The Impact of New Regulations on Wallet Providers

This article explores the evolving landscape of wallet providers in light of recent regulatory changes, examining both challenges and opportunities that these regulations present for the industry.

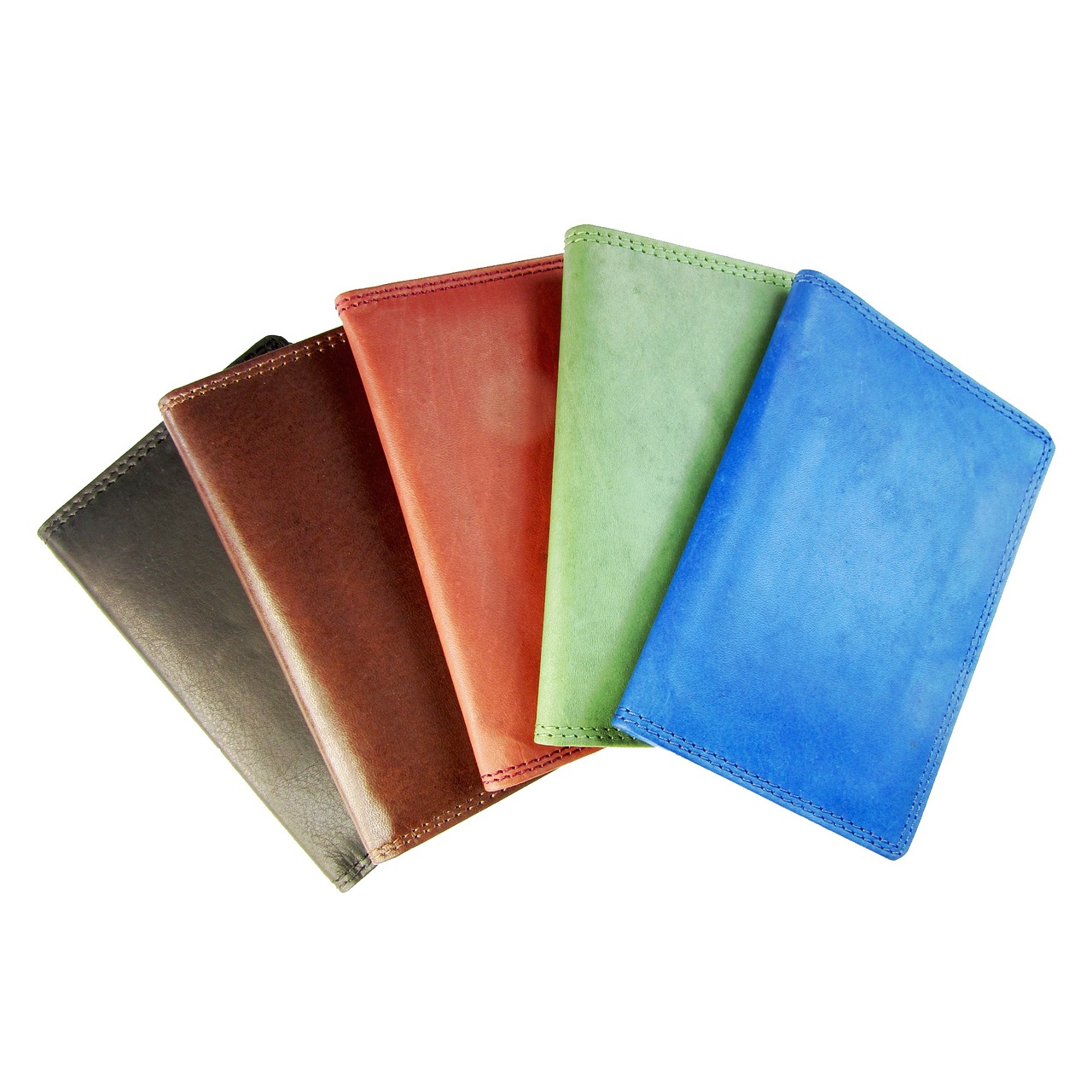

Wallet providers play a crucial role in digital transactions, acting as the bridge between consumers and their financial activities. Imagine a digital wallet as your virtual purse; it holds not just cash but also a plethora of payment options, loyalty cards, and even tickets. These providers can be categorized into various types, including mobile wallets, web wallets, and hardware wallets, each serving unique purposes in the modern financial ecosystem. As the world shifts towards cashless transactions, wallet providers have become increasingly important, facilitating seamless payments and enhancing user convenience.

