How to Implement Blockchain Solutions for Better Compliance

In today's fast-paced business environment, compliance is more than just a checkbox; it's a crucial aspect that can make or break an organization. As businesses grapple with complex regulations and the ever-increasing demand for transparency, blockchain technology emerges as a game-changer. But how can organizations effectively implement blockchain solutions to enhance their compliance practices? This article dives deep into the integration of blockchain technology within compliance frameworks, illuminating its myriad benefits, the challenges that may arise, and the best practices that can guide organizations toward a successful implementation.

Before diving into the compliance applications of blockchain, it's essential to grasp what blockchain is all about. At its core, blockchain is a decentralized digital ledger that records transactions across multiple computers. This means that once a transaction is recorded, it cannot be altered retroactively without altering all subsequent blocks, which adds an unprecedented layer of security. Unlike traditional databases, where a single entity can control and modify the data, blockchain's distributed nature ensures that all participants in the network have access to the same information, fostering an environment of trust and transparency.

Now that we've laid the groundwork, let's explore the benefits that blockchain brings to compliance. One of the most significant advantages is enhanced transparency. With blockchain, every transaction is recorded in real-time and is visible to all authorized parties. This level of transparency not only helps in tracking the flow of goods and services but also in ensuring that compliance requirements are met without the need for extensive audits. Additionally, blockchain improves traceability, enabling organizations to trace the origin of products and verify their compliance with regulations. As a result, the risk of fraud is significantly reduced, streamlining regulatory processes and enhancing accountability.

However, it’s not all smooth sailing. Implementing blockchain solutions comes with its own set of challenges. Organizations may face scalability issues, particularly if the blockchain network grows significantly. This can lead to slower transaction speeds, which is counterproductive in a compliance context where speed is often of the essence. Furthermore, regulatory uncertainty looms large. As governments and regulatory bodies grapple with the implications of blockchain, organizations must navigate a complicated landscape of regulations that may not yet be fully defined. Lastly, industry-wide collaboration is crucial; without it, the full potential of blockchain cannot be realized.

Speaking of regulations, understanding the current regulatory landscape is vital for organizations looking to implement blockchain solutions. Different countries and regions have varying regulations regarding blockchain technology. For instance, the European Union has proposed regulations aimed at creating a comprehensive framework for digital assets, while the U.S. is still in the process of defining its approach. Organizations must stay informed about these regulations to ensure compliance and avoid potential penalties. Key regulations to consider include:

- GDPR (General Data Protection Regulation)

- AML (Anti-Money Laundering) regulations

- KYC (Know Your Customer) guidelines

So, how can organizations successfully integrate blockchain solutions within their compliance frameworks? Start with thorough planning. Identify the specific compliance challenges you face and align your blockchain strategy accordingly. Engaging stakeholders early in the process is also crucial. This ensures that everyone is on board and understands the benefits of blockchain technology. Lastly, adopt an iterative development process. This allows for flexibility and adjustments as you learn more about how blockchain can serve your compliance needs.

Real-world examples can provide invaluable insights into the successful implementation of blockchain for compliance. For instance, a major financial institution recently adopted blockchain to streamline its KYC processes. By creating a shared, immutable ledger of customer data, the bank reduced its compliance costs by over 30% while improving the speed of customer onboarding. Lessons learned from such case studies can guide other organizations in their blockchain journey, emphasizing the importance of adaptability and continuous learning.

As we look ahead, several trends are poised to shape the future of blockchain compliance solutions. One emerging trend is the integration of artificial intelligence (AI) with blockchain technology. By leveraging AI's analytical capabilities, organizations can automate compliance checks and enhance decision-making processes. Additionally, the rise of decentralized finance (DeFi) platforms is prompting regulators to adapt their approaches, leading to more robust compliance frameworks. Keeping an eye on these trends can help organizations stay ahead of the curve.

