The Art of Timing - When to Buy and Sell

In the world of investing, timing can be everything. Imagine you're standing at a busy intersection, waiting for the perfect moment to cross. You wouldn't want to rush into traffic, nor would you want to wait too long and miss your opportunity. This analogy holds true in the financial markets as well. Knowing when to buy and sell assets can significantly impact your investment returns. Timing isn't just about luck; it's a skill that can be honed through understanding market cycles, technical analysis, and emotional discipline.

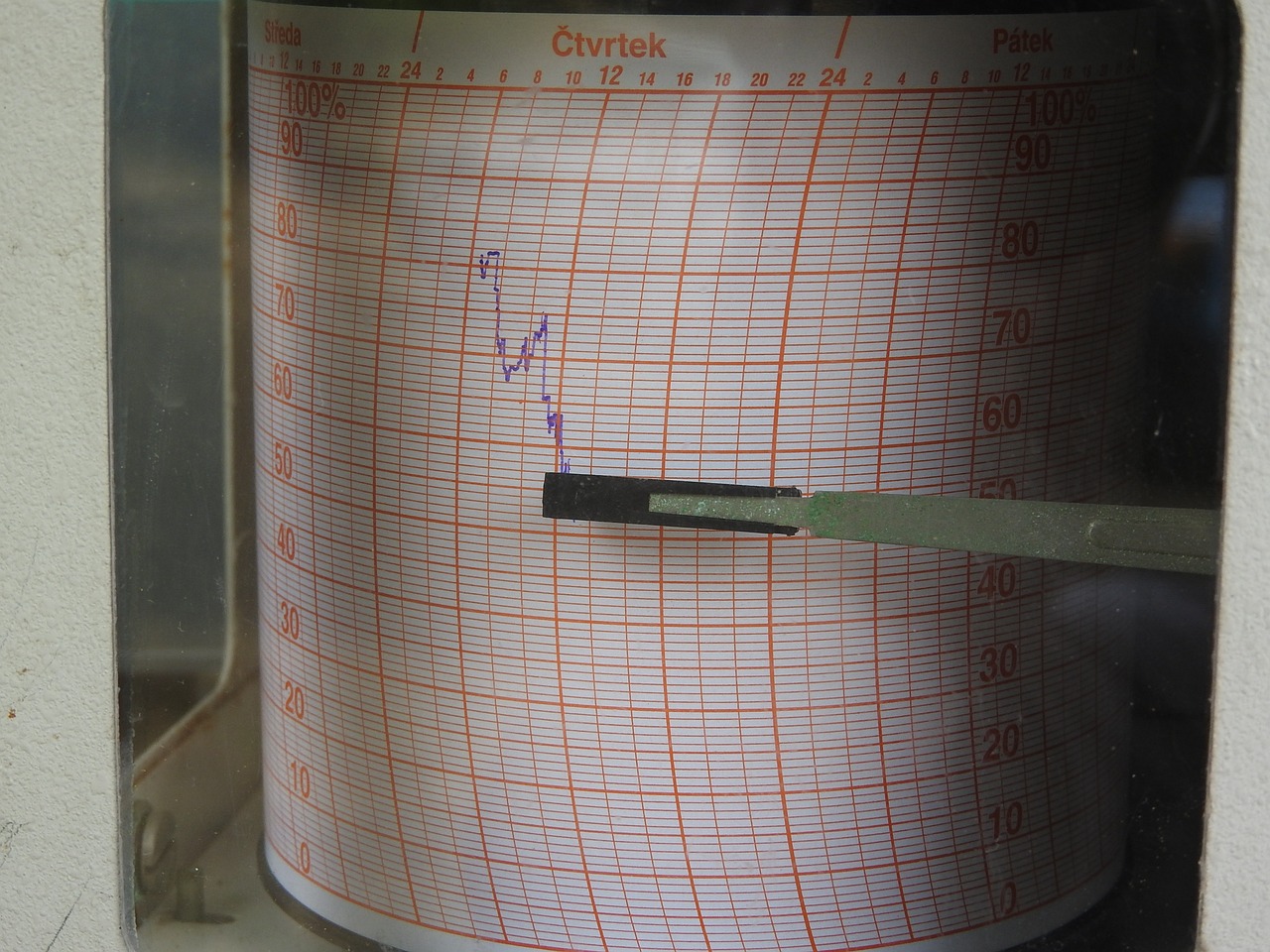

Market cycles are the natural ebb and flow of economic activity. These cycles consist of periods of expansion and contraction, influenced by various factors such as interest rates, consumer confidence, and geopolitical events. Recognizing these cycles can help investors make informed decisions. For instance, during a market expansion, asset prices typically rise, making it an opportune time to sell. Conversely, during a contraction, prices may drop, presenting a buying opportunity for savvy investors. The key is to stay informed and be aware of where we are in the cycle.

Technical analysis is like reading the pulse of the market. It involves evaluating price movements and trading volumes to forecast future behavior. By understanding the principles of technical analysis, you can enhance your timing when buying or selling assets. This approach is especially useful for short-term traders who rely on charts and indicators to make swift decisions. It’s akin to having a map that guides you through the unpredictable terrain of the financial markets.

