Synthetix - Trading Synthetic Assets in DeFi

The world of finance is evolving at a breakneck speed, and if you haven't heard of Synthetix, you're missing out on one of the most revolutionary platforms in the decentralized finance (DeFi) space. Imagine being able to trade assets that mirror the value of real-world commodities, currencies, or even stocks, without ever having to own them. That's the magic of synthetic assets! In this article, we will explore the innovative platform Synthetix, its features, benefits, and what the future holds for synthetic asset trading.

Synthetix is not just another trading platform; it’s a whole new way of thinking about assets. By creating synthetic assets, or "Synths," users can gain exposure to a plethora of markets without the traditional barriers that come with asset ownership. Think of it like having a virtual ticket to a concert—you get to enjoy the experience without owning the stage! This accessibility is a game changer, especially in a world where financial inclusivity is paramount.

But why should you care about synthetic assets? For starters, they provide an incredible level of market accessibility. Whether you’re interested in trading oil, gold, or even foreign currencies, Synthetix allows you to do so with ease. Plus, the platform is designed to enhance liquidity, making it easier for traders to enter and exit positions without the fear of slippage. In other words, you can trade with the confidence that you’ll get the price you see!

As we dive deeper into the Synthetix protocol, you'll discover how its architecture sets it apart from other DeFi platforms. With its unique combination of oracles, liquidity pools, and staking mechanisms, Synthetix creates a robust ecosystem that not only supports synthetic asset trading but also fosters community engagement and governance.

In summary, Synthetix is paving the way for a new era in trading, allowing users to harness the power of synthetic assets in a decentralized environment. So, buckle up as we explore the nuts and bolts of this innovative platform and what it means for the future of finance!

- What are synthetic assets? Synthetic assets are digital representations of real-world assets that allow users to gain exposure without owning the actual asset.

- How does Synthetix work? Synthetix operates on a decentralized protocol that facilitates the creation and trading of synthetic assets through various core components.

- What are SNX tokens? SNX tokens are the native cryptocurrency of the Synthetix protocol and are used as collateral for minting Synths.

- Can I earn rewards on Synthetix? Yes, SNX holders can earn rewards by staking their tokens and participating in the governance of the platform.

Understanding Synthetic Assets

Synthetic assets are a fascinating innovation in the realm of decentralized finance (DeFi). They are digital representations of real-world assets that allow users to gain exposure to various markets without actually owning the underlying asset. Imagine being able to trade gold, stocks, or currencies at the click of a button, all while sitting in your pajamas! This is the magic of synthetic assets. They bridge the gap between traditional finance and the burgeoning world of cryptocurrency, enabling a more inclusive trading experience for everyone.

The significance of synthetic assets in the DeFi ecosystem cannot be overstated. They provide a unique opportunity for traders to diversify their portfolios, hedge against market volatility, and access a plethora of assets that might otherwise be out of reach. For instance, if you're an investor in a country with limited access to foreign stocks, synthetic assets can offer you a way to invest in those markets without the hassle of regulatory barriers. This democratization of trading opportunities is one of the core principles driving the growth of DeFi.

So, how do synthetic assets function? At their core, they are created through a process called "minting," where users lock up collateral—typically in the form of cryptocurrencies—against the value of the synthetic asset they wish to create. This collateralization ensures that the synthetic asset maintains its value relative to the underlying asset. For example, if you want to create a synthetic version of Bitcoin, you would lock up a certain amount of another cryptocurrency as collateral. The system then issues you a synthetic Bitcoin, which you can trade freely on the Synthetix platform.

To give you a clearer picture, let's break down the process into a few key points:

- Collateralization: Users lock up cryptocurrencies as collateral.

- Minting: Synthetic assets are created based on the collateral value.

- Trading: Users can trade these synthetic assets on various platforms.

The beauty of synthetic assets lies in their ability to mimic the price movements of real-world assets while providing additional benefits inherent to the blockchain. For example, synthetic assets can be traded 24/7 without the constraints of traditional market hours. This flexibility allows traders to react to market changes instantly, making it easier to capitalize on opportunities as they arise. Moreover, because they are built on blockchain technology, transactions are transparent and secure, further enhancing user trust in the system.

