The Role of Chart Patterns in Predicting Market Movements

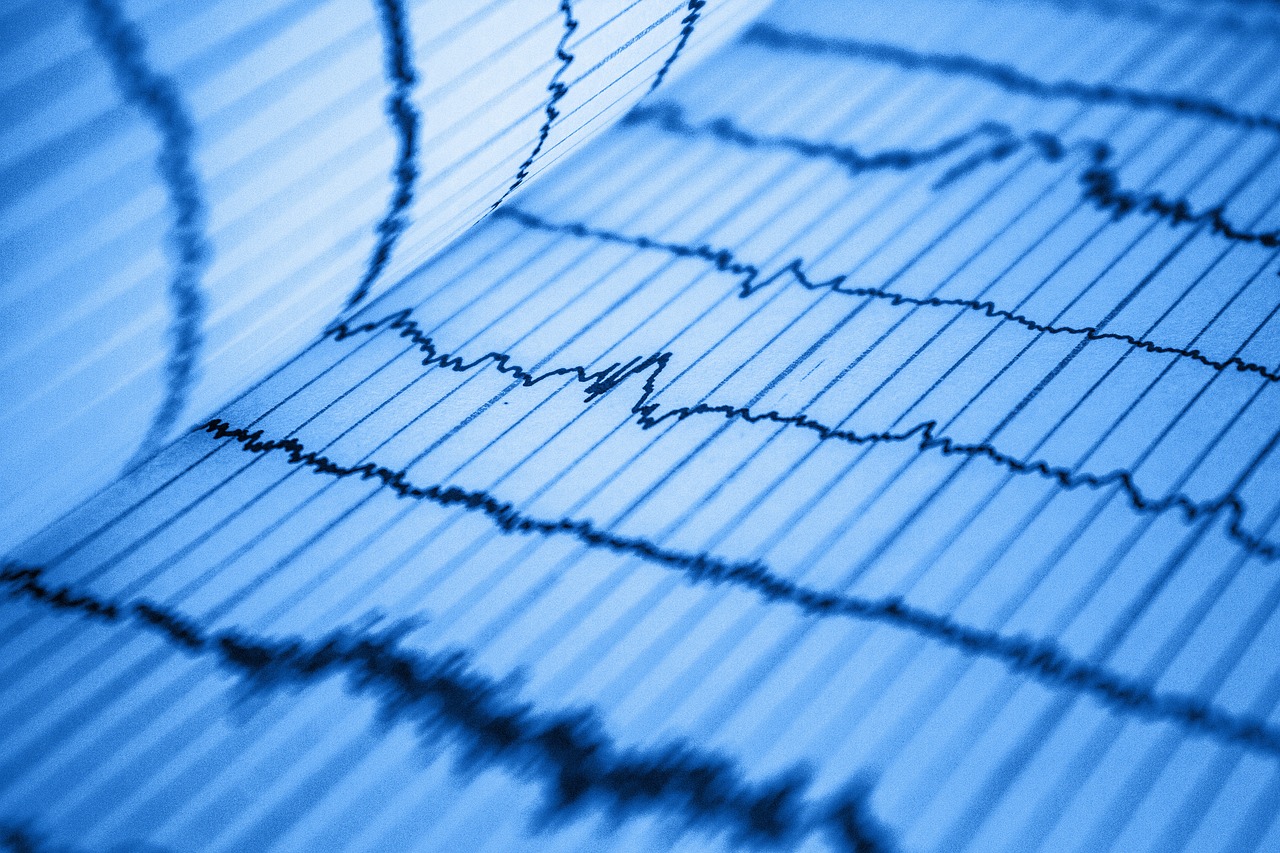

In the dynamic world of trading and investing, understanding market movements is akin to reading the pulse of the financial landscape. Chart patterns serve as a critical compass for traders, guiding them through the often turbulent waters of market trends and price fluctuations. By analyzing these patterns, traders can glean valuable insights into potential future price actions based on historical data. But what exactly are chart patterns, and why do they hold such significant importance in the realm of trading? This article explores the intricate role of chart patterns in predicting market movements, illustrating how they can empower traders to make informed decisions.

Chart patterns are visual representations formed by the price movements of assets over time. They emerge from the collective behavior of market participants, reflecting their sentiments and expectations. When traders observe these patterns, they can interpret the underlying market psychology, which ultimately influences future price movements. For instance, a series of higher highs and higher lows might indicate a bullish trend, whereas lower highs and lower lows could signal a bearish trend. Recognizing these patterns is not just a skill; it's an art that can significantly enhance a trader's ability to navigate the complexities of the market.

But why do chart patterns work? The answer lies in the psychology of traders. Market participants often react similarly to certain price movements, creating predictable patterns. This phenomenon is akin to a dance where the traders are the dancers, and the price movements are the rhythm guiding their steps. When a particular formation appears, it often leads to a collective response among traders, resulting in price movements that can be anticipated. This predictability is what makes chart patterns such powerful tools in the arsenal of traders and investors alike.