Identifying chart patterns is a fundamental skill in technical analysis. These patterns can signal potential buying or selling opportunities, helping traders act at the right moments. For example, the Head and Shoulders pattern indicates a reversal in trend, signaling when to sell. Recognizing this pattern can protect profits and minimize losses. On the other hand, Double Tops and Bottoms are powerful indicators of market reversals, aiding in timely decisions. Understanding these formations can be the difference between a profitable trade and a costly mistake.

The Head and Shoulders pattern consists of three peaks: a higher peak (the head) flanked by two lower peaks (the shoulders). This formation often signals a reversal from a bullish to a bearish trend, making it crucial for traders to watch for this pattern to protect their investments.

Double tops occur when the price reaches a high point twice before reversing, indicating a potential downturn. Conversely, double bottoms signal a price drop followed by a rebound, suggesting a bullish reversal. Both patterns are essential for timing your trades effectively.

Various indicators and signals assist traders in timing their market entries and exits. Familiarizing yourself with these tools can improve your trading strategy. Common indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands. Each of these tools provides valuable insights into market conditions, helping you make more informed decisions.

While technical analysis focuses on price movements, fundamental analysis looks at the underlying value of an asset. This involves examining economic indicators and company performance to determine the best times to buy or sell. For instance, strong GDP growth may signal a robust economy, prompting investors to buy stocks. Conversely, poor earnings reports can lead to sell-offs, making it essential to stay updated on economic trends.

Monitoring economic indicators, such as GDP growth and unemployment rates, can help investors gauge market conditions. These indicators serve as a compass, guiding your investment decisions. A growing economy usually translates to higher corporate profits, which can drive stock prices up, while rising unemployment may signal trouble ahead.

Earnings reports are pivotal moments for investors. They can significantly impact stock prices, making it crucial to understand how to interpret these reports. A company that consistently beats earnings expectations may see its stock price soar, while disappointing results can lead to sharp declines. Keeping an eye on these reports can help you time your investments effectively.

Emotional discipline is vital in trading. Learning to manage emotions can prevent impulsive decisions and improve your timing in the market. The psychological aspect of trading can often overshadow analytical skills, leading to hasty decisions that can cost you dearly.

The fear of missing out (FOMO) can lead to poor investment choices. Developing strategies to combat FOMO is essential for maintaining effective timing in buying and selling. Instead of chasing trends, focus on your investment strategy and stick to your plan. Remember, the market will always present new opportunities; there’s no need to rush.

Market volatility can trigger emotional reactions, leading to knee-jerk decisions. Cultivating a calm mindset during turbulent times can help you stick to your trading plan and time your decisions better. Think of yourself as a captain navigating through stormy seas; staying calm and focused will help you reach your destination safely.

- What is the best time to buy stocks? The best time to buy stocks typically aligns with market downturns or corrections, when prices are lower.

- How can I improve my timing in the market? By studying market cycles, utilizing technical and fundamental analysis, and maintaining emotional discipline.

- What are some common mistakes investors make? Common mistakes include acting on emotions, ignoring market trends, and failing to do thorough research.

Understanding Market Cycles

This article explores the essential strategies for optimizing your investment decisions, focusing on the critical timing for buying and selling assets in various markets.

Market cycles are like the seasons of nature; they have their own rhythms and patterns that can significantly influence your investment decisions. Understanding these cycles is crucial for any investor looking to maximize returns and minimize losses. Just as you wouldn't plant a garden in the winter, you shouldn't make investment decisions without considering the current market cycle.

To truly grasp market cycles, you need to recognize that they generally consist of four distinct phases: accumulation, uptrend, distribution, and downtrend. Each phase has its own characteristics and signals, which can help you determine the best times to buy or sell. Let's break them down:

| Market Cycle Phase | Description | Investor Action |

|---|---|---|

| Accumulation | Investors start buying assets at lower prices as the market begins to stabilize. | Buy |

| Uptrend | Prices begin to rise as more investors enter the market, driven by positive sentiment. | Hold or Sell |

| Distribution | Prices peak and investors start selling to lock in profits as market sentiment begins to wane. | Sell |

| Downtrend | Prices decline as selling pressure increases, leading to panic among investors. | Wait or Buy |

Recognizing these phases can help you make informed decisions. For instance, during the accumulation phase, savvy investors often seek undervalued assets, preparing for the upcoming uptrend. Conversely, during the distribution phase, the smart move is to take profits before the market turns. It's like surfing; you need to catch the right wave at the right time to ride it successfully.

However, understanding market cycles isn't just about identifying these phases; it also involves being aware of external factors that can influence market behavior. Economic indicators, geopolitical events, and even social trends can cause shifts in market sentiment, altering the cycle's trajectory. Are you keeping an eye on these factors? They can be the difference between a profitable investment and a costly mistake.

In conclusion, mastering the art of timing your investments requires a keen understanding of market cycles. By recognizing the phases and their characteristics, you can position yourself to make smarter buying and selling decisions. Remember, the market is always in motion, and staying informed will help you navigate its complexities like a seasoned sailor charting through unpredictable waters.