In conclusion, synthetic assets are not just a passing trend; they represent a fundamental shift in how we think about trading and investing. By providing access to a wide array of markets and reducing barriers to entry, they empower individuals to take control of their financial futures. As the DeFi landscape continues to evolve, synthetic assets will undoubtedly play a crucial role in shaping the future of finance. So, are you ready to dive into the world of synthetic assets and explore the endless possibilities they offer?

The Synthetix Protocol

The Synthetix Protocol stands as a groundbreaking framework within the decentralized finance (DeFi) landscape, enabling users to create and trade synthetic assets seamlessly. Unlike traditional finance, where intermediaries often dictate terms and access, Synthetix empowers individuals to engage directly with the market. This protocol is built on the Ethereum blockchain, ensuring transparency, security, and decentralization, which are essential in today's digital economy.

At its core, the Synthetix Protocol operates on a unique model that allows users to mint synthetic assets, known as Synths, by locking up collateral in the form of the Synthetix Network Token (SNX). This innovative approach not only facilitates the creation of diverse financial instruments but also ensures that the value of these Synths is pegged to real-world assets. Imagine trading gold, stocks, or even fiat currencies without ever having to own them physically—this is the essence of synthetic asset trading.

One of the standout features of the Synthetix Protocol is its reliance on oracles. These oracles provide real-time price feeds for the underlying assets, ensuring that the value of Synths accurately reflects market conditions. Without oracles, the integrity of the synthetic asset market could be compromised, leading to discrepancies that could harm traders. In this way, oracles act as the lifeblood of the Synthetix ecosystem, bridging the gap between the on-chain and off-chain worlds.

Moreover, the architecture of the Synthetix Protocol is designed to be modular. This means that as the DeFi landscape evolves, Synthetix can adapt and integrate new functionalities without compromising its core principles. The protocol’s ability to innovate while maintaining a robust structure is a testament to its forward-thinking design. For traders, this translates into a dynamic platform that not only meets their current needs but also anticipates future demands.

In summary, the Synthetix Protocol is more than just a platform for trading synthetic assets; it's a comprehensive ecosystem that fosters innovation, accessibility, and community involvement. By utilizing SNX as collateral, leveraging oracles for price accuracy, and maintaining a modular architecture, Synthetix is paving the way for a new era of financial trading. As we delve deeper into its core components, the true power of this protocol will become even more apparent.

- What are synthetic assets? Synthetic assets are digital representations of real-world assets, allowing users to gain exposure without owning the underlying asset.

- How does the Synthetix Protocol work? The Synthetix Protocol allows users to mint synthetic assets by locking up collateral in SNX tokens, which are then used to create various Synths.

- What role do oracles play in Synthetix? Oracles provide real-time price feeds for the underlying assets, ensuring that the value of Synths accurately reflects market conditions.

- Can I trade multiple types of assets on Synthetix? Yes! Synthetix enables trading across a wide range of markets, including commodities, currencies, and stocks.

Core Components of Synthetix

The Synthetix protocol is a sophisticated ecosystem built on several core components that work harmoniously to facilitate the creation and trading of synthetic assets. Understanding these components is crucial for grasping how Synthetix operates and why it stands out in the crowded DeFi space. At the heart of this protocol are Synths, the Synthetix Network Token (SNX), and oracles. Each plays a pivotal role in ensuring the functionality and reliability of the platform.

First, let's dive into Synths. These are the synthetic assets that users can create and trade on the Synthetix platform. Think of Synths as digital clones of real-world assets—whether it's a commodity like gold, a currency like the Euro, or even stocks from major companies. This ability to mimic real assets allows traders to gain exposure without the hassle of ownership. There are various types of Synths available, each designed to cater to different trading strategies and market conditions.

Next up is the Synthetix Network Token (SNX). This token serves as the backbone of the Synthetix ecosystem. SNX holders are required to lock up their tokens as collateral to mint Synths. This process not only ensures that the system remains solvent but also incentivizes SNX holders to participate actively in the platform. By staking SNX, users can earn rewards in the form of additional SNX tokens, making it a win-win situation. Moreover, SNX holders have a voice in governance, allowing them to influence the future direction of the protocol.

Finally, we have oracles. These are essential for providing real-time price feeds that underpin the trading of Synths. Oracles act as bridges between the Synthetix protocol and external data sources, ensuring that the prices of synthetic assets reflect the current market conditions. Without oracles, traders would be left in the dark, unable to make informed decisions. The reliability and accuracy of these price feeds are crucial for maintaining the integrity of the entire trading system.