In recent years, the regulatory landscape for wallet providers has undergone significant transformations. Governments and regulatory bodies are stepping up their efforts to ensure that digital financial services are safe, secure, and transparent. Key changes include enhanced anti-money laundering (AML) requirements, stricter Know Your Customer (KYC) protocols, and increased scrutiny of digital transactions. These regulations aim to protect consumers and maintain the integrity of the financial system, but they also pose challenges for wallet providers as they adapt to new compliance measures.

Compliance with new regulations is imperative for wallet providers. These requirements often involve substantial operational adjustments and resource allocation. For instance, wallet providers must invest in advanced technology to enhance their KYC processes, ensuring that they can accurately verify user identities. Specific compliance requirements include:

- Implementing robust KYC procedures to verify customer identities.

- Adopting effective AML practices to prevent illicit activities.

- Maintaining detailed transaction records for regulatory audits.

These compliance measures not only demand financial investment but also require a shift in company culture, emphasizing the importance of regulatory adherence across all levels of the organization.

User privacy concerns are heightened by new compliance measures. As wallet providers collect more data to comply with KYC and AML regulations, the risk of data breaches becomes a pressing issue. Regulations often dictate how data should be handled, stored, and shared, impacting consumer trust. Wallet providers must strike a delicate balance between compliance and user privacy, ensuring that they protect sensitive information while adhering to regulatory standards. This challenge can either erode or enhance consumer confidence in digital wallets, depending on how providers manage their data practices.

New financial reporting obligations require wallet providers to maintain transparency in their operations. The shift towards stricter reporting standards means that companies must be diligent in tracking their financial activities, which can significantly impact operational efficiency. These obligations include:

- Regularly submitting detailed financial statements to regulatory authorities.

- Conducting internal audits to ensure compliance with financial regulations.

- Implementing systems to monitor and report suspicious transactions.

While these requirements may seem burdensome, they ultimately foster a culture of accountability and transparency, which can strengthen the reputation of wallet providers in the long run.

The implementation of new regulations presents various challenges for wallet providers. Adapting to these changes requires not only time but also significant financial resources. Some major hurdles include:

- The need for advanced technology to meet compliance standards.

- Increased operational costs associated with staff training and system upgrades.

- Potential loss of customers who may be deterred by stringent verification processes.

These challenges can be daunting, but they also present an opportunity for wallet providers to innovate and improve their services.

Despite challenges, new regulations can foster innovation. Wallet providers can leverage compliance as a catalyst for developing new services and enhancing customer experiences in a regulated environment. For instance, regulations often drive improvements in security, pushing providers to innovate security features that not only meet regulatory standards but also address consumer concerns about fraud and data breaches.

Regulations often drive improvements in security. Wallet providers are innovating security features to meet these standards, implementing advanced encryption methods and biometric authentication to protect user data. This not only helps in compliance but also builds consumer trust, as users feel safer knowing their information is secure. The implementation of two-factor authentication and real-time transaction alerts are just a few examples of how wallet providers are enhancing security.

Regulatory clarity can open doors to new markets. By complying with regulations, wallet providers can expand their services into previously inaccessible regions. This not only drives growth but also diversifies their offerings, allowing them to tap into new customer bases. As regulations evolve, wallet providers that adapt quickly will be well-positioned to capitalize on emerging opportunities.

Q: What are wallet providers?

