Market Predictions - What to Expect in the Next Crypto Cycle

The cryptocurrency market is like a roller coaster, full of thrilling ups and terrifying downs. As we stand on the brink of the next crypto cycle, many investors are asking: what should we expect? The landscape is constantly evolving, and understanding the upcoming trends is key to navigating this volatile environment. From potential price movements to regulatory impacts and technological advancements, this article will provide a comprehensive overview of what lies ahead in the crypto world.

Historically, crypto markets have followed a pattern of cycles, each with distinct phases. These include accumulation, where savvy investors buy in at lower prices; the bull phase, characterized by soaring prices and exuberance; the distribution phase, where early adopters cash out; and finally, the bear phase, which can feel like a long, dark tunnel. Recognizing these phases can help investors time their entries and exits more effectively. But what’s next? Are we headed for another bull run, or will the bear linger longer than expected?

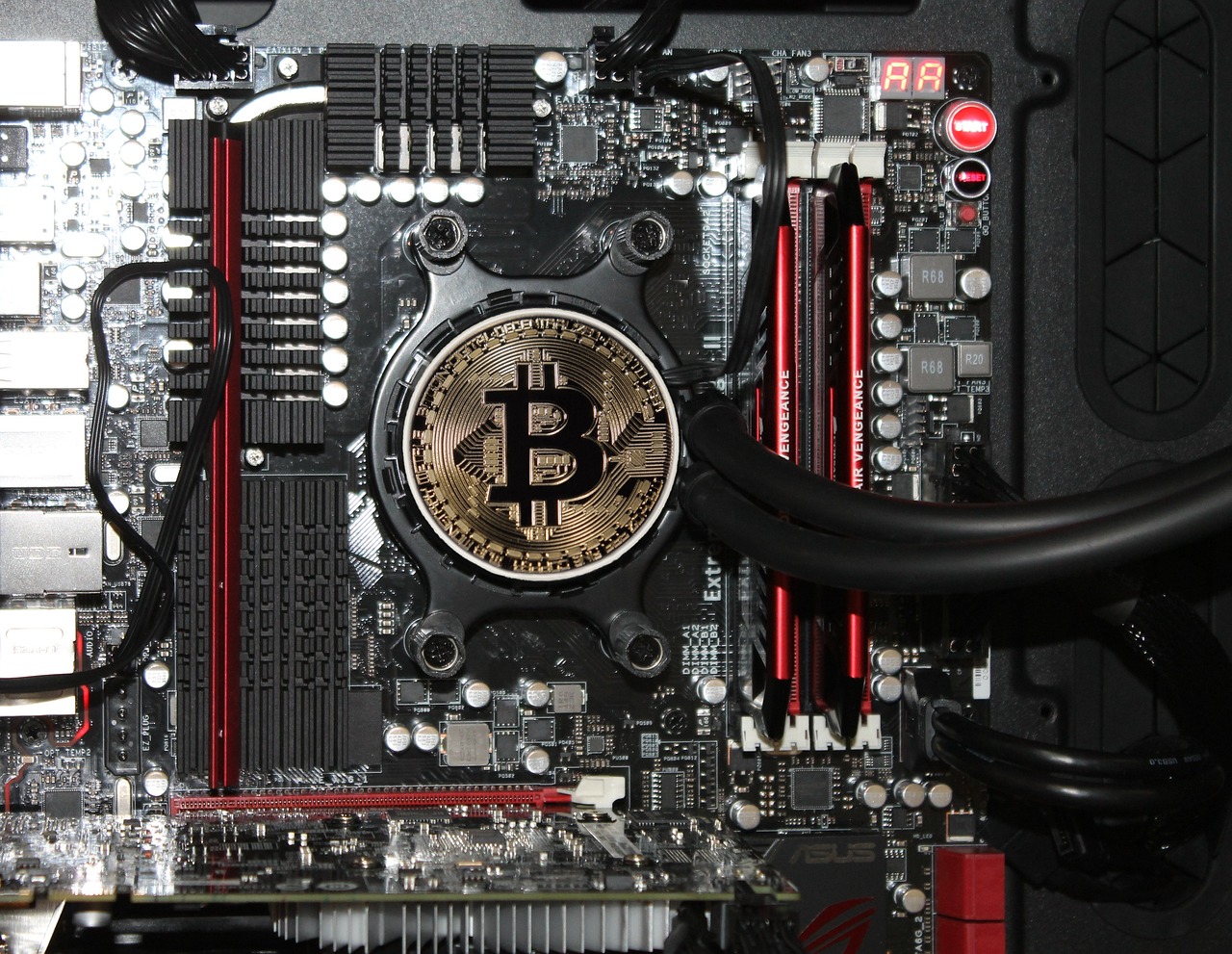

One of the most exciting aspects of the upcoming cycle is the potential for technological innovations to reshape the crypto landscape. We’re witnessing rapid advancements in areas such as blockchain scalability, which could allow for faster and cheaper transactions, and the rise of decentralized finance (DeFi), which is revolutionizing how we think about banking and finance. Additionally, non-fungible tokens (NFTs) are not just a passing trend; they are set to redefine ownership and value in the digital space. These innovations will likely have a profound impact on market dynamics, influencing everything from investor sentiment to price volatility.

Market cycles are crucial for predicting future trends. This section delves into the phases of crypto market cycles, including accumulation, bull, distribution, and bear phases, and their historical significance.

Technological advancements play a pivotal role in shaping the crypto landscape. Here, we examine emerging technologies such as blockchain scalability, DeFi, and NFTs that could influence market dynamics in the next cycle.

DeFi has revolutionized the financial sector by enabling decentralized transactions. This section discusses how DeFi platforms are expected to evolve and impact the overall crypto market in the coming years.

Identifying promising DeFi projects can provide investment opportunities. We highlight several key projects that are likely to gain traction and influence market trends in the next cycle.

While DeFi offers numerous advantages, it also comes with risks. This part outlines potential pitfalls investors should be aware of when engaging with DeFi platforms.

Regulations are a significant factor affecting cryptocurrency markets. This section analyzes potential regulatory developments and their implications for market participants in the next crypto cycle.

