Understanding Wallet Interactions with Payment Gateways

In today's fast-paced digital world, the way we handle money is undergoing a radical transformation. The emergence of digital wallets has revolutionized the way consumers conduct transactions, offering unparalleled convenience and speed. But have you ever wondered how these digital wallets actually interface with payment gateways? Understanding this interaction is crucial for anyone looking to navigate the evolving landscape of online transactions. In this article, we will explore the intricate relationship between digital wallets and payment gateways, shedding light on the benefits they offer and the challenges they face.

Digital wallets have gained immense popularity in recent years, and it's not hard to see why. They provide users with a convenient way to make transactions without the need for physical cash or cards. Imagine walking into a store and simply tapping your phone to pay—it's as easy as that! Factors contributing to the rise of digital wallets include:

- Increased smartphone penetration: With more people owning smartphones, the accessibility of digital wallets has skyrocketed.

- Enhanced security features: Advanced security measures, such as biometric authentication, make users feel safer when using digital wallets.

- Seamless integration with payment gateways: Digital wallets can easily connect with various payment gateways, simplifying the transaction process.

This seamless integration not only enhances user experience but also allows businesses to cater to a tech-savvy customer base eager for innovative payment solutions.

To fully grasp the role of payment gateways in wallet transactions, it's essential to understand their core functions. Payment gateways act as the bridge between a consumer's digital wallet and the merchant's bank account, facilitating secure online payments. They encrypt sensitive information, ensuring that every transaction is safe from prying eyes. Think of payment gateways as the secure tunnel through which your financial data travels—hidden from potential threats. Their importance in the digital ecosystem cannot be overstated, as they enable:

- Real-time transaction processing: Quick and efficient payment processing keeps customers happy and businesses thriving.

- Multi-currency support: Payment gateways can handle transactions in various currencies, making them suitable for global commerce.

- Comprehensive reporting tools: Merchants can track their sales and analyze trends, leading to more informed business decisions.

Security is paramount in online transactions, and payment gateways take this responsibility seriously. They employ a variety of security protocols to protect users' financial information during wallet interactions. Some of the most common security measures include:

- SSL Certificates: These certificates encrypt data transmitted between the user and the payment gateway, ensuring that sensitive information remains confidential.

- Tokenization: This process replaces sensitive card information with a unique identifier or token, reducing the risk of fraud.

By implementing these security measures, payment gateways help maintain user trust and confidence in digital transactions.

Encryption plays a critical role in safeguarding data during transactions. Payment gateways utilize various encryption methods to ensure secure communications between wallets and transaction processors. The most common techniques include:

- Advanced Encryption Standard (AES): A symmetric encryption algorithm widely used to secure sensitive data.

- Transport Layer Security (TLS): A protocol that ensures privacy between communicating applications and users on the internet.

These encryption techniques create a secure environment for transactions, making it difficult for unauthorized parties to access sensitive data.

Fraud detection is vital for maintaining trust in digital payments. Payment gateways implement various technologies and strategies to identify and prevent fraudulent activities. These may include:

- Machine Learning Algorithms: These algorithms analyze transaction patterns to detect anomalies that could indicate fraud.

- Real-time Monitoring: Continuous monitoring of transactions can quickly identify and flag suspicious activities.

By proactively addressing potential fraud, payment gateways help protect both consumers and merchants, fostering a safer online shopping environment.

The user experience is a key factor in the adoption of digital wallets. A seamless integration with payment gateways enhances the overall transaction experience for users. When transactions are quick and hassle-free, customers are more likely to return. Imagine trying to pay for your morning coffee only to encounter a glitch at the checkout—frustrating, right? By ensuring that digital wallets work smoothly with payment gateways, businesses can provide an enjoyable and efficient shopping experience.

Despite their advantages, wallet interactions with payment gateways face several challenges. Compatibility issues, transaction delays, and user trust concerns can all hinder the effectiveness of these digital payment methods.

Compatibility between different wallets and payment gateways can create significant hurdles for users. Technical challenges may arise when a wallet does not support a specific payment gateway, leading to failed transactions. To improve interoperability, both wallet providers and payment gateways must work together to establish common standards and protocols.

