Frax - A New Era of Stablecoins

Welcome to the exciting world of Frax, a revolutionary player in the cryptocurrency realm that is set to redefine how we perceive stablecoins! In a landscape often characterized by volatility, Frax emerges as a beacon of innovation, merging the best of both worlds: algorithmic stability and collateralization. Imagine a stablecoin that not only aims to maintain its value but does so through a clever blend of technology and financial principles. This article will take you on a journey through Frax’s unique mechanisms, its potential impact on the crypto market, and why it might just be the game-changer we’ve all been waiting for.

Stablecoins are digital currencies designed to maintain a stable value, acting as a bridge between the unpredictable world of cryptocurrencies and the stability of traditional fiat currencies. They play a crucial role in the cryptocurrency market by providing a reliable medium of exchange and a safe haven for traders during market fluctuations. With the rise of decentralized finance (DeFi), the demand for stablecoins has skyrocketed, making it essential for new entrants like Frax to create innovative solutions that stand out from the crowd.

What sets Frax apart from traditional stablecoins is its fractional-algorithmic model, which combines the benefits of collateralization with algorithmic adjustments. This unique approach not only enhances the stability of the coin but also increases its liquidity and reduces volatility. By balancing between collateralized and non-collateralized components, Frax can adapt to changing market conditions while maintaining its peg to the US dollar. This flexibility is akin to a tightrope walker skillfully balancing on a thin line, adjusting their movements in response to the shifting environment beneath them.

As we dive deeper into the mechanics of Frax, we find that its collateralization mechanisms are diverse and strategic. Frax employs various assets, including cryptocurrencies and stable assets, to back its value. This multi-faceted approach ensures that even in turbulent times, Frax can maintain its stability by leveraging the strength of its collateral. Think of it as a well-diversified investment portfolio that mitigates risk through careful selection of assets.

Moreover, the algorithmic adjustments play a pivotal role in Frax's operation. These algorithms are designed to respond dynamically to market fluctuations, ensuring that the stablecoin remains resilient against external pressures. By continuously analyzing market data and making real-time adjustments, Frax can effectively manage supply and demand, keeping its value stable. This is similar to a thermostat that adjusts the temperature in a room, ensuring comfort regardless of the weather outside.

The benefits of using Frax are numerous and compelling. Users can enjoy enhanced liquidity, lower volatility, and a more robust framework for transactions. Unlike traditional stablecoins that may rely heavily on a single asset, Frax’s hybrid model offers a more resilient solution, appealing to a broader range of users from traders to everyday consumers. Whether you are looking to hedge against market volatility or simply seeking a reliable medium for transactions, Frax provides an enticing option.

As we look at the broader market implications, the introduction of Frax could lead to significant shifts in the stablecoin landscape. With its innovative model, Frax may challenge existing stablecoins, fostering healthy competition that drives improvements across the board. This could result in a more efficient market, benefiting users and investors alike. The potential for adoption is vast, with use cases spanning various sectors, from e-commerce to remittances, making Frax a versatile addition to the cryptocurrency ecosystem.

Looking ahead, the future of Frax appears bright. As it continues to evolve and adapt to the ever-changing landscape of digital currencies, we can expect to see exciting developments and broader acceptance within the crypto community. With its commitment to innovation and stability, Frax is poised to become a cornerstone of the stablecoin market, paving the way for a new era of financial transactions.

- What is Frax? Frax is a fractional-algorithmic stablecoin that combines collateralization with algorithmic adjustments to maintain its value.

- How does Frax maintain its stability? Frax balances between collateralized and non-collateralized components, using algorithms to respond to market fluctuations.

- What are the benefits of using Frax? It offers enhanced liquidity, lower volatility, and a more resilient framework for transactions compared to traditional stablecoins.

- What are the potential use cases for Frax? Frax can be used in various sectors, including e-commerce, remittances, and decentralized finance (DeFi).

- What does the future hold for Frax? The future looks promising as Frax continues to evolve and gain acceptance within the cryptocurrency ecosystem.