As we dive deeper into the world of chart patterns, it's essential to understand the different types that exist. Chart patterns are typically categorized into two main groups: continuation patterns and reversal patterns. Each category serves a unique purpose and provides distinct insights into market behavior. Continuation patterns suggest that the current trend is likely to persist, while reversal patterns indicate a potential change in trend direction. By mastering these patterns, traders can position themselves strategically, maximizing their chances of success in the market.

In conclusion, chart patterns are not just random shapes on a graph; they are vital indicators of market sentiment and potential price movements. Understanding and interpreting these patterns can empower traders to make well-informed decisions, enhancing their trading strategies and ultimately improving their chances of success. As we continue to explore the various types of chart patterns, the importance of volume, and the integration of other technical indicators, it becomes clear that chart patterns are indispensable tools for anyone serious about trading.

- What are chart patterns? Chart patterns are formations created by the price movements of assets on a chart, reflecting market sentiment and potential future price actions.

- Why are chart patterns important? They help traders predict market movements based on historical data, enabling informed trading decisions.

- What are the main types of chart patterns? The two main types are continuation patterns, which indicate that a trend will continue, and reversal patterns, which suggest a change in trend direction.

- How does volume affect chart patterns? Volume plays a critical role in validating chart patterns; higher trading volumes often confirm the strength of a pattern.

Understanding Chart Patterns

Chart patterns are fascinating formations that emerge from the price movements of assets on a chart. They serve as a visual representation of market psychology and sentiment, encapsulating the emotional dynamics of traders and investors. By analyzing these patterns, traders can gain valuable insights into potential future price actions, making them indispensable tools in technical analysis. Think of chart patterns as the fingerprints of market behavior; each formation tells a story about what traders are feeling and anticipating.

These patterns can be categorized into two main types: continuation patterns and reversal patterns. Continuation patterns suggest that the current trend will persist after a brief pause, while reversal patterns indicate a potential shift in the market direction. Understanding these categories is crucial for traders looking to make informed decisions. For instance, when you spot a continuation pattern, it’s like seeing a green light at an intersection—an indication to keep moving forward with your trading strategy. Conversely, identifying a reversal pattern can feel like a sudden stop sign, urging you to reassess your position before proceeding.

Moreover, chart patterns are not just random shapes; they are often accompanied by volume, which adds another layer of depth to their significance. A pattern that forms with high trading volume tends to carry more weight than one that appears during low volume. This relationship between price movements and volume is essential for validating the strength of a pattern. In essence, the volume acts as a confirmation signal, ensuring that traders can trust what they see on the chart.

To further illustrate this point, let’s consider a simple table that summarizes the key aspects of chart patterns:

| Type of Pattern | Description | Market Implication |

|---|---|---|

| Continuation Patterns | Indicate that the existing trend is likely to continue. | Opportunity to capitalize on ongoing momentum. |

| Reversal Patterns | Signal a potential change in trend direction. | Opportunity to reposition before significant shifts. |

In conclusion, understanding chart patterns is essential for any trader or investor looking to navigate the complexities of the financial markets. These patterns not only offer insights into market sentiment but also help in predicting future price movements based on historical data. By mastering the art of reading chart patterns, traders can enhance their strategies and make more informed decisions, ultimately leading to greater success in the ever-evolving world of trading.

Types of Chart Patterns

Chart patterns are like the fingerprints of market behavior; they tell a story about the past and hint at what might happen next. Understanding the different types of chart patterns is crucial for traders and investors aiming to make informed decisions. There are primarily two categories of chart patterns: continuation patterns and reversal patterns. Each type serves a unique purpose and provides insights into market psychology.

Continuation patterns indicate that the existing trend is likely to persist after a brief pause. These patterns are essential for traders looking to capitalize on ongoing market momentum. For instance, think of a runner who takes a quick breather before sprinting toward the finish line. Some common types of continuation patterns include:

- Flags: These resemble small rectangles that slope against the prevailing trend. They signify a brief consolidation before the trend resumes.

- Pennants: These are similar to flags but are shaped like small triangles. They usually follow a strong price movement and indicate a potential continuation.

- Triangles: This category includes ascending, descending, and symmetrical triangles. Each type suggests potential breakout points, where the price may surge or dip significantly.

On the other hand, reversal patterns serve as warning signs that the current trend may be about to change direction. Recognizing these patterns can be a game-changer for traders, allowing them to position themselves strategically before significant market shifts occur. Imagine a calm sea suddenly turning into a storm; that’s how impactful these patterns can be. Common reversal patterns include:

- Head and Shoulders: This pattern signals a potential reversal from bullish to bearish, resembling a head between two shoulders.

- Double Tops and Bottoms: These patterns indicate a shift in trend direction, with double tops suggesting a bearish reversal and double bottoms indicating a bullish one.

Understanding these types of chart patterns is not just about recognizing shapes; it's about interpreting the underlying market sentiment. Traders often use these patterns in conjunction with other indicators to enhance their trading strategies. By doing so, they can improve their chances of making profitable trades and avoid costly mistakes.

In summary, whether you’re looking at continuation patterns that signal ongoing trends or reversal patterns that hint at impending changes, the key is to stay alert and informed. The world of trading is dynamic, and being able to read these patterns effectively can make all the difference in your trading journey.

