Market Trends - How Technology is Reshaping Cryptocurrency

The world of cryptocurrency is undergoing a seismic shift, and it's all thanks to the relentless march of technology. As we dive deeper into the digital age, we're witnessing an evolution that not only transforms how we think about money but also reshapes entire economies. The intersection of technology and cryptocurrency is a fascinating realm, filled with opportunities and challenges that are redefining market trends. Imagine a world where transactions are instantaneous, secure, and free from the clutches of traditional banking systems. Sounds enticing, right? Well, that's the promise of the latest technological advancements driving the cryptocurrency market today.

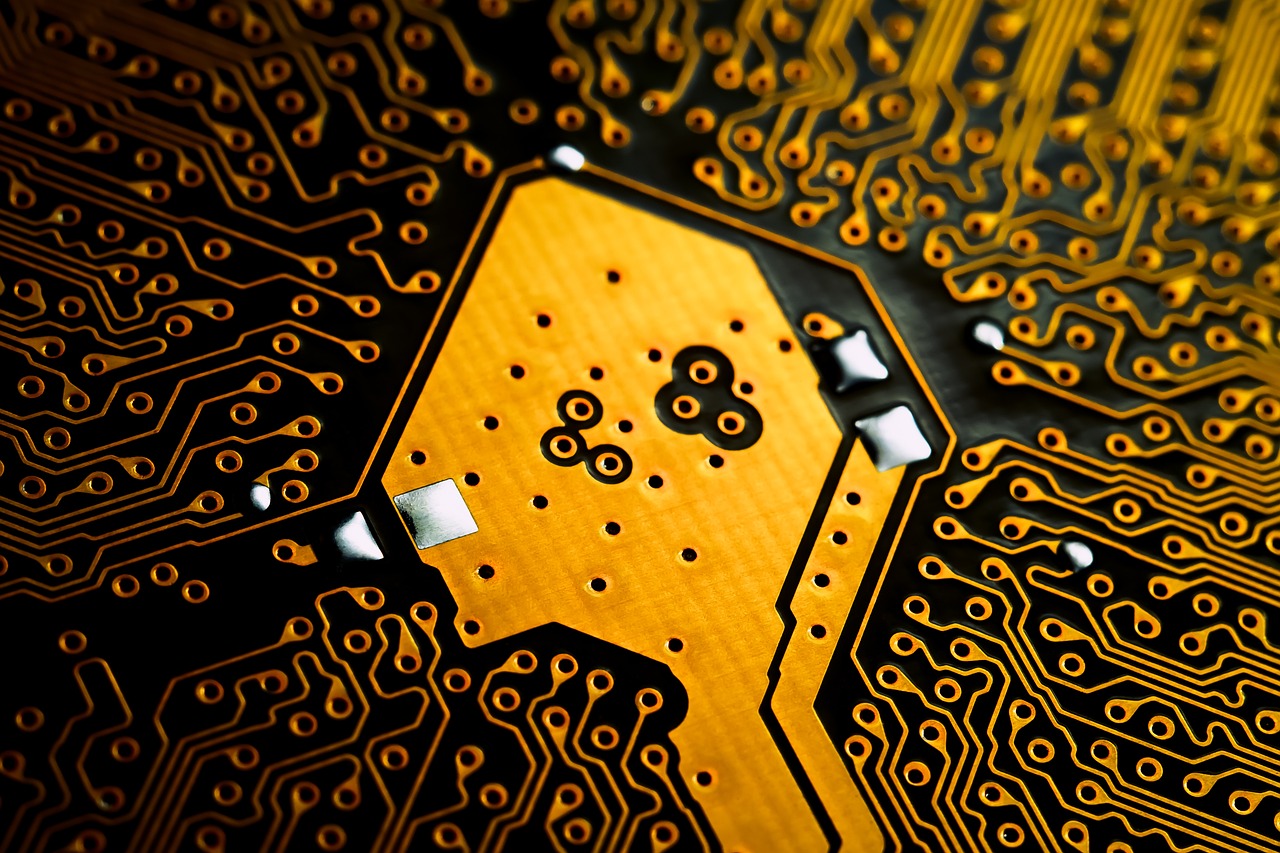

At the heart of this transformation lies the revolutionary blockchain technology. This decentralized ledger system is not just the backbone of cryptocurrencies like Bitcoin and Ethereum; it's a game-changer that enhances transparency and security in transactions. As more businesses and individuals recognize the benefits of blockchain, we're seeing a surge in its adoption across various sectors. But the story doesn't end there. With the rise of Decentralized Finance (DeFi), the landscape is evolving even further, allowing users to engage in financial transactions without the need for intermediaries. Think of it as a financial playground where everyone can participate without the restrictions of traditional banking.

