How to Develop a Risk Management Strategy for Crypto Trading

In the fast-paced world of cryptocurrency trading, developing a robust risk management strategy is not just a suggestion—it's a necessity. With the market's notorious volatility, traders can find themselves on a rollercoaster ride of emotions and financial swings. But fear not! By understanding the essential components of risk management, you can navigate this thrilling landscape with confidence and precision. This article will guide you through the critical aspects of creating a risk management strategy that not only protects your investments but also enhances your trading performance.

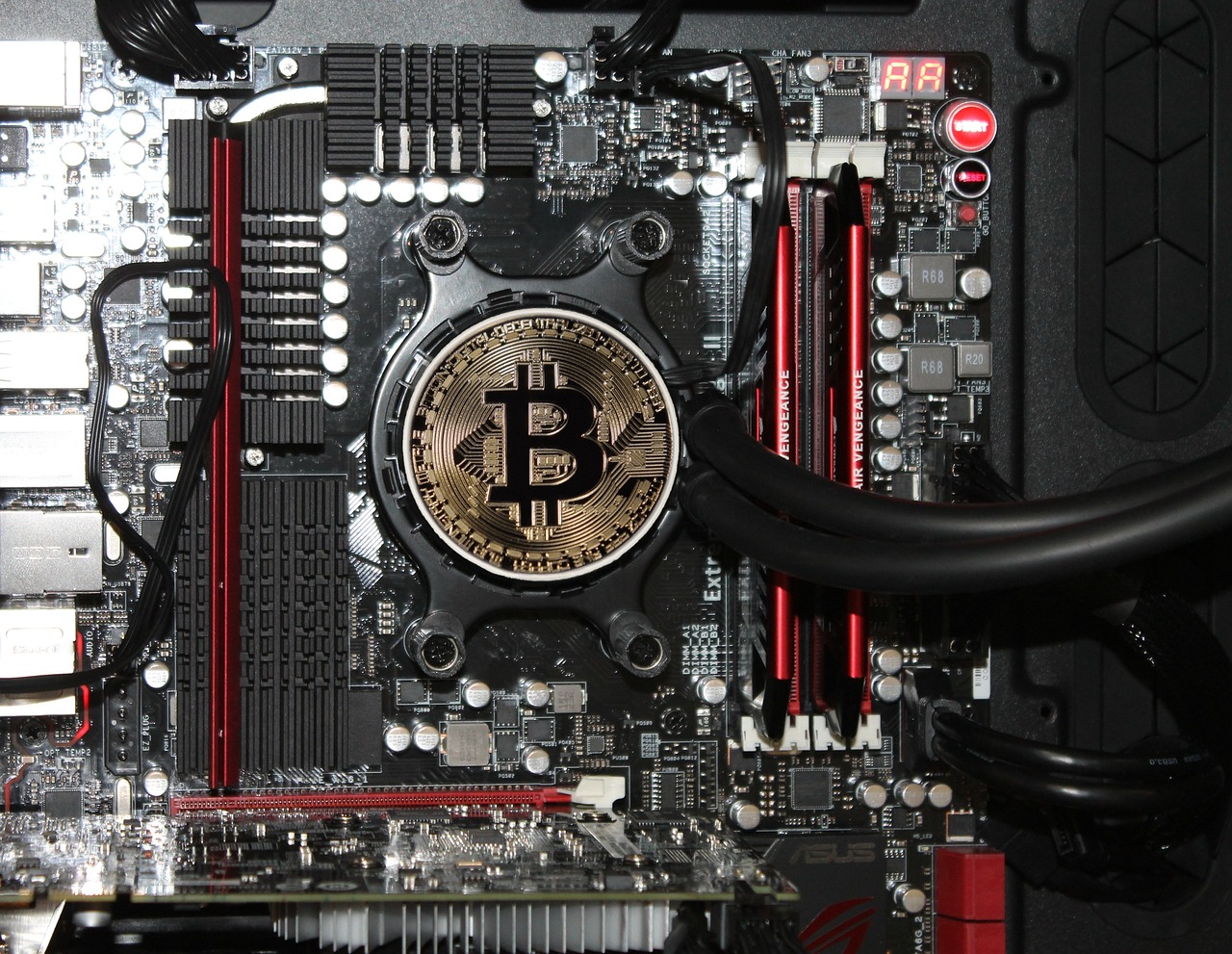

Before diving into the nitty-gritty of risk management, it's essential to recognize the types of risks you might encounter in the crypto space. Market volatility is perhaps the most significant risk, as prices can swing dramatically in a matter of minutes. Additionally, regulatory risks loom large, with governments around the world constantly reassessing their stance on cryptocurrencies. Finally, technological vulnerabilities, such as hacking and system failures, can impact your trading strategies. By acknowledging these risks, you can better prepare yourself to face them head-on.

One of the foundational steps in risk management is setting clear and achievable investment goals. Think of your goals as the compass that guides your trading journey. Are you looking to make quick profits, or are you in it for the long haul? Aligning your trading strategies with personal financial objectives and risk tolerance is crucial. This alignment helps you define your risk appetite—essentially, how much risk you're willing to take on in pursuit of your investment goals.

Understanding your individual risk tolerance levels is vital for effective trading. It’s like knowing how spicy you can handle your food; too much heat can ruin the experience. Assessing your comfort with potential losses and market fluctuations will help you make informed decisions. Are you the type who panics at the first sign of a downturn, or can you hold steady during turbulent times? Knowing the answer to these questions will shape your trading strategy.

Before you jump into the crypto pool, it's crucial to evaluate your personal finances. Just like you wouldn’t dive into a pool without checking the water depth, understanding your income, expenses, and savings is essential. This assessment will help you gauge how much capital you can invest without jeopardizing your financial stability. Remember, trading should enhance your financial situation, not put you in a tight spot.

Differentiating between short-term and long-term investment goals can significantly shape your risk management strategies. Short-term trading may require a more aggressive approach, while long-term investing often calls for a more measured stance. The timeframes you choose will directly affect your risk tolerance and trading decisions. So, ask yourself: Are you looking to capitalize on quick market movements, or are you willing to weather the storm for potential long-term gains?

