Creating a Winning Trading Strategy from Scratch

Welcome to the exciting world of trading! If you're here, it means you're ready to dive into the financial markets and craft a strategy that not only suits your style but also maximizes your potential for success. But where do you start? It can feel like standing at the edge of a vast ocean, unsure of how to navigate the waves. Fear not! This comprehensive guide will help you build a solid trading strategy from the ground up, ensuring you have the tools and knowledge to ride the waves of the market effectively.

First things first, understanding the basics is crucial. Think of it like learning to ride a bike; you wouldn't hop on without knowing how to balance, right? In trading, the fundamentals include grasping how different markets operate, familiarizing yourself with key terminologies, and recognizing the impact of economic indicators on your trading decisions. Once you have a firm grasp of these concepts, you can start to formulate your strategy with confidence.

Next, defining your trading goals is a must. Ask yourself: What do I want to achieve? Setting clear, realistic objectives based on your risk tolerance, time commitment, and desired returns will serve as your guiding light. It's like setting a destination on a map before embarking on a road trip. Without a destination, you might find yourself going in circles.

Now, let’s talk about risk management techniques. Imagine you're walking a tightrope; one misstep can lead to a fall. Effective risk management is your safety net. Techniques such as setting stop-loss orders and diversifying your portfolio are essential in protecting your capital and minimizing losses while maximizing potential gains. For instance, stop-loss orders act as a shield against significant downturns, allowing you to exit a position before losses escalate.

Here’s a closer look at two key risk management strategies:

- Setting Stop-Loss Orders: These orders automatically sell your assets when they reach a certain price, helping to minimize losses.

- Diversification Strategies: By spreading your investments across various assets and markets, you can reduce your overall risk exposure.

Choosing your trading style is another vital step. Just like different sports require different skills, trading styles vary based on your personality and lifestyle. Whether you prefer the fast-paced action of day trading, the swing trading approach, or the long-term investing strategy, finding the right fit is key to your trading success.

Market analysis is where the magic happens. Understanding market trends through technical and fundamental analysis is essential for making informed trading decisions. Technical analysis involves studying chart patterns and indicators, while fundamental analysis looks at economic factors driving market prices. Both methods provide invaluable insights that can help you predict market movements and adjust your strategy accordingly.

To give you a clearer picture, here's a breakdown of the two analysis methods:

| Type of Analysis | Description | Key Tools |

|---|---|---|

| Technical Analysis | Analyzes price movements and trading volumes to forecast future price movements. | Charts, Indicators, Patterns |

| Fundamental Analysis | Examines economic indicators and news events that affect market prices. | Financial Statements, Economic Reports |

Once you’ve developed your strategy, backtesting is a crucial step in validating its effectiveness. This process involves testing your strategy against historical data to see how it would have performed in the past. Think of it as a rehearsal before the big performance; it helps you fine-tune your approach and build confidence before entering the live market.

Finally, remember that the financial markets are dynamic and ever-changing. Continuous improvement and adaptation are essential for ongoing success. Stay updated with market trends, refine your strategies, and never stop learning. Just like a great chef perfects their recipes over time, you too will evolve as a trader.

- What is the best trading strategy for beginners? Start with a simple strategy that focuses on risk management and gradually expand your knowledge.

- How much money do I need to start trading? It varies, but you can start with a small amount; the key is to trade what you can afford to lose.

- Is it necessary to analyze both technical and fundamental factors? While not mandatory, using both analyses can provide a more comprehensive view of the market.

Understanding Market Fundamentals

Before you dive headfirst into the world of trading, it's essential to get a solid grasp of market fundamentals. Think of this as your foundation; without it, your trading strategy could crumble like a house of cards. So, what exactly are market fundamentals? They encompass the basic elements that govern how different markets operate, including key terminologies, the roles of various participants, and the influence of economic indicators on trading decisions. Understanding these elements can significantly enhance your trading prowess.

First off, let's talk about the different types of markets you might encounter. The financial landscape is vast and varied, including stock markets, forex markets, commodities markets, and more. Each market has its unique characteristics and operates based on different principles. For instance, the stock market is often driven by company performance and investor sentiment, while the forex market is influenced by geopolitical events and economic data from countries around the world. It's like navigating a maze; knowing the layout can help you find your way much easier!

Next, you’ll want to familiarize yourself with some key terminologies. Here are a few crucial terms that every trader should know:

- Bid and Ask Price: The bid price is the highest price a buyer is willing to pay, while the ask price is the lowest price a seller will accept.

- Spread: This is the difference between the bid and ask price, and it can indicate market liquidity.

- Volatility: A measure of how much the price of an asset fluctuates over time. High volatility can mean higher risk but also higher potential rewards.