Understanding Stablecoins

In the ever-evolving world of cryptocurrency, stablecoins have emerged as a beacon of stability amidst the chaos of price volatility. But what exactly are stablecoins? Simply put, they are digital currencies designed to maintain a stable value, often pegged to traditional fiat currencies like the US dollar or the euro. This stability is crucial, especially for users who want to engage in transactions without the risk of sudden price fluctuations. Imagine trying to buy your morning coffee with a currency that could double in value by lunchtime; it would be quite the rollercoaster ride!

Stablecoins serve several important purposes in the crypto market. They act as a bridge between traditional finance and the burgeoning world of digital assets, providing a reliable means of exchange. Many traders and investors use stablecoins as a safe haven during market downturns, allowing them to preserve their capital without converting back to fiat. Furthermore, stablecoins facilitate smoother transactions on decentralized exchanges (DEXs), enabling users to trade and swap assets without the need for traditional banking systems.

To understand stablecoins better, we can categorize them into three main types:

- Fiat-collateralized stablecoins: These are backed by fiat currency held in reserve, maintaining a 1:1 peg. Examples include Tether (USDT) and USD Coin (USDC).

- Crypto-collateralized stablecoins: These are backed by other cryptocurrencies, which are often over-collateralized to absorb price fluctuations. A well-known example is DAI, which is pegged to the US dollar.

- Algorithmic stablecoins: These rely on algorithms to control the supply of the stablecoin, adjusting it based on demand to maintain its value. Frax is a prime example of this innovative approach.

Each type of stablecoin has its own set of advantages and disadvantages, but they all share the common goal of providing stability in a volatile market. For instance, fiat-collateralized stablecoins offer simplicity and transparency, as users can easily verify the reserves backing the currency. On the other hand, crypto-collateralized stablecoins can be more complex, requiring users to understand the intricacies of collateral management and liquidation risks.

In summary, stablecoins play a vital role in the cryptocurrency ecosystem by providing a stable medium of exchange, a store of value, and a means to hedge against volatility. As the crypto market continues to mature, the demand for stablecoins is likely to grow, paving the way for innovative solutions like Frax that aim to redefine what stability means in the digital currency space.

The Frax Model

The Frax Model represents a groundbreaking approach to stablecoins that merges both algorithmic stability and collateralization. Unlike traditional stablecoins that are either fully backed by reserves or purely algorithmic, Frax introduces a hybrid model that seeks to strike a balance between these two methodologies. Imagine a seesaw, where on one side you have the weight of collateral backing and on the other, the flexibility of algorithms; Frax aims to keep that seesaw perfectly balanced, ensuring stability while also allowing for scalability.

At its core, the Frax Model operates on a fractional-algorithmic system. This means that a portion of the stablecoin's supply is backed by collateral, while the rest is managed through algorithmic adjustments. The beauty of this system lies in its ability to dynamically adjust the ratio of collateralized to non-collateralized assets based on market conditions. Think of it as a smart thermostat that not only keeps your home at a comfortable temperature but also learns from your habits to optimize energy use. This adaptability is crucial for maintaining the value of Frax amidst the inherent volatility of the cryptocurrency market.

The fractional-algorithmic system is central to Frax's design and sets it apart from its peers. The system is designed to maintain a stable value while allowing for expansion and contraction based on demand. When the demand for Frax increases, the algorithm can mint new tokens while ensuring that a sufficient amount remains collateralized. Conversely, if demand decreases, the algorithm can reduce the supply, effectively maintaining price stability. This dual mechanism allows Frax to be both stable and responsive, a rare combination in the world of stablecoins.

Frax employs various collateralization methods to ensure its value remains stable. The collateral backing Frax can include a range of assets such as cryptocurrencies, stablecoins, and even traditional assets. This diversification in collateral types not only helps in maintaining stability but also enhances the overall resilience of the system. By not relying solely on one type of asset, Frax can better withstand market fluctuations. For instance, if one collateral asset experiences a drop in value, the others can help buffer the overall stability of the Frax token.

The algorithmic aspect of Frax plays a crucial role in its operation. The algorithms monitor market conditions in real-time, making necessary adjustments to the supply of Frax tokens. When the price of Frax deviates from its target value, the algorithm can automatically increase or decrease the supply to bring it back in line. This mechanism is akin to a skilled conductor leading an orchestra, ensuring that every instrument plays in harmony to create a beautiful symphony. By continuously adjusting to market signals, Frax maintains its peg more effectively than many traditional stablecoins.