Once you've established your goals and understood your risk appetite, the next step is to implement various risk mitigation techniques. These strategies are your safety net, designed to protect your investments from unforeseen market shifts. Techniques like diversification—spreading your investments across various cryptocurrencies—can help minimize risk. Additionally, using stop-loss orders allows you to set predetermined exit points, ensuring that you cut losses before they spiral out of control. Position sizing is another critical element; it helps you determine how much of your capital to allocate to each trade, balancing potential rewards with acceptable risks.

Regularly monitoring market conditions is essential for successful crypto trading. The crypto landscape is constantly changing, and staying informed about market trends, news, and regulatory changes can give you a significant edge. Utilize tools and platforms that provide real-time updates and analytics to keep your finger on the pulse of the market.

Technical analysis plays a significant role in identifying market trends. By leveraging charts and indicators, traders can make informed decisions based on historical data and market behavior. It’s like using a map to navigate through unfamiliar territory; the right indicators can help you pinpoint potential entry and exit points, reducing the risk of making impulsive trades.

Being aware of news and events that impact the crypto market is crucial. Reliable sources for market news include cryptocurrency news websites, social media platforms, and financial news channels. Understanding how to interpret these events and their effects on trading strategies can make a world of difference. For instance, a regulatory announcement can cause prices to plummet or skyrocket, and being prepared for such outcomes is key to successful trading.

Maintaining emotional control is critical in crypto trading. The thrill of potential profits can easily lead to fear and greed, which can cloud judgment and lead to poor decision-making. Developing strategies for managing these emotions is essential for making rational decisions. Remember, trading is not just about numbers; it's also about mindset.

Identifying your personal emotional triggers can help you avoid impulsive decisions. Common emotional pitfalls include fear of missing out (FOMO) and panic selling. By recognizing these triggers, you can develop strategies to counteract them, ensuring that your trading decisions remain grounded in logic rather than emotion.

Discipline is key to successful trading. Techniques such as setting strict trading rules and adhering to your trading plan—even in volatile market conditions—will help you maintain focus. Think of it like a diet; sticking to your plan, even when tempted by indulgences, will yield better long-term results.

Regularly reviewing and adjusting trading strategies is essential for long-term success. Learning from past trades and adapting to changing market conditions can significantly improve your trading outcomes. This iterative process allows you to refine your strategies continually and respond to new information effectively.

Analyzing previous trades helps traders identify patterns and mistakes. Conducting effective post-trade analyses can reveal what worked and what didn’t, providing invaluable insights for future trading decisions. It’s like reviewing game footage; understanding your past performance can help you improve your strategy moving forward.

Flexibility in trading strategies allows traders to respond to market fluctuations. The ability to adjust your strategies based on new information and market dynamics is crucial for staying ahead of the curve. Always be ready to pivot; the crypto market waits for no one!

- What is risk management in crypto trading?

Risk management in crypto trading involves identifying, assessing, and prioritizing risks, then implementing strategies to minimize their impact on your investments. - How can I determine my risk appetite?

Assess your financial situation, investment goals, and comfort level with potential losses to define your risk appetite. - What are some effective risk mitigation techniques?

Diversification, stop-loss orders, and position sizing are key techniques for mitigating risk in crypto trading. - How often should I review my trading strategy?

Regular reviews, ideally after each trading cycle or significant market change, can help you adapt your strategies effectively.

Understanding Risk in Crypto Trading

When it comes to crypto trading, understanding risk is like having a compass in a dense forest. Without it, you might wander aimlessly, unaware of the dangers lurking around every corner. The world of cryptocurrency is notorious for its market volatility. Prices can swing wildly in a matter of minutes, which can be both exhilarating and terrifying. For instance, imagine investing in a coin that skyrockets by 50% one day, only to plummet by 30% the next. This kind of volatility is part and parcel of the crypto landscape and requires traders to be alert and prepared.

But market volatility isn’t the only risk you face. There are also regulatory risks to consider. Governments around the world are still figuring out how to regulate cryptocurrencies, and sudden changes in regulations can have a profound impact on the market. For example, a country might suddenly ban cryptocurrency trading, leading to a massive sell-off. As a trader, staying informed about regulatory developments is crucial to navigating these waters.

Additionally, the impact of technological vulnerabilities can’t be overlooked. Cryptocurrency exchanges can be susceptible to hacks, and wallets can be compromised. If you’re not careful, you could lose your entire investment in the blink of an eye. It’s essential to choose reputable exchanges and use secure wallets to mitigate this risk. The crypto world is rife with stories of individuals who lost fortunes due to security breaches. Therefore, understanding the technological landscape is as important as grasping market trends.

To summarize, the risks in crypto trading can be categorized into three main types:

- Market Volatility: Fluctuations in asset prices can lead to significant gains or losses.

- Regulatory Risks: Changes in laws and regulations can impact trading environments.

- Technological Vulnerabilities: Security breaches can lead to loss of funds.

As you dive deeper into crypto trading, remember that understanding these risks is not just about recognizing them; it’s about developing a strategy to manage them effectively. Knowledge is power, and in the unpredictable world of cryptocurrency, it can be your best ally. By being aware of the risks and preparing for them, you can navigate the crypto market with greater confidence and resilience.

Q: What is market volatility in crypto trading?

A: Market volatility refers to the rapid and significant price movements of cryptocurrencies. High volatility means prices can change dramatically in a short period, which can present both opportunities and risks for traders.

Q: How can I protect myself from regulatory risks?

A: Stay informed about the latest developments in cryptocurrency regulations in your country and globally. Following reputable news sources and joining community forums can help you stay updated.

Q: What steps can I take to secure my investments?

A: Use secure wallets, enable two-factor authentication on exchanges, and be cautious about sharing sensitive information. Always choose reputable platforms for trading.

Setting Clear Investment Goals

When it comes to crypto trading, one of the first things you should do is set clear investment goals. Why? Because without a roadmap, you might find yourself lost in the chaotic world of cryptocurrencies. Think of your investment goals as a compass that guides you through the unpredictable waters of the market. By establishing these goals, you not only define your risk appetite but also align your trading strategies with your personal financial objectives. This alignment is crucial because it helps you stay focused and prevents you from making impulsive decisions based on market hype or fear.