Moreover, the integration of Artificial Intelligence (AI) into cryptocurrency trading is another trend that's hard to ignore. AI is becoming an indispensable tool for traders, offering insights and predictions that were once unimaginable. It's like having a crystal ball that analyzes vast amounts of data to forecast market movements. As we explore these trends, it's essential to understand how they impact not only investors but also the broader financial ecosystem.

In this article, we will delve into the latest technologies reshaping the cryptocurrency market, examine the role of AI in trading, and explore the rapid growth of DeFi. We'll also discuss the implications of these trends for traditional finance and the potential risks associated with them. So, buckle up as we navigate through this exciting and ever-evolving landscape of cryptocurrency!

As we look at the emerging technologies in cryptocurrency, we see a landscape rich with innovation. Blockchain innovations are at the forefront, enabling faster and more secure transactions. For instance, the introduction of smart contracts has revolutionized how agreements are executed, eliminating the need for intermediaries and reducing costs. This technology allows developers to create decentralized applications (dApps) that can operate on the blockchain, opening up a world of possibilities.

Moreover, the rise of Layer 2 solutions, such as Lightning Network for Bitcoin and Polygon for Ethereum, is addressing scalability issues that have plagued cryptocurrencies. These technologies allow for faster transactions and lower fees, making cryptocurrency more accessible to the average user. With these advancements, we're not just seeing a shift in how transactions are conducted; we're witnessing a complete transformation of the financial landscape.

Artificial Intelligence is becoming a crucial player in the cryptocurrency market. With its ability to analyze vast datasets, AI tools are helping investors make informed decisions. Imagine having a personal assistant that can sift through mountains of data in seconds, providing you with insights that would take a human days to uncover. This is the power of AI in the crypto space.

AI-driven trading algorithms are revolutionizing how traders operate in the cryptocurrency market. These algorithms can analyze market trends and execute trades at lightning speed, allowing traders to capitalize on opportunities before they disappear. However, while the benefits are substantial, there are also challenges to consider. For instance, the reliance on algorithms can lead to over-optimization, where traders might miss out on valuable market signals.

One of the significant advantages of using AI in cryptocurrency investments is its ability to enhance risk management. AI can provide real-time analysis and alerts, helping investors mitigate risks effectively. By monitoring market conditions and identifying potential threats, AI tools allow investors to react swiftly, protecting their assets in volatile markets.

AI's predictive capabilities are reshaping market analysis in the cryptocurrency sector. By leveraging machine learning models, AI can forecast cryptocurrency trends with remarkable accuracy. This ability to predict market movements empowers investors to adjust their strategies accordingly, making informed decisions that can lead to substantial gains.

As blockchain technology continues to evolve, new applications and improvements are emerging. Innovations like interoperability solutions are making it easier for different blockchains to communicate, enhancing the overall functionality of the cryptocurrency ecosystem. These advancements are not just technical; they are paving the way for a more interconnected and efficient financial system.

The rise of Decentralized Finance (DeFi) platforms is one of the most exciting developments in the cryptocurrency market. DeFi allows users to engage in financial transactions without intermediaries, offering services like lending, borrowing, and trading directly on blockchain networks. This democratization of finance is a game-changer, providing access to financial services for individuals who may have been excluded from traditional banking systems.

As DeFi continues to gain traction, it's challenging traditional financial systems in unprecedented ways. Banks and financial institutions are now competing with decentralized platforms that offer lower fees and greater accessibility. This shift is forcing traditional players to innovate and adapt, leading to a more competitive financial landscape.

While DeFi offers numerous benefits, it also presents risks and challenges. Issues such as smart contract vulnerabilities and regulatory uncertainties pose significant threats to users. As the DeFi space continues to grow, it's crucial for investors to remain vigilant and informed about the potential pitfalls.

- What is cryptocurrency? Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates on decentralized networks based on blockchain technology.

- How does blockchain technology work? Blockchain is a distributed ledger that records transactions across many computers, ensuring that the data is secure, transparent, and immutable.

- What is DeFi? Decentralized Finance (DeFi) refers to financial services that use smart contracts on blockchains, allowing users to lend, borrow, and trade without traditional intermediaries.

- How is AI used in cryptocurrency trading? AI analyzes market data to identify trends and make predictions, allowing traders to make informed decisions and execute trades more efficiently.

