How to Balance Risk and Reward in Crypto Trading

In the fast-paced world of cryptocurrency trading, finding the right balance between risk and reward is crucial for success. As a trader, you're constantly navigating a landscape filled with opportunities and pitfalls. It’s akin to walking a tightrope, where one misstep could lead to significant losses, while a well-calculated move could yield substantial profits. The key lies in understanding the dynamics of the market and employing strategies that help you manage risk while maximizing your potential gains. This article will explore various strategies, insights, and techniques that can help both novice and experienced traders enhance their trading outcomes.

Risk in crypto trading is a multifaceted concept that encompasses various factors, including market volatility, regulatory changes, and technological issues. The cryptocurrency market is notorious for its price swings, which can happen in the blink of an eye. For example, a coin that surges by 20% one day could plummet by the same percentage the next. Recognizing these risks is essential for developing effective trading strategies. Moreover, external factors such as government regulations or technological advancements can also impact market dynamics. Therefore, understanding the landscape and being aware of potential risks is the first step toward becoming a successful trader.

Evaluating reward potential involves assessing the likelihood of profit against the inherent risks of an investment. In the volatile crypto market, this can be a daunting task. Traders must analyze various factors, including market trends, historical performance, and news events that could influence prices. One effective method is to calculate the risk-reward ratio, which compares the expected profit of a trade to the potential loss. For instance, if you expect to gain $300 on a trade but risk $100, your risk-reward ratio is 3:1. This means for every dollar you risk, you aim to make three. Understanding this ratio aids in making informed trading decisions and helps you prioritize trades that offer the best potential returns.

The risk-reward ratio is a key metric that helps traders determine the potential profit against the loss they might incur. A favorable risk-reward ratio allows traders to take calculated risks without exposing themselves to significant losses. It’s vital to remember that even the best traders experience losses; the goal is to ensure that the wins outweigh the losses. To illustrate, consider the following table that outlines different risk-reward scenarios:

| Trade Scenario | Potential Gain | Potential Loss | Risk-Reward Ratio |

|---|---|---|---|

| Trade A | $600 | $200 | 3:1 |

| Trade B | $400 | $100 | 4:1 |

| Trade C | $200 | $50 | 4:1 |

Setting target prices is a vital strategy that involves establishing specific price points for taking profits or cutting losses. This disciplined approach helps traders avoid emotional decision-making, which can often lead to unfavorable outcomes. By having clear targets, you can reduce the anxiety that comes with trading and make more rational decisions. For instance, if you set a target price based on your risk-reward analysis, you can stick to your plan and avoid the temptation to hold onto a losing position in hopes of a rebound.

Stop-loss orders are essential tools for managing risk in crypto trading. These orders automatically sell an asset when it reaches a predetermined price, helping to limit potential losses in volatile markets. Implementing stop-loss orders can be compared to wearing a seatbelt in a car; it may not prevent an accident, but it significantly reduces the impact. By using stop-loss orders, you can protect your investments and ensure that a single trade doesn’t derail your overall trading strategy.

Market analysis techniques, including fundamental and technical analysis, provide valuable insights into price movements. Fundamental analysis involves examining the underlying factors that affect a cryptocurrency's value, such as technology, adoption, and market demand. On the other hand, technical analysis focuses on price charts and patterns to predict future movements. Utilizing these methods helps traders make informed decisions based on market trends and data, ultimately leading to better risk management and reward optimization.

Diversification is a proven risk management strategy that involves spreading investments across various assets. By diversifying your crypto portfolio, you can mitigate risks while enhancing potential rewards. Instead of putting all your eggs in one basket, consider investing in a mix of established coins, altcoins, and even stablecoins. This approach can cushion your portfolio against the volatility of individual assets and provide a more stable investment experience.