A: Wallet providers are digital platforms that facilitate online transactions, allowing users to store and manage their payment methods securely.

Q: How do regulations affect wallet providers?

A: Regulations impose compliance requirements that wallet providers must meet, impacting their operations, costs, and security measures.

Q: Can regulations lead to innovation?

A: Yes, while regulations can pose challenges, they can also drive wallet providers to innovate and enhance their services to meet compliance standards.

Understanding Wallet Providers

Wallet providers are the unsung heroes of the digital transaction world, acting as the bridge between consumers and their financial resources. In today’s fast-paced economy, where cash is becoming increasingly obsolete, these providers enable seamless, secure, and efficient transactions. Whether you're buying coffee with your smartphone or transferring money to a friend across the globe, wallet providers are at the heart of these interactions.

So, what exactly do wallet providers do? At their core, they offer a digital platform that allows users to store, send, and receive money. They come in various forms, including mobile wallets, online wallets, and even hardware wallets. Each type serves a unique purpose, catering to different user needs:

- Mobile Wallets: These are apps on your smartphone that store your payment information and allow you to make purchases directly from your device. Think of Apple Pay or Google Wallet.

- Online Wallets: These are web-based services that enable users to manage their funds and conduct transactions through a browser. Examples include PayPal and Skrill.

- Hardware Wallets: For those who prioritize security, these devices store cryptocurrencies offline, making them less vulnerable to hacking.

The importance of wallet providers in the modern financial ecosystem cannot be overstated. They not only facilitate transactions but also enhance user experience by providing features like transaction tracking, budgeting tools, and loyalty rewards. In an age where convenience is king, wallet providers are revolutionizing how we interact with money.

Moreover, wallet providers are crucial for financial inclusion. They empower individuals who may not have access to traditional banking services, enabling them to participate in the digital economy. This democratization of financial services is particularly significant in developing regions, where banking infrastructure is often lacking.

In summary, understanding wallet providers is essential for grasping the broader implications of recent regulatory changes. As these providers evolve to meet consumer demands and navigate the complexities of compliance, they play a pivotal role in shaping the future of finance. With the rapid advancements in technology and changing consumer behaviors, wallet providers are not just adapting; they are thriving in the digital age.

Recent Regulatory Changes

The world of wallet providers has been shaken up recently due to a slew of new regulatory changes that have come into play. These changes are not just minor tweaks; they represent a significant shift in how these digital transaction facilitators operate. Regulatory bodies have stepped up their game, aiming to create a safer, more transparent environment for users. But what does this mean for wallet providers? Well, it's a mixed bag of challenges and opportunities.

One of the most notable changes is the introduction of stricter anti-money laundering (AML) and know your customer (KYC) regulations. These regulations are designed to ensure that wallet providers verify the identities of their users and monitor transactions for suspicious activities. This means that wallet providers must invest in robust identity verification systems and transaction monitoring tools. The goal is clear: to enhance trust and security in the digital financial ecosystem.

Additionally, regulatory authorities are pushing for increased data protection measures. With the rise of cyber threats, the need to safeguard user data has never been more critical. Wallet providers are now required to implement stringent data handling and storage protocols to comply with regulations such as the General Data Protection Regulation (GDPR) in Europe. This not only protects users but also enhances the overall credibility of wallet services.

Another significant regulatory change involves financial reporting obligations. Wallet providers must now adhere to new standards that require them to maintain detailed records of transactions and report them to regulatory bodies. This shift aims to increase transparency and accountability in the industry, ensuring that all financial activities are above board. While this may seem like an added burden, it can also serve as a competitive advantage, as users are likely to gravitate towards providers that prioritize transparency.

In summary, the recent regulatory changes are reshaping the landscape for wallet providers. These measures, while challenging, are ultimately aimed at creating a safer and more trustworthy environment for users. As wallet providers adapt to these changes, they will need to find innovative ways to meet compliance requirements while still delivering exceptional service to their customers. The road ahead may be rocky, but it also promises exciting opportunities for growth and improvement.