Understanding market sentiment is essential for predicting price movements. We explore how investor psychology and market sentiment can influence the crypto market in the upcoming cycle.

Social media has a profound impact on market sentiment. This section examines how platforms like Twitter and Reddit shape investor perceptions and decisions in the crypto space.

Different investor strategies can lead to varying market outcomes. We discuss the distinctions between long-term and short-term investment approaches and their effects on market trends.

- What are the main phases of a crypto market cycle? The main phases include accumulation, bull, distribution, and bear phases.

- How can technological innovations affect the crypto market? Innovations can lead to improved transaction efficiency, new financial products, and changes in investor behavior.

- What role do regulations play in the crypto market? Regulations can impact market stability, investor confidence, and the overall growth of the crypto ecosystem.

- How does social media influence crypto investments? Social media can sway investor sentiment and create hype or fear, affecting market movements.

- What should I consider when investing in DeFi? Be aware of the risks associated with DeFi, including smart contract vulnerabilities and market volatility.

Understanding Market Cycles

Market cycles are an essential concept for anyone looking to navigate the often turbulent waters of the cryptocurrency world. Just like the changing seasons, the crypto market experiences various phases that can significantly influence prices and investment strategies. Understanding these cycles can be the difference between riding the wave of success and getting swept away by a downturn. The four primary phases of a market cycle are accumulation, bull, distribution, and bear. Each phase has its own characteristics and historical significance that can provide valuable insights for investors.

During the accumulation phase, savvy investors start buying assets at lower prices, often when the market sentiment is negative. This phase is akin to planting seeds in a garden; it requires patience and a keen eye for potential growth. As more investors begin to recognize the value of the assets, we transition into the bull phase, characterized by rising prices and increased market enthusiasm. It’s during this phase that excitement and optimism reach their peak, leading to a frenzy of buying. Think of it as a rollercoaster climbing to the top—there's a thrilling anticipation of the drop that follows.

Next comes the distribution phase, where early investors start to take profits. This phase can often be misleading, as it may appear that the market is still bullish. However, it's crucial to recognize that this is typically a signal of a market top, where the smart money is offloading their assets to less informed investors. Finally, we reach the bear phase, marked by declining prices and widespread fear. This phase can feel like a long, dark tunnel, but it’s also an opportunity for new investors to enter the market at lower prices, setting the stage for the next accumulation phase.