- What are market cycles? Market cycles refer to the recurring patterns of price movements in financial markets, typically categorized into four phases: accumulation, uptrend, distribution, and downtrend.

- How can I identify market cycles? You can identify market cycles by analyzing price charts, studying economic indicators, and staying updated on market news and trends.

- Why is timing important in investing? Timing is crucial because buying or selling at the right moment can significantly impact your investment returns, helping you maximize profits and minimize losses.

Technical Analysis Basics

When it comes to investing, understanding the technical analysis is like having a secret map that guides you through the often turbulent waters of the financial markets. This method involves evaluating price movements, trading volumes, and historical data to forecast future market behavior. Imagine trying to predict the weather without looking at the clouds; technical analysis gives you the tools to see those clouds clearly. By mastering its principles, you can significantly enhance your timing for buying and selling assets, making your investment journey far more rewarding.

At its core, technical analysis is about patterns and trends. Investors and traders use charts to visualize price movements over time, which allows them to identify potential opportunities. These charts can be overwhelming at first glance, but once you get the hang of it, they become your best friends in the market. Think of them as a language that speaks to you about the market's past and hints at its future. By understanding how to read these charts, you can make more informed decisions and avoid the common pitfalls that many investors fall into.

One of the key aspects of technical analysis is recognizing chart patterns. These patterns can signal potential buying or selling opportunities, helping traders act at the right moments. For instance, patterns like head and shoulders or double tops and bottoms can indicate significant market reversals. When you see these patterns forming, it’s like a flashing neon sign telling you to pay attention. By learning to identify these signals, you can position yourself to take advantage of market movements before they happen.

Another crucial component of technical analysis is the use of indicators and signals. These tools help traders determine the best times to enter or exit a trade. For example, moving averages, Relative Strength Index (RSI), and Bollinger Bands can provide insights into market momentum and potential reversals. By familiarizing yourself with these indicators, you can build a robust trading strategy that enhances your timing and boosts your confidence in the market.

To sum it up, technical analysis is not just a set of complex formulas and charts; it's an art form that requires practice and patience. By dedicating time to learn its intricacies, you can unlock the potential to make smarter investment decisions. Remember, the market is like a dance, and with the right steps, you can lead rather than follow. So, take the plunge into the world of technical analysis, and watch how it transforms your trading experience!

Chart Patterns

Chart patterns are like the secret language of the market, speaking volumes about future price movements. When you dive into the world of technical analysis, understanding these patterns can be your golden ticket to making timely investment decisions. Imagine walking into a room full of investors, and instead of guessing what will happen next, you have a roadmap that guides you through the twists and turns of market behavior. That's the power of chart patterns!

One of the most fascinating aspects of chart patterns is how they can reveal potential buying or selling opportunities. For instance, when you spot a bullish pattern, it often indicates that prices are likely to rise, suggesting it might be a good time to buy. Conversely, a bearish pattern could signal that prices are about to drop, prompting you to consider selling. But how do you identify these patterns? It takes a keen eye and a bit of practice.

Some of the most commonly recognized chart patterns include:

- Head and Shoulders: This pattern typically indicates a reversal in trend, often seen as a signal to sell.

- Double Tops and Bottoms: These formations are powerful indicators of market reversals, assisting traders in making timely decisions.

- Triangles: These can indicate continuation or reversal of trends, depending on the direction they break.

Let’s break down a couple of these patterns further. The Head and Shoulders pattern consists of three peaks: a higher peak (the head) between two lower peaks (the shoulders). When this pattern forms, it suggests that the market is likely to reverse from an uptrend to a downtrend. Recognizing this pattern can be crucial in protecting your profits and minimizing losses.

On the other hand, Double Tops and Bottoms are equally significant. A double top forms after an uptrend and signals a potential reversal when the price reaches a high point twice without breaking through. Conversely, a double bottom appears after a downtrend, indicating a potential bullish reversal as the price hits a low point twice. These patterns serve as a reminder that history often repeats itself in the market, making it vital for traders to stay vigilant.

To wrap it up, mastering chart patterns is not just about memorizing shapes but understanding the psychology behind them. Each pattern tells a story of market sentiment, and as a trader, your job is to interpret that story accurately. By honing your skills in recognizing these patterns, you can significantly enhance your timing in buying and selling assets, leading to more informed and potentially profitable investment decisions.

Q: How can I practice identifying chart patterns?

A: You can practice by analyzing historical charts using trading platforms or charting software. Start with well-known patterns and gradually move to more complex ones.

Q: Are chart patterns foolproof indicators?

A: While chart patterns are valuable tools, they are not guaranteed. It’s essential to combine them with other analysis methods for better accuracy.

Q: How long does it take to become proficient in reading chart patterns?

A: Proficiency varies by individual, but with consistent practice and study, many traders start feeling comfortable within a few months.

