Bitcoin - The Pioneer of Digital Currency

Bitcoin, introduced to the world in 2009, is not just a form of currency; it's a revolutionary concept that has reshaped the entire landscape of finance. Imagine a world where money doesn't rely on banks or governments, where transactions can be made directly between individuals without the need for a middleman. This is the reality that Bitcoin has created. Developed by an enigmatic figure known as Satoshi Nakamoto, Bitcoin operates on a technology called blockchain, which ensures transparency and security. As we dive deeper into the world of Bitcoin, we will explore its fascinating history, the innovative technology behind it, the myriad benefits it offers, the challenges it faces, and what the future may hold for this pioneering digital currency.

Bitcoin's journey began with the release of its white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This document laid the groundwork for what would become a global phenomenon. The identity of Satoshi Nakamoto remains a mystery, fueling speculation and intrigue. Since its inception, Bitcoin has achieved several significant milestones, including its first real-world transaction in 2010, when a programmer famously paid for two pizzas with 10,000 Bitcoins. Fast forward to today, and Bitcoin has evolved into a multi-billion dollar asset, with millions of users worldwide. Its rise has sparked a wave of interest in cryptocurrencies and blockchain technology, leading to the creation of thousands of alternative coins.

To truly appreciate Bitcoin, one must understand the mechanics behind it. At its core, Bitcoin operates on a decentralized network, meaning it is not controlled by any single entity. This decentralization is achieved through blockchain technology, which is a public ledger that records all transactions across a network of computers. Each block in the chain contains a list of transactions, and once a block is filled, it is added to the chain in a way that is irreversible. This ensures that all transactions are transparent and tamper-proof.

Blockchain is the backbone of Bitcoin, providing the foundation for its operation. Imagine a digital notebook that everyone can see but no one can erase. This is how blockchain functions. It allows for secure, transparent, and immutable transactions. Each transaction is verified by a network of nodes, which are computers that participate in the network. This verification process eliminates the need for intermediaries, making transactions faster and cheaper compared to traditional banking systems.

