Understanding the Role of the IRS in Cryptocurrency Taxation

In recent years, the rise of cryptocurrencies has transformed the financial landscape, capturing the attention of investors, tech enthusiasts, and, importantly, the Internal Revenue Service (IRS). As digital currencies like Bitcoin and Ethereum gain popularity, understanding how the IRS approaches cryptocurrency taxation becomes essential for anyone engaging in these transactions. The IRS has made it clear that cryptocurrencies are treated as property for tax purposes, which means that the same rules that apply to stocks and real estate also apply to your digital assets. But what does that really mean for taxpayers? Let’s dive deeper into the intricate world of cryptocurrency taxation.

First and foremost, it’s crucial to grasp the basics of how cryptocurrencies are taxed. When you buy, sell, or trade cryptocurrencies, you are potentially realizing gains or losses, which must be reported to the IRS. The key here is that every time you sell or exchange your cryptocurrency for goods, services, or even other cryptocurrencies, you may trigger a taxable event. This can feel overwhelming, especially for newcomers to the crypto market, but don’t worry—understanding the fundamental principles can help demystify the process.

So, how does the IRS define gains and losses in the realm of cryptocurrencies? Essentially, it boils down to the difference between what you paid for the asset (your basis) and what you sold it for. If you sold your Bitcoin for more than you purchased it, congratulations—you have a capital gain! Conversely, if you sold it for less, you’ve incurred a capital loss. This is similar to selling a stock; the IRS expects you to report these transactions accurately, which can lead to tax liabilities or, in some cases, tax deductions.

Now, let’s talk about the IRS guidelines surrounding cryptocurrency transactions. The IRS has issued specific instructions that outline how taxpayers should report their crypto activities. For individual taxpayers, it means keeping meticulous records of every transaction, including the date, amount, and purpose. Businesses, on the other hand, face additional complexities, as they must also consider the implications of accepting cryptocurrency as payment. The IRS has made it clear that failing to adhere to these guidelines can lead to significant penalties, so staying informed is paramount.

Moreover, cryptocurrencies can be classified in various ways for tax purposes, which can affect how you report your transactions. Generally, cryptocurrencies are considered property, but they can also fall into categories such as capital assets or ordinary income, depending on the context of the transaction. For instance, if you receive cryptocurrency as payment for goods or services, it’s treated as ordinary income, while trades and sales are viewed as capital gains. Understanding these classifications is vital for accurate reporting and compliance.

One of the most critical distinctions taxpayers must grasp is between capital gains and ordinary income. Capital gains arise from the sale of an asset, while ordinary income includes wages, tips, and other forms of compensation. The tax rates applied to these two categories can differ significantly, making it essential to categorize your transactions correctly. For example, short-term capital gains—those from assets held for less than a year—are taxed at your ordinary income rate, whereas long-term capital gains benefit from lower tax rates.

With the IRS ramping up enforcement actions and clarifying reporting obligations, it’s more important than ever for taxpayers to understand their responsibilities. Failure to report cryptocurrency transactions can lead to hefty fines and even legal repercussions. Therefore, keeping detailed records is not just a good practice; it’s a necessity. As the crypto landscape evolves, so too do the IRS regulations, making it crucial for taxpayers to stay informed and compliant.

- Do I have to pay taxes on cryptocurrency transactions? Yes, any gains from the sale or exchange of cryptocurrency are subject to taxation.

- How do I report cryptocurrency on my taxes? You must report your gains and losses on your tax return using the appropriate forms.

- What happens if I don’t report my cryptocurrency transactions? Failing to report can result in penalties, fines, and potential legal action from the IRS.

- Are there any exemptions for cryptocurrency taxes? Currently, there are no specific exemptions; all transactions must be reported.

The Basics of Cryptocurrency Taxation

Understanding how cryptocurrencies are taxed is crucial for compliance in today's digital economy. With the rise of Bitcoin, Ethereum, and countless altcoins, many people are diving into the world of cryptocurrencies. However, with this exciting venture comes the responsibility of adhering to tax regulations. So, how exactly does the IRS view these digital assets? Well, the IRS treats cryptocurrencies as property, not currency. This means that every time you sell or exchange your crypto, it can trigger a taxable event. Just like selling a stock, if you sell your cryptocurrency for more than you paid for it, you might have to pay capital gains tax on the profit.