Transaction delays can be a major source of frustration for users and can negatively impact businesses. Factors contributing to delays may include high traffic on payment gateways, technical glitches, or even poor internet connectivity. To mitigate these issues, payment gateways must invest in robust infrastructure and optimize their systems for speed and efficiency.

As technology evolves, so do digital wallets and payment gateways. Innovations such as biometric authentication, blockchain technology, and artificial intelligence are set to shape the future of online payments. These advancements promise to enhance security, improve user experience, and streamline transactions even further.

Q: What is a digital wallet?

A: A digital wallet is an electronic device or online service that allows individuals to make electronic transactions securely. It stores payment information and passwords for numerous payment methods and websites.

Q: How do payment gateways work?

A: Payment gateways facilitate the transfer of information between a payment portal (like a website or mobile app) and the acquiring bank. They ensure that sensitive data is encrypted and securely transmitted.

Q: Are digital wallets safe to use?

A: Yes, digital wallets are generally safe to use, especially when they implement strong security measures like encryption and two-factor authentication.

The Rise of Digital Wallets

In recent years, digital wallets have surged in popularity, transforming the way we conduct transactions. Imagine a world where you can pay for your morning coffee, split a dinner bill, or shop online without fumbling for cash or cards. This convenience has made digital wallets a preferred choice for many consumers. But what exactly has fueled this rise? Several factors play a pivotal role, including the increasing penetration of smartphones, the demand for seamless payment experiences, and the growing concern for security in financial transactions.

One of the primary drivers behind the adoption of digital wallets is the widespread use of smartphones. With over 3.8 billion smartphone users worldwide, the ability to carry your entire wallet in your pocket is more appealing than ever. Digital wallets, such as Apple Pay, Google Wallet, and PayPal, leverage this trend by providing users with a simple, one-tap solution for payments. Moreover, as more merchants adopt contactless payment systems, consumers are finding it easier to integrate these wallets into their daily lives.

Another significant factor is the demand for seamless payment experiences. In our fast-paced world, people are looking for ways to make transactions quicker and easier. Digital wallets offer a streamlined process that eliminates the need for physical cards or cash. With just a few taps on a smartphone, users can complete purchases, making the shopping experience more efficient. This convenience is especially appealing to younger generations who value speed and efficiency in their daily transactions.

Security is also a major concern for consumers, and digital wallets address this issue head-on. Many wallets incorporate advanced security features such as biometric authentication (like fingerprints or facial recognition) and encryption technologies. This gives users peace of mind, knowing that their financial information is protected. In fact, studies show that consumers are more likely to adopt digital wallets when they feel confident in the security measures in place.

To illustrate the rise of digital wallets, consider the following statistics:

| Year | Global Digital Wallet Users (in billions) |

|---|---|

| 2020 | 1.2 |

| 2021 | 1.5 |

| 2022 | 2.1 |

| 2023 | 2.8 |

As the table indicates, the number of global digital wallet users has seen a remarkable increase. This trend is expected to continue as more people recognize the benefits of digital wallets and as technology advances, making these solutions even more accessible. In addition, the COVID-19 pandemic has accelerated the shift towards contactless payments, further propelling the adoption of digital wallets. With health concerns at the forefront, consumers are increasingly opting for touchless transactions, making digital wallets a go-to option for many.

In conclusion, the rise of digital wallets can be attributed to a combination of factors including smartphone ubiquity, the demand for seamless transactions, and enhanced security measures. As we move forward, it’s clear that digital wallets are not just a passing trend; they represent a fundamental shift in how we handle money, paving the way for a more convenient and secure future in financial transactions.

Payment Gateway Functionality

Understanding the core functions of payment gateways is essential for grasping their role in wallet transactions. At their heart, payment gateways serve as the bridge between a customer’s digital wallet and the merchant’s bank account, facilitating secure online payments while ensuring a seamless user experience. When you make a purchase online, think of the payment gateway as the traffic cop directing the flow of sensitive financial information, ensuring that everything moves smoothly and securely.

Payment gateways are equipped with a variety of functionalities that enhance the online shopping experience. They handle the authorization process, which involves verifying that the buyer has sufficient funds or credit to complete the transaction. This process is crucial because it prevents fraud and ensures that merchants receive payment for their goods and services. Additionally, payment gateways offer features such as:

- Transaction Processing: Handling the actual transaction by communicating with the bank and processing the payment.

