A Comprehensive Guide to Arbitrage Trading in Crypto

Welcome to the fascinating world of arbitrage trading in the cryptocurrency market! If you’ve ever found yourself wondering how traders seem to capitalize on price discrepancies across different exchanges, you’re in the right place. Arbitrage trading isn’t just a buzzword; it’s a strategy that can significantly boost your trading profits if executed correctly. In this guide, we will dive deep into the intricacies of arbitrage trading, covering everything from its fundamental principles to advanced strategies, risks, and the essential tools you need to succeed.

At its core, arbitrage trading involves taking advantage of price differences for the same asset in different markets. Imagine you’re at a marketplace where two vendors are selling the same apple. Vendor A sells it for $1, while Vendor B sells it for $1.50. If you buy the apple from Vendor A and sell it to Vendor B, you pocket a neat profit of $0.50. This simple concept translates directly to the crypto world, where prices can vary from one exchange to another due to factors like liquidity, trading volume, and even geographical location.

But why is arbitrage trading particularly significant in the cryptocurrency landscape? Unlike traditional markets, the crypto market operates 24/7, leading to rapid price fluctuations and opportunities that can arise in the blink of an eye. The decentralized nature of cryptocurrencies means that prices can differ widely across platforms, creating a playground for savvy traders. However, it's essential to note that while arbitrage can be lucrative, it’s not without its challenges. Understanding these intricacies is vital for anyone looking to dive into this trading strategy.

In the following sections, we’ll break down the various types of arbitrage strategies available to traders, including spatial, temporal, and statistical arbitrage. We’ll also discuss the risks involved, the tools that can aid your trading efforts, and even share case studies of successful traders who have navigated this complex landscape. So, whether you’re a seasoned trader or just starting, this comprehensive guide will equip you with the knowledge you need to maximize your profits through arbitrage trading.

Arbitrage trading is a strategy that allows traders to exploit price discrepancies in various markets. The essence of arbitrage lies in buying low in one market and selling high in another. This section will define arbitrage trading, its significance in crypto, and how it differs from traditional trading methods.

There are several strategies traders can use in arbitrage. This section will detail the most common types, including spatial, temporal, and statistical arbitrage, highlighting their unique features and applications.

Spatial arbitrage takes advantage of price differences for the same asset across different exchanges. This subsection will explain how traders can identify and execute spatial arbitrage opportunities effectively.

Choosing the right exchanges is crucial for successful spatial arbitrage. When selecting exchanges, consider factors such as:

- Liquidity: Higher liquidity means you can buy and sell assets quickly without affecting the price.

- Fees: Transaction fees can eat into your profits, so look for exchanges with competitive rates.

- Trading Volume: Higher trading volumes typically indicate a more active market, which can lead to better price stability.

Timing can significantly impact the success of spatial arbitrage. The crypto market is fast-paced, and prices can change rapidly. Traders must be quick on their feet, often using automated tools to execute trades at lightning speed. Optimizing your timing can mean the difference between profit and loss, so it's essential to stay alert and ready to act.

Temporal arbitrage focuses on price fluctuations over time. This subsection will delve into how traders can capitalize on these changes and the tools that can assist in this strategy.

While arbitrage can be profitable, it comes with risks. This section will outline the potential pitfalls, including market volatility, execution risks, and regulatory challenges that traders should be aware of.

Market volatility can affect arbitrage opportunities. Sudden price changes can impact trades, making it crucial for traders to develop strategies to mitigate these risks. Understanding market trends and using stop-loss orders can help safeguard your investments.

Regulations in the crypto space can vary widely. Traders must stay informed about legal issues that may arise, as regulatory changes can impact trading strategies and opportunities.

Effective arbitrage trading requires the right tools. This section will introduce essential resources, including trading bots, arbitrage calculators, and market analysis platforms that can enhance trading efficiency.

Trading bots can automate arbitrage strategies, allowing traders to capitalize on opportunities without constant monitoring. These tools can execute trades based on predefined criteria, making them invaluable for busy traders.

Arbitrage calculators help traders assess potential profits. By inputting variables such as purchase and sale prices, fees, and transaction times, traders can make informed decisions about their trades.

Learning from real-life examples can provide valuable insights. This section will present case studies of successful arbitrage traders, analyzing their strategies and the lessons learned from their experiences.

This part will profile individual traders who have excelled in arbitrage. It will highlight their approaches, challenges faced, and how they overcame obstacles to achieve success.

Analyzing the experiences of successful traders can reveal key takeaways. This section will summarize the most important lessons learned from case studies and how they can be applied to your trading strategy.

What is arbitrage trading?

Arbitrage trading involves buying and selling the same asset in different markets to profit from price discrepancies.

Is arbitrage trading safe?

While it can be profitable, arbitrage trading carries risks such as market volatility and regulatory challenges.

What tools do I need for arbitrage trading?

Essential tools include trading bots, arbitrage calculators, and market analysis platforms.

How can I maximize my profits in arbitrage trading?

By choosing the right exchanges, optimizing execution timing, and utilizing automated tools, you can enhance your profit potential.

Understanding Arbitrage Trading

Arbitrage trading is a fascinating concept that has gained immense popularity, especially in the world of cryptocurrencies. At its core, arbitrage is all about exploiting price differences across various markets. Imagine walking into two different stores selling the same product at different prices; you would buy it from the cheaper store and sell it at a profit in the more expensive one. This is the essence of arbitrage trading, but in the context of digital assets.

In the cryptocurrency market, where prices can fluctuate wildly within minutes, the opportunities for arbitrage are plentiful. Traders can buy a cryptocurrency at a lower price on one exchange and sell it at a higher price on another. This process not only helps individual traders capitalize on price discrepancies but also contributes to market efficiency by aligning prices across platforms.

