Understanding the Effects of Global Economic Policies on Crypto

In today's fast-paced digital world, the intersection of global economic policies and cryptocurrency is not just a point of interest; it's a crucial area of study for investors, policymakers, and tech enthusiasts alike. As we navigate through the complexities of economic frameworks, it becomes evident that decisions made by central banks and governments can have profound impacts on the valuation and adoption of cryptocurrencies. Think of the cryptocurrency market as a vast ocean, with economic policies acting as the winds that can either propel it forward or hold it back. With the rise of digital assets, understanding these influences is more important than ever.

When we discuss global economic policies, we’re really diving into the heart of how traditional finance interacts with this revolutionary digital landscape. As central banks adjust interest rates and set inflation targets, they send ripples through financial markets, and cryptocurrencies are no exception. For instance, when interest rates are low, traditional investments may offer lower returns, prompting investors to explore the potentially higher returns of cryptocurrencies. This shift in sentiment can lead to increased demand for digital currencies, causing their prices to soar. Conversely, when inflation rises, the purchasing power of fiat currencies diminishes, often driving investors toward assets perceived as more stable, such as Bitcoin, which is often hailed as 'digital gold.'

Moreover, the regulatory environment surrounding cryptocurrencies varies widely across the globe, adding another layer of complexity to this dynamic relationship. Countries like El Salvador have embraced Bitcoin as legal tender, fostering an environment ripe for innovation and investment. In contrast, nations with stringent regulations may inadvertently push crypto activities underground, stifling growth and innovation. This divergence in regulatory approaches not only affects local markets but also shapes global perceptions of cryptocurrencies. If a country is seen as hostile to crypto, it might deter investment, while a supportive regulatory framework can attract global talent and capital.

As we delve deeper into the effects of global economic policies on cryptocurrencies, it's essential to consider the behavioral aspects of investors. Investor sentiment is often swayed by economic indicators, leading to fluctuations in market activity. For example, positive economic news can create a bullish atmosphere, while negative reports may lead to panic selling. This psychological aspect of trading is crucial; it’s not just about numbers and charts, but also about how people react to the news and events shaping our world.

Ultimately, understanding the interconnectedness of traditional finance and digital assets requires a holistic view of the various factors at play. From monetary policies and regulatory frameworks to market psychology and investor behavior, each element contributes to the evolving landscape of cryptocurrency. As we continue to witness the maturation of this market, staying informed about these influences will be key for anyone looking to navigate the exciting yet unpredictable waters of crypto investing.

- What is the impact of monetary policy on cryptocurrency? Monetary policy decisions, such as interest rates and inflation targeting, can significantly influence investor sentiment and the valuation of cryptocurrencies.

- How do regulatory frameworks affect the crypto market? Different countries have varying regulations that can either foster growth or stifle innovation in the cryptocurrency sector.

- What role does market psychology play in crypto trading? Market psychology influences trader emotions and can lead to volatility, affecting investment strategies and decisions.

- Are there positive examples of cryptocurrency regulation? Yes, countries that have embraced supportive regulations often see growth in innovation and investment within their crypto markets.

- What are the consequences of strict regulations? Nations imposing strict regulations may drive investment overseas and hinder local market development.

Impact of Monetary Policy

Monetary policy is a powerful tool wielded by central banks around the world, and its effects on the cryptocurrency market are profound and multifaceted. When central banks adjust interest rates or implement quantitative easing, they are not just influencing traditional financial markets; they are also sending ripples through the digital asset space. For instance, when interest rates are lowered, borrowing becomes cheaper, leading to increased spending and investment. This can boost the prices of cryptocurrencies as investors seek higher returns in the volatile crypto market.