- Data Encryption: Protecting sensitive information through advanced encryption methods.

- Fraud Prevention: Incorporating tools to identify and mitigate fraudulent transactions.

- Multi-Currency Support: Allowing transactions in various currencies, which is essential for global e-commerce.

Moreover, the importance of payment gateways in the digital ecosystem cannot be overstated. They not only facilitate transactions but also provide valuable insights through analytics. Merchants can track sales, understand customer behavior, and optimize their offerings based on data collected through these gateways. This capability transforms raw data into actionable insights, enabling businesses to improve their strategies and enhance customer satisfaction.

In essence, the functionality of payment gateways is a critical component of the online shopping experience. They streamline the transaction process, enhance security measures, and provide merchants with the tools they need to thrive in an increasingly competitive digital market. As we continue to embrace the convenience of digital wallets, understanding how payment gateways operate will empower consumers and businesses alike to make informed decisions about their online transactions.

Security Measures in Payment Gateways

When it comes to online transactions, security is not just a priority; it's a necessity. Payment gateways act as the bridge between digital wallets and merchants, and they must implement robust security measures to protect sensitive financial information. Without these measures, users would be hesitant to engage in online shopping, fearing that their data could fall into the wrong hands. So, what exactly do payment gateways do to ensure the safety of your transactions?

First and foremost, encryption is a cornerstone of security in payment gateways. This process transforms your data into a code that can only be deciphered by authorized parties. Essentially, it’s like sending a secret message that only you and the intended recipient can read. Different encryption methods are employed, including:

- SSL (Secure Socket Layer): This is the most common encryption protocol used, ensuring that all data transferred between the user and the payment gateway is secure.

- TLS (Transport Layer Security): An upgraded version of SSL, TLS provides even stronger encryption, making it harder for hackers to intercept data.

Moreover, payment gateways utilize tokenization, which replaces sensitive card information with a unique identifier or token. This means that even if a hacker were to gain access to the transaction data, they would only see meaningless tokens rather than actual credit card numbers. This significantly reduces the risk of fraud.

In addition to these encryption techniques, payment gateways also implement fraud detection systems. These systems use advanced algorithms and machine learning to analyze transaction patterns and identify suspicious activity. For example, if a transaction appears to be coming from a location or device that is inconsistent with a user's usual behavior, the system can flag it for further review or even block it entirely. This proactive approach helps in preventing fraudulent transactions before they occur.

Furthermore, many payment gateways offer two-factor authentication (2FA). This is an extra layer of security that requires users to provide two forms of identification before completing a transaction. For instance, after entering a password, a user might also need to input a code sent to their mobile device. This makes it significantly more difficult for unauthorized users to access accounts.

Ultimately, the combination of these security measures creates a fortified environment for online transactions, allowing users to shop with confidence. Payment gateways are continuously evolving their security protocols to stay ahead of cyber threats, ensuring that both consumers and merchants can trust the digital payment landscape.

Q: What is the most important security measure for payment gateways?

A: While all security measures are important, encryption is often considered the most crucial as it protects the data during transmission.

Q: How does tokenization work?

A: Tokenization replaces sensitive card information with a unique token that cannot be used outside of the specific transaction, enhancing security.

Q: Is two-factor authentication necessary?

A: Yes, two-factor authentication adds an essential layer of security, making it much harder for unauthorized users to access accounts.

Encryption Techniques

When we think about securing our online transactions, come to mind as the unsung heroes of digital security. These methods are like the locks on our doors, ensuring that only the right people can access our sensitive information. In the world of digital wallets and payment gateways, encryption acts as a shield, protecting our financial data from prying eyes and malicious actors. But how exactly does this process work, and why is it so crucial?

At its core, encryption transforms readable data into a scrambled format, making it nearly impossible for unauthorized users to decipher. Imagine sending a letter in a foreign language that only you and the recipient understand; that's essentially what encryption does for your data. There are several types of encryption techniques employed by payment gateways, each with its unique purpose and level of security:

- Symmetric Encryption: This method uses a single key for both encryption and decryption. While it's fast and efficient, the challenge lies in securely sharing the key.

- Asymmetric Encryption: Also known as public-key cryptography, this technique uses two keys: a public key for encryption and a private key for decryption. This method enhances security, as the private key never has to be shared.

