How to Spot Trends Using Moving Average Convergence Divergence (MACD)

In the dynamic world of trading, spotting trends can be the difference between making a profit and incurring a loss. One of the most effective tools in a trader's arsenal is the Moving Average Convergence Divergence (MACD) indicator. This powerful tool helps traders analyze price movements and identify potential entry and exit points in the market. But how can you effectively utilize the MACD to enhance your trading strategies? In this article, we will explore the ins and outs of the MACD, from its basic components to advanced interpretations of its signals.

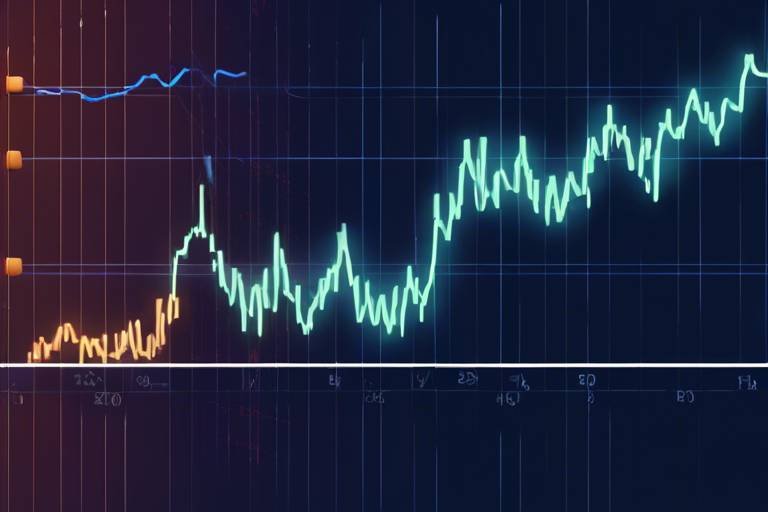

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. It consists of three main components: the MACD line, the signal line, and the MACD histogram. The MACD line is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. The signal line, which is a 9-period EMA of the MACD line, helps to smooth out the MACD line's fluctuations. Lastly, the MACD histogram represents the difference between the MACD line and the signal line, providing a visual representation of the momentum behind price movements.

Why is the MACD such a valuable tool for traders? Well, it allows them to identify potential bullish and bearish trends, making it easier to make informed investment decisions. By understanding how the MACD works and interpreting its signals, traders can gain insights into market momentum and adjust their strategies accordingly.

Interpreting the signals generated by the MACD is crucial for successful trading. The most common signals include bullish and bearish crossovers, divergence, and the MACD histogram. Each of these signals provides valuable information about potential market movements.

Crossovers are significant events in the world of MACD. When the MACD line crosses above the signal line, it indicates a bullish crossover, suggesting that the market may be entering an upward trend. Conversely, when the MACD line crosses below the signal line, it's known as a bearish crossover, signaling a potential downward trend. These moments can serve as critical entry and exit points for traders.

A bullish crossover occurs when the MACD line rises above the signal line. This crossover can be an indication of increasing buying momentum, suggesting that traders may want to consider entering a long position. The implications of a bullish crossover can be significant, often leading to a surge in price as more traders jump on the upward trend.

On the flip side, a bearish crossover is characterized by the MACD line falling below the signal line. This signal can indicate a potential downtrend, prompting traders to consider selling or shorting their positions. Recognizing a bearish crossover can help traders avoid losses and capitalize on downward price movements.

Divergence occurs when the price of a security moves in the opposite direction of the MACD. This can provide valuable insights into potential reversals. There are two types of divergence to be aware of: regular and hidden divergence. Regular divergence can signal a potential reversal in the market, while hidden divergence may indicate a continuation of the current trend. Understanding these concepts can enhance a trader's ability to make timely decisions.

While the MACD is a powerful tool on its own, combining it with other technical indicators can create a more robust trading strategy. By integrating the MACD with indicators like the Relative Strength Index (RSI) or moving averages, traders can gain a clearer picture of market momentum and improve their decision-making process.

The RSI is another popular momentum indicator that measures the speed and change of price movements. When used alongside the MACD, it can help traders confirm signals and provide additional context to potential market movements. For instance, if both indicators signal a bullish trend, it may strengthen the case for entering a long position.

