How Blockchain is Changing the Real Estate Market

In recent years, the real estate market has witnessed a significant transformation, largely driven by the advent of blockchain technology. This innovative technology is not just a buzzword; it's a game-changer that has the potential to revolutionize how we buy, sell, and manage properties. Imagine a world where real estate transactions are as seamless as sending an email, where transparency reigns supreme, and where fraud is a thing of the past. Sounds too good to be true? Well, that's the promise of blockchain in the real estate sector.

At its core, blockchain is a decentralized digital ledger that records transactions across multiple computers. This means that the data is not stored in a single location, making it nearly impossible to alter or hack. The implications of this for the real estate market are staggering. By enhancing transparency, reducing costs, and streamlining processes, blockchain is set to change the way we think about property ownership and management.

As we delve deeper into this topic, we will explore the various ways blockchain is enhancing transparency in transactions, streamlining property dealings, and even tokenizing real estate assets. We will also discuss how these changes can lead to reduced costs and improved property management, making real estate investment more accessible to everyone. So, buckle up as we embark on this exciting journey through the intersection of blockchain technology and the real estate market!

To fully grasp the impact of blockchain on real estate, we first need to understand its foundational principles. At its essence, blockchain is built on three key concepts: decentralization, immutability, and security. Decentralization means that no single entity controls the entire network, which fosters trust among users. Immutability ensures that once a transaction is recorded, it cannot be altered or deleted, providing a permanent record. Lastly, security is bolstered through cryptographic techniques that protect data from unauthorized access.

One of the most compelling advantages of blockchain technology is its ability to enhance transparency in real estate transactions. By providing a decentralized ledger that is accessible to all parties involved, blockchain reduces the likelihood of fraud and enhances trust among buyers, sellers, and agents. Imagine being able to verify ownership history and transaction details at the click of a button! This transparency not only builds confidence but also simplifies the due diligence process, making it easier for all parties to engage in transactions.

Blockchain's efficiency can significantly speed up property transactions, which have traditionally been bogged down by paperwork and lengthy processes. With the introduction of smart contracts, many of these cumbersome tasks can be automated. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This means that once conditions are met, the contract executes automatically, eliminating the need for intermediaries and reducing the time it takes to close a deal.

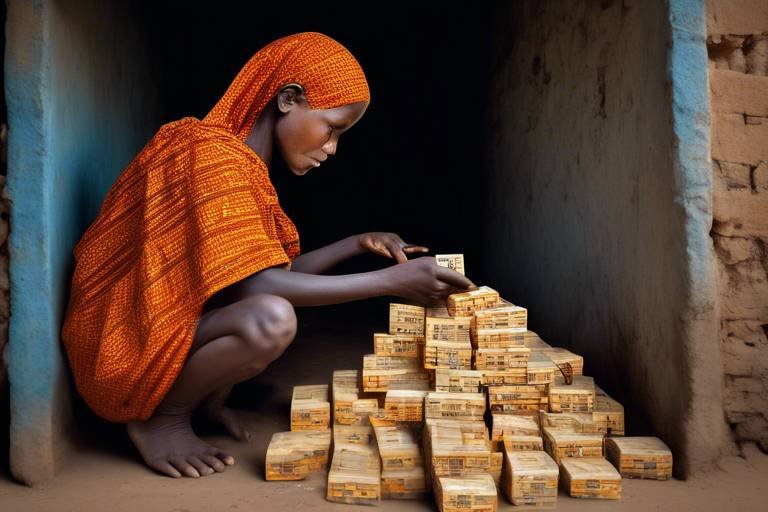

Tokenization is another fascinating application of blockchain in real estate. By dividing properties into digital tokens, real estate assets become more accessible to a wider range of investors. This democratization of investment allows individuals to buy fractions of properties, lowering the barrier to entry for many. However, while tokenization presents exciting opportunities, it also comes with challenges, such as regulatory hurdles and market acceptance.

One of the most appealing aspects of blockchain technology is its potential to reduce costs and fees associated with real estate transactions. By eliminating intermediaries such as brokers and title companies, blockchain can significantly lower transaction costs. This reduction not only makes real estate investments more attractive but also opens the door for a broader audience to participate in the market.