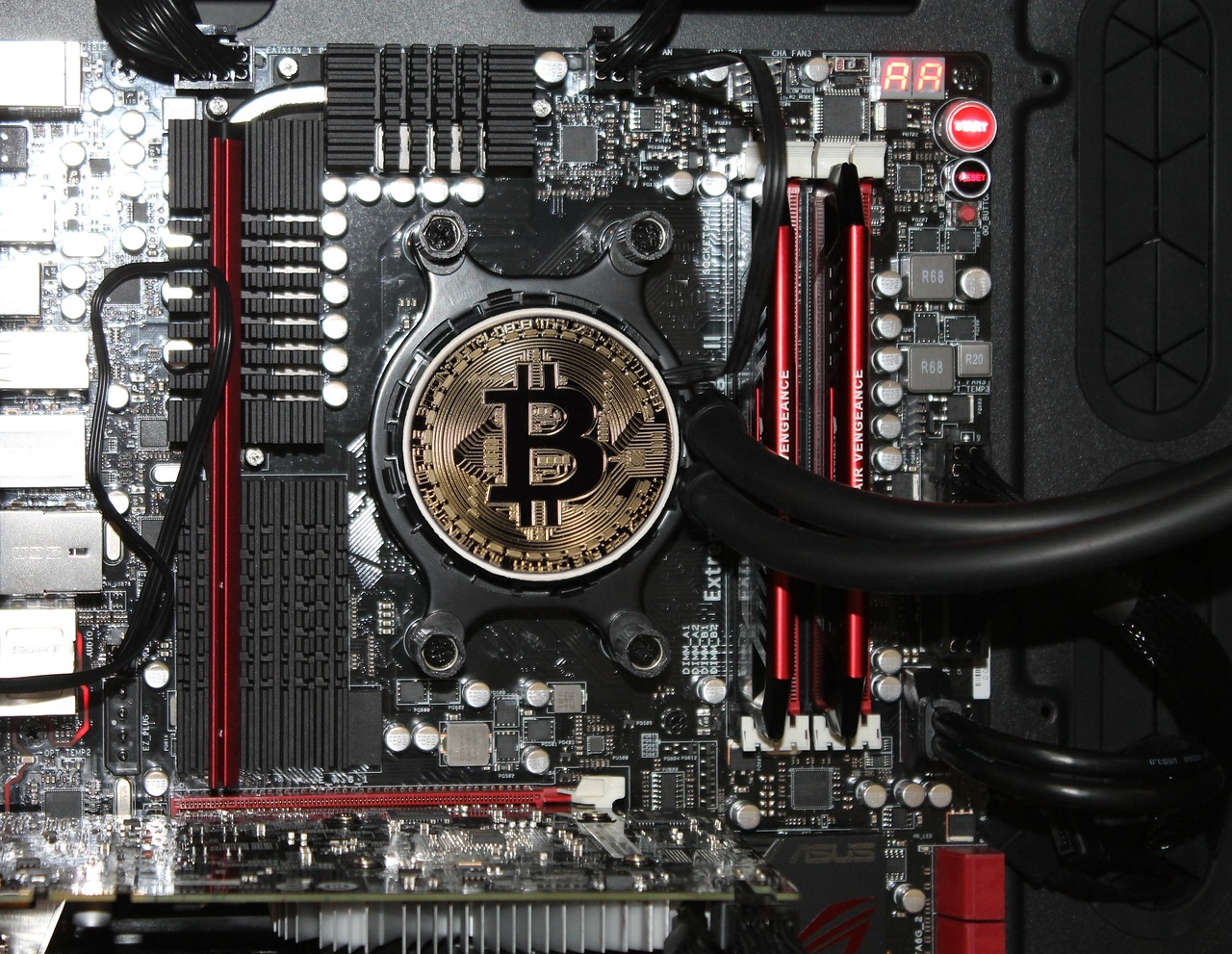

Now, let’s talk about the mining process. Bitcoin mining is not about digging in the ground; rather, it involves solving complex mathematical problems to validate transactions and secure the network. Miners compete to solve these problems, and the first one to succeed gets to add a new block to the blockchain. As a reward, they receive newly minted Bitcoins. However, this process has raised concerns about its environmental impact due to the significant energy consumption involved. Many are now advocating for greener alternatives to mining.

Transaction verification is crucial for maintaining the integrity of Bitcoin exchanges. Each transaction is confirmed by multiple nodes in the network, ensuring that no double spending occurs. This process relies on consensus mechanisms, which are protocols that ensure all nodes agree on the validity of transactions. This decentralized verification process is what makes Bitcoin resilient against fraud and hacking attempts.

Bitcoin offers numerous advantages that set it apart from traditional currencies. Here are some key benefits:

- Decentralization: No central authority controls Bitcoin, reducing the risk of government interference.

- Lower Transaction Fees: Bitcoin transactions often have lower fees compared to traditional banking and remittance services.

- Financial Inclusion: Bitcoin has the potential to provide financial services to the unbanked populations around the world.

Despite its advantages, Bitcoin is not without challenges. Regulatory scrutiny is one of the most pressing issues, as governments around the world grapple with how to regulate this new form of currency. Additionally, Bitcoin's price volatility can be a barrier to its adoption as a stable medium of exchange. Security remains a significant concern, with instances of hacking and fraud impacting user confidence.

Regulation is a major concern for Bitcoin's future. Different countries have adopted varying approaches to cryptocurrency regulation, leading to confusion and uncertainty. Some nations embrace Bitcoin, while others impose strict regulations or outright bans. This inconsistency can hinder innovation and limit the growth of the cryptocurrency market.

Security is paramount in the digital currency space. The decentralized nature of Bitcoin can be a double-edged sword; while it offers protection against centralized control, it also exposes users to risks such as hacking incidents and fraud. To combat these threats, various measures are being implemented, including two-factor authentication and advanced encryption techniques to safeguard user funds.

Looking ahead, Bitcoin's future remains a topic of debate. Many believe that as more people become aware of its benefits, adoption will continue to grow. Speculation about Bitcoin becoming a mainstream currency is rampant, but challenges such as regulatory hurdles and security concerns must be addressed first. As technology evolves, so too will Bitcoin, potentially leading to innovations that could further enhance its utility and acceptance in the financial landscape.

1. What is Bitcoin?

Bitcoin is a decentralized digital currency that allows for peer-to-peer transactions without the need for intermediaries.

2. How does Bitcoin mining work?

Bitcoin mining involves solving complex mathematical problems to validate transactions and secure the network, with miners being rewarded in Bitcoin.

3. Is Bitcoin safe?

While Bitcoin itself is secure due to blockchain technology, users must take precautions against hacking and fraud.

4. What are the benefits of using Bitcoin?

Benefits include decentralization, lower transaction fees, and the potential for financial inclusion.

The History of Bitcoin

Bitcoin's inception in 2009 marked the beginning of a new era in digital finance. It all started with a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" authored by the mysterious figure known as Satoshi Nakamoto. This document laid the groundwork for what would become the first decentralized cryptocurrency, paving the way for a financial revolution. But who exactly is Satoshi Nakamoto? Despite various theories and claims, the true identity remains a closely guarded secret, adding an air of intrigue to Bitcoin’s origin story.