- Hashing: While not technically encryption, hashing transforms data into a fixed-size string of characters, which is unique to the original data. This is often used for storing passwords securely.

These encryption methods work together to create a robust security framework for digital wallets. For instance, when you make a purchase using your digital wallet, your payment information is encrypted before it even leaves your device. This ensures that, even if intercepted, the data remains unreadable to anyone without the proper decryption key.

Furthermore, payment gateways often employ additional layers of security, such as SSL (Secure Socket Layer) certificates. SSL creates a secure connection between your browser and the server, ensuring that any data transferred remains confidential. Think of it as a secure tunnel that protects your information as it travels across the internet.

In the ever-evolving landscape of online transactions, staying ahead of potential threats is crucial. Payment gateways continuously update their encryption techniques to counteract emerging security risks. This proactive approach not only protects users but also builds trust in the digital payment ecosystem.

In summary, encryption techniques are vital for safeguarding our online transactions. They serve as the first line of defense against cyber threats, ensuring that our financial information remains private and secure. As technology advances, so too will these encryption methods, adapting to meet the challenges of an increasingly digital world.

Q: What is encryption, and why is it important?

A: Encryption is the process of converting information into a code to prevent unauthorized access. It's crucial for protecting sensitive data, especially in online transactions.

Q: What are the different types of encryption?

A: The main types of encryption include symmetric encryption, asymmetric encryption, and hashing. Each has its own use cases and security levels.

Q: How does SSL enhance security?

A: SSL creates a secure, encrypted connection between your web browser and the server, ensuring that data transferred remains confidential.

Q: Can encryption prevent all cyber threats?

A: While encryption significantly enhances security, it cannot prevent all cyber threats. It's one part of a broader security strategy that includes firewalls, anti-virus software, and user education.

Fraud Detection Systems

In the ever-evolving world of online transactions, serve as the vigilant guardians of digital wallets and payment gateways. These systems are not just an afterthought; they are essential components designed to protect users from the growing threat of online fraud. Imagine walking through a bustling marketplace, where every vendor is vying for your attention, but there's always that one shady character lurking in the shadows. That's the reality of digital payments today, and fraud detection systems are the bright lights that keep those shadows at bay.

Fraud detection systems employ a variety of sophisticated technologies and strategies to identify and prevent fraudulent activities. They analyze transaction patterns, monitor user behavior, and utilize machine learning algorithms to spot anomalies that may indicate fraudulent behavior. For instance, if a user typically makes purchases in one geographic location and suddenly tries to buy something from halfway across the world, the system flags this as suspicious. This proactive approach not only protects users but also builds trust in the digital payment ecosystem.

There are several key components that make these fraud detection systems effective:

- Real-time Monitoring: Continuous observation of transactions allows for immediate action, minimizing potential losses.

- Behavioral Analytics: By understanding normal user behavior, these systems can quickly identify deviations that may signal fraud.

- Machine Learning: Advanced algorithms learn from historical data to improve detection accuracy over time.

- Multi-Factor Authentication: Adding layers of security ensures that even if a fraudster gains access, they still face barriers.

Moreover, the integration of artificial intelligence (AI) into fraud detection systems has revolutionized the way payment gateways operate. AI can process vast amounts of data at lightning speed, identifying potential threats much faster than human analysts could. This not only enhances security but also streamlines the user experience, as legitimate transactions can be completed without unnecessary delays. Think of it as having a highly skilled security team that works around the clock, ensuring that your transactions are safe and sound.

However, the fight against fraud is not without its challenges. As fraudsters become more sophisticated, payment gateways must continuously evolve their strategies to stay one step ahead. This includes adapting to new fraud techniques and ensuring that their systems can handle the increasing volume of online transactions without compromising security. It's a constant battle, but one that is crucial for maintaining the integrity of digital payments.

In conclusion, fraud detection systems are a vital part of the digital payment landscape. They not only protect users from potential threats but also enhance the overall trust and reliability of payment gateways. As technology continues to advance, we can expect these systems to become even more sophisticated, making online transactions safer for everyone involved.

User Experience and Wallet Integration

When it comes to digital transactions, the user experience is everything. Imagine walking into a store, picking up your favorite items, and then facing a long line at the checkout. Frustrating, right? Now, think about that scenario in the digital world, where every second counts. This is where the integration of digital wallets with payment gateways shines. A seamless experience can make all the difference, transforming a tedious transaction into a smooth, enjoyable process.

