How to Create a Successful Trading Routine with Technical Analysis

Are you ready to dive into the exciting world of trading? If so, creating a successful trading routine using technical analysis is your golden ticket! This article explores the essential components for developing an effective trading routine that not only enhances your trading performance but also sharpens your decision-making skills. Imagine being able to read the market like a book—this is what technical analysis empowers you to do. So, grab your virtual toolbox, and let’s get started!

First things first, what exactly is technical analysis? In simple terms, it’s the art of evaluating price movements and identifying market trends through various charts and indicators. Think of it as having a crystal ball that helps you predict future price movements based on historical data. By analyzing patterns and trends, traders can make informed decisions about when to buy or sell an asset. This approach is crucial in today’s fast-paced trading environment, where quick decisions can lead to significant gains—or losses. Remember, knowledge is power, and understanding the fundamentals of technical analysis will give you a leg up in your trading journey!

Now that you have a grasp on technical analysis, let’s talk about setting clear trading goals. Establishing realistic objectives is crucial for a successful trading routine. Without clear goals, you might find yourself wandering aimlessly in the vast sea of trading opportunities. Think of your trading goals as a roadmap that guides you toward your desired destination. Whether you aim to make a quick profit or build long-term wealth, your goals should align with your trading style and risk tolerance.

When it comes to trading, differentiating between short-term and long-term goals is essential. Short-term goals might include making a specific profit within a day or week, while long-term goals focus on wealth accumulation over several years. Understanding how each type of goal influences your trading decisions is vital. For instance, if you’re a day trader, your strategy will differ significantly from that of a long-term investor. It’s like choosing between a sprint and a marathon—both require different training and approaches!

Setting daily profit targets can help maintain discipline and focus in your trading routine. But how do you determine what’s achievable? Consider factors such as your trading strategy, market conditions, and your own risk appetite. For example, if you’re using a scalping strategy, you might aim for smaller, more frequent profits. On the other hand, if you’re a swing trader, your targets might be larger but less frequent. Whatever your approach, having a target keeps you accountable and motivated!

Long-term goals are all about wealth accumulation and portfolio growth. This requires a different mindset—patience and strategic planning are key. Think of it like planting a tree; it takes time to grow, but with the right care, it will bear fruit for years to come. Focus on building a diversified portfolio and reinvesting your profits to maximize growth. Remember, trading isn’t just a sprint; it’s a marathon, and those who plan for the long haul often reap the most rewards.

Effective risk management is vital in trading. Without it, you’re essentially gambling with your hard-earned money. Implementing strategies to protect your capital and minimize losses is crucial for a sustainable trading routine. Consider using techniques like stop-loss orders, position sizing, and risk-reward ratios. These tools act as your safety net, allowing you to trade confidently while safeguarding your investments.

To enhance your trading routine, selecting the right tools for technical analysis is essential. Think of these tools as your trading arsenal—each one plays a specific role in helping you make informed decisions. From charting software to technical indicators, having the right resources at your disposal can make all the difference.