In summary, implementing blockchain solutions for better compliance is not just a technological shift; it's a strategic move that can enhance transparency, reduce fraud, and streamline regulatory processes. To embark on this journey, organizations should focus on strategic planning, stakeholder engagement, and continuous improvement. Remember, the road to successful blockchain implementation may be fraught with challenges, but with the right approach, the rewards can be significant.

Q: What is blockchain technology?

A: Blockchain is a decentralized digital ledger that records transactions across multiple computers, ensuring that the data is secure and transparent.

Q: How does blockchain enhance compliance?

A: Blockchain enhances compliance through improved transparency, traceability, and reduced fraud, making regulatory processes more efficient.

Q: What are the challenges of implementing blockchain for compliance?

A: Challenges include scalability issues, regulatory uncertainty, and the need for industry-wide collaboration.

Q: What are some best practices for implementing blockchain solutions?

A: Best practices include thorough planning, engaging stakeholders, and adopting an iterative development process.

Understanding Blockchain Technology

Blockchain technology is often described as a digital ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This technology is revolutionary because it ensures a high level of security and transparency. Imagine a giant book that everyone can see but no one can change without everyone else knowing. That's the essence of blockchain!

At its core, a blockchain is composed of a series of blocks that contain data. Each block is linked to the previous one, forming a chain. This structure is what makes blockchain so unique compared to traditional databases. While conventional databases can be altered by a single entity, a blockchain is decentralized, meaning that it is maintained by a network of computers, known as nodes. This decentralization is crucial for compliance applications, as it provides a level of trust that is often lacking in traditional systems.

The fundamental principles of blockchain technology include:

- Decentralization: No single entity has control over the entire blockchain, which reduces the risk of fraud.

- Transparency: All transactions are visible to all participants in the network, enhancing accountability.

- Immutability: Once a block is added to the chain, it cannot be changed, ensuring the integrity of the data.

To better illustrate how blockchain differs from traditional databases, consider this analogy: if a traditional database is like a library where only a librarian can edit the books, a blockchain is like a community library where every member can see the books, but no one can change them without everyone agreeing. This creates a sense of shared responsibility and trust among users.

In compliance applications, these principles translate into significant benefits. For instance, the immutability of blockchain records ensures that once a compliance-related transaction is logged, it cannot be tampered with, thus providing a reliable audit trail. This is particularly valuable in industries where regulatory compliance is crucial, such as finance and healthcare.

Moreover, the transparency offered by blockchain means that all stakeholders can access the same information, reducing the likelihood of misunderstandings or disputes. This level of visibility is essential for organizations striving to enhance their compliance practices, as it fosters a culture of accountability and trust.

In summary, understanding blockchain technology is fundamental for organizations looking to implement it for compliance purposes. Its unique structure and principles offer a promising alternative to traditional compliance methods, paving the way for enhanced transparency, security, and trustworthiness in regulatory practices.

Benefits of Blockchain in Compliance

When it comes to compliance, organizations often find themselves navigating a labyrinth of regulations and requirements that can be overwhelming. Enter blockchain technology, a game-changer that offers a plethora of benefits that can simplify and enhance compliance efforts. Imagine having a digital ledger that is not only secure and immutable but also transparent and easily accessible. That’s the essence of blockchain, and it’s revolutionizing the way organizations approach compliance.

One of the most significant advantages of blockchain is its ability to enhance transparency. With traditional compliance processes, information can be siloed, leading to discrepancies and a lack of trust among stakeholders. Blockchain, on the other hand, operates on a decentralized model where all parties involved have access to the same data in real-time. This transparency fosters trust and accountability, as everyone can verify transactions and changes without relying on a central authority. The result? A smoother regulatory process that minimizes the risk of non-compliance.

Another compelling benefit is improved traceability. In industries such as finance, pharmaceuticals, and supply chain management, keeping track of the origin and journey of products is crucial. Blockchain allows organizations to create a detailed audit trail of every transaction, making it easy to trace the history of an asset from its inception to its current state. This level of traceability not only helps in meeting regulatory requirements but also reduces the chances of fraud and misconduct. Imagine being able to pinpoint exactly where a product failed compliance checks, all thanks to a transparent and tamper-proof record.