To illustrate these phases, let's take a look at the following table that summarizes the characteristics of each market cycle phase:

| Market Cycle Phase | Characteristics | Investor Sentiment |

|---|---|---|

| Accumulation | Prices are low, buying activity increases | Pessimistic to Neutral |

| Bull | Prices rise significantly, high trading volume | Optimistic to Euphoria |

| Distribution | Prices plateau, early investors sell | Optimistic to Cautious |

| Bear | Prices decline, fear prevails | Pessimistic to Despair |

Understanding these phases is crucial for any investor looking to make informed decisions in the crypto market. By recognizing where we are in the cycle, you can better anticipate price movements and adjust your investment strategy accordingly. So, whether you're a seasoned trader or a curious newcomer, keeping an eye on these cycles can help you navigate the unpredictable nature of cryptocurrency investing with greater confidence.

Technological Innovations

The cryptocurrency world is constantly evolving, and are at the heart of this transformation. As we look ahead to the next crypto cycle, several emerging technologies are poised to reshape the landscape, paving the way for new opportunities and challenges. Understanding these innovations is crucial for investors and enthusiasts alike, as they can significantly influence market dynamics.

One of the most exciting areas of development is blockchain scalability. As more users flock to the crypto space, the need for faster and more efficient transaction processing becomes paramount. Innovations such as Layer 2 solutions, like the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum, are designed to enhance transaction speeds and reduce costs. These solutions allow for a greater number of transactions to be processed off the main blockchain, which not only alleviates congestion but also makes the network more accessible to everyday users.

Furthermore, the rise of Decentralized Finance (DeFi) has introduced a wave of innovation that is changing how we think about financial services. DeFi platforms are built on blockchain technology and enable users to engage in lending, borrowing, and trading without the need for traditional intermediaries. This shift not only democratizes access to financial services but also creates a more inclusive financial ecosystem. As these platforms evolve, we can expect to see enhanced features, improved user experiences, and even greater adoption.

DeFi is more than just a buzzword; it represents a fundamental shift in how financial transactions are conducted. By leveraging smart contracts, DeFi platforms automate processes that typically require a third party, such as banks or brokers. This not only reduces costs but also minimizes the potential for fraud. As the DeFi sector continues to grow, we will likely see an influx of innovative products and services that cater to a diverse range of financial needs.

As we navigate the next crypto cycle, certain DeFi projects stand out as potential game-changers. For instance, platforms like Aave, Uniswap, and Compound are leading the charge in providing decentralized lending and trading solutions. Each of these projects offers unique features that could attract more users and investors, ultimately driving market trends. Keeping an eye on these projects can provide valuable insights into where the market may be headed.

While the advantages of DeFi are compelling, it’s essential to acknowledge the risks involved. The decentralized nature of these platforms can lead to vulnerabilities, such as smart contract bugs or hacks. Additionally, the lack of regulatory oversight can expose users to scams and fraudulent schemes. Therefore, it is crucial for investors to conduct thorough research and understand the risks before diving into the DeFi space.

In conclusion, technological innovations are set to play a pivotal role in the upcoming crypto cycle. From enhancing blockchain scalability to revolutionizing finance through DeFi, these advancements will not only shape market trends but also redefine how we interact with cryptocurrencies. Staying informed about these developments will be key for anyone looking to navigate the ever-changing crypto landscape.

- What is blockchain scalability?

Blockchain scalability refers to the ability of a blockchain network to handle an increasing amount of transactions efficiently. Solutions like Layer 2 technologies help achieve this by processing transactions off the main chain. - How does DeFi differ from traditional finance?

DeFi eliminates the need for intermediaries, allowing users to engage in financial transactions directly through smart contracts, which can lead to lower costs and increased accessibility. - What are the risks of investing in DeFi?

Risks include potential smart contract vulnerabilities, scams, and the lack of regulatory protection. It’s essential to do thorough research before investing.

The Rise of Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is not just a buzzword; it's a movement that's reshaping the financial landscape as we know it. Imagine a world where financial services are accessible to anyone with an internet connection, free from the constraints of traditional banking systems. That's the promise of DeFi! This revolutionary concept leverages blockchain technology to create an open-source, permissionless financial ecosystem. It enables users to lend, borrow, trade, and earn interest on their assets without intermediaries, putting the power directly into the hands of the people.