Head and Shoulders

The pattern is one of the most recognizable and reliable indicators in technical analysis, often acting as a harbinger of market reversals. Imagine a mountain range: the first peak is the left shoulder, the highest point is the head, and the final peak is the right shoulder. When traders spot this formation, it’s like seeing a red flag waving in the wind—it's a signal that the trend is about to change direction.

This pattern typically forms after a bullish trend, indicating that a bearish reversal may be on the horizon. The left shoulder forms when the price rises to a peak and then declines. Following this, the price climbs higher to form the head, only to drop again. Finally, the right shoulder appears, mirroring the left shoulder's height but failing to reach the head's peak. Once the price breaks below the neckline, which is drawn by connecting the lows of the two troughs, it confirms the pattern and suggests that it's time to sell.

Understanding the implications of this pattern is crucial for investors. Here are some key points to consider:

- Trend Reversal: Head and Shoulders indicates a shift from bullish to bearish sentiment.

- Volume Confirmation: Ideally, volume should decrease during the formation of the pattern and spike during the breakout.

- Price Target: The potential price target can be estimated by measuring the distance from the head to the neckline and projecting that distance downward from the breakout point.

To visualize this, consider a simple table that outlines the formation stages:

| Stage | Description |

|---|---|

| Left Shoulder | Price rises and then falls, creating the first peak. |

| Head | Price rises to a new high before declining again. |

| Right Shoulder | Price rises again but does not surpass the head's height. |

| Neckline | A line connecting the lows of the two troughs; a breakout below this line confirms the pattern. |

In conclusion, recognizing the Head and Shoulders pattern can significantly enhance your trading strategy. It serves as a powerful tool for timing your sales, helping you to lock in profits before a potential downturn. Remember, the key is to remain vigilant and combine this pattern with other indicators for the best results.

What does the Head and Shoulders pattern indicate?

The Head and Shoulders pattern typically signals a reversal from a bullish trend to a bearish trend, suggesting that it's time to sell.

How do I confirm a Head and Shoulders pattern?

Confirmation occurs when the price breaks below the neckline, which connects the lows of the two troughs. It's also beneficial to observe a decrease in volume during the formation and an increase during the breakout.

Can the Head and Shoulders pattern appear in any market?

Yes, this pattern can be observed in various markets, including stocks, commodities, and forex, making it a versatile tool for traders.

Double Tops and Bottoms

The concept of is fundamental in technical analysis, acting as a beacon for traders navigating the turbulent waters of market fluctuations. A double top occurs when the price of an asset reaches a peak twice, failing to break through a resistance level in between. This pattern often signifies a potential reversal from a bullish trend to a bearish one. Imagine a basketball player attempting to dunk; if they hit the rim twice without scoring, it’s likely they won’t make the shot on the third attempt. Similarly, when an asset struggles to break through resistance, it may be time to reconsider your position.

On the flip side, a double bottom is the inverse of a double top. This pattern forms when the price hits a low point twice, with a brief rally in between. Think of it as a spring being compressed; once it hits the ground twice, it’s poised to bounce back up. Recognizing these formations can be crucial for making timely buying or selling decisions. It’s like having a roadmap that guides you through the often chaotic landscape of trading.

To help visualize these concepts, here’s a simple table that outlines the characteristics of double tops and bottoms:

| Pattern | Description | Trading Implication |

|---|---|---|

| Double Top | Price reaches a high point twice, failing to break resistance. | Potential sell signal; indicates a trend reversal. |

| Double Bottom | Price hits a low point twice, failing to break support. | Potential buy signal; indicates a trend reversal. |

Traders often look for confirmation signals after spotting a double top or bottom. This could include a significant drop in trading volume during the formation of a double top, which reinforces the bearish sentiment. Conversely, an increase in volume during the formation of a double bottom can indicate strong buying interest, suggesting that the price is likely to rise. Thus, keeping an eye on volume trends alongside these patterns is essential for making informed trading decisions.

In summary, double tops and bottoms are powerful indicators of potential market reversals. By mastering these patterns, you can enhance your timing in buying and selling assets, ultimately leading to more successful trading outcomes. Remember, in the world of investing, knowledge is your best ally, and understanding these patterns can help you navigate the market with confidence.

- What is the significance of double tops and bottoms? These patterns indicate potential reversals in market trends, helping traders decide when to buy or sell.

- How can I identify a double top or bottom? Look for two peaks or troughs at approximately the same price level, separated by a moderate price movement in between.

- Do I need to wait for confirmation before acting on these patterns? Yes, waiting for additional signals, such as volume changes, can help validate the pattern and improve the odds of a successful trade.

Indicators and Signals

This article explores the essential strategies for optimizing your investment decisions, focusing on the critical timing for buying and selling assets in various markets.

Market cycles play a crucial role in determining the right time to buy or sell. Recognizing these cycles can help investors make informed decisions and maximize their returns.

Technical analysis involves evaluating price movements and trading volumes to forecast future market behavior. Understanding its principles can enhance your timing in buying and selling assets effectively.

Identifying chart patterns is key in technical analysis. These patterns can signal potential buying or selling opportunities, helping traders act at the right moments.