To break it down further, let's explore the fundamental principles of cryptocurrency taxation. First, you need to know how gains and losses are calculated. When you sell or trade your crypto, the IRS requires you to report the difference between what you sold it for and what you originally paid. This is known as your cost basis. For instance, if you bought 1 Bitcoin for $5,000 and later sold it for $10,000, your capital gain would be $5,000. Conversely, if the market dips and you sell at a loss, you can use that loss to offset other capital gains or even deduct it from your taxable income, up to a certain limit.

Additionally, it’s essential to keep accurate records of all your transactions. The IRS expects taxpayers to maintain detailed records of purchases, sales, and exchanges of cryptocurrencies. This includes the date of the transaction, the amount of cryptocurrency involved, and the fair market value at the time of the transaction. Without proper documentation, you might find yourself in a tricky situation come tax season.

Here’s a quick overview of some key points to remember about cryptocurrency taxation:

- Taxable Events: Selling, trading, or using cryptocurrency to purchase goods and services can trigger taxes.

- Holding Period: The length of time you hold your cryptocurrency can affect the tax rate applied to your gains.

- Reporting Requirements: You must report all transactions, even if they result in a loss.

In conclusion, navigating the world of cryptocurrency taxation can be complex, but understanding the basics is the first step toward compliance. As you engage with digital currencies, remember that the IRS is watching, and staying informed will help you avoid any pitfalls along the way.

IRS Guidelines on Cryptocurrency

When it comes to the world of cryptocurrency, the IRS (Internal Revenue Service) has laid down some clear guidelines that every taxpayer should be aware of. These guidelines are not just arbitrary rules; they are essential for ensuring that individuals and businesses comply with tax laws while navigating this fast-paced financial landscape. Understanding these regulations can save you from potential headaches and penalties down the road. So, what exactly does the IRS say about cryptocurrency?

First off, it's crucial to recognize that the IRS treats cryptocurrencies as property rather than currency. This means that transactions involving cryptocurrencies are subject to the same tax principles that apply to property transactions. In practical terms, if you sell, exchange, or even use cryptocurrency to purchase goods or services, you may trigger a taxable event. The IRS requires taxpayers to report gains and losses on their tax returns, which can be a bit overwhelming for those new to the crypto world.

The IRS has also provided guidance on how to calculate these gains and losses. Generally, the gain or loss is determined by the difference between the fair market value of the cryptocurrency at the time of the transaction and your adjusted basis in the cryptocurrency (essentially what you paid for it). This can get complicated, especially if you’ve bought and sold your cryptocurrency at different prices. To simplify, let’s take a look at a quick example:

| Transaction | Purchase Price | Sale Price | Gain/Loss |

|---|---|---|---|

| Bitcoin Purchase | $5,000 | N/A | N/A |

| Bitcoin Sale | $N/A | $7,000 | $2,000 Gain |

As you can see, if you bought Bitcoin for $5,000 and then sold it for $7,000, you would report a $2,000 gain. However, if you had sold it for $3,000 instead, you would report a $2,000 loss. This example highlights the importance of keeping meticulous records of all your cryptocurrency transactions to ensure accurate reporting come tax season.

Moreover, the IRS has emphasized the importance of reporting cryptocurrency transactions accurately. This includes not only sales but also exchanges between different cryptocurrencies, as these transactions can also trigger capital gains or losses. Failing to report these transactions can lead to significant penalties, including fines and interest on unpaid taxes. The IRS has even implemented measures to identify non-compliant taxpayers, so it’s vital to stay on top of your reporting obligations.