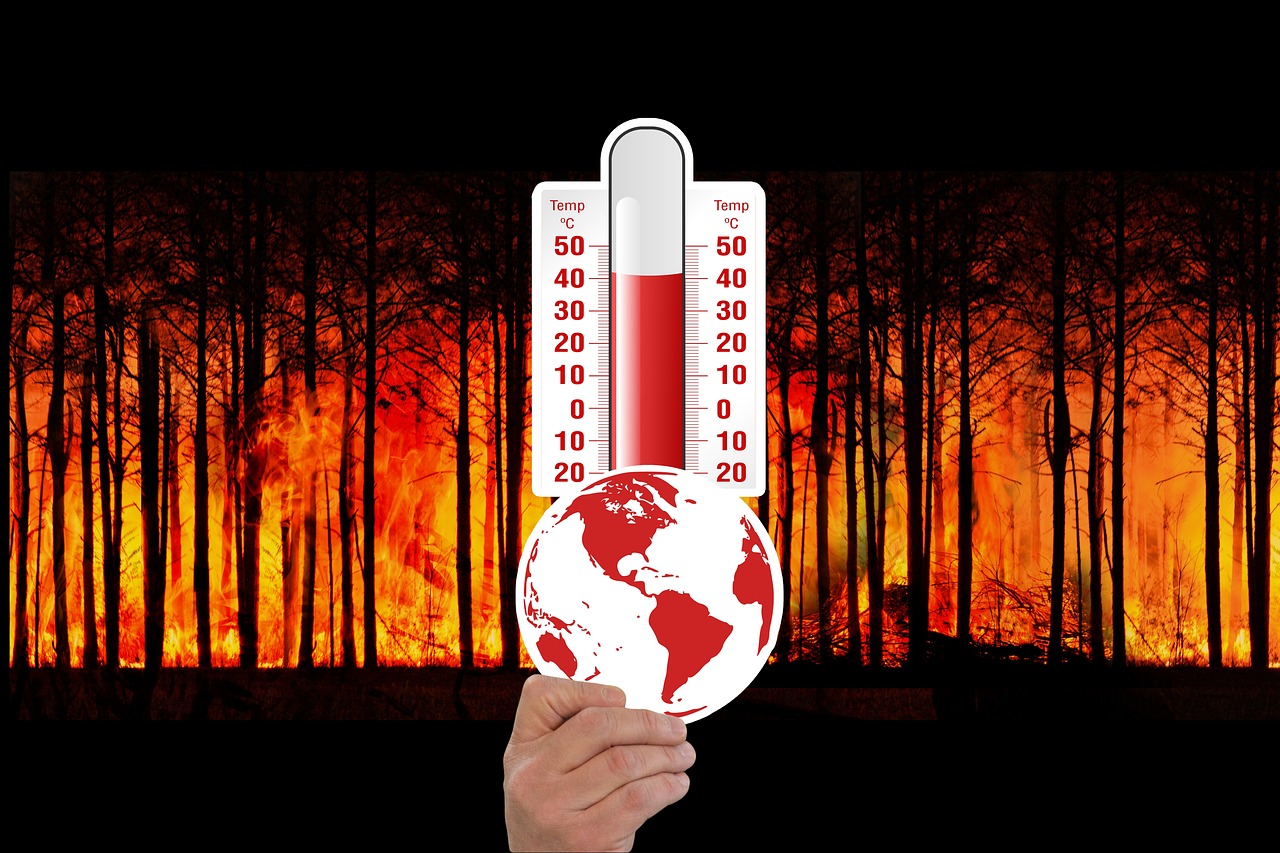

One of the most significant ways that monetary policy impacts cryptocurrencies is through inflation targeting. As central banks aim to keep inflation in check, they often adopt measures that can lead to increased demand for cryptocurrencies. Investors may view digital currencies as a hedge against inflation, especially when traditional fiat currencies are perceived to be losing value. This sentiment can drive up demand for cryptocurrencies, leading to price surges. For example, during periods of high inflation, many investors flock to Bitcoin and other digital assets, viewing them as a store of value akin to gold.

Moreover, the relationship between interest rates and cryptocurrency prices can be likened to a seesaw. When interest rates rise, the appeal of holding cryptocurrencies may diminish as yields on traditional investments become more attractive. Conversely, when rates fall, the opposite occurs. This dynamic creates a volatile environment where investor sentiment can shift rapidly based on economic news and central bank announcements.

It's essential to consider the global interconnectedness of monetary policies. For instance, when the Federal Reserve in the United States changes its policy, it can have a cascading effect on other countries' economies and their respective cryptocurrencies. Investors worldwide are paying close attention to these shifts, often reacting in real-time. This interconnectedness means that a policy change in one country can lead to significant price fluctuations across the global crypto market.

| Monetary Policy Tool | Effect on Crypto Market |

|---|---|

| Interest Rate Decrease | Increases demand for cryptocurrencies as investors seek higher returns. |

| Interest Rate Increase | Decreases demand for cryptocurrencies as traditional investments become more attractive. |

| Quantitative Easing | Injects liquidity into the economy, often leading to increased investment in riskier assets like crypto. |

In summary, the impact of monetary policy on the cryptocurrency market is significant and cannot be overlooked. As central banks navigate the complex landscape of economic challenges, their decisions will continue to shape investor behavior and market dynamics. Understanding these influences is crucial for anyone looking to invest in cryptocurrencies. The dance between traditional finance and digital assets is ongoing, and staying informed about monetary policy changes is key to making savvy investment decisions.