Integrating the MACD with moving averages can further enhance trend identification. By analyzing the relationship between the MACD and moving averages, traders can gain additional layers of confirmation for their trading strategies. This combination can help traders make more informed decisions and improve their overall trading performance.

- What is the MACD indicator? The MACD (Moving Average Convergence Divergence) is a momentum indicator that shows the relationship between two moving averages of a security's price.

- How do I interpret MACD signals? Look for crossovers between the MACD line and the signal line, as well as divergence between the MACD and price movements.

- Can I use MACD with other indicators? Yes! Combining MACD with indicators like RSI or moving averages can enhance your trading strategy.

Understanding MACD Basics

The Moving Average Convergence Divergence (MACD) indicator is a powerful tool in the arsenal of traders, designed to help them navigate the often turbulent waters of financial markets. At its core, the MACD is a trend-following momentum indicator that reveals the relationship between two moving averages of a security’s price. But what does that really mean? Let's dive deeper into its components and significance.

The MACD consists of three main components: the MACD line, the signal line, and the MACD histogram. The MACD line is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. This calculation helps traders identify the direction of the trend. The signal line, which is a 9-period EMA of the MACD line, acts as a trigger for buy and sell signals. Finally, the MACD histogram illustrates the difference between the MACD line and the signal line, providing a visual representation of momentum.

Understanding how these components interact is crucial for traders. When the MACD line crosses above the signal line, it typically indicates a bullish trend, while a cross below suggests a bearish trend. This interplay can be visualized in a

| MACD Component | Description |

|---|---|

| MACD Line | Difference between the 12-period and 26-period EMAs |

| Signal Line | 9-period EMA of the MACD line, used for generating signals |

| MACD Histogram | Visual representation of the difference between the MACD line and the signal line |

One of the reasons the MACD is so valuable is its ability to provide signals that are not only based on price movements but also on the momentum behind those movements. This dual approach allows traders to make more informed decisions. For instance, if the MACD line is rising while the price is falling, it might suggest that a reversal could be on the horizon. This is where the concept of divergence comes into play, which we will explore in detail later.

Moreover, the MACD is favored for its simplicity and versatility. It can be applied across various time frames, making it suitable for both short-term traders and long-term investors. Whether you're a day trader looking for quick gains or a swing trader aiming to capture larger price movements, the MACD can be tailored to fit your strategy.

In conclusion, the MACD is not just a set of lines on a chart; it’s a dynamic tool that can enhance your trading strategy significantly. By understanding its components and how they interact, traders can gain insights into market trends and make more informed investment decisions. So, are you ready to unlock the full potential of the MACD and elevate your trading game?

Interpreting MACD Signals

When it comes to trading, understanding the signals generated by the Moving Average Convergence Divergence (MACD) indicator is crucial. This tool doesn’t just throw random numbers at you; it provides insights that can help you navigate the often turbulent waters of the market. So, how do you translate these signals into actionable trading decisions? Let’s break it down!

The MACD consists of two lines: the MACD line and the signal line. The interaction between these two lines can give you a plethora of information. For instance, when the MACD line crosses above the signal line, it typically indicates a bullish signal, suggesting that it might be a good time to consider buying. Conversely, when the MACD line crosses below the signal line, it usually signifies a bearish signal, hinting that it may be wise to sell or short the asset. But wait, there's more! The MACD histogram, which represents the difference between the MACD line and the signal line, adds another layer of depth to your analysis.

To really grasp the significance of these signals, let’s look at a few key components:

- Bullish Crossover: This occurs when the MACD line crosses above the signal line. It’s like a green light, indicating that upward momentum is likely. Traders often use this moment to enter a position.

- Bearish Crossover: The opposite happens here; the MACD line crosses below the signal line. Think of it as a warning sign, suggesting that a downtrend may be on the horizon.

- Divergence: This is where things get interesting. Divergence occurs when the price of an asset moves in the opposite direction of the MACD. For example, if prices are making new highs but the MACD is not, this could indicate a potential reversal. Recognizing these divergences can be a game-changer for traders.

Now, let’s not forget about the MACD histogram. The histogram visually represents the distance between the MACD line and the signal line. A growing histogram indicates strengthening momentum, while a shrinking histogram can signal a potential reversal or weakening trend. By keeping an eye on the histogram, traders can gauge the strength of the current trend and make more informed decisions.