In the early days, Bitcoin was primarily a niche interest for tech enthusiasts and cryptography aficionados. The first recorded Bitcoin transaction occurred in 2010, when a programmer named Laszlo Hanyecz famously paid 10,000 BTC for two pizzas. Can you imagine the value of that transaction today? As Bitcoin began to gain traction, it caught the attention of the media and investors, leading to significant price fluctuations that would characterize its history.

Over the years, Bitcoin has hit several key milestones that have shaped its journey into mainstream consciousness. Here are some notable events:

- 2011: Bitcoin reached the $1 mark for the first time.

- 2013: The price surged to over $1,000, attracting global media coverage.

- 2014: The infamous Mt. Gox exchange was hacked, leading to the loss of thousands of Bitcoins and raising concerns about security.

- 2017: Bitcoin reached an all-time high of nearly $20,000, sparking a massive influx of new investors.

- 2020: Institutional interest surged, with companies like MicroStrategy and Tesla investing heavily in Bitcoin.

As Bitcoin's popularity grew, so did the number of alternative cryptocurrencies, or "altcoins," that sought to replicate its success. However, Bitcoin has remained the dominant player, often referred to as "digital gold" due to its limited supply and store of value characteristics. The total supply of Bitcoin is capped at 21 million coins, a feature designed to combat inflation and ensure scarcity.

In recent years, Bitcoin has transcended its original purpose of being an alternative to traditional currencies. It's now seen as a legitimate asset class, with institutional investors and hedge funds increasingly adding it to their portfolios. This shift in perception has led to the development of various financial products, such as Bitcoin futures and exchange-traded funds (ETFs), further legitimizing its role in the global financial landscape.

As we look back at the history of Bitcoin, it’s clear that it has evolved from a niche digital currency into a significant player in the financial world. Its journey has been marked by highs and lows, yet it continues to capture the imagination of millions around the globe. The question now is: what’s next for Bitcoin? As we explore its mechanics, benefits, and challenges, we’ll uncover how this digital asset might shape our financial future.

How Bitcoin Works

Understanding how Bitcoin operates is crucial for anyone looking to dive into the world of digital currency. At its core, Bitcoin is built on a groundbreaking technology known as blockchain. This decentralized ledger system records all transactions across a network of computers, ensuring transparency and security. But how does this all come together? Let’s break it down.

Blockchain is the backbone of Bitcoin. Imagine it as a digital notebook that everyone can see but no one can alter. Each page of this notebook is called a block, and when a block is filled with transaction data, it gets added to the chain of previous blocks, creating a blockchain. This structure ensures that all transactions are permanent and cannot be changed retroactively, which is a significant advantage over traditional financial systems. Each block contains a unique code called a hash, which is generated based on the contents of the block and the hash of the previous block. This interlinking of blocks is what makes blockchain so secure.

Now, let’s talk about the mining process. Bitcoin mining is akin to a competitive game where participants, known as miners, use powerful computers to solve complex mathematical puzzles. The first miner to solve the puzzle gets to add a new block to the blockchain and is rewarded with newly minted bitcoins. This process not only creates new bitcoins but also verifies and secures transactions on the network. However, it's important to note that mining requires a significant amount of energy, raising concerns about its environmental impact.

Transaction verification is another vital aspect of how Bitcoin works. When you send or receive bitcoins, your transaction needs to be confirmed by the network. This is where nodes come into play. Nodes are computers that maintain a copy of the blockchain and work to validate transactions. Once a transaction is verified, it is grouped with others into a block and added to the blockchain. The consensus mechanism, often referred to as Proof of Work, ensures that the majority of nodes agree on the validity of transactions, thereby maintaining the integrity of the entire network.

In summary, Bitcoin operates through a combination of innovative technologies and processes that ensure its security, transparency, and decentralization. Understanding these mechanics not only enhances your knowledge of Bitcoin but also empowers you to navigate the exciting world of digital finance more confidently.

- What is Bitcoin mining? Bitcoin mining is the process by which transactions are verified and added to the public ledger, the blockchain. Miners compete to solve complex mathematical problems, and the first to solve it gets to add a new block to the chain.

- How secure is Bitcoin? Bitcoin is highly secure due to its decentralized nature and the blockchain technology that underpins it. However, users must also take precautions to protect their wallets and private keys.

- Can Bitcoin be traced? Yes, while Bitcoin transactions are pseudonymous, they are recorded on the public blockchain, making them traceable.