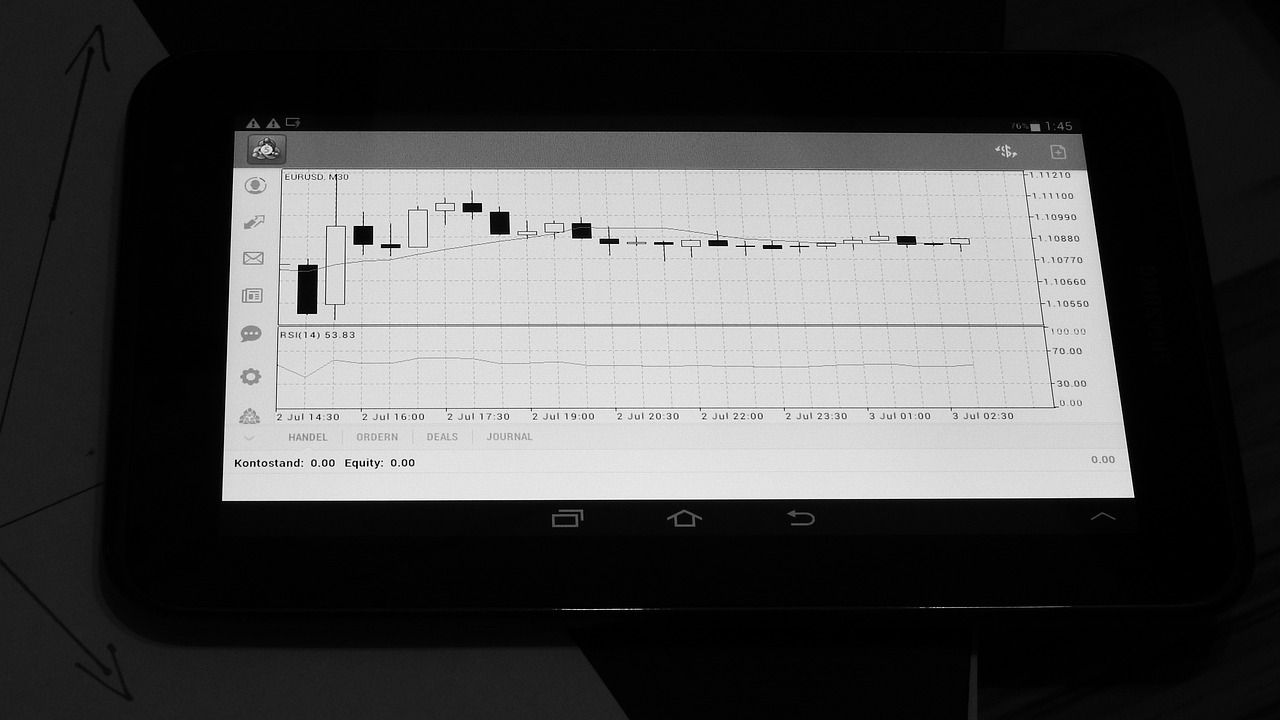

Charting software is crucial for visualizing price movements. Popular tools like MetaTrader, TradingView, and ThinkorSwim offer a range of features that can aid traders in analyzing market trends. These platforms allow you to customize charts, apply various indicators, and even backtest your strategies. The better your visualization, the clearer your trading decisions will be!

Technical indicators provide valuable insights into market behavior. Familiarize yourself with various indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands. Each indicator offers unique insights, and understanding how to effectively use them can significantly improve your trading performance. It’s like having a toolbox; each tool serves a different purpose, and knowing when to use each one is key to your success.

A well-structured trading plan is essential for consistency. Think of your trading plan as your personal blueprint for success. It should incorporate your analysis, strategies, and risk management techniques. A solid plan not only helps you stay focused but also allows you to review your performance and make necessary adjustments over time.

Backtesting allows traders to evaluate the effectiveness of their strategies using historical data. This process is invaluable in refining your trading approach. By analyzing past performance, you can identify what works and what doesn’t, ultimately increasing your chances of success in live trading. It’s like rehearsing for a play; the more you practice, the better your performance will be!

Continuous improvement is crucial for long-term success in trading. Regularly reviewing and adjusting your trading routine based on performance and market changes will keep you ahead of the curve. Embrace the mindset of a lifelong learner; the trading landscape is always evolving, and staying adaptable is key to thriving in this dynamic environment.

- What is technical analysis? Technical analysis is the evaluation of price movements and market trends through charts and indicators.

- Why is setting trading goals important? Clear trading goals provide direction and help maintain focus in your trading routine.

- How can I manage risk in trading? Implement strategies like stop-loss orders and position sizing to protect your capital.

- What tools are essential for technical analysis? Charting software and technical indicators are crucial for analyzing market trends and making informed decisions.

- How can backtesting improve my trading strategy? Backtesting allows you to evaluate the effectiveness of your strategies using historical data, helping refine your approach.

Understanding Technical Analysis

Technical analysis is like having a crystal ball for traders—it allows them to peek into the future of price movements and market trends. By studying historical data, traders can identify patterns and make educated guesses about where the market is headed next. Imagine trying to navigate through a dense fog; technical analysis provides the light that cuts through the uncertainty, guiding traders in their decision-making process.

At its core, technical analysis relies on charts and various indicators to evaluate price movements. These tools help traders visualize market behavior over time, making it easier to spot trends and potential reversal points. For instance, a trader might look at a candlestick chart to see how prices have changed over a specific period. Each candlestick represents price action within a given timeframe, providing insights into market sentiment and potential future movements.

One of the most significant advantages of technical analysis is its ability to apply to any market, whether it’s stocks, forex, or cryptocurrencies. This versatility makes it a valuable tool for traders across different asset classes. Moreover, technical analysis is based on three fundamental assumptions:

- Market Discounts Everything: All available information, including economic data, news, and investor sentiment, is reflected in the price.

- Price Moves in Trends: Prices tend to move in trends, which can be upward, downward, or sideways. Identifying these trends is crucial for making informed trading decisions.

- History Tends to Repeat Itself: Historical price movements and patterns can provide insights into future price behavior.

In addition to understanding these principles, traders often use a variety of technical indicators to enhance their analysis. Some popular indicators include:

| Indicator | Description |

|---|---|

| Moving Averages | Smooth out price data to identify trends over a specific period. |

| Relative Strength Index (RSI) | Measures the speed and change of price movements to identify overbought or oversold conditions. |

| Bollinger Bands | Indicate volatility and potential price reversals by using standard deviations from a moving average. |

By combining these indicators with chart patterns, traders can create a robust framework for their trading decisions. For example, a trader might notice that the RSI is indicating an overbought condition while the price reaches a resistance level. This confluence of signals could suggest a potential reversal, prompting the trader to consider taking a short position.

Ultimately, mastering technical analysis is about practice and continuous learning. As markets evolve, so too should a trader's approach to analysis. By staying informed and adaptable, traders can enhance their skills and make more confident decisions in their trading routine.