Moreover, blockchain can significantly reduce the risk of fraud. Traditional compliance systems are often vulnerable to manipulation and errors, whether intentional or accidental. Blockchain’s inherent security features, such as cryptographic hashing and consensus mechanisms, ensure that data cannot be altered without detection. This makes it extremely difficult for malicious actors to commit fraud, thereby protecting both the organization and its stakeholders. In a world where trust is paramount, blockchain provides a robust solution that can safeguard sensitive information.

In addition to these benefits, blockchain also streamlines regulatory processes. By automating compliance checks through smart contracts—self-executing contracts with the terms of the agreement directly written into code—organizations can reduce the time and resources spent on manual compliance tasks. This not only increases efficiency but also allows compliance teams to focus on more strategic initiatives rather than getting bogged down in paperwork. The automation of compliance processes can lead to faster reporting, quicker audits, and ultimately a more agile organization.

To sum it up, the integration of blockchain technology into compliance practices can yield remarkable benefits, including:

- Enhanced Transparency: Real-time access to data fosters trust.

- Improved Traceability: Detailed audit trails make it easier to track assets.

- Reduced Fraud Risk: Tamper-proof records protect sensitive information.

- Streamlined Regulatory Processes: Automation saves time and resources.

As organizations begin to recognize these advantages, the question arises: Why wouldn't you consider blockchain as a viable solution for your compliance needs? With its ability to transform traditional processes into more efficient, transparent, and secure systems, blockchain is not just a trend; it's a necessity for organizations looking to stay ahead in a rapidly changing regulatory landscape.

Q: What industries can benefit from blockchain in compliance?

A: Almost any industry that deals with regulatory requirements can benefit, including finance, healthcare, supply chain, and more.

Q: How does blockchain ensure data security?

A: Blockchain uses cryptographic techniques to secure data, making it nearly impossible to alter records without detection.

Q: Can blockchain replace existing compliance systems?

A: While blockchain can significantly enhance compliance processes, it is often best used in conjunction with existing systems to maximize effectiveness.

Q: What are smart contracts?

A: Smart contracts are self-executing contracts with the terms of the agreement directly written into code, automating compliance tasks.

Challenges in Implementing Blockchain Solutions

Implementing blockchain solutions for compliance is not all sunshine and rainbows; there are significant challenges that organizations must navigate. First off, let's talk about scalability issues. While blockchain technology offers incredible benefits, it can struggle to handle high transaction volumes, especially in industries that require rapid processing. Imagine trying to fit a giant puzzle piece into a tiny slot; that’s what scalability feels like when you're dealing with traditional blockchain systems. Organizations need to ensure that their blockchain can scale effectively without compromising performance.

Next, we have regulatory uncertainty. The regulatory landscape surrounding blockchain is still evolving, which can create confusion and hesitation among organizations. Many companies are left scratching their heads, wondering how to comply with existing laws while also keeping up with new regulations that seem to pop up overnight. This uncertainty can lead to a risk-averse culture, where organizations are reluctant to fully embrace the technology for fear of running afoul of the law.

Another challenge is the need for industry-wide collaboration. Blockchain thrives on network effects, meaning that the more participants there are, the more valuable the system becomes. However, getting various stakeholders—ranging from regulators to industry players—to collaborate can be like herding cats. Each entity has its own interests, and aligning these can be a daunting task. Without a unified approach, the potential of blockchain in compliance can remain unrealized.

Moreover, the technical complexity of blockchain solutions can serve as a barrier to entry. Many organizations lack the necessary technical expertise to implement and maintain these systems effectively. It’s akin to trying to operate a complex machine without a manual; the risk of malfunction is high. This complexity can lead to reliance on third-party vendors, which introduces additional risks related to data security and operational control.

Finally, we cannot overlook the cultural resistance that often accompanies any significant technological shift. Employees accustomed to traditional compliance methods may be hesitant to adopt blockchain solutions, fearing that their jobs might be at risk or that the new system will be too complicated to learn. This resistance can stall implementation efforts and create a divide within the organization. To counter this, leaders must prioritize change management strategies that promote understanding and acceptance of the new technology.