Understanding these terms is like having a cheat sheet that helps you navigate the trading arena with confidence. But wait, there's more! Economic indicators play a crucial role in shaping market movements. These indicators, such as GDP growth rates, unemployment rates, and inflation figures, can provide valuable insights into the health of an economy. For instance, strong GDP growth might lead to bullish sentiment in the stock market, while rising inflation could trigger a sell-off in bonds. Keeping an eye on these indicators can help you anticipate market trends and make informed decisions.

To sum it all up, grasping market fundamentals is not just a nice-to-have; it's a must-have for anyone serious about trading. By understanding how different markets operate, familiarizing yourself with essential terminologies, and staying updated on economic indicators, you’ll be well-equipped to craft a winning trading strategy. Remember, knowledge is power, and in the world of trading, it can be the difference between success and failure. So, are you ready to build your trading foundation?

Defining Your Trading Goals

When it comes to trading, having a clear vision is like having a map on a road trip. You wouldn’t set off on a journey without knowing your destination, right? Similarly, defining your trading goals is essential for navigating the complex world of financial markets. It’s not just about making money; it’s about understanding what you want to achieve and how you plan to get there. So, let’s dive into the nitty-gritty of goal-setting and why it matters.

First off, you need to establish realistic objectives. Think about your risk tolerance, the time you can dedicate to trading, and the kind of returns you hope to see. Are you looking to make a quick buck, or are you in it for the long haul? Your goals should reflect your personal circumstances and trading style. For instance, if you can only spare a few hours a week, setting a goal to become a full-time trader might not be the best fit. Instead, you could aim for a steady income from part-time trading.

Let’s break this down a bit further. Here are some key factors to consider when defining your trading goals:

- Risk Tolerance: Are you comfortable with high-risk trades that could lead to significant losses, or do you prefer a more conservative approach?

- Time Commitment: How much time can you realistically devote to trading each week? This will influence your strategy and goals.

- Desired Returns: What kind of profit are you aiming for? Setting a specific percentage can help keep you focused.

Once you’ve thought through these factors, it’s time to put pen to paper (or fingers to keyboard). Write down your goals and make them as specific as possible. Instead of saying, “I want to make money,” try something like, “I want to achieve a 15% return on my investment over the next six months.” This specificity not only gives you a target to aim for but also helps you measure your progress along the way.

Moreover, it’s essential to review and adjust your goals periodically. The financial landscape is constantly shifting, and your initial goals may need tweaking as you gain experience and insight. For instance, if you find that you’re consistently hitting your targets, it might be time to set more ambitious goals. On the flip side, if you’re struggling, it’s okay to reassess and set more achievable objectives.

In summary, defining your trading goals is a foundational step in your trading journey. It shapes your strategy, influences your decisions, and ultimately determines your success. So, take the time to think about what you want to achieve, write it down, and be ready to adapt as you grow in your trading career.

Q: Why is it important to set trading goals?

A: Setting trading goals helps you stay focused, measure your progress, and make informed decisions based on your objectives.

Q: How often should I review my trading goals?

A: It’s a good practice to review your goals every few months or after significant changes in your trading performance or market conditions.

Q: Can I change my trading goals?

A: Absolutely! As you gain experience and your circumstances change, it’s perfectly fine to adjust your goals to better align with your current situation.

Risk Management Techniques

When it comes to trading, the phrase "don't put all your eggs in one basket" rings especially true. Effective risk management is the backbone of a successful trading strategy. It’s not just about making profits; it's about protecting your capital and ensuring longevity in the market. Think of your trading account as a garden: if you don't nurture it and protect it from pests, it won't flourish. By implementing solid risk management techniques, you can cultivate a thriving trading portfolio.

One of the first steps in risk management is to understand your risk tolerance. This means knowing how much you can afford to lose without it impacting your lifestyle. Everyone has a different threshold; some might be comfortable with high-risk trades, while others prefer a more conservative approach. By defining your risk tolerance, you can make informed decisions and avoid emotional trading, which often leads to poor outcomes.

Another crucial aspect is the use of stop-loss orders. These are like safety nets that automatically close your trades at predetermined price levels, minimizing potential losses. Setting an effective stop-loss order requires a balance; it should be tight enough to protect your capital but not so tight that it gets triggered by normal market fluctuations. For example, if you buy a stock at $50, you might set a stop-loss at $48. This way, if the stock price drops, you’ll limit your loss to $2 per share.