What makes arbitrage trading in crypto unique compared to traditional trading methods? Well, the crypto market operates 24/7, unlike stock markets that have set trading hours. This constant activity means that price differences can appear and disappear in the blink of an eye, creating a thrilling environment for traders.

However, it's essential to understand that while arbitrage trading can be lucrative, it is not without its challenges. Traders must be quick and decisive, as the window of opportunity can close rapidly. Moreover, the process involves several factors that can affect profitability, such as trading fees, withdrawal limits, and market liquidity.

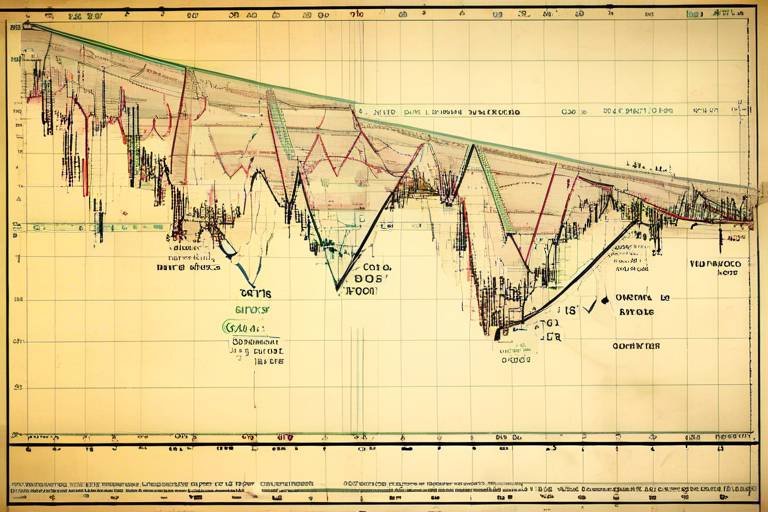

To illustrate this further, let’s take a look at a simple example:

| Exchange | Price of Bitcoin (BTC) |

|---|---|

| Exchange A | $30,000 |

| Exchange B | $30,500 |

In this scenario, a trader could buy Bitcoin from Exchange A for $30,000 and sell it on Exchange B for $30,500, making a profit of $500 per Bitcoin (minus any fees).

In summary, understanding arbitrage trading is crucial for anyone looking to navigate the crypto landscape effectively. By recognizing the potential for profit and the inherent risks, traders can make informed decisions and enhance their trading strategies. As we delve deeper into the various types of arbitrage strategies, you'll discover the nuances that can help you become a successful trader in this exciting domain.

Types of Arbitrage Strategies

When it comes to arbitrage trading in the cryptocurrency market, there isn't just one way to play the game. In fact, traders have developed several distinct arbitrage strategies that cater to various market conditions and personal trading styles. Understanding these strategies is crucial for anyone looking to maximize their profits while minimizing risks. Let's dive into the most common types of arbitrage strategies: spatial, temporal, and statistical arbitrage.

Spatial arbitrage is one of the most straightforward approaches. It involves taking advantage of price discrepancies for the same asset across different exchanges. Imagine you find Bitcoin priced at $40,000 on Exchange A and $40,500 on Exchange B. By buying low on Exchange A and selling high on Exchange B, you pocket the difference. This strategy requires a keen eye for market fluctuations and quick execution to capitalize on these fleeting opportunities.

Choosing the right exchanges is paramount for successful spatial arbitrage. Not all exchanges are created equal, and several factors should influence your decision:

- Liquidity: Ensure that the exchange has enough trading volume to facilitate your trades without significantly impacting the price.

- Fees: Consider trading fees, withdrawal fees, and deposit fees, as these can eat into your profits.

- Trading Volume: Higher trading volumes generally mean better price stability and less slippage.

By carefully selecting exchanges based on these criteria, you can enhance your chances of executing successful spatial arbitrage trades.

Timing is everything in arbitrage trading. The window of opportunity can close in seconds, so quick execution is essential. Traders often use automated tools to help with this, allowing them to react swiftly to market changes. For instance, having a trading bot set up to monitor price differences can significantly improve your chances of executing trades before the prices converge.

On the other hand, temporal arbitrage focuses on price fluctuations over time rather than across different exchanges. This strategy involves buying an asset when its price is low and selling it when the price increases. Traders often rely on historical data and market analysis to predict these price movements. By understanding market trends and employing technical analysis, traders can effectively capitalize on temporal arbitrage opportunities.

Statistical arbitrage is a more complex strategy that utilizes mathematical models and algorithms to identify trading opportunities. This method often involves analyzing historical price data to forecast future price movements. Traders using statistical arbitrage typically employ sophisticated software that can process vast amounts of data quickly, identifying patterns and correlations that may not be immediately visible to the naked eye.

In summary, understanding the various types of arbitrage strategies can significantly enhance your trading game. Whether you prefer the straightforward approach of spatial arbitrage or the analytical depth of statistical arbitrage, each method offers unique opportunities and challenges. By leveraging the right strategy, traders can navigate the dynamic cryptocurrency market more effectively, maximizing their potential for profit.

Q1: What is the best arbitrage strategy for beginners?

A: For beginners, spatial arbitrage is often the easiest to understand and execute. It involves simply buying low on one exchange and selling high on another, making it a straightforward concept to grasp.

Q2: Are there any tools to help with arbitrage trading?

A: Yes, there are several tools available, including trading bots and arbitrage calculators, that can help automate and optimize your trading strategies.

Q3: What are the risks associated with arbitrage trading?

A: Risks include market volatility, execution risks, and regulatory challenges. It's essential to be aware of these factors and have strategies in place to mitigate them.