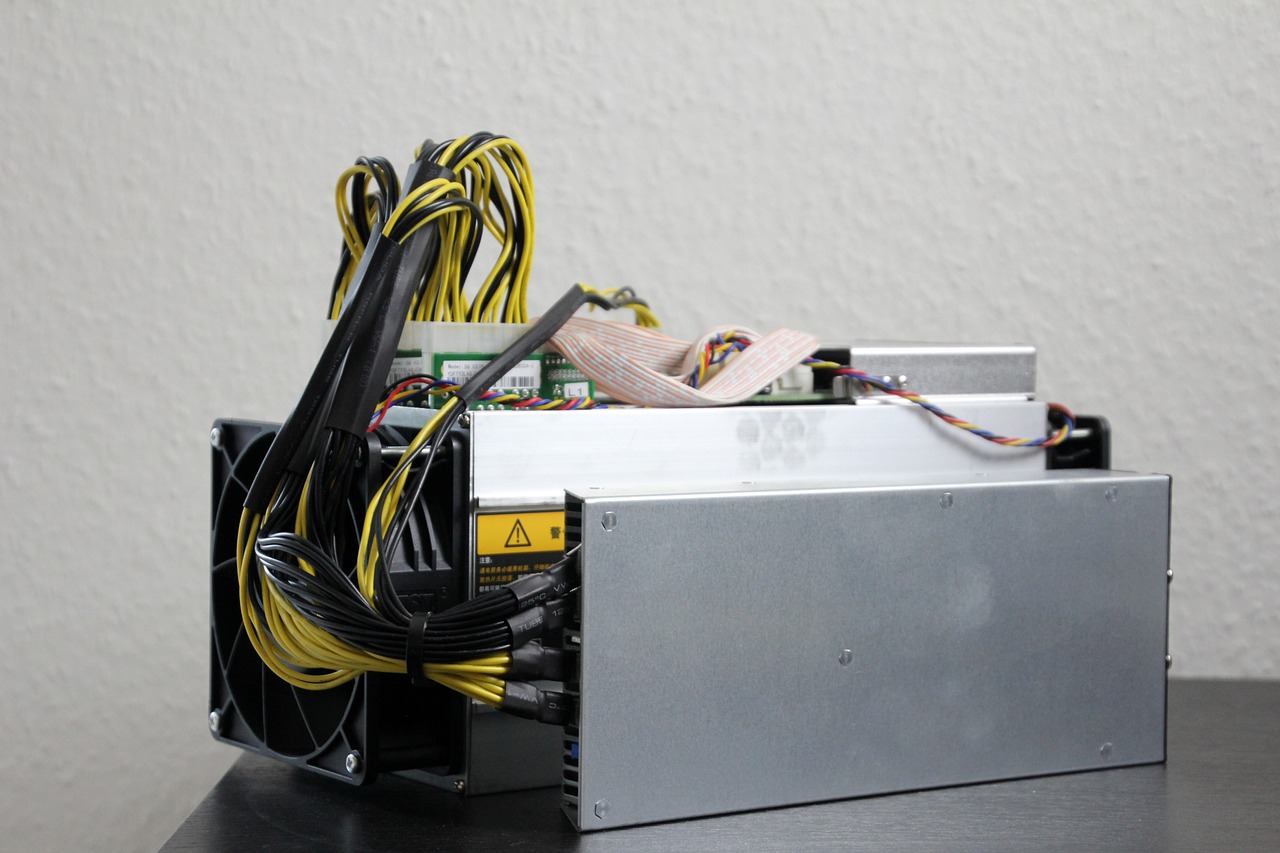

For those who mine cryptocurrency, the IRS has specific guidelines as well. If you mine cryptocurrency, the fair market value of the coins at the time they are mined is considered ordinary income and must be reported on your tax return. This can add another layer of complexity, especially if you are mining multiple cryptocurrencies or engaging in mining as a business.

In summary, the IRS has established clear guidelines regarding cryptocurrency transactions that every taxpayer should understand. By treating cryptocurrencies as property and requiring reporting of gains and losses, the IRS aims to ensure compliance in this rapidly evolving financial environment. As the landscape of cryptocurrency continues to change, staying informed about IRS guidelines will help you navigate your tax obligations effectively.

Classification of Cryptocurrencies

When it comes to understanding cryptocurrency taxation, one of the first hurdles is grasping how the IRS classifies these digital assets. The classification of cryptocurrencies is not just a matter of semantics; it has real implications for tax reporting and compliance. Essentially, cryptocurrencies can be categorized into several classes, each with its own tax treatment. The most common classifications include:

- Currency: Some cryptocurrencies, like Bitcoin and Litecoin, are treated as currencies. This means that transactions using these digital currencies are subject to capital gains tax, similar to traditional currencies.

- Property: The IRS classifies most cryptocurrencies as property rather than currency. This classification means that any gains or losses from the sale or exchange of cryptocurrencies are subject to capital gains tax.

- Investment Assets: Many investors treat cryptocurrencies as investment assets, which can lead to different tax implications based on the holding period and the nature of the transactions.

Understanding these classifications is crucial because they dictate how taxpayers report their cryptocurrency transactions. For example, if you sell Bitcoin for a profit, it’s essential to calculate the capital gain accurately, taking into account your initial purchase price and the sale price.