So, how do you go about setting these goals? Start by asking yourself some important questions. What do you want to achieve with your investments? Are you looking for short-term gains to fund a vacation, or are you more interested in building a long-term nest egg for retirement? Understanding the timeframe of your investment can significantly shape your risk management strategy. For instance, if you're aiming for quick profits, you might be more willing to take on higher risks. Conversely, if you're investing for the long haul, a more conservative approach might be in order.

Another critical aspect to consider is your risk appetite. This involves understanding how much risk you can tolerate without losing sleep at night. Everyone has a different comfort level when it comes to potential losses. To assess your risk appetite, evaluate your financial situation, including income, expenses, and savings. Are you in a stable financial position, or do you have debts that could weigh you down? Knowing where you stand financially can help you make more informed decisions about how much you're willing to invest in high-risk assets like cryptocurrencies.

It's also essential to differentiate between long-term and short-term goals. Long-term goals might include saving for a house or retirement, while short-term goals could involve trading for immediate cash flow. Understanding the difference can help you tailor your risk management strategies accordingly. For example, if you're focused on long-term growth, you might choose to invest in more stable cryptocurrencies and hold onto them for years. On the other hand, if you're looking for short-term profits, you may want to engage in more active trading, which often involves higher risks.

In summary, setting clear investment goals is a fundamental step in developing a successful risk management strategy for crypto trading. By defining what you want to achieve, assessing your risk appetite, and differentiating between long-term and short-term objectives, you can create a focused and effective trading plan. This not only enhances your chances of success but also helps you navigate the emotional rollercoaster that often accompanies trading in such a volatile market.

- What are investment goals? Investment goals are specific objectives that guide your trading and investment decisions, helping you define what you want to achieve financially.

- How do I assess my risk appetite? To assess your risk appetite, evaluate your financial situation, including your income, expenses, savings, and comfort level with potential losses.

- Why is it important to differentiate between long-term and short-term goals? Differentiating between long-term and short-term goals helps tailor your trading strategies and risk management approaches to align with your financial objectives.

Defining Risk Appetite

Understanding your risk appetite is like knowing how spicy you can handle your food. Just as some people can devour the hottest chili peppers while others prefer a mild salsa, traders have different thresholds for risk. In the world of cryptocurrency, where prices can swing wildly, recognizing your comfort level with potential losses is essential for developing a sound trading strategy. But how do you determine this? It starts with self-reflection and an honest assessment of your financial situation.

First, consider your financial circumstances. Are you investing with money you can afford to lose, or are you risking funds that are critical for your day-to-day living? This distinction is crucial. If you’re using essential funds, your risk appetite is likely to be lower. Conversely, if you’re investing discretionary income, you might be more open to taking risks. To help clarify your risk appetite, think about the following factors:

- Investment Horizon: Are you looking to make quick profits or are you in it for the long haul? Short-term traders may be more tolerant of volatility, while long-term investors often prefer stability.

- Experience Level: New traders might feel overwhelmed by market fluctuations, making them more risk-averse. In contrast, seasoned traders may have the confidence to weather market storms.

- Financial Goals: Your personal financial objectives should align with your risk tolerance. If your goal is to save for retirement, a more conservative approach might be suitable.

Next, it’s important to quantify your risk appetite. You can do this by asking yourself some key questions:

- How much of my portfolio am I willing to lose before I start to feel uncomfortable?

- What percentage of my total investment am I willing to risk on a single trade?

- How would I react if my investments dropped by 20% overnight?

By answering these questions, you can create a clearer picture of your risk tolerance. For example, if a 10% loss feels unbearable, you might want to adopt a more conservative trading strategy. On the other hand, if you can handle a 30% drop without losing sleep, you may be ready to embrace a more aggressive approach.

In addition to personal reflection, consider using a risk assessment tool or questionnaire. Many online platforms offer resources that help traders evaluate their risk tolerance based on their financial situation, investment goals, and emotional responses to market changes. These tools can provide valuable insights and help you make informed decisions.

Ultimately, defining your risk appetite is not a one-time task; it’s an ongoing process. As your financial situation, market conditions, and personal circumstances change, so too should your risk tolerance. Regularly revisiting your risk appetite ensures that your trading strategies remain aligned with your current goals and comfort levels.

What is risk appetite in crypto trading?

Risk appetite refers to the level of risk a trader is willing to take when investing in cryptocurrencies. It varies from person to person based on financial circumstances, experience, and investment goals.

How can I assess my risk appetite?

You can assess your risk appetite by evaluating your financial situation, considering your investment horizon, and reflecting on how you would react to potential losses. Tools and questionnaires available online can also aid in this assessment.

Is it possible to change my risk appetite?

Yes, your risk appetite can change over time due to shifts in your financial situation, market conditions, or personal circumstances. It’s important to regularly reassess your risk tolerance to ensure it aligns with your current goals.

Assessing Financial Situation

Before diving into the world of cryptocurrency trading, it's essential to take a step back and assess your financial situation. Think of this as laying the foundation for a house; without a solid base, everything you build on top could come crashing down. Understanding your financial health not only helps you determine how much you can invest but also shapes your overall risk appetite.

Start by evaluating your income, expenses, and savings. This evaluation will provide a clearer picture of your financial landscape. Ask yourself:

- What are my monthly income sources?

- How much do I spend each month on essential and non-essential items?

- Do I have an emergency fund to cover unexpected expenses?

By answering these questions, you can gauge how much disposable income you have available for trading. It's crucial to remember that investing in crypto should never come at the cost of your basic living expenses or savings. Think of your investments as a garden; you need to water it, but you also need to ensure that you have enough resources for your daily needs.

Next, consider your financial goals. Are you looking to make a quick profit, or are you in it for the long haul? Your goals will significantly influence your risk tolerance. For instance, if you're aiming for long-term growth, you might be more willing to weather market fluctuations compared to someone looking for short-term gains. This is akin to choosing between planting a seed for a tree that will take years to bear fruit versus planting a flower that blooms in a few months.