Spatial Arbitrage

Spatial arbitrage is a fascinating strategy that allows traders to profit from the price discrepancies of the same asset across different cryptocurrency exchanges. Imagine walking into two different stores and finding the same product at two different prices; that’s the essence of spatial arbitrage in the crypto world. Traders can buy a cryptocurrency at a lower price on one exchange and sell it at a higher price on another, effectively capitalizing on the market inefficiencies. But how does one identify these opportunities, and what are the best practices for executing such trades?

To successfully engage in spatial arbitrage, traders must first identify the exchanges that exhibit significant price differences for the same cryptocurrency. This can be done by monitoring multiple exchanges simultaneously. Tools like price tracking websites or trading bots can streamline this process, providing real-time data on price fluctuations across various platforms. Moreover, traders should pay attention to the liquidity of the exchanges they are considering, as higher liquidity typically means smoother transactions and less slippage.

When selecting exchanges for spatial arbitrage, several factors come into play:

- Liquidity: Higher liquidity allows for faster trades without significantly affecting the price.

- Fees: Transaction fees can eat into profits, so it’s essential to choose exchanges with competitive fee structures.

- Trading Volume: Higher trading volumes often correlate with better price stability and faster execution times.

However, identifying the right exchanges is just the beginning. The timing of your trades is equally crucial. In the world of cryptocurrency, prices can change in the blink of an eye. Therefore, having a quick execution plan is vital. This means being prepared to act fast once a price discrepancy is identified. Many successful traders use automated trading bots that can execute trades within milliseconds, ensuring they don’t miss out on profitable opportunities.

In conclusion, spatial arbitrage can be a lucrative strategy for those willing to put in the effort to monitor multiple exchanges and act quickly. By understanding the market dynamics and employing the right tools, traders can exploit price differences effectively. However, as with any trading strategy, it's essential to remain vigilant and adaptable, as market conditions can change rapidly.

- What is spatial arbitrage? Spatial arbitrage is the practice of buying an asset at a lower price on one exchange and selling it at a higher price on another.

- How do I identify opportunities for spatial arbitrage? You can use price tracking tools and trading bots to monitor multiple exchanges for price discrepancies.

- What factors should I consider when choosing exchanges? Consider liquidity, fees, and trading volume to ensure successful trades.

- Why is timing important in spatial arbitrage? Prices can change rapidly in the crypto market, so quick execution is essential to capitalize on opportunities.

Exchange Selection

When diving into the world of spatial arbitrage, one of the most critical steps is selecting the right cryptocurrency exchanges. Think of it as choosing the best fishing spots before casting your line; the right choice can make all the difference between a bountiful catch and coming home empty-handed. The exchanges you select can significantly impact your trading success, and there are several factors you should consider to ensure you’re making informed decisions.

First and foremost, liquidity is a vital factor. High liquidity means that there are plenty of buyers and sellers on the platform, which allows for easier entry and exit points. If you try to execute a trade on an exchange with low liquidity, you might find that the price you want to buy or sell at isn’t available, leading to slippage and reduced profits. Therefore, look for exchanges that have a high trading volume and are known for their liquidity.

Next, trading fees can eat into your profits if you’re not careful. Different exchanges have various fee structures, including maker and taker fees, withdrawal fees, and even deposit fees. It’s essential to calculate how much of your profit will be consumed by these fees before you start trading. Some exchanges might offer lower fees but have other drawbacks, so it’s crucial to analyze the overall cost of trading on each platform.

Additionally, consider the trading pairs available on each exchange. Not all exchanges will have the same cryptocurrencies or trading pairs, which could limit your arbitrage opportunities. For instance, if you find a price discrepancy for Bitcoin on one exchange but it’s not paired with a stablecoin or another asset you hold on that platform, you might miss out on a profitable trade. Always check the available pairs and ensure they align with your trading strategy.

Another essential aspect is the security measures of the exchange. The cryptocurrency market has seen its fair share of hacks and security breaches, and you want to ensure that your funds are safe. Look for exchanges that offer two-factor authentication (2FA), cold storage for assets, and a solid reputation in the community. Reading reviews and checking the exchange’s history can provide insights into its reliability.

Lastly, user experience and customer support should not be overlooked. A user-friendly interface can make your trading experience much smoother, especially if you’re executing trades quickly. Additionally, responsive customer support can be invaluable when you encounter issues or have questions. Ensure that the exchange you choose has a reputation for good customer service, as this can save you a lot of headaches down the road.

In summary, selecting the right exchange for spatial arbitrage involves considering several factors:

- Liquidity

- Trading Fees

- Available Trading Pairs

- Security Measures

- User Experience and Customer Support

By carefully evaluating these elements, you can position yourself for success in the fast-paced world of cryptocurrency arbitrage trading.

Q: What is arbitrage trading?

A: Arbitrage trading is the practice of exploiting price differences of the same asset across different markets to make a profit.

Q: Is arbitrage trading risk-free?

A: While arbitrage trading can be less risky than other trading methods, it is not entirely risk-free. Factors like market volatility and execution risks can impact trades.

Q: How do I choose a cryptocurrency exchange?

A: Consider factors such as liquidity, trading fees, available trading pairs, security measures, and user experience when selecting an exchange.

Q: Can I automate my arbitrage trading?

A: Yes, many traders use trading bots to automate their arbitrage strategies, which can help execute trades more quickly and efficiently.

Execution Timing

Timing is everything in the world of arbitrage trading, especially when it comes to capitalizing on price discrepancies across different exchanges. Imagine you spot a golden opportunity where Bitcoin is trading for $30,000 on Exchange A while it's listed at $30,500 on Exchange B. Sounds like a no-brainer, right? But here's the catch: the window of opportunity can close faster than you can say "crypto." This is why is crucial. If you take too long to execute your trades, the prices may converge, and the profit you were aiming for could evaporate into thin air.