Asset allocation principles guide traders in distributing their investments among different cryptocurrencies based on risk tolerance and market conditions. This approach helps maintain a balanced portfolio, ensuring that no single investment can significantly impact your overall financial health. For instance, if you're risk-averse, you might allocate a larger portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, while reserving a smaller percentage for more volatile altcoins.

Incorporating stablecoins into your crypto portfolio can provide stability during market fluctuations. Stablecoins are pegged to traditional currencies, making them less susceptible to the wild price swings seen in other cryptocurrencies. This section explores how stablecoins can act as a buffer against volatility while still offering growth potential. By holding a portion of your portfolio in stablecoins, you can quickly pivot back into more volatile assets when market conditions are favorable, allowing you to seize opportunities without taking on excessive risk.

Understanding the psychological factors influencing trading decisions is vital for balancing risk and reward. Emotions like fear and greed can cloud judgment, leading to impulsive decisions that can jeopardize your trading success. This section delves into common emotional pitfalls and strategies to maintain a disciplined trading mindset. By recognizing these psychological triggers, traders can develop a more rational approach to decision-making, ultimately improving their trading outcomes.

Fear and greed are powerful emotions that can significantly impact trading decisions. Fear of missing out (FOMO) can lead to impulsive buying, while fear of loss can result in premature selling. Learning to recognize and manage these emotions is essential for making rational trading decisions. One effective strategy is to establish a clear trading plan that outlines your goals and risk tolerance. By adhering to this plan, you can minimize the influence of emotions on your trading activities.

A well-defined trading plan outlines strategies, goals, and risk management techniques. This structured approach is crucial for navigating the complexities of crypto trading. Your trading plan should include your risk tolerance, entry and exit strategies, and criteria for evaluating trades. By having a clear roadmap, you can reduce the stress associated with trading and make more informed decisions. Remember, a good trader is not just reactive but proactive, anticipating market movements and adjusting their strategies accordingly.

- What is the best way to manage risk in crypto trading?

The best way to manage risk is through a combination of strategies such as setting stop-loss orders, diversifying your portfolio, and using a well-defined trading plan. - How can I evaluate the reward potential of a trade?

You can evaluate reward potential by analyzing the risk-reward ratio, assessing market trends, and considering fundamental factors that might impact the asset's value. - Why is psychological discipline important in trading?

Psychological discipline helps traders avoid impulsive decisions driven by fear or greed, leading to more rational and calculated trading outcomes.

Understanding Risk in Crypto Trading

When diving into the world of cryptocurrency trading, one must first grasp the concept of risk. In this volatile market, risk is not just a buzzword; it’s a reality that every trader, whether novice or seasoned, must confront. The potential for loss is ever-present, driven by factors such as market volatility, regulatory changes, and technological issues. Imagine riding a roller coaster—there are thrilling ups and terrifying downs, and the same applies to crypto trading. The key to navigating this ride is understanding what risks you’re facing and how to manage them effectively.

Market volatility is perhaps the most notorious risk in crypto trading. Prices can swing wildly within hours, leading to significant gains or losses. For instance, a cryptocurrency that surges by 20% in one day can plummet by the same percentage the next. This unpredictability can be exhilarating, but it can also lead to sleepless nights for traders who are unprepared. To illustrate this, consider the following table that showcases the price fluctuations of a popular cryptocurrency over a week:

| Day | Price ($) | Change (%) |

|---|---|---|

| Monday | 50 | - |

| Tuesday | 60 | +20% |

| Wednesday | 48 | -20% |

| Thursday | 70 | +45% |

| Friday | 55 | -21% |

| Saturday | 65 | +18% |

| Sunday | 50 | -23% |

This table highlights how quickly fortunes can change in the crypto landscape. As a trader, recognizing these patterns and preparing for them is crucial. Additionally, regulatory changes can introduce new risks. Governments worldwide are still figuring out how to handle cryptocurrencies, and sudden regulations can impact prices dramatically. For example, a country announcing a ban on crypto trading can lead to panic selling, causing prices to crash.