Finally, it’s wise to create a simple

| Category | Amount ($) |

|---|---|

| Monthly Income | [Enter Amount] |

| Monthly Expenses | [Enter Amount] |

| Emergency Fund | [Enter Amount] |

| Available for Investment | [Enter Amount] |

By filling in this table, you’ll have a clearer understanding of your financial standing, which is crucial for making informed trading decisions. Remember, knowledge is power, especially in the unpredictable world of crypto trading. The more you know about your finances, the better equipped you’ll be to navigate the risks and rewards of this exciting market.

Q: Why is it important to assess my financial situation before trading?

A: Assessing your financial situation helps you understand how much you can afford to invest without jeopardizing your essential living expenses.

Q: How do I determine my risk appetite?

A: Your risk appetite can be determined by evaluating your financial goals, investment horizon, and comfort level with potential losses.

Q: What should I include in my financial assessment?

A: Include your income, expenses, savings, and any existing debts. This will give you a comprehensive view of your financial health.

Q: Should I invest all my disposable income in crypto?

A: No, it’s advisable to only invest what you can afford to lose. Always keep a portion of your disposable income for emergencies and other investments.

Long-term vs. Short-term Goals

When it comes to crypto trading, understanding the difference between long-term and short-term goals is crucial for shaping your risk management strategy. Think of it this way: investing in cryptocurrencies can be like planting a tree versus growing a flower. The tree requires patience and nurturing over years, while the flower may bloom quickly but has a shorter lifespan. Similarly, your trading approach should align with the time frame you are comfortable with.

Long-term goals typically involve holding onto your investments for an extended period, often years, to ride out the market's ups and downs. This strategy is generally less stressful as it allows you to ignore short-term volatility, but it does require a strong belief in the potential of your chosen cryptocurrencies. On the other hand, short-term goals focus on quick profits, leveraging market fluctuations for immediate gains. This approach can be exhilarating, but it also comes with its own set of risks, including the potential for rapid losses.

To effectively navigate these two approaches, you should consider your overall financial situation, your risk tolerance, and your investment knowledge. Here are a few factors to contemplate:

- Time Commitment: How much time can you dedicate to trading? Short-term trading often requires constant monitoring, while long-term investing allows for a more hands-off approach.

- Market Knowledge: Are you well-versed in technical analysis and market trends? If you lack experience, a long-term strategy might be more suitable.

- Emotional Resilience: Can you handle the stress of rapid market changes? Short-term trading can be emotionally taxing, while long-term investing may offer more stability.

Ultimately, the choice between long-term and short-term goals should reflect your personal financial objectives and lifestyle. Some traders even opt for a hybrid approach, combining both strategies to balance risk and reward. For instance, you could allocate a portion of your portfolio to long-term investments while actively trading another part for short-term gains. This diversification can help mitigate risks and maximize potential returns.

In summary, whether you choose a long-term or short-term strategy, the key is to remain disciplined and informed. Each approach has its advantages and challenges, so understanding your goals and aligning them with your risk management strategy is essential for success in the unpredictable world of cryptocurrency trading.

Q: What is the main difference between long-term and short-term crypto trading?

A: Long-term trading involves holding assets for an extended period, typically years, while short-term trading focuses on making quick profits from market fluctuations.

Q: Can I combine both strategies in my trading plan?

A: Yes! Many traders use a hybrid approach, allocating portions of their portfolio to both long-term investments and short-term trades to balance risk and reward.

Q: How do I determine my risk tolerance?

A: Assess your financial situation, investment knowledge, and emotional resilience to understand how much risk you're comfortable taking in your trading activities.

Q: What are some common mistakes in crypto trading?

A: Common mistakes include failing to set clear goals, not researching investments, and letting emotions dictate trading decisions.

Implementing Risk Mitigation Techniques

In the volatile world of cryptocurrency trading, implementing effective risk mitigation techniques is not just a good idea; it’s a necessity. Think of it as wearing a seatbelt in a car—while you may never expect to get into an accident, it's better to be prepared for the unexpected. The primary goal of these techniques is to safeguard your investments while maximizing potential gains. Let’s delve into some essential strategies that can help you navigate the tumultuous waters of crypto trading.

One of the most effective methods for mitigating risk is diversification. By spreading your investments across various cryptocurrencies and asset classes, you can reduce the impact of a poor-performing asset on your overall portfolio. Imagine you have a fruit basket filled with apples, oranges, and bananas. If one type of fruit spoils, you still have others to enjoy. In trading, this means that if one cryptocurrency crashes, the others may remain stable or even thrive, cushioning your losses.

Another crucial technique is the use of stop-loss orders. A stop-loss order is a predetermined price point at which you will sell a cryptocurrency to prevent further losses. It acts like a safety net, ensuring that if the market takes a sudden downturn, your losses are limited. For instance, if you buy Bitcoin at $50,000 and set a stop-loss at $48,000, your position will automatically sell if the price drops to that level, thereby protecting your capital from larger declines.

Position sizing is also a vital component of risk management. This involves determining how much capital to allocate to each trade based on your total portfolio size and risk tolerance. A common rule of thumb is to risk only 1-2% of your total capital on a single trade. For example, if your trading capital is $10,000, risking 1% means you would only invest $100 in one trade. This strategy helps ensure that even a series of losses won't deplete your account, allowing you to continue trading with confidence.

Moreover, regularly reviewing your portfolio and adjusting your strategies is essential. The cryptocurrency market is ever-changing, and what works today may not work tomorrow. By keeping an eye on market trends and your own performance, you can make informed decisions about rebalancing your investments or changing your trading tactics. This proactive approach is like steering a ship; you need to adjust your sails to navigate through changing winds.

In summary, implementing risk mitigation techniques is crucial for any crypto trader looking to protect their investments while still aiming for growth. By diversifying your portfolio, utilizing stop-loss orders, practicing proper position sizing, and regularly reviewing your strategies, you can create a robust framework that minimizes risks and maximizes opportunities. Remember, the key is not just to survive the market's ups and downs, but to thrive in them.

- What is the best way to start diversifying my crypto portfolio?

Begin by researching various cryptocurrencies and investing in a mix of established coins like Bitcoin and Ethereum, as well as promising altcoins. Consider your risk tolerance when selecting assets.

- How can I determine the right stop-loss level?