In summary, interpreting MACD signals is about more than just looking for crossovers. It’s about understanding the nuances of the indicator and how it interacts with price movements. By paying attention to bullish and bearish crossovers, recognizing divergences, and analyzing the MACD histogram, traders can enhance their strategy and potentially increase their chances of success in the market.

MACD Crossovers Explained

The Moving Average Convergence Divergence (MACD) indicator is a powerful tool in the trader's arsenal, and one of its most significant features is the crossover. But what exactly does a crossover mean, and why should you care? Simply put, a crossover occurs when the MACD line intersects with the signal line. This moment can be a game-changer, indicating potential shifts in market momentum. Traders often use these crossovers to pinpoint entry and exit points in their strategies, making it essential to understand how they work.

There are two main types of crossovers that traders focus on: bullish and bearish. A bullish crossover happens when the MACD line crosses above the signal line, suggesting that it's time to consider buying. Conversely, a bearish crossover occurs when the MACD line crosses below the signal line, signaling a potential sell opportunity. These moments can be likened to the turning point in a story—the climax that dictates the direction of the plot. Just like in a gripping novel, recognizing these pivotal moments can lead to significant rewards in trading.

Now, let’s break down the implications of these crossovers a bit further. When a bullish crossover occurs, it often indicates that the market is gaining upward momentum. Traders might interpret this as a signal to enter a long position, hoping to ride the wave of rising prices. On the flip side, a bearish crossover can serve as a red flag, suggesting that the market may be turning against them. This is the moment where traders might decide to either sell their positions or consider shorting the market. It’s crucial to act swiftly during these crossovers, as the market can be highly volatile.

To better visualize these crossovers, here’s a simple table that outlines the key characteristics:

| Crossover Type | MACD Line Movement | Signal |

|---|---|---|

| Bullish Crossover | MACD line crosses above signal line | Potential buy signal |

| Bearish Crossover | MACD line crosses below signal line | Potential sell signal |

It's important to remember that while MACD crossovers can provide valuable insights, they are not foolproof. Traders should always consider other factors and indicators before making decisions. The market is unpredictable, much like a roller coaster ride—full of ups and downs, twists and turns. So, using MACD in conjunction with other tools can help to create a more comprehensive trading strategy.

In conclusion, understanding MACD crossovers is crucial for any trader looking to enhance their trading strategies. By paying attention to these signals, traders can make more informed decisions, potentially leading to greater success in the markets. So, the next time you’re analyzing your charts, keep an eye out for those crossovers—they might just be the key to unlocking your trading potential.

- What is the MACD indicator? The MACD, or Moving Average Convergence Divergence, is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- How do I use MACD for trading? Traders use MACD to identify potential buy and sell signals through crossovers, as well as to gauge the strength of a trend.

- Can MACD be used in all markets? Yes, MACD can be applied to stocks, forex, commodities, and cryptocurrencies, making it a versatile tool for traders.

Bullish Crossover

A occurs when the MACD line crosses above the signal line, signaling a potential upward momentum in the market. This event is often seen as a powerful indicator for traders, suggesting that it might be an opportune moment to enter a long position. Imagine standing at the edge of a bustling market; the moment you see a surge of buyers, you instinctively know that prices are likely to rise. Similarly, a bullish crossover indicates a shift in market sentiment, where buyers are starting to outnumber sellers, creating an environment ripe for price increases.

Understanding the implications of a bullish crossover is crucial for making informed trading decisions. When this crossover occurs, it often leads to a series of price increases, as traders react to the signal. However, it’s essential to remember that while a bullish crossover can indicate a potential uptrend, it does not guarantee that prices will continue to rise indefinitely. Just like a wave that crashes on the shore, it can retreat just as quickly as it arrives. Therefore, traders should look for additional confirmation before making any significant moves.

One way to confirm a bullish crossover is to examine the MACD histogram. A rising histogram alongside a bullish crossover strengthens the signal, suggesting that the momentum is building. Furthermore, combining this signal with other indicators can provide a more comprehensive view of the market. For instance, if the Relative Strength Index (RSI) is also showing bullish momentum, traders can feel more confident in their decision to enter a trade.