Emerging Technologies in Cryptocurrency

The cryptocurrency landscape is undergoing a remarkable transformation, driven by a wave of emerging technologies that are reshaping how we perceive and interact with digital currencies. At the heart of this evolution lies blockchain technology, the foundational element that enables cryptocurrencies to operate in a decentralized and secure manner. But it doesn't stop there; innovations such as smart contracts, layer 2 solutions, and interoperability protocols are elevating the potential of cryptocurrencies to new heights.

One of the most exciting advancements is the development of decentralized finance (DeFi), which allows users to access financial services without the need for traditional intermediaries like banks. Imagine a world where you can lend, borrow, and trade assets directly with others, all while maintaining complete control over your funds. This is not just a dream; it's the reality that DeFi is creating. By leveraging blockchain technology, DeFi platforms are providing users with unprecedented accessibility and transparency.

Furthermore, the rise of non-fungible tokens (NFTs) has introduced a new dimension to the cryptocurrency market. NFTs are unique digital assets that represent ownership of a specific item, whether it's art, music, or even virtual real estate. This innovation is not only transforming the art world but also creating new opportunities for creators and collectors alike. The ability to verify authenticity and ownership through blockchain technology adds a layer of security that was previously unattainable.

To illustrate the impact of these technologies, consider the following table that highlights some key advancements:

| Technology | Description | Impact |

|---|---|---|

| Blockchain | A decentralized ledger that records transactions across many computers. | Enhances security and transparency in cryptocurrency transactions. |

| Smart Contracts | Self-executing contracts with the terms of the agreement directly written into code. | Automates processes and reduces the need for intermediaries. |

| Layer 2 Solutions | Protocols built on top of existing blockchains to improve scalability and transaction speed. | Facilitates faster and cheaper transactions, making cryptocurrencies more user-friendly. |

| Interoperability Protocols | Technologies that allow different blockchains to communicate and share data. | Promotes collaboration between various blockchain networks, enhancing overall functionality. |

As these technologies continue to evolve, they are not only enhancing the security and accessibility of cryptocurrencies but also paving the way for new use cases that can disrupt traditional financial systems. The implications for investors and businesses are profound, as they must adapt to this rapidly changing environment. Are you ready to embrace the future of finance?

The Role of Artificial Intelligence

Artificial Intelligence (AI) is not just a buzzword; it’s becoming the backbone of modern cryptocurrency trading and investment strategies. Imagine having a digital assistant that can analyze vast amounts of market data faster than any human could ever dream of. That’s precisely what AI brings to the table. With its ability to process information at lightning speed, AI is transforming how traders make decisions, helping them stay ahead in a volatile market that can change in the blink of an eye. But how exactly is AI reshaping the cryptocurrency landscape? Let’s dive deeper into its multifaceted role.

One of the most significant contributions of AI in cryptocurrency is its prowess in analyzing data. Traders are inundated with information—price movements, trading volumes, social media sentiment, and even global news that might impact the market. AI algorithms can sift through this mountain of data, identifying patterns and trends that might escape the naked eye. For instance, AI can analyze historical price data to predict future movements, providing traders with insights that can inform their strategies. This capability is akin to having a crystal ball that reveals potential market shifts before they happen.

Moreover, AI is revolutionizing trading algorithms. These AI-driven systems can execute trades automatically based on predefined criteria, significantly reducing the emotional bias that often clouds human judgment. When the market is in turmoil, emotions can lead to poor decision-making. However, with AI, traders can rely on data-driven insights to guide their actions. This not only enhances efficiency but also increases the likelihood of profitable trades.

The integration of AI in trading algorithms offers numerous advantages. For starters, it allows for high-frequency trading, enabling traders to capitalize on minute price movements that occur in milliseconds. Additionally, AI can adapt to changing market conditions in real-time, adjusting strategies as needed. However, it’s essential to recognize that while AI enhances trading capabilities, it also comes with its own set of challenges.

For instance, the reliance on algorithms can lead to systemic risks. If many traders use similar AI models, it could result in synchronized trading behaviors, amplifying market volatility. Thus, while AI provides powerful tools for traders, it’s crucial to approach its use with caution, ensuring that strategies remain diversified and adaptable.

One of the most critical areas where AI shines is in risk management. In the unpredictable world of cryptocurrency, where prices can swing wildly, having a robust risk management strategy is essential. AI tools can monitor market conditions continuously, providing real-time analysis and alerts to investors. Imagine receiving a notification on your phone that your investment is at risk due to sudden market changes—this is the kind of proactive approach AI offers.

With AI, investors can set risk thresholds and receive alerts when those thresholds are breached. This capability allows for timely interventions, potentially saving investors from significant losses. Furthermore, AI can analyze historical data to identify potential risk factors, enabling investors to make informed decisions about their portfolios.