Stop-loss levels can be set based on technical analysis, such as support and resistance levels, or as a percentage of your entry price. Adjust them as you gain more experience in trading.

- Is there a universal position sizing strategy I should follow?

While many traders use the 1-2% rule, the best position size varies based on your risk tolerance and trading style. Experiment with different sizes to find what works for you.

Monitoring Market Conditions

In the fast-paced world of cryptocurrency trading, staying informed about market conditions is not just beneficial; it's essential for survival. The crypto market is notorious for its volatility, which can lead to significant gains or devastating losses in a matter of minutes. Therefore, traders must develop a keen sense of awareness regarding market trends, news, and regulatory changes that could affect their investments. But how do you keep your finger on the pulse of such a dynamic environment? Let’s explore some effective methods and tools that can help you stay ahead.

First off, leveraging market analysis tools can provide invaluable insights. Platforms like CoinMarketCap and TradingView offer real-time data on price movements, trading volumes, and market capitalization. These tools often come equipped with advanced charting features that allow traders to visualize trends and make informed predictions. By regularly checking these platforms, you can identify bullish and bearish trends and adjust your trading strategies accordingly.

Another critical aspect of monitoring market conditions is being aware of news and events that can impact the crypto landscape. Major announcements, such as regulatory changes or technological advancements, can cause significant price swings. To stay updated, consider following reputable news sources like CoinDesk and The Block. You can also set up Google Alerts for specific keywords related to your investments. This way, you won’t miss out on important developments that could influence your trading decisions.

Additionally, understanding the influence of social media cannot be overstated. Platforms like Twitter and Reddit are buzzing with discussions about cryptocurrencies, and they often serve as a barometer for market sentiment. Traders frequently share insights, rumors, and analyses that can provide a glimpse into the market's psyche. However, it’s crucial to approach social media with caution. While it can be a treasure trove of information, it can also be a breeding ground for misinformation. Always cross-reference information before making trading decisions based on social media chatter.

To summarize, monitoring market conditions involves a combination of utilizing analytical tools, staying updated with news, and engaging with the trading community on social media. By adopting a proactive approach to market monitoring, you can equip yourself with the knowledge needed to navigate the unpredictable waters of cryptocurrency trading. Remember, in this realm, knowledge isn't just power; it's your best defense against potential losses.

Using Technical Analysis

When diving into the world of crypto trading, understanding how to leverage technical analysis can be your golden ticket to making informed decisions. Technical analysis is like having a roadmap that guides you through the chaotic landscape of cryptocurrency markets. Instead of wandering aimlessly, you can analyze past price movements and trading volumes to predict future trends. But how do you get started? Let’s break it down!

At its core, technical analysis involves studying charts and using various indicators to interpret market behavior. Think of it as reading a book where each price movement tells a story about market sentiment. Traders often rely on several key tools to help them make sense of this data:

- Charts: Line charts, bar charts, and candlestick charts are popular formats that visualize price movements over different time frames.

- Indicators: Tools like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands provide insights into market trends and potential reversals.

- Volume Analysis: Understanding the volume behind price movements can indicate the strength of a trend. High volume often confirms that the price movement is significant.

For instance, a candlestick chart can reveal patterns that indicate bullish or bearish trends. A series of green candles might suggest that buyers are in control, while red candles could indicate sellers are taking charge. Recognizing these patterns can help you time your entries and exits more effectively.

Moreover, combining different indicators can enhance your trading strategy. For example, using the RSI in conjunction with moving averages can provide a more comprehensive view of the market. If the RSI indicates that an asset is overbought while the moving average shows a downward trend, it could be a signal to consider selling or at least reassessing your position.

However, it’s essential to remember that no analysis is foolproof. Markets can be unpredictable, and emotional factors can often lead to sudden price swings. This is where discipline comes into play. Sticking to your analysis and trading plan, even when emotions run high, can set you apart from the average trader.

In summary, mastering technical analysis requires practice and a willingness to learn. The more you familiarize yourself with the tools and indicators, the better equipped you will be to navigate the often volatile crypto markets. So, grab your charts, start analyzing, and let the data guide your trading decisions!

Q: What is the best chart type for beginners?

A: Candlestick charts are often recommended for beginners as they provide more information about price action compared to line charts.

Q: How often should I analyze my trades?

A: Regular analysis is crucial. Aim to review your trades weekly to identify patterns and areas for improvement.

Q: Can technical analysis guarantee profits?

A: While technical analysis can improve your decision-making, it does not guarantee profits. Market conditions can change rapidly, so always be prepared for the unexpected.

Staying Updated with News

In the fast-paced world of cryptocurrency trading, staying updated with news is not just a good practice; it's absolutely essential. The crypto market is notoriously volatile, and prices can swing dramatically based on the latest headlines. Imagine if you were sailing a ship in a stormy sea, where every wave represents a piece of news. If you’re not paying attention, you might find yourself capsized by unexpected changes. Therefore, being informed allows you to navigate these turbulent waters effectively.

To keep your finger on the pulse of the crypto market, consider utilizing a mix of reliable news sources and tools. Here are some types of sources that can help you stay informed:

- Crypto News Websites: Websites like CoinDesk, CoinTelegraph, and CryptoSlate provide timely updates and in-depth analyses of market trends.

- Social Media Platforms: Twitter and Reddit are gold mines for real-time news and community sentiment. Follow influential figures in the crypto space to gain insights.

- News Aggregators: Platforms like Feedly or CryptoPanic can help you consolidate news from various sources into one convenient feed.

Moreover, it's crucial to understand the impact of news on trading strategies. For instance, regulatory announcements can lead to significant price movements. If a government announces a crackdown on crypto trading, you may want to adjust your strategy to mitigate risks. On the other hand, positive news such as institutional adoption can present lucrative opportunities. Therefore, it’s not just about being aware of the news but also about interpreting its potential impact on your investments.

Another important aspect is the timing of news consumption. Being proactive rather than reactive can make a world of difference. Set up alerts for major news events or significant market changes so you can react swiftly. This way, you can make informed decisions rather than relying on impulse or speculation.

Finally, remember that not all news is created equal. It’s essential to distinguish between reliable information and mere speculation. Always cross-check facts and consider the credibility of the sources you’re following. This diligence can protect you from falling into traps set by misinformation, which could lead to poor trading decisions.