To optimize your execution timing, you need to be aware of several factors. First, consider the speed of your internet connection. A sluggish connection can delay your trades, making it difficult to capitalize on fleeting opportunities. Second, the trading platform’s performance matters. Some exchanges have faster transaction speeds than others, which can significantly impact your ability to execute trades quickly. You might want to test the platforms before diving in; after all, you wouldn’t want to be stuck in a slow lane while others zoom past you.

Another essential aspect of execution timing is market conditions. During periods of high volatility, prices can change dramatically within seconds. This means that the price you see now may not be the price you get when you place your order. To mitigate this risk, traders often use limit orders instead of market orders. A limit order allows you to set the price at which you want to buy or sell, ensuring that you don’t settle for a less favorable price if the market moves against you.

Additionally, utilizing tools like trading bots can dramatically enhance your execution timing. These bots can execute trades on your behalf based on predefined criteria, allowing you to react to market changes much faster than you could manually. However, it’s essential to choose a reliable bot and configure it correctly to align with your trading strategy. Remember, in the fast-paced world of crypto trading, every second counts!

In summary, honing your execution timing is a vital skill for successful arbitrage trading. By focusing on your internet speed, the performance of your trading platform, market conditions, and leveraging automated tools, you can significantly increase your chances of capitalizing on profitable opportunities. So, the next time you spot a price discrepancy, remember that your ability to act quickly can make all the difference between profit and loss.

- What is arbitrage trading? Arbitrage trading is the practice of exploiting price differences for the same asset across different markets to make a profit.

- How can I improve my execution timing? You can improve execution timing by ensuring a fast internet connection, choosing a reliable trading platform, using limit orders, and employing trading bots.

- What are the risks of arbitrage trading? Risks include market volatility, execution risks, and regulatory challenges that can impact your trades.

- Can trading bots help with arbitrage? Yes, trading bots can automate your trades, allowing for quicker execution and better management of opportunities.

Temporal Arbitrage

Temporal arbitrage is a fascinating strategy that focuses on capitalizing on price fluctuations of cryptocurrencies over time. Unlike spatial arbitrage, which exploits price differences across various exchanges simultaneously, temporal arbitrage is all about timing. Imagine it as a game of chess, where every move counts, and anticipating your opponent's strategy can lead to victory. In the world of crypto, traders who master temporal arbitrage can significantly enhance their profit margins by predicting when prices will rise or fall on a specific exchange.

To effectively engage in temporal arbitrage, traders must closely monitor market trends and price movements. This involves analyzing historical data and using various tools to forecast future price behavior. By understanding the patterns and trends, traders can make informed decisions about when to buy and sell their assets. For instance, if a trader notices that a particular coin often drops in price during certain hours of the day, they can buy during those dips and sell when the price rebounds. This strategic timing can lead to substantial profits, provided the trader is quick and decisive.

One of the essential tools for executing temporal arbitrage is market analysis platforms. These platforms offer real-time data, historical price charts, and various indicators that help traders identify potential opportunities. Additionally, automated trading bots can be invaluable in this strategy, as they can execute trades at lightning speed, taking advantage of price changes before the trader even has a chance to react. However, it’s crucial to choose the right bot that aligns with your trading style and risk tolerance.

Moreover, the success of temporal arbitrage heavily relies on the trader's ability to stay informed about market news and events. For example, significant announcements, regulatory changes, or technological advancements can drastically affect cryptocurrency prices. By keeping a finger on the pulse of the crypto world, traders can anticipate these changes and adjust their strategies accordingly.

In summary, temporal arbitrage is a dynamic and potentially lucrative trading strategy that requires keen observation, timely execution, and the right tools. By understanding market trends and utilizing advanced technology, traders can capitalize on the natural ebb and flow of cryptocurrency prices over time. Just like a surfer riding a wave, those who can navigate the highs and lows of the market will find themselves riding the tide of profitability.

Risks Involved in Arbitrage Trading

While arbitrage trading can be a lucrative venture, it is not without its risks. Understanding these risks is crucial for anyone looking to dive into the world of cryptocurrency arbitrage. One of the primary risks is market volatility. The crypto market is notorious for its rapid price fluctuations, and these sudden changes can significantly impact the profitability of arbitrage trades. For instance, if a trader identifies a price discrepancy between two exchanges, a sudden market movement could eliminate the opportunity before the trade is executed. This highlights the importance of being prepared for quick decision-making.

Another critical risk to consider is execution risk. In the fast-paced world of cryptocurrency trading, delays in executing trades can lead to lost opportunities. This is especially true in arbitrage, where the window of opportunity may be very small. Traders must ensure they have reliable internet connections and efficient trading setups to minimize these risks. Additionally, regulatory challenges can pose significant hurdles. The legal landscape surrounding cryptocurrencies is constantly evolving, and regulations can vary widely from one jurisdiction to another. Traders must stay informed about the latest developments to avoid potential legal issues.

To further illustrate the potential risks, consider the following table that summarizes key risks associated with arbitrage trading:

| Risk Type | Description | Mitigation Strategies |

|---|---|---|

| Market Volatility | Rapid price changes can eliminate arbitrage opportunities. | Use stop-loss orders and monitor the market closely. |

| Execution Risk | Delays in trade execution may lead to missed opportunities. | Utilize trading bots for faster execution. |

| Regulatory Challenges | Varying regulations can lead to legal complications. | Stay updated on local laws and regulations. |

In addition to these risks, traders should also be aware of liquidity issues. Not all exchanges have the same level of liquidity, which can affect the ability to buy or sell assets at desired prices. Low liquidity can result in slippage, where the execution price differs from the expected price, potentially eating into profits. Therefore, it is vital to choose exchanges with high trading volumes to ensure better execution of trades.