Additionally, the classification can vary based on the specific use case of the cryptocurrency. For instance, if a cryptocurrency is used as a utility token within a specific platform, it may be treated differently than a currency used for general transactions. This nuance can complicate tax reporting, especially for individuals who are actively trading or using various cryptocurrencies for different purposes.

Moreover, it’s worth noting that the IRS is continually updating its guidelines as the cryptocurrency landscape evolves. Taxpayers must stay informed about these changes to ensure compliance and avoid potential penalties. The classification of cryptocurrencies may also influence the way in which taxpayers can deduct losses or report income, making it essential to consult with a tax professional who understands the intricacies of cryptocurrency taxation.

In summary, the classification of cryptocurrencies plays a pivotal role in how they are taxed. Whether viewed as currency, property, or investment assets, each classification carries distinct tax implications. Therefore, it’s crucial for taxpayers to be aware of these classifications and how they apply to their individual situations.

1. What is the primary classification of cryptocurrencies for tax purposes?

Most cryptocurrencies are classified as property by the IRS, meaning that transactions are subject to capital gains tax.

2. Can cryptocurrencies be classified as currency?

Yes, some cryptocurrencies like Bitcoin can be treated as currencies, but they are primarily classified as property for tax purposes.

3. How does the classification affect tax reporting?

The classification determines how gains and losses are calculated and reported, which can impact the overall tax liability.

Capital Gains vs. Ordinary Income

Understanding the distinction between capital gains and ordinary income is essential for anyone involved in cryptocurrency transactions. This differentiation is not just a matter of semantics; it has significant implications for how you report your earnings to the IRS and the amount of tax you ultimately owe. In simple terms, capital gains arise from the sale of an asset, in this case, cryptocurrencies, when the sale price exceeds the purchase price. For instance, if you bought Bitcoin at $5,000 and later sold it for $10,000, your capital gain would be $5,000. This gain is typically taxed at a lower rate than ordinary income, which is the money you earn from your job or other sources, like rental income or interest from savings accounts.

On the flip side, ordinary income includes wages, salaries, and any income earned from business activities. When you receive cryptocurrency as payment for services rendered or as a salary, you must report that as ordinary income. The IRS treats this income as equivalent to cash, meaning you would report it at its fair market value at the time you receive it. For example, if you were paid 1 Bitcoin when its value was $8,000, you would need to report that amount as ordinary income, regardless of what you may later do with that Bitcoin.

The tax rates for capital gains can vary depending on how long you've held the asset. If you hold a cryptocurrency for more than a year before selling, it qualifies for the long-term capital gains rate, which is generally lower than the short-term capital gains rate applied to assets held for less than a year. This is a crucial point for investors to consider when planning their transactions. Long-term capital gains can be taxed at rates ranging from 0% to 20%, depending on your taxable income, while short-term capital gains are taxed at your ordinary income tax rate, which can be significantly higher.

To illustrate this further, here’s a simple table comparing the two types of income:

| Type of Income | Definition | Tax Rate |

|---|---|---|

| Capital Gains | Profit from the sale of an asset | 0% - 20% (depending on holding period and income) |

| Ordinary Income | Income earned from work or services | Taxed at ordinary income rates (10% - 37%) |

In summary, grasping the difference between capital gains and ordinary income is vital for anyone engaged in cryptocurrency transactions. Not only does it affect how you report your earnings, but it also influences your overall tax liability. With the rapid evolution of the cryptocurrency landscape, staying informed about these distinctions can help you navigate your financial obligations more effectively and avoid potential pitfalls with the IRS.

Frequently Asked Questions

- What is the current tax rate for capital gains? The tax rate for capital gains can range from 0% to 20%, depending on your income level and how long you've held the asset.

- How do I report cryptocurrency received as payment? Cryptocurrency received as payment should be reported as ordinary income at its fair market value on the date you received it.

- What happens if I don’t report my cryptocurrency transactions? Failing to report cryptocurrency transactions can lead to penalties, including fines and interest on unpaid taxes.

Tax Reporting Obligations

When it comes to cryptocurrency, understanding your is not just important—it's essential. The IRS has made it clear that all cryptocurrency transactions must be reported, and failing to do so can lead to hefty penalties. If you're thinking about ignoring those transactions because they seem small or insignificant, think again! The IRS has sophisticated tools and methods to track cryptocurrency transactions, and they are not shy about using them.