Continuation Patterns

Continuation patterns are essential tools for traders looking to capitalize on existing market trends. These patterns emerge after a brief pause in the price movement, suggesting that the prevailing trend is likely to resume. Think of it like a runner taking a quick breather before sprinting towards the finish line—it's a moment of rest before the momentum kicks back in. Recognizing these formations can significantly boost a trader's ability to make informed decisions and maximize profits.

Among the most common continuation patterns are flags, pennants, and triangles. Each of these patterns provides unique insights into market behavior, helping traders identify the right moments to enter or exit a trade. For instance, flags and pennants often appear after a strong price movement, indicating a consolidation phase. During this phase, traders can prepare for the next surge in price, armed with the knowledge that the trend is likely to continue.

To further illustrate, let’s break down the key continuation patterns:

| Pattern | Description | Market Implication |

|---|---|---|

| Flags | Short-term consolidation after a strong price move, resembling a rectangle. | Indicates a continuation of the previous trend after a brief pause. |

| Pennants | Similar to flags but with converging trendlines, forming a triangle. | Suggests that the price will break out in the direction of the previous trend. |

| Triangles | Can be ascending, descending, or symmetrical, indicating potential breakout points. | Signals that a significant price movement is imminent, often in the direction of the prevailing trend. |

Understanding these patterns is crucial for traders who want to stay ahead of the game. For example, when a flag pattern forms, it indicates that the market is taking a breather, giving traders a chance to position themselves for the next upward or downward movement. Similarly, triangle patterns can serve as a warning sign, alerting traders to prepare for a breakout, whether it be bullish or bearish.

In summary, mastering continuation patterns can significantly enhance a trader's strategy. By recognizing these formations and understanding their implications, traders can make more informed decisions, ultimately leading to greater success in the market. Remember, the key is to stay vigilant and always look for the signs that the trend is about to continue!

- What are continuation patterns? Continuation patterns are chart formations that suggest the current trend will continue after a brief pause in price movement.

- How can I identify continuation patterns? Look for specific formations like flags, pennants, and triangles on the price chart, which indicate consolidation before a trend resumes.

- Why are continuation patterns important? They help traders make informed decisions about when to enter or exit trades, capitalizing on existing market momentum.

Flags and Pennants

Flags and pennants are fascinating short-term continuation patterns that traders often encounter on price charts. These formations typically emerge after a strong price movement, signaling a brief consolidation before the existing trend resumes. Think of them as a quick rest stop on a long journey; the vehicle (or in this case, the price) has to pause for a moment, but it’s gearing up to continue at full speed. Recognizing these patterns can be a game-changer for traders looking to capitalize on ongoing market momentum.

To visualize these patterns, imagine a flag waving in the wind or a pennant fluttering at the top of a pole. Flags are rectangular-shaped and slope against the prevailing trend, while pennants look like small symmetrical triangles that form after a strong price movement. The key to spotting these patterns lies in their formation:

- Flags: Typically characterized by a sharp price movement followed by a period of consolidation that creates a rectangular shape. They can slope either up or down, depending on the direction of the preceding trend.

- Pennants: Formed after a significant price movement, pennants appear as small triangles that converge. They often indicate a brief pause before the price breaks out in the direction of the previous trend.

Understanding the psychology behind flags and pennants can also enhance your trading strategies. During the consolidation phase, traders are assessing the market and deciding whether to continue buying or selling. If the price breaks out of the pattern with strong volume, it often signifies that the previous trend is likely to resume, providing a potential entry point for traders. Conversely, if the breakout occurs in the opposite direction, it can signal a reversal, and traders may want to adjust their positions accordingly.

Incorporating flags and pennants into your trading strategy can provide several advantages:

- Clear Entry Points: These patterns help traders identify precise moments to enter the market, minimizing uncertainty.

- Defined Risk Levels: With clear patterns, traders can set stop-loss orders just outside the formation, protecting their investments.

- Enhanced Profit Potential: By recognizing these patterns early, traders can ride the wave of momentum and maximize their gains.

In conclusion, flags and pennants are more than just shapes on a chart; they are vital indicators of market behavior and potential future price movements. By mastering the art of recognizing these patterns, traders can position themselves advantageously in the market, turning fleeting moments of consolidation into lucrative trading opportunities.

What is the difference between flags and pennants?

Flags are rectangular-shaped patterns that slope against the prevailing trend, while pennants are small symmetrical triangles that form after a significant price movement. Both indicate a continuation of the trend but differ in shape and formation.

How can I confirm a breakout from a flag or pennant?

To confirm a breakout, look for a strong price movement accompanied by increased trading volume. This combination often indicates that the previous trend is likely to continue.

Can flags and pennants be used in any market?

Yes! Flags and pennants can be applied across various markets, including stocks, forex, and cryptocurrencies. Their principles remain consistent regardless of the asset class.

Triangles

Triangles are fascinating chart patterns that traders often encounter in their market analyses. These formations can be categorized into three main types: ascending triangles, descending triangles, and symmetrical triangles. Each type carries its own implications regarding potential price movements and can serve as a roadmap for traders looking to navigate the often tumultuous waters of the market.