Compliance Requirements

In today's rapidly evolving financial landscape, compliance with new regulations is not just a box to check; it's a fundamental necessity for wallet providers. These regulations have been designed to protect consumers, enhance security, and ensure that the digital economy functions smoothly. However, the implications of these compliance requirements extend far beyond mere adherence to rules—they reshape the entire operational framework for wallet providers.

One of the primary aspects of compliance involves stringent Know Your Customer (KYC) protocols. Wallet providers must now implement robust identity verification processes to prevent fraud and ensure that they are dealing with legitimate users. This often includes collecting sensitive information such as government-issued IDs, proof of address, and even biometric data in some cases. While these measures are essential for maintaining security, they also introduce complexities in terms of user experience. Imagine trying to sign up for a service only to be met with a mountain of paperwork—it's a hurdle that can deter potential users.

Moreover, compliance with anti-money laundering (AML) regulations is another critical requirement. Wallet providers are now expected to monitor transactions for suspicious activities and report any anomalies to the relevant authorities. This not only demands sophisticated technological solutions but also a significant investment in human resources to analyze data and ensure compliance. The challenge here is balancing compliance with the need for a seamless user experience. After all, how many users are willing to endure lengthy transaction verifications just to comply with regulations?

To illustrate the breadth of these compliance requirements, we can look at a few key areas that wallet providers must focus on:

- Data Protection: Compliance with regulations like the General Data Protection Regulation (GDPR) means that wallet providers must handle user data with the utmost care, ensuring it is stored securely and used ethically.

- Transaction Monitoring: Continuous monitoring of transactions is essential to detect and prevent fraudulent activities, requiring advanced algorithms and machine learning techniques.

- Reporting Standards: Regular reporting to regulatory bodies about user activities and any suspicious transactions is now mandatory, which can be resource-intensive.

In summary, while compliance requirements are undoubtedly challenging for wallet providers, they also serve as a catalyst for innovation. By investing in advanced technology and refining their operational processes, these providers can not only meet regulatory standards but also enhance their overall service offerings. The road to compliance may be fraught with obstacles, but it also presents an opportunity to build a more secure and trustworthy digital financial ecosystem.

Impact on User Privacy

The recent wave of regulatory changes has significantly impacted user privacy, and it's essential to understand how wallet providers are navigating this complex landscape. With the introduction of stringent compliance measures, wallet providers are now required to implement enhanced data protection protocols. This means that the way they handle user information is under closer scrutiny than ever before. Imagine your favorite coffee shop suddenly having to follow a new set of rules that dictate how they store your order history and payment information. It’s a shift that can feel invasive, but it's designed to protect you.

One of the most critical aspects of these regulations is the emphasis on data minimization. Wallet providers are now encouraged to collect only the information necessary for transactions, reducing the risk of exposing sensitive data. For instance, if you’re using a digital wallet to pay for coffee, the provider should only need your payment method and not your entire purchase history. This shift not only enhances user privacy but also builds trust. When customers know that their data is being handled with care, they are more likely to engage with the service.

However, this increased focus on compliance does come with its challenges. Wallet providers must invest in robust technology and training to ensure that they are meeting these new standards. This can lead to increased operational costs, which might be passed on to the consumer. So, how do wallet providers strike a balance between compliance costs and maintaining competitive pricing? It’s a delicate dance that requires innovation and strategic planning.

Moreover, the regulations often dictate how long user data can be retained. This can lead to a scenario where wallet providers must regularly purge data, potentially losing valuable insights into consumer behavior. On the flip side, this also means that users can feel more secure knowing their information isn't stored indefinitely. It’s like cleaning out your closet; while it may feel wasteful to get rid of items you rarely use, it ultimately creates a more organized and secure space.

In addition to these operational changes, wallet providers are also tasked with enhancing transparency in their data practices. Users now have the right to know what data is collected, how it is used, and with whom it is shared. This transparency is crucial in fostering a sense of security among users. They want to feel that they are not just another data point in a vast system; they want to know that their personal information is treated with respect and care.