Moreover, technological issues pose another layer of risk. The crypto market relies heavily on blockchain technology, which, while revolutionary, is not infallible. Hacks, system failures, or even human errors can lead to significant losses. Just think about it: if you lose access to your wallet due to a technical glitch, all your investments could vanish in an instant. This scenario underscores the importance of securing your assets and staying informed about the technology behind your investments.

To effectively manage these risks, traders need to develop a well-rounded strategy. This involves not only understanding the risks but also being proactive in mitigating them. Here are a few strategies to consider:

- Research: Always stay informed about market trends and news that could affect your investments.

- Risk Assessment: Evaluate your risk tolerance before making any trades.

- Continuous Learning: The crypto market is constantly evolving; keep learning to stay ahead.

In conclusion, understanding risk in crypto trading is not just about acknowledging that it exists; it’s about developing a comprehensive strategy to navigate it. By recognizing the various risks—market volatility, regulatory changes, and technological issues—traders can better prepare themselves for the unpredictable nature of the crypto world. Remember, the goal isn’t to eliminate risk entirely but to manage it wisely so that you can enjoy the rewards that come with trading.

Evaluating Reward Potential

When diving into the world of cryptocurrency, one of the most thrilling yet daunting tasks is evaluating the reward potential of your investments. Imagine you’re standing at the edge of a vast ocean, with waves representing the unpredictable nature of crypto markets. Each wave carries the promise of profit, but it also harbors the risk of loss. So, how do you gauge whether the rewards are worth the risks? It’s all about assessing the likelihood of profit against the inherent risks involved in each investment.

To start, it’s essential to understand that the crypto market is notoriously volatile. Prices can soar to new heights one moment and plummet the next. Therefore, evaluating reward potential involves not just looking at past performance but also considering various factors that could influence future gains. Here are a few key aspects to consider:

- Market Trends: Keep an eye on the overall market sentiment. Bullish trends often lead to higher reward potential, while bearish trends can signify risks.

- Technological Developments: Innovations in blockchain technology or upgrades in specific cryptocurrencies can significantly impact their value.

- Regulatory Changes: Changes in government regulations can either bolster or hinder the growth of cryptocurrencies, affecting their reward potential.

Next, let’s talk about the Risk-Reward Ratio. This vital metric helps traders make informed decisions by comparing the potential profit of a trade against the potential loss. For instance, if a trader is considering an investment with a potential profit of $300, but the maximum loss is $100, the risk-reward ratio would be 3:1. This suggests that for every dollar risked, there is a potential reward of three dollars. A favorable risk-reward ratio is generally considered to be 1:2 or higher, meaning the potential reward should be at least double the potential risk.

But how do you actually calculate this risk-reward ratio? Here’s a simple formula:

| Potential Profit | Potential Loss | Risk-Reward Ratio |

|---|---|---|

| $300 | $100 | 3:1 |

| $200 | $100 | 2:1 |

| $150 | $150 | 1:1 |

As you can see from the table, a higher risk-reward ratio indicates a more attractive investment opportunity. However, it’s crucial to remember that a favorable ratio does not guarantee profits. It merely serves as a guideline to help inform your trading decisions.

Moreover, evaluating reward potential also involves setting realistic expectations. While it’s tempting to chase after the next Bitcoin or Ethereum, it’s essential to ground your expectations in reality. Researching the fundamentals of a cryptocurrency, such as its use case, team, and market position, can provide valuable insights into its long-term viability and potential for growth.

In conclusion, evaluating reward potential in crypto trading is a multifaceted process that requires a keen understanding of market dynamics, a solid grasp of risk-reward ratios, and a realistic approach to expectations. By carefully analyzing these factors, you can enhance your trading strategies and increase your chances of achieving favorable outcomes. Remember, in the world of crypto, knowledge is your best ally!

Q1: What is the best way to evaluate reward potential in crypto trading?