Ultimately, while the potential rewards of arbitrage trading are enticing, it is essential to approach it with a clear understanding of the associated risks. By being aware of these challenges and implementing effective strategies to mitigate them, traders can increase their chances of success in the competitive world of cryptocurrency arbitrage.

- What is arbitrage trading? Arbitrage trading involves exploiting price differences of the same asset across different markets to make a profit.

- Is arbitrage trading risk-free? No, while arbitrage can be profitable, it carries risks such as market volatility, execution delays, and regulatory challenges.

- How can I minimize risks in arbitrage trading? You can minimize risks by using reliable trading platforms, staying informed about market conditions, and employing trading bots for faster execution.

- What tools can assist in arbitrage trading? Essential tools include trading bots, arbitrage calculators, and market analysis platforms.

Market Volatility

Market volatility is a term that often sends shivers down the spine of traders, and for good reason. In the world of cryptocurrency, where prices can swing wildly within minutes, understanding this concept is crucial for anyone looking to engage in arbitrage trading. Simply put, market volatility refers to the degree of variation in trading prices over time. This fluctuation can create both opportunities and challenges for arbitrage traders. Imagine trying to catch a wave while surfing; if you miss the right moment, you could wipe out, but if you time it just right, you could ride it all the way to the shore!

One of the primary factors contributing to market volatility in crypto is the sheer amount of market participants and their varying behaviors. Unlike traditional markets, where institutional investors often dominate, the crypto space is filled with individual traders, each reacting to news, trends, and social media buzz. This collective behavior can cause rapid price movements. For instance, a tweet from a prominent figure can send prices soaring or plummeting in a matter of minutes. As an arbitrage trader, you need to be aware of these dynamics and how they can impact your strategies.

To navigate the choppy waters of market volatility, traders can employ several strategies:

- Monitoring News and Trends: Staying updated with the latest news can help you anticipate price movements. Use news aggregators and social media to track significant developments.

- Setting Stop-Loss Orders: Implementing stop-loss orders can protect your investments from sudden price drops, allowing you to minimize potential losses.

- Using Technical Analysis: Familiarizing yourself with chart patterns and indicators can provide insights into potential price movements, helping you make informed decisions.

However, it’s essential to remember that while these strategies can mitigate risks, they are not foolproof. The unpredictable nature of the crypto market means that even the best-laid plans can go awry. For example, a sudden regulatory announcement can cause a market-wide panic, leading to unexpected price fluctuations that could disrupt your arbitrage opportunities. Therefore, it’s vital to remain adaptable and ready to pivot your strategies as needed.

In conclusion, market volatility is a double-edged sword in the realm of arbitrage trading. It presents both risks and rewards, and understanding how to navigate this volatility can be the difference between a profitable trade and a costly mistake. As you embark on your arbitrage journey, keep in mind that staying informed, using the right tools, and maintaining a flexible approach will serve you well in this ever-changing landscape.

- What is market volatility? Market volatility refers to the degree of variation in trading prices over time, indicating how much prices fluctuate.

- How does market volatility affect arbitrage trading? High volatility can create opportunities for arbitrage but also increases the risk of sudden price changes that can impact trades.

- What strategies can I use to manage market volatility? Strategies include monitoring news, setting stop-loss orders, and using technical analysis to anticipate price movements.

Regulatory Challenges

When diving into the world of arbitrage trading in cryptocurrencies, one cannot overlook the that loom over the landscape. The crypto market is notorious for its rapidly changing regulations, which can vary significantly from one jurisdiction to another. This unpredictability can create a minefield for traders who are trying to navigate the complexities of compliance while also seeking to capitalize on price discrepancies.

Firstly, it's essential to understand that regulations can impact liquidity and the availability of trading pairs across different exchanges. For instance, some exchanges may be subject to stricter regulations than others, which can lead to limited access for traders in certain regions. This limitation can hinder the ability to execute arbitrage strategies effectively. Furthermore, the lack of uniformity in regulations across countries can create confusion. A strategy that is perfectly legal in one nation could be deemed illegal in another, putting traders at risk of facing legal repercussions.

Additionally, regulatory bodies are becoming increasingly vigilant in monitoring cryptocurrency transactions. This heightened scrutiny means that traders must be aware of anti-money laundering (AML) and know your customer (KYC) requirements that many exchanges enforce. Failing to comply with these regulations can lead to account freezes or even legal action, which can severely disrupt trading activities. Therefore, it's crucial for traders to stay informed about the regulatory landscape in their region and any changes that may occur.

Moreover, the potential for regulatory crackdowns can lead to sudden market shifts. For example, when a government announces new regulations, it can cause panic selling or buying, which directly influences price movements. Such volatility can create both opportunities and risks for arbitrage traders. To mitigate these challenges, traders should adopt a proactive approach by:

- Staying updated on local and international regulatory news.

- Engaging with communities and forums to share insights and experiences.

- Consulting with legal experts who specialize in cryptocurrency regulations.

In conclusion, while the arbitrage trading landscape offers exciting opportunities, it is fraught with regulatory challenges that traders must navigate carefully. By understanding the implications of regulations and remaining vigilant, traders can better position themselves to thrive in this dynamic environment.

- What are the main regulatory bodies overseeing cryptocurrency?

Regulatory bodies vary by country, but some of the most influential include the SEC in the United States, the FCA in the UK, and the ESMA in the EU. - How can I ensure compliance with regulations while trading?