To summarize, the impact of new regulations on user privacy is profound. While it presents challenges for wallet providers, it also opens up avenues for building stronger relationships with users. By prioritizing data minimization, enhancing transparency, and investing in security measures, wallet providers can not only comply with regulations but also cultivate a loyal customer base. In this evolving landscape, the focus on user privacy could very well be the key differentiator for wallet providers looking to thrive.

- What are the main privacy regulations affecting wallet providers?

The most significant regulations include GDPR in Europe and various state-level laws in the U.S., which dictate how user data must be handled and protected. - How can I ensure my data is safe when using a wallet provider?

Always choose wallet providers that are transparent about their data practices and have robust security measures in place. - Will new regulations increase costs for consumers?

While compliance may lead to increased operational costs for providers, many are finding innovative ways to absorb these costs without passing them on to consumers.

Financial Reporting Obligations

The landscape of financial reporting for wallet providers has undergone a significant transformation with the introduction of new regulations. These changes are not just bureaucratic hurdles; they represent a paradigm shift that impacts how these businesses operate on a fundamental level. Wallet providers must now navigate a complex web of compliance requirements that demand transparency and accuracy in their financial reporting.

At the heart of these new obligations is the need for enhanced accountability. Regulators are pushing for wallet providers to provide detailed insights into their financial activities, ensuring that they are not only compliant with existing laws but also capable of demonstrating their financial health to stakeholders. This means that wallet providers must invest in robust accounting systems and practices that can handle the intricacies of these new regulations.

One of the most significant implications of these reporting obligations is the increase in operational costs. Wallet providers will need to allocate resources towards hiring skilled professionals, such as accountants and compliance officers, who can ensure that the company meets all regulatory requirements. This shift may strain smaller wallet providers more than their larger counterparts, as they often operate with limited resources.

Moreover, the reporting standards have become more stringent, requiring wallet providers to maintain detailed records of transactions, customer interactions, and compliance measures. This increased documentation can lead to a more cumbersome operational process. However, it also presents an opportunity for wallet providers to improve their internal processes, potentially leading to greater efficiency and better service delivery in the long run.

To illustrate the changes in financial reporting obligations, consider the following table that outlines key aspects of the new requirements:

| Requirement | Description | Impact on Wallet Providers |

|---|---|---|

| Transaction Reporting | Detailed reporting of all transactions processed through the wallet | Increased transparency and accountability |

| Audit Trails | Maintaining records that track all financial activities | Higher operational costs and need for robust systems |

| Compliance Audits | Regular audits to ensure adherence to regulatory standards | Potential for increased scrutiny and operational adjustments |

In conclusion, while the new financial reporting obligations pose challenges for wallet providers, they also pave the way for improved practices and greater trust among consumers and regulators alike. As these businesses adapt to the evolving landscape, they will not only comply with regulations but may also emerge stronger and more resilient in the competitive market.

- What are the new financial reporting obligations for wallet providers?

The new obligations require wallet providers to maintain detailed records of transactions, implement audit trails, and undergo regular compliance audits to ensure transparency and accountability.

- How do these obligations impact smaller wallet providers?

Smaller wallet providers may face greater challenges due to limited resources, as they will need to invest in compliance measures and potentially higher operational costs.

- Can compliance lead to better services for users?

Yes, as wallet providers enhance their internal processes to meet compliance standards, they may also improve their overall service delivery and customer experience.

Challenges Faced by Wallet Providers

The landscape for wallet providers is rapidly evolving, and with this evolution comes a host of challenges that businesses must navigate. One of the most pressing issues is the need for compliance with new regulations, which can often feel like trying to hit a moving target. As regulations are introduced and modified, wallet providers must continuously adapt their operations, which can strain resources and disrupt existing workflows. This constant adaptation may lead to increased operational costs, as companies invest in technology and training to ensure they meet the latest standards.