As we move into the next crypto cycle, the evolution of DeFi is expected to be nothing short of explosive. The market is already witnessing a surge in DeFi applications, with platforms offering innovative solutions that challenge conventional finance. For instance, lending protocols like Aave and Compound allow users to earn interest on their crypto holdings while providing liquidity to others. This peer-to-peer model not only increases efficiency but also democratizes access to financial services.

But what makes DeFi so compelling? Let's break it down:

- Accessibility: Anyone can participate, regardless of their financial background.

- Transparency: All transactions are recorded on the blockchain, providing complete visibility.

- Interoperability: Different DeFi protocols can work together, creating a more cohesive ecosystem.

- Yield Farming: Users can maximize their returns by moving assets across platforms to chase the best interest rates.

However, the rise of DeFi is not without its challenges. As these platforms gain traction, issues such as smart contract vulnerabilities and regulatory scrutiny are becoming more prominent. Investors must tread carefully, as the decentralized nature of these platforms can sometimes lead to a lack of accountability. Nonetheless, the potential for innovation and disruption in the financial sector is enormous, and many believe that DeFi will continue to flourish in the coming years.

In summary, the rise of Decentralized Finance represents a significant shift in how we think about and interact with money. With its ability to democratize financial services and enhance accessibility, DeFi is poised to be a key player in the next crypto cycle. As we keep our eyes on this rapidly evolving landscape, it's essential to stay informed and be prepared for the opportunities and challenges that lie ahead.

- What is DeFi? DeFi stands for Decentralized Finance, which refers to financial services that operate on blockchain technology without traditional intermediaries.

- How does DeFi work? DeFi platforms use smart contracts to automate transactions, allowing users to lend, borrow, and trade assets directly with one another.

- What are the risks associated with DeFi? Risks include smart contract vulnerabilities, market volatility, and potential regulatory changes that could impact the ecosystem.

- Can anyone participate in DeFi? Yes! DeFi is designed to be accessible to anyone with an internet connection, regardless of their financial background.

Key DeFi Projects to Watch

As the DeFi sector continues to evolve at a breakneck pace, several projects stand out as potential game-changers in the upcoming crypto cycle. These projects not only showcase innovative technology but also have robust communities and real-world applications that could redefine the financial landscape. One of the most exciting aspects of DeFi is its ability to democratize finance, and these key projects are at the forefront of this movement.

First on our radar is Aave. Aave is a decentralized lending platform that allows users to lend and borrow a variety of cryptocurrencies without the need for intermediaries. What sets Aave apart is its unique feature of "flash loans," which enable users to borrow assets without collateral as long as the loan is repaid within the same transaction. This innovation has opened up new avenues for arbitrage opportunities and liquidity provision, making it a project to watch closely.

Another noteworthy project is Uniswap, a decentralized exchange (DEX) that has gained immense popularity due to its user-friendly interface and automated market-making capabilities. Uniswap allows users to swap ERC-20 tokens without the need for an order book or centralized authority, thereby enhancing trading efficiency and reducing costs. With its recent version upgrades, Uniswap is expected to further solidify its position in the DeFi ecosystem.

Next, we have Compound, which has become a cornerstone in the DeFi lending space. Compound allows users to earn interest on their crypto holdings by lending them out to other users. The platform uses an algorithmic interest rate model to determine the rates, ensuring that they reflect supply and demand dynamics. Compound's governance token, COMP, has also empowered its community, allowing them to vote on key protocol decisions.

Lastly, let’s not forget about Yearn Finance. This project has gained attention for its yield farming strategies that optimize returns for investors by automatically reallocating funds across various DeFi protocols. Yearn Finance's ability to maximize yield with minimal user intervention is a significant draw for both novice and seasoned investors alike.

In summary, the DeFi landscape is bursting with potential, and these projects exemplify the innovation and transformative power of decentralized finance. As we move into the next crypto cycle, keeping an eye on these key players could provide valuable insights and opportunities for investment. The DeFi space is not without its challenges, but the promise of financial inclusivity and efficiency makes it an exciting frontier for investors and enthusiasts alike.