Let's break it down a bit further. An ascending triangle is characterized by a horizontal resistance line at the top and an upward-sloping support line at the bottom. This pattern suggests that buyers are gaining strength, pushing prices higher while sellers are reluctant to sell at higher prices. The result? A potential breakout to the upside, which can be incredibly lucrative for traders who spot it early.

On the flip side, we have the descending triangle, which features a horizontal support line at the bottom and a downward-sloping resistance line at the top. This pattern indicates that sellers are becoming more aggressive, pushing prices lower while buyers are struggling to maintain support. The breakout here is typically to the downside, signaling a potential decline in price. Recognizing this pattern can help traders prepare for a downturn, allowing them to either exit their positions or short the asset.

Then we have the symmetrical triangle, which is a bit of a wild card. This pattern forms when both the support and resistance lines converge, creating a triangle shape. It signifies a period of consolidation where neither buyers nor sellers have the upper hand. The breakout direction can be either up or down, making it essential for traders to stay alert and ready to act when the price finally breaks out of the triangle. This unpredictability can be both thrilling and nerve-wracking, akin to waiting for a roller coaster to drop!

Understanding these triangle patterns is crucial for traders looking to enhance their strategies. By recognizing the nuances of each triangle, traders can make informed decisions about when to enter or exit trades. Additionally, integrating volume analysis can provide further confirmation of potential breakouts, making these patterns even more powerful in predicting market movements.

- What is a triangle pattern in trading? A triangle pattern is a technical analysis formation that indicates a period of consolidation before a potential breakout in either direction.

- How can I identify a triangle pattern? Look for converging trend lines on a price chart where the price action creates a triangle shape, indicating a buildup of pressure.

- Are triangle patterns reliable? While they can be effective indicators, it's essential to use them in conjunction with other technical analysis tools for better accuracy.

- What should I do when I see a triangle pattern? Monitor the price action closely and prepare for a breakout, considering your trading strategy and risk management practices.

Reversal Patterns

Reversal patterns are like the dramatic plot twists in a gripping novel; they signal a potential change in the current trend direction, giving traders a heads up that the market might be about to take a sharp turn. Imagine you're driving down a highway and suddenly spot a sign that says "Road Ahead Closed." That's what reversal patterns do—they alert you to slow down and reassess your journey in the market. Recognizing these patterns early can be the difference between riding the wave of profits and getting caught in a downturn.

There are several key types of reversal patterns that traders should be aware of, each with its own unique characteristics and implications. Some of the most common reversal patterns include:

- Head and Shoulders: This classic pattern indicates a bullish-to-bearish reversal. It consists of three peaks: a higher peak (the head) between two lower peaks (the shoulders). When the price breaks below the neckline, it often signals a trend reversal.

- Inverse Head and Shoulders: Essentially the opposite of the head and shoulders pattern, this formation suggests a bearish-to-bullish reversal. It features three troughs with the middle trough being the lowest, and a breakout above the neckline can confirm the bullish reversal.

- Double Tops and Bottoms: These patterns are characterized by two peaks (double top) or two troughs (double bottom) at approximately the same price level. A double top suggests a reversal from bullish to bearish, while a double bottom indicates a change from bearish to bullish.

Understanding these reversal patterns can significantly enhance a trader's ability to anticipate market shifts. However, it's crucial to remember that no pattern guarantees absolute certainty. Just like predicting the weather, reversal patterns can provide insights, but they should be used in conjunction with other analytical tools.

Additionally, volume plays a pivotal role in confirming reversal patterns. A reversal pattern accompanied by an increase in trading volume is generally more reliable than one formed in low volume conditions. For instance, if a double top pattern forms and is followed by a surge in volume, it adds weight to the bearish reversal signal. Conversely, if the volume is weak, it might indicate that the reversal is not as strong or reliable.

In conclusion, mastering reversal patterns is akin to learning the art of reading between the lines in a story. By recognizing these patterns and understanding their implications, traders can position themselves advantageously before significant market shifts occur, potentially maximizing their profits while minimizing losses.

- What are reversal patterns? Reversal patterns are formations on price charts that indicate a potential change in the direction of the market trend.

- How can I identify a reversal pattern? Look for specific formations such as head and shoulders, double tops, or bottoms, and confirm with volume analysis.

- Are reversal patterns always reliable? No, while they can provide valuable insights, they should be used alongside other analysis tools for better accuracy.

- What role does volume play in reversal patterns? Increased volume during the formation of a reversal pattern can confirm the strength and reliability of the signal.