Blockchain can also enhance property management through efficient record-keeping and tenant verification. Property managers can leverage blockchain to maintain accurate records of tenant information, lease agreements, and maintenance requests, all on a secure and tamper-proof platform. This not only improves service delivery but also enhances the overall tenant experience, leading to higher satisfaction and retention rates.

The impact of blockchain technology is not limited to a single region; its global nature means that its effects are felt worldwide. Countries across the globe are beginning to adopt blockchain to innovate their real estate markets, from streamlining transactions to enhancing regulatory compliance. As this technology continues to evolve, we can expect to see even more countries embracing blockchain solutions to improve their real estate sectors.

As we look ahead, it's clear that blockchain technology will continue to shape the future of real estate. Emerging trends, such as increased regulatory clarity, advancements in smart contract technology, and greater acceptance of tokenization, will further streamline processes and enhance transparency. The potential for blockchain to disrupt traditional real estate practices is immense, and as more stakeholders recognize its benefits, we can expect to see this technology become a cornerstone of the industry.

- What is blockchain? Blockchain is a decentralized digital ledger that records transactions across multiple computers, ensuring transparency and security.

- How does blockchain enhance transparency in real estate? By providing a publicly accessible ledger, blockchain allows all parties to verify ownership and transaction history, reducing the risk of fraud.

- What are smart contracts? Smart contracts are self-executing contracts with terms directly written into code, automating processes and reducing the need for intermediaries.

- What is tokenization in real estate? Tokenization divides real estate assets into digital tokens, making them more accessible to a wider range of investors.

- How can blockchain reduce costs in real estate transactions? By eliminating intermediaries, blockchain can lower transaction fees, making real estate investments more attractive.

The Basics of Blockchain Technology

Understanding blockchain technology is essential for grasping its applications in the real estate sector. At its core, blockchain is a decentralized digital ledger that records transactions across multiple computers. This means that every participant in the network can access and verify the records, ensuring that no single entity has control over the entire chain. Imagine a library where every book is a transaction, and instead of one librarian managing the entire collection, every reader can add, check, or verify the books. This decentralization is one of the key features that sets blockchain apart from traditional databases.

Another fundamental principle of blockchain is immutability. Once a transaction is recorded on the blockchain, it cannot be altered or deleted. This creates a permanent history of all transactions, which is crucial for maintaining trust and accountability. Think of it like carving your name into a tree; once it's there, it stays there forever. This feature is particularly beneficial in real estate, where the history of property ownership and transaction details is vital for buyers and sellers alike.

Furthermore, blockchain technology is built on security. Each transaction is encrypted and linked to the previous one, creating a chain of data that is incredibly difficult to tamper with. This is akin to a series of locked boxes, where each box is secured with a unique key. To change any information, a hacker would need to unlock all the boxes in the chain, which is virtually impossible due to the complex cryptographic algorithms involved. This level of security not only protects sensitive information but also enhances the overall integrity of the real estate market.

In summary, the basic principles of blockchain—decentralization, immutability, and security—are what make it a revolutionary technology in the real estate sector. As we continue to explore its applications, it’s clear that these features can significantly enhance transparency, streamline transactions, and ultimately transform the way we buy, sell, and manage properties.

- What is blockchain technology? Blockchain is a decentralized digital ledger that records transactions across multiple computers, ensuring transparency and security.

- How does blockchain enhance security? Each transaction is encrypted and linked to previous ones, making it extremely difficult to alter any information.

- Why is immutability important in real estate? Immutability ensures that once a transaction is recorded, it cannot be changed, providing a reliable history of property ownership.

Enhanced Transparency in Transactions

When it comes to real estate, trust is everything. Buyers want to feel confident that they’re making a sound investment, while sellers need assurance that their property is being valued correctly. Enter blockchain technology, a game-changer that enhances transparency in transactions like never before. Imagine a world where every property transaction is recorded in a digital ledger that is accessible to all parties involved. This is the essence of blockchain—a decentralized system that eliminates the need for middlemen and provides a clear, tamper-proof record of ownership.

By utilizing blockchain, every transaction is logged in a way that is both secure and immutable. This means that once a transaction is recorded, it cannot be altered or deleted, making fraud nearly impossible. For instance, if a property has a history of ownership disputes or liens, that information will be readily available on the blockchain. Buyers can easily verify the legitimacy of a property’s title, which builds trust and confidence in the purchasing process.