Furthermore, diversification plays a pivotal role in risk management. By spreading your investments across different asset classes, sectors, and geographical regions, you can significantly reduce the impact of a poor-performing investment. Picture this: if you only invest in tech stocks and the tech market crashes, your entire portfolio could suffer. However, if you also invest in commodities, bonds, and other sectors, the losses in one area could be offset by gains in another. Here’s a quick look at how diversification can work:

| Asset Class | Example Investments | Risk Level |

|---|---|---|

| Stocks | Technology, Healthcare | High |

| Bonds | Government, Corporate | Low |

| Real Estate | REITs, Rental Properties | Medium |

| Commodities | Gold, Oil | Medium |

In addition to these techniques, it's essential to regularly review and adjust your risk management strategies. The market is ever-changing, and what worked yesterday may not work tomorrow. By staying adaptable and continuously learning about new risk management tools and techniques, you can better safeguard your investments. Remember, successful trading is not just about making the right calls; it’s also about knowing when to cut your losses and move on.

- What is the most important aspect of risk management? Understanding your own risk tolerance is crucial. It helps you make informed decisions and avoid emotional trading.

- How can I effectively set stop-loss orders? Set your stop-loss orders based on your trading strategy and market volatility. They should protect your capital without being too tight.

- Is diversification really necessary? Yes! Diversification helps reduce the risk of significant losses by spreading your investments across various asset classes.

Setting Stop-Loss Orders

Setting stop-loss orders is one of the most effective ways to manage risk in trading. Imagine you're on a roller coaster, and as thrilling as the ride may be, you wouldn't want to go off the rails, right? Just like that, in trading, a stop-loss order acts as your safety harness, ensuring that you don’t lose more than you can afford. It's a tool that automatically sells a stock or asset when it reaches a certain price, protecting your investments from significant downturns.

To set a stop-loss order effectively, you first need to determine the price level at which you are willing to exit a losing trade. This decision should not be made impulsively; instead, it should be based on thorough analysis and a clear understanding of your risk tolerance. For instance, if you buy a stock at $50 and decide that you are willing to risk a 10% loss, you would set your stop-loss order at $45. This way, if the stock price drops to $45, your order will trigger, and your shares will be sold automatically, preventing further losses.

It's essential to consider various factors when setting your stop-loss orders:

- Market Volatility: If a stock is highly volatile, setting a tighter stop-loss might result in being stopped out of a position too early. Conversely, a wider stop-loss could expose you to larger losses.

- Trading Style: Are you a day trader looking for quick profits, or a long-term investor? Your trading style will influence how you set your stop-loss orders.

- Support and Resistance Levels: Analyze the stock's chart to identify key support and resistance levels. Setting your stop-loss just below a support level can provide a buffer against normal price fluctuations.

Here's a simple table summarizing the types of stop-loss orders you might consider:

| Type of Stop-Loss Order | Description |

|---|---|

| Standard Stop-Loss | Automatically sells your asset at a predetermined price. |

| Trailing Stop-Loss | Moves with the market price, maintaining a set distance as the price increases. |

| Guaranteed Stop-Loss | Ensures your position is closed at the specified price, regardless of market fluctuations. |

By incorporating stop-loss orders into your trading strategy, you can significantly enhance your risk management. Remember, the goal is not just to avoid losses but to ensure that they remain manageable and within your predefined limits. It's like having a safety net that catches you before you hit the ground. So, take the time to determine the right stop-loss strategy for your trades, and you’ll find that it not only protects your capital but also gives you the confidence to trade more effectively.

Q: What is the main purpose of a stop-loss order?

A: The main purpose of a stop-loss order is to limit potential losses on a trade by automatically selling an asset when it reaches a specified price.

Q: Can I adjust my stop-loss order after setting it?

A: Yes, you can adjust your stop-loss order at any time. However, it’s important to do so based on market conditions and your trading strategy.

Q: Is there a difference between a stop-loss order and a stop-limit order?

A: Yes, a stop-loss order triggers a market order to sell once the stop price is reached, while a stop-limit order sets a specific price at which to sell, which may not execute if the market price drops too quickly.

Q: Should I always use a stop-loss order?

A: While using a stop-loss order is highly recommended for risk management, the decision ultimately depends on your trading strategy and risk tolerance.

Diversification Strategies

Diversification is like a safety net for your investments; it helps to cushion the blows when the market takes a nosedive. By spreading your investments across various assets, you can significantly reduce your risk exposure. Imagine you’re at a party with a mix of friends from different circles—if one group starts talking about a topic you’re not interested in, you can easily switch to another conversation that excites you. Similarly, in trading, if one asset class takes a hit, others might still perform well, keeping your overall portfolio stable.

When it comes to diversification, the first step is to understand the types of assets available to you. You can diversify across several dimensions, including:

- Asset Classes: Stocks, bonds, commodities, and real estate.

- Geographical Regions: Investing in both domestic and international markets.

- Market Capitalization: Including large-cap, mid-cap, and small-cap stocks.