Importance of Volume in Chart Patterns

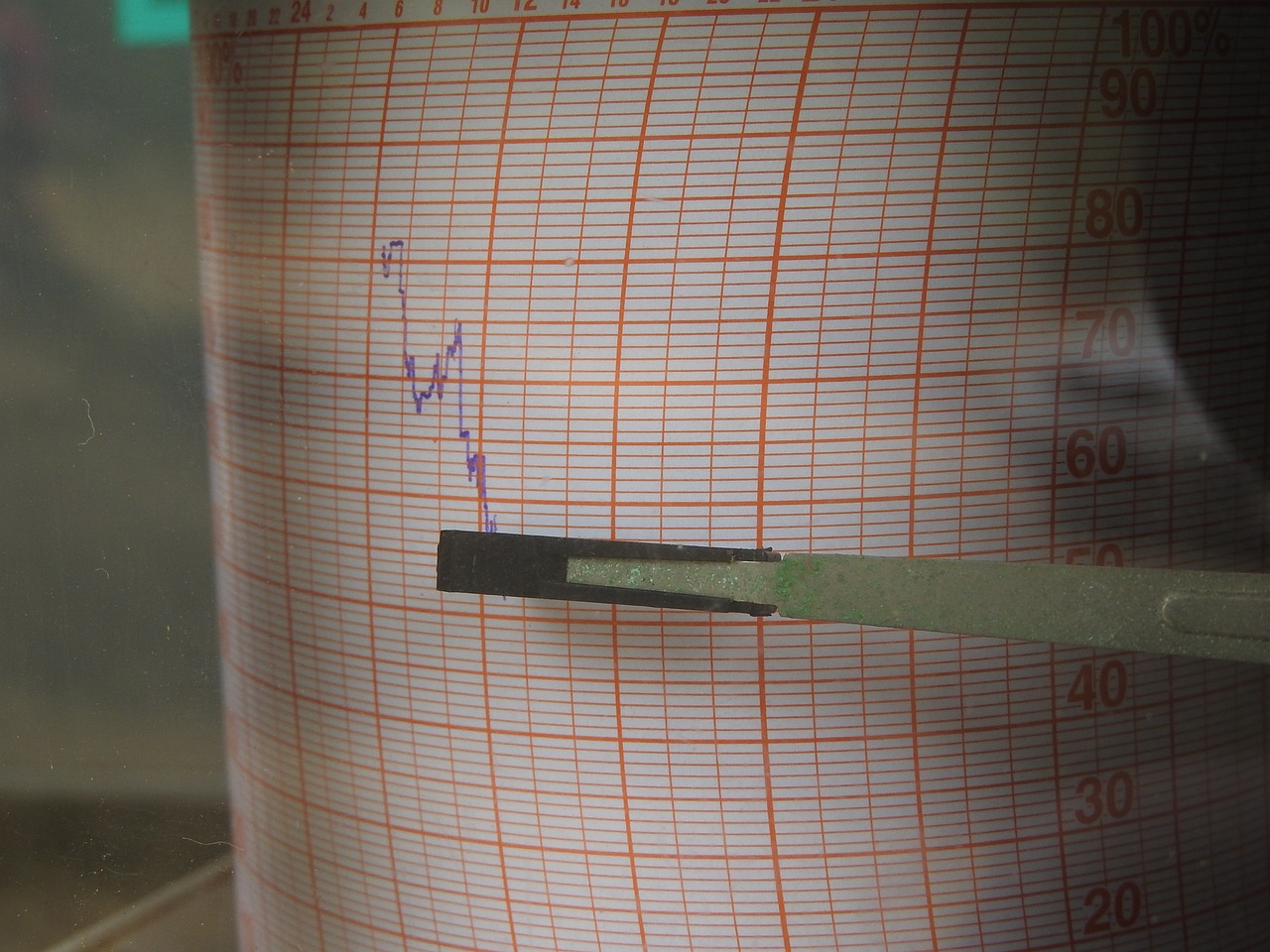

When it comes to trading, the saying "volume speaks louder than words" couldn't be more accurate. Volume is a crucial component in the analysis of chart patterns because it provides significant clues about the strength and sustainability of a price movement. Think of volume as the fuel that powers the engine of market trends. Without sufficient volume, even the most promising chart pattern can fizzle out like a soda left open for too long.

So, why does volume matter so much? Well, when traders see a price movement accompanied by high volume, it often indicates strong interest and participation from the market. This can mean that the trend is likely to continue, making it a vital factor for traders looking to capitalize on price movements. Conversely, low volume during a price change might suggest a lack of conviction, raising red flags for traders who are trying to gauge the reliability of a pattern.

To illustrate the importance of volume further, let’s consider some key aspects:

- Confirmation of Patterns: High volume can confirm the validity of a chart pattern. For instance, if a breakout occurs from a triangle formation with a surge in volume, it indicates that the breakout is more likely to be genuine.

- Trend Strength: Volume can help traders assess the strength of a trend. A strong uptrend, for example, is often characterized by increasing volume, while a downtrend may show decreasing volume, signaling a potential reversal.

- Identifying Reversals: Volume spikes can also signal potential reversals. If a stock is in a downtrend and suddenly experiences a significant increase in volume, it may indicate that buyers are stepping in, which could lead to a price reversal.

Furthermore, traders often use volume analysis techniques to enhance their decision-making process. For example, the On-Balance Volume (OBV) indicator combines price and volume data to give traders a clearer picture of market momentum. This technique helps in identifying whether a trend is likely to continue or reverse, adding another layer of analysis to chart patterns.