So, what exactly do you need to report? Generally, if you sell, trade, or even use your cryptocurrency to purchase goods or services, you are required to report any gains or losses. This means that every time you exchange your Bitcoin for Ethereum or buy a cup of coffee with Litecoin, you need to keep meticulous records. It might feel overwhelming, but keeping track of your transactions can save you from future headaches. Consider using a spreadsheet to log every transaction, including:

- The date of the transaction

- The amount of cryptocurrency involved

- The fair market value at the time of the transaction

- Any fees associated with the transaction

It's also crucial to differentiate between short-term and long-term capital gains. If you've held your cryptocurrency for over a year before selling, you may qualify for lower long-term capital gains tax rates. However, if you sell within a year of acquiring it, you will be subject to the higher short-term capital gains tax rates, which are taxed as ordinary income. The tax implications can be significant, so understanding these distinctions can help you plan accordingly.

Additionally, the IRS requires taxpayers to answer a specific question on Form 1040 regarding cryptocurrency transactions. This question is designed to ensure that taxpayers are aware of their obligations and are reporting their activities correctly. Ignoring this question can lead to increased scrutiny from the IRS, so it's better to be safe than sorry.

Moreover, if you're involved in mining cryptocurrencies, the income generated from mining is also taxable and must be reported as ordinary income. This means that if you've mined coins, you should include the fair market value of the coins at the time they were mined as part of your income. It's a good idea to consult with a tax professional who understands the intricacies of cryptocurrency taxation to ensure you're compliant and taking advantage of any deductions available to you.

In summary, staying on top of your tax reporting obligations regarding cryptocurrency is not just a good practice; it's a necessity. By keeping detailed records and understanding the different classifications of your transactions, you can navigate the complex world of cryptocurrency taxation with confidence. Remember, the IRS is watching, and being proactive about your reporting can save you from potential legal troubles down the line.

Q: Do I need to report cryptocurrency transactions if I didn't make a profit?

A: Yes, you still need to report all transactions, even if there was no profit. The IRS requires you to report gains and losses to determine your tax obligations accurately.

Q: What forms do I need to fill out for cryptocurrency transactions?

A: Most taxpayers will report their cryptocurrency transactions on Form 8949 and then summarize this information on Schedule D of Form 1040.

Q: How long should I keep records of my cryptocurrency transactions?

A: It's advisable to keep records for at least three years from the date you file your tax return, or longer if you have significant transactions or if you are involved in business activities related to cryptocurrency.

Common Tax Scenarios Involving Cryptocurrencies

When diving into the world of cryptocurrencies, it's not just about buying and selling; it's about understanding the tax implications that come with every transaction. Picture this: you’ve just bought some Bitcoin, and a few months later, its value skyrockets. You decide to sell, thinking you’ve hit the jackpot. But wait! Have you considered how that sale will affect your taxes? In this section, we’ll explore some of the most common tax scenarios that taxpayers encounter when dealing with cryptocurrencies and what you need to know to stay compliant.

First off, let’s discuss the scenario of buying and selling cryptocurrencies. If you purchase Bitcoin for $10,000 and later sell it for $15,000, that $5,000 gain is considered a capital gain and is subject to taxation. However, if you had bought it for $15,000 and sold it for $10,000, you would incur a capital loss, which can potentially offset other gains you may have. This is a critical aspect of tax planning, as capital losses can reduce your overall tax liability.

Another common scenario is trading one cryptocurrency for another. For example, if you trade Ethereum for Litecoin, the IRS treats this as a taxable event. You need to report the fair market value of the Ethereum you traded at the time of the transaction. This means if you bought Ethereum at $1,000 and traded it for Litecoin valued at $1,200, you have a $200 taxable gain, even though you didn’t cash out into fiat currency. This can be a real eye-opener for many investors who think they’re only taxed when they convert to cash.

Then there’s the issue of staking and earning interest. If you stake your cryptocurrencies to earn rewards or interest, those rewards are also taxable as ordinary income at their fair market value at the time you receive them. So, if you earn $100 worth of crypto from staking, that amount is subject to income tax, regardless of whether you decide to sell it or hold onto it.

Additionally, let’s not forget about airdrops and forks. If you receive tokens from an airdrop or a hard fork, these are considered income and must be reported. The value of the tokens at the time you receive them is what you’ll need to report as taxable income. For instance, if you received tokens worth $300 from an airdrop, you’d need to report that on your tax return.