- How do interest rates affect cryptocurrency prices? Interest rates can influence the attractiveness of cryptocurrencies as an investment. Lower rates often lead to increased demand for digital assets, while higher rates can reduce their appeal.

- What role does inflation play in cryptocurrency investment? Investors often view cryptocurrencies as a hedge against inflation, leading to increased demand during periods of high inflation.

- Are cryptocurrencies affected by global monetary policies? Yes, changes in monetary policy in major economies can have significant impacts on the global cryptocurrency market, affecting investor sentiment and market dynamics.

Regulatory Frameworks

The world of cryptocurrency operates in a complex web of regulatory frameworks that vary significantly from one country to another. These frameworks are crucial because they shape not only how cryptocurrencies are traded and taxed but also how they are perceived by the general public and institutional investors. Imagine you’re navigating a maze; each turn represents a different country’s approach to regulation, and depending on which way you go, your experience can be drastically different. Some nations have embraced cryptocurrencies with open arms, creating a fertile ground for innovation and investment, while others have imposed stringent regulations that can feel more like a chokehold.

For instance, in countries like Switzerland and Singapore, the regulatory environment is relatively friendly towards cryptocurrencies. These nations have established clear guidelines that promote transparency and compliance, which, in turn, fosters a sense of trust among investors. On the flip side, countries such as China and India have taken a more cautious approach, implementing restrictions that can create uncertainty and push investors to seek more favorable conditions elsewhere. This disparity in regulatory attitudes raises an important question: How do these frameworks impact the overall growth and stability of the cryptocurrency market?

To better understand the implications of various regulatory frameworks, let's take a look at some key aspects:

| Country | Regulatory Approach | Impact on Market |

|---|---|---|

| Switzerland | Supportive | High innovation and investment |

| Singapore | Clear guidelines | Growing crypto ecosystem |

| China | Restrictive | Market uncertainty |

| India | Mixed | Investor caution |

This table illustrates how different regulatory approaches can lead to varying levels of market activity and investor confidence. When regulations are clear and supportive, as seen in Switzerland and Singapore, investors are more likely to engage with the market, leading to greater innovation and economic growth. Conversely, restrictive regulations can create an environment of uncertainty, making investors hesitant to commit their resources.

Moreover, the regulatory landscape is not static; it evolves as governments respond to the fast-paced changes in the crypto market. For example, recent developments in the United States have seen regulators attempting to catch up with the rapid growth of digital assets. The introduction of frameworks like the Infrastructure Investment and Jobs Act has sparked discussions about taxation and compliance for cryptocurrency transactions. This ongoing evolution highlights the importance of staying informed about regulatory changes, as they can significantly influence market dynamics.

In conclusion, the regulatory frameworks governing cryptocurrencies play a pivotal role in shaping the market landscape. They can either act as a catalyst for growth or a barrier to entry, depending on how they are structured. As the global economy continues to integrate digital assets into its fabric, the need for clear and supportive regulations becomes increasingly critical. Investors and stakeholders must remain vigilant, adapting to these changes to navigate the complexities of the crypto world effectively.

- What are the main factors influencing cryptocurrency regulations? Regulatory bodies consider factors such as consumer protection, financial stability, and the prevention of illegal activities.

- How do regulatory changes affect cryptocurrency prices? Sudden regulatory changes can lead to market volatility, influencing investor sentiment and, consequently, prices.

- Are there any global standards for cryptocurrency regulation? Currently, there are no universally accepted standards, but organizations like the Financial Action Task Force (FATF) are working towards harmonization.

Case Studies of Regulation

When it comes to the world of cryptocurrency, regulation plays a pivotal role in shaping market dynamics. Different countries have adopted various approaches to managing digital assets, and these regulatory frameworks can either foster innovation or create hurdles for growth. To understand the real-world implications of these regulations, let’s delve into some intriguing case studies that illustrate both the successes and challenges faced by different jurisdictions.