Blockchain Technology

is the backbone of Bitcoin, and understanding it is crucial to grasping why Bitcoin has become such a revolutionary force in the world of finance. At its core, a blockchain is a decentralized digital ledger that records transactions across many computers so that the recorded transactions cannot be altered retroactively. This ensures that all transactions are transparent and secure, which is a significant improvement over traditional financial systems where a single entity controls the records.

The beauty of blockchain lies in its transparency and security. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant's ledger. This means that everyone involved can see the same information, which drastically reduces the chances of fraud. To put it simply, imagine a group of friends keeping a shared diary where each entry is written down by all of them; if someone tries to change an entry, everyone else can easily spot the discrepancy.

Moreover, the immutability of blockchain technology is one of its standout features. Once a transaction is recorded in a block and added to the chain, altering that information becomes nearly impossible. This is because every block is linked to the previous one through cryptographic hashes. To change a single block, one would need to alter every subsequent block, which would require an enormous amount of computing power. This characteristic not only enhances security but also builds trust among users, as they can be confident that their transactions are safe.

In addition to transparency and security, blockchain technology also introduces the concept of decentralization. Unlike traditional financial systems that rely on central authorities like banks, blockchain operates on a peer-to-peer network. This means that no single entity has control over the entire network, which reduces the risk of manipulation and corruption. Think of it as a potluck dinner where everyone brings a dish; no single person dictates the menu, and everyone has a say in what’s served.

To further illustrate how blockchain operates, let’s take a look at the components that make it work:

| Component | Description |

|---|---|

| Nodes | These are the computers that participate in the network, maintaining a copy of the entire blockchain. |

| Blocks | These are the individual units of data that contain transaction records. |

| Consensus Mechanism | This is the method by which the network agrees on the validity of transactions (e.g., Proof of Work). |

| Cryptography | This secures the data and ensures that transactions are conducted safely. |

In conclusion, blockchain technology is not just a component of Bitcoin; it is the very foundation that enables the cryptocurrency to function securely and transparently. As we move forward in the digital age, understanding this technology will be essential for anyone looking to engage with cryptocurrencies or the broader financial landscape.

Mining Process

The of Bitcoin is akin to a digital treasure hunt, where miners compete to solve complex mathematical puzzles in order to validate transactions and secure the network. When Bitcoin was first introduced, mining was relatively easy, allowing individuals with standard computers to participate. However, as more people joined the network and the puzzles became more challenging, mining evolved into a highly competitive and resource-intensive endeavor.

At its core, mining serves two primary purposes: it confirms transactions and introduces new bitcoins into circulation. Miners collect transactions from the Bitcoin network, bundle them into a block, and then race to solve a cryptographic puzzle. The first miner to solve the puzzle gets to add the block to the blockchain and is rewarded with newly minted bitcoins, as well as transaction fees from the transactions included in the block. This reward system not only incentivizes miners but also helps to regulate the supply of Bitcoin over time.

The mining process can be broken down into several key steps:

- Transaction Collection: Miners gather pending transactions from the Bitcoin network.

- Block Creation: Once they have enough transactions, miners create a new block.

- Puzzle Solving: Miners compete to solve a cryptographic puzzle, which requires significant computational power.

- Block Verification: Once a miner solves the puzzle, the block is verified by other miners to ensure its validity.

- Chain Update: The verified block is added to the blockchain, and the miner receives their reward.

However, the mining process is not without its challenges. The increasing difficulty of puzzles means that miners often invest in specialized hardware, known as ASICs (Application-Specific Integrated Circuits), which are designed specifically for mining Bitcoin. This has led to a concentration of mining power in the hands of a few large players, raising concerns about centralization and the potential for a 51% attack, where a single entity could gain control over the network.

Moreover, the environmental impact of Bitcoin mining cannot be overlooked. The energy consumption associated with mining operations has sparked debates about sustainability and the carbon footprint of cryptocurrency. As miners seek cheaper electricity, many have turned to renewable energy sources, but the overall impact remains a critical issue for the future of Bitcoin.

In summary, the mining process is a fascinating blend of technology, competition, and economics that plays a vital role in the Bitcoin ecosystem. As the cryptocurrency continues to evolve, so too will the methods and technologies used in mining, shaping the landscape of digital finance for years to come.

- What is Bitcoin mining? Bitcoin mining is the process by which transactions are verified and added to the public ledger, known as the blockchain. Miners use computational power to solve complex puzzles, and in return, they are rewarded with bitcoins.

- How does one become a Bitcoin miner? To become a Bitcoin miner, you need specialized hardware, mining software, and access to a reliable power source. Joining a mining pool can also increase your chances of earning rewards.

- Is Bitcoin mining profitable? Profitability can vary based on factors like electricity costs, mining difficulty, and the price of Bitcoin. It’s essential to calculate potential earnings against operational costs.

