage and allowing you to take advantage of fleeting market opportunities.

- What are the best indicators for scalping?

Some of the most effective indicators for scalping include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). These indicators help you identify trends and potential entry and exit points for your trades.

- How can I manage risk while scalping?

Effective risk management in scalping involves setting stop-loss orders to limit potential losses and employing proper position sizing techniques to determine how much capital to allocate per trade. This way, you can protect your capital while aiming for profits.

- What psychological traits are important for scalping?

Successful scalpers need strong mental discipline to manage emotions like fear and greed. Staying focused and sticking to your trading plan is crucial to avoid impulsive decisions that can lead to losses.

- How do I handle emotions while scalping?

To handle emotions effectively, it’s important to develop a solid trading plan and stick to it. Techniques such as taking breaks, practicing mindfulness, and keeping a trading journal can help you stay calm and composed during trades.