Setting Clear Goals

When it comes to trading, one of the most critical components of a successful routine is . Think of it as your roadmap; without a clear destination, you might find yourself wandering aimlessly through the unpredictable landscape of the financial markets. Establishing realistic objectives not only helps you maintain focus but also aligns your trading activities with your individual style and risk tolerance. So, how do you go about setting these goals?

First off, it’s essential to differentiate between short-term and long-term goals. Short-term goals might include daily profit targets or a specific number of trades you plan to execute each week. These are like the stepping stones that lead to your ultimate destination. On the other hand, long-term goals are more about the bigger picture—like building a retirement fund or accumulating wealth over several years. Both types of goals play a crucial role in shaping your trading strategy.

Understanding the distinction between short-term and long-term goals can significantly influence your trading decisions. Short-term goals are often more tactical. For example, you might aim to achieve a certain percentage return on your capital within a week or month. This requires a more active approach, where you’re constantly analyzing market trends and adjusting your strategies. Conversely, long-term goals require a more strategic mindset. They’re about patience and persistence, focusing on gradual growth rather than immediate gains.

Setting daily profit targets is a fantastic way to maintain discipline and keep your eyes on the prize. Imagine you’re a marathon runner; you wouldn’t just focus on crossing the finish line. Instead, you’d set small milestones along the way to keep your motivation high. Similarly, by determining achievable daily profit targets based on your trading strategy and current market conditions, you can create a sense of accomplishment that fuels your trading journey. It’s essential to be realistic here—setting targets that are too ambitious can lead to frustration and impulsive decisions.

On the flip side, long-term goals focus on wealth accumulation and portfolio growth. Think of this as planting a tree; it takes time to grow and bear fruit. In trading, this means committing to a disciplined approach, making informed decisions, and allowing your investments to mature. Patience is key here. You might not see immediate results, but with strategic planning and consistent effort, you can cultivate a robust trading portfolio that thrives over time.

To summarize, setting clear goals in trading is not just about defining what you want to achieve; it’s about creating a structured approach that guides your daily actions and long-term strategies. By distinguishing between short-term and long-term objectives, you can develop a balanced trading routine that keeps you motivated and focused on the ultimate prize—financial success.

- What are the benefits of setting trading goals?

Setting trading goals helps you stay focused, measure your progress, and make informed decisions aligned with your risk tolerance. - How can I ensure my goals are realistic?

Consider your trading experience, market conditions, and personal circumstances when setting your goals. Aim for targets that challenge you but are still achievable. - What should I do if I consistently miss my targets?

Review your trading strategies and risk management practices. It may also be helpful to adjust your goals to be more realistic based on your performance.

Short-term vs. Long-term Goals

When it comes to trading, understanding the difference between short-term and long-term goals is essential for sculpting a successful trading routine. Think of short-term goals as the sprint while long-term goals represent the marathon. Both are crucial, but they require different strategies and mindsets. Short-term goals typically involve making quick profits from market fluctuations, while long-term goals focus on building wealth over time through strategic investments.

Short-term trading can be exhilarating! It’s like riding a roller coaster—full of ups and downs, twists and turns. Traders often look for quick gains, aiming to capitalize on market volatility. This type of trading requires sharp analytical skills, quick decision-making, and a strong grasp of technical analysis. In contrast, long-term trading is more akin to planting a tree. You nurture it, give it time to grow, and eventually reap the fruits of your labor. This approach emphasizes patience, strategic planning, and a deep understanding of market fundamentals.

To illustrate the difference further, let’s break down some characteristics of each:

| Aspect | Short-term Goals | Long-term Goals |

|---|---|---|

| Time Frame | Minutes to days | Months to years |

| Focus | Market fluctuations | Overall market trends |

| Risk Level | Higher risk | Lower risk |

| Emotional Impact | High stress | More stable |

As you can see from the table above, the risk level associated with short-term trading is notably higher. This is because traders are often at the mercy of sudden market changes. However, this doesn’t mean that long-term trading is without its challenges. It requires a solid strategy and the ability to stay disciplined over time, resisting the temptation to make impulsive decisions based on short-term market movements.

So, how do you decide which approach is right for you? It ultimately boils down to your personal trading style, risk tolerance, and financial goals. If you thrive on excitement and can handle the pressure, short-term trading might be your calling. But if you prefer a more laid-back approach and are willing to wait for your investments to mature, then long-term trading could be the way to go. In many cases, traders find a balance between the two, setting both short-term and long-term goals to create a well-rounded trading strategy.

In conclusion, whether you lean towards short-term or long-term goals, maintaining clarity in your objectives will help you navigate the trading waters more effectively. Remember, the key is to align your goals with your trading style and to remain adaptable as market conditions change. After all, a successful trader is not just one who knows how to make money but also one who knows how to manage their expectations and emotions.

- What is the best strategy for short-term trading? The best strategy often involves using technical analysis and setting tight stop-loss orders to manage risk.