In summary, the core components of Synthetix—Synths, SNX tokens, and oracles—are intricately linked, creating a robust framework for synthetic asset trading. Understanding how these elements interact not only enhances your trading experience but also empowers you to navigate the exciting world of DeFi with confidence.

- What are synthetic assets? Synthetic assets are digital representations of real-world assets, allowing users to trade without owning the underlying asset.

- How does Synthetix ensure the value of Synths? Synthetix uses oracles to provide real-time price feeds, ensuring that Synths reflect current market conditions.

- What is the role of SNX tokens in Synthetix? SNX tokens are used as collateral for minting Synths and allow holders to earn rewards while participating in governance.

- Can I trade multiple types of assets on Synthetix? Yes, Synthetix offers a variety of Synths, enabling users to trade commodities, currencies, and stocks all in one platform.

Synths Explained

Synths are the lifeblood of the Synthetix platform, representing a groundbreaking innovation in the realm of digital finance. Essentially, a Synth is a synthetic asset that mirrors the value of real-world assets, allowing users to trade them without actually owning the underlying asset. This opens up a world of opportunities, enabling traders to gain exposure to various markets, including commodities, currencies, and even cryptocurrencies, all from a single platform. Imagine being able to invest in gold or the stock market without the hassle of traditional trading; that's the power of Synths!

The fascinating aspect of Synths is their versatility. They can be categorized into different types based on the assets they represent. Some common categories include:

- Commodity Synths: These represent physical goods like gold, silver, or oil.

- Fiat Synths: These mirror the value of traditional currencies such as USD, EUR, or JPY.

- Crypto Synths: These track the price of various cryptocurrencies, allowing users to trade Bitcoin or Ethereum without actually holding them.

- Index Synths: These are designed to reflect the value of a collection of assets, such as stock indices.

Each type of Synth offers unique trading options and characteristics, catering to different trading strategies and risk appetites. For instance, if you are bullish on gold prices but don’t want to deal with physical storage or the complexities of futures trading, you can simply trade a gold Synth. This not only simplifies the process but also enhances liquidity, making it easier to enter and exit positions.

One of the most exciting features of Synths is that they are created through a process called "minting." Users can mint new Synths by locking up the Synthetix Network Token (SNX) as collateral. This mechanism ensures that the value of Synths is backed by the SNX tokens, creating a robust and secure trading environment. Furthermore, the decentralized nature of the Synthetix protocol means that anyone can participate in the creation of Synths, democratizing access to markets that were once only available to a select few.

In summary, Synths are not just a passing trend; they represent a significant evolution in how we think about trading and investing in the digital age. With their ability to provide exposure to a wide array of assets, combined with the innovative minting process, Synths are paving the way for a more inclusive and accessible financial landscape. As the DeFi space continues to grow, the importance of Synths in facilitating seamless trading experiences cannot be overstated.

The Role of SNX Tokens

The SNX token, or Synthetix Network Token, plays a pivotal role within the Synthetix protocol. It serves as the backbone of the platform, providing the necessary collateral for the minting of synthetic assets, known as Synths. When users want to create a new Synth, they must lock up a certain amount of SNX tokens as collateral. This mechanism ensures that the synthetic assets are fully backed, providing a layer of security and trust within the ecosystem. Think of SNX tokens as the foundation of a house; without a solid base, everything built on top would be unstable.

Moreover, SNX holders are not just passive participants; they actively engage in the governance of the Synthetix protocol. By holding SNX, users can vote on crucial decisions regarding the platform's future, including changes to the protocol and the introduction of new Synths. This democratic approach empowers the community and aligns the interests of token holders with the overall success of the platform. It’s like being part of a club where your voice matters, and your contributions can shape the direction of the entire organization.

In addition to governance, SNX holders can earn rewards through staking. When users stake their SNX tokens, they help to provide liquidity to the Synthetix ecosystem. In return, they receive a portion of the transaction fees generated from trading activities on the platform. This creates a win-win scenario: traders benefit from a robust trading environment, while SNX holders enjoy passive income from their investments. The staking process can be likened to planting seeds in a garden; with proper care and attention, those seeds can grow into fruitful rewards over time.