The head and shoulders pattern indicates a reversal in trend, signaling when to sell. Recognizing this pattern can protect profits and minimize losses.

Double tops and bottoms are powerful indicators of market reversals. Understanding these formations can aid in making timely buying or selling decisions.

When it comes to trading, are your best friends. They act as guides, illuminating the path ahead in the often murky waters of market fluctuations. By analyzing various data points, these indicators help traders determine the optimal moments to enter or exit trades. For instance, moving averages smooth out price data, allowing investors to identify trends more clearly. If the price crosses above a moving average, it may signal a buying opportunity, while a drop below could indicate a potential sell.

Another crucial tool in a trader's arsenal is the Relative Strength Index (RSI). This momentum oscillator measures the speed and change of price movements. An RSI above 70 suggests that an asset may be overbought, while an RSI below 30 indicates it may be oversold. Understanding these signals can significantly enhance your timing in the market.

Moreover, traders often rely on volume indicators, as they provide insight into the strength of a price movement. High volume during a price increase can confirm a bullish trend, while high volume during a price decrease can signal bearish sentiment. For example, consider the following table that highlights some common indicators and their implications:

| Indicator | Type | Implication |

|---|---|---|

| Moving Average | Trend | Indicates direction of the trend |

| Relative Strength Index (RSI) | Momentum | Overbought or oversold conditions |

| MACD (Moving Average Convergence Divergence) | Trend | Identifies changes in momentum |

| Volume | Volume | Strength of price movements |

Lastly, it's worth noting that no single indicator should be used in isolation. Instead, combining multiple indicators can provide a more comprehensive view of the market. For example, a trader might use RSI to identify potential reversals while also monitoring volume trends to confirm the strength of those signals. This holistic approach can lead to more informed and confident trading decisions.

Fundamental analysis focuses on economic indicators and company performance, providing insights into the best times to buy or sell based on underlying value.

Monitoring economic indicators, such as GDP growth and unemployment rates, can help investors gauge market conditions and make timely investment decisions.

Earnings reports can significantly impact stock prices. Understanding how to interpret these reports can guide investors on when to buy or sell shares.

Emotional discipline is vital in trading. Learning to manage emotions can prevent impulsive decisions and improve your timing in the market.

Fear of missing out (FOMO) can lead to poor investment choices. Developing strategies to combat FOMO is essential for maintaining effective timing in buying and selling.

Market volatility can trigger emotional reactions. Cultivating a calm mindset during turbulent times can help you stick to your trading plan and time your decisions better.

- What are the best indicators for timing trades? The best indicators often depend on your trading strategy, but common ones include Moving Averages, RSI, and MACD.

- How can I avoid emotional trading? Developing a solid trading plan and sticking to it, regardless of market emotions, can help you avoid impulsive decisions.

- Is technical analysis better than fundamental analysis? Both analyses have their strengths and weaknesses. Using them in combination can often yield the best results.

Fundamental Analysis Insights

When it comes to investing, understanding the underlying factors that drive market movements is crucial. This is where fundamental analysis comes into play. Unlike technical analysis, which focuses on price movements and patterns, fundamental analysis digs deep into the economic indicators and company performance. By examining these elements, investors can gain valuable insights into the best times to buy or sell based on the intrinsic value of an asset.

One of the first steps in fundamental analysis is to monitor key economic indicators. These indicators serve as a compass for investors, guiding them through the often turbulent waters of the financial markets. Some of the primary indicators to keep an eye on include:

- Gross Domestic Product (GDP): A measure of a country's economic performance. A growing GDP often signals a healthy economy, making it a good time to invest.

- Unemployment Rates: High unemployment can indicate economic distress, while low rates often correlate with economic growth.

- Inflation Rates: Moderate inflation is generally a sign of a growing economy, but high inflation can erode purchasing power and affect investment decisions.

Understanding these indicators can help investors gauge market conditions and make timely investment decisions. For instance, if GDP is on the rise and unemployment is falling, it may be a prime time to consider buying stocks as the market is likely to respond positively.

Another critical aspect of fundamental analysis is analyzing company earnings reports. These reports provide a snapshot of a company's financial health and can significantly impact stock prices. Investors should pay attention to a few key components within these reports:

| Component | Importance |

|---|---|

| Revenue Growth | Indicates the company's ability to increase sales over time. |

| Profit Margins | Shows how much profit a company makes for every dollar of sales. |

| Earnings Per Share (EPS) | A key indicator of a company's profitability. |

| Guidance | Management’s outlook for future performance, which can sway investor sentiment. |

By interpreting these components, investors can make informed decisions about when to buy or sell shares. For example, if a company reports strong revenue growth and an increase in EPS, it might indicate a good time to invest, as the stock price is likely to rise in response to positive news.

In conclusion, mastering fundamental analysis is essential for any investor looking to optimize their buying and selling strategies. By keeping an eye on economic indicators and company performance, you can make decisions that align with the market's true potential, ensuring that you buy low and sell high.

Q: What is fundamental analysis?

A: Fundamental analysis involves evaluating economic indicators and a company's financial health to determine the best times to buy or sell assets.