- What is DeFi? - DeFi, or decentralized finance, refers to financial services that use smart contracts on blockchains, primarily Ethereum, to offer services like lending, borrowing, and trading without traditional intermediaries.

- How do I invest in DeFi projects? - You can invest in DeFi projects by purchasing their tokens on decentralized exchanges or participating in liquidity pools, but always conduct thorough research before investing.

- What are the risks associated with DeFi? - Risks include smart contract vulnerabilities, market volatility, and regulatory uncertainties. It's essential to understand these risks before diving into DeFi.

Risks Associated with DeFi

The world of Decentralized Finance (DeFi) is undoubtedly thrilling, offering the promise of financial freedom and innovative solutions that traditional finance often lacks. However, as with any investment opportunity, it comes with its own set of risks that every investor should be aware of. Understanding these risks is crucial because while the potential rewards can be substantial, the pitfalls can be equally daunting. So, what are these risks?

One of the most significant risks in the DeFi space is smart contract vulnerabilities. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. If there are bugs or vulnerabilities in the code, it can lead to significant losses. In fact, there have been numerous instances where poorly coded smart contracts have been exploited, resulting in millions of dollars being drained from DeFi platforms. This highlights the importance of thorough audits and due diligence before engaging with any DeFi project.

Another risk to consider is liquidity risk. DeFi platforms often rely on liquidity pools to facilitate transactions. If a platform experiences a sudden drop in liquidity, it can lead to slippage, where the price you pay for a transaction is significantly higher than expected. This can be particularly detrimental for larger trades, where the impact on the market can be more pronounced. Always assess the liquidity of a platform before diving in.

Additionally, regulatory uncertainty looms over the DeFi sector. As governments worldwide begin to scrutinize cryptocurrencies and DeFi projects, changing regulations can impact how these platforms operate. Investors might find themselves in a precarious position if a platform they have invested in suddenly becomes non-compliant with new regulations. Staying informed about regulatory changes is essential for anyone involved in DeFi.

Lastly, market volatility is a risk that cannot be ignored. The crypto market is known for its extreme fluctuations. Prices can soar one day and plummet the next, often without any clear reason. This volatility can be amplified in the DeFi space due to the relatively smaller market caps of many projects. Investors should be prepared for the emotional rollercoaster that comes with such volatility and have a solid risk management strategy in place.

In summary, while DeFi presents exciting opportunities for innovation and investment, it is vital to approach it with caution. Understanding the risks associated with smart contracts, liquidity, regulatory changes, and market volatility can help investors make informed decisions. So, before jumping into the DeFi pool, take a moment to assess your risk tolerance and do your homework. After all, in the world of finance, knowledge is power!

- What is DeFi? - DeFi, or Decentralized Finance, refers to financial services that are built on blockchain technology, allowing for peer-to-peer transactions without intermediaries.

- What are smart contracts? - Smart contracts are self-executing contracts with the terms written into code, enabling automated transactions on the blockchain.

- What risks should I consider before investing in DeFi? - Key risks include smart contract vulnerabilities, liquidity risk, regulatory uncertainty, and market volatility.

- How can I mitigate risks in DeFi? - Conduct thorough research, diversify your investments, and stay updated on regulatory changes to mitigate risks.

Impact of Regulatory Changes

The cryptocurrency market is a dynamic landscape, constantly influenced by a myriad of factors, with regulatory changes being one of the most significant. As governments and regulatory bodies around the world grapple with how to approach cryptocurrencies, the implications of these regulations can send shockwaves through the market. For instance, when a country announces stricter regulations, it can lead to immediate sell-offs, while more favorable policies can spark a surge in prices. This volatility underscores the importance of staying informed about potential regulatory shifts.

One of the key areas where regulation is expected to evolve is in the realm of anti-money laundering (AML) and know your customer (KYC) requirements. As cryptocurrencies gain mainstream acceptance, regulators are increasingly focused on ensuring that these digital assets are not used for illicit activities. This means that exchanges and DeFi platforms may need to implement stricter verification processes, which could affect user accessibility and operational efficiency.