To give you a clearer picture of how SNX tokens function within the Synthetix ecosystem, here’s a brief overview of their roles:

| Role | Description |

|---|---|

| Collateral | SNX tokens are locked up as collateral for minting Synths, ensuring they are fully backed. |

| Governance | SNX holders can vote on protocol changes and new Synths, influencing the platform’s evolution. |

| Staking Rewards | By staking SNX, users earn a share of transaction fees, generating passive income. |

In summary, SNX tokens are not just a means of trading; they are integral to the Synthetix ecosystem, providing security, governance, and rewards. As the platform continues to grow and evolve, the role of SNX tokens will likely expand, making them a crucial asset for anyone looking to engage in the world of synthetic assets.

- What are SNX tokens used for? SNX tokens are primarily used as collateral for minting Synths, participating in governance, and earning staking rewards.

- How can I earn rewards with SNX? By staking your SNX tokens, you can earn a portion of transaction fees generated from trading activities on the platform.

- Can I participate in governance without holding SNX? No, only SNX holders have the right to vote on protocol changes and other governance matters.

Key Features of Synthetix

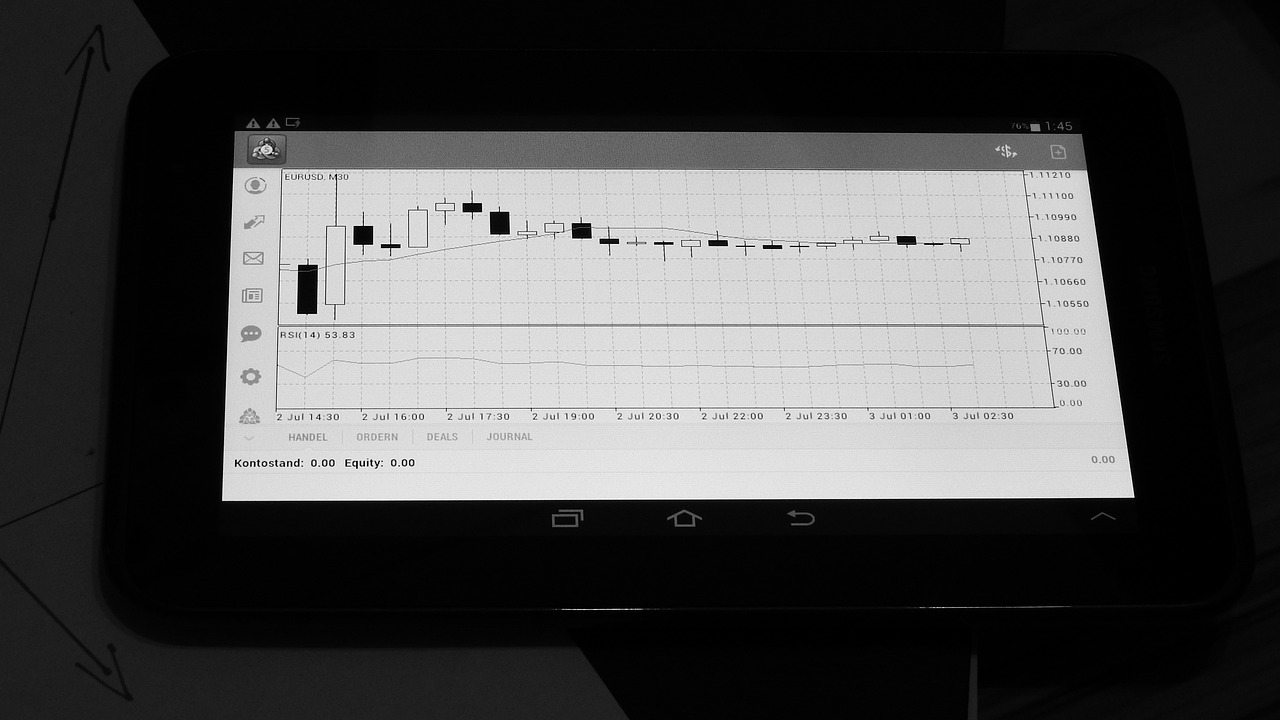

The Synthetix platform is not just another player in the DeFi space; it brings a unique set of features that make trading synthetic assets an exciting and rewarding experience. One of the standout aspects of Synthetix is its on-chain price feeds. These feeds provide real-time price data for various assets, ensuring that traders have the most accurate information at their fingertips. This is crucial in a market where every second counts, and even the slightest delay can mean the difference between profit and loss.