One of the key aspects that enhance user experience is speed. Digital wallets allow users to store payment information securely and access it with just a few taps. When integrated with payment gateways, this process becomes lightning-fast. Users can complete transactions in mere seconds, which is crucial in today’s fast-paced environment. The convenience of not having to enter card details every time they make a purchase is a game-changer. It’s like having a VIP pass that lets you skip the line and get straight to the fun part—shopping!

Moreover, the interface design of both wallets and payment gateways plays a significant role in user satisfaction. A well-designed interface should be intuitive and user-friendly. Users shouldn’t have to think twice about how to complete a transaction. Clear buttons, easy navigation, and helpful prompts can guide users through the process, minimizing confusion and errors. When users feel comfortable and confident in their transactions, they are more likely to return for future purchases.

Additionally, integrating features such as transaction history and notifications can greatly enhance the user experience. Users appreciate being able to track their spending and receive updates on their transactions. For example, if a payment fails or a transaction goes through, timely notifications can keep users informed and reduce anxiety. This transparency fosters trust, which is essential in building long-term relationships between users and payment platforms.

Another critical factor is customer support. Even with the best technology, issues can arise. Having robust customer support available can significantly improve user experience. Whether through live chat, email, or a comprehensive FAQ section, users should feel supported and valued. Quick resolutions to problems can turn a potentially negative experience into a positive one, encouraging users to continue using the service.

In conclusion, the integration of digital wallets with payment gateways is not just about technology; it's about creating a holistic experience for users. By focusing on speed, design, transparency, and support, businesses can ensure that their customers enjoy a seamless and satisfying transaction process. This not only drives customer loyalty but also encourages more frequent use of digital wallets in the long run.

- What is a digital wallet? A digital wallet is an electronic device or online service that allows individuals to make electronic transactions securely. It stores payment information and passwords for numerous payment methods and websites.

- How do digital wallets integrate with payment gateways? Digital wallets integrate with payment gateways by providing a secure connection that allows for the quick transfer of payment information during transactions, ensuring a fast and secure checkout process.

- Are digital wallets safe to use? Yes, digital wallets employ various security measures, including encryption and two-factor authentication, to protect users' financial information during transactions.

Challenges in Wallet-Gateway Interactions

Despite the numerous advantages that digital wallets bring to the table, their interactions with payment gateways are not without challenges. One of the most significant issues is compatibility. With a multitude of wallet options available, each with its unique features and functionalities, ensuring that these wallets work seamlessly with various payment gateways can be quite a daunting task. Imagine trying to fit a square peg into a round hole; that’s often how users feel when they encounter compatibility issues. This can lead to frustrating experiences, where users are unable to complete transactions or face unexpected errors.

Moreover, transaction delays can be a real headache for both users and businesses. In an age where instant gratification is the norm, waiting for a transaction to process can feel like an eternity. Factors contributing to these delays can include network congestion, technical glitches, or even the payment gateway’s internal processing speed. It’s akin to being stuck in traffic when all you want is to reach your destination swiftly. These delays not only annoy users but can also lead to lost sales for businesses, as customers may abandon their carts in frustration.

Another challenge is the issue of user trust. In the digital realm, where security breaches seem to make headlines daily, consumers are understandably cautious about sharing their financial information. Payment gateways must work tirelessly to build and maintain this trust. Any hiccup in security can cause users to second-guess their choice of wallet or payment method. Therefore, it’s crucial for payment gateways to communicate their security measures effectively, ensuring users feel safe every time they transact.

To summarize, the challenges in wallet-gateway interactions can be distilled into the following key areas:

- Compatibility Issues: Different wallets may not work seamlessly with all payment gateways.

- Transaction Delays: Slow processing times can frustrate users and impact business sales.

- User Trust Concerns: Security issues can lead to hesitation in using digital wallets.

As we navigate through these challenges, it’s essential for both wallet providers and payment gateways to collaborate closely, ensuring that they create a more cohesive and user-friendly experience. By addressing these hurdles head-on, they can foster greater adoption of digital wallets and enhance the overall efficiency of online transactions.

Q1: What are the common compatibility issues faced by digital wallets?