Moreover, the classification of cryptocurrencies—whether they are deemed securities, commodities, or currencies—will play a pivotal role in determining the regulatory framework applicable to them. For example, if a cryptocurrency is classified as a security, it could become subject to stringent regulations that govern traditional securities markets. This could lead to a scenario where only a handful of cryptocurrencies can operate freely, while others may face significant hurdles. This classification can also impact investor sentiment, as uncertainty around regulatory status can lead to hesitation among potential investors.

Additionally, the global nature of cryptocurrencies adds another layer of complexity. Different countries have varying approaches to regulation. For instance, while some countries like El Salvador have embraced Bitcoin as legal tender, others have outright banned it. This disparity can create a fragmented market, where investors must navigate a patchwork of regulations. As a result, many investors may look for jurisdictions with more favorable regulations, which can lead to capital flight from less friendly environments.

To illustrate the potential impacts of regulatory changes, let's consider a hypothetical scenario where a major economy, such as the United States or the European Union, introduces comprehensive regulations for cryptocurrencies. The table below outlines possible outcomes:

| Regulatory Change | Potential Impact |

|---|---|

| Stricter KYC/AML Regulations | Increased compliance costs for exchanges; potential decrease in user engagement. |

| Classification of Cryptocurrencies as Securities | Limited number of compliant cryptocurrencies; increased scrutiny from regulators. |

| Taxation on Crypto Gains | Higher tax liabilities could deter small investors; may push trading underground. |

| Legalization of Stablecoins | Increased trust and usage of stablecoins; potential growth in DeFi applications. |

As we look ahead to the next crypto cycle, it’s clear that regulatory changes will continue to be a double-edged sword. On one hand, they can lend legitimacy to the market and protect investors; on the other hand, they can stifle innovation and limit growth. Investors and market participants must remain vigilant, adapting to these changes as they unfold. After all, in the world of crypto, being proactive rather than reactive can make all the difference.

- What are the main types of regulations affecting cryptocurrencies? Regulations can include AML/KYC requirements, securities classification, taxation, and operational guidelines for exchanges.

- How do regulatory changes affect cryptocurrency prices? Stricter regulations may lead to price drops due to reduced market participation, while favorable regulations can boost prices by increasing investor confidence.

- What should investors do in response to regulatory news? Investors should stay informed, adjust their strategies accordingly, and consider diversifying their portfolios to mitigate risks associated with regulatory changes.

Market Sentiment and Investor Behavior

When it comes to the cryptocurrency market, one thing is abundantly clear: market sentiment can be a game-changer. Think of it as the mood of the market, a collective feeling that can swing prices up or down faster than you can say "blockchain." Understanding this sentiment is crucial for anyone looking to navigate the often-turbulent waters of crypto investing. But what exactly drives this sentiment? And how can investors use it to their advantage?

At its core, market sentiment is influenced by a variety of factors, including news events, social media trends, and even the actions of influential investors. For instance, when a major news outlet publishes a positive article about a specific cryptocurrency, you can bet that the price will likely rise as a wave of optimism sweeps through the community. Conversely, negative news can send prices plummeting, leaving investors scrambling to make sense of the chaos. This is why keeping an ear to the ground and staying updated on the latest developments is essential for any serious investor.

One of the most significant platforms shaping market sentiment today is social media. Platforms like Twitter and Reddit have become the new town squares for crypto enthusiasts, where information spreads like wildfire. Consider the phenomenon of memecoins; these cryptocurrencies often gain traction not because of their technology or utility, but due to viral trends and memes that capture the public's imagination. The power of social media cannot be overstated, as it can create a frenzy of buying or selling that influences the market in real-time.

Investor behavior also plays a pivotal role in shaping market trends. There are generally two types of investors in the crypto space: long-term holders and short-term traders. Long-term holders, often referred to as "HODLers," believe in the fundamental value of their investments and are less likely to be swayed by short-term market fluctuations. On the other hand, short-term traders are more reactive, often buying and selling based on the latest news or social media buzz. This creates a dynamic interplay between different types of investors, which can lead to significant price volatility.