One notable example is Japan, which has emerged as a leader in cryptocurrency regulation. In 2017, the country recognized Bitcoin as a legal payment method, providing a regulatory framework that has encouraged the growth of a vibrant crypto market. Japan's Financial Services Agency (FSA) implemented licensing requirements for cryptocurrency exchanges, ensuring that they comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. This proactive approach has not only boosted investor confidence but also attracted numerous crypto startups to set up shop in Japan, leading to increased innovation and investment. The result? A flourishing crypto ecosystem that has positioned Japan as a global hub for digital currencies.

On the flip side, we have China, which has taken a much stricter stance on cryptocurrency. The Chinese government has imposed a series of bans on cryptocurrency trading and initial coin offerings (ICOs), citing concerns over financial stability and fraud. These regulations have led to a significant exodus of crypto-related businesses from China, with many companies relocating to more crypto-friendly countries. The impact of these stringent regulations has been profound, stifling innovation within the country and pushing investors to seek opportunities abroad. As a result, China’s once-thriving crypto market has been largely diminished, showcasing how negative regulatory measures can have dire consequences for local economies.

Another interesting case is that of Switzerland, which has adopted a balanced approach to cryptocurrency regulation. Known for its progressive financial policies, Switzerland has established itself as a crypto-friendly nation by creating a regulatory framework that supports innovation while ensuring investor protection. The Swiss Financial Market Supervisory Authority (FINMA) has provided clear guidelines for ICOs and cryptocurrency exchanges, allowing businesses to operate within a structured environment. This approach has led to the emergence of the “Crypto Valley” in Zug, where numerous blockchain startups thrive. The Swiss example highlights how a supportive regulatory environment can lead to economic growth and attract global talent.

To further illustrate the varying impacts of regulation, let’s take a look at a comparative table of these three countries:

| Country | Regulatory Stance | Impact on Crypto Market |

|---|---|---|

| Japan | Proactive and Supportive | Thriving crypto ecosystem, increased innovation |

| China | Restrictive | Stifled innovation, exodus of businesses |

| Switzerland | Balanced and Supportive | Emergence of Crypto Valley, economic growth |

In conclusion, these case studies underscore the critical role that regulation plays in the cryptocurrency landscape. Countries that embrace a supportive regulatory framework tend to see flourishing markets, while those that impose strict restrictions often face negative consequences. As the global economy continues to evolve, it will be fascinating to observe how regulatory approaches adapt and influence the future of digital assets.

- What is the impact of regulation on cryptocurrency markets? Regulation can either foster growth and innovation or stifle development, depending on how supportive or restrictive it is.

- Which countries have the most favorable regulations for cryptocurrencies? Countries like Japan and Switzerland are known for their supportive regulatory environments that encourage crypto innovation.

- How do strict regulations affect investors? Strict regulations can drive investors away from local markets, leading them to seek opportunities in more favorable jurisdictions.

Positive Regulatory Examples

When it comes to the world of cryptocurrency, not all regulations are created equal. In fact, some countries have taken a proactive approach to embrace digital currencies, creating an environment ripe for innovation and investment. Take Switzerland, for example. Known for its crypto-friendly regulations, Switzerland has positioned itself as a global hub for blockchain technology. The Swiss Financial Market Supervisory Authority (FINMA) has established clear guidelines that allow startups to thrive while ensuring investor protection. This clarity has attracted numerous blockchain projects, leading to a flourishing ecosystem that benefits both entrepreneurs and investors alike.

Another notable example is Singapore, where the Monetary Authority of Singapore (MAS) has implemented a regulatory framework that encourages innovation while maintaining a robust oversight mechanism. The Payment Services Act, introduced in 2020, provides a comprehensive regulatory structure for payment services, including cryptocurrencies. This has paved the way for major financial institutions to explore cryptocurrency services, thereby enhancing the legitimacy and acceptance of digital assets in the region.

Let's not forget about Estonia, a small nation that has made a big impact in the crypto space. Estonia’s government has actively supported blockchain initiatives and has even developed its own e-residency program, allowing entrepreneurs from around the world to establish a business in Estonia without being physically present. This forward-thinking approach has attracted a plethora of crypto startups, resulting in a vibrant digital economy.