Stay informed about local laws, adhere to KYC and AML requirements, and consider consulting with legal professionals. - What happens if I violate crypto regulations?

Violating regulations can lead to penalties, account suspensions, or even criminal charges, depending on the severity of the violation.

Tools and Resources for Arbitrage Trading

When it comes to arbitrage trading, having the right tools and resources can make all the difference between a profitable venture and a costly mistake. In the fast-paced world of cryptocurrency, where prices can fluctuate within seconds, leveraging technology is essential. So, what tools can help you optimize your arbitrage trading strategies?

First and foremost, trading bots are a game-changer. These automated programs can execute trades on your behalf, allowing you to take advantage of price discrepancies without needing to be glued to your screen 24/7. Imagine you're at dinner, and a lucrative arbitrage opportunity arises. With a trading bot, you can rest easy knowing that your trades are being executed automatically, maximizing your profit potential even when you're not actively trading.

Next up, we have arbitrage calculators. These handy tools help you assess potential profits by calculating the differences in prices across various exchanges. By inputting the purchase and selling prices, as well as any associated fees, you can quickly determine whether a trade is worth pursuing. Think of it as your personal financial advisor, crunching the numbers so you don’t have to. Some popular arbitrage calculators include:

| Calculator Name | Features | Link |

|---|---|---|

| Crypto Arbitrage Calculator | Real-time price updates, multiple exchange support | Visit |

| ArbiTool | Customizable settings, profit margin analysis | Visit |

| CoinMarketCap Arbitrage | Comprehensive market data, user-friendly interface | Visit |

Another essential resource is market analysis platforms. These platforms provide in-depth insights into market trends, price movements, and trading volumes across different exchanges. By utilizing these resources, traders can make informed decisions and identify potential arbitrage opportunities more effectively. Some well-known platforms include CoinGecko, TradingView, and Binance Research. Each of these platforms offers unique features that cater to different trading styles, so it's worth exploring them to find the one that suits you best.

Moreover, staying connected with the trading community can also be incredibly beneficial. Online forums, social media groups, and trading Discord channels are excellent places to share insights, strategies, and tips with fellow traders. Engaging with others can help you stay updated on the latest trends and tools in the arbitrage trading space. You never know when a fellow trader might share a tool or resource that could significantly improve your trading efficiency!

In summary, effective arbitrage trading hinges on having the right tools at your disposal. From trading bots that automate your trades to calculators that help you evaluate potential profits, these resources can enhance your trading experience and help you capitalize on market opportunities. So, whether you're a seasoned trader or just starting, investing time in exploring these tools can pay off in the long run.

Trading Bots

In the fast-paced world of cryptocurrency trading, have emerged as indispensable tools for many traders. These automated systems are designed to execute trades on behalf of the user based on predefined criteria. Imagine having a tireless assistant that works around the clock, analyzing market data, and making split-second decisions while you catch some much-needed sleep. Sounds appealing, right? That's the power of trading bots!

At their core, trading bots operate using algorithms that assess market conditions and execute trades when certain parameters are met. They can be programmed to follow various strategies, from simple ones that buy low and sell high to more complex strategies that incorporate technical indicators and market sentiment analysis. The beauty of using a trading bot is that it removes the emotional aspect of trading, allowing for a more disciplined approach.

When selecting a trading bot, there are several key factors to consider:

- Performance History: Look for bots with a proven track record. Check reviews and backtesting results to gauge their effectiveness.

- Customization Options: The best bots allow you to tailor their strategies to fit your trading style. A one-size-fits-all approach rarely yields optimal results.

- Security Features: Ensure the bot has robust security protocols in place. After all, you want to protect your investments from potential threats.

- Customer Support: A responsive support team can be a lifesaver if you encounter issues or have questions about the bot's functionality.

Moreover, trading bots can be categorized into different types based on their functionality:

| Type of Trading Bot | Description |

|---|---|

| Market Making Bots | These bots provide liquidity by placing buy and sell orders around the current market price, profiting from the spread. |

| Trend Following Bots | These bots analyze market trends and execute trades based on the direction of the market, aiming to capitalize on momentum. |

| Arbitrage Bots | Designed specifically for arbitrage trading, these bots identify price discrepancies across different exchanges and execute trades to profit from them. |

While trading bots can significantly enhance your trading efficiency, it's important to remember that they are not foolproof. Market conditions can change rapidly, and no bot can guarantee profits in every scenario. Therefore, it's wise to keep an eye on your bot's performance and adjust your strategies as needed. Think of it as having a co-pilot; you still need to be engaged and ready to take control if necessary.

In conclusion, trading bots can be a powerful ally in your cryptocurrency trading journey. They offer the potential for increased profits while minimizing the emotional stress that often accompanies trading. However, like any tool, their effectiveness depends on how well you understand and utilize them. So, do your research, choose wisely, and let these bots help you navigate the thrilling world of crypto trading!

1. What are trading bots?

Trading bots are automated software programs that execute trades on behalf of a trader based on specific parameters and algorithms.

2. Are trading bots safe to use?

While many reputable trading bots have robust security features, it's essential to research and choose a reliable bot to minimize risks.

3. Can trading bots guarantee profits?

No, trading bots cannot guarantee profits. They can enhance trading efficiency, but market conditions can change rapidly, affecting outcomes.

4. How do I choose the right trading bot?

Consider factors like performance history, customization options, security features, and customer support when selecting a trading bot.

5. Can I use multiple trading bots simultaneously?

Yes, many traders use multiple bots to diversify their strategies across different markets and trading pairs.