A1: Compatibility issues often arise when a digital wallet does not support the specific payment gateway being used, leading to transaction failures or errors.

Q2: How can transaction delays be minimized?

A2: Transaction delays can be minimized by optimizing the payment gateway's processing speed, ensuring robust server infrastructure, and reducing network congestion.

Q3: What measures can be taken to enhance user trust in digital wallets?

A3: Payment gateways can enhance user trust by implementing strong security protocols, providing transparent information about data protection, and offering customer support for any concerns.

Compatibility Issues

In the fast-paced world of digital transactions, between digital wallets and payment gateways can create significant roadblocks. Imagine trying to fit a square peg into a round hole; that's how frustrating it can be when a wallet doesn't seamlessly interact with a payment gateway. With the multitude of wallets available today, each with its own set of functionalities and technologies, achieving smooth interoperability is a complex challenge.

One of the primary reasons for these compatibility issues is the diversity of payment protocols used by different wallets and gateways. Some wallets may utilize cutting-edge technologies like blockchain, while others may rely on traditional banking networks. This disparity can lead to situations where a wallet cannot communicate effectively with a payment gateway, resulting in failed transactions or errors that can alienate users.

Moreover, the rapid evolution of technology means that both wallets and gateways are constantly upgrading their systems. This can lead to temporary mismatches in compatibility, where a new feature in a wallet may not yet be supported by an older payment gateway. It's akin to trying to play a new video game on an outdated console; the experience can be frustrating and unsatisfactory. Therefore, ensuring that both parties are on the same page is crucial for a smooth transaction experience.

To tackle these compatibility issues, several strategies can be employed:

- Standardization of Protocols: One potential solution is the establishment of universal standards that all wallets and gateways can adopt. This would create a common framework, reducing the chances of incompatibility.

- Regular Updates: Both wallets and payment gateways should commit to regular updates and communication to ensure that their systems can work harmoniously together.

- Testing and Feedback: Continuous testing and soliciting user feedback can help identify and resolve compatibility issues before they escalate into significant problems.

In conclusion, while compatibility issues between digital wallets and payment gateways pose a challenge, they are not insurmountable. By fostering collaboration and innovation, the digital payment landscape can evolve toward a more integrated and user-friendly experience. Just like a well-oiled machine, when all components work together seamlessly, the result is a smooth and efficient transaction process that benefits everyone involved.

- What are digital wallets?

Digital wallets are electronic devices or online services that allow individuals to make electronic transactions. They store payment information and passwords for numerous payment methods and websites. - Why are compatibility issues important?

Compatibility issues can lead to transaction failures, which frustrate users and may result in lost sales for businesses. Ensuring compatibility is crucial for a seamless payment experience. - How can I ensure my wallet is compatible with a payment gateway?

Before using a wallet, check with the payment gateway provider for a list of supported wallets, or consult user reviews and forums for feedback on compatibility.

Transaction Delays

Imagine you’re at the checkout, ready to snag that fantastic deal, and suddenly, your digital wallet lags. Frustrating, right? Transaction delays can be a significant headache for users and businesses alike. These delays can stem from various factors, including network issues, payment gateway processing times, and even the complexity of the transaction itself. Understanding the root causes of these delays is crucial for both consumers and merchants looking to streamline their payment processes.

One primary cause of transaction delays is the network latency. When a user initiates a payment, the request travels through multiple servers and gateways before reaching the final destination. If any part of this journey experiences a slowdown, it can lead to frustrating wait times. Additionally, if the payment gateway is experiencing high traffic, it may take longer to process transactions, further aggravating the situation.

Another significant factor contributing to transaction delays is the verification processes that payment gateways employ. While these verification steps are essential for security, they can slow down the transaction. For example, if a transaction triggers a fraud detection alert, the payment may be held for additional scrutiny, causing delays. In fact, studies have shown that over 40% of users abandon their carts due to lengthy payment processes. This statistic highlights the importance of balancing security with efficiency.

To mitigate these delays, businesses can consider several strategies:

- Optimize Payment Gateway Selection: Choose a payment gateway known for its speed and reliability.

- Enhance Network Infrastructure: Invest in robust internet connectivity to reduce network latency.

- Streamline Verification Processes: Work with payment gateways to find a balance between security and speed.