Furthermore, countries such as Germany and Malta have also adopted positive regulatory stances. Germany recognizes cryptocurrencies as a form of legal tender, which has led to increased adoption among businesses and consumers. Malta, often referred to as the "Blockchain Island," has implemented a comprehensive regulatory framework that has attracted numerous crypto exchanges and blockchain companies.

In summary, these countries exemplify how supportive regulations can foster a thriving cryptocurrency ecosystem. By providing clarity and security, they not only attract investment but also encourage innovation, creating a win-win situation for both regulators and the crypto community. It's a testament to the idea that when governments embrace change rather than resist it, the entire economy can benefit.

- What are the benefits of positive cryptocurrency regulations?

Positive regulations can lead to increased investment, innovation, and consumer protection, creating a stable environment for the growth of digital assets. - How do countries like Switzerland and Singapore attract crypto businesses?

These countries offer clear regulatory frameworks, supportive government policies, and a robust financial infrastructure, making them attractive destinations for crypto startups. - Can strict regulations negatively impact the crypto market?

Yes, overly strict regulations can drive businesses and investments to more favorable jurisdictions, stifling innovation and growth in the local market.

Negative Regulatory Examples

When it comes to the world of cryptocurrency, not all regulatory frameworks are created equal. Some countries have taken a hardline stance against digital currencies, and the repercussions of these actions can be profound. For instance, countries like China and India have implemented stringent regulations that have not only stifled innovation but also pushed many investors and projects to seek more favorable environments elsewhere.

In China, the government has cracked down on cryptocurrency trading and initial coin offerings (ICOs), citing concerns over financial stability and fraud. This has led to a significant decline in local crypto activities, with many exchanges shutting down or relocating to more crypto-friendly jurisdictions. The result? A massive brain drain as talented developers and entrepreneurs migrate to countries with more supportive policies. The irony is palpable: a nation that once led the charge in blockchain technology now finds itself on the sidelines, watching as other countries reap the benefits of innovation.

Similarly, India has seen its share of regulatory turmoil. The Reserve Bank of India (RBI) previously imposed a ban on banks dealing with crypto businesses, which led to a chilling effect on the market. Although the Supreme Court later overturned this ban, the uncertainty created by such abrupt regulatory changes has left many investors wary. This kind of volatility in regulations can create a vicious cycle where potential investors hesitate to enter the market, fearing future crackdowns.

To understand the impact of these negative regulatory examples, let’s take a closer look at some of the consequences:

| Country | Regulatory Action | Impact on Crypto Market |

|---|---|---|

| China | Ban on trading and ICOs | Decline in local crypto activities; relocation of businesses |

| India | Banking ban on crypto transactions | Market uncertainty; reduced investor confidence |

| South Korea | Tax on crypto transactions | Increased compliance costs; potential decrease in trading volume |

These examples illustrate how negative regulatory environments can lead to a significant downturn in market activity. Investors often seek stability and predictability, and when regulations become unpredictable, they may choose to invest their capital in more welcoming markets. This not only affects local economies but can also hinder the overall growth of the cryptocurrency ecosystem on a global scale.

Moreover, the fear of stringent regulations can lead to a psychological barrier for new investors. Many potential participants in the crypto space may hesitate to dive in, worried that their investments could be jeopardized by sudden regulatory changes. This hesitation can dampen the overall enthusiasm and adoption of digital currencies, stalling what could be a vibrant and innovative market.

In conclusion, while regulation is essential for protecting investors and ensuring market integrity, overly harsh measures can do more harm than good. Countries that impose strict regulations may find themselves left behind in the rapidly evolving world of cryptocurrency, as innovation and investment flow to more accommodating environments. The challenge lies in finding a balance that fosters growth while ensuring adequate protections for all market participants.

- What are the main negative effects of strict cryptocurrency regulations? Strict regulations can lead to reduced market activity, investor uncertainty, and a potential brain drain as businesses relocate to more favorable jurisdictions.

- How do regulatory changes impact investor behavior? Abrupt regulatory changes can create fear and hesitation among investors, discouraging them from entering the market or making long-term commitments.

- Can positive regulation coexist with strict measures? Yes, a balanced approach that provides clarity and security while encouraging innovation can create a thriving crypto ecosystem.