To summarize, here are some common scenarios you might encounter:

- Buying and selling cryptocurrencies: Report capital gains or losses based on the purchase and sale price.

- Trading cryptocurrencies: Taxable event; report the fair market value of the traded asset.

- Staking rewards: Taxable as ordinary income at the time of receipt.

- Airdrops and forks: Taxable income based on the fair market value when received.

Understanding these scenarios is crucial for navigating the complex landscape of cryptocurrency taxation. Not only does it help you stay compliant with IRS regulations, but it also allows you to plan your investments more strategically. After all, no one wants to be caught off guard when tax season rolls around!

Q: Do I need to report cryptocurrency transactions if I didn't make a profit?

A: Yes, you are required to report all cryptocurrency transactions, even if they result in a loss. Reporting losses can help offset gains from other transactions.

Q: What if I forget to report a transaction?

A: It's essential to amend your tax return if you discover an unreported transaction. The IRS has strict rules regarding compliance, and failing to report can lead to penalties.

Q: Are there any tax-free ways to use cryptocurrencies?

A: Yes, certain transactions, like using cryptocurrencies for purchases under a specific threshold, may qualify for tax exclusions, but it's best to consult a tax professional for guidance.

Recent Developments in Cryptocurrency Taxation

As the world of cryptocurrency continues to grow and evolve, so too does the regulatory landscape surrounding it. The IRS has been actively updating its guidelines and enforcement strategies to keep pace with the rapid changes in this digital financial realm. Recent developments have brought to light several key aspects that every taxpayer should be aware of. For instance, the IRS has made significant strides in clarifying how different types of cryptocurrency transactions should be reported, which is crucial for compliance. These updates not only aim to simplify the tax filing process but also to ensure that taxpayers are fully aware of their obligations.

One of the most notable developments is the introduction of new forms and reporting requirements specifically tailored for cryptocurrency transactions. In 2022, the IRS began requiring taxpayers to report cryptocurrency transactions on Form 1040, Schedule 1, which includes questions about any digital assets sold or exchanged. This change has created a ripple effect, prompting taxpayers to pay closer attention to their transactions and potential tax liabilities. It's not just about buying and selling anymore; even simple actions like trading one cryptocurrency for another can trigger tax implications.

Moreover, the IRS has ramped up its enforcement actions against those who fail to report their cryptocurrency transactions accurately. With the increasing use of blockchain technology, the IRS has the ability to trace transactions more effectively than ever before. This means that taxpayers who underestimate the importance of reporting their cryptocurrency gains might find themselves facing audits or penalties. The message is clear: the IRS is watching, and compliance is more important than ever.

In addition to enforcement actions, legislative changes are also making waves in the cryptocurrency taxation landscape. Lawmakers are currently debating new bills that could impact how cryptocurrencies are classified and taxed. For instance, there are proposals on the table that aim to provide clearer definitions of what constitutes a digital asset, which could help in standardizing reporting requirements across different states. This could lead to a more cohesive framework for taxpayers, allowing them to navigate the complexities of cryptocurrency taxation with greater ease.

Furthermore, the IRS has been collaborating with other government agencies to enhance their understanding of the cryptocurrency market. This partnership aims to create a more comprehensive approach to regulating and taxing digital assets, ensuring that taxpayers are not only compliant but also informed. As the IRS continues to adapt to the evolving landscape, taxpayers can expect more updates and guidelines in the coming months.

In summary, recent developments in cryptocurrency taxation are reshaping the way taxpayers approach their digital investments. With new reporting requirements, increased enforcement, and potential legislative changes on the horizon, it's crucial for individuals and businesses to stay informed. Ignoring these developments could lead to significant tax liabilities and penalties, so being proactive is key. As always, consulting with a tax professional who understands the intricacies of cryptocurrency is advisable to navigate these changes effectively.

- What are the new reporting requirements for cryptocurrency transactions?

The IRS now requires taxpayers to report cryptocurrency transactions on Form 1040, Schedule 1, which includes specific questions about digital asset sales or exchanges. - How does the IRS enforce cryptocurrency tax compliance?

The IRS utilizes blockchain technology to trace transactions and identify taxpayers who may not be accurately reporting their cryptocurrency gains, leading to potential audits or penalties. - Are there any legislative changes affecting cryptocurrency taxation?

Yes, lawmakers are currently discussing new bills that may provide clearer definitions and classifications for digital assets, potentially standardizing reporting requirements. - Should I consult a tax professional for cryptocurrency tax issues?