In summary, while blockchain technology presents exciting opportunities for improving compliance, organizations must be prepared to tackle these challenges head-on. A proactive approach that includes addressing scalability, regulatory uncertainties, fostering collaboration, overcoming technical complexities, and managing cultural resistance will be key to successful implementation.

- What are the main challenges of implementing blockchain? The main challenges include scalability issues, regulatory uncertainty, the need for industry-wide collaboration, technical complexity, and cultural resistance.

- How can organizations overcome these challenges? Organizations can overcome these challenges by adopting a proactive approach that involves strategic planning, stakeholder engagement, and continuous education on blockchain technology.

- Is blockchain suitable for all industries? While blockchain can provide significant benefits in many industries, its suitability depends on specific use cases and the readiness of the organization to embrace the technology.

Regulatory Landscape for Blockchain

As organizations venture into the realm of blockchain technology, understanding the regulatory landscape becomes crucial. The regulatory environment surrounding blockchain is as dynamic as the technology itself. It is influenced by various factors, including jurisdiction, use case, and the rapid pace of innovation. For instance, while some countries are embracing blockchain with open arms, others remain hesitant, imposing stringent regulations that can stifle growth and innovation.

At the heart of the regulatory conversation is the need for clarity. Different nations have adopted varying approaches to blockchain regulation, which can create confusion for organizations looking to implement these solutions. For example, the European Union is working on the Digital Services Act and the MiCA (Markets in Crypto-Assets) regulation, aimed at creating a comprehensive framework for digital assets, including those built on blockchain technology. Conversely, in the United States, the regulatory landscape is fragmented, with different states having their own regulations, leading to a patchwork of compliance requirements.

One of the major challenges organizations face is the lack of a unified global standard for blockchain regulation. This inconsistency can lead to complications, especially for companies operating in multiple jurisdictions. The table below summarizes the regulatory approaches of selected countries:

| Country | Regulatory Approach | Key Regulations |

|---|---|---|

| United States | Fragmented | SEC, CFTC guidelines |

| European Union | Developing | MiCA, Digital Services Act |

| China | Restrictive | ICO bans, strict regulations |

| Singapore | Proactive | Payment Services Act |

Additionally, organizations must navigate the compliance requirements specific to their industry. For example, financial services firms may be subject to anti-money laundering (AML) and know your customer (KYC) regulations, which can complicate the implementation of blockchain solutions. The decentralized nature of blockchain can conflict with traditional compliance measures, necessitating innovative approaches to ensure adherence to regulations.

Moreover, the regulatory landscape is continuously evolving. Governments and regulatory bodies are actively engaging with stakeholders to understand the implications of blockchain technology better. This engagement is essential for developing regulations that promote innovation while protecting consumers and maintaining market integrity. As organizations consider integrating blockchain into their compliance frameworks, staying informed about regulatory changes is paramount.

In conclusion, the regulatory landscape for blockchain is complex and multifaceted. Organizations must be proactive in understanding the regulations that apply to their operations and engage with regulators to shape a favorable environment for blockchain innovation. By doing so, they can not only ensure compliance but also leverage blockchain technology to enhance transparency and accountability in their practices.

- What is the primary challenge in blockchain regulation? The primary challenge is the lack of a unified global standard, leading to confusion and compliance difficulties across jurisdictions.

- How do different countries approach blockchain regulation? Countries like the EU are developing comprehensive frameworks, while others like China impose strict regulations, creating a varied landscape.

- Why is stakeholder engagement important in blockchain regulation? Engaging stakeholders helps regulators understand the technology's implications, ensuring that regulations promote innovation while protecting consumers.

Best Practices for Implementation

When it comes to implementing blockchain solutions for compliance, strategic planning is paramount. Organizations need to approach the integration of this revolutionary technology with a clear roadmap that outlines their objectives, timelines, and resource allocations. Think of it like building a house; without a solid foundation and a well-thought-out blueprint, the structure is bound to face issues down the line. So, where do you start?