- How can I ensure my long-term goals are realistic? Regularly review your financial situation and market conditions, and adjust your goals as necessary to keep them achievable.

- Can I combine short-term and long-term trading? Absolutely! Many traders use a hybrid approach to take advantage of both strategies.

Daily Profit Targets

Setting is a critical component of maintaining discipline and focus in your trading routine. Think of it as your daily roadmap—without it, you might find yourself lost in the vast ocean of market fluctuations. By establishing clear, achievable profit targets, you can create a structured approach that not only helps you stay on track but also enhances your decision-making process.

When determining your daily profit targets, consider factors such as your trading style, market conditions, and risk tolerance. For instance, if you are a day trader, your targets might be more aggressive compared to someone who trades on a longer time frame. Here are a few steps to help you set realistic daily profit targets:

- Analyze Historical Performance: Look back at your previous trading sessions to identify average daily profits. This can give you a baseline for setting future targets.

- Consider Market Volatility: High volatility can present more opportunities for profit but also increases risk. Adjust your targets accordingly.

- Be Realistic: Setting targets that are too ambitious can lead to frustration and emotional trading. Aim for targets that are challenging yet achievable.

For example, if your analysis shows that you typically achieve a profit of $100 per day, you might set a target of $120 to push yourself slightly beyond your comfort zone. However, if market conditions are particularly volatile, you might decide to lower your target to $80 to mitigate risk. The key is to remain flexible and adjust your targets based on both your performance and the current market environment.

Another important aspect to consider is the psychological impact of achieving or missing your daily profit targets. Celebrating small wins can boost your confidence and motivate you to stick to your trading plan. Conversely, consistently missing your targets can lead to frustration and impulsive trading decisions. Therefore, it's essential to maintain a positive mindset and view each trading day as an opportunity to learn and improve.

In conclusion, setting daily profit targets is not just about numbers; it's about creating a disciplined approach to trading that fosters growth and resilience. By carefully analyzing your performance, considering market conditions, and maintaining a flexible mindset, you can enhance your trading routine and move closer to achieving your long-term financial goals.

- What is a daily profit target? A daily profit target is a specific amount of profit you aim to achieve within a single trading day.

- How do I determine my daily profit target? Analyze your historical performance, consider market volatility, and be realistic about what you can achieve.

- What should I do if I consistently miss my profit targets? Review your trading strategy, assess market conditions, and adjust your targets to be more achievable.

Long-term Wealth Accumulation

When it comes to trading, many people often get caught up in the excitement of quick profits and instant gratification. However, is where the real magic happens. Imagine planting a tree; it takes time and care for it to grow and bear fruit. Similarly, building wealth through trading requires patience, strategic planning, and a focus on sustainable growth.

To truly succeed in the long run, you must develop a mindset that prioritizes consistency over short-term wins. This means understanding that market fluctuations are a natural part of trading and that your focus should be on the bigger picture. By setting realistic long-term goals, you pave the way for a more stable and rewarding trading experience. For instance, consider setting a target to achieve a certain percentage increase in your portfolio over five or ten years. This approach not only keeps you motivated but also helps you stay grounded during market volatility.

Another important aspect of long-term wealth accumulation is the power of compounding. Just like interest on your savings account, your trading profits can grow exponentially over time if reinvested wisely. Picture this: if you earn a 10% return on your investments and reinvest those profits, your next return will be calculated on a larger amount. This compounding effect can significantly enhance your wealth over the years, making it essential to adopt a long-term perspective.

Furthermore, maintaining a well-diversified portfolio is crucial for long-term success. By spreading your investments across various assets, you can mitigate risks and enhance the potential for returns. For example, consider the following asset allocation strategy:

| Asset Class | Percentage Allocation |

|---|---|

| Stocks | 60% |

| Bonds | 25% |

| Real Estate | 10% |

| Cash | 5% |

This allocation strategy allows you to benefit from the growth potential of stocks while balancing your risk with bonds and real estate. Remember, the market may fluctuate, but a diversified portfolio can help you weather the storms and keep your long-term goals in sight.

Lastly, don’t forget the importance of continuous learning and adapting your strategies. The trading landscape is ever-evolving, and what worked yesterday may not work tomorrow. By staying informed about market trends and continuously refining your trading plan, you can position yourself for long-term success.

In conclusion, long-term wealth accumulation in trading is not just about making quick profits; it’s about developing a sustainable strategy, maintaining patience, and being willing to adapt. Set your sights on the horizon, invest wisely, and watch your financial tree grow strong and fruitful over time.

- What is the best strategy for long-term wealth accumulation? A diversified portfolio combined with a consistent investment strategy is key.

- How often should I review my trading plan? Regular reviews, at least quarterly, help ensure your plan remains aligned with your long-term goals.

- Is it necessary to use technical analysis for long-term trading? While not mandatory, technical analysis can provide valuable insights into market trends and help inform your decisions.