Q: How can I differentiate between reliable and unreliable news sources?

A: Look for established platforms with a history of accurate reporting, check for citations, and follow industry experts to gauge credibility.

Q: Should I react immediately to every piece of news?

A: Not necessarily. It's important to evaluate the potential impact of the news before making any trading decisions. Sometimes, waiting for more information can be beneficial.

Q: How often should I check for news updates?

A: While it's essential to stay informed, constantly checking news can lead to anxiety. Set specific times during the day to review updates so you can maintain focus on your trading strategy.

Emotional Control in Trading

When it comes to crypto trading, emotional control is not just a nice-to-have; it's a critical component of success. Imagine you're on a rollercoaster, feeling the highs and lows of the market—one moment you're soaring with profits, and the next, you're plummeting into despair with losses. This emotional ride can lead to impulsive decisions that derail your trading strategy. So, how do you maintain your cool amidst the chaos? Let's break it down.

First and foremost, it's essential to recognize your emotional triggers. These triggers can vary from person to person. For some, it might be the thrill of a sudden price surge, while for others, it could be the fear of missing out (FOMO) when they see others making profits. By identifying what specifically rattles your emotional cage, you can develop a strategy to manage those feelings. For instance, if you know that a sudden drop in price sends you into a panic, you might set strict rules for yourself about when to sell, ensuring that your decisions are based on logic rather than emotion.

Next, practicing discipline is paramount. Discipline in trading is akin to a muscle that needs to be trained regularly. It requires consistency and commitment to stick to your trading plan, even when the market is throwing curveballs. One effective technique is to create a trading journal where you document your trades, the reasons behind them, and your emotional state at the time. This practice not only helps you reflect on your decisions but also reinforces a disciplined approach to trading.

Additionally, consider implementing a few strategies to help manage your emotions:

- Set realistic expectations: Understand that losses are part of trading. By accepting this reality, you can reduce the emotional impact of a bad trade.

- Take breaks: If you find yourself feeling overwhelmed, step away from the screen. A short break can help clear your mind and reset your emotional state.

- Engage in mindfulness practices: Techniques such as meditation or deep-breathing exercises can help you maintain a calm demeanor, allowing you to make more rational decisions.

In conclusion, emotional control in trading is not just about resisting the urge to panic or celebrate wildly; it's about creating a balanced mindset that allows you to navigate the unpredictable waters of the crypto market. By recognizing your triggers, practicing discipline, and employing effective strategies, you can enhance your trading experience and improve your chances of long-term success.

Q: Why is emotional control important in crypto trading?

A: Emotional control helps traders make rational decisions rather than impulsive ones, which can lead to significant losses.

Q: What are common emotional triggers in trading?

A: Common triggers include fear of missing out (FOMO), fear of loss, and overconfidence after a winning streak.

Q: How can I practice discipline in trading?

A: You can practice discipline by setting clear trading goals, maintaining a trading journal, and adhering to a well-defined trading plan.

Q: What techniques can help manage emotions while trading?

A: Techniques such as setting realistic expectations, taking breaks, and engaging in mindfulness practices can help manage emotions effectively.

Recognizing Emotional Triggers

In the fast-paced world of crypto trading, recognizing your emotional triggers is like having a map in a dense forest; it guides you through the uncertainties and helps you avoid pitfalls. Emotional triggers are those moments when feelings like fear, greed, or anxiety take the wheel and steer your decisions in a direction you might later regret. Imagine you’re at a party, and someone brings up a topic that makes you uncomfortable; your reaction is immediate, often without thought. Similarly, in trading, certain market movements or news can evoke strong emotions that cloud your judgment.

To effectively manage these emotions, you first need to identify what specifically triggers them. For instance, you might find that watching your portfolio drop suddenly sends your heart racing, prompting you to sell off assets in a panic. On the flip side, a sudden surge in your investments might fill you with excitement, leading you to make impulsive buys without proper analysis. Understanding these triggers is crucial because it allows you to create a strategy to manage them.

Here are some common emotional triggers that traders often experience:

- Market Volatility: Sudden price swings can lead to feelings of anxiety or excitement.

- News Events: Major news announcements can cause fear of missing out (FOMO) or fear of loss.

- Peer Influence: Seeing others make profits can trigger jealousy or a sense of urgency to act.

Once you’ve identified your triggers, the next step is to develop a plan to manage them. One effective technique is to maintain a trading journal where you document your trades along with the emotions you felt at the time. This practice can help you see patterns in your emotional responses and give you insights into how to handle them better in the future. Additionally, consider setting predefined rules for your trades, such as stop-loss limits, to help mitigate impulsive decisions driven by emotion.

Remember, trading is as much about psychology as it is about strategy. By recognizing your emotional triggers and developing strategies to counteract them, you can position yourself for more rational decision-making, ultimately leading to a more successful trading experience. The goal is to train your mind to respond to market changes with logic rather than emotion, allowing you to navigate the crypto landscape with confidence.

Q: How can I identify my emotional triggers in trading?

A: Start by keeping a trading journal where you note your trades and the emotions you experienced during each transaction. Over time, you’ll begin to see patterns and can identify which situations lead to emotional responses.

Q: What are some strategies to manage emotional triggers?

A: You can manage emotional triggers by setting predefined trading rules, using stop-loss orders, and practicing mindfulness techniques to stay calm during market fluctuations.

Q: Why is emotional control important in crypto trading?

A: Emotional control helps you make rational decisions rather than impulsive ones, reducing the risk of significant losses and improving your overall trading performance.

Practicing Discipline

Discipline is the backbone of successful crypto trading. Without it, even the most knowledgeable traders can find themselves spiraling into impulsive decisions that can lead to significant losses. Think of discipline as a sturdy fence around your garden; it keeps out the weeds of emotional decision-making, allowing your investments to flourish. So, how can you cultivate this essential trait in your trading practice?

First and foremost, developing a solid trading plan is crucial. A well-structured plan serves as a roadmap, guiding you through the tumultuous landscape of cryptocurrency markets. It should outline your entry and exit strategies, risk management techniques, and specific goals. By adhering to this plan, you can resist the temptation to make rash decisions driven by market noise or emotional fluctuations. Remember, a plan is only as good as your commitment to it.