To illustrate this further, let's take a look at a simple table that outlines the key differences between long-term and short-term investors:

| Investor Type | Investment Strategy | Market Impact |

|---|---|---|

| Long-term Holders | Buy and hold for extended periods | Stabilizes prices, reduces volatility |

| Short-term Traders | Frequent buying and selling | Increases volatility, creates rapid price changes |

As we venture into the next crypto cycle, understanding these dynamics will be more important than ever. The market is expected to experience fluctuations driven by both technological advancements and regulatory changes. Therefore, being attuned to market sentiment and investor behavior can provide valuable insights that help you make informed decisions. After all, in the world of cryptocurrency, information is power, and the more you know, the better positioned you'll be to ride the waves of the market.

- What is market sentiment? Market sentiment refers to the overall attitude of investors toward a particular security or financial market, often influenced by news, social media, and market trends.

- How does social media impact crypto prices? Social media can create rapid shifts in investor sentiment, leading to quick buying or selling, which can significantly affect cryptocurrency prices.

- What are the differences between long-term and short-term investors? Long-term investors typically hold onto their assets for extended periods, while short-term traders frequently buy and sell based on market conditions.

Influence of Social Media

In today's digital age, social media isn't just a platform for sharing memes or catching up with friends; it has become a powerful catalyst for market movements, especially in the cryptocurrency sector. Imagine a world where a single tweet can send a coin's price soaring or crashing within minutes. It's almost like a modern-day digital oracle, where influencers and everyday users alike can sway the market with their words. The impact of social media on crypto is profound, and understanding this influence is key for investors looking to navigate the tumultuous waters of the next crypto cycle.

Platforms like Twitter, Reddit, and Telegram have emerged as the epicenters of crypto discussions. On Twitter, hashtags can ignite trends, while Reddit communities, often referred to as subreddits, can rally behind projects, creating a sense of community and urgency. For instance, the infamous WallStreetBets subreddit not only revolutionized stock trading but also had a significant impact on certain cryptocurrencies. When the community collectively decides to back a coin, the effects can be explosive. This phenomenon illustrates the power of collective sentiment, where the voice of the crowd can lead to dramatic price shifts.

Moreover, the psychology of social media plays a crucial role in shaping investor behavior. The fear of missing out (FOMO) is a real sentiment that drives many to invest impulsively, often leading to poor decision-making. Conversely, negative news or sentiments can lead to panic selling, further exacerbating market volatility. It's essential for investors to be aware of these emotional triggers and how they can affect their investment strategies. In fact, many seasoned investors now include social media sentiment analysis as part of their research toolkit, recognizing that understanding the mood of the market can be just as important as analyzing charts and data.

To illustrate the impact of social media on cryptocurrency, consider the following table that highlights key events where social media played a critical role:

| Date | Event | Platform | Impact |

|---|---|---|---|

| January 2021 | GameStop and Dogecoin surge | Dogecoin's price skyrocketed by over 800% in a matter of days. | |

| May 2021 | Elon Musk's SNL appearance | Bitcoin's price dropped significantly following Musk's comments. | |

| October 2021 | Shiba Inu coin hype | Shiba Inu saw a massive price increase due to viral tweets. |

In conclusion, the influence of social media on the cryptocurrency market is undeniable. As we move into the next cycle, investors must remain vigilant, not only in their technical analyses but also in monitoring social media trends. The ability to discern genuine community sentiment from hype can be the difference between a successful investment and a costly mistake. So, the next time you see a trending hashtag or a viral tweet about a new crypto project, remember: it could either be a golden opportunity or a fleeting illusion.

Long-term vs Short-term Investors

When it comes to investing in the volatile world of cryptocurrency, understanding the differences between long-term and short-term investors can be a game-changer. Each type of investor has its own strategies, goals, and risk tolerance, which ultimately shape market dynamics. So, what really sets them apart? Let's dive in!

Long-term investors, often referred to as "HODLers," are those who buy and hold their investments for an extended period, usually years. They believe in the fundamental value of the assets they purchase and are not easily swayed by short-term market fluctuations. Imagine planting a tree and nurturing it over time; long-term investors are like those gardeners, patiently waiting for their investment to grow and yield fruits in the future. They typically conduct thorough research and focus on the potential of the technology behind a cryptocurrency, rather than its daily price movements.

On the other hand, short-term investors, or "traders," thrive on the excitement of the market's ups and downs. They actively buy and sell cryptocurrencies, often making decisions based on technical analysis, market trends, and news events. Think of them as surfers riding the waves—they're always looking for the next big swell to catch. This approach can be rewarding but also risky, as the volatile nature of crypto markets can lead to significant losses just as quickly as gains.