Global Trade Policies

Global trade policies are like the invisible strings that pull the economy's puppet show. They can shape the landscape of international commerce and, surprisingly, have a ripple effect on the cryptocurrency market. When countries negotiate trade agreements or impose tariffs, they don't just impact traditional goods; they also influence how digital currencies are perceived and adopted. For instance, if a country imposes high tariffs on imported goods, it might lead to inflation and a weakened local currency. In such scenarios, individuals may turn to cryptocurrencies as a hedge against inflation, seeking refuge in digital assets that are not tied to their national currency.

Moreover, trade policies can affect the overall economic environment, altering investor confidence. When nations engage in trade wars, the uncertainty can lead to increased volatility in both traditional markets and crypto markets. Investors often look for safe havens during turbulent times, and cryptocurrencies can serve as a viable option. This is particularly evident during periods of economic instability when the demand for decentralized assets tends to rise.

To illustrate this dynamic, consider the following table that summarizes how specific trade policies can influence cryptocurrency adoption and investment:

| Trade Policy | Impact on Cryptocurrency |

|---|---|

| High Tariffs | Increased inflation, leading to higher interest in crypto as a hedge |

| Trade Agreements | Improved economic stability, fostering a positive environment for crypto investment |

| Trade Wars | Market volatility, prompting investors to seek safer assets like cryptocurrencies |

In addition, the interconnectedness of global economies means that a change in trade policy in one country can have far-reaching effects. For instance, if a major economy decides to adopt more favorable trade policies towards technology and innovation, it could boost the local cryptocurrency market by attracting investment and talent. On the other hand, restrictive trade policies can lead to isolation, pushing investors and innovators to seek opportunities in more crypto-friendly jurisdictions.

In conclusion, global trade policies are not just about tariffs and agreements; they are a crucial part of the economic puzzle that affects cryptocurrency markets. As investors become more aware of these connections, understanding the broader implications of trade policies on crypto adoption will be essential for making informed decisions in an ever-evolving landscape.

Frequently Asked Questions

- How do trade policies affect cryptocurrency prices? Trade policies can influence investor sentiment and economic stability, which in turn can affect cryptocurrency prices.

- Can cryptocurrencies act as a hedge against trade wars? Yes, during trade wars, cryptocurrencies can be seen as a safer investment option as they are not tied to any national currency.

- What role do tariffs play in crypto adoption? High tariffs may lead to inflation and a decrease in local currency value, prompting individuals to seek alternative investments like cryptocurrencies.

Investor Behavior and Sentiment

Understanding how global economic policies shape investor sentiment is crucial in the ever-evolving landscape of cryptocurrency. Unlike traditional assets, cryptocurrencies are often subject to extreme volatility, making the psychology of investors a pivotal factor in market movements. Have you ever noticed how a single tweet from a prominent figure can send Bitcoin prices soaring or crashing? This phenomenon underscores the emotional and psychological aspects that drive investor behavior in the crypto space.

One of the primary drivers of investor sentiment is the overarching economic environment influenced by global monetary policies. For instance, when central banks announce changes in interest rates, it can lead to a ripple effect in the crypto markets. Lower interest rates typically make borrowing cheaper, which encourages spending and investment in riskier assets, including cryptocurrencies. Conversely, when interest rates rise, investors may flock back to safer, traditional investments, leaving digital assets to languish. This dynamic creates a push-pull effect that can significantly alter market trends.

Moreover, the impact of inflation cannot be overstated. In times of high inflation, many investors turn to cryptocurrencies as a hedge against currency devaluation. The perceived scarcity of digital currencies like Bitcoin often attracts those looking to preserve their wealth. It's fascinating to see how investor sentiment can shift based on inflation reports, driving a surge in crypto purchases as individuals seek refuge from eroding purchasing power.

Additionally, market psychology plays a significant role in cryptocurrency trading. The emotional reactions to global economic news, such as changes in trade policies or economic sanctions, can lead to heightened volatility. For instance, when a country announces new tariffs, it can create uncertainty that ripples through markets, leading traders to react impulsively. This emotional trading can create a feedback loop where fear and greed dictate market movements, making it essential for investors to be aware of their psychological biases.

To illustrate this further, let's consider a few key psychological factors that influence investor behavior:

- Fear of Missing Out (FOMO): As prices rise, many investors feel compelled to join the market, fearing they will miss out on potential gains.

- Panic Selling: Negative news can lead to mass sell-offs, as investors rush to cut their losses.

- Herd Behavior: Investors often follow the crowd, which can lead to bubbles or crashes based on collective sentiment rather than fundamentals.