Moreover, setting specific rules for your trading activities can help maintain discipline. For instance, you might establish a rule that you will never risk more than 1% of your total capital on a single trade. This kind of guideline not only protects your investments but also reinforces a disciplined mindset. Here are a few examples of rules you might consider:

- Limit your daily trades to a maximum of three.

- Never chase losses; if a trade goes against you, stick to your stop-loss and move on.

- Review your trades at the end of each week to identify areas for improvement.

Additionally, keeping a trading journal can be a game-changer. Documenting your trades, including your thought process and emotional state at the time, allows you to reflect on your behavior and decision-making patterns. Over time, you will start to recognize which emotions lead you astray and how to counteract them. This practice not only enhances your self-awareness but also fosters a disciplined approach to trading.

Another vital aspect of practicing discipline is avoiding overtrading. It's easy to get caught up in the excitement of the market, especially with the rapid price movements typical in cryptocurrencies. However, overtrading can lead to burnout and poor decision-making. Establish specific trading hours for yourself, and stick to them. This approach helps you maintain a healthy balance between trading and other life responsibilities.

Lastly, embracing patience is essential. The crypto market can be incredibly volatile, and it may take time for your trading strategies to yield results. Resist the urge to act hastily in response to short-term market fluctuations. Instead, trust in your analysis and the strategies you’ve developed. By practicing patience, you’re not only respecting your plan but also allowing your investments the time they need to mature.

In summary, practicing discipline in crypto trading involves creating a detailed trading plan, setting specific rules, maintaining a trading journal, avoiding overtrading, and embracing patience. By incorporating these elements into your trading routine, you'll be better equipped to navigate the unpredictable waters of cryptocurrency markets and achieve long-term success.

Q: How can I improve my trading discipline?

A: Improving your trading discipline involves creating a solid trading plan, setting specific rules, maintaining a trading journal, and being patient with your strategies.

Q: What are some common emotional pitfalls in trading?

A: Common emotional pitfalls include fear of missing out (FOMO), fear of loss, and overconfidence. Recognizing these triggers can help you manage your emotions better.

Q: How often should I review my trading strategies?

A: Regular reviews, such as weekly or monthly, can help you identify patterns and improve your strategies based on past performance and changing market conditions.

Reviewing and Adjusting Strategies

In the ever-evolving world of crypto trading, regularly reviewing and adjusting your strategies is not just a good practice; it’s a necessity. The crypto market is notorious for its volatility, and what worked yesterday may not work today. Think of it like a ship navigating through stormy seas; if the captain doesn’t adjust the sails, the ship could easily capsize. By consistently evaluating your trading strategies, you can identify what’s working, what’s not, and how to pivot effectively.

First and foremost, analyzing past trades is essential. This isn’t just about tallying up wins and losses; it’s about digging deep to understand the why behind each result. Were your decisions based on solid analysis, or were they influenced by emotions? Did you stick to your trading plan, or did you deviate? By reflecting on these questions, you can uncover patterns in your trading behavior. A simple table can help you visualize your performance:

| Date | Trade Type | Outcome | Notes |

|---|---|---|---|

| 2023-10-01 | Buy Bitcoin | Profit | Followed plan |

| 2023-10-05 | Sell Ethereum | Loss | Emotional decision |

| 2023-10-10 | Buy Cardano | Profit | Market analysis |

This table is a simple yet powerful tool for tracking your trades. It allows you to spot trends over time, such as whether you tend to make better decisions when following a specific strategy. Remember, the goal is to learn from your experiences. If you notice that certain types of trades consistently lead to losses, it’s time to rethink your approach.

Another crucial aspect of reviewing your strategies is adapting to market changes. The crypto landscape can shift dramatically due to regulatory news, technological advancements, or market sentiment. For instance, if a major exchange announces a security breach, it could cause market panic that affects your holdings. Staying flexible in your trading strategies allows you to respond to these changes promptly. This means not being afraid to adjust your risk management techniques, such as setting tighter stop-loss orders or diversifying your portfolio further.

Moreover, maintaining a trading journal can be immensely beneficial. Documenting each trade, along with your thought process and the context surrounding it, can reveal insights that you might overlook otherwise. Over time, this journal becomes a treasure trove of knowledge, helping you refine your strategies and avoid previous mistakes.

Ultimately, reviewing and adjusting your strategies is an ongoing process. It’s about creating a feedback loop where you learn continuously and evolve as a trader. So, ask yourself: are you ready to take the necessary steps to refine your trading approach? Are you willing to adapt and grow, even when the market throws curveballs your way? Embrace the journey of learning and improvement, and you’ll find yourself better equipped to navigate the unpredictable waters of crypto trading.

- How often should I review my trading strategies? It's advisable to review your strategies regularly, ideally after each trading session or at least once a week.

- What should I focus on when analyzing past trades? Focus on your decision-making process, the market conditions at the time, and whether you adhered to your trading plan.

- How can I adapt my strategies to market changes? Stay informed about market news, analyze trends, and be willing to adjust your risk management techniques as needed.

- Is it necessary to keep a trading journal? Yes, a trading journal can help you track your performance, identify patterns, and learn from your experiences.

Analyzing Past Trades

When it comes to mastering the art of crypto trading, one of the most powerful tools at your disposal is the ability to analyze your past trades. Think of it as your own personal trading detective work, where you sift through the evidence of your previous decisions to uncover patterns, mistakes, and opportunities for improvement. This process not only helps you understand what went right or wrong but also equips you with the knowledge to refine your strategies moving forward.

To begin your analysis, it's essential to gather all relevant data from your past trades. This includes the entry and exit points, the size of your positions, the assets traded, and the market conditions at the time. By compiling this information, you can create a comprehensive overview of your trading history. Consider using a spreadsheet to track these details, as it allows for easy manipulation and visualization of your data. Here’s a simple structure you might follow:

| Trade Date | Asset | Entry Price | Exit Price | Position Size | Profit/Loss |

|---|---|---|---|---|---|

| 2023-01-15 | Bitcoin (BTC) | $40,000 | $42,000 | 1 BTC | $2,000 |

| 2023-02-10 | Ethereum (ETH) | $2,500 | $2,300 | 5 ETH | -$1,000 |

Once you have your data organized, start looking for trends. Ask yourself questions like: What types of trades were most successful? Did I tend to perform better in bullish or bearish markets? Were there specific times of day or week when I was more profitable? By answering these questions, you can identify strengths to capitalize on and weaknesses to address.