Another key feature is the liquidity pools. Unlike traditional exchanges, Synthetix allows users to contribute to liquidity pools, which in turn facilitates smoother trading experiences. These pools are designed to ensure that there is always enough liquidity for traders, enabling them to buy and sell synthetic assets without significant price slippage. This is particularly important in volatile markets, where rapid price changes can lead to unexpected losses.

Additionally, Synthetix incorporates a robust staking mechanism. Users can stake their SNX tokens to mint new Synths, which not only helps in creating a diverse array of synthetic assets but also allows SNX holders to earn rewards for their participation. This creates a win-win situation where users can actively contribute to the ecosystem while also enjoying financial benefits. The staking rewards are often tied to the overall performance of the Synthetix network, making it an attractive option for long-term holders.

Furthermore, Synthetix's decentralized governance model empowers users to have a say in the platform's future. SNX holders can participate in governance proposals, voting on changes and improvements to the protocol. This democratic approach fosters a sense of community and shared responsibility among users, which is a refreshing change from centralized platforms where decisions are made behind closed doors.

To summarize, the key features of Synthetix can be encapsulated in the following table:

| Feature | Description |

|---|---|

| On-Chain Price Feeds | Provides real-time price data for accurate trading. |

| Liquidity Pools | Ensures smooth trading experiences with minimal slippage. |

| Staking Mechanism | Allows users to mint Synths and earn rewards. |

| Decentralized Governance | Empowers users to vote on protocol changes. |

These features collectively create an environment where traders can navigate the complexities of synthetic asset trading with confidence. Whether you're a seasoned trader or just starting, Synthetix offers the tools and resources necessary to thrive in the dynamic world of DeFi.

- What are synthetic assets? Synthetic assets are digital representations of real-world assets that allow users to gain exposure without owning the underlying asset.

- How does Synthetix work? Synthetix allows users to create and trade synthetic assets through its decentralized protocol, utilizing SNX tokens as collateral.

- What are SNX tokens? SNX tokens are the native cryptocurrency of the Synthetix platform, used for staking and governance.

- Can I earn rewards on Synthetix? Yes, by staking SNX tokens, users can earn rewards and participate in the governance of the platform.

Benefits of Trading Synthetic Assets

Trading synthetic assets has become increasingly popular in the decentralized finance (DeFi) ecosystem, and for good reason. These innovative financial instruments offer a plethora of benefits that traditional asset trading simply can't match. Imagine being able to gain exposure to a wide range of markets without the hassle of owning the underlying assets. That's the beauty of synthetic assets! They allow you to tap into the potential of various asset classes, such as commodities, currencies, and stocks, all from the comfort of your digital wallet.

One of the most significant advantages of trading synthetic assets is market accessibility. Traditional trading often comes with barriers like high fees, geographical restrictions, and the need for a broker. Synthetic assets break down these barriers, enabling anyone with an internet connection to participate in global markets. This democratization of trading opportunities means that whether you're a seasoned trader or a complete novice, you can easily access a diverse range of assets.

In addition to enhanced accessibility, synthetic assets also provide increased liquidity. Liquidity is crucial in trading, as it allows for quicker transactions and less slippage. With synthetic assets, users can trade without the need for the actual underlying asset, which often leads to higher liquidity in the market. This means that you can enter and exit positions more efficiently, making your trading experience smoother and more profitable.

Another compelling benefit is the ability to hedge against real-world asset price movements. Traders can utilize synthetic assets to protect their investments from market volatility. For instance, if you hold a significant amount of a particular cryptocurrency and fear that its price may drop, you can trade a synthetic asset that inversely tracks its price. This strategy allows you to mitigate potential losses and manage your risk effectively. Additionally, synthetic assets can be used to create complex trading strategies, including arbitrage opportunities and spread trading.

Moreover, synthetic assets enable diversification of your trading portfolio. By trading a variety of Synths, you can spread your risk across multiple asset classes rather than putting all your eggs in one basket. This diversification can be particularly valuable during periods of market uncertainty when certain assets may be more volatile than others. For example, you could trade synthetic commodities alongside synthetic currencies, balancing your exposure and potentially increasing your overall returns.