For instance, let’s say you have a portfolio consisting solely of tech stocks. If the tech industry faces a downturn due to regulatory issues or a market correction, your entire investment could suffer. However, if you diversify your portfolio to include bonds and real estate, the impact of the tech downturn may be cushioned by the stability of bonds or the appreciation in real estate values.

Moreover, diversification isn’t just about throwing a bunch of different assets together and hoping for the best. It requires a strategic approach. You should consider the correlation between assets; ideally, you want to include assets that don’t move in sync with one another. For example, when stocks are down, bonds often perform better, providing a buffer for your portfolio.

To illustrate this concept, here's a simple table showing how different asset classes might perform in various market conditions:

| Market Condition | Stocks | Bonds | Real Estate |

|---|---|---|---|

| Bull Market | High Returns | Moderate Returns | High Returns |

| Bear Market | Low Returns | High Returns | Moderate Returns |

| Recession | Negative Returns | Stable Returns | Low Returns |

In summary, a well-diversified portfolio can help mitigate risks and enhance returns. However, it’s crucial to regularly review and adjust your diversification strategy as market conditions change. Markets are dynamic, and what worked yesterday may not work tomorrow. So, keep your eyes peeled for new opportunities and be ready to adapt your strategy accordingly!

1. What is diversification in trading?

Diversification in trading refers to the practice of spreading investments across various assets to reduce risk. By not putting all your eggs in one basket, you can protect your portfolio from significant losses.

2. How do I know if my portfolio is diversified enough?

A well-diversified portfolio should include a mix of asset classes, geographical regions, and industries. Regularly assess the correlation of your assets and adjust as needed to ensure they are not overly reliant on one market condition.

3. Can too much diversification be harmful?

Yes, over-diversification can lead to diminishing returns and may complicate your investment strategy. It’s important to strike a balance and ensure you’re not spreading your investments too thin.

4. How often should I review my diversification strategy?

It’s advisable to review your diversification strategy at least annually or whenever there are significant changes in the market or your personal financial situation.

Choosing Your Trading Style

When it comes to trading, one size definitely does not fit all. Just like choosing a pair of shoes, your trading style should align with your personal preferences, lifestyle, and risk tolerance. So, how do you find the perfect fit? Let’s dive into the various trading styles to help you make an informed decision.

First up, we have day trading. This style is all about making quick trades within a single day. Day traders capitalize on small price movements and often execute dozens of trades in a day. It’s a fast-paced environment that requires a keen eye for market trends and a solid grasp of technical analysis. If you thrive on adrenaline and enjoy making rapid decisions, day trading might just be your calling. However, be prepared for the emotional rollercoaster that comes with it!

Next, we have swing trading. This style is a bit more relaxed compared to day trading. Swing traders typically hold positions for several days to weeks, aiming to profit from expected price swings. This approach allows for a more balanced lifestyle, as you won’t be glued to your screen all day. If you have a full-time job or other commitments, swing trading could be a great option. It combines the excitement of trading with the flexibility to maintain your daily routine.

Then there’s the long-term investing strategy. This is for those who prefer a more patient approach. Long-term investors buy and hold assets for extended periods, often years, to benefit from overall market growth. This style requires a solid understanding of fundamental analysis and a belief in the long-term potential of your investments. If you like the idea of watching your investments grow over time without the stress of daily market fluctuations, long-term investing might be your best bet.

To help you visualize these styles, here’s a quick comparison table:

| Trading Style | Time Frame | Risk Level | Ideal For |

|---|---|---|---|

| Day Trading | Intraday | High | Adrenaline Seekers |

| Swing Trading | Days to Weeks | Moderate | Part-Time Traders |

| Long-Term Investing | Years | Low | Patient Investors |

As you weigh your options, consider your financial goals, time availability, and emotional resilience. Are you someone who can handle the stress of rapid trading, or do you prefer a more laid-back approach? Remember, the best trading style is one that aligns with your personality and financial objectives.

In conclusion, choosing your trading style is not just about picking a method; it’s about finding a strategy that resonates with you. Take the time to explore each option, and don’t hesitate to experiment until you find the perfect fit. After all, trading should not only be profitable but also enjoyable!

- What is day trading? Day trading involves buying and selling financial instruments within the same trading day, aiming to capitalize on short-term price movements.

- Is swing trading suitable for beginners? Yes, swing trading can be a good choice for beginners as it allows more time to analyze trades compared to day trading.

- How do I know which trading style is right for me? Consider your risk tolerance, time availability, and personal preferences to find a trading style that suits you best.

Analyzing Market Trends

When it comes to trading, is like having a compass in uncharted waters. Without it, you might find yourself lost, making decisions based on gut feelings rather than solid data. The essence of market analysis lies in understanding the movements and patterns that dictate price changes. By mastering the art of trend analysis, you can make informed decisions that could significantly enhance your trading success.