Risk Management Strategies

When it comes to trading, one of the most critical aspects that can make or break your success is risk management. Think of it as your safety net, ensuring that your capital is protected even when the market takes a turn for the worse. Without a robust risk management strategy, traders can find themselves in precarious situations, leading to significant losses that could derail their trading journey. So, how do you effectively manage risk? Let’s dive into some essential strategies that can help you safeguard your investments.

First off, it’s essential to understand that risk management is not about avoiding risk altogether; rather, it’s about making informed decisions that minimize potential losses. A common approach is to determine how much of your total capital you are willing to risk on a single trade. A general rule of thumb is to risk no more than 1-2% of your trading capital on any given trade. This way, even if you encounter a string of losses, you’ll still have enough capital to recover and continue trading.

Another vital strategy is to use stop-loss orders. These are predetermined price levels at which you will exit a losing trade to prevent further losses. Setting a stop-loss can be a lifesaver, especially in volatile markets. For instance, if you buy a stock at $100 and set a stop-loss at $95, your maximum loss will be limited to $5 per share. This practice not only helps in minimizing losses but also allows you to trade with more confidence, knowing that your downside is limited.

Moreover, it’s crucial to diversify your trading portfolio. Instead of putting all your eggs in one basket, consider spreading your investments across various assets, such as stocks, commodities, and currencies. This diversification can help mitigate risk because, typically, different assets respond differently to market conditions. For example, when the stock market is down, commodities like gold might perform well, thus balancing your overall portfolio performance.

Furthermore, keeping an eye on the risk-reward ratio is another key aspect of risk management. This ratio helps you evaluate the potential profit of a trade compared to its potential loss. A favorable risk-reward ratio is typically 1:2 or higher, meaning that for every dollar you risk, you aim to make at least two dollars. By focusing on trades with a solid risk-reward ratio, you can improve your chances of overall profitability.

Lastly, continuously monitoring and adjusting your strategies is essential. Markets are dynamic, and what works today may not work tomorrow. Regularly reviewing your trades, analyzing your performance, and making necessary adjustments can significantly enhance your risk management approach. This could involve tweaking your stop-loss levels, adjusting your position sizes, or even re-evaluating your trading goals based on market conditions.

In summary, implementing effective risk management strategies is vital for any trader looking to succeed in the market. By setting risk limits, utilizing stop-loss orders, diversifying your portfolio, maintaining a favorable risk-reward ratio, and continuously reviewing your strategies, you can navigate the complexities of trading with greater confidence and resilience.

- What is the purpose of risk management in trading?

Risk management aims to protect your capital and minimize potential losses while maximizing your chances of making profitable trades. - How much of my capital should I risk on a single trade?

A common guideline is to risk no more than 1-2% of your total trading capital on any single trade. - What is a stop-loss order?

A stop-loss order is a predetermined price level at which you will exit a losing trade to limit your losses. - Why is diversification important in trading?

Diversification helps mitigate risk by spreading investments across various assets, reducing the impact of poor performance in any single asset. - What is a good risk-reward ratio?

A favorable risk-reward ratio is typically 1:2 or higher, meaning you aim to make at least two dollars for every dollar you risk.

Choosing the Right Tools

When it comes to trading, especially in the world of technical analysis, having the right tools at your disposal is absolutely crucial. Think of it like being a chef; no matter how talented you are, if you don’t have the right knives or pans, your culinary creations might not turn out as expected. Similarly, in trading, the tools you choose can significantly influence your success in the market.

So, what exactly should you be looking for in trading tools? First and foremost, you need charting software. This is your window into the market, allowing you to visualize price movements and identify trends. Popular charting platforms like TradingView, MetaTrader, and ThinkorSwim offer a range of features that cater to both novice and experienced traders. They allow you to customize your charts, apply various technical indicators, and even backtest your strategies.

Another essential component is technical indicators. These are like the seasoning in your trading recipe; they enhance your understanding of market behavior and help you make informed decisions. Some of the most widely used indicators include:

- Moving Averages: Great for identifying trends over a specific period.

- Relative Strength Index (RSI): Helps determine whether an asset is overbought or oversold.

- Bollinger Bands: Useful for measuring market volatility and potential price movements.

But remember, while tools can provide valuable insights, they are not foolproof. It’s essential to combine these indicators with your own analysis and intuition. Relying solely on tools can lead to a false sense of security, much like a driver who only trusts their GPS without knowing how to read a map.

Moreover, consider the trading platform you choose. This is where you will execute your trades, so it needs to be user-friendly and reliable. Look for platforms that offer low fees, fast execution times, and good customer support. Some traders prefer platforms that provide a demo account option, allowing them to practice their strategies without risking real money.

In summary, choosing the right tools involves a combination of charting software, technical indicators, and a robust trading platform. Each of these elements plays a critical role in enhancing your trading routine and improving your decision-making process. By investing time in selecting the best tools that suit your trading style, you set yourself up for a more successful trading journey.

Q1: What is the best charting software for beginners?

A1: For beginners, TradingView is often recommended due to its user-friendly interface and extensive community support. It offers a free version with plenty of features to get started.