To summarize, here are the key benefits of trading synthetic assets:

- Market Accessibility: Trade a wide range of assets without geographical restrictions.

- Increased Liquidity: Enjoy quicker transactions and less slippage.

- Hedging Opportunities: Protect your investments from market volatility.

- Diversification: Spread risk across multiple asset classes.

As we look to the future, the advantages of trading synthetic assets will likely continue to attract more users to platforms like Synthetix. With the rise of DeFi, the potential for innovative financial products and strategies is boundless. So, whether you're looking to diversify your portfolio, hedge against risks, or simply explore new trading opportunities, synthetic assets are a fantastic avenue to consider.

Q1: What are synthetic assets?

Synthetic assets are digital representations of real-world assets that allow users to gain exposure to various markets without owning the underlying assets.

Q2: How do synthetic assets work?

Synthetic assets are created through a process called minting, where users provide collateral (usually in the form of SNX tokens) to generate Synths, which can then be traded on the Synthetix platform.

Q3: What are the risks associated with trading synthetic assets?

As with any trading, there are risks involved, including market volatility, liquidity risks, and smart contract vulnerabilities. It's essential to conduct thorough research and understand these risks before trading.

Q4: Can anyone trade synthetic assets?

Yes! One of the benefits of synthetic assets is their accessibility. Anyone with an internet connection can trade them on platforms like Synthetix.

Market Accessibility

One of the most exciting aspects of trading synthetic assets on the Synthetix platform is the incredible it provides. Imagine being able to dive into a vast ocean of trading opportunities without the constraints typically associated with traditional markets. With Synthetix, users can gain exposure to a diverse range of assets, including commodities, currencies, and even stocks, all from the comfort of their wallets. This is a game-changer for traders who have previously felt limited by geographical boundaries or the high entry costs of conventional investing.

Traditional trading often requires significant capital to enter various markets, not to mention the complexities involved in owning physical assets. However, synthetic assets eliminate these barriers, allowing anyone with an internet connection to trade. For instance, if you're interested in commodities like gold or oil, you no longer need to purchase physical barrels or bars. Instead, you can trade their synthetic counterparts directly on the Synthetix platform. This democratization of trading opportunities means that whether you're a seasoned investor or just starting, you can participate in markets that were once out of reach.

Furthermore, the flexibility of synthetic assets extends beyond just accessibility. Users can trade 24/7, unlike traditional markets that have set hours. This means that if you spot a trading opportunity at 2 AM, you can act on it immediately. The ability to trade at any time is not just a convenience; it’s a powerful tool that can lead to more informed and timely trading decisions.

To illustrate this point, consider the following table that highlights the differences between traditional asset trading and synthetic asset trading on Synthetix:

| Feature | Traditional Trading | Synthetix Trading |

|---|---|---|

| Market Hours | Limited to exchange hours | 24/7 trading |

| Entry Costs | High (e.g., buying physical assets) | Low (trade synthetic assets) |

| Geographical Restrictions | Often restricted by location | Accessible globally |

| Asset Diversity | Limited to available markets | Wide variety of assets |

The Synthetix platform not only allows for trading established assets but also enables users to create new synthetic assets based on their preferences. This opens up a world of opportunities where traders can speculate on virtually any asset they can think of, from emerging cryptocurrencies to niche commodities. The potential for innovation is enormous, and it’s this kind of flexibility that truly sets Synthetix apart.

In summary, the market accessibility provided by Synthetix is a key factor that enhances the trading experience. It breaks down barriers, allowing traders from all walks of life to engage in a wide array of markets. With the ability to trade synthetic assets anytime, anywhere, the platform is not just a tool for trading but a gateway to a more inclusive financial ecosystem.

Hedging and Risk Management

In the fast-paced world of trading, risk management is not just a strategy; it's a necessity. With the advent of synthetic assets on platforms like Synthetix, traders have found innovative ways to protect their investments. So, how exactly can one use synthetic assets for hedging? Let's dive into the fascinating world of risk management.

Hedging involves taking a position in a market that offsets potential losses in another investment. Think of it as an insurance policy for your trades. When you trade synthetic assets, you can effectively hedge against price fluctuations in real-world assets. For example, if you're holding a significant amount of a cryptocurrency, you might worry about price drops. By purchasing a synthetic asset that inversely correlates to that cryptocurrency, you can safeguard your portfolio against potential losses.