- What are the environmental concerns associated with Bitcoin mining? Bitcoin mining consumes a significant amount of energy, leading to concerns about its carbon footprint. Many miners are now exploring renewable energy sources to mitigate this impact.

Transaction Verification

Transaction verification is a fundamental process in the world of Bitcoin that ensures the integrity and security of each exchange. Imagine a bustling marketplace where every transaction needs to be validated before it can be completed. In the case of Bitcoin, this marketplace is a decentralized network of computers, known as nodes, that work together to confirm transactions. When a Bitcoin transaction is initiated, it is broadcasted to the network, where it awaits verification.

Each transaction is grouped with others into a block, which is then added to the blockchain—a public ledger that records all Bitcoin transactions. But how do these nodes reach a consensus to confirm that a transaction is legitimate? This is where the magic of consensus mechanisms comes into play. The most common method used in Bitcoin is called Proof of Work. In this system, miners compete to solve complex mathematical puzzles, and the first one to solve it gets to add the new block to the blockchain. This process not only verifies the transactions but also secures the network against fraudulent activities.

Once a block is added, it becomes nearly impossible to alter the information within it, thanks to the cryptographic principles underlying blockchain technology. The verification process typically takes around 10 minutes for a new block to be mined and added to the chain, although this can vary based on network congestion. The time it takes for a transaction to be confirmed can influence users' decisions, especially in a fast-paced trading environment.

Moreover, the concept of transaction confirmations plays a crucial role in the verification process. Each time a new block is added to the blockchain after a transaction, it is considered a confirmation. For example, a transaction with six confirmations is generally regarded as secure and irreversible. This layered security is vital for maintaining trust in the Bitcoin network, as it deters double-spending and ensures that each Bitcoin can only be spent once.

In summary, transaction verification in Bitcoin is not just a technical process; it's the backbone of the entire cryptocurrency system. It fosters security, builds trust, and ensures that the digital currency can operate without a central authority. As the network continues to grow, the mechanisms of verification will evolve, but the fundamental principles of transparency and decentralization will remain at its core.

- What is the role of miners in transaction verification? Miners validate transactions by solving complex puzzles, ensuring that only legitimate transactions are added to the blockchain.

- How long does it take for a Bitcoin transaction to be confirmed? On average, a Bitcoin transaction takes about 10 minutes to be confirmed, but this can vary based on network traffic.

- What happens if a transaction is not verified? If a transaction is not verified, it will not be added to the blockchain, and the bitcoins involved will remain in the sender's wallet.

Benefits of Bitcoin

Bitcoin has emerged as a revolutionary force in the world of finance, and its benefits are numerous and compelling. One of the most significant advantages of Bitcoin is its decentralization. Unlike traditional currencies that are controlled by central banks and governments, Bitcoin operates on a peer-to-peer network. This means that no single entity has control over the currency, making it resistant to manipulation and interference. Imagine a world where your money isn't subject to the whims of political agendas or economic downturns—this is the promise that Bitcoin holds.

Another key benefit is the lower transaction fees. Traditional banking systems often impose hefty fees for international transfers or currency exchanges. Bitcoin, on the other hand, allows for quick and cost-effective transactions, especially across borders. This is particularly beneficial for individuals in developing countries who may not have access to traditional banking services. With Bitcoin, they can participate in the global economy without the burden of excessive fees.

Furthermore, Bitcoin offers the potential for financial inclusion. In regions where banking infrastructure is lacking, Bitcoin provides a viable alternative. People can store, send, and receive money without needing a bank account. This opens up opportunities for entrepreneurship and economic growth in underserved areas. Think of it as a digital lifeline that connects individuals to the global marketplace, empowering them to take control of their financial futures.

Additionally, Bitcoin transactions are secure and transparent. The underlying blockchain technology ensures that every transaction is recorded and immutable, meaning it cannot be altered once confirmed. This level of security builds trust among users, as they can verify transactions independently. In a world where fraud and identity theft are rampant, Bitcoin offers a refreshing change—users can transact with confidence, knowing their funds are protected.

Lastly, Bitcoin is often seen as a hedge against inflation. With central banks around the world printing money at unprecedented rates, many investors are turning to Bitcoin as a store of value. Unlike fiat currencies, which can be devalued, Bitcoin has a capped supply of 21 million coins. This scarcity can potentially lead to appreciation over time, making it an attractive investment option for those looking to preserve their wealth.

In summary, the benefits of Bitcoin are profound and multifaceted. From its decentralized nature and low transaction fees to its potential for financial inclusion and security, Bitcoin is not just a digital currency; it is a revolutionary tool that has the power to change the financial landscape. As we continue to navigate the complexities of the modern economy, Bitcoin stands out as a beacon of hope for many, offering a pathway to greater financial freedom and opportunity.