In summary, volume is not just an afterthought in chart pattern analysis; it is a critical element that can make or break a trading strategy. By paying close attention to volume trends and patterns, traders can improve their accuracy and effectiveness, leading to more informed trading decisions. So, the next time you analyze a chart pattern, remember to check the volume—it could be the difference between a winning trade and a missed opportunity!

1. Why is volume important in trading?

Volume is essential because it indicates the strength of a price movement. High volume suggests strong interest in a stock, while low volume can indicate a lack of conviction.

2. How can I analyze volume effectively?

You can analyze volume by looking for volume spikes during key price movements, using volume indicators like On-Balance Volume (OBV), and comparing volume trends with price trends.

3. What does it mean if a chart pattern forms with low volume?

A chart pattern that forms with low volume may lack reliability, suggesting that the price movement could be weak or unsustainable.

Volume Analysis Techniques

Volume analysis techniques are essential for traders looking to enhance their understanding of market dynamics. By examining trading volume alongside chart patterns, traders can gain valuable insights into the strength and validity of price movements. When a price movement is accompanied by a significant increase in volume, it often indicates that the trend is supported by a strong consensus among market participants. Conversely, low volume can signal a lack of conviction, suggesting that the price movement may not be sustainable.

One of the most effective volume analysis techniques is the use of volume spikes. These sudden increases in trading volume can indicate potential breakouts or reversals. For instance, if a stock is consolidating within a range and suddenly experiences a volume spike, it may suggest that a breakout is imminent. Traders often look for these spikes to confirm their predictions based on chart patterns. Additionally, volume can be analyzed in relation to price movements; for example, if a security's price rises but volume decreases, it may indicate a weakening trend.

Another technique involves comparing current volume levels to historical averages. By establishing a baseline of average volume, traders can identify whether current trading activity is above or below normal levels. This comparison can help traders determine whether a price move is likely to be sustained or if it might fizzle out. For example, if a stock breaks out of a resistance level with volume significantly above its average, it can reinforce the likelihood of a continued upward trend.

Moreover, traders often utilize the On-Balance Volume (OBV) indicator, which combines price and volume data to provide insights into buying and selling pressure. The OBV line increases when the price closes higher on increased volume and decreases when the price closes lower on increased volume. This technique helps traders visualize the relationship between price and volume, making it easier to identify potential trend reversals or continuations.

In summary, volume analysis techniques are invaluable tools in a trader's toolkit. By integrating volume analysis with chart patterns, traders can improve their decision-making process and increase the likelihood of successful trades. Remember, the key is to look for confirmation from volume when interpreting chart patterns, as this can provide a clearer picture of market sentiment and potential future price movements.

- What is the significance of volume in trading?

Volume indicates the number of shares or contracts traded in a security or market during a given period. High volume often suggests strong investor interest and can validate price movements.

- How can I identify a volume spike?

A volume spike can be identified by observing a sudden and significant increase in trading volume compared to previous levels, often accompanied by a notable price movement.

- What is the On-Balance Volume (OBV) indicator?

The OBV is a technical analysis tool that uses volume flow to predict changes in stock price. It helps traders assess whether volume is supporting a price trend.

- Can low volume affect my trading strategy?

Yes, low volume can lead to increased volatility and less reliable price movements, making it harder to predict trends. Traders often prefer to trade in higher volume environments for better stability.

Common Mistakes in Chart Pattern Analysis

When it comes to chart pattern analysis, even seasoned traders can fall into a few common traps that can lead to costly mistakes. One of the biggest pitfalls is over-reliance on patterns without considering the broader market context. It's easy to become enamored with a specific formation and ignore external factors such as economic news, earnings reports, or geopolitical events that could significantly influence market behavior. This narrow focus can lead to misguided trades, as patterns may not always hold true under varying market conditions.

Another common mistake is the failure to account for timeframes. Traders often analyze patterns on different timeframes without realizing that a pattern that appears significant on a 5-minute chart might not carry the same weight on a daily chart. For instance, a bullish flag on a shorter timeframe may just be a minor fluctuation within a larger bearish trend. Therefore, it’s crucial to analyze multiple timeframes to get a holistic view of the market.

Additionally, many traders overlook the importance of volume analysis. A pattern accompanied by low trading volume may signal a lack of conviction in the move, which can lead to false breakouts. For example, if a trader spots a head and shoulders pattern but ignores the low volume during the formation, they might enter a trade only to find that the market lacks the necessary momentum to follow through. Understanding volume can provide critical insights into the strength of a pattern.

Moreover, confirmation bias can cloud judgment. Traders often seek out information that supports their existing beliefs about a pattern while disregarding contradictory data. This selective perception can result in missed opportunities or, worse, significant losses. It's vital to approach each analysis with an open mind and be willing to adjust one's strategy based on new information.

Finally, not having a well-defined risk management strategy can be detrimental. Traders sometimes enter positions based solely on chart patterns without considering stop-loss levels or position sizing. This lack of discipline can lead to excessive losses when trades don’t go as planned. Implementing a robust risk management framework is essential for long-term trading success.