Q: Why are economic indicators important?

A: Economic indicators help investors gauge the overall health of the economy, which can influence market conditions and investment decisions.

Q: How do earnings reports affect stock prices?

A: Earnings reports provide insights into a company's profitability and performance, which can lead to significant movements in stock prices depending on the results.

Q: Can I rely solely on fundamental analysis for investing?

A: While fundamental analysis is crucial, it is often best used in conjunction with technical analysis to create a well-rounded investment strategy.

Economic Indicators

When it comes to investing, understanding is like having a map in uncharted territory. These indicators provide vital insights into the health of the economy and can significantly influence your decision to buy or sell assets. Think of them as the pulse of the market, giving you clues about where things might be headed. For instance, indicators such as Gross Domestic Product (GDP), unemployment rates, and inflation rates are crucial benchmarks that can help you gauge overall economic performance.

Let’s break down some of these key indicators:

- Gross Domestic Product (GDP): This measures the total value of all goods and services produced within a country. A rising GDP often signals a growing economy, which can be a good time to invest.

- Unemployment Rate: High unemployment can indicate economic trouble, leading to lower consumer spending. Conversely, a low unemployment rate typically suggests a healthy economy.

- Inflation Rate: This indicates how much prices for goods and services are rising. Moderate inflation is normal in a growing economy, but high inflation can erode purchasing power and impact investment decisions.

By closely monitoring these indicators, you can better understand market conditions and make more informed decisions. For example, if GDP is on the rise, it might be a signal to buy, as companies are likely to perform better, driving stock prices up. On the other hand, if unemployment is climbing, it may be wise to hold off on new investments until the job market stabilizes.

Moreover, economic indicators can also affect interest rates, which in turn influence borrowing costs for consumers and businesses. When the economy is strong, central banks might raise interest rates to prevent overheating. Conversely, in a weak economy, they may lower rates to encourage borrowing and spending. This interplay can create opportunities for savvy investors who understand the timing of these changes.

In summary, keeping an eye on economic indicators is essential for any investor looking to optimize their timing in the market. By understanding these metrics, you can make more strategic decisions that align with the broader economic landscape, allowing you to buy and sell at the most opportune moments.

Q: What are economic indicators?

A: Economic indicators are statistics that provide information about the economic performance of a country. They help investors gauge the health of the economy and make informed investment decisions.

Q: Why are economic indicators important for investing?

A: They help investors understand market conditions, predict future trends, and determine the best times to buy or sell assets.

Q: How often are economic indicators released?

A: Many economic indicators are released on a monthly or quarterly basis, providing regular updates on the economy's performance.

Q: Can I rely solely on economic indicators for investment decisions?

A: While they are crucial, it's important to combine economic indicators with other analyses, such as technical analysis and market sentiment, for a well-rounded investment strategy.

Company Earnings Reports

When it comes to investing in the stock market, understanding is like having a secret map guiding you through a treasure hunt. These reports provide a detailed look into a company's financial health, revealing crucial information about its performance over a specific period. Typically released quarterly, they include key metrics such as revenue, net income, and earnings per share (EPS), which can significantly influence stock prices. Ignoring these reports is akin to sailing a ship without a compass—you might find yourself lost in turbulent waters.

Investors need to pay close attention to a few vital components within these reports to make informed decisions. For instance, the earnings per share (EPS) figure is critical; it shows how much profit a company makes for each share of its stock. A higher EPS often indicates a more profitable company, which can lead to increased investor confidence and a rising stock price. On the flip side, if a company's EPS falls short of expectations, it may trigger a sell-off as investors rush to cut their losses. This phenomenon can create a ripple effect, influencing other stocks in the market.

Another essential aspect to consider is the guidance provided by the company during these reports. Companies often offer insights into their future performance expectations, which can be a game-changer for investors. For example, if a tech company announces plans for a new product line that is expected to boost sales, savvy investors might see this as a golden opportunity to buy before the stock price skyrockets. Conversely, if a company warns of potential challenges ahead, it might be wise to hold off on buying or even consider selling.

To illustrate the impact of earnings reports on stock prices, let's take a look at a simplified example:

| Company | EPS (Previous Quarter) | EPS (Current Quarter) | Stock Price Change (%) |

|---|---|---|---|

| Tech Innovations Inc. | $1.50 | $2.00 | +15% |

| Green Energy Corp. | $0.80 | $0.60 | -10% |

In this table, you can see how the earnings reports affected the stock prices of two different companies. Tech Innovations Inc. reported a better-than-expected EPS, leading to a 15% increase in stock price, while Green Energy Corp. saw a decline after reporting lower earnings. This example underscores the importance of keeping an eye on these reports and understanding the broader implications of the data presented.

In summary, company earnings reports are a treasure trove of information that can significantly impact your investment decisions. By analyzing these reports carefully, you can identify potential buying or selling opportunities, making you a more informed and strategic investor. Just remember, timing is everything in the world of investing, and the insights gained from earnings reports can help you strike while the iron is hot.