There are two primary methods for analyzing market trends: technical analysis and fundamental analysis. Each has its unique approach and tools, but both aim to provide insights into future price movements. Let’s break these down further.

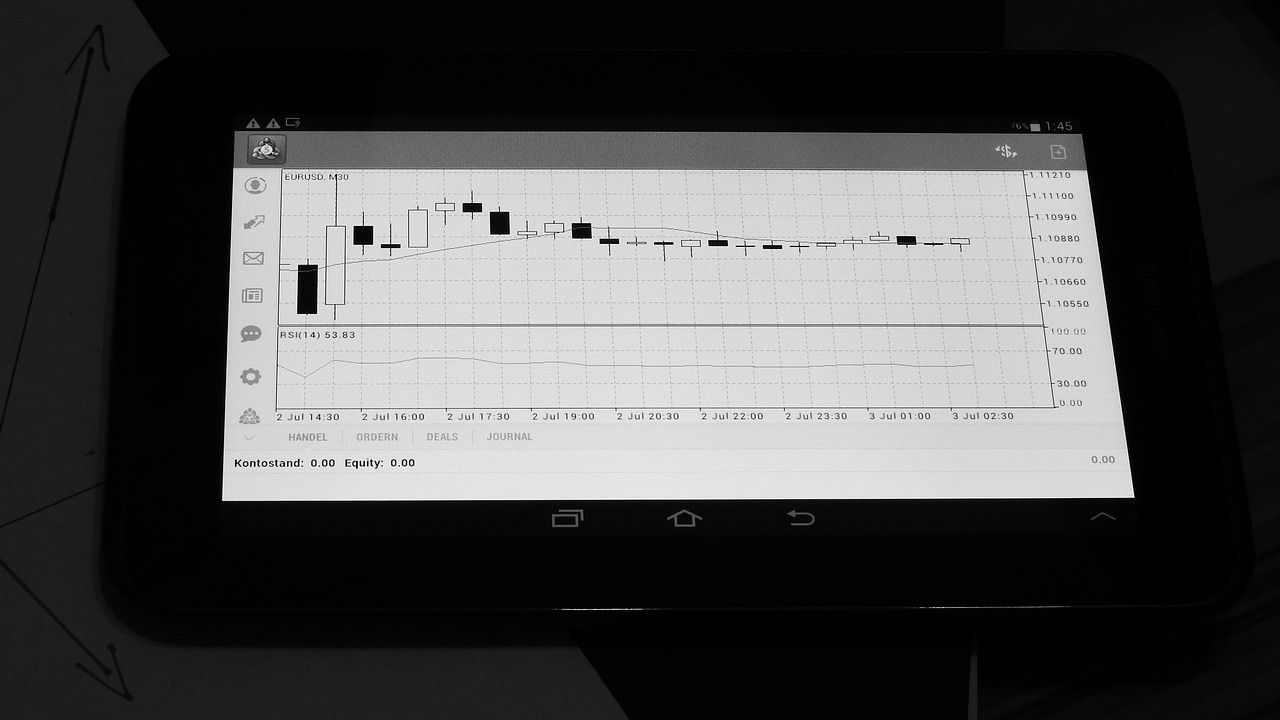

Technical analysis is like reading the pulse of the market. It involves studying price charts and using various indicators to forecast future movements. Traders rely on chart patterns, which are visual representations of price movements over a particular time frame. For instance, you might encounter patterns like head and shoulders, triangles, or flags, each suggesting potential market behavior.

Some of the most popular technical indicators include:

- Moving Averages: These smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

- Bollinger Bands: These bands expand and contract based on market volatility, providing insights into potential price movements.

Understanding how to read these indicators effectively can give you an edge in predicting market trends. However, remember that no indicator is foolproof. They should be used in conjunction with other tools and analysis methods for the best results.

On the flip side, fundamental analysis focuses on the underlying factors that influence market prices. Think of it as looking at the bigger picture. This method examines economic indicators, financial statements, and news events that can impact market sentiment. For example, changes in interest rates, employment data, or geopolitical events can all sway market trends significantly.

To perform fundamental analysis, consider the following:

- Economic Indicators: These include GDP growth rates, inflation rates, and consumer confidence indices.

- Company Financials: Analyze earnings reports, revenue growth, and profit margins to gauge a company's health.

- Market Sentiment: Social media trends, news articles, and analyst ratings can provide insight into how the market perceives certain assets.

Combining both technical and fundamental analysis can create a robust trading strategy. By understanding market trends through both lenses, you can make well-rounded decisions that are informed by both historical data and current events.