Moreover, educating users on potential delays can help manage expectations. For instance, informing customers that transactions may take a few moments can alleviate frustration. Transparency is key in maintaining trust in the payment process.

In conclusion, while transaction delays are a common issue in the world of digital wallets and payment gateways, they can be effectively managed with the right strategies and communication. By understanding the underlying causes and implementing solutions, both consumers and businesses can enjoy a smoother transaction experience.

Q1: What causes transaction delays when using digital wallets?

A1: Transaction delays can be caused by network latency, high traffic on payment gateways, and verification processes triggered for security reasons.

Q2: How can I reduce transaction delays?

A2: You can reduce delays by choosing a reliable payment gateway, ensuring good internet connectivity, and streamlining verification processes with your payment provider.

Q3: Are transaction delays common?

A3: Yes, transaction delays are relatively common in digital payments, but their frequency can vary based on the payment gateway and network conditions.

The Future of Wallets and Payment Gateways

The future of digital wallets and payment gateways is not just bright; it's blindingly brilliant! As technology continues to advance at a breakneck pace, we can expect to see a wave of innovations that will reshape the way we think about transactions. Imagine a world where making payments is as effortless as a flick of your wrist or a simple voice command. With the rise of artificial intelligence, machine learning, and blockchain technology, the possibilities are endless.

One of the most exciting developments on the horizon is the integration of biometric authentication into digital wallets. Picture this: instead of fumbling with passwords or PINs, you can authorize payments with just a fingerprint or facial recognition. This not only enhances security but also streamlines the user experience. As consumers become more accustomed to these technologies, we can expect to see a significant uptick in wallet adoption.

Moreover, the concept of cryptocurrency wallets is gaining traction. As more merchants begin to accept cryptocurrencies, the need for wallets that can handle these digital currencies will grow. Payment gateways will need to adapt quickly to accommodate this shift. This evolution could lead to a more decentralized payment ecosystem, where users have greater control over their funds and transactions.

In addition to technological advancements, the regulatory landscape will also play a crucial role in shaping the future of wallets and payment gateways. Governments around the world are beginning to recognize the importance of regulating digital payments to protect consumers and businesses alike. As regulations become clearer, we can expect to see a surge in consumer confidence, leading to increased usage of digital wallets.