- What is Bitcoin? Bitcoin is a decentralized digital currency that allows for peer-to-peer transactions without the need for intermediaries like banks.

- How can I buy Bitcoin? You can buy Bitcoin through cryptocurrency exchanges, peer-to-peer platforms, or Bitcoin ATMs.

- Is Bitcoin safe to use? While Bitcoin transactions are secure due to blockchain technology, users must take precautions to protect their wallets from hacks and scams.

- What are the risks associated with Bitcoin? Bitcoin is subject to price volatility, regulatory scrutiny, and security concerns, which can impact its adoption and value.

Challenges Facing Bitcoin

Despite its revolutionary potential, Bitcoin is not without its challenges. As the first and most well-known cryptocurrency, it has paved the way for countless others, but it also faces significant hurdles that could impact its adoption and long-term viability. One of the most pressing issues is regulatory scrutiny. Governments around the world are grappling with how to classify and regulate Bitcoin. This can lead to a patchwork of laws that vary dramatically from one country to another, creating uncertainty for users and investors alike.

For instance, in some jurisdictions, Bitcoin is embraced as a legitimate form of currency, while in others, it is viewed with suspicion or outright banned. The lack of a unified regulatory framework can hinder innovation and drive potential users away. Additionally, the volatility of Bitcoin's price poses a significant challenge. Unlike traditional currencies, Bitcoin's value can swing dramatically in a short period, making it a risky investment and a less reliable medium of exchange. This volatility can deter businesses from accepting it as payment, further stunting its growth.

Another critical challenge is security concerns. The digital nature of Bitcoin makes it susceptible to a range of security threats. High-profile hacking incidents have resulted in substantial losses for exchanges and individual users alike. For example, the infamous Mt. Gox hack in 2014 saw the loss of approximately 850,000 Bitcoins, highlighting the need for robust security measures. Users must be vigilant about safeguarding their wallets and private keys, but even the most careful individuals can fall victim to phishing scams or malware.

Moreover, the environmental impact of Bitcoin mining has come under scrutiny. The process of mining Bitcoin requires significant computational power, which translates into high energy consumption. Critics argue that this contributes to climate change and raises questions about the sustainability of Bitcoin as a digital currency. As more people become aware of environmental issues, Bitcoin's energy usage could become a significant barrier to its acceptance.

In summary, while Bitcoin offers a glimpse into the future of finance, it must navigate a landscape filled with regulatory, economic, and security challenges. The path forward is fraught with obstacles, but overcoming these challenges could ultimately solidify Bitcoin's place in the financial ecosystem.

- What are the main regulatory challenges Bitcoin faces? Bitcoin faces varied regulations across different countries, leading to uncertainty and potential legal challenges for users and businesses.

- How does Bitcoin's volatility affect its use? The significant price fluctuations make Bitcoin a less reliable medium of exchange and a risky investment, discouraging its adoption in everyday transactions.

- What security measures can Bitcoin users take? Users can protect their Bitcoins by using secure wallets, enabling two-factor authentication, and being cautious of phishing attempts.

- Is Bitcoin mining harmful to the environment? Yes, Bitcoin mining consumes a considerable amount of energy, raising concerns about its environmental impact and sustainability.

Regulatory Issues

The world of Bitcoin is as thrilling as it is complex, and one of the most significant hurdles it faces is the maze of that surround it. Governments around the globe are still figuring out how to handle this revolutionary digital currency. Some nations embrace it, while others impose strict regulations or outright bans. This inconsistency creates a confusing landscape for users and investors alike. Have you ever tried to navigate a maze blindfolded? That’s what it feels like for many in the crypto space.

In the United States, for example, the regulatory framework is fragmented, with different states adopting various approaches. While some states like Wyoming are creating a friendly environment for cryptocurrency businesses, others, like New York, have stringent regulations that can stifle innovation. This patchwork of rules can lead to uncertainty, making it challenging for businesses to operate effectively. It’s like trying to play a game where the rules keep changing!

On an international scale, the situation is even more complicated. The European Union is working towards a unified regulatory approach, but progress is slow. Meanwhile, countries like China have taken a hard stance against Bitcoin, banning its mining and trading activities. Such actions can have ripple effects across the entire market, causing volatility and impacting the price of Bitcoin. It’s a game of chess where each move can alter the outcome dramatically.

Moreover, the lack of clear regulations can expose users to risks. Without regulatory oversight, fraudulent schemes and scams can flourish. In 2021 alone, billions of dollars were lost to crypto scams, leaving unsuspecting investors in the lurch. It raises the question: how can we protect ourselves in such a wild west of finance? The answer lies in the development of robust regulations that safeguard consumers while fostering innovation.