Furthermore, the distinction between long-term and short-term investment strategies also plays a crucial role in shaping investor behavior. Long-term investors tend to focus on the fundamentals of the cryptocurrency market, believing in the technology's potential despite short-term fluctuations. In contrast, short-term traders often react to immediate market conditions and news, leading to a more volatile trading environment. This difference in approach can significantly influence overall market sentiment, as long-term holders may remain unfazed by temporary downturns, while short-term traders may exacerbate volatility through rapid buying and selling.

In conclusion, the intricate relationship between global economic policies and investor behavior in the cryptocurrency market is a fascinating subject. As we continue to navigate this digital frontier, understanding the psychological underpinnings of investor sentiment will be key to successfully engaging with this dynamic asset class.

- How do interest rates affect cryptocurrency prices? - Lower interest rates can lead to increased investment in cryptocurrencies, while higher rates may drive investors back to traditional assets.

- What role does inflation play in crypto investment? - High inflation often drives investors to seek cryptocurrencies as a hedge against currency devaluation.

- Why is market psychology important in crypto trading? - Emotional reactions to news and market trends can lead to significant price volatility, influencing investor behavior.

- What are the differences between long-term and short-term investment strategies in crypto? - Long-term investors focus on fundamentals, while short-term traders react to immediate market conditions, affecting overall market sentiment.

Market Psychology

When it comes to cryptocurrency trading, is like the unseen force that drives the waves of volatility. Imagine standing on a beach, watching the tide ebb and flow; that’s how trader emotions influence the market. Investors are not just numbers; they are people reacting to news, trends, and their own fears and hopes. One moment, you might feel euphoric about a price surge, and the next, panic sets in as prices plummet. This emotional rollercoaster can lead to irrational decisions, often resulting in dramatic market shifts.

The psychological impact of global economic news is profound. For instance, when central banks announce changes in interest rates or inflation targets, traders often react swiftly. If a central bank hints at lowering interest rates, it can create a sense of optimism, encouraging investors to pour money into cryptocurrencies as they seek higher returns. Conversely, if inflation is on the rise, fear can grip the market, leading to sell-offs. This is where the concept of fear and greed comes into play, two powerful emotions that can dictate market movements.

Additionally, the bandwagon effect plays a crucial role. When investors see others making profits, they want in. This can create a snowball effect, driving prices up as more people jump on the bandwagon. However, this can also lead to bubbles, where prices soar beyond their intrinsic value, only to crash later. It’s a classic case of “FOMO” (Fear of Missing Out) versus “FOJI” (Fear of Joining In), where the psychological battle between these two emotions can dictate market trends.

Understanding market psychology is essential for any investor looking to navigate the choppy waters of cryptocurrency. By recognizing how emotions influence trading decisions, investors can develop strategies that account for these psychological factors. For example, implementing a disciplined approach to investing, such as setting predetermined entry and exit points, can help mitigate the risks associated with emotional trading.

In conclusion, the interplay between market psychology and global economic policies is complex and ever-evolving. Investors who grasp these dynamics can better position themselves in the market, making informed decisions rather than succumbing to the whims of fear and greed. After all, in the world of crypto, knowledge is power, and understanding the psychology behind market movements can be the key to success.

- What is market psychology in cryptocurrency?

Market psychology refers to the emotional and psychological factors that influence investor behavior and decision-making in the cryptocurrency market. - How do global economic policies affect market psychology?

Global economic policies can create uncertainty or optimism, which in turn influences investor sentiment, leading to changes in trading behavior. - Can understanding market psychology help me trade better?

Yes, understanding market psychology can help you anticipate market movements and make more informed trading decisions. - What are common psychological biases in trading?

Common biases include fear of missing out (FOMO), overconfidence, loss aversion, and herd mentality, all of which can impact trading decisions.

Long-term vs. Short-term Investment

When it comes to investing in cryptocurrencies, one of the most crucial decisions you’ll face is whether to adopt a long-term or short-term investment strategy. Each approach has its unique advantages and challenges, shaped by various global economic policies and market conditions. Long-term investors typically buy and hold digital assets for extended periods, often years, banking on the potential for substantial appreciation over time. On the other hand, short-term investors, or traders, seek to capitalize on price fluctuations, making quick profits from market volatility.