- What is an earnings report? An earnings report is a financial document released by a company that details its performance over a specific period, usually quarterly. It includes important metrics like revenue, net income, and earnings per share (EPS).

- Why are earnings reports important for investors? Earnings reports provide insights into a company's financial health and future performance, helping investors make informed decisions about buying or selling stocks.

- What should I look for in an earnings report? Key elements to focus on include EPS, revenue growth, guidance for future performance, and any significant changes in expenses or profit margins.

- How often are earnings reports released? Most publicly traded companies release earnings reports quarterly, following the end of each fiscal quarter.

Emotional Discipline in Trading

When it comes to trading, emotional discipline is not just a fancy term; it's a necessity. Imagine you’re on a rollercoaster, feeling the highs and lows as you twist and turn. That’s pretty much what trading feels like, right? The thrill of a potential profit can be exhilarating, but it can also lead to some hasty decisions if you let your emotions take the wheel. The ability to manage your feelings, especially during market fluctuations, is what sets successful traders apart from the rest. So, how can you cultivate this all-important emotional discipline?

First off, it’s crucial to recognize that emotions are natural. Everyone feels excitement when their stocks are soaring and dread when they’re plummeting. The trick lies in how you respond to these feelings. Instead of letting fear dictate your actions—like selling at a loss simply because you’re scared of losing more—try to stick to your trading plan. This is where having a well-defined strategy comes into play. A solid plan acts like your safety harness on that rollercoaster ride, keeping you secure even when things get bumpy.

One common emotional pitfall traders face is the Fear of Missing Out (FOMO). You might see a stock skyrocketing and feel an overwhelming urge to jump in, fearing you’ll miss out on the next big thing. But remember, investing on impulse rarely leads to success. Instead, take a step back and ask yourself: “Is this part of my strategy? Am I buying based on research or just emotion?” This self-reflection can help you avoid rash decisions that you might regret later.

Another aspect of emotional discipline is learning to stay calm during periods of market volatility. Picture this: the market is swinging wildly, and your heart is racing. It’s easy to panic and make sudden moves. However, cultivating a calm mindset can be your best ally. Techniques such as deep breathing, meditation, or even taking a short break from trading can help you regain your composure. When you’re calm, you’re more likely to make rational decisions rather than emotional ones.

In addition, consider keeping a trading journal. This tool can be invaluable for tracking not just your trades, but also your emotions during those trades. When you look back, you might notice patterns in your emotional responses that led to poor decisions. By identifying these triggers, you can develop strategies to manage them better in the future. For instance, if you find that you tend to overtrade when you’re feeling anxious, you might set a rule to limit the number of trades you make in a day.

Ultimately, emotional discipline is about striking a balance. It’s perfectly fine to feel excited or anxious about your trades, but the key is to ensure those feelings don’t control your actions. By developing a structured approach and maintaining a level head, you can enhance your timing in the market and make more informed decisions.

- What is emotional discipline in trading?

Emotional discipline refers to the ability to manage your emotions and reactions while trading, ensuring that decisions are made based on strategy rather than impulse. - How can I improve my emotional discipline?

Improving emotional discipline involves creating a solid trading plan, practicing self-reflection, and employing techniques to stay calm during market volatility. - Why is emotional discipline important?

Emotional discipline is crucial because it helps prevent impulsive decisions that can lead to significant losses, allowing traders to stick to their strategies and improve their overall performance.

Avoiding FOMO

In the fast-paced world of trading and investing, the fear of missing out, commonly referred to as FOMO, can be a trader's worst enemy. Imagine standing on the sidelines while everyone around you is celebrating their big wins; it’s a feeling that can push even the most rational investors into making impulsive decisions. So, how do you combat this urge and maintain a clear head when the market is buzzing with excitement?

First, it’s essential to recognize that FOMO is often driven by emotions rather than logic. This emotional response can lead to hasty investments based on hype rather than thorough analysis. When you find yourself feeling anxious about missing a potential opportunity, take a step back. Ask yourself: Is this decision based on sound analysis or merely on the fear of missing out? This self-reflection can be a game-changer.

Another effective strategy is to establish a well-defined trading plan before entering any market. This plan should outline your investment goals, risk tolerance, and the criteria you will use to make buying and selling decisions. By having a structured approach, you can reduce the likelihood of making impulsive choices driven by FOMO. Consider incorporating the following elements into your trading plan:

- Clear Entry and Exit Points: Define when you will buy and sell based on your analysis, not market noise.

- Risk Management Strategies: Set limits on how much you are willing to lose on a trade, ensuring you don't chase losses.

- Regular Review: Periodically assess your plan and adjust based on market conditions and your performance.

Additionally, it’s crucial to cultivate a mindset of patience and discipline. The market will always present new opportunities, and it’s important to remember that chasing trends can often lead to losses. Instead of jumping into a trade because everyone else is, focus on your analysis and stick to your strategy. Consider this analogy: Successful investing is like planting a garden; it requires time, care, and the right conditions to flourish. Rushing in without preparation can lead to a barren outcome.