AI’s predictive capabilities are another game-changer in the cryptocurrency market. By employing complex algorithms and machine learning techniques, AI can forecast market trends with impressive accuracy. This predictive power is not just about guessing where prices might go; it’s about understanding the underlying factors that drive those changes.

For example, AI can analyze social media trends, news articles, and even economic indicators to gauge market sentiment. By synthesizing this information, AI models can provide insights into how certain events might impact cryptocurrency prices. This level of analysis allows investors to adjust their strategies proactively, whether it’s buying, selling, or holding their assets.

In conclusion, the role of AI in cryptocurrency is multifaceted and continually evolving. As technology advances, we can expect even more sophisticated AI tools that will further enhance trading strategies and risk management. However, with great power comes great responsibility. Investors must remain vigilant and informed, leveraging AI’s capabilities while understanding its limitations. The future of cryptocurrency is undoubtedly intertwined with AI, and those who embrace this technology will likely find themselves at an advantage in the dynamic digital currency landscape.

AI in Trading Algorithms

The cryptocurrency market is known for its volatility, and navigating it can feel like trying to ride a rollercoaster blindfolded. However, with the advent of artificial intelligence (AI), traders now have a powerful ally in their quest for profits. AI-driven trading algorithms are transforming the way we approach cryptocurrency trading, making it more efficient, data-driven, and, dare I say, a bit more predictable.

Imagine having a personal assistant who can analyze thousands of data points in mere seconds, spotting trends and patterns that a human might miss. That’s precisely what AI does. These algorithms sift through vast amounts of historical data, market sentiment, and trading volumes to identify potential trading opportunities. This level of analysis not only enhances decision-making but also allows traders to execute their strategies at lightning speed, giving them a competitive edge.

But it’s not all sunshine and rainbows. While AI can significantly improve trading outcomes, it also comes with its own set of challenges. For instance, the reliance on algorithms can lead to over-optimization, where traders focus too much on past data and fail to adapt to new market conditions. This is akin to driving a car while only looking in the rearview mirror—dangerous, right?

Moreover, the complexity of AI systems can make them somewhat of a black box. Traders often struggle to understand how these algorithms make decisions, which can lead to a lack of trust in the system. To put it simply, if you can't see how the sausage is made, are you really going to want to eat it?

Despite these challenges, the benefits of AI in trading algorithms are hard to ignore. Here are some key advantages:

- Speed: AI can process information and execute trades faster than any human trader.

- Data Analysis: It can analyze market data in real-time, providing insights that would take humans hours or days to uncover.

- Emotionless Trading: AI algorithms operate without emotional bias, making decisions based solely on data.

As the technology continues to evolve, we can expect even more sophisticated AI trading algorithms to emerge. These advancements may include machine learning techniques that allow algorithms to learn and adapt from new data, improving their predictive capabilities over time. It’s like teaching a dog new tricks—once they learn, they can perform better and better!

In conclusion, while AI in trading algorithms presents both opportunities and challenges, it’s clear that this technology is reshaping the cryptocurrency landscape. For traders willing to embrace AI, the potential for enhanced profitability and smarter decision-making is immense. Just remember, in the world of cryptocurrency, staying ahead of the curve is not just an advantage; it’s a necessity.

Risk Management with AI

In the fast-paced world of cryptocurrency, risk management has become more crucial than ever. With prices fluctuating wildly and market sentiment changing in the blink of an eye, investors are constantly seeking ways to protect their assets. This is where Artificial Intelligence (AI) steps in, acting as a powerful ally in navigating the complexities of the market. By leveraging AI, investors can gain insights that were once only available to seasoned analysts, making informed decisions that can significantly reduce their exposure to risk.

AI tools can analyze vast amounts of data in real-time, identifying patterns and anomalies that human traders might miss. Imagine having a highly skilled analyst working around the clock, sifting through data from various sources—social media, market trends, and historical prices—all to provide you with actionable insights. This capability allows investors to stay ahead of the curve, responding to market changes swiftly and effectively.

One of the standout features of AI in risk management is its ability to provide real-time alerts. For instance, if a cryptocurrency starts to show unusual volatility, AI algorithms can notify investors immediately, allowing them to take preemptive action. This proactive approach can be a game-changer, as it enables investors to mitigate potential losses before they escalate. Here are some ways AI enhances risk management:

- Predictive Analytics: AI can forecast potential market downturns by analyzing historical data and current trends.

- Sentiment Analysis: By evaluating public sentiment on social media and news platforms, AI can gauge market sentiment and its potential impact on prices.

- Portfolio Optimization: AI algorithms can suggest optimal asset allocations based on risk tolerance and market conditions.