Moreover, the transparency provided by blockchain can significantly reduce the chances of fraud. Traditional real estate transactions often involve a multitude of documents, each one susceptible to manipulation. With blockchain, all necessary documents—such as title deeds, contracts, and transaction histories—are stored in a single, easily accessible location. This not only streamlines the process but also makes it easier for all parties to conduct due diligence.

To illustrate the impact of blockchain on transparency, consider the following table:

| Traditional Method | Blockchain Method |

|---|---|

| Multiple intermediaries involved | Direct peer-to-peer transactions |

| Risk of document forgery | Immutable digital records |

| Lengthy verification processes | Instant access to verified information |

| Hidden fees and commissions | Transparent cost structures |

As you can see, the advantages of using blockchain in real estate transactions are profound. The transparency it offers not only protects buyers and sellers but also fosters a more trustworthy environment for real estate agents and investors. When everyone has equal access to information, it levels the playing field and encourages fair practices across the board.

In conclusion, enhanced transparency in transactions facilitated by blockchain technology is revolutionizing the real estate market. It’s not just about making processes faster or cheaper; it’s about building a foundation of trust and integrity that can lead to a more stable and robust market. As we move forward, the adoption of blockchain in real estate will likely become the norm rather than the exception, paving the way for a brighter, more transparent future.

- What is blockchain technology? Blockchain is a decentralized digital ledger that records transactions across many computers, making it secure and immutable.

- How does blockchain enhance transparency in real estate? By providing a tamper-proof record of property transactions that is accessible to all parties, reducing the risk of fraud.

- Can blockchain reduce transaction costs? Yes, by eliminating intermediaries and streamlining processes, blockchain can lower overall transaction costs.

- Is blockchain technology widely adopted in real estate? While still emerging, many markets are beginning to explore blockchain's potential to innovate and enhance transparency.

Streamlining Property Transactions

When it comes to buying or selling real estate, the process can often feel like navigating a labyrinth. There are countless documents to sign, multiple parties involved, and the ever-present threat of delays lurking around every corner. But what if I told you that blockchain technology is like a magic key that can unlock this maze, making property transactions smoother and faster? Yes, you heard that right! With blockchain, the days of waiting weeks or even months to close a deal could soon be a thing of the past.

At its core, blockchain is a decentralized digital ledger that records transactions across many computers. This means that all parties involved in a real estate deal have access to the same information in real-time. Imagine a world where buyers, sellers, agents, and even banks can see the same records without the need for endless phone calls or emails. This level of transparency not only reduces the chances of misunderstandings but also enhances trust among all parties.

One of the most exciting features of blockchain in real estate is the use of smart contracts. Think of smart contracts as self-executing agreements with the terms of the deal directly written into code. They automatically execute actions when certain conditions are met, eliminating the need for intermediaries. For instance, once a buyer makes a payment, the smart contract can instantly transfer ownership of the property without any human intervention. This not only speeds up the process but also minimizes the risk of human error.

Let’s break down the key benefits of using blockchain to streamline property transactions:

- Reduced Paperwork: Traditional real estate transactions often involve mountains of paperwork that can be cumbersome and time-consuming. Blockchain simplifies this by digitizing the entire process.

- Minimized Delays: With everything recorded on a blockchain, the need for back-and-forth communication is drastically reduced, leading to faster closings.

- Increased Efficiency: By automating various tasks, such as title searches and escrow services, blockchain can cut down the time it takes to finalize a deal.

To illustrate the impact of blockchain on transaction speed, consider the following table comparing traditional real estate transactions to blockchain-enabled transactions:

| Aspect | Traditional Transactions | Blockchain Transactions |

|---|---|---|

| Time to Close | 30-60 days | 1-7 days |

| Number of Parties Involved | Multiple (agents, banks, lawyers) | Fewer (directly between buyer and seller) |

| Risk of Fraud | Higher | Lower |

| Cost of Transaction | Higher due to fees | Lower due to reduced intermediaries |

As we can see, blockchain technology not only accelerates the transaction process but also enhances security and reduces costs. This is a win-win for everyone involved. So, whether you’re a first-time homebuyer or a seasoned investor, the integration of blockchain into real estate could make your next transaction a whole lot smoother!