Another significant challenge is the heightened scrutiny from regulators. Wallet providers are now under a microscope, and any misstep can result in severe penalties. This increased oversight can create a culture of fear and hesitation, where companies might be reluctant to innovate or expand their services for fear of running afoul of regulations. The pressure to maintain compliance can stifle creativity, making it difficult for wallet providers to differentiate themselves in a crowded market.

Additionally, wallet providers face the challenge of maintaining user trust in an environment where privacy concerns are at an all-time high. With regulations demanding stricter data handling practices, users are becoming more aware of how their information is used. If wallet providers fail to reassure their customers about the safety and security of their data, they risk losing users to competitors who can offer a more transparent and trustworthy service. This is particularly important in a digital age where users are increasingly concerned about data breaches and fraud.

Moreover, the need for technical upgrades cannot be overlooked. Many wallet providers may find their existing systems outdated in light of new regulatory requirements. Implementing new technologies to comply with regulations can be a daunting task, often requiring significant investment and time. This technical overhaul can disrupt existing operations and may lead to temporary service outages, which can further erode user trust.

In summary, the challenges faced by wallet providers are multifaceted and require a strategic approach to overcome. From compliance and regulatory scrutiny to maintaining user trust and upgrading technology, the road ahead is fraught with obstacles. However, those who can navigate these challenges effectively may find themselves well-positioned for future success in a rapidly changing digital financial landscape.

- What are the main challenges wallet providers face with new regulations?

Wallet providers must deal with compliance costs, regulatory scrutiny, user trust issues, and the need for technical upgrades. - How can wallet providers maintain user trust?

By being transparent about data handling practices and implementing robust security measures, wallet providers can reassure users about their privacy. - What impact do new regulations have on wallet provider innovation?

While regulations can stifle creativity, they can also drive innovation as companies seek to develop compliant yet user-friendly services.

Opportunities for Innovation

In the face of stringent regulations, wallet providers are finding themselves at a crossroads where challenges meet opportunities. While it may seem daunting to adapt to new compliance measures, these regulations can actually serve as a springboard for innovation. Just like a caterpillar transforms into a butterfly, wallet providers can evolve and flourish in a regulated landscape. By embracing these changes, they can not only ensure compliance but also enhance their offerings and improve customer satisfaction.

One of the most significant opportunities lies in the realm of enhanced security features. As regulations tighten around data protection and user privacy, wallet providers are compelled to innovate their security protocols. This is not merely a burden; it’s a chance to implement cutting-edge technologies such as biometric authentication, advanced encryption methods, and real-time fraud detection systems. Imagine a digital wallet that not only safeguards your funds but also anticipates and neutralizes threats before they escalate. By investing in robust security measures, wallet providers can build trust with their users, reassuring them that their financial data is in safe hands.

Moreover, regulatory clarity can act as a catalyst for expansion into new markets. When regulations are clear and well-defined, wallet providers can confidently venture into regions that were previously considered too risky or complicated. This expansion can lead to a more diverse customer base, allowing wallet providers to tap into emerging markets and meet the needs of a broader audience. For instance, a wallet provider that adheres to local regulations in a new country can offer tailored services that resonate with local users, ultimately driving growth and profitability.

Additionally, the push for innovation can lead to the development of new services that enhance customer experiences. As wallet providers adapt to regulatory requirements, they can explore new functionalities such as loyalty programs, instant payment solutions, and even integration with other financial services. By offering a seamless user experience, wallet providers can differentiate themselves from competitors and attract more users. Picture a wallet that not only allows you to make payments but also rewards you for every transaction, creating a win-win scenario for both the provider and the consumer.

In conclusion, while the regulatory landscape may appear challenging, it is also ripe with opportunities for wallet providers to innovate and grow. By focusing on enhanced security, expanding into new markets, and developing new services, these providers can turn compliance into a competitive advantage. The key is to embrace the change, adapt swiftly, and keep the user experience at the forefront of their strategies.