However, it’s essential to recognize that while AI offers significant advantages, it is not without its challenges. The reliance on algorithms can lead to overconfidence, where investors might neglect their own judgment. Moreover, the technology is only as good as the data it processes; poor-quality data can lead to inaccurate predictions and potentially devastating losses. Therefore, while AI can enhance risk management strategies, it should complement, rather than replace, human intuition and expertise.

In conclusion, the integration of AI into risk management strategies in cryptocurrency trading represents a transformative shift. By harnessing the power of AI, investors can navigate the tumultuous waters of the crypto market with greater confidence, armed with insights that drive informed decision-making. As technology continues to evolve, those who adapt and embrace these innovations will likely find themselves at a significant advantage in the ever-changing landscape of digital currencies.

Q: How does AI improve risk management in cryptocurrency?

A: AI enhances risk management by providing real-time analysis, predictive analytics, and alerts for unusual market behavior, allowing investors to make informed decisions quickly.

Q: Can AI completely eliminate risk in cryptocurrency trading?

A: No, while AI can significantly reduce risk, it cannot eliminate it entirely. Market conditions can change rapidly, and human judgment is still essential.

Q: What are the main challenges of using AI in risk management?

A: The main challenges include reliance on potentially flawed algorithms, the quality of data used for analysis, and the risk of overconfidence in AI predictions.

Market Predictions and Trends

The cryptocurrency market is a whirlwind of activity, constantly shifting and evolving with the tides of technology and investor sentiment. As we dive into the world of market predictions and trends, it's essential to understand that these forecasts are not just educated guesses; they are backed by sophisticated algorithms and data analysis that leverage the power of artificial intelligence. Imagine trying to navigate a vast ocean without a compass—this is how many traders feel without the insights provided by AI tools.

AI models analyze vast amounts of historical data, identifying patterns and correlations that human traders might miss. This capability allows for a more nuanced understanding of market dynamics. For instance, AI can detect subtle shifts in trading volumes, social media sentiment, and macroeconomic indicators that signal potential price movements. With this information, traders can make more informed decisions, optimizing their strategies to ride the waves of market trends rather than being swept away by them.

Moreover, the integration of AI in market predictions has led to the emergence of various predictive models. These models can forecast price trends, volatility, and even market reversals with a degree of accuracy that was previously unattainable. For example, a recent study highlighted that AI-driven predictions could outperform traditional methods by as much as 20% in accuracy, giving traders a significant edge in their investment strategies.

However, while the benefits of AI in market predictions are clear, there are also challenges that come with relying on technology. The cryptocurrency market is notoriously volatile, and even the most advanced algorithms can struggle to predict sudden market shifts caused by unforeseen events, such as regulatory changes or technological failures. Thus, investors must remain cautious and not solely rely on AI predictions. Instead, they should view these insights as one of many tools in their investment toolbox.

In addition to AI, it's crucial to consider other factors that influence market trends. The rise of decentralized finance (DeFi), for example, is reshaping the landscape of cryptocurrency investments. As more users engage with DeFi platforms, the demand for cryptocurrencies is likely to increase, potentially driving prices higher. However, this growth also brings inherent risks, as the DeFi space is still relatively new and can be susceptible to vulnerabilities and exploits.

To better understand the current market trends and predictions, let's take a look at a table summarizing key factors influencing cryptocurrency prices:

| Factor | Impact on Market |

|---|---|

| AI Predictions | Improved accuracy in forecasting trends |

| DeFi Growth | Increased demand for cryptocurrencies |

| Regulatory Changes | Potential market volatility |

| Technological Innovations | Enhanced security and usability |

As we look ahead, it’s clear that the intersection of technology and cryptocurrency will continue to shape the market. Investors should keep an eye on emerging technologies, regulatory developments, and evolving market dynamics to stay ahead of the curve. By leveraging AI tools and understanding the broader landscape, traders can position themselves to capitalize on the opportunities presented by this exciting and unpredictable market.

- What role does AI play in cryptocurrency trading? AI assists traders by analyzing large datasets to predict market trends and optimize trading strategies.

- Are AI predictions always accurate? While AI can improve prediction accuracy, it is not infallible, especially in a volatile market like cryptocurrency.

- How does DeFi affect traditional finance? DeFi offers users a way to conduct financial transactions without intermediaries, challenging the conventional banking system.

- What are the risks of investing in DeFi? Risks include smart contract vulnerabilities, regulatory uncertainty, and market volatility.

Blockchain Innovations

Blockchain technology is not just a buzzword; it’s a revolutionary force that is continuously evolving and reshaping the landscape of cryptocurrency. At its core, blockchain is a decentralized ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This fundamental characteristic of immutability is what gives blockchain its power and reliability. But what’s exciting is how these innovations are paving the way for new applications, enhancing security, and increasing accessibility for users.