First, engage with stakeholders across your organization. This includes not just the IT department but also compliance officers, legal advisors, and even end-users. By fostering a culture of collaboration, you can ensure that the blockchain solution aligns with the needs of various departments, thereby enhancing its effectiveness. Regular meetings and workshops can be beneficial in gathering insights and addressing concerns early in the process.

Next, consider the importance of iterative development processes. Instead of attempting to implement a full-scale solution all at once, break the project into manageable phases. This approach allows for testing, feedback, and adjustments along the way. For instance, start with a pilot project in a specific area of compliance before rolling it out organization-wide. This not only minimizes risks but also helps in building confidence among users.

It's also crucial to invest in training and education for your team. Blockchain technology can be complex, and ensuring that your staff understands how it works and its implications for compliance will significantly increase the chances of successful implementation. Consider creating comprehensive training programs that cover the fundamentals of blockchain, its applications in compliance, and how to utilize the new system effectively.

Moreover, collaboration with industry peers can be incredibly advantageous. Join forums, attend conferences, and participate in workshops focused on blockchain in compliance. Sharing experiences and learning from others can provide valuable insights that may help you avoid common pitfalls. Remember, blockchain is still an evolving technology, and staying updated on the latest trends and best practices is key to maintaining a competitive edge.

Lastly, don't overlook the importance of regulatory compliance. As you develop your blockchain solution, ensure it adheres to existing regulations and guidelines. Keeping abreast of the regulatory landscape will not only help you avoid legal issues but also build trust with stakeholders and clients. Consider creating a compliance checklist that aligns with your blockchain implementation strategy.

In summary, successful implementation of blockchain solutions for compliance requires a multifaceted approach. By engaging stakeholders, adopting iterative processes, investing in training, collaborating with peers, and ensuring regulatory compliance, organizations can set themselves up for success in this innovative arena.

- What is the first step in implementing blockchain for compliance? Start with strategic planning and stakeholder engagement to outline objectives and gather insights.

- How can I ensure my team is prepared for blockchain implementation? Invest in training programs that cover the fundamentals of blockchain and its applications in compliance.

- Is it necessary to collaborate with other organizations? Yes, collaboration can provide valuable insights and help avoid common pitfalls in blockchain implementation.

- What should I consider regarding regulatory compliance? Stay updated on regulations and create a compliance checklist to align with your blockchain strategy.