- What are the main opportunities for wallet providers in a regulated environment?

Wallet providers can enhance security features, expand into new markets, and develop innovative services that improve customer experience. - How can regulations drive innovation?

Regulations can prompt wallet providers to adopt new technologies and practices that not only ensure compliance but also enhance their offerings. - What role does user trust play in the wallet industry?

User trust is crucial; by implementing robust security measures, wallet providers can reassure customers and build long-term loyalty.

Enhanced Security Features

In the ever-evolving landscape of digital transactions, security has become a paramount concern for wallet providers. With the introduction of new regulations, these companies are not just responding to compliance demands; they are seizing the opportunity to enhance their security features. Think of it as a digital fortress being built around users' sensitive information. Just as a castle needs strong walls and vigilant guards, wallet providers are now investing heavily in advanced security measures to protect their users.

One of the most significant changes is the implementation of multi-factor authentication (MFA). This means that instead of relying solely on a password, users must verify their identity through multiple steps. Imagine trying to enter a secret club; you wouldn't just show a membership card, right? You'd likely need to provide a password, answer a security question, and maybe even show a fingerprint. This layered approach significantly reduces the risk of unauthorized access and gives users peace of mind.

Moreover, many wallet providers are adopting biometric security features. Fingerprint scanning and facial recognition are not just for high-end smartphones anymore; they are becoming standard in wallet applications. This technology not only enhances security but also streamlines the user experience. Users can quickly access their wallets without the hassle of remembering complex passwords. It’s like having a personal bodyguard who knows you by sight!

Additionally, the incorporation of end-to-end encryption has become a non-negotiable requirement. This means that any data shared between the user and the wallet provider is scrambled, making it nearly impossible for hackers to decipher. Think of it as sending a letter written in a secret code; only the intended recipient can read it. This level of security is crucial in building trust with users, especially in a world where data breaches are becoming alarmingly common.

Wallet providers are also increasingly focusing on real-time transaction monitoring. This feature allows them to detect suspicious activities as they happen, enabling swift action to prevent potential fraud. It's akin to having a security camera monitoring your home 24/7. If something unusual occurs, immediate alerts can be sent to the user, prompting them to take action. This proactive approach not only enhances security but also fosters a sense of safety among users.

In conclusion, the new regulations are not merely constraints; they are catalysts for wallet providers to innovate and enhance their security features. By adopting advanced technologies such as multi-factor authentication, biometric security, end-to-end encryption, and real-time monitoring, these providers are not just complying with the law; they are setting new standards in user safety. As the digital landscape continues to evolve, one thing is clear: security will remain a top priority, ensuring that users can engage in digital transactions with confidence.

- What is multi-factor authentication?

Multi-factor authentication (MFA) is a security measure that requires users to verify their identity through multiple methods, such as a password and a fingerprint. - How does end-to-end encryption work?

End-to-end encryption scrambles data so that only the sender and the intended recipient can read it, protecting it from unauthorized access. - Why is real-time transaction monitoring important?

Real-time transaction monitoring helps detect suspicious activities immediately, allowing for quick action to prevent fraud. - Are biometric features safe?

Yes, biometric features like fingerprint and facial recognition provide a high level of security, making unauthorized access extremely difficult.

Expansion into New Markets

In the ever-evolving world of digital finance, regulatory clarity can act as a beacon of opportunity for wallet providers. As these businesses navigate the intricate web of new regulations, they often discover that compliance not only helps them avoid penalties but also opens the door to new markets that were once considered off-limits. Imagine standing at the edge of a vast ocean, where the waves of opportunity are just waiting for you to dive in. That's what regulatory compliance can feel like for wallet providers looking to expand their reach.

By adhering to the new regulations, wallet providers can establish a level of trust and credibility that is essential when entering new geographical regions. Many consumers are understandably cautious about adopting digital wallets, especially in regions where financial regulations are still developing. When wallet providers can demonstrate compliance with local laws, they signal to potential users that their services are safe and reliable. This trust can be the difference between a hesitant user and a loyal customer.