In essence, analyzing market trends is not just about crunching numbers or interpreting charts; it’s about understanding the story behind the data. The more you immerse yourself in both technical and fundamental analysis, the better equipped you’ll be to navigate the complexities of the financial markets. Remember, the market is always evolving, and so should your analysis techniques.

Q: What is the best method for analyzing market trends?

A: There isn't a one-size-fits-all answer. Many successful traders use a combination of both technical and fundamental analysis to make informed decisions.

Q: How often should I analyze market trends?

A: It depends on your trading style. Day traders may analyze trends multiple times a day, while long-term investors might do so weekly or monthly.

Q: Can I rely solely on technical analysis?

A: While technical analysis can provide valuable insights, it's advisable to consider fundamental factors as well to gain a comprehensive view of the market.

Technical Analysis Basics

Technical analysis is like the compass for traders navigating the vast ocean of financial markets. It involves studying historical price movements and trading volumes to forecast future price behavior. By analyzing charts and using various indicators, traders can identify patterns that often repeat themselves, helping them make informed decisions about when to enter or exit a trade. Think of it as reading the waves of the market; understanding their rhythm can lead to successful trades.

One of the foundational aspects of technical analysis is the use of charts. These visual representations of price movements provide a snapshot of an asset's performance over time. The most common types of charts include:

- Line Charts: Simple and effective, line charts connect closing prices over a specific period, providing a clear view of the asset's trend.

- Bar Charts: These show the open, high, low, and close prices for a specific time frame, offering more detail than line charts.

- Candlestick Charts: Popular among traders, candlestick charts display the same information as bar charts but in a more visually appealing format, making it easier to identify market sentiment.

Once traders are familiar with charts, they often turn to technical indicators to enhance their analysis. These indicators are mathematical calculations based on price and volume, and they help traders identify trends, momentum, and potential reversal points. Some widely used indicators include:

- Moving Averages: These smooth out price data to identify trends over a specific period. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are two popular types.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

- Bollinger Bands: These bands expand and contract based on market volatility, providing insights into potential price breakouts or reversals.

Understanding chart patterns is another critical component of technical analysis. Patterns like head and shoulders, double tops, and triangles can signal potential market movements. Recognizing these patterns is akin to spotting constellations in the night sky; once you learn to identify them, they can guide your trading decisions.

Moreover, traders should be aware of the importance of volume in technical analysis. Volume measures the number of shares or contracts traded in a given period and can confirm the strength of a price movement. For instance, a price increase accompanied by high volume suggests strong buying interest, while a price increase on low volume may indicate a lack of conviction in the move.

In summary, mastering technical analysis is essential for any trader looking to enhance their trading strategy. By understanding charts, utilizing indicators, recognizing patterns, and analyzing volume, traders can better anticipate market movements and make more informed trading decisions. It's like assembling a puzzle; each piece of information helps complete the picture of market behavior.

What is the primary goal of technical analysis?

The primary goal of technical analysis is to forecast future price movements based on historical price data and trading volumes. Traders use it to identify potential entry and exit points in the market.

Can technical analysis guarantee profits?

No, technical analysis cannot guarantee profits. It is a tool that helps traders make informed decisions, but market conditions can change rapidly, and losses can still occur.

How do I start learning technical analysis?

Start by familiarizing yourself with different types of charts and indicators. There are numerous online resources, courses, and books available that can provide a solid foundation in technical analysis.

Fundamental Analysis Insights

When it comes to trading, understanding the underlying factors that drive market prices is crucial. This is where fundamental analysis comes into play. At its core, fundamental analysis is about examining the economic, financial, and other qualitative and quantitative factors that can influence the value of an asset. Think of it as trying to uncover the hidden story behind the numbers. By diving deep into the fundamentals, you can gain insights that help you make more informed trading decisions.

To start with, you should familiarize yourself with a few key elements of fundamental analysis. These include:

- Economic Indicators: These are statistics that provide insights into the economic performance of a country. Examples include GDP growth rates, unemployment rates, and inflation figures. A strong economy generally leads to higher asset prices.

- Company Financials: For stock trading, analyzing a company's financial statements—such as the balance sheet, income statement, and cash flow statement—can reveal its profitability and overall financial health. Look for metrics like earnings per share (EPS) and price-to-earnings (P/E) ratios.

- Market News: Events such as mergers, acquisitions, or regulatory changes can significantly impact asset prices. Staying updated with the latest news can give you an edge in predicting market movements.

Now, you might wonder, how do these factors work together? Let’s break it down further. Consider a scenario where a company releases its quarterly earnings report. If the results exceed market expectations, the stock price may surge as investors rush to buy shares, anticipating future growth. Conversely, if the results are disappointing, the stock may plummet. This reaction underscores the importance of understanding how to interpret these financial reports and news events.