In summary, avoiding these common mistakes can significantly enhance the effectiveness of chart pattern analysis. By considering the broader market context, analyzing multiple timeframes, incorporating volume analysis, combating confirmation bias, and implementing sound risk management practices, traders can improve their decision-making processes and increase their chances of success in the market.

Q: What are chart patterns?

A: Chart patterns are formations created by the price movements of assets on charts, providing insights into market sentiment and potential future price actions.

Q: How can I avoid mistakes in chart pattern analysis?

A: To avoid mistakes, consider the broader market context, analyze multiple timeframes, incorporate volume analysis, and implement a solid risk management strategy.

Q: Why is volume important in chart patterns?

A: Volume validates chart patterns; higher trading volumes often confirm the strength of a pattern, providing traders with additional confidence in their predictions.

Q: Can I rely solely on chart patterns for trading decisions?

A: While chart patterns are valuable tools, they should not be the only factor in trading decisions. It's essential to combine them with other indicators and market analysis.

Integrating Chart Patterns with Other Indicators

When it comes to trading, relying solely on chart patterns can be a bit like trying to navigate a ship using just the stars; while helpful, it’s not the complete picture. Integrating chart patterns with other technical indicators can significantly enhance your market analysis, providing a more robust framework for making informed trading decisions. By combining these tools, traders can uncover deeper insights into market behavior, which can lead to more confident and precise trading actions.

For instance, when you overlay moving averages on top of your chart patterns, you create a powerful synergy that can illuminate the trend direction. Moving averages help smooth out price data, reducing noise and allowing traders to identify the prevailing trend more clearly. Imagine you spot a bullish flag pattern, which typically indicates a continuation of the upward trend. If this pattern coincides with a rising moving average, it adds an extra layer of validation to your trade decision. The alignment of these two indicators can serve as a strong signal that the momentum is likely to continue, making it an attractive entry point.

Another valuable tool in your trading arsenal is the Relative Strength Index (RSI). This momentum oscillator measures the speed and change of price movements, helping traders identify overbought or oversold conditions in the market. When you see a reversal pattern, such as a double top or head and shoulders, integrating the RSI can provide crucial context. For example, if the RSI is above 70—indicating overbought conditions—while you identify a double top, it’s a strong signal that a price reversal may be imminent. This combination allows traders to act before the market shifts, maximizing potential gains.

Moreover, volume analysis plays a pivotal role in confirming the validity of both chart patterns and other indicators. High trading volumes accompanying a breakout from a chart pattern suggest strong interest and commitment from traders, reinforcing the likelihood that the trend will continue. Conversely, low volume during a breakout may indicate a lack of conviction, serving as a warning sign to traders. By examining volume alongside chart patterns and indicators like the RSI and moving averages, traders can make more informed decisions and avoid common pitfalls.

To illustrate the benefits of integrating these tools, consider the following table that summarizes how different indicators can complement chart patterns:

| Chart Pattern | Complementary Indicator | Benefits |

|---|---|---|

| Bullish Flag | Moving Average | Confirms trend continuation |

| Double Top | RSI | Indicates potential reversal |

| Symmetrical Triangle | Volume | Validates breakout strength |

In conclusion, integrating chart patterns with other technical indicators not only enhances your analysis but also boosts your confidence in making trading decisions. It's like having a multi-tool in your trading toolkit—each tool serves a unique purpose, but together, they empower you to tackle market movements more effectively. So, the next time you analyze a chart, remember to look beyond the patterns and consider how other indicators can provide additional clarity. By doing so, you’ll be well on your way to becoming a more proficient trader.

- What are chart patterns? Chart patterns are formations created by the price movements of assets on a chart, which help traders predict future price movements based on historical data.

- Why should I integrate indicators with chart patterns? Integrating indicators with chart patterns provides a more comprehensive analysis, helping to confirm trends and potential price movements, enhancing decision-making.

- How do moving averages improve chart pattern analysis? Moving averages help smooth out price data, making it easier to identify trends and potential entry or exit points when used alongside chart patterns.

- What role does volume play in chart pattern validation? Volume confirms the strength of a chart pattern; higher volumes during a breakout indicate stronger momentum, while lower volumes might signal a lack of conviction.

Moving Averages

Moving averages are one of the most popular technical indicators used in trading, and for good reason! They help smooth out price data over a specific period, making it easier to identify trends and potential entry or exit points. Imagine trying to find a clear path through a thick forest; moving averages act like a well-trodden trail, guiding you through the noise of price fluctuations.

There are two primary types of moving averages that traders often use: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA calculates the average price over a specified number of periods, giving equal weight to all prices in that timeframe. On the other hand, the EMA gives more weight to recent prices, making it more responsive to new information. This responsiveness can be crucial in fast-moving markets where timing is everything.

Incorporating moving averages with chart patterns can significantly enhance your trading strategy. For instance, when a moving average crosses above a chart pattern's resistance level, it may signal a strong bullish trend ahead. Conversely, if it crosses below a support level, it could indicate a bearish reversal. The combination of these two tools allows traders to make more informed decisions, reducing the risk of being caught off guard by sudden market shifts.