It's also crucial to evaluate your emotional state during these trades. Did fear or greed influence your decisions? Were there moments when you deviated from your trading plan? Recognizing these emotional triggers can help you develop strategies to maintain discipline in future trades. For instance, if you notice that you tend to panic sell during market dips, consider implementing a rule to hold your positions for a predetermined period before making any drastic decisions.

After analyzing your trades, it’s time to put your insights into action. This means adjusting your trading strategy based on what you've learned. Perhaps you’ll decide to focus more on certain assets that have historically performed well for you, or maybe you'll implement stricter risk management techniques to minimize losses. The key is to remain flexible and willing to adapt as you gather more data from your ongoing trading activities.

In conclusion, analyzing past trades is not just about tallying profits and losses; it's about understanding your trading behavior and continuously evolving as a trader. By taking the time to reflect on your experiences, you can cultivate a more informed, disciplined approach that leads to greater success in the volatile world of cryptocurrency trading.

- Why is analyzing past trades important? Analyzing past trades helps traders identify patterns, learn from mistakes, and refine their strategies for better future performance.

- What should I include in my trade analysis? Key details to include are trade dates, assets, entry and exit prices, position sizes, and profit or loss.

- How can I track my trades effectively? Using a spreadsheet or trading journal can help you organize and analyze your trading data efficiently.

- What emotional factors should I consider in my analysis? Recognizing emotional triggers like fear and greed can help you maintain discipline and improve decision-making in future trades.

Adapting to Market Changes

In the fast-paced world of cryptocurrency trading, the ability to adapt to market changes can be the difference between a successful trade and a costly mistake. The crypto market is notorious for its volatility, where prices can swing dramatically in a matter of minutes. This unpredictability means that traders must be ready to pivot their strategies at a moment's notice. But how do you effectively adapt to these ever-changing conditions?

First and foremost, staying informed is crucial. Regularly checking market updates, news, and trends can provide valuable insights into how external factors might influence prices. For instance, a sudden regulatory announcement or a major technological breakthrough can have immediate repercussions on the market. By keeping a finger on the pulse of the industry, traders can adjust their strategies accordingly. Consider setting up alerts for significant news events that could impact your investments.

Another essential aspect of adapting to market changes is flexibility in your trading strategy. This means being open to revising your approach based on new information. If a particular coin is experiencing a downturn due to negative news, it might be prudent to reassess your position. Are you holding on for dear life, hoping for a rebound, or are you willing to cut your losses and reallocate your resources? The latter often requires a level of emotional control, but it can save you from larger losses down the line.

Moreover, utilizing technical analysis can aid in adapting your trading strategy. By analyzing price charts and identifying patterns, you can make more informed decisions about when to enter or exit trades. For example, if you notice a consistent downtrend in a cryptocurrency's price, it might be wise to either sell your holdings or wait for a more favorable price point. Understanding indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can provide you with the tools needed to navigate these turbulent waters.

Lastly, consider creating a plan that includes specific criteria for adjusting your strategies. This plan should outline what conditions warrant a change in your approach. For instance, you might decide that if a cryptocurrency drops below a certain support level, you will exit your position. By having a predefined plan, you can reduce the emotional burden of making decisions on the fly, allowing you to react to market changes more effectively.

In summary, adapting to market changes is not just about reacting to the current state of affairs; it's about proactively preparing for potential shifts. By staying informed, being flexible, employing technical analysis, and having a solid plan in place, you can navigate the unpredictable waters of cryptocurrency trading with confidence.

- What is the best way to stay updated on market changes? Regularly check reliable news sources, set up alerts, and follow industry leaders on social media.

- How often should I review my trading strategy? It's advisable to review your strategy at least once a month or after significant market events.

- What indicators should I focus on for technical analysis? Key indicators include moving averages, RSI, and MACD, which can help identify trends and potential reversal points.

- How can I manage my emotions while trading? Implementing a trading plan, setting clear goals, and practicing discipline can help maintain emotional control.

Frequently Asked Questions

-

What is a risk management strategy in crypto trading?

A risk management strategy in crypto trading is a set of guidelines that helps traders identify, assess, and mitigate potential risks associated with their investments. It involves understanding market volatility, defining risk appetite, and employing techniques like diversification and stop-loss orders to protect capital.

-

Why is it important to understand my risk appetite?

Understanding your risk appetite is crucial because it defines how much risk you are willing to take on in your trading activities. Knowing your comfort level with potential losses allows you to make informed decisions that align with your financial goals and emotional tolerance, ultimately leading to more successful trading outcomes.

-

How can I set clear investment goals?

To set clear investment goals, start by evaluating your financial situation and determining what you want to achieve with your investments. Consider whether you have short-term or long-term goals, and align your trading strategies accordingly. This clarity will help you stay focused and disciplined in your trading approach.

-

What are some effective risk mitigation techniques?

Effective risk mitigation techniques include diversification of your portfolio, using stop-loss orders to limit potential losses, and determining appropriate position sizes based on your overall capital and risk tolerance. These strategies can help minimize risks while maximizing potential returns.

-

How can I monitor market conditions effectively?

You can monitor market conditions effectively by utilizing various tools such as price alerts, trading platforms with real-time data, and following reliable news sources. Staying updated on market trends and regulatory changes will help you make timely and informed trading decisions.

-

What role does emotional control play in trading?

Emotional control is vital in trading because it helps you avoid impulsive decisions driven by fear or greed. By recognizing your emotional triggers and practicing discipline, you can stick to your trading plan and make rational decisions, even in volatile market situations.

-

How often should I review and adjust my trading strategies?

You should review and adjust your trading strategies regularly, ideally after significant market movements or at the end of each trading period. Analyzing past trades helps you learn from mistakes and adapt your strategies to changing market conditions, ensuring long-term success in your trading endeavors.