Case Studies of Successful Blockchain Implementation

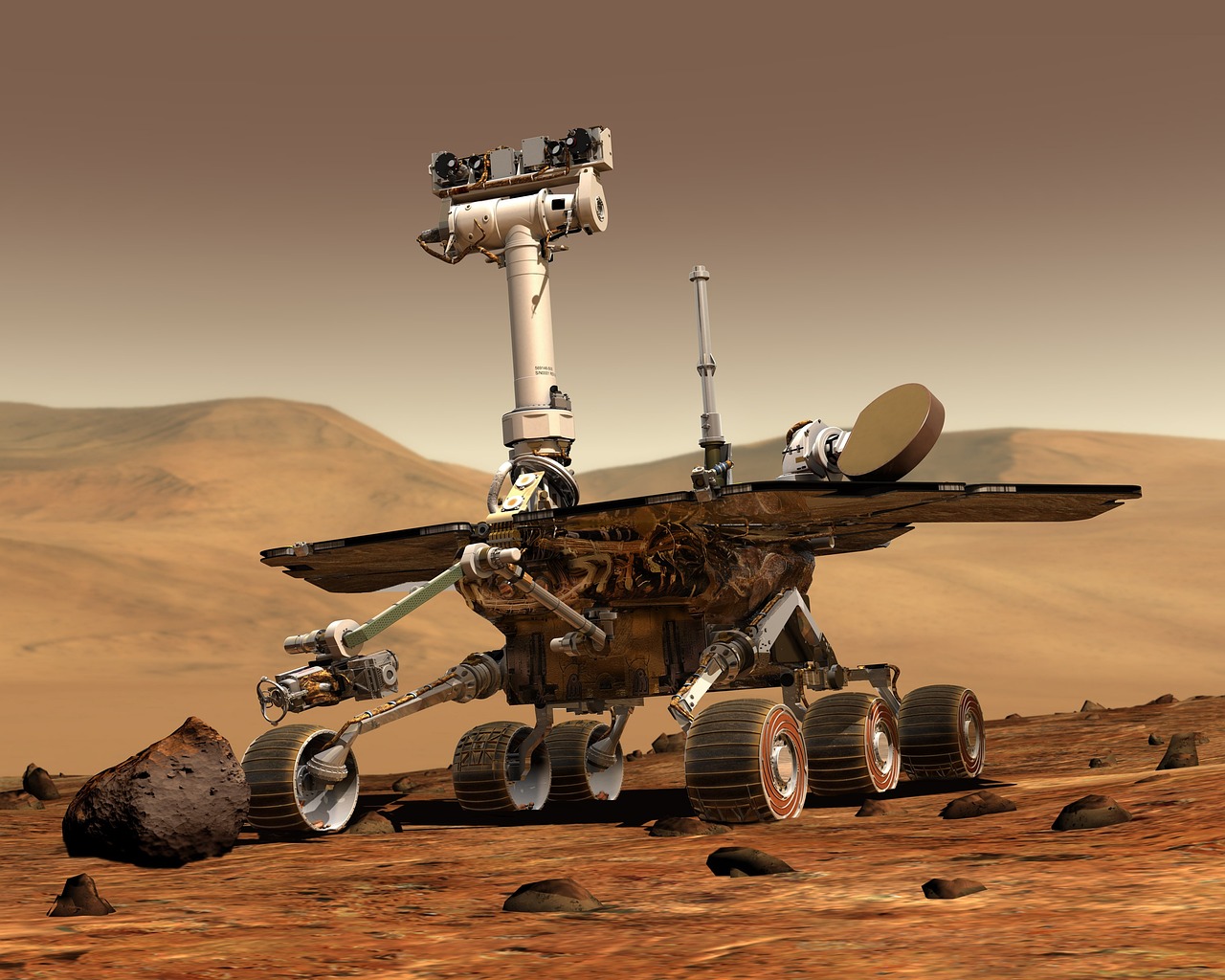

When it comes to the real-world application of blockchain technology in compliance, there are some fascinating case studies that stand out, showcasing how organizations have leveraged this innovative technology to enhance their compliance frameworks. One such example is the implementation by IBM and Maersk, which created a blockchain-based shipping and logistics platform called TradeLens. This platform has revolutionized the way shipping data is shared among stakeholders, providing unmatched transparency and traceability. By digitizing the shipping process, TradeLens allows all parties to access the same information in real-time, significantly reducing the chances of fraud and errors that often plague traditional shipping methods.

Another compelling case study comes from the financial sector, where HSBC has adopted blockchain technology to streamline its trade finance operations. By utilizing blockchain for letter of credit transactions, HSBC has reduced processing times from weeks to mere hours. This not only enhances compliance with regulatory requirements but also fosters greater trust among trading partners. The ability to track and verify every step of the transaction on a secure ledger means that all stakeholders are kept in the loop, minimizing disputes and enhancing accountability.

Moreover, the healthcare industry has also begun to see the potential of blockchain solutions. Guardtime, a leading blockchain company, partnered with the Estonian government to implement a blockchain-based system for health records. This system ensures that patient data is secure and immutable, allowing healthcare providers to comply with stringent data protection regulations while maintaining the integrity of patient information. The results have been remarkable, leading to a dramatic reduction in data breaches and enhancing patient trust in the healthcare system.