As we look to the future, the challenge lies in finding a balance. Regulators must create frameworks that not only protect consumers but also allow for the growth of this exciting technology. This is no small feat, as the rapid pace of innovation often outstrips the ability of lawmakers to keep up. It’s a dance between progress and precaution, and both sides must find a way to work together.

In summary, regulatory issues remain a significant barrier to Bitcoin's widespread adoption. The landscape is ever-changing, and as governments continue to grapple with how to approach cryptocurrencies, the future remains uncertain. However, one thing is clear: the conversation around regulation is essential for the evolution of Bitcoin and its place in the financial ecosystem.

- What are the main regulatory challenges Bitcoin faces? Bitcoin faces challenges such as inconsistent regulations across countries, government bans, and the lack of consumer protection laws.

- How do regulations affect Bitcoin's price? Regulatory news can lead to significant price fluctuations, as markets respond to the potential for increased scrutiny or acceptance.

- Can regulations help improve Bitcoin security? Yes, well-designed regulations can help create safer environments for users and reduce the prevalence of scams and fraud.

- What is the future of Bitcoin regulation? The future of Bitcoin regulation is uncertain but is likely to evolve as governments seek to balance innovation with consumer protection.

Security Concerns

When it comes to Bitcoin, security is not just a buzzword; it’s a fundamental aspect that can make or break the confidence of users in this revolutionary digital currency. As we delve deeper into the world of Bitcoin, we must address the that loom over this decentralized network. The digital landscape is fraught with challenges, and Bitcoin is no exception. From hacking incidents to fraud, the risks are real and can lead to significant financial losses.

One of the most alarming aspects of Bitcoin security is the potential for hacking. Exchanges, where users buy and sell Bitcoin, have been prime targets for cybercriminals. Notable incidents, such as the infamous Mt. Gox hack in 2014, saw the loss of approximately 850,000 Bitcoins, worth hundreds of millions of dollars at the time. Such breaches not only result in financial loss but also shake the very foundation of trust that Bitcoin relies on. Users must remain vigilant and choose reputable exchanges that prioritize security.

Another concern is the prevalence of fraud in the cryptocurrency space. Scams can take many forms, from Ponzi schemes to phishing attacks that trick users into revealing their private keys. It’s crucial for users to educate themselves about these risks and employ best practices for safeguarding their assets. For instance, using hardware wallets, enabling two-factor authentication, and being cautious of unsolicited communications can significantly reduce the risk of falling victim to fraud.

Moreover, the decentralized nature of Bitcoin means that if a user loses access to their wallet, there is often no way to recover those funds. Unlike traditional banking systems, there is no customer service hotline to call or a bank manager to plead with. This aspect can be likened to losing a physical wallet; once it’s gone, it’s gone for good. Therefore, proper wallet management is essential. Users should consider using wallets with strong encryption and backup options, ensuring that their private keys are stored securely.

To further illustrate the importance of security in the Bitcoin ecosystem, let’s look at some statistics regarding hacking incidents and their impact:

| Year | Exchange | Amount Lost (BTC) | Estimated Value (USD) |

|---|---|---|---|

| 2014 | Mt. Gox | 850,000 | $450 million |

| 2016 | Bitfinex | 120,000 | $72 million |

| 2018 | Coincheck | 523,000 | $530 million |

As the table shows, the financial implications of security breaches can be staggering. Users must stay informed and proactive in protecting their investments. The community is also working tirelessly to enhance security measures, from improving exchange protocols to developing decentralized finance (DeFi) solutions that minimize the risks associated with centralized platforms.

In conclusion, while Bitcoin offers incredible opportunities for financial freedom and innovation, it is vital to acknowledge and address the security concerns that accompany it. As a user, staying informed, practicing good security hygiene, and choosing reliable platforms can help mitigate risks and ensure a safer Bitcoin experience.

- What should I do if I think my Bitcoin wallet has been hacked?

If you suspect your wallet has been compromised, immediately transfer your remaining funds to a new wallet with a different private key. Change any related passwords and enable two-factor authentication if available.

- How can I prevent Bitcoin fraud?

Stay educated about common scams, use secure wallets, and never share your private keys. Always verify the legitimacy of exchanges and investment opportunities.

- Is my Bitcoin safe in an exchange?

While reputable exchanges implement strong security measures, it’s generally safer to store your Bitcoin in a personal wallet rather than leaving it on an exchange.