In summary, the Frax Model is a revolutionary approach that combines the best of both worlds: the security of collateralization and the flexibility of algorithmic adjustments. As the cryptocurrency landscape evolves, models like Frax are likely to play a pivotal role in shaping the future of stablecoins.

- What is Frax? Frax is a fractional-algorithmic stablecoin that combines collateralization with algorithmic stability to maintain its value.

- How does the fractional-algorithmic system work? It balances between collateralized and non-collateralized components, adjusting supply based on market demand.

- What types of collateral does Frax use? Frax can be backed by various assets, including cryptocurrencies and stablecoins, to ensure resilience.

- Why is the algorithmic aspect important? It allows Frax to respond to market fluctuations in real-time, maintaining price stability more effectively.

Fractional-Algorithmic System

The is the beating heart of the Frax stablecoin model, and it’s a game-changer in the world of cryptocurrency. Imagine a balance beam where one side is supported by traditional collateral and the other side is governed by smart algorithms. This unique setup allows Frax to maintain stability in a way that traditional stablecoins simply can't. While most stablecoins are fully backed by fiat or crypto assets, Frax introduces a refreshing twist by blending collateralization with algorithmic adjustments. This hybrid approach not only enhances stability but also offers a level of flexibility that is crucial in today’s volatile market.

At its core, the fractional-algorithmic system operates on a principle of dynamic adjustment. When demand for Frax increases, the algorithm kicks in to manage the supply effectively. Think of it like a thermostat that adjusts your home’s temperature based on the weather outside; it keeps things just right. This means that as more users flock to adopt Frax, the system can expand its supply without the need for an equivalent increase in collateral. Conversely, if demand dips, the algorithm can reduce the supply, helping to prevent drastic price drops. This dual mechanism ensures that Frax can adapt to changing market conditions while maintaining its peg to the dollar.

To better understand how this system functions, let’s break it down into its key components:

- Collateralized Component: A portion of Frax is backed by traditional assets, providing a safety net that assures users of its value.

- Algorithmic Component: The remaining portion is governed by algorithms that adjust the supply based on market demand, ensuring stability.

This fractional approach not only stabilizes the currency but also minimizes the risks associated with being fully collateralized. In a world where market conditions can shift rapidly, having this flexibility is akin to having a Swiss Army knife in your pocket; it prepares you for a variety of scenarios. By leveraging both collateral and algorithms, Frax ensures that it can weather the storm of market volatility while still offering users the reliability they expect from a stablecoin.

Moreover, the fractional-algorithmic system paves the way for enhanced liquidity and lower volatility. By not being fully reliant on collateral, Frax can offer users more opportunities to engage with their assets without fear of losing value. It’s this innovative blend of traditional finance principles with cutting-edge technology that positions Frax as a frontrunner in the stablecoin race.

In summary, the fractional-algorithmic system is not just a technical marvel; it represents a significant shift in how stablecoins can operate. As we move forward in the cryptocurrency landscape, this model could very well set a new standard for stability, flexibility, and overall user experience. With Frax at the helm, the future of stablecoins looks not only promising but also excitingly unpredictable.