Q2: How do technical indicators improve trading?

A2: Technical indicators provide insights into market trends and potential price movements, helping traders make informed decisions based on historical data and patterns.

Q3: Can I rely solely on trading tools?

A3: While trading tools are valuable, they should complement your own analysis and intuition. Relying solely on them can lead to poor decision-making.

Charting Software

When it comes to trading, having the right can make a world of difference in your decision-making process. Imagine trying to navigate a complex maze without a map; that’s what trading can feel like without proper tools. Charting software provides a visual representation of price movements, allowing traders to analyze historical data and identify trends effectively. But what should you look for in charting software? Let's break it down.

First and foremost, a good charting tool should be user-friendly. If the software is too complicated, it can lead to frustration and missed opportunities. Look for platforms that offer intuitive interfaces and customizable layouts. For instance, you might want to drag and drop various indicators onto your charts or switch between different time frames effortlessly. Some popular charting software options include:

- TradingView: Known for its social trading features and extensive range of indicators.

- MetaTrader 4/5: A staple in the trading community, offering robust charting tools and automated trading capabilities.

- Thinkorswim: A powerful platform that offers advanced charting options and a wide variety of technical indicators.

Additionally, consider the types of charts available. Most traders rely on candlestick charts due to their ability to convey more information than standard line charts. Candlestick charts show open, high, low, and close prices, which can help traders identify market sentiment and potential reversals. Make sure your chosen software supports various chart types, including:

- Candlestick Charts

- Bar Charts

- Line Charts

- Point and Figure Charts

Another critical feature to look for is the ability to add technical indicators. Indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can provide valuable insights into market behavior. The right software will allow you to customize these indicators and even create your own, providing you with a tailored trading experience.

Moreover, integration with other tools is essential. Your charting software should seamlessly connect with your trading platform, allowing you to execute trades directly from the charts. This integration can save you precious time and help you capitalize on market movements more effectively.

Lastly, don't underestimate the importance of historical data. The ability to backtest strategies using past data can provide you with a significant edge. Look for charting software that offers comprehensive historical data, allowing you to refine your strategies and improve your trading performance over time.

In conclusion, the right charting software is not just a tool; it's your trading compass. It guides you through the complexities of the market, helping you make informed decisions. So take the time to explore different options and find the one that best suits your trading style and needs. Remember, in the world of trading, knowledge is power, and having the right tools can enhance that power exponentially.

Q: What is charting software?

A: Charting software is a tool that enables traders to visualize price movements and analyze market trends through various types of charts and indicators.

Q: Why is charting software important for trading?

A: It helps traders make informed decisions by providing insights into market behavior, allowing for better strategy formulation and risk management.

Q: Can I use charting software for free?

A: Yes, many platforms offer free versions with basic features, but premium versions usually provide more advanced tools and capabilities.

Q: What should I look for when choosing charting software?

A: Look for user-friendliness, a variety of chart types, customizable indicators, integration with trading platforms, and access to historical data.

Technical Indicators

When diving into the world of trading, one term that frequently pops up is . These are powerful tools that help traders make sense of price movements and market trends. Think of them as the compass guiding you through the vast ocean of market data. Without them, navigating could feel like sailing blindfolded! Technical indicators can be categorized into various types, each serving a specific purpose, and understanding them can significantly enhance your trading strategy.

At their core, technical indicators are mathematical calculations based on the price, volume, or open interest of a security. They are typically displayed on price charts and can provide insights into market momentum, trends, and potential reversal points. Here are some of the most commonly used technical indicators:

- Moving Averages (MA): These indicators smooth out price data to identify the direction of the trend. They can be simple (SMA) or exponential (EMA), each with its own unique properties.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions.

- Bollinger Bands: These bands consist of a middle band (SMA) and two outer bands that indicate volatility. When the price approaches the upper band, it may be overbought, while the lower band may suggest oversold conditions.

Utilizing these indicators effectively requires understanding their strengths and weaknesses. For instance, while moving averages can help identify the trend, they might lag behind the price action due to their nature of smoothing data. On the other hand, the RSI can signal potential reversals but may give false signals during strong trends. Therefore, it's essential to combine multiple indicators to create a more robust trading strategy.

Moreover, traders often use divergence between price action and indicators to spot potential reversals. For example, if the price is making new highs but the RSI is not, this could indicate a weakening trend. This type of analysis can provide valuable insights and help traders make more informed decisions.

In conclusion, technical indicators are not just numbers and lines on a chart; they are vital tools that can help you decode market behavior and enhance your trading routine. By mastering these indicators and understanding their implications, you can develop a more disciplined and effective trading strategy. Just remember, while they can guide you, the ultimate responsibility lies in your ability to interpret and act on the information they provide.

- What are the most important technical indicators for beginners?

For beginners, focusing on a few key indicators like Moving Averages and RSI can provide a solid foundation for understanding market trends and momentum.

- Can I rely solely on technical indicators for trading decisions?

While technical indicators are useful, it's essential to consider other factors like market news and fundamental analysis for a well-rounded approach.