To illustrate the concept of a bullish crossover, consider the following example:

| Date | MACD Line | Signal Line | Action |

|---|---|---|---|

| Day 1 | -0.5 | -0.6 | No Action |

| Day 2 | -0.4 | -0.5 | No Action |

| Day 3 | -0.2 | -0.3 | No Action |

| Day 4 | 0.1 | -0.2 | Buy |

In this example, on Day 4, the MACD line crosses above the signal line, prompting a buy signal. Traders who acted on this crossover could potentially benefit from the subsequent upward price movement.

In conclusion, recognizing a bullish crossover is a key skill for traders looking to capitalize on market trends. By combining this signal with other indicators and analyzing market conditions, traders can enhance their strategies and improve their chances of success. Remember, while the bullish crossover is a strong indicator, it’s just one piece of the puzzle in the vast landscape of trading.

Bearish Crossover

A occurs when the MACD line crosses below the signal line, signaling a potential downtrend in the market. This moment can be a trader's warning bell, indicating that it might be time to exit long positions or consider shorting the asset. But what does this really mean for your trading strategy? Think of the MACD as a compass; when the needle points south, it’s often a sign that the winds of the market are shifting toward a stormy sea.

Understanding the implications of a bearish crossover can significantly enhance your trading decisions. When this crossover happens, it suggests that the momentum is shifting from bullish to bearish. This shift can be attributed to several factors, including changes in market sentiment, economic news, or shifts in supply and demand dynamics. Here are a few key points to keep in mind when interpreting a bearish crossover:

- Market Sentiment: A bearish crossover often reflects a shift in trader sentiment. If traders start to feel pessimistic about an asset, it can lead to increased selling pressure.

- Volume Confirmation: It's essential to look for confirmation through trading volume. A bearish crossover accompanied by high volume can strengthen the signal, suggesting that the trend is more likely to continue.

- Timeframe Matters: The significance of a bearish crossover can vary depending on the timeframe you’re trading. A crossover on a daily chart may have more weight than one on a 5-minute chart.

Now, let’s break down the anatomy of a bearish crossover. Imagine you’re sailing your ship through calm waters, and suddenly, dark clouds gather on the horizon. The MACD line, which represents the difference between two moving averages, begins to dip below the signal line. This is your cue to prepare for rough seas ahead. The bearish crossover is not just a simple crossing; it’s a sign that the bullish momentum that previously propelled the price upward is waning.

What should you do when you spot a bearish crossover? It’s crucial to have a plan in place. Here are some strategies to consider:

- Exit Long Positions: If you’re holding long positions, consider taking profits or cutting losses when a bearish crossover occurs.

- Short Selling: For more experienced traders, this could be an opportunity to enter a short position, betting that the price will continue to decline.

- Set Stop-Loss Orders: If you decide to stay in the market, consider setting stop-loss orders to minimize potential losses.

In summary, a bearish crossover is an essential indicator that traders should not ignore. It serves as a crucial tool in your trading arsenal, helping you navigate the often turbulent waters of market trends. By understanding its implications and developing a strategic response, you can enhance your trading outcomes and make more informed decisions. Remember, in the world of trading, knowledge is your best ally, and recognizing these signals can help you stay one step ahead of the market.

What is a bearish crossover?

A bearish crossover occurs when the MACD line crosses below the signal line, indicating a potential downtrend in the market.

How can I confirm a bearish crossover?

Confirmation can be sought through increased trading volume accompanying the crossover or by analyzing other indicators, such as the RSI.

Should I always act on a bearish crossover?

While a bearish crossover is a significant signal, it's essential to consider the broader market context and other indicators before making trading decisions.

Can a bearish crossover lead to a trend reversal?

Yes, a bearish crossover can indicate a trend reversal, but it’s crucial to look for additional confirmation to avoid false signals.

Divergence in MACD

Divergence in the Moving Average Convergence Divergence (MACD) indicator is a powerful concept that traders often overlook. It refers to a discrepancy between the MACD line and the price action of the asset. When you see divergence, it's like a warning sign flashing in the distance, indicating that a potential reversal could be on the horizon. Understanding this phenomenon can significantly enhance your trading strategy by helping you identify shifts in market momentum before they happen.