One of the most significant innovations in blockchain technology is the development of smart contracts. These self-executing contracts with the terms of the agreement directly written into code allow for automatic and trustworthy transactions without the need for intermediaries. Imagine a vending machine: you insert your coins, and the machine automatically dispenses your snack. Smart contracts work in a similar way, executing transactions only when predefined conditions are met. This innovation not only speeds up processes but also reduces costs and minimizes the potential for disputes.

Another exciting advancement is the emergence of layer 2 solutions. As the demand for transactions on popular blockchains like Ethereum has surged, the need for scalability has become apparent. Layer 2 solutions, such as the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum, enhance the speed and efficiency of transactions by processing them off the main blockchain. This means users can enjoy faster transaction times and lower fees, making cryptocurrency more user-friendly and efficient. It’s akin to taking a shortcut through a park instead of sticking to the crowded main road!

Moreover, the integration of interoperability protocols is another significant innovation. These protocols allow different blockchain networks to communicate and share information seamlessly. Imagine various islands in an ocean; each island represents a different blockchain. Interoperability acts like bridges connecting these islands, allowing them to share resources and information. This innovation is crucial for the future of decentralized applications (dApps) and can lead to a more unified blockchain ecosystem, increasing the overall utility of cryptocurrencies.

Furthermore, the rise of decentralized autonomous organizations (DAOs) is transforming how decisions are made within blockchain networks. DAOs operate on smart contracts and allow stakeholders to vote on proposals, creating a democratic governance structure. This model empowers users and gives them a voice in the development and direction of projects. It’s like having a community council where everyone has a say, ensuring that the interests of the members are prioritized.

To summarize, blockchain innovations are not just enhancing the functionality of cryptocurrencies; they are redefining how we think about finance, security, and trust in digital transactions. As these technologies continue to evolve, they hold the promise of creating a more inclusive and efficient financial system. The question remains: how will these innovations shape the future of cryptocurrency? Only time will tell, but one thing is for sure—the blockchain revolution is just getting started.

- What are smart contracts? Smart contracts are self-executing contracts with the terms of the agreement directly written into code, allowing for automatic and trustworthy transactions.

- What are layer 2 solutions? Layer 2 solutions are enhancements built on top of existing blockchains to improve transaction speed and reduce costs.

- What is interoperability in blockchain? Interoperability refers to the ability of different blockchain networks to communicate and share information seamlessly.

- What are decentralized autonomous organizations (DAOs)? DAOs are organizations that operate on smart contracts, allowing stakeholders to vote on proposals and decisions democratically.

Decentralized Finance (DeFi) Growth

Decentralized Finance, or DeFi, is not just a buzzword; it’s a revolution that is reshaping how we think about financial transactions. Imagine a world where you can lend, borrow, trade, and earn interest on your assets without the need for traditional banks or financial institutions. That’s the promise of DeFi, and its growth has been nothing short of explosive. In recent years, the DeFi sector has seen an influx of users and capital, driven by technological advancements and a desire for greater financial autonomy.

The core idea behind DeFi is to create an open-source financial system that is accessible to anyone with an internet connection. This means that even if you are unbanked or underbanked, you can participate in financial activities. With the rise of blockchain technology, DeFi platforms are able to offer services that were once exclusive to banks. Users can access a variety of financial products, from lending and borrowing to trading and insurance, all without intermediaries. This shift is making finance more inclusive and democratized.

One of the most exciting aspects of DeFi is its ability to provide users with control over their assets. In traditional finance, your funds are held by banks, which can impose restrictions and fees. In contrast, DeFi platforms allow users to maintain custody of their assets, often resulting in lower costs and greater flexibility. This has led to a surge in user adoption, with billions of dollars locked in various DeFi protocols. According to recent statistics, the total value locked (TVL) in DeFi has reached unprecedented levels, illustrating the growing trust and interest in this sector.

However, while the growth of DeFi is promising, it’s essential to recognize that it comes with its own set of challenges and risks. The decentralized nature of these platforms means that they are often less regulated than traditional financial systems, which can expose users to vulnerabilities. For instance, smart contracts, which underpin DeFi transactions, can be prone to bugs and exploits. Users must exercise caution and conduct thorough research before participating in any DeFi project.

Despite these risks, the potential for innovation in DeFi is vast. Many projects are emerging that aim to enhance security and user experience. For example, some platforms are integrating insurance mechanisms to protect users against smart contract failures, while others are developing user-friendly interfaces to make DeFi more accessible to the average person. The future of DeFi looks bright, with ongoing developments that promise to address current challenges while paving the way for more robust financial solutions.