Absolutely! Given the complexities of cryptocurrency taxation, it's highly recommended to seek advice from a tax professional who is knowledgeable in this area.

Legislative Changes

As the world of cryptocurrency continues to evolve at breakneck speed, so too does the legislative framework surrounding it. can have profound implications for how cryptocurrencies are taxed, and staying informed is crucial for both individual taxpayers and businesses. In recent years, lawmakers have been grappling with how to regulate this digital frontier, leading to a flurry of new proposals and amendments aimed at clarifying the tax implications of cryptocurrency transactions.

One significant area of focus has been the classification of cryptocurrencies. For example, some legislators are advocating for clearer definitions that distinguish between different types of digital assets. This is important because the tax treatment can vary widely based on classification. If a cryptocurrency is classified as a currency, it might be treated differently than if it's considered a commodity or security. Consequently, taxpayers may find themselves navigating a complex web of regulations that could affect their tax liabilities.

Moreover, the Infrastructure Investment and Jobs Act, enacted in late 2021, introduced provisions that require brokers to report digital asset transactions to the IRS. This change aims to enhance transparency and ensure that taxpayers are accurately reporting their cryptocurrency gains. However, this has raised concerns among many in the crypto community about the potential for overreach and the burden it places on smaller entities who may not have the resources to comply with stringent reporting requirements.

In addition to federal legislation, states are also taking steps to regulate cryptocurrency taxation. Some states have begun to implement their own rules, which can create a patchwork of regulations that vary significantly from one jurisdiction to another. For instance, while some states may offer tax incentives for cryptocurrency-related businesses, others may impose hefty taxes that could stifle innovation. This inconsistency can be frustrating for taxpayers who are trying to navigate their obligations across different states.

To further complicate matters, there have been ongoing discussions about the introduction of a digital currency issued by the Federal Reserve. If such a currency were to be implemented, it could fundamentally change the landscape of cryptocurrency taxation. Taxpayers would need to stay vigilant and adapt to new rules that could emerge as the government seeks to regulate this new form of digital currency.

In summary, the legislative landscape surrounding cryptocurrency taxation is in a state of flux. Taxpayers must remain proactive in understanding how these changes could impact their financial obligations. With the potential for new regulations on the horizon, it's essential to keep an eye on both federal and state-level developments. Engaging with tax professionals who specialize in cryptocurrency can provide valuable insights and help ensure compliance in this ever-evolving environment.

- What are the recent legislative changes affecting cryptocurrency taxation?

Recent laws have introduced stricter reporting requirements for digital asset transactions and clarified the classification of cryptocurrencies for tax purposes. - How do state regulations differ regarding cryptocurrency?

State regulations vary widely, with some states offering tax incentives while others impose higher taxes on cryptocurrency transactions. - What should I do if I'm unsure about my cryptocurrency tax obligations?

It's advisable to consult with a tax professional who specializes in cryptocurrency to ensure compliance with current regulations.

IRS Enforcement Actions

The landscape of cryptocurrency taxation has seen a significant shift in recent years, particularly due to the increased enforcement actions taken by the IRS. As the popularity of digital currencies has soared, so too has the IRS's focus on ensuring compliance among taxpayers who engage in cryptocurrency transactions. This heightened scrutiny is not just a passing phase; it's a clear indication that the IRS is serious about enforcing tax regulations in this burgeoning sector. For many, the question arises: why is the IRS ramping up its enforcement efforts? The answer lies in the unique challenges posed by cryptocurrencies, including their decentralized nature and the anonymity they can provide.

In recent years, the IRS has implemented various strategies to identify taxpayers who may not be reporting their cryptocurrency earnings accurately. One notable approach has been the issuance of John Doe summonses to cryptocurrency exchanges. These summonses compel exchanges to disclose the identities and transaction histories of customers who have engaged in significant trading activities. This means that if you've bought, sold, or traded cryptocurrencies, your transactions could potentially be scrutinized by the IRS. The goal of these actions is to create a more transparent environment in which taxpayers are held accountable for their financial activities.

Moreover, the IRS has made it clear that they are not just interested in large-scale traders. Even individual investors who engage in relatively small transactions need to be aware of their tax obligations. The IRS has updated its tax forms to include specific questions about cryptocurrency holdings, ensuring that taxpayers cannot overlook this aspect of their financial reporting. This means that when you file your taxes, you’ll likely encounter questions aimed at uncovering any cryptocurrency transactions you've engaged in throughout the year.