Collateralization Mechanisms

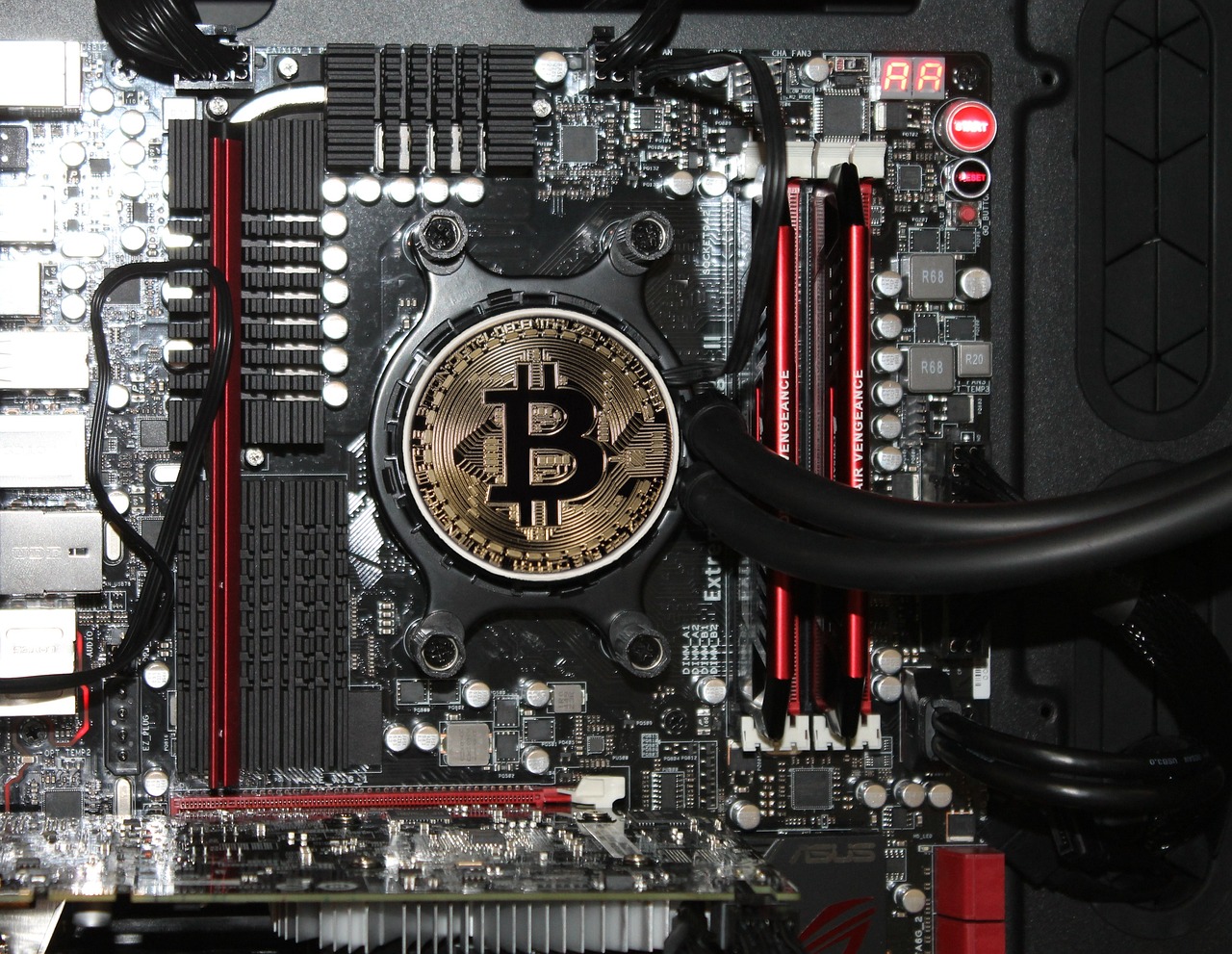

When it comes to the world of stablecoins, play a pivotal role in ensuring stability and trust. Frax, with its innovative approach, employs a variety of assets to back its value, providing a safety net that traditional stablecoins often lack. This is crucial because, without proper collateralization, a stablecoin's value could fluctuate wildly, undermining the very purpose it was created for.

Frax utilizes a combination of both crypto-assets and fiat-backed reserves to maintain its stability. This dual approach not only enhances the coin's resilience but also allows it to adapt to the ever-changing dynamics of the cryptocurrency market. For instance, when the market experiences a downturn, the collateralization mechanisms can be adjusted to ensure that the value of Frax remains stable. Here’s a breakdown of the primary collateral types used:

| Collateral Type | Description | Impact on Stability |

|---|---|---|

| Crypto-assets | Digital currencies like ETH or BTC that can be locked as collateral. | Provides liquidity and market responsiveness. |

| Fiat-backed reserves | Traditional currencies held in reserve to back the stablecoin. | Ensures trust and stability during market volatility. |

This diversified collateral strategy is akin to having a safety net made of different materials; each material offers unique benefits and strengths. By combining these assets, Frax can dynamically adjust its collateralization levels based on market conditions. This means that if one asset type experiences a significant drop in value, the other can help cushion the blow, maintaining the overall stability of the Frax stablecoin.