- How do I choose the right indicators for my trading strategy?

Choosing the right indicators depends on your trading style. Experiment with different ones to see which align best with your strategy and market conditions.

Developing a Trading Plan

Creating a trading plan is like crafting a roadmap for your financial journey; it outlines the path you’ll take, the stops you’ll make, and the risks you’re willing to encounter. A well-structured trading plan is essential for consistency and success in the ever-changing world of trading. Without it, you might find yourself lost in a sea of market fluctuations, making impulsive decisions that could lead to significant losses. So, how do you develop a trading plan that not only suits your style but also adapts to market conditions?

First and foremost, your trading plan should clearly define your trading goals. Are you looking to make quick profits, or are you more interested in long-term wealth accumulation? Understanding what you want to achieve will guide your strategy and help you stay focused. For example, if your goal is to generate income quickly, your plan might involve more frequent trades and a tighter risk management approach. On the other hand, if you’re focused on long-term growth, your plan might include fewer trades with a focus on holding assets for extended periods.

Next, it’s crucial to include specific entry and exit strategies in your trading plan. This means deciding in advance what conditions will trigger a buy or sell action. Think of it as setting the rules of engagement for your trades. For instance, you might decide to enter a trade when a stock hits a certain moving average or exits when it reaches a specific profit target. By having these parameters in place, you can reduce emotional trading and stick to your strategy, even in volatile market conditions.

Risk management is another cornerstone of your trading plan. It’s vital to determine how much of your capital you’re willing to risk on each trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on a single trade. This approach can help you withstand losing streaks without depleting your account. For example, if your trading capital is $10,000, risking 2% means you would only risk $200 on any single trade. This way, even if you face a series of losses, you can continue trading without the fear of significant financial fallout.

Moreover, incorporating a section for performance evaluation within your trading plan is essential. Regularly reviewing your trades will help you identify what’s working and what’s not. Consider keeping a trading journal where you can log your trades, including the rationale behind each decision, the outcomes, and any lessons learned. This practice not only aids in refining your strategy but also builds your confidence as you see your progress over time.

Finally, remember that a trading plan is not set in stone. The markets are constantly evolving, and so should your plan. Regularly revisiting and adjusting your trading strategies based on market changes and your performance is crucial for long-term success. Think of it as tuning a musical instrument; you need to make adjustments to keep it in harmony with the current market conditions.

In summary, developing a comprehensive trading plan involves:

- Defining your trading goals - Short-term vs. long-term.

- Establishing entry and exit strategies - Clear rules for trading.

- Implementing risk management - Protecting your capital.

- Evaluating performance - Learning from past trades.

- Adapting to market changes - Keeping your plan relevant.

By following these steps, you can create a trading plan that not only enhances your trading performance but also instills a sense of discipline and confidence in your trading activities. So, get started on your trading plan today, and watch how it transforms your approach to the markets!

What is a trading plan? A trading plan is a comprehensive document that outlines your trading goals, strategies, risk management techniques, and performance evaluation methods.

Why is a trading plan important? A trading plan is crucial because it helps you stay disciplined, reduces emotional trading, and provides a clear roadmap for your trading activities.

How often should I review my trading plan? You should review your trading plan regularly, especially after a series of trades or when market conditions change significantly.

Can I change my trading plan? Yes, a trading plan should be flexible and adaptable to new insights, market conditions, and your evolving trading style.

Backtesting Strategies

Backtesting is a crucial component of developing a successful trading routine. It allows traders to evaluate the effectiveness of their strategies by applying them to historical data. Imagine trying to hit a target without ever having practiced; that's what trading without backtesting feels like. By simulating trades using past market conditions, you can gain valuable insights into how your strategy might perform in real-time scenarios. This process not only helps in validating your trading approach but also boosts your confidence as you step into the market.

To effectively backtest your strategies, you need to follow a systematic approach. First, select a reliable source of historical data that is relevant to the instruments you intend to trade. This could be price data from stock exchanges, forex markets, or cryptocurrency platforms. Next, you must define your trading strategy clearly. What indicators will you use? What are your entry and exit criteria? The more detailed your plan, the more accurate your backtest will be.

Once you have your data and strategy in place, it's time to run the backtest. Many traders opt for specialized software that can automate this process. Popular platforms like MetaTrader, TradingView, or NinjaTrader offer built-in backtesting features that make this task easier. You can set parameters, run simulations, and analyze the results. But remember, just because a strategy worked in the past doesn't guarantee it will work in the future. Market conditions are constantly changing, so always approach backtesting with a critical eye.

After running your backtest, it's essential to analyze the results thoroughly. Look for key metrics such as:

- Win Rate: The percentage of trades that were profitable.

- Profit Factor: The ratio of gross profit to gross loss.

- Maximum Drawdown: The largest drop from a peak to a trough in your equity curve.

These metrics can help you understand the potential strengths and weaknesses of your strategy. If the results are not satisfactory, don't be discouraged. Use this information to tweak your strategy, make adjustments, and run the backtest again. It’s a continuous cycle of testing, learning, and improving.