The Future of Bitcoin

As we gaze into the crystal ball of Bitcoin's future, it's hard not to feel a mix of excitement and uncertainty. The landscape of digital currency is constantly evolving, and Bitcoin, as the pioneer of this movement, is at the forefront of discussions about the future of finance. Will it become a mainstream currency, or will it face obstacles that hinder its growth? These questions linger in the minds of enthusiasts and skeptics alike.

One of the most significant factors influencing Bitcoin's future is its adoption rate. As more people and businesses begin to accept Bitcoin as a form of payment, its legitimacy and stability in the financial ecosystem will likely increase. For instance, companies like Tesla and Square have already integrated Bitcoin into their payment systems, which could pave the way for others to follow suit. Imagine walking into your favorite coffee shop and paying for your latte with Bitcoin – it’s not as far-fetched as it once seemed!

Moreover, the potential for Bitcoin to act as a hedge against inflation is another compelling reason for its continued growth. In times of economic uncertainty, individuals often seek alternative assets to protect their wealth. Bitcoin, with its capped supply of 21 million coins, offers a sense of scarcity that traditional fiat currencies lack. This characteristic could make it an attractive option for investors looking to diversify their portfolios.

However, Bitcoin's journey is not without its challenges. Regulatory scrutiny is a significant concern that could shape its future. Governments worldwide are grappling with how to regulate cryptocurrencies, balancing the need for consumer protection with the desire to foster innovation. The outcome of these regulatory discussions could either bolster Bitcoin's adoption or stifle it. If regulations are too restrictive, we may see a decline in interest from institutional investors, who are crucial for Bitcoin's long-term success.

On the technological front, advancements in blockchain technology could also play a pivotal role in Bitcoin's future. As developers continue to enhance the network's scalability and efficiency, Bitcoin could become more user-friendly and accessible. For example, the implementation of the Lightning Network aims to facilitate faster transactions and lower fees, making Bitcoin a more practical choice for everyday use. Imagine sending Bitcoin to a friend as easily as sending a text message – that’s the kind of future many are hoping for!

In conclusion, while the future of Bitcoin is filled with potential, it’s also fraught with uncertainty. Its success will depend on various factors, including adoption rates, regulatory developments, and technological advancements. As we move forward, one thing is clear: Bitcoin will continue to be a topic of conversation, speculation, and innovation in the world of finance.

- Will Bitcoin replace traditional currencies? While Bitcoin has the potential to coexist with traditional currencies, it is unlikely to completely replace them in the near future.

- What are the risks of investing in Bitcoin? Bitcoin is known for its price volatility, making it a risky investment. Additionally, regulatory changes and security concerns can also impact its value.

- How can I buy Bitcoin? Bitcoin can be purchased through various exchanges, wallets, and peer-to-peer platforms. It’s essential to research and choose a reputable source.

Frequently Asked Questions

- What is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009 by an anonymous person or group known as Satoshi Nakamoto. It allows for peer-to-peer transactions without the need for intermediaries like banks, making it a revolutionary force in the world of finance.

- How does Bitcoin work?

Bitcoin operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers. Each transaction is verified by network nodes through cryptography and added to a chain of blocks, ensuring transparency and security.

- What is blockchain technology?

Blockchain is the underlying technology of Bitcoin, functioning as a secure and transparent method of recording transactions. It consists of a series of blocks that are linked and secured using cryptographic hashes, making it nearly impossible to alter past records.

- What is Bitcoin mining?

Bitcoin mining is the process by which new bitcoins are created and transactions are verified on the network. Miners use powerful computers to solve complex mathematical problems, and in return, they receive bitcoin as a reward for their efforts.

- What are the benefits of using Bitcoin?

Bitcoin offers several advantages, including lower transaction fees, decentralization, and the potential for financial inclusion for those without access to traditional banking systems. It also allows for greater privacy and security in transactions.

- What challenges does Bitcoin face?

Bitcoin faces numerous challenges, such as regulatory scrutiny, volatility in its price, and security concerns. These issues can impact its adoption and overall viability as a currency.

- How are Bitcoin transactions verified?

Transactions are verified through a consensus mechanism involving network nodes that validate the authenticity of each transaction. Once confirmed, transactions are added to the blockchain, ensuring their integrity and security.

- What are the security concerns associated with Bitcoin?

Security concerns for Bitcoin include risks of hacking, fraud, and loss of private keys. Users are encouraged to take precautions, such as using secure wallets and enabling two-factor authentication, to protect their assets.

- What is the future of Bitcoin?

The future of Bitcoin is still uncertain, with ongoing debates about its potential for mainstream adoption and its role in the global financial system. Factors such as regulatory developments and technological advancements will play a significant role in shaping its trajectory.