Moreover, Frax employs sophisticated algorithms to monitor the value of its collateral in real-time. This means that the system can react quickly to market fluctuations, adjusting the collateralization ratios as necessary. This responsiveness is a game-changer; it allows Frax to maintain its peg to the dollar more effectively than many traditional stablecoins, which might rely solely on fixed reserves.

In essence, the collateralization mechanisms of Frax are designed not just to protect its value but to enhance its overall efficiency in the market. By leveraging a mix of crypto-assets and fiat, Frax is setting a new standard for stablecoins, paving the way for greater adoption and trust in the cryptocurrency ecosystem.

- What is Frax? Frax is a fractional-algorithmic stablecoin that combines collateralized and non-collateralized components to maintain price stability.

- How does collateralization work in Frax? Frax uses a mix of crypto-assets and fiat-backed reserves to ensure its value remains stable, adjusting in response to market conditions.

- What are the benefits of using Frax? Frax offers enhanced liquidity, lower volatility, and a more resilient mechanism for maintaining its peg compared to traditional stablecoins.

- Can I use Frax for transactions? Yes, Frax is designed for various use cases, including everyday transactions, lending, and trading.

Algorithmic Adjustments

The world of cryptocurrencies is notoriously volatile, with prices swinging wildly in a matter of hours. This is where the of Frax come into play, acting like a finely tuned orchestra conductor, ensuring that each section harmonizes to create a stable financial environment. By leveraging sophisticated algorithms, Frax can respond dynamically to market conditions, making real-time adjustments to maintain its peg to the dollar. Think of it as a smart thermostat that adjusts the temperature based on the weather outside; it keeps the environment comfortable despite external fluctuations.

At the core of Frax's algorithmic adjustments is a set of mechanisms designed to monitor market activity continuously. These algorithms analyze various factors, such as trading volume, market demand, and price movements, to determine whether the supply of Frax needs to be increased or decreased. For instance, if the price of Frax starts to rise above its target value, the algorithm may initiate a minting process, increasing the supply to bring the price back down. Conversely, if the price dips below the target, the algorithm can reduce the supply, helping to stabilize the value. This dynamic approach to supply and demand is a game changer in the stablecoin arena.

To better understand how these adjustments work, let's look at a simplified table illustrating the process:

| Market Condition | Algorithmic Response | Outcome |

|---|---|---|

| Price above target | Increase supply through minting | Price stabilizes downward |

| Price below target | Decrease supply through burning | Price stabilizes upward |

| Stable price | No action needed | Maintained stability |

This algorithmic flexibility not only helps maintain the value of Frax but also enhances user confidence. Imagine walking into a store where the prices fluctuate wildly; it would be unsettling, right? Now, picture a store where prices are stable, thanks to smart management. That’s the kind of confidence Frax aims to instill in its users.

Moreover, the algorithmic adjustments are not just reactive; they can also be proactive. By analyzing trends and predicting future market movements, Frax can implement strategies that anticipate changes before they happen. This forward-thinking approach allows it to stay ahead of the curve, making it a formidable contender in the stablecoin market.

In summary, Frax's algorithmic adjustments are a pivotal component of its design, enabling it to maintain stability in a turbulent market. By intelligently managing supply and demand, Frax not only preserves its value but also builds trust among its users, paving the way for broader adoption and integration into everyday transactions.

- What is a stablecoin? Stablecoins are digital currencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar.

- How does Frax differ from traditional stablecoins? Frax combines algorithmic stability with collateralization, allowing it to adapt dynamically to market conditions.

- What are algorithmic adjustments? They are mechanisms used by Frax to manage its supply in response to market fluctuations, helping maintain its peg to the dollar.

- Can Frax be used for everyday transactions? Yes, Frax's stability and liquidity make it suitable for various financial transactions.

Benefits of Frax

The introduction of Frax to the stablecoin ecosystem brings a plethora of benefits that set it apart from traditional stablecoins. One of the most significant advantages is its enhanced liquidity. Unlike many stablecoins that rely solely on fiat backing, Frax's fractional-algorithmic model allows for a more dynamic liquidity provision. This means that users can enjoy faster transactions and reduced slippage, making it an attractive option for traders and investors alike.