In conclusion, the future of property transactions looks bright with blockchain technology paving the way for a more efficient, transparent, and trustworthy real estate market. As more companies adopt this revolutionary technology, we can expect to see a significant shift in how we buy and sell properties. Are you ready to embrace the change?

Q: What is a smart contract?

A: A smart contract is a self-executing contract with the terms of the agreement directly written into code. It automatically executes actions when certain conditions are met.

Q: How does blockchain enhance security in real estate transactions?

A: Blockchain records transactions in a decentralized manner, making it nearly impossible to alter or manipulate the data, thus reducing the risk of fraud.

Q: Can blockchain reduce transaction costs?

A: Yes, by eliminating intermediaries and automating processes, blockchain can significantly lower the fees associated with real estate transactions.

Tokenization of Real Estate Assets

Imagine being able to own a slice of your dream property without needing to buy the entire thing. Tokenization is making this a reality in the real estate market. By converting real estate assets into digital tokens, blockchain technology allows for fractional ownership, making investment opportunities more accessible than ever. This means that instead of needing hundreds of thousands of dollars to buy a property outright, you can invest a smaller amount and still benefit from the property's value appreciation.

But how does this work? In simple terms, tokenization involves creating a digital representation of a real estate asset on the blockchain. This digital token can represent ownership, rights to rental income, or even a share in the property's appreciation. The process is akin to how stocks represent ownership in a company, but here we are talking about tangible assets like apartments, office buildings, or even commercial spaces.

One of the most significant advantages of tokenization is increased liquidity. Traditionally, real estate transactions can take weeks or even months to close, often tied up in legalities and negotiations. However, with tokenized assets, transactions can occur almost instantaneously. Buyers and sellers can trade their tokens on a blockchain platform, much like trading stocks on an exchange. This liquidity opens up the market, allowing more investors to participate and enabling quicker exit strategies for current owners.

Of course, while the benefits are numerous, there are challenges to consider. Regulatory frameworks surrounding tokenization are still evolving, and potential investors must navigate these waters carefully. Here are some key points to keep in mind:

- Legal Compliance: Each jurisdiction has its own laws regarding real estate and securities, which can complicate the tokenization process.

- Market Acceptance: While tokenization is gaining traction, it is still a relatively new concept. Educating potential investors about its benefits and mechanics is crucial for widespread adoption.

- Technology Risks: As with any technology, there are risks associated with security breaches and system failures that could affect tokenized assets.

In summary, tokenization of real estate assets is a groundbreaking development that has the potential to revolutionize how we think about property investment. By allowing fractional ownership and increasing liquidity, blockchain technology is opening doors that were previously closed to many investors. As the market evolves and regulatory frameworks become clearer, we can expect to see even more innovative applications of this technology in the real estate sector.

What is tokenization in real estate?

Tokenization in real estate refers to the process of converting physical properties into digital tokens on a blockchain, allowing for fractional ownership and easier trading of property assets.

How does tokenization increase liquidity?

Tokenization increases liquidity by enabling faster transactions and allowing fractional ownership, meaning investors can buy and sell their shares more easily on blockchain platforms.

What are the risks associated with tokenization?

The risks include regulatory challenges, market acceptance hurdles, and potential technology vulnerabilities that could affect the security of tokenized assets.

Reducing Costs and Fees

One of the most compelling advantages of blockchain technology in real estate is its ability to reduce costs and fees. Traditionally, real estate transactions involve a maze of intermediaries, including real estate agents, lawyers, and banks, each of whom takes a cut of the deal. This can lead to a significant increase in transaction costs, making it less appealing for many potential buyers and investors. However, with blockchain, the landscape is changing dramatically. Imagine a world where you can buy a property directly from the seller, cutting out the middlemen and their hefty commissions. Sounds enticing, right?

Blockchain operates on a decentralized ledger system, which means that all transactions are recorded in a secure and transparent manner without the need for a central authority. This decentralization can lead to substantial cost savings. For instance, using smart contracts—self-executing contracts with the terms of the agreement directly written into code—can automate many processes that would typically require human oversight. This automation not only speeds up transactions but also eliminates the need for various administrative fees. In fact, a recent study indicated that blockchain could reduce transaction costs by as much as 30% to 50% in some real estate markets.