Arbitrage Calculators

When diving into the world of arbitrage trading, having the right tools at your disposal can make all the difference. One of the most essential tools for any trader is the arbitrage calculator. These calculators are designed to help traders quickly assess potential profits by analyzing price discrepancies across different exchanges. Imagine trying to solve a puzzle without knowing what the final picture looks like; that’s what trading can feel like without an arbitrage calculator.

Arbitrage calculators simplify the complex calculations involved in determining whether a trade is worth executing. They consider various factors, including the price of the asset on different exchanges, transaction fees, and the amount of capital you intend to invest. By inputting these variables, traders can receive a clear picture of their potential profit margins.

There are several types of arbitrage calculators available, each catering to different trading strategies and preferences. Some calculators focus solely on spatial arbitrage, while others may cater to temporal arbitrage or triangular arbitrage. Below is a brief overview of the types of calculators you might encounter:

| Calculator Type | Description |

|---|---|

| Spatial Arbitrage Calculator | Compares prices of the same asset across different exchanges. |

| Temporal Arbitrage Calculator | Analyzes price changes over time on a single exchange. |

| Triangular Arbitrage Calculator | Calculates potential profit from converting one currency into another through multiple exchanges. |

Using an arbitrage calculator is straightforward. Most platforms require you to enter the following information:

- Asset Price: The current price of the asset on different exchanges.

- Transaction Fees: The fees associated with buying and selling on each exchange.

- Investment Amount: The amount of capital you plan to invest in the arbitrage opportunity.

Once you input this data, the calculator will provide you with a detailed analysis, including potential profits and the best exchanges to execute your trades. This can save you a significant amount of time and reduce the risk of human error in your calculations.

However, while arbitrage calculators are incredibly beneficial, they are not foolproof. Traders should remain aware of the market conditions and ensure they’re using up-to-date information. Prices can change rapidly, and what seemed like a profitable opportunity five minutes ago may no longer be valid. Therefore, it’s crucial to act quickly and have a solid understanding of the market dynamics at play.

In conclusion, arbitrage calculators are an invaluable resource for traders looking to maximize their profits in the cryptocurrency market. By providing quick and accurate calculations, these tools enable traders to make informed decisions and seize opportunities as they arise. Just remember, while these calculators can guide you, the ultimate success of your trading strategy will depend on your ability to analyze the market and respond swiftly to changes.

Case Studies of Successful Arbitrage Traders

When it comes to arbitrage trading in the cryptocurrency market, learning from those who have successfully navigated its complexities can be invaluable. These case studies not only highlight effective strategies but also reveal the mindset and approaches that can lead to success. One such trader, known in the crypto community as "CryptoGenius," began his journey with a modest investment. Through diligent research and a keen understanding of market dynamics, he identified price discrepancies between two popular exchanges. By executing trades swiftly, he capitalized on these differences, turning a profit that steadily increased over time.

Another noteworthy example is "ArbitrageQueen," who took a slightly different route. Instead of focusing solely on spatial arbitrage, she incorporated temporal arbitrage into her strategy. By analyzing historical price data and using advanced trading bots, she was able to predict price movements with remarkable accuracy. Her approach involved monitoring multiple exchanges simultaneously and executing trades based on anticipated price changes. This not only minimized her risks but also maximized her returns, showcasing the effectiveness of combining different arbitrage strategies.

These traders' stories illustrate the importance of adaptability and continuous learning in the ever-evolving crypto landscape. While CryptoGenius relied on swift execution in spatial arbitrage, ArbitrageQueen emphasized the predictive power of data analysis. Their experiences underscore the varied paths to success in arbitrage trading. To further enrich your understanding, let’s explore some key takeaways from their journeys:

- Research is Key: Both traders dedicated significant time to understanding market trends and price movements.

- Speed Matters: Quick execution can make or break an arbitrage opportunity, especially in a volatile market.

- Embrace Technology: Using trading bots and analytical tools can enhance your trading strategy and efficiency.

Ultimately, the insights gained from these case studies can serve as a blueprint for aspiring arbitrage traders. By adopting a flexible mindset and leveraging the right tools, anyone can potentially replicate their success in the dynamic world of cryptocurrency arbitrage.

What is arbitrage trading?

Arbitrage trading is a strategy that involves exploiting price differences of the same asset across different markets or exchanges to make a profit. Traders buy low on one platform and sell high on another, capitalizing on the price variance.

Is arbitrage trading safe?

While arbitrage trading can be less risky than other trading strategies, it is not without its challenges. Market volatility, execution risks, and regulatory issues can impact profitability. Traders should be aware of these risks and have strategies in place to mitigate them.

What tools can help with arbitrage trading?

Several tools can enhance arbitrage trading, including trading bots that automate trades, arbitrage calculators to assess potential profits, and market analysis platforms to track price movements across exchanges.

Can anyone become a successful arbitrage trader?

Yes, with the right knowledge, tools, and strategies, anyone can become a successful arbitrage trader. Continuous learning and adapting to market changes are crucial for long-term success.

Trader Profiles

When diving into the world of arbitrage trading, it’s not just about the strategies or the tools; it's also about the people behind the trades. Understanding the profiles of successful arbitrage traders can provide invaluable insights into what it takes to thrive in this fast-paced market. Let’s take a closer look at a few exemplary traders who have made their mark in the crypto arbitrage scene.

One standout figure is Jane Doe, who began her trading journey in 2017. Jane focuses primarily on spatial arbitrage, capitalizing on price discrepancies across multiple exchanges. She emphasizes the importance of thorough research and quick execution. Jane often shares her experiences on social media, where she highlights her strategies and challenges. Her success can be attributed to her rigorous selection process for exchanges, ensuring she only trades on those with high liquidity and minimal fees.