To summarize, the growth of DeFi is reshaping the financial landscape in profound ways. It offers unprecedented access to financial services, empowers users with control over their assets, and fosters innovation. As the DeFi ecosystem continues to evolve, it will be fascinating to see how it challenges traditional finance and what new opportunities it creates for individuals and businesses alike.

- What is DeFi? - Decentralized Finance (DeFi) refers to a financial system built on blockchain technology that allows users to engage in financial transactions without intermediaries.

- How does DeFi work? - DeFi operates on smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, enabling automated and trustless transactions.

- What are the risks associated with DeFi? - Risks include smart contract vulnerabilities, lack of regulation, and potential loss of funds due to hacks or exploits.

- How can I get started with DeFi? - To start with DeFi, you need a cryptocurrency wallet, some digital assets, and access to a DeFi platform where you can participate in various financial activities.

Impact on Traditional Finance

The rise of Decentralized Finance (DeFi) is nothing short of a seismic shift in the world of finance. Imagine a world where you can lend, borrow, and trade cryptocurrencies without the need for traditional banks or financial institutions. Sounds revolutionary, right? This is exactly what DeFi is bringing to the table, and it’s shaking up the foundations of traditional finance like a strong earthquake. Traditional banks and financial services have long been the gatekeepers of financial transactions, but with the advent of DeFi, we are witnessing a democratization of finance that empowers individuals and small businesses alike.

One of the most significant impacts of DeFi on traditional finance is the disintermediation of financial services. In simple terms, this means that DeFi platforms eliminate the need for middlemen, allowing users to engage in peer-to-peer transactions. This not only cuts down on costs associated with fees and commissions but also enhances the speed of transactions. For instance, while a bank transfer might take days to process, a DeFi transaction can occur in a matter of minutes. This rapid processing time is particularly appealing in a world where speed is crucial, especially in trading scenarios.

Moreover, DeFi is fostering greater financial inclusion. According to recent studies, nearly 1.7 billion adults worldwide remain unbanked, lacking access to traditional banking services. DeFi platforms provide an alternative for these individuals, allowing them to participate in financial systems without the barriers of entry imposed by traditional banks. With just a smartphone and an internet connection, anyone can access DeFi applications, thus bridging the gap between the banked and unbanked populations.

However, the rise of DeFi is not without its challenges. Traditional financial institutions are beginning to feel the heat as they grapple with the implications of this new financial landscape. Many banks are exploring ways to integrate blockchain technology and DeFi services into their offerings to remain competitive. Some are even launching their own digital currencies to compete with the likes of Bitcoin and Ethereum. The competition is fierce, and banks are under pressure to innovate or risk being left behind.

To illustrate the impact of DeFi on traditional finance, let’s look at a comparison in terms of transaction speed and cost:

| Aspect | Traditional Finance | DeFi |

|---|---|---|

| Transaction Speed | 1-3 days | Minutes |

| Average Transaction Fee | $10-$30 | Less than $1 |

| Accessibility | Requires bank account | Requires internet access |

As we can see from the table, the advantages of DeFi are compelling. However, it’s important to note that with these advantages come risks. The lack of regulation in the DeFi space can lead to vulnerabilities, including smart contract bugs and potential hacks. Traditional financial institutions are often seen as safe havens due to their regulatory frameworks, which can provide a sense of security to consumers. As DeFi continues to grow, it will be essential for both users and regulators to navigate these waters carefully.

In conclusion, the impact of DeFi on traditional finance is profound and multifaceted. It is reshaping how we think about financial transactions, creating opportunities for greater accessibility and innovation. However, it also poses challenges that must be addressed to ensure a secure and stable financial environment for all. As we move forward, the relationship between DeFi and traditional finance will likely evolve, leading to a new era of financial services that combines the best of both worlds.

- What is DeFi? DeFi, or Decentralized Finance, refers to financial services that operate on blockchain technology without intermediaries like banks.

- How does DeFi impact traditional banks? DeFi challenges traditional banks by offering faster, cheaper, and more accessible financial services, pushing banks to innovate.

- What are the risks associated with DeFi? Risks include smart contract vulnerabilities, lack of regulation, and potential hacks.

- Can anyone use DeFi? Yes! Anyone with internet access can use DeFi platforms, making finance more inclusive.

- Will DeFi replace traditional finance? While DeFi is growing rapidly, it is more likely to coexist with traditional finance, each offering unique benefits.