Additionally, it's essential to keep an eye on macroeconomic trends. For instance, if central banks are hinting at interest rate hikes, it could lead to a stronger currency, which might impact the profitability of exporters. Similarly, geopolitical events can create volatility in the markets. For example, tensions in oil-producing regions can lead to spikes in oil prices, affecting everything from transportation costs to inflation rates.

To effectively conduct fundamental analysis, consider using a structured approach. Here’s a simple framework to guide you:

| Step | Description |

|---|---|

| 1 | Gather Data: Collect relevant economic indicators, financial reports, and news articles. |

| 2 | Analyze Trends: Look for patterns and trends in the data that could indicate potential price movements. |

| 3 | Make Predictions: Use your insights to forecast potential market movements and make informed trading decisions. |

| 4 | Review and Adjust: Continuously review your analysis and adjust your strategy based on new information. |

In conclusion, fundamental analysis is a powerful tool that can enhance your trading strategy. By understanding the economic and financial factors that drive market prices, you can make more informed decisions and potentially increase your trading success. Remember, the market is not just about charts and numbers; it's about the stories behind them. So, dive deep, stay curious, and let the fundamentals guide your trading journey!

Q: What is fundamental analysis?

A: Fundamental analysis is the evaluation of economic, financial, and other qualitative and quantitative factors to determine the intrinsic value of an asset.

Q: How can I start with fundamental analysis?

A: Begin by familiarizing yourself with key economic indicators, company financial statements, and current market news. Use a structured approach to analyze this information.

Q: Why is fundamental analysis important in trading?

A: It helps traders understand the underlying factors driving market prices, enabling them to make more informed decisions and potentially enhance trading performance.

Backtesting Your Strategy

Backtesting your trading strategy is like taking a time machine back to test your ideas against historical data. It allows you to see how your strategy would have performed in various market conditions, giving you valuable insights before you put your hard-earned money on the line. Imagine being able to analyze the past to predict the future—sounds like a superpower, right? But, before you don your cape, let’s break down the process.

First and foremost, you need to gather historical data that is relevant to your trading strategy. This data can include price movements, volume, and even economic indicators. The more comprehensive your dataset, the better your backtesting results will be. You can find this data from various sources, including trading platforms, financial news websites, and dedicated market data providers. Once you have your data, the next step is to define the parameters of your trading strategy. This includes:

- Entry and exit points: Determine the conditions under which you will enter and exit trades.

- Position size: Decide how much capital you will allocate to each trade.

- Timeframe: Specify the timeframe you will analyze, whether it's minutes, hours, days, or weeks.

After setting these parameters, it’s time to run your backtest. This can be done using various trading software or platforms that offer backtesting capabilities. The software will simulate trades based on your defined parameters and the historical data you provided. As the simulation runs, you’ll want to pay close attention to key metrics such as:

| Metric | Description |

|---|---|

| Win Rate | The percentage of profitable trades out of the total trades taken. |

| Risk-Reward Ratio | The ratio of potential profit to potential loss in each trade. |

| Maximum Drawdown | The largest peak-to-trough decline in your portfolio value during the backtest. |

| Sharpe Ratio | A measure of risk-adjusted return, indicating how much excess return you receive for the extra volatility endured. |

Analyzing these metrics will help you determine whether your strategy has the potential for success. However, it’s crucial to remember that past performance is not always indicative of future results. Markets are dynamic, and what worked in the past may not work in the future. Therefore, after backtesting, it’s essential to refine your strategy based on the insights gained. This could mean tweaking your entry and exit points, adjusting your position sizes, or even re-evaluating your risk management techniques.

Moreover, consider the importance of forward testing. After backtesting, try implementing your strategy in a simulated trading environment or with a small amount of capital. This will help you gauge how your strategy performs in real-time market conditions without risking significant losses. It’s a way to bridge the gap between theory and practice, ensuring you’re not just a backtesting whiz but also a capable trader.

In conclusion, backtesting is an indispensable tool in a trader's arsenal. It not only provides insights into the viability of your trading strategy but also equips you with the confidence to make informed decisions in the ever-changing financial markets. Remember, the goal is not just to create a strategy but to continuously learn and adapt as you navigate the thrilling world of trading.

1. What is backtesting in trading?

Backtesting is the process of testing a trading strategy using historical data to see how it would have performed in the past.

2. Why is backtesting important?

Backtesting helps traders validate their strategies before risking real money, offering insights into potential performance and risk metrics.

3. Can I rely solely on backtesting results?

While backtesting is valuable, it's essential to combine it with forward testing and ongoing market analysis, as past performance does not guarantee future results.