Here’s a quick comparison to highlight the key differences:

| Aspect | Long-term Investors | Short-term Investors |

|---|---|---|

| Investment Horizon | Years | Days/Weeks |

| Strategy | Buy and hold | Active trading |

| Risk Tolerance | Lower | Higher |

| Focus | Fundamental value | Market trends |

| Emotional Impact | Less affected by volatility | Highly affected by volatility |

Both types of investors play a crucial role in shaping the market. Long-term investors contribute to the overall stability and growth of the crypto ecosystem, often providing liquidity and support for projects they believe in. Meanwhile, short-term investors can add excitement and volatility, which can lead to price surges that attract more attention to the market. However, the challenge lies in finding a balance. Too much speculative trading can lead to bubbles and crashes, while a strong base of long-term holders can help sustain price levels over time.

Ultimately, whether you identify as a long-term or short-term investor, it's essential to understand your own financial goals and risk tolerance. Are you in it for the long haul, or do you thrive on the thrill of the trade? Knowing where you stand can help you make informed decisions and navigate the unpredictable waters of the cryptocurrency market.

- What is a HODLer? A HODLer is a long-term investor who holds onto their cryptocurrency investments despite market fluctuations.

- What are the risks of short-term trading? Short-term trading can lead to significant losses due to the volatile nature of the crypto market, as prices can change rapidly.

- Can I switch between long-term and short-term investing? Absolutely! Many investors adjust their strategies based on market conditions and personal financial goals.

Frequently Asked Questions

- What are the main phases of a crypto market cycle?

The crypto market typically goes through four main phases: accumulation, bull, distribution, and bear. During the accumulation phase, savvy investors buy in at lower prices. The bull phase sees prices surge as more people jump in, creating excitement. In the distribution phase, early investors start selling, leading to a peak. Finally, the bear phase occurs when prices decline, often causing panic among investors.

- How do technological innovations impact the crypto market?

Technological advancements are like the fuel for the crypto engine. Innovations such as blockchain scalability, decentralized finance (DeFi), and non-fungible tokens (NFTs) can significantly alter market dynamics. For instance, improvements in blockchain technology can enhance transaction speeds and reduce costs, attracting more users and investors.

- What is DeFi and why is it important?

Decentralized Finance, or DeFi, represents a shift from traditional finance to a more open and accessible financial system. It allows users to perform transactions without intermediaries, which can lead to lower fees and increased financial freedom. DeFi is crucial because it can democratize financial services, making them available to anyone with an internet connection.

- What are the risks associated with investing in DeFi?

While DeFi offers exciting opportunities, it also comes with risks. Smart contract vulnerabilities, regulatory uncertainty, and market volatility can lead to significant losses. Investors should be cautious, do their research, and understand the potential pitfalls before diving into DeFi projects.

- How do regulatory changes affect the crypto market?

Regulations can have a profound impact on the cryptocurrency landscape. Changes in laws can either bolster market confidence or create uncertainty. For example, clear regulations can encourage institutional investment, while sudden crackdowns can lead to panic selling. Staying informed about regulatory developments is essential for anyone involved in the crypto space.

- Why is market sentiment important in cryptocurrency trading?

Market sentiment acts like the heartbeat of the crypto market. It reflects how investors feel about price movements, news, and overall market conditions. Positive sentiment can drive prices up, while negative sentiment can lead to sharp declines. Understanding market sentiment can help investors make informed decisions and anticipate potential market shifts.

- How does social media influence crypto prices?

Social media platforms like Twitter and Reddit have a massive influence on crypto prices. They can create buzz around certain coins, leading to rapid price increases or declines. A single tweet from a prominent figure can spark a buying frenzy or a sell-off. Therefore, keeping an eye on social media trends is crucial for crypto investors.

- What’s the difference between long-term and short-term investing in crypto?

Long-term investors typically buy and hold cryptocurrencies for extended periods, betting on their future growth. Short-term investors, on the other hand, capitalize on quick price movements, often buying and selling within days or even hours. Each strategy has its advantages and risks, and the choice depends on individual investment goals and risk tolerance.