The choice between these strategies often hinges on several factors, including market sentiment, economic indicators, and personal risk tolerance. For instance, during periods of economic uncertainty, long-term investors might feel more secure holding onto their assets, believing that the market will eventually rebound. Conversely, short-term investors might find opportunities in the same uncertainty, using it as a chance to buy low and sell high.

Let’s break down some of the key differences between these two investment styles:

| Aspect | Long-term Investment | Short-term Investment |

|---|---|---|

| Time Horizon | Years | Days to months |

| Risk Level | Generally lower, with a focus on market trends | Higher, due to volatility and quick market changes |

| Investment Strategy | Buy and hold, based on fundamental analysis | Active trading, based on technical analysis |

| Emotional Stress | Lower, as investors are less frequently monitoring | Higher, due to constant market watching |

Psychologically, long-term investors often adopt a more patient approach, akin to a gardener nurturing a plant, waiting for it to grow over time. They focus on the underlying value and potential of the cryptocurrency, often ignoring short-term market noise. In contrast, short-term investors are like day traders on a busy market floor, constantly reacting to news, trends, and price movements. They thrive on excitement and rapid changes, but this can lead to heightened stress and emotional decision-making.

Moreover, global economic policies can profoundly influence both strategies. For example, a sudden increase in interest rates might prompt short-term investors to sell off their assets quickly, fearing a downturn. Meanwhile, long-term investors might view this as a temporary obstacle, sticking to their strategy and trusting in the long-term potential of their holdings.

Ultimately, the decision between long-term and short-term investment boils down to your personal goals, risk appetite, and market understanding. Are you in it for the long haul, or do you thrive on the thrill of quick trades? Understanding the implications of global economic policies can help you make a more informed choice, aligning your investment strategy with the broader economic landscape.

- What is the best strategy for beginners? Beginners are often advised to start with long-term investing, as it requires less daily monitoring and can yield substantial returns over time.

- How can I manage risk in short-term trading? Utilizing stop-loss orders and diversifying your portfolio can help mitigate risks associated with short-term trading.

- Is it possible to switch strategies? Yes, many investors adjust their strategies based on market conditions and personal financial goals.

Frequently Asked Questions

- How do monetary policies affect cryptocurrency prices?

Monetary policies, particularly those related to interest rates and inflation, can significantly sway investor sentiment towards cryptocurrencies. When central banks adjust interest rates, it can either encourage or discourage investment in digital assets. For instance, lower interest rates might lead investors to seek higher returns in cryptocurrencies, driving prices up.

- What role do regulatory frameworks play in the crypto market?

Regulatory frameworks are crucial as they define how cryptocurrencies can operate within a country. Different countries have varying regulations, which can either foster innovation or create barriers. Supportive regulations can lead to increased investment and growth in the crypto sector, while stringent rules may push investors to look for opportunities elsewhere.

- Can you provide examples of positive regulatory approaches?

Absolutely! Countries like Switzerland and Singapore have implemented favorable regulations that encourage cryptocurrency innovation. These nations have created clear guidelines for crypto businesses, which not only builds investor confidence but also attracts startups and investments in the digital asset space.

- What about negative regulatory examples?

On the flip side, countries like China have imposed strict regulations on cryptocurrencies, leading to a decline in local market activity. Such actions can stifle innovation and drive investors to more crypto-friendly jurisdictions, ultimately harming the local economy.

- How do global trade policies influence cryptocurrency adoption?

Global trade policies can impact the overall economic environment, which in turn affects cryptocurrency adoption. Tariffs and trade agreements can create uncertainty, prompting investors to seek alternative assets like cryptocurrencies as a hedge against economic instability.

- What factors influence investor behavior in crypto?

Investor behavior in the crypto market is shaped by a variety of factors, including market psychology, news events, and economic indicators. Understanding these elements helps investors make informed decisions, whether they are looking to invest long-term or capitalize on short-term market movements.

- How does market psychology affect cryptocurrency trading?

Market psychology is a significant driver of cryptocurrency trading. News about global economic conditions can trigger emotional responses in traders, leading to increased volatility. For instance, positive news might create a buying frenzy, while negative reports could lead to panic selling.

- What is the difference between long-term and short-term investment strategies?

Long-term investors typically look at the bigger picture, focusing on the potential growth of cryptocurrencies over time, while short-term investors may react quickly to market fluctuations. Economic indicators can influence these strategies, as they provide insights into market conditions and potential future performance.