Another notable trader is John Smith, who has a knack for temporal arbitrage. John’s approach is to monitor price fluctuations over time, using sophisticated algorithms to predict market trends. He utilizes various trading bots to automate his trades, allowing him to react swiftly to market changes. John’s journey hasn’t been without its hurdles; he faced significant losses during a market crash in 2018. However, he learned the importance of risk management and now employs strict stop-loss measures to protect his investments.

Lastly, we have Emily Chen, a trader who blends both spatial and temporal strategies. Emily’s unique approach involves analyzing historical data to forecast potential price movements while simultaneously exploiting current price discrepancies across exchanges. She advocates for continuous learning and often participates in webinars to stay updated on market trends and regulatory changes. Emily’s success is a testament to the power of adaptability and the willingness to evolve with the market.

These trader profiles illustrate that there’s no one-size-fits-all approach to arbitrage trading. Each trader brings their own style, strategies, and lessons learned along the way. By studying their journeys, aspiring traders can glean important insights into the mindset and techniques that can lead to success in the competitive world of cryptocurrency arbitrage.

- What is arbitrage trading? Arbitrage trading involves buying and selling the same asset in different markets to profit from price discrepancies.

- Is arbitrage trading risky? Yes, while it can be profitable, arbitrage trading comes with risks such as market volatility and execution challenges.

- What tools can help with arbitrage trading? Essential tools include trading bots, arbitrage calculators, and market analysis platforms.

- How can I start arbitrage trading? Begin by researching different exchanges, understanding the types of arbitrage strategies, and utilizing the right tools.

Lessons Learned

When diving into the world of arbitrage trading, the journeys of successful traders offer invaluable insights that can significantly enhance your own trading strategies. One of the most important lessons learned is the necessity of thorough research. Traders who take the time to understand market dynamics, liquidity, and the specific characteristics of different exchanges are often the ones who find consistent success. For instance, one trader noted that by diligently monitoring price discrepancies and adjusting their strategies based on real-time data, they were able to capitalize on fleeting opportunities that others missed.

Another critical takeaway revolves around the importance of risk management. Successful arbitrage traders often emphasize that while the potential for profit is enticing, the risks involved cannot be overlooked. They recommend setting strict limits on how much capital to allocate to each trade, as well as employing stop-loss orders to safeguard against unexpected market movements. By establishing a clear risk management plan, traders can protect their investments and maintain longevity in the market.

Moreover, the role of technology cannot be understated. Many successful arbitrage traders leverage advanced tools such as trading bots and arbitrage calculators to streamline their processes. These tools not only help in identifying profitable trades but also in executing them swiftly, which is crucial in a market that operates 24/7. A trader who utilized a trading bot reported that automation allowed them to focus on strategy development rather than being bogged down by manual trading tasks.

Lastly, the importance of networking and community engagement has come to light through various case studies. Traders who actively participate in forums and online communities often gain access to shared knowledge and insights that can lead to improved trading decisions. Engaging with others in the field can provide fresh perspectives on strategies and market conditions, allowing traders to adapt more effectively. As one trader put it, "In this game, you're only as good as the information you have."

In summary, the lessons learned from successful arbitrage traders highlight the need for continuous learning, effective risk management, technological integration, and community engagement. By incorporating these elements into your trading approach, you can enhance your potential for success in the fast-paced world of cryptocurrency arbitrage.

- What is arbitrage trading? Arbitrage trading is the practice of exploiting price differences of the same asset across different markets to make a profit.

- Is arbitrage trading risky? Yes, while it can be profitable, it comes with risks such as market volatility and execution risks.

- What tools are essential for arbitrage trading? Key tools include trading bots, arbitrage calculators, and market analysis platforms.

- How can I start arbitrage trading? Begin by researching different exchanges, understanding market dynamics, and utilizing the right tools to identify opportunities.

Frequently Asked Questions

- What is arbitrage trading in crypto?

Arbitrage trading in crypto involves taking advantage of price discrepancies for the same asset across different exchanges. Traders buy low on one exchange and sell high on another, pocketing the difference as profit.

- What are the main types of arbitrage strategies?

The primary types of arbitrage strategies include spatial arbitrage, which exploits price differences across exchanges, and temporal arbitrage, which capitalizes on price fluctuations over time. Each strategy has its own unique features and applications.

- How do I choose the right exchanges for spatial arbitrage?

When selecting exchanges for spatial arbitrage, consider factors such as liquidity, trading fees, and overall trading volume. A well-chosen exchange can significantly enhance your chances of successful trades.

- What risks should I be aware of in arbitrage trading?

Arbitrage trading comes with several risks, including market volatility that can affect price discrepancies, execution risks from delays in trading, and regulatory challenges that vary by region. Being aware of these risks can help you mitigate potential losses.

- How can trading bots help with arbitrage trading?

Trading bots automate the execution of arbitrage strategies, allowing traders to react quickly to market changes. They can help you capitalize on opportunities that may arise in a matter of seconds, making them an essential tool for serious arbitrage traders.

- What tools are essential for effective arbitrage trading?

Key tools for effective arbitrage trading include trading bots, arbitrage calculators, and market analysis platforms. These resources can enhance your trading efficiency and help you make informed decisions based on real-time data.

- Can you provide examples of successful arbitrage traders?

Yes! Many traders have found success through strategic arbitrage. By analyzing their approaches and the challenges they faced, you can gain valuable insights and lessons that can be applied to your own trading strategy.

- How can I stay informed about regulatory changes affecting arbitrage trading?

Staying informed about regulatory changes is crucial for any trader. Following reputable crypto news sources, joining trading communities, and regularly checking updates from regulatory bodies can help you keep your finger on the pulse of the market.