Another compelling benefit of Frax is its lower volatility. Traditional stablecoins often experience fluctuations due to market demand and supply pressures. However, Frax employs a unique mechanism that helps it maintain a more stable price point. By balancing collateralized and non-collateralized components, Frax can adapt to market changes without the same level of price swings that other stablecoins might face. This stability is crucial for users who require certainty in their transactions, especially in a market as unpredictable as cryptocurrency.

Moreover, Frax's innovative design allows it to be more resilient to market shocks. In the event of a sudden surge in demand, the algorithmic component can quickly adjust the supply of Frax tokens to meet the needs of the market. This responsiveness is vital in ensuring that users can trust the currency to maintain its value, even during turbulent times. Think of it like a well-tuned engine that can rev up or slow down as needed, ensuring smooth performance no matter the external conditions.

Additionally, Frax opens up new opportunities for yield generation. Users can leverage their Frax holdings in various DeFi protocols, allowing them to earn interest or rewards while still maintaining a stable asset. This dual benefit of stability and earning potential makes Frax an appealing option for both conservative investors and those looking to maximize their returns.

Finally, the community-driven aspect of Frax cannot be overlooked. As a decentralized protocol, users have a say in its governance and future developments. This democratic approach fosters a sense of ownership and engagement among users, which can lead to a more robust and supportive ecosystem. In essence, Frax is not just a stablecoin; it’s a community-driven project that aims to reshape the way we think about digital assets.

In summary, the benefits of Frax—enhanced liquidity, lower volatility, resilience to market shocks, yield generation opportunities, and community involvement—make it a standout option in the crowded stablecoin market. Its innovative approach not only provides stability but also opens the door to new possibilities for users across various sectors.

- What makes Frax different from traditional stablecoins?

Frax combines algorithmic stability with collateralization, allowing it to maintain a stable value while being more responsive to market changes. - How does Frax ensure its stability?

Frax uses a fractional-algorithmic system that balances collateralized and non-collateralized components to adapt to market fluctuations. - Can I earn interest on my Frax holdings?

Yes, users can leverage their Frax in various DeFi protocols to generate yield while maintaining a stable asset. - Is Frax community-driven?

Absolutely! Frax encourages community participation in its governance, allowing users to influence its future developments.

Market Implications

The introduction of Frax into the cryptocurrency ecosystem is not just a minor update; it represents a seismic shift in the stablecoin market. As investors and users become increasingly aware of the limitations of traditional stablecoins, such as their reliance on full collateralization, Frax’s innovative approach could catalyze a new way of thinking about digital currencies. Imagine a world where stablecoins are not only reliable but also adaptable, responding to market conditions in real-time. This is what Frax promises.

One of the most significant implications of Frax's fractional-algorithmic model is its potential to enhance liquidity in the market. Traditional stablecoins often face challenges related to liquidity during times of high volatility. However, Frax’s unique blend of collateralized and algorithmic components allows it to maintain a steady supply of coins, even when demand fluctuates. This could lead to a more stable trading environment, attracting a wider range of users—from casual investors to institutional players.

Furthermore, as Frax continues to gain traction, it could instigate a shift in how existing stablecoins operate. Competitors may feel the pressure to innovate, leading to a new wave of advancements in the stablecoin sector. For instance, we might see traditional stablecoins adopting more algorithmic features or experimenting with partial collateralization to keep up with Frax's appeal. This competitive landscape could ultimately benefit users by providing them with more options and better services.

To illustrate the potential impact of Frax on the market, let’s consider some key shifts that could occur:

- Increased Adoption: As users seek more stable and efficient stablecoins, Frax could see rapid adoption across various sectors, including DeFi, remittances, and e-commerce.

- Market Diversification: The introduction of a new model encourages diversification of stablecoin offerings, leading to a more robust and resilient market.

- Regulatory Attention: With innovation comes scrutiny. Regulators may take a closer look at how fractional-algorithmic stablecoins operate, prompting discussions about new regulations that could shape the future of digital currencies.

In summary, the market implications of Frax are profound and far-reaching. By challenging the status quo, Frax not only paves the way for a new era of stablecoins but also encourages a more dynamic and competitive market. The future of stablecoins may very well be defined by how well they can adapt to the changing needs of users, and Frax stands at the forefront of this evolution.

What is Frax?

Frax is a fractional-algorithmic stablecoin that combines both collateralized and algorithmic mechanisms to maintain its value. This innovative approach allows it to adapt to market conditions effectively.