Finally, surround yourself with a supportive community of fellow investors. Engaging with others who share your investment philosophy can help mitigate feelings of FOMO. When you have a network that encourages thoughtful decision-making rather than impulsive actions, you’re more likely to stay grounded. Remember, investing is a marathon, not a sprint; it's about making informed decisions over time rather than chasing every fleeting opportunity.

In conclusion, avoiding FOMO is about developing emotional discipline, establishing a clear trading plan, and fostering a patient mindset. By doing so, you can navigate the markets with confidence and make decisions that align with your long-term investment goals.

- What is FOMO in trading? FOMO, or fear of missing out, refers to the anxiety that traders feel when they believe they are missing profitable opportunities in the market.

- How can I manage my emotions while trading? Establish a trading plan, practice patience, and engage with a supportive community to help manage emotional responses.

- Is it okay to miss out on certain trades? Absolutely! The market will always present new opportunities. It’s better to make informed decisions than to chase every trend impulsively.

Staying Calm During Volatility

Market volatility can feel like riding a roller coaster; one moment you're soaring high, and the next, you're plummeting down. It's easy to get caught up in the whirlwind of emotions that accompany sudden market shifts. However, maintaining a sense of calm during these turbulent times is crucial for making rational investment decisions. Just like a seasoned sailor navigates through stormy seas, you can learn to steer your financial ship through the choppy waters of market fluctuations.

One effective strategy for staying calm is to develop a solid trading plan. This plan should outline your investment goals, risk tolerance, and the specific strategies you will employ. By having a clear roadmap, you can avoid making impulsive decisions based on fleeting emotions. Think of your trading plan as your personal lighthouse, guiding you safely to shore even when the waves are crashing around you.

Another key element is to practice mindfulness. Taking a moment to breathe deeply and center yourself can work wonders when anxiety begins to creep in. Whether it’s a short meditation session or simply stepping away from your trading desk for a few minutes, these small actions can help clear your mind and enable you to approach the market with a fresh perspective. Remember, it's not about how the market is behaving, but how you respond to it.

Additionally, consider diversifying your portfolio. By spreading your investments across different asset classes, you can reduce the impact of volatility on your overall holdings. This strategy acts like a safety net, catching you when one investment takes a nosedive while others may still be performing well. It's akin to having multiple income streams; if one dries up, you still have others to rely on.

Lastly, don't forget the importance of community support. Engaging with fellow investors can provide a sense of camaraderie and shared experience. Whether through online forums, social media groups, or local investment clubs, discussing your thoughts and feelings about market movements can help alleviate some of the stress. Just as athletes rely on their teammates for encouragement, you too can benefit from the insights and support of others who understand the challenges of investing.

- What should I do when I feel overwhelmed by market volatility?

Take a step back, breathe, and revisit your trading plan. It's important to stay focused on your long-term goals rather than reacting to short-term fluctuations. - How can I improve my emotional discipline?

Practice mindfulness techniques, such as meditation or deep breathing, to help manage your emotions during stressful market conditions. - Is diversification really effective in reducing risk?

Yes, diversifying your portfolio can help mitigate the impact of volatility by spreading risk across different investments.

Frequently Asked Questions

- What are market cycles, and why are they important?

Market cycles refer to the fluctuations in market prices over time, typically characterized by periods of growth and decline. Understanding these cycles is crucial for investors as it helps them identify the optimal times to buy low and sell high, ultimately maximizing their returns.

- How does technical analysis improve my trading decisions?

Technical analysis involves studying price movements and trading volumes to predict future market behavior. By recognizing chart patterns and using indicators, traders can make more informed decisions on when to enter or exit the market, improving their overall timing and strategy.

- What are some common chart patterns I should know?

Some essential chart patterns include the head and shoulders, which signals a trend reversal, and double tops and bottoms, indicating potential market reversals. Familiarizing yourself with these patterns can help you identify lucrative buying or selling opportunities.

- How can economic indicators influence my investment timing?

Economic indicators, such as GDP growth, inflation rates, and unemployment statistics, provide insights into the overall health of the economy. By monitoring these indicators, investors can gauge market conditions and make more informed decisions about when to buy or sell assets.

- What role do company earnings reports play in trading?

Earnings reports provide critical information about a company's financial performance. Investors can use these reports to assess a company's value and make timely decisions about buying or selling shares based on the results and market reactions.

- How can I maintain emotional discipline while trading?

Maintaining emotional discipline is vital for successful trading. Strategies such as setting clear goals, sticking to a trading plan, and practicing mindfulness can help you manage emotions like fear and greed, preventing impulsive decisions that can negatively impact your timing.

- What is FOMO, and how can I avoid it?

FOMO, or fear of missing out, can lead to hasty investment decisions. To combat FOMO, it’s essential to have a solid trading plan, stay informed about market trends, and remember that there will always be opportunities. This mindset helps you make rational decisions rather than emotional ones.

- How should I react during market volatility?

During times of market volatility, it's crucial to stay calm and adhere to your trading plan. Avoid making knee-jerk reactions and instead focus on your long-term strategy. Cultivating a calm mindset helps you better navigate turbulent times and make more rational decisions.