To illustrate the potential savings, consider the following table that breaks down typical costs associated with a traditional real estate transaction versus a blockchain-enabled transaction:

| Cost Category | Traditional Transaction Costs | Blockchain Transaction Costs |

|---|---|---|

| Real Estate Agent Fees | 5% - 6% | 0% - 1% |

| Legal Fees | $1,000 - $3,000 | $200 - $500 |

| Title Insurance | $1,500 - $4,000 | $1,000 - $2,000 |

| Closing Costs | $2,000 - $5,000 | $500 - $1,000 |

As you can see, the potential for savings is significant. By minimizing the number of intermediaries and leveraging smart contracts, blockchain can make real estate transactions not only more affordable but also more accessible to a broader audience. Imagine a young couple wanting to buy their first home—lower fees mean they can allocate more of their budget towards finding the perfect place rather than paying off a mountain of commissions and fees.

Moreover, the reduction in costs doesn't just benefit buyers; it also opens up opportunities for sellers. With lower fees, sellers can price their properties more competitively, which can lead to quicker sales. This creates a win-win situation for everyone involved. In essence, blockchain is democratizing the real estate market, making it more efficient and fair for all parties.

In conclusion, the reduction of costs and fees through blockchain technology is not just a minor improvement—it's a game-changer that could reshape the entire real estate landscape. As more people become aware of these benefits, we may see an increasing shift towards blockchain-based transactions, paving the way for a more equitable real estate market.

- How does blockchain reduce transaction fees?

Blockchain eliminates the need for intermediaries, reducing the commissions and fees typically associated with real estate transactions. - What are smart contracts?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, allowing for automated and secure transactions. - Can blockchain technology be used in all real estate transactions?

While blockchain has the potential to be applied to various types of real estate transactions, its adoption may vary by region and regulatory environment.

Improving Property Management

When it comes to property management, efficiency and reliability are paramount. Imagine a world where landlords and tenants can interact seamlessly without the usual hiccups of paperwork and miscommunication. This is where blockchain technology steps in to revolutionize the landscape. By leveraging a decentralized system, property managers can streamline operations, enhance communication, and ultimately provide a better experience for everyone involved.

One of the most significant advantages of blockchain in property management is its ability to maintain an immutable record of transactions. This means that every lease agreement, payment, and maintenance request is securely recorded on the blockchain, making it nearly impossible to alter or erase any information. This level of transparency not only builds trust between landlords and tenants but also simplifies the auditing process. Imagine a scenario where a tenant disputes a charge; with blockchain, all relevant transactions are easily accessible, allowing for quick resolution without the need for lengthy investigations.

Furthermore, tenant verification becomes a breeze with blockchain. In a traditional setting, landlords often face challenges in verifying a tenant's background. However, through blockchain, property managers can access verified identities and rental histories, ensuring that they are making informed decisions. This not only saves time but also reduces the risk of renting to unreliable tenants. It’s like having a security blanket that wraps around the entire rental process, providing peace of mind to both parties.

In addition to improving tenant verification, blockchain can significantly enhance maintenance management. Property managers can utilize smart contracts to automate maintenance requests. For instance, if a tenant reports a plumbing issue, a smart contract can automatically notify the maintenance team, schedule a visit, and even process payments upon completion of the work. This automation minimizes delays and ensures that issues are addressed promptly, leading to happier tenants and less stress for property managers.

Moreover, the financial aspects of property management can also benefit from blockchain. With reduced reliance on traditional banking systems and intermediaries, transactions can be processed faster and at a lower cost. Imagine being able to receive rent payments in real-time, without the hassle of waiting for checks to clear or dealing with bank fees. This not only improves cash flow for property owners but also makes the renting process smoother for tenants.

In conclusion, the integration of blockchain technology in property management is not just a futuristic concept; it's becoming a reality that can enhance the way we manage properties. From secure record-keeping to streamlined communication and automated maintenance processes, blockchain holds the key to a more efficient and transparent property management experience. As we move forward, it's clear that those who embrace this technology will not only improve their operations but also set themselves apart in a competitive market.