There are two primary types of divergence to consider: regular divergence and hidden divergence. Each type provides unique insights into market behavior. Regular divergence occurs when the price makes a new high or low that is not confirmed by the MACD. For instance, if the price reaches a new high while the MACD fails to do so, it suggests that the upward momentum may be weakening, and a reversal could be imminent. This scenario is often seen as a bearish signal, prompting traders to consider exiting long positions or even initiating short ones.

On the flip side, hidden divergence can be equally telling. It often occurs during a trend and indicates a continuation of that trend. For example, if the price makes a higher low while the MACD makes a lower low, it signifies that the bullish momentum is still intact, and the trend is likely to continue. Recognizing these patterns can be crucial for traders looking to capitalize on ongoing trends or avoid potential pitfalls.

To illustrate the differences between regular and hidden divergence, let's take a look at the following table:

| Divergence Type | Price Action | MACD Action | Implication |

|---|---|---|---|

| Regular Divergence | New High/Low | No New High/Low | Potential Reversal |

| Hidden Divergence | Higher Low/Lower High | Lower Low/Higher High | Trend Continuation |

Recognizing these divergences isn't just about spotting a pattern; it's about understanding the underlying market psychology. When the MACD diverges from the price, it signals that the momentum behind the price movement may not be as strong as it appears. This insight can lead to more informed trading decisions, allowing you to enter or exit positions with greater confidence.

In conclusion, divergence in MACD serves as a crucial tool for traders aiming to enhance their market analysis. By keeping an eye on both regular and hidden divergences, you can better anticipate potential market reversals or continuations. Remember, the key to successful trading lies not just in following indicators blindly but in interpreting what those indicators are telling you about market sentiment. So, the next time you analyze a chart, take a moment to look for divergence—it could be the edge you need to make more informed trading decisions.

- What is MACD divergence? MACD divergence occurs when the MACD indicator and the price movement of an asset are moving in opposite directions, signaling potential reversals or trend continuations.

- How do I identify regular divergence? Regular divergence is identified when the price makes a new high or low that is not confirmed by the MACD, indicating a potential reversal.

- What is hidden divergence? Hidden divergence occurs when the price makes a higher low or lower high that is not confirmed by the MACD, suggesting that the current trend is likely to continue.

- Why is divergence important in trading? Divergence provides insights into market momentum and can help traders identify potential entry and exit points, ultimately improving their trading strategies.

Combining MACD with Other Indicators

When it comes to trading, relying solely on one indicator can be a bit like trying to navigate a ship with just one sail. You might make some progress, but the winds of the market can change unexpectedly, leaving you adrift. This is where the Moving Average Convergence Divergence (MACD) shines when combined with other technical indicators. By layering MACD with tools like the Relative Strength Index (RSI) or moving averages, traders can create a more comprehensive strategy that enhances decision-making and improves the chances of success.

Combining indicators allows traders to confirm signals and reduce the likelihood of false positives. For instance, when MACD indicates a bullish crossover, checking the RSI can help confirm whether the market is indeed gaining strength or if it’s just a temporary blip. This dual approach not only provides a clearer picture of market momentum but also helps in identifying potential reversals. Think of it as having a second opinion from a trusted advisor before making a significant investment.

Let’s dive deeper into how you can effectively combine MACD with other indicators:

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. When used in conjunction with MACD, it can provide traders with valuable insights. For example, if MACD shows a bullish crossover, and the RSI is above 50, it indicates strong upward momentum. Conversely, if the RSI is below 30 while MACD signals a bearish crossover, it may suggest that the market is oversold, presenting a potential buying opportunity.

Here’s a quick overview of how to interpret the combination of MACD and RSI:

| Signal | MACD Indicator | RSI Indicator | Implication |

|---|---|---|---|

| Bullish Crossover | MACD line crosses above the signal line | RSI above 50 | Strong buying signal |

| Bearish Crossover | MACD line crosses below the signal line | RSI below 50 | Strong selling signal |

| Overbought Condition | MACD shows divergence | RSI above 70 | Potential reversal to the downside |

| Oversold Condition | MACD shows divergence | RSI below 30 | Potential reversal to the upside |

Another powerful combination is integrating MACD with moving averages. Moving averages help smooth out price data to identify the direction of the trend over a specific period. When you overlay MACD onto moving averages, it can provide additional layers of confirmation for your trading strategy. For example, if the price is above the moving average and MACD shows a bullish crossover, it suggests a strong upward trend. On the flip side, if the price is below the moving average and MACD indicates a bearish crossover, it reinforces the idea of a downward trend.