4. What metrics should I focus on during backtesting?

Key metrics include win rate, risk-reward ratio, maximum drawdown, and Sharpe ratio, which help assess the effectiveness of your strategy.

Continuous Improvement and Adaptation

In the ever-evolving landscape of financial markets, the ability to continuously improve and adapt your trading strategy is not just beneficial—it's essential. Think of trading as a living organism; it thrives on change and growth. If you become stagnant, you risk falling behind. So, how do you ensure that your trading strategy remains relevant and effective? Let's dive into some key principles that can guide you on this journey.

First and foremost, embracing a mindset of learning is crucial. The financial markets are influenced by a myriad of factors, from global economic shifts to technological advancements. By keeping an open mind and a willingness to learn, you can stay ahead of the curve. Regularly reading financial news, market analysis, and trading literature can provide you with insights that can refine your strategies. You might ask yourself, "What did I learn today that can enhance my trading?" This question can be a powerful motivator for continuous improvement.

Another vital aspect is to analyze your past trades. After each trading session, take some time to reflect on your decisions. What worked? What didn’t? By maintaining a trading journal, you can document your trades, emotions, and the market conditions at the time. This practice not only helps you identify patterns in your trading behavior but also highlights areas for improvement. Consider the following table to illustrate the elements you should track:

| Date | Trade Type | Entry Point | Exit Point | Profit/Loss | Notes |

|---|---|---|---|---|---|

| 01/01/2023 | Buy | $100 | $120 | +$20 | Followed trend indicators |

| 01/02/2023 | Sell | $150 | $140 | -$10 | Market volatility caught me off guard |

Moreover, staying updated with market trends is vital. Subscribe to reputable financial news sources, participate in trading forums, and consider joining online trading communities. Engaging with other traders can expose you to different perspectives and strategies, which can be instrumental in refining your own approach. Remember, the more you share and learn from others, the more you grow.

Lastly, don’t shy away from adapting your strategy based on market conditions. What worked yesterday may not work today. For instance, if you notice a shift in market volatility, it may be time to adjust your risk management techniques. Being flexible and responsive to the market is what separates successful traders from the rest. Ask yourself, "Is my strategy still effective in the current market?" If not, be prepared to pivot.

In conclusion, continuous improvement and adaptation are not merely buzzwords in trading; they are the lifeblood of a successful trader. By fostering a learning mindset, analyzing past trades, staying informed, and being adaptable, you can enhance your trading strategy and improve your chances of success in the financial markets. Remember, the journey of a trader is one of constant evolution, and those who embrace it will reap the rewards.

- How often should I review my trading strategy? It's advisable to review your strategy after every trading session and perform a more comprehensive review monthly.

- What resources can I use for continuous learning? Consider financial news websites, trading books, webinars, and online courses to enhance your knowledge.

- Is it necessary to join a trading community? While not mandatory, joining a community can provide valuable insights and support from fellow traders.

Frequently Asked Questions

- What is a trading strategy?

A trading strategy is a systematic plan that outlines how a trader will enter and exit trades in the financial markets. It includes rules for risk management, position sizing, and market analysis to guide decision-making.

- Why is risk management important in trading?

Risk management is crucial because it helps protect your trading capital from significant losses. By implementing strategies like stop-loss orders and diversifying your portfolio, you can minimize potential risks and enhance your chances of long-term success.

- How do I set realistic trading goals?

To set realistic trading goals, consider your risk tolerance, the amount of time you can dedicate to trading, and your desired returns. It's essential to create specific, measurable, achievable, relevant, and time-bound (SMART) goals to keep you focused and motivated.

- What are stop-loss orders?

Stop-loss orders are automated instructions to sell a security when it reaches a certain price. They help limit potential losses by exiting a trade before it declines significantly, acting as a safety net for your investments.

- What is the difference between technical and fundamental analysis?

Technical analysis focuses on historical price movements and chart patterns to predict future market behavior. In contrast, fundamental analysis examines economic factors, such as company earnings and macroeconomic indicators, to assess the intrinsic value of an asset.

- How can I backtest my trading strategy?

You can backtest your trading strategy by using historical market data to simulate trades based on your strategy's rules. Various trading platforms offer backtesting tools that allow you to analyze the performance of your strategy over a specified period.

- Why is continuous improvement important in trading?

Continuous improvement is vital in trading because the financial markets are constantly changing. By refining your strategies, learning from past trades, and staying updated with market trends, you can adapt to new conditions and enhance your trading performance.

- What trading style should I choose?

Your trading style should align with your personality, lifestyle, and goals. Consider factors like how much time you can dedicate to trading and your risk tolerance. Common styles include day trading, swing trading, and long-term investing, each with its unique approach and time commitment.