How does Frax differ from traditional stablecoins?

Unlike traditional stablecoins that are fully collateralized, Frax operates on a hybrid model, which means it has both collateralized and non-collateralized components. This allows for greater flexibility and stability.

What are the benefits of using Frax?

Frax offers enhanced liquidity, lower volatility, and a more adaptable structure compared to traditional stablecoins, making it appealing for various users in the cryptocurrency market.

Could Frax influence existing stablecoins?

Yes, the introduction of Frax may compel existing stablecoins to innovate and adapt, leading to a more competitive and diverse stablecoin market.

Adoption and Use Cases

Frax is not just another stablecoin; it represents a transformative approach to digital currency that can be applied across various sectors. Its unique fractional-algorithmic model opens the door to a plethora of adoption scenarios that traditional stablecoins might struggle to accommodate. Imagine a world where your daily transactions are not only secure but also incredibly efficient. That’s the promise of Frax!

One of the most compelling use cases for Frax lies in the realm of decentralized finance (DeFi). As DeFi continues to expand, the need for stable assets is paramount. Frax can serve as a reliable medium of exchange for lending and borrowing platforms, allowing users to engage in transactions without the fear of sudden price fluctuations. Its ability to maintain stability while being partially collateralized makes it an attractive option for liquidity providers and borrowers alike.

Moreover, the retail sector stands to benefit significantly from the adoption of Frax. Imagine walking into a store and paying for your groceries with a digital currency that is not only stable but also widely accepted. Merchants can integrate Frax into their payment systems, allowing for seamless transactions that reduce the costs associated with traditional payment methods. This could lead to faster checkouts and a more enjoyable shopping experience for consumers.

In addition, Frax has the potential to revolutionize remittances. Sending money across borders can be a costly and time-consuming process, often hindered by high fees and exchange rate volatility. With Frax, individuals can send funds internationally at a fraction of the cost and time, thanks to its algorithmic stability and low transaction fees. This could empower millions of people, especially in developing countries, to access financial services that were previously out of reach.

Furthermore, Frax can be utilized in the gaming industry. As more games incorporate blockchain technology, the need for a stable in-game currency becomes apparent. Gamers can use Frax to purchase in-game items or assets without worrying about the value of their currency fluctuating wildly. This adds a layer of security and trust, encouraging more players to engage in digital economies.

To sum it up, the adoption of Frax can take many forms, from DeFi applications to retail transactions, remittances, and gaming. Its versatility and stability position it as a frontrunner in the evolving landscape of digital currencies. As more users and businesses recognize the benefits of using Frax, we can expect to see a significant shift in how we perceive and utilize stablecoins in our daily lives.

- What is Frax? Frax is a fractional-algorithmic stablecoin that aims to provide a stable value while utilizing both collateralized and algorithmic methods.

- How does Frax differ from traditional stablecoins? Unlike traditional stablecoins that are fully backed by collateral, Frax combines collateralization with algorithmic adjustments to maintain its value.

- What are the benefits of using Frax? Frax offers enhanced liquidity, lower volatility, and a unique model that allows for greater flexibility in various applications.

- Can Frax be used for everyday transactions? Yes, Frax can be integrated into payment systems, making it suitable for everyday purchases and transactions.

- Is Frax secure? Yes, Frax employs various mechanisms to ensure its stability and security, making it a reliable option for users.

Future Prospects

The future of Frax is not just bright; it’s practically glowing with potential! As the cryptocurrency landscape continues to evolve, Frax stands at the forefront of innovation, ready to carve out its niche in the stablecoin market. So, what does the horizon look like for this fractional-algorithmic stablecoin? Let's dive in.

First off, the adoption rate for Frax is likely to surge as more users and institutions recognize the benefits of its unique model. Unlike traditional stablecoins that are fully collateralized, Frax offers a blend of collateralization and algorithmic adjustments, which could attract a broader audience. Imagine a world where users can enjoy the benefits of a stablecoin without being entirely reliant on reserves. This flexibility can lead to a wider range of applications across different sectors.