In conclusion, backtesting is not just a checkbox in your trading routine; it's a vital process that can significantly enhance your trading performance. Think of it as your personal training session before the big game. By investing time in backtesting, you’re not just preparing for success; you're setting yourself up for it.

- What is backtesting? Backtesting involves testing a trading strategy on historical data to determine its potential effectiveness.

- Why is backtesting important? It helps traders validate their strategies, gain confidence, and identify potential weaknesses before risking real capital.

- How do I backtest a trading strategy? Select historical data, define your strategy, run simulations using backtesting software, and analyze the results.

- Can past performance guarantee future results? No, past performance does not guarantee future results, but it can provide valuable insights into a strategy's potential.

Continuous Improvement

In the ever-evolving world of trading, the concept of is not just a buzzword; it's a necessity. Think of your trading routine as a living organism that requires regular nurturing and adaptation to thrive. As markets change, so should your strategies and approaches. But how do you effectively implement continuous improvement in your trading routine? It's all about being proactive, reflective, and willing to learn.

First and foremost, regular review sessions are essential. Set aside time each week to analyze your trades and performance. Ask yourself questions like:

- What worked well this week?

- What didn’t go as planned?

- Are there recurring patterns in my successes or failures?

This self-reflection will help you identify strengths to leverage and weaknesses to address. It's akin to being a coach for yourself; you need to analyze the game tape to improve your performance.

Moreover, consider keeping a trading journal. This journal acts as a roadmap of your trading journey, documenting not just the trades you made, but the thought processes behind them. By reviewing your journal entries, you can spot trends in your decision-making and emotional responses. Did you panic during a downturn? Did you stick to your plan? This documentation will provide invaluable insights into your trading psyche.

Another critical aspect of continuous improvement is education. The trading landscape is dynamic, and new tools, strategies, and insights are continually emerging. Commit to lifelong learning by attending webinars, reading books, or joining trading communities. Engaging with other traders can expose you to different perspectives and techniques that could enhance your routine. Remember, even the most experienced traders are always learning.

Finally, don't shy away from adjusting your strategies. If a particular approach isn’t yielding the desired results, be willing to pivot. This might involve backtesting new strategies or incorporating different technical indicators. The key is to remain flexible and open-minded, much like a surfer adjusting their stance to ride the perfect wave. The market is unpredictable, and adaptability is your best ally.

Q1: How often should I review my trading performance?

A1: It's beneficial to review your performance weekly to identify trends, but monthly reviews can also provide a broader perspective on your trading journey.

Q2: What should I include in my trading journal?

A2: Your journal should include details about each trade, your rationale for entering/exiting, emotional responses, and any lessons learned.

Q3: How can I find reliable educational resources for trading?

A3: Look for reputable trading websites, online courses, and forums where experienced traders share their knowledge. Always check reviews and testimonials before committing to a resource.

Q4: Is it necessary to change my trading strategy frequently?

A4: Not necessarily. While it's important to adapt to market conditions, consistency in your strategy can lead to better results. Make changes only when you have sufficient data to support the adjustment.

Frequently Asked Questions

-

What is technical analysis?

Technical analysis is a method used by traders to evaluate price movements and market trends through the use of charts and indicators. By analyzing historical price data, traders can make informed decisions about future price movements, helping them to optimize their trading strategies.

-

How do I set clear trading goals?

Setting clear trading goals involves defining realistic objectives that match your trading style and risk tolerance. Start by identifying what you want to achieve, whether it's short-term profits or long-term wealth accumulation, and then create specific, measurable, achievable, relevant, and time-bound (SMART) goals to keep you focused.

-

What are some effective risk management strategies?

Effective risk management strategies include setting stop-loss orders, diversifying your portfolio, and only risking a small percentage of your capital on each trade. By implementing these strategies, you can protect your capital and minimize losses, which is crucial for maintaining a sustainable trading routine.

-

Which tools are essential for technical analysis?

Essential tools for technical analysis include charting software, technical indicators like moving averages and RSI, and trading platforms that provide real-time market data. These tools help traders visualize price movements and gain insights into market behavior, enhancing their decision-making process.

-

How can I develop a successful trading plan?

To develop a successful trading plan, outline your trading strategies, risk management techniques, and criteria for entering and exiting trades. Incorporate backtesting to evaluate your strategies against historical data, and ensure that you regularly review and adjust your plan based on your performance and market conditions.

-

What is backtesting and why is it important?

Backtesting is the process of testing your trading strategies against historical market data to determine their effectiveness. It’s important because it allows you to refine your strategies based on past performance, helping you to identify what works and what doesn’t before risking real capital in live trading.

-

How can I ensure continuous improvement in my trading routine?

To ensure continuous improvement in your trading routine, regularly review your performance, analyze your trading decisions, and adjust your strategies as needed. Keeping a trading journal can also help you track your progress and identify areas for improvement, making it easier to adapt to changing market conditions.