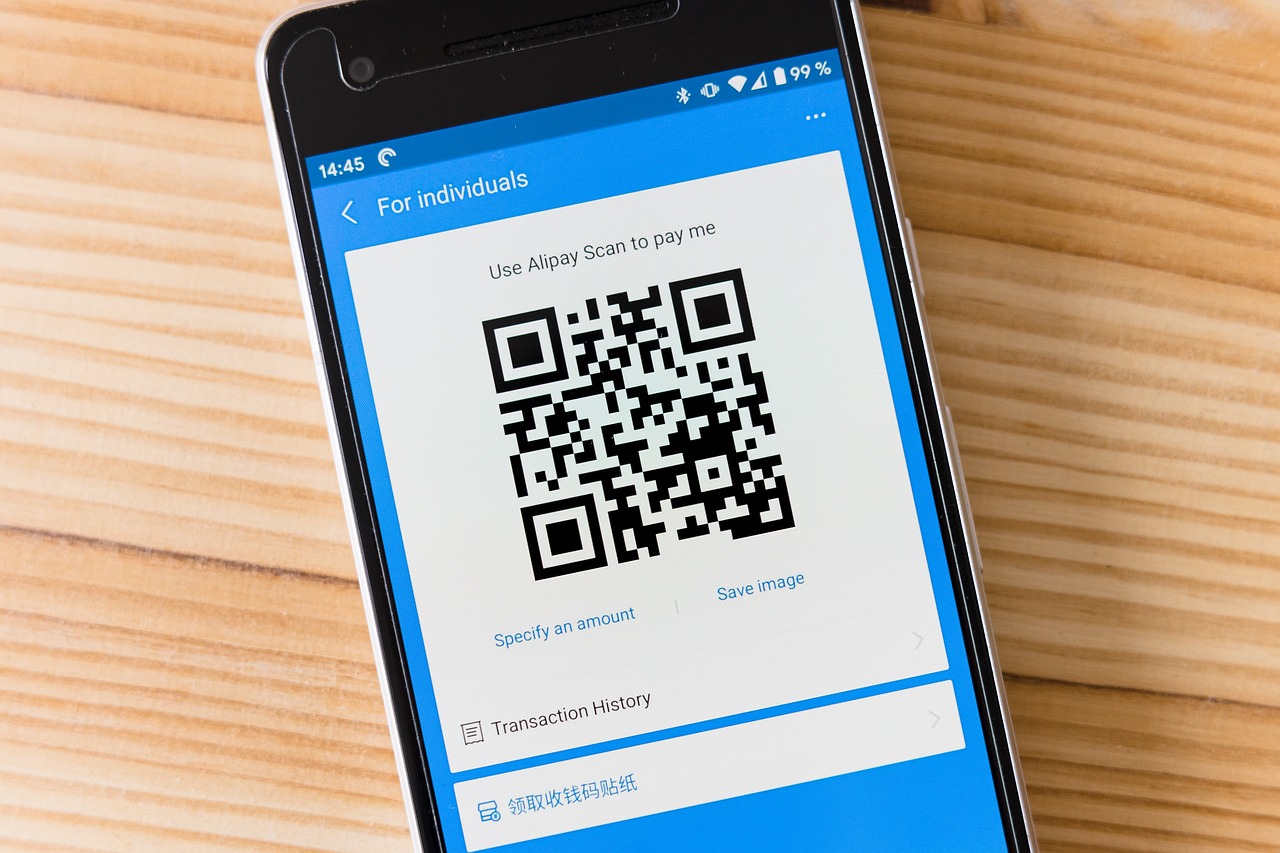

Another trend to watch for is the rise of contactless payments. With the ongoing pandemic, consumers have become more aware of hygiene and safety. This has led to a significant increase in the adoption of contactless payment methods. Payment gateways will need to ensure that they can seamlessly integrate with various contactless technologies, from NFC to QR codes, to meet consumer demands.

Furthermore, the future of wallets will likely involve enhanced personalization. Imagine a digital wallet that learns your spending habits and preferences, offering tailored recommendations for discounts, promotions, and even budgeting tools. This level of personalization could revolutionize the way consumers interact with their finances, making digital wallets not just a payment method but a financial companion.

In summary, the future of wallets and payment gateways is poised for transformation. With advancements in technology, regulatory support, and evolving consumer expectations, we can anticipate a more secure, efficient, and user-friendly payment landscape. The key players in this space will need to stay agile, adapting to these changes to meet the needs of a tech-savvy consumer base.

- Will digital wallets replace traditional payment methods? While digital wallets are gaining popularity, traditional payment methods will likely coexist for the foreseeable future. However, their usage may decline as more people embrace digital solutions.

- Are digital wallets safe to use? Yes, digital wallets employ various security measures such as encryption and biometric authentication to protect users' financial information.

- Can I use my digital wallet for international transactions? Many digital wallets support international transactions, but it's essential to check with your wallet provider for specific capabilities and fees.

Frequently Asked Questions

-

What are digital wallets and how do they work with payment gateways?

Digital wallets are applications or services that allow users to store their payment information securely and make transactions online. They work with payment gateways by securely transmitting the user's payment details to merchants during a transaction. This integration simplifies the payment process, making it faster and more convenient for users.

-

What benefits do digital wallets offer over traditional payment methods?

Digital wallets offer numerous benefits, including enhanced security through encryption, faster transaction speeds, and the convenience of making payments from mobile devices. They also often provide loyalty rewards and discounts, making them an attractive option for users looking to save money while shopping.

-

How do payment gateways ensure the security of transactions?

Payment gateways employ various security measures, including encryption techniques to protect sensitive data during transmission. They also utilize fraud detection systems that analyze transaction patterns and flag any suspicious activity, helping to prevent unauthorized transactions and maintain user trust.

-

What are some common challenges faced in wallet-gateway interactions?

Common challenges include compatibility issues between different wallets and payment gateways, which can hinder transactions. Additionally, transaction delays may occur due to network issues or processing times, leading to user frustration. Addressing these challenges is crucial for improving the overall user experience.

-

What future trends can we expect in the world of digital wallets and payment gateways?

As technology continues to advance, we can expect to see further innovations in digital wallets and payment gateways, such as enhanced security features, improved integration with emerging technologies like blockchain, and greater interoperability among different payment systems. These developments aim to create a more seamless and secure payment experience for users.