- How does blockchain improve tenant verification?

Blockchain allows property managers to access verified identities and rental histories, ensuring informed decisions. - What are smart contracts?

Smart contracts are self-executing contracts with the terms directly written into code, automating processes like maintenance requests. - Can blockchain reduce costs in property management?

Yes, by eliminating intermediaries and streamlining transactions, blockchain can significantly lower costs. - Is blockchain secure?

Yes, blockchain is highly secure due to its decentralized nature and the immutability of records.

Global Real Estate Markets and Blockchain

As the world becomes increasingly interconnected, the global real estate market is experiencing a seismic shift thanks to blockchain technology. This innovative digital ledger is not just a buzzword; it is revolutionizing how properties are bought, sold, and managed across borders. Imagine a world where a property transaction in New York can be finalized with the same speed and security as one in Tokyo. Sounds futuristic, right? But with blockchain, this is becoming a reality.

Countries around the globe are recognizing the potential of blockchain to streamline their real estate processes. For instance, in Estonia, the government has already integrated blockchain into its land registry system, allowing for secure and transparent property transactions. This has not only reduced the time needed to transfer ownership but has also significantly minimized the risk of fraud. Similarly, in Switzerland, blockchain is being used to create digital identities for properties, enhancing transparency and making it easier for buyers to verify ownership history.

But it's not just about efficiency; blockchain is democratizing real estate investment. Through tokenization, properties can be divided into smaller shares, allowing investors from different economic backgrounds to participate in the market. This is particularly beneficial in high-value markets like San Francisco and London, where traditional barriers to entry can be prohibitively high. By tokenizing real estate assets, investors can buy fractions of properties, making real estate investment accessible to a broader audience.

However, the adoption of blockchain in real estate isn't without its challenges. Different countries have varying regulations regarding property transactions, and navigating these can be complex. For example, while Singapore is embracing blockchain for its potential to improve efficiency, other nations may be more hesitant due to concerns over security and regulatory compliance. This inconsistency can create hurdles for international investors looking to capitalize on opportunities in foreign markets.

To illustrate the global landscape of blockchain in real estate, let's take a look at a table comparing some key countries and their blockchain initiatives:

| Country | Blockchain Initiative | Impact |

|---|---|---|

| Estonia | Land Registry System | Reduced fraud, faster transactions |

| Switzerland | Digital Property Identities | Enhanced transparency, easier verification |

| Singapore | Tokenization of Real Estate | Increased accessibility for investors |

| United States | Real Estate Blockchain Platforms | Streamlined processes, reduced costs |

As we move forward, the influence of blockchain on global real estate markets is expected to grow exponentially. With ongoing advancements in technology and regulatory frameworks, we may soon see a world where property transactions are not only faster and cheaper but also more secure and transparent. The question remains: are we ready to embrace this change? The answer lies in our willingness to adapt and innovate in the face of new technology.

- What is blockchain technology? Blockchain is a decentralized digital ledger that records transactions across multiple computers securely and transparently.

- How does blockchain enhance transparency in real estate? By providing a public ledger that all parties can access, blockchain reduces the chances of fraud and builds trust among buyers, sellers, and agents.

- What is tokenization in real estate? Tokenization involves converting real estate assets into digital tokens, allowing fractional ownership and making investments more accessible.

- Are there any challenges to using blockchain in real estate? Yes, challenges include varying regulations across countries, security concerns, and the need for widespread adoption among industry stakeholders.

Future Trends in Blockchain and Real Estate

The future of blockchain technology in the real estate sector is not just bright; it’s practically glowing with potential. As we look ahead, several trends are emerging that could dramatically reshape how we buy, sell, and manage properties. Imagine a world where your home’s history is as transparent as a clear blue sky, and transactions occur faster than you can say "real estate." Exciting, right? Let’s delve into some of the most significant trends that are on the horizon.

One of the most promising trends is the increased adoption of smart contracts. These self-executing contracts with the terms of the agreement directly written into code are set to revolutionize how transactions are conducted. Instead of relying on lengthy paperwork and intermediaries, buyers and sellers can engage in transactions that are automated and secure. This means fewer delays, reduced chances of disputes, and a smoother overall experience. In fact, smart contracts can significantly cut down the time it takes to close a deal, making the entire process more efficient.