This combination can be particularly effective in trending markets. Traders often look for moving average crossovers, and when these align with MACD signals, it can create a robust framework for making trading decisions. Just like a well-tuned orchestra, where each instrument plays its part to create beautiful music, combining these indicators can lead to a harmonious trading experience.

In summary, combining MACD with other indicators like RSI and moving averages can significantly enhance your trading strategy. By confirming signals and providing a broader perspective on market movements, you can navigate the complexities of trading with greater confidence and precision.

- What is MACD? MACD stands for Moving Average Convergence Divergence, a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- How do I use MACD with RSI? Use MACD to identify potential buy or sell signals through crossovers, and confirm these signals with the RSI to ensure the market momentum supports your decision.

- Can I rely solely on MACD for trading? While MACD is a powerful tool, it’s best used in conjunction with other indicators to confirm signals and reduce the risk of false positives.

Using MACD with RSI

The combination of the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) is like pairing a fine wine with a gourmet meal; each enhances the other, creating a more robust trading strategy. When traders use these two indicators together, they can achieve a more comprehensive view of market momentum, which is essential for making informed trading decisions. The MACD helps in identifying the strength and direction of a trend, while the RSI provides insight into whether an asset is overbought or oversold. This synergy can lead to better entry and exit points, ultimately improving the chances of successful trades.

To understand how to effectively use MACD with RSI, let’s break down their individual roles. The MACD operates on two moving averages, generating signals based on their convergence and divergence. In contrast, the RSI is a momentum oscillator that ranges from 0 to 100, typically indicating overbought conditions above 70 and oversold conditions below 30. By analyzing these indicators in tandem, traders can confirm trends and avoid false signals.

For instance, imagine the MACD line crossing above the signal line—this is a bullish signal. If the RSI is also below 30 at that moment, it indicates that the asset is oversold, suggesting that a price increase may be imminent. Conversely, if the MACD line crosses below the signal line while the RSI is above 70, it signals a bearish trend, indicating that the asset might be overbought and due for a correction.

Here’s a simple table to illustrate the potential signals generated by combining MACD and RSI:

| MACD Signal | RSI Condition | Interpretation |

|---|---|---|

| Bullish Crossover | RSI < 30 | Potential upward momentum; consider buying. |

| Bearish Crossover | RSI > 70 | Potential downward momentum; consider selling. |

| MACD Divergence | RSI Divergence | Possible trend reversal; exercise caution. |

In conclusion, the combination of MACD and RSI can significantly enhance your trading strategy. The key is to look for confirmations between the two indicators. When both indicators align, it strengthens the reliability of the signals you receive. However, like any tool in trading, it’s essential to remember that no indicator is foolproof. Always consider market conditions and other factors before making trading decisions.

- What is the best setting for MACD and RSI? While the default settings are typically 12-26-9 for MACD and 14 for RSI, traders often adjust these settings based on their trading style and the asset being analyzed.

- Can MACD and RSI be used in any market? Yes, both indicators can be applied across various markets, including stocks, forex, and cryptocurrencies, making them versatile tools for traders.

- How do I avoid false signals when using MACD and RSI? Combining these indicators with additional tools, such as trend lines or support and resistance levels, can help filter out false signals and improve the accuracy of your trades.

Integrating MACD with Moving Averages

Integrating the Moving Average Convergence Divergence (MACD) with moving averages is a powerful strategy that can significantly enhance your trading decisions. By combining these two indicators, traders can gain a clearer understanding of market trends and make more informed choices. The beauty of this integration lies in its ability to provide a more comprehensive view of price movements, reducing the noise that often clouds decision-making.

Moving averages smooth out price data, helping to identify the direction of the trend over a specific period. When you overlay MACD onto this analysis, you can pinpoint the momentum behind price movements. For instance, a bullish MACD crossover occurring above a rising moving average can be a strong indication of a potential uptrend. Conversely, if the MACD shows a bearish crossover while the price is below a declining moving average, it might signal an impending downtrend.