To illustrate how moving averages work in conjunction with chart patterns, consider the following table:

| Type of Moving Average | Characteristics | Best Used With |

|---|---|---|

| Simple Moving Average (SMA) | Calculates the average price over a set number of periods; smooths out price data. | Trend-following strategies, longer timeframes. |

| Exponential Moving Average (EMA) | Gives more weight to recent prices; reacts faster to price changes. | Short-term trading, volatile markets. |

In addition to understanding the types of moving averages, it's essential to know how to set them up effectively in your trading platform. Most platforms allow you to customize the period of the moving average, which can be adjusted based on your trading style. For example, day traders might use a 9-day EMA to capture short-term trends, while long-term investors might prefer a 50-day or 200-day SMA to identify broader market movements.

Moreover, the crossover strategy is a popular method among traders. This strategy involves observing when a shorter-term moving average crosses above or below a longer-term moving average. A bullish signal occurs when the short-term average crosses above the long-term average, while a bearish signal happens when it crosses below. This can serve as a powerful confirmation of the chart patterns you identify, adding another layer of confidence to your trading decisions.

In summary, integrating moving averages with chart patterns can be a game-changer for traders. They not only help clarify trends but also provide critical signals that can guide your trading actions. Just like a compass in the wilderness, moving averages can help you navigate the often unpredictable terrain of the financial markets.

Relative Strength Index (RSI)

The is a powerful momentum oscillator that measures the speed and change of price movements. Developed by J. Welles Wilder Jr., this indicator ranges from 0 to 100 and is primarily used to identify overbought or oversold conditions in a market. But what does that really mean for traders? Well, when the RSI is above 70, it often indicates that an asset is becoming overbought, suggesting that a price correction could be on the horizon. Conversely, when the RSI dips below 30, it signals that an asset may be oversold, hinting at a potential price rebound.

Understanding the RSI can significantly enhance your trading strategy, especially when combined with chart patterns. For instance, imagine you spot a head and shoulders pattern signaling a reversal. If the RSI is also showing overbought conditions at this point, it adds a layer of confirmation to your analysis. This synergy between chart patterns and the RSI can be the difference between a successful trade and a costly mistake.

Additionally, the RSI can be used to identify divergences. A divergence occurs when the price of an asset moves in the opposite direction of the RSI. For example, if the price makes a new high while the RSI fails to reach a new high, it could indicate a weakening trend. This is a subtle yet powerful signal that traders often overlook. By paying attention to these divergences, you can stay ahead of potential market shifts.

To illustrate the effectiveness of the RSI, let's take a look at a simple table that summarizes its key levels and their implications:

| RSI Level | Market Condition | Implication for Traders |

|---|---|---|

| Above 70 | Overbought | Potential price correction expected |

| Below 30 | Oversold | Potential price rebound expected |

| Between 30 and 70 | Neutral | Market is consolidating; wait for confirmation |

Incorporating the RSI into your trading toolkit can provide a more rounded perspective on market conditions. It’s not just about spotting patterns; it’s about understanding the underlying momentum driving those patterns. So, the next time you analyze a chart, take a moment to check the RSI. It could just give you the edge you need to make informed trading decisions.

- What is the best RSI setting for trading? While the standard setting is 14 periods, traders often adjust it based on their strategy and the asset's volatility.

- Can RSI be used for all types of markets? Yes, RSI is versatile and can be applied to stocks, forex, commodities, and cryptocurrencies.

- How do I combine RSI with other indicators? Many traders use RSI alongside moving averages or MACD to confirm signals and enhance their trading strategies.

Frequently Asked Questions

- What are chart patterns?

Chart patterns are formations created by the price movements of assets on a chart. They help traders understand market sentiment and predict potential future price movements based on historical data.

- Why are chart patterns important for traders?

Chart patterns are crucial because they provide insights into market behavior, allowing traders to make informed decisions. By recognizing these patterns, traders can anticipate market trends and potential price changes.

- What are the main types of chart patterns?

The main types of chart patterns include continuation patterns, which indicate that the current trend will likely continue, and reversal patterns, which suggest a potential change in trend direction.

- How do flags and pennants work?

Flags and pennants are short-term continuation patterns that signal a brief consolidation before the previous trend resumes. They can help traders capitalize on ongoing market momentum.

- What role does volume play in chart patterns?

Volume is critical in validating chart patterns. Higher trading volumes often confirm the strength of a pattern, giving traders more confidence in their predictions and decisions.

- What are some common mistakes in chart pattern analysis?

Common mistakes include misinterpreting patterns, ignoring volume, and not considering other indicators. Being aware of these pitfalls can enhance the accuracy and effectiveness of trading strategies.

- How can I integrate chart patterns with other indicators?

Combining chart patterns with indicators like moving averages or the Relative Strength Index (RSI) can provide a more comprehensive market analysis, improving prediction accuracy and trading strategies.

- What is the significance of the Relative Strength Index (RSI) in chart pattern analysis?

The RSI helps indicate overbought or oversold conditions, which can complement chart patterns. By integrating the RSI, traders can enhance the effectiveness of their pattern analysis.