Furthermore, compliance with regulations can also facilitate partnerships with local financial institutions. These partnerships are crucial for wallet providers looking to expand their services. For example, a wallet provider that complies with regulations in a new market can collaborate with local banks to offer seamless integration of banking services. This not only enhances user experience but also solidifies the wallet provider's position in the market.

To illustrate the potential benefits, consider the following table that outlines key regions where regulatory compliance has led to successful market entry for wallet providers:

| Region | Regulatory Change | Resulting Opportunity |

|---|---|---|

| Europe | GDPR Implementation | Increased user trust, leading to higher adoption rates |

| Asia | Digital Payment Regulations | Partnerships with local banks for better service integration |

| North America | AML and KYC Regulations | Expansion into underserved markets with a secure offering |

Moreover, wallet providers can leverage the insights gained from navigating these regulations to innovate their offerings. For instance, by understanding the specific needs and preferences of users in new markets, they can tailor their services to better meet those demands. This could mean introducing local payment methods, supporting multiple currencies, or even customizing user interfaces to align with cultural preferences.

In conclusion, while the regulatory landscape may seem daunting at first, it is essential for wallet providers to view it as a springboard for growth. By embracing compliance, they not only mitigate risks but also unlock a plethora of opportunities for expansion into new markets. This proactive approach can lead to a more resilient business model, ultimately benefiting both the providers and their users.

- What are wallet providers? Wallet providers are companies that offer digital wallets, enabling users to store, send, and receive digital currencies and traditional money securely.

- How do regulations affect wallet providers? Regulations can impose compliance requirements that wallet providers must follow, impacting their operations but also creating opportunities for market expansion.

- What are some benefits of compliance for wallet providers? Compliance can enhance user trust, facilitate partnerships with local banks, and open doors to new markets.

- Can wallet providers innovate under new regulations? Yes! Regulations can drive wallet providers to innovate their services, enhancing security features and tailoring offerings to meet local needs.

Frequently Asked Questions

- What are wallet providers?

Wallet providers are digital platforms that facilitate online transactions by allowing users to store, send, and receive digital currencies or traditional currencies. They play a vital role in the modern financial ecosystem, enabling seamless transactions across various platforms.

- What recent regulations have affected wallet providers?

Recent regulations have introduced new compliance requirements related to user privacy, financial reporting, and security measures. These changes aim to enhance consumer protection and ensure transparency within the digital transaction space.

- How do new regulations impact user privacy?

New regulations impose stricter data handling practices on wallet providers, which can heighten user privacy concerns. While these measures aim to protect consumer data, they also require wallet providers to implement robust security protocols to maintain trust and safeguard sensitive information.

- What are the compliance requirements for wallet providers?

Compliance requirements vary by jurisdiction but generally include maintaining accurate financial records, implementing strong anti-money laundering practices, and ensuring data protection measures are in place. These requirements often necessitate significant operational adjustments for wallet providers.

- What challenges do wallet providers face with new regulations?

Wallet providers face numerous challenges, including the need for substantial investment in technology upgrades, staff training, and ongoing compliance monitoring. These hurdles can strain resources and impact operational efficiency.

- How can wallet providers innovate despite regulatory challenges?

Regulations can serve as a catalyst for innovation. Wallet providers can leverage compliance as an opportunity to enhance security features, develop new services, and improve customer experiences, ultimately driving growth in a regulated environment.

- What opportunities do regulations create for wallet providers?

Regulatory clarity can open new markets for wallet providers. By adhering to regulations, these businesses can expand their services into regions that were previously inaccessible, leading to increased growth and diversification.

- How do regulations influence security features in wallet services?

Regulations often drive wallet providers to innovate their security features. By meeting regulatory standards, they not only comply with the law but also address consumer concerns about fraud and data breaches, fostering a safer transaction environment.