Moreover, the concept of decentralized finance (DeFi) is making waves in the real estate market. DeFi platforms allow individuals to lend, borrow, and trade real estate assets without traditional financial institutions. This democratization of finance could open the doors for more people to invest in real estate, breaking down barriers that previously kept many potential investors on the sidelines. Imagine being able to invest in a fraction of a property with just a few clicks, all thanks to blockchain technology!

Another trend gaining momentum is the global standardization of blockchain protocols. As more countries recognize the benefits of blockchain, there’s a push towards creating universal standards that can facilitate cross-border real estate transactions. This would not only enhance transparency but also make it easier for international investors to navigate various markets. Picture a scenario where you can buy a property in another country as easily as you could purchase a concert ticket online. That’s the kind of future we’re heading towards!

Additionally, the rise of property tokenization is set to redefine investment strategies in real estate. By converting properties into digital tokens, investors can buy and sell fractions of real estate assets, making it more accessible and affordable. This trend could lead to a more liquid real estate market, allowing for quicker transactions and a broader range of investment opportunities. It’s like turning a massive, unwieldy ship into a fleet of nimble boats ready to navigate the waters of investment!

As we move towards a more tech-driven world, the integration of artificial intelligence (AI) with blockchain is another trend to watch. AI can analyze vast amounts of data to provide insights into market trends, property valuations, and investment opportunities. When combined with the transparency and security of blockchain, this could lead to smarter, data-driven decisions in real estate. Imagine having a personal assistant that not only helps you find the best properties but also predicts market shifts before they happen!

In conclusion, the future of blockchain in real estate is filled with innovations that promise to enhance efficiency, accessibility, and transparency. As these trends unfold, they will not only transform the industry but also empower buyers, sellers, and investors alike. The real estate landscape is on the brink of a revolution, and those who embrace these changes will undoubtedly be at the forefront of this exciting new era.

- What is blockchain technology?

Blockchain is a decentralized digital ledger that records transactions across many computers securely and immutably.

- How does blockchain enhance transparency in real estate?

By providing a public ledger that all parties can access, blockchain reduces the chances of fraud and builds trust among participants.

- What are smart contracts?

Smart contracts are self-executing contracts with the terms directly written into code, automating transactions and reducing the need for intermediaries.

- What is property tokenization?

Tokenization is the process of converting real estate assets into digital tokens, allowing for fractional ownership and increased liquidity.

- How will AI impact blockchain in real estate?

AI can analyze data to provide insights for better decision-making, and when integrated with blockchain, it enhances the security and efficiency of real estate transactions.

Frequently Asked Questions

- What is blockchain technology?

Blockchain technology is a decentralized digital ledger that records transactions across many computers. This ensures that the recorded transactions cannot be altered retroactively, enhancing security and trust.

- How does blockchain increase transparency in real estate transactions?

With blockchain, all parties involved in a transaction can access the same information in real-time. This transparency minimizes the chances of fraud, as every transaction is recorded and publicly verifiable.

- What are smart contracts?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate processes in real estate transactions, reducing the need for intermediaries and speeding up the closing process.

- What is tokenization in real estate?

Tokenization is the process of converting real estate assets into digital tokens that can be bought and sold. This makes investing in real estate more accessible, allowing fractional ownership and opening the market to a wider range of investors.

- How can blockchain reduce costs in real estate transactions?

By eliminating intermediaries like brokers and agents, blockchain can significantly lower transaction fees. This not only makes real estate investments more affordable but also attracts a broader audience.

- What benefits does blockchain offer for property management?

Blockchain improves property management through better record-keeping, efficient tenant verification, and streamlined communication. This leads to enhanced service delivery and a better experience for both property managers and tenants.

- How is blockchain being adopted globally in real estate?

Countries around the world are exploring blockchain to innovate their real estate markets. From streamlining property registrations to facilitating international transactions, the global impact of blockchain is becoming increasingly evident.

- What future trends can we expect in blockchain and real estate?

As blockchain technology continues to evolve, we can anticipate more advanced applications in real estate, such as improved regulatory compliance, enhanced security measures, and even greater accessibility for investors.