Moreover, as DeFi (Decentralized Finance) continues to gain traction, Frax's liquidity and lower volatility will be significant assets. Users are always on the lookout for stablecoins that can provide them with a secure haven during market turbulence. The ability of Frax to dynamically adjust its supply based on demand will likely make it a preferred choice for those looking to invest or transact without the fear of sudden price swings.

In addition, the team behind Frax is committed to continuous improvement and innovation. They are actively working on integrating new features and partnerships that could enhance the functionality of the coin. For instance, collaborations with decentralized exchanges or lending platforms could significantly boost Frax’s visibility and usability. This could lead to a scenario where Frax becomes a staple in the DeFi ecosystem, much like how Ethereum has established itself as a foundational layer for countless projects.

To illustrate the potential growth trajectory for Frax, consider the following table that outlines some key factors influencing its future:

| Factor | Impact |

|---|---|

| Increased Adoption | Higher transaction volumes and market cap |

| Partnerships | Enhanced functionality and user base |

| Market Conditions | Greater demand for stablecoins during volatility |

| Technological Advancements | Improved user experience and security |

Furthermore, as regulatory frameworks around cryptocurrencies continue to develop, Frax is well-positioned to adapt. Being a fractional-algorithmic stablecoin, it has the potential to meet regulatory requirements while maintaining its innovative edge. This adaptability could serve as a significant advantage over traditional stablecoins that may struggle to comply with evolving regulations.

Finally, it’s essential to recognize that the community plays a vital role in the future of Frax. Engaging with users, gathering feedback, and implementing changes based on community input will be crucial for its success. A strong, active community can drive the adoption of Frax, making it a household name in the cryptocurrency world.

In conclusion, the future of Frax is not just about surviving; it’s about thriving in a competitive landscape. With its unique model, commitment to innovation, and potential for widespread adoption, Frax could very well redefine what we expect from stablecoins in the years to come. So, buckle up! The ride is just getting started.

- What is Frax? Frax is a fractional-algorithmic stablecoin that combines collateralization with algorithmic adjustments to maintain its value.

- How does Frax differ from traditional stablecoins? Unlike traditional stablecoins that are fully backed by reserves, Frax uses a hybrid model that allows for a portion of its supply to be algorithmically adjusted.

- What are the benefits of using Frax? Frax offers enhanced liquidity, lower volatility, and a flexible model that can adapt to changing market conditions.

- What does the future hold for Frax? The future looks promising as Frax continues to innovate, expand its user base, and adapt to regulatory changes.

Frequently Asked Questions

- What is Frax?

Frax is a new type of stablecoin that operates on a fractional-algorithmic model. This means it combines aspects of both algorithmic and collateralized stablecoins to maintain price stability, providing users with a unique and innovative digital currency experience.

- How does the fractional-algorithmic system work?

The fractional-algorithmic system of Frax balances between collateralized and non-collateralized components. Essentially, a portion of the supply is backed by collateral, while the remaining part is algorithmically adjusted based on market demand, allowing it to maintain its peg effectively.

- What types of assets are used for collateralization in Frax?

Frax utilizes various assets for collateralization, including cryptocurrencies like Ethereum and stablecoins. These assets help maintain the value of Frax by providing a safety net during market fluctuations, ensuring that users can trust its stability.

- How does Frax respond to market fluctuations?

Frax employs algorithmic adjustments to respond to market changes. When demand increases, the algorithm can mint additional coins to meet this demand, and when demand drops, it can reduce the supply, helping to stabilize the currency's value.

- What are the benefits of using Frax over traditional stablecoins?

Frax offers several advantages, including enhanced liquidity, lower volatility, and a more dynamic response to market conditions. This makes it appealing for users looking for a stable yet flexible digital currency option.

- How could Frax impact the stablecoin market?

The introduction of Frax could lead to significant shifts in the stablecoin market. Its unique model may challenge existing stablecoins, prompting them to adapt and innovate, which could ultimately benefit the entire ecosystem.

- What are some potential use cases for Frax?

Frax's versatility allows it to be used in various sectors, such as decentralized finance (DeFi), remittances, and everyday transactions. Its unique properties could reshape how we think about financial transactions in the digital age.

- What does the future hold for Frax?

The future of Frax looks bright, with ongoing developments and potential for wider acceptance in the crypto ecosystem. As it continues to evolve, we can expect to see more use cases and possibly even integration into mainstream financial systems.