To illustrate this integration, let’s consider a practical example. Imagine you're analyzing a stock that has been trending upwards. You notice that the 50-day moving average is sloping upwards, indicating a strong bullish trend. Now, if the MACD line crosses above the signal line during this period, it reinforces the bullish sentiment and suggests that the upward momentum is likely to continue. This combination not only confirms the trend but also provides a potential entry point for traders looking to capitalize on the upward movement.

On the flip side, if the price is below the moving average and the MACD is showing a bearish crossover, this can serve as a warning signal. It suggests that the momentum is shifting and that the trend may be reversing. This kind of analysis can be crucial for traders, as it helps them avoid entering positions that could lead to losses.

When using MACD in conjunction with moving averages, it’s essential to choose the right time frames. Shorter moving averages (like the 10-day or 20-day) can provide quicker signals but may also generate more false alarms. On the other hand, longer moving averages (such as the 50-day or 200-day) tend to filter out the noise, providing a more stable view of the trend but may lag behind actual price movements. Therefore, finding a balance that suits your trading style and objectives is key.

In addition, consider the following tips when integrating MACD with moving averages:

- Use Multiple Time Frames: Analyzing different time frames can provide a more comprehensive view of market trends.

- Confirm Signals: Always look for confirmation from both MACD and moving averages before making a trade.

- Practice Risk Management: Regardless of the signals, always have a risk management strategy in place to protect your capital.

In conclusion, integrating MACD with moving averages is not just about adding indicators to your chart; it's about enhancing your overall trading strategy. By understanding how these tools work together, you can make more informed decisions and potentially increase your trading success. Remember, the goal is to create a robust system that helps you navigate the complexities of the market with confidence.

Q1: What is the best moving average to use with MACD?

A1: There isn't a one-size-fits-all answer as it depends on your trading strategy. However, many traders find that using a combination of short-term (like 10 or 20 days) and long-term (like 50 or 200 days) moving averages works well with MACD for trend confirmation.

Q2: Can I use MACD and moving averages on any trading instrument?

A2: Yes, MACD and moving averages can be applied to various trading instruments, including stocks, forex, and commodities. The principles remain the same, although the volatility and characteristics of each market may affect the signals.

Q3: How do I set up MACD on my trading platform?

A3: Most trading platforms have MACD as a built-in indicator. You can usually find it in the indicators section. Simply add it to your chart and adjust the settings to your preference, typically using the default settings of 12, 26, and 9.

Frequently Asked Questions

- What is the MACD indicator?

The Moving Average Convergence Divergence (MACD) is a popular technical analysis tool used by traders to identify potential buy and sell signals in the market. It consists of two moving averages and a histogram, helping traders understand momentum and trend direction.

- How do I calculate MACD?

The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This difference is then plotted as the MACD line. A 9-period EMA of the MACD line is also plotted, known as the signal line, which traders use to identify buy or sell signals.

- What do bullish and bearish crossovers mean?

A bullish crossover occurs when the MACD line crosses above the signal line, indicating potential upward momentum and a buy signal. Conversely, a bearish crossover happens when the MACD line crosses below the signal line, suggesting a potential downtrend and a sell signal.

- What is divergence in MACD?

Divergence in MACD occurs when the price of an asset moves in the opposite direction of the MACD indicator. Regular divergence can signal potential reversals, while hidden divergence may indicate trend continuation. Recognizing these patterns can help traders make more informed decisions.

- Can I use MACD with other indicators?

Absolutely! Combining MACD with other indicators like the Relative Strength Index (RSI) or moving averages can enhance your trading strategy. This integration provides additional confirmation of signals, helping traders make more reliable decisions based on multiple data points.

- What is the best time frame to use MACD?

The best time frame for using MACD varies depending on your trading style. Day traders may prefer shorter time frames like 5 or 15 minutes, while swing traders might opt for daily or weekly charts. It's essential to choose a time frame that aligns with your trading goals and strategy.

- How reliable is the MACD indicator?

While the MACD is a powerful tool for identifying trends and momentum, no indicator is foolproof. It's essential to use MACD in conjunction with other analysis methods and risk management strategies to improve the reliability of your trades.