Risks and Challenges of DeFi

As the world of Decentralized Finance (DeFi) continues to expand, it brings with it a plethora of opportunities but also a series of significant risks and challenges that users must navigate. One of the primary concerns is the security vulnerabilities inherent in smart contracts, the backbone of most DeFi applications. These contracts, while revolutionary, can be prone to bugs and exploits. In fact, there have been numerous high-profile hacks that have resulted in millions of dollars worth of cryptocurrencies being stolen. This raises a critical question: how safe is your investment in DeFi?

Moreover, the lack of regulation in the DeFi space can be a double-edged sword. On one hand, it allows for greater innovation and accessibility; on the other, it leaves investors exposed to potential fraud and scams. Without a regulatory body overseeing transactions, users must rely on their own due diligence to assess the legitimacy of a platform. This can be daunting, especially for newcomers who may not have the expertise to identify red flags.

Another challenge is liquidity risks. While many DeFi platforms promise high returns, they often rely on liquidity pools that can be volatile. If a large number of users decide to withdraw their funds simultaneously, it can lead to significant price fluctuations and even losses for those who remain invested. This phenomenon can create a ripple effect, impacting the broader market and causing panic among investors.

Additionally, the complexity of DeFi protocols can be overwhelming. Many platforms require a certain level of technical knowledge to navigate effectively. This barrier to entry can deter potential users, limiting the growth of DeFi as a mainstream financial alternative. To illustrate, consider the following table that outlines some of the common risks associated with DeFi:

| Risk Type | Description |

|---|---|

| Smart Contract Vulnerabilities | Exploits and bugs in smart contracts can lead to loss of funds. |

| Lack of Regulation | Absence of oversight increases the risk of fraud and scams. |

| Liquidity Risks | Withdrawal of funds by many users can cause price instability. |

| Complexity | Technical knowledge is often required to use DeFi platforms effectively. |

Lastly, it's important to consider the market volatility that is characteristic of cryptocurrencies. DeFi is no exception, as the prices of tokens can fluctuate wildly, leading to potential losses for investors. This volatility can be exacerbated by external factors such as regulatory news, technological advancements, or even social media trends. Therefore, understanding the market dynamics is crucial for anyone looking to venture into the DeFi space.

In conclusion, while DeFi presents exciting opportunities for financial freedom and innovation, it is essential to approach this new frontier with caution. By being aware of the risks and challenges, investors can make informed decisions and better protect their assets in this rapidly evolving landscape.

- What are the main risks associated with DeFi? The main risks include smart contract vulnerabilities, lack of regulation, liquidity risks, complexity, and market volatility.

- How can I protect myself when investing in DeFi? Conduct thorough research on platforms, understand the technology, and consider diversifying your investments to mitigate risks.

- Is DeFi safe for beginners? While DeFi offers great potential, beginners should proceed with caution and educate themselves about the risks involved.

Frequently Asked Questions

- What are the key technologies reshaping cryptocurrency today?

The cryptocurrency landscape is being transformed by several key technologies, including blockchain innovations and decentralized finance (DeFi). These advancements enhance accessibility and security, making it easier for users to engage with digital currencies.

- How is artificial intelligence impacting cryptocurrency trading?

Artificial intelligence (AI) plays a crucial role in analyzing market data and predicting trends. AI-driven trading algorithms are revolutionizing how traders operate, offering insights that help in making informed investment decisions.

- What are the benefits of using AI in trading algorithms?

AI in trading algorithms provides several benefits, such as improved accuracy in market predictions, faster data processing, and enhanced risk management. However, it also comes with challenges, including the need for robust data and the potential for over-reliance on technology.

- How does AI improve risk management in cryptocurrency investments?

AI enhances risk management by providing real-time analysis and alerts to investors. This allows for quick decision-making in volatile markets, helping investors mitigate potential losses effectively.

- What is the significance of DeFi in the cryptocurrency market?

Decentralized finance (DeFi) is significant because it allows users to conduct financial transactions without intermediaries, challenging traditional financial systems. This shift is democratizing finance and providing more opportunities for users globally.

- What challenges does DeFi present?

While DeFi offers numerous benefits, it also presents challenges such as security vulnerabilities, regulatory uncertainties, and the potential for market manipulation. Users must be aware of these risks before engaging with DeFi platforms.

- How do blockchain innovations influence cryptocurrency?

Blockchain innovations are continuously evolving, leading to new applications that improve transaction speed, security, and scalability. These advancements are crucial for the overall growth and adoption of cryptocurrencies.

- What are the implications of AI-driven market predictions?

AI-driven market predictions can significantly influence investment strategies by providing insights into potential future trends. This predictive capability allows investors to make data-driven decisions, potentially increasing their chances of success in the market.