Here are some common strategies that traders utilize when hedging with synthetic assets:

- Shorting Synthetic Assets: If you anticipate a decline in the price of an asset, you can short a synthetic version of that asset. This means you can profit from the downturn, effectively balancing out any losses from your other investments.

- Diversifying with Different Synths: By holding a variety of synthetic assets that represent different markets—like commodities, stocks, and currencies—you can spread your risk. This diversification can buffer your portfolio against volatility in any single market.

- Using Options and Futures: Some traders combine synthetic assets with traditional options and futures to create complex hedging strategies. By doing this, they can tailor their risk exposure to their specific needs.

Moreover, Synthetix allows traders to leverage their positions, which can amplify both gains and losses. While this can be a double-edged sword, it also provides an opportunity for savvy traders to maximize their hedging strategies. For instance, if a trader believes that a market will experience short-term volatility, they can use synthetic assets to hedge their bets while still maintaining exposure to potential gains.

However, it's important to remember that while hedging can reduce risk, it doesn't eliminate it. Traders must be aware of the potential costs associated with maintaining synthetic positions, such as fees and slippage. Therefore, understanding the nuances of the Synthetix platform and the synthetic assets available is crucial for effective risk management.

In summary, hedging with synthetic assets on Synthetix can be a game-changer for traders looking to protect their investments. By employing various strategies, such as shorting, diversifying, and utilizing options, traders can navigate the volatile waters of the DeFi space with greater confidence. So, are you ready to explore the world of synthetic assets and take control of your trading destiny?

Here are some common questions traders have about hedging and risk management in the context of synthetic assets:

- What are synthetic assets? Synthetic assets are digital representations of real-world assets, allowing traders to gain exposure without owning the underlying asset.

- How can I hedge my investments using Synthetix? You can hedge by taking positions in synthetic assets that counterbalance your existing investments, such as shorting or diversifying across different markets.

- Are there risks associated with hedging? Yes, while hedging can mitigate risk, it does not eliminate it. Costs associated with maintaining synthetic positions should also be considered.

- Can I trade synthetic assets on other platforms? While Synthetix is a leading platform for synthetic assets, other DeFi platforms may offer similar functionalities, but the specifics can vary.

Frequently Asked Questions

- What are synthetic assets?

Synthetic assets are digital representations of real-world assets, allowing users to gain exposure to various markets without actually owning the underlying asset. They can mimic the price movements of assets like stocks, currencies, or commodities, providing traders with more options in their trading strategies.

- How does the Synthetix protocol work?

The Synthetix protocol is a decentralized platform that enables the creation and trading of synthetic assets, known as Synths. Users can mint Synths by locking up Synthetix Network Tokens (SNX) as collateral, which helps maintain the value and stability of the synthetic assets within the ecosystem.

- What are the different types of Synths available?

Synthetix offers various types of Synths, including fiat currencies, commodities, and cryptocurrencies. Each type of Synth has unique characteristics, allowing traders to diversify their portfolios and access different markets seamlessly.

- How can I earn rewards with SNX tokens?

By holding SNX tokens, users can participate in the Synthetix ecosystem and earn rewards through staking. When SNX is staked, it serves as collateral for minting Synths, and in return, stakers receive a portion of the fees generated by the platform, along with additional incentives.

- What are the key features of Synthetix?

Synthetix boasts several key features, including on-chain price feeds that ensure accurate pricing for Synths, liquidity pools that facilitate trading, and staking mechanisms that allow users to earn rewards. These features enhance the trading experience and provide users with more opportunities to maximize their investments.

- How does trading synthetic assets enhance market accessibility?

Synthetic assets democratize trading by providing access to a broader range of markets, including those that may be difficult to reach through traditional means. This allows more users to participate in trading opportunities and diversify their investments across various asset classes.

- Can synthetic assets be used for hedging?

Absolutely! Traders can use synthetic assets to hedge against price fluctuations in real-world assets. By strategically utilizing Synths, they can protect their investments from market volatility and manage risk more effectively.

- Is Synthetix safe to use?

While Synthetix employs robust security measures, users should always exercise caution when trading in the DeFi space. It's essential to do thorough research, understand the risks involved, and only invest what you can afford to lose.