These case studies illustrate not only the versatility of blockchain technology but also its potential to drive compliance in various industries. However, the journey doesn’t stop here. Organizations looking to implement blockchain must take a strategic approach, learning from these examples to tailor solutions that fit their unique needs. The key takeaway is that blockchain is not just a buzzword; it is a transformative tool that can lead to significant improvements in compliance practices.

To further enrich our understanding, let’s take a look at a summary of the key benefits realized by these organizations:

| Organization | Industry | Blockchain Solution | Benefits |

|---|---|---|---|

| IBM & Maersk | Shipping & Logistics | TradeLens | Increased transparency, reduced fraud, real-time data access |

| HSBC | Finance | Trade Finance | Faster processing times, improved trust, enhanced compliance |

| Guardtime | Healthcare | Health Records System | Secure patient data, reduced breaches, enhanced trust |

As we can see, the integration of blockchain technology is not just a theoretical exercise but a practical solution that has yielded tangible results. Organizations that embrace these innovations will not only enhance their compliance efforts but also position themselves as leaders in their respective industries.

Q: What are the main benefits of using blockchain for compliance?

A: The main benefits include enhanced transparency, improved traceability, reduced fraud, and streamlined regulatory processes.

Q: What challenges might organizations face when implementing blockchain?

A: Challenges can include scalability issues, regulatory uncertainty, and the need for collaboration across different sectors.

Q: Are there specific industries that benefit more from blockchain compliance solutions?

A: Yes, industries such as shipping, finance, and healthcare have shown significant improvements in compliance through blockchain technology.

Future Trends in Blockchain Compliance Solutions

As we look ahead, the landscape of blockchain compliance solutions is poised for significant transformation. The rapid evolution of technology, coupled with increasing regulatory scrutiny, is pushing organizations to rethink their compliance strategies. One of the most exciting trends is the integration of artificial intelligence (AI) with blockchain technology. Imagine a future where AI algorithms analyze blockchain data in real-time, identifying compliance risks and anomalies before they escalate. This synergy could revolutionize how businesses navigate complex regulatory environments.

Another emerging trend is the rise of decentralized finance (DeFi) platforms that prioritize compliance. These platforms are not only streamlining financial transactions but also embedding compliance protocols directly into their frameworks. This shift could lead to a more transparent and accountable financial ecosystem, where compliance is an inherent feature rather than an afterthought. Organizations will need to adapt to this new paradigm, ensuring their compliance strategies are aligned with these innovative platforms.

Moreover, the push for interoperability among different blockchain networks is gaining momentum. As various industries adopt blockchain solutions, the need for seamless communication between different systems becomes critical. Future compliance solutions will likely focus on creating standards that facilitate interoperability, enabling organizations to share compliance data across platforms without compromising security. This could enhance collaboration between businesses and regulators, fostering a more cohesive approach to compliance.

Additionally, we can expect an increased emphasis on privacy-enhancing technologies within blockchain. As data privacy regulations become more stringent, organizations will seek solutions that allow them to comply without sacrificing user privacy. Techniques such as zero-knowledge proofs could enable companies to demonstrate compliance while keeping sensitive information confidential. This balance between transparency and privacy will be crucial for maintaining trust in blockchain systems.

Lastly, the concept of self-sovereign identity is likely to gain traction. This approach empowers individuals to control their own identity data, allowing them to share only the necessary information with organizations. By leveraging blockchain, companies can verify identities without storing excessive personal data, thereby reducing their compliance burden. As consumers become more aware of their data rights, organizations that adopt self-sovereign identity solutions will likely gain a competitive edge.

In summary, the future of blockchain compliance solutions is bright, with numerous trends indicating a shift towards more integrated, transparent, and user-centric approaches. Organizations that stay ahead of these trends will not only enhance their compliance efforts but also build stronger relationships with regulators and customers alike. Embracing these innovations will be key to thriving in an increasingly complex compliance landscape.

- What is the role of AI in blockchain compliance? AI can help analyze vast amounts of blockchain data to identify compliance risks and anomalies in real-time.

- How does decentralized finance impact compliance? DeFi platforms embed compliance protocols directly into their frameworks, making compliance a core feature of financial transactions.