To illustrate the impact of these enforcement actions, consider the following table that outlines some key IRS enforcement initiatives:

| Enforcement Initiative | Description | Impact on Taxpayers |

|---|---|---|

| John Doe Summons | Requests information from exchanges to identify non-compliant taxpayers. | Increased likelihood of audits for those trading significant amounts. |

| Updated Tax Forms | Incorporation of cryptocurrency questions in tax filings. | Mandatory disclosure of cryptocurrency transactions. |

| Educational Campaigns | IRS initiatives to inform taxpayers about their obligations. | Increased awareness of tax responsibilities related to crypto. |

As a result of these enforcement actions, taxpayers must be more vigilant than ever. Ignoring the IRS's guidelines or failing to report cryptocurrency transactions can lead to severe penalties, including fines and interest on unpaid taxes. In extreme cases, taxpayers may even face criminal charges for tax evasion. This is why it’s crucial to maintain accurate records of all cryptocurrency transactions, including purchases, sales, and trades. Keeping detailed records can help you accurately report your gains and losses, ensuring compliance with IRS regulations.

In conclusion, the IRS's enforcement actions regarding cryptocurrency taxation are a clear signal that the agency is committed to ensuring compliance in this rapidly evolving financial landscape. Taxpayers must stay informed about their obligations and be proactive in reporting their cryptocurrency activities. Ignorance is not an excuse, and as the IRS continues to tighten its grip on enforcement, being prepared is not just wise—it's essential.

- What happens if I fail to report my cryptocurrency earnings?

If you fail to report your cryptocurrency earnings, you may face penalties, including fines and interest on unpaid taxes. In severe cases, it could lead to criminal charges for tax evasion. - How can I keep track of my cryptocurrency transactions?

Using cryptocurrency tracking software or maintaining a detailed spreadsheet can help you keep track of all your transactions, including dates, amounts, and types of transactions. - Are all cryptocurrencies treated the same for tax purposes?

No, different cryptocurrencies may have different classifications and tax treatments, so it's essential to understand how each type is viewed by the IRS.

Frequently Asked Questions

- What is the IRS's stance on cryptocurrency taxation?

The IRS treats cryptocurrencies as property for tax purposes. This means that general tax principles applicable to property transactions apply to cryptocurrencies. So, if you sell, trade, or use cryptocurrency, you may trigger capital gains or losses, which need to be reported on your tax return.

- How do I calculate gains and losses from cryptocurrency transactions?

To calculate gains or losses, you need to determine the difference between the purchase price (basis) and the selling price. If you sell your cryptocurrency for more than you paid, you have a capital gain. Conversely, if you sell for less, you incur a capital loss. Keep in mind that these calculations can get complex, especially if you have multiple transactions.

- Are there specific reporting requirements for cryptocurrency?

Yes, taxpayers must report cryptocurrency transactions on their tax returns. This includes disclosing any gains or losses from sales, trades, or even using cryptocurrency to purchase goods or services. Failing to report these transactions can lead to penalties, so it’s crucial to keep accurate records.

- What are the tax implications of receiving cryptocurrency as payment?

If you receive cryptocurrency as payment for goods or services, it is treated as ordinary income. You must report the fair market value of the cryptocurrency at the time of receipt as income, and this amount will be subject to income tax. Additionally, any future gains or losses from selling that cryptocurrency will be subject to capital gains tax.

- What happens if I don’t report my cryptocurrency transactions?

Not reporting your cryptocurrency transactions can lead to serious consequences, including fines and penalties. The IRS has increased its focus on cryptocurrency compliance, and failing to report can result in audits or even criminal charges in severe cases. It’s always best to stay compliant and report accurately.

- Are there any recent changes in cryptocurrency tax laws?

Yes, the regulatory landscape for cryptocurrency taxation is constantly evolving. Recent legislative proposals and IRS enforcement actions aim to clarify rules and improve compliance. Staying updated on these changes is crucial for taxpayers to ensure they are meeting their obligations and avoiding potential pitfalls.

- How does the IRS enforce cryptocurrency tax compliance?

The IRS has ramped up its enforcement efforts by issuing warnings, sending letters to taxpayers with unreported cryptocurrency transactions, and utilizing sophisticated data analytics. They also collaborate with cryptocurrency exchanges to obtain transaction data. It’s essential to be proactive in reporting to avoid falling under scrutiny.