- What are privacy-enhancing technologies? These are techniques that allow organizations to comply with regulations while protecting user privacy, such as zero-knowledge proofs.

- What is self-sovereign identity? It is a concept where individuals control their own identity data, sharing only what is necessary with organizations.

Conclusion and Next Steps

In conclusion, the integration of blockchain technology into compliance practices is not just a trend; it's a significant leap towards enhancing transparency, accountability, and efficiency within organizations. As we've explored, the benefits of adopting blockchain are substantial, ranging from improved traceability of transactions to a marked reduction in fraud. However, the journey to implementing blockchain solutions is filled with challenges, including scalability issues and the necessity for collaboration across industries. It's essential for organizations to approach this transition with a well-thought-out strategy.

Moving forward, organizations should focus on the following key steps:

- Strategic Planning: Develop a comprehensive plan that outlines the objectives and expected outcomes of blockchain integration.

- Stakeholder Engagement: Involve all relevant parties early in the process to foster collaboration and ensure buy-in.

- Iterative Development: Embrace an agile approach that allows for continuous improvement and adaptation as the technology and regulatory landscape evolves.

Furthermore, staying informed about the regulatory landscape is crucial. As regulations around blockchain continue to develop, organizations must be prepared to adapt their compliance strategies accordingly. This adaptability will not only help in meeting current regulations but will also position companies favorably for future changes.

Lastly, the future of blockchain compliance solutions is bright, with emerging trends promising to revolutionize how organizations approach compliance management. By remaining proactive and open to innovation, organizations can leverage these advancements to create more robust compliance frameworks.

Q1: What are the primary benefits of using blockchain for compliance?

A1: The primary benefits include enhanced transparency, improved traceability, reduced fraud, and streamlined regulatory processes.

Q2: What challenges might organizations face when implementing blockchain?

A2: Organizations may encounter scalability issues, regulatory uncertainty, and the need for collaboration across the industry.

Q3: How can organizations stay compliant with evolving blockchain regulations?

A3: By continuously monitoring the regulatory landscape and adapting their compliance strategies, organizations can ensure they remain compliant with new regulations.

Q4: What are some best practices for implementing blockchain solutions?

A4: Effective strategies include strategic planning, stakeholder engagement, and adopting an iterative development process.

Frequently Asked Questions

- What is blockchain technology?

Blockchain technology is a decentralized digital ledger that records transactions across multiple computers. This ensures that the recorded transactions cannot be altered retroactively, providing a high level of security and transparency. Think of it like a digital notebook that everyone can see but no one can erase!

- How can blockchain improve compliance?

Blockchain enhances compliance by providing a transparent and immutable record of transactions. This means organizations can easily track and verify their activities, making it simpler to adhere to regulations. Imagine having a crystal-clear window into all your business processes—no more hiding in the shadows!

- What are the main challenges of implementing blockchain?

Some of the challenges include scalability issues, regulatory uncertainties, and the need for collaboration across industries. It’s like trying to build a bridge while ensuring that everyone on both sides agrees on how to cross it!

- Are there specific regulations for blockchain?

Yes, the regulatory landscape for blockchain is constantly evolving. Organizations must stay updated on laws and guidelines that pertain to their specific industry and jurisdiction. It's crucial to navigate this maze carefully to avoid penalties!

- What are the best practices for implementing blockchain solutions?

Effective strategies include thorough planning, engaging stakeholders early, and adopting an iterative development process. Think of it like cooking a new recipe—gather your ingredients, involve your sous-chefs, and adjust the flavors as you go!

- Can you give examples of successful blockchain implementation?

Absolutely! Many organizations have successfully integrated blockchain for compliance, such as supply chain companies that track products from origin to store. These case studies provide valuable insights and lessons learned that can guide future implementations.

- What future trends should we expect in blockchain compliance?

Emerging trends include the integration of artificial intelligence with blockchain for enhanced data analysis and the development of more user-friendly platforms. It's like watching technology evolve into a smarter, more efficient version of itself!