A1: The best way to evaluate reward potential is by analyzing market trends, technological developments, and regulatory changes, while also calculating the risk-reward ratio for each investment.

Q2: How important is the risk-reward ratio?

A2: The risk-reward ratio is crucial as it helps traders assess whether the potential profit justifies the risk taken on an investment. A favorable ratio can guide better trading decisions.

Q3: Can I predict the reward potential of a cryptocurrency?

A3: While you can analyze various factors that may influence a cryptocurrency's value, predicting the exact reward potential is challenging due to market volatility and external influences.

Risk-Reward Ratio Explained

The risk-reward ratio is a fundamental concept in trading, especially in the unpredictable world of cryptocurrency. It essentially measures the potential profit of a trade relative to its potential loss. Imagine you're at a casino: you wouldn't bet $100 to win just $10, would you? That’s where the risk-reward ratio comes into play. A favorable ratio is typically considered to be 1:2 or better, meaning for every dollar you risk, you aim to make two. This principle helps traders make informed decisions and manage their expectations.

To calculate the risk-reward ratio, you can use a simple formula:

Risk-Reward Ratio (Potential Profit) / (Potential Loss)

Understanding this ratio allows traders to evaluate whether a trade is worth taking. For instance, if you plan to buy Bitcoin at $40,000 and set a target price of $45,000, your potential profit is $5,000. If you also set a stop-loss at $39,000, your potential loss is $1,000. Plugging these values into the formula gives you:

Risk-Reward Ratio $5,000 / $1,000 5:1

This means you are willing to risk $1 to potentially gain $5, which is a favorable scenario. However, if the ratio is less than 1:1, it might be a sign that the trade is too risky, and you should rethink your strategy.

Moreover, the risk-reward ratio isn't just a static number; it should be adjusted based on market conditions and your own trading style. For instance, if you're a day trader, you might look for tighter ratios because you are executing multiple trades throughout the day. On the other hand, a long-term investor might be more comfortable with wider ratios, banking on the overall market trend. The key is to find a balance that suits your risk tolerance and trading goals.

Incorporating the risk-reward ratio into your trading strategy can dramatically improve your decision-making process. By consistently evaluating potential trades against this metric, you can enhance your chances of success in the volatile crypto market. Remember, it's not just about making profits; it's about managing your risks effectively.

- What is a good risk-reward ratio? A good risk-reward ratio is typically considered to be 1:2 or better, meaning you aim to gain twice as much as you risk.

- How do I adjust my risk-reward ratio? You can adjust your risk-reward ratio by changing your target prices or stop-loss levels based on market conditions and your trading strategy.

- Can I use the risk-reward ratio for all types of trading? Yes, the risk-reward ratio can be applied to various trading styles, including day trading, swing trading, and long-term investing.

Setting Target Prices

Setting target prices is a fundamental strategy in crypto trading that can significantly enhance your decision-making process. Imagine you're on a road trip; you wouldn't just drive aimlessly without a destination, right? Similarly, in trading, having clear target prices helps you navigate the volatile landscape of cryptocurrency markets. Target prices are specific price points at which you plan to take profits or cut losses, and they serve as your guiding stars in the often-chaotic world of digital assets.

When establishing these target prices, it's essential to consider various factors, including market trends, historical price movements, and your own risk tolerance. For instance, if you've invested in a cryptocurrency that has shown consistent growth over the past few months, you might set a target price that reflects a reasonable percentage gain based on that trend. However, it's crucial to remain flexible; the crypto market is notorious for its unpredictability, and sticking rigidly to a target can lead to missed opportunities.

One effective approach to setting target prices is to utilize the Risk-Reward Ratio. This ratio helps you evaluate the potential profit against the potential loss of a trade. For example, if you enter a trade at $100 with a target price of $120, your potential profit is $20. If you set a stop-loss at $90, your potential loss is $10. In this case, your risk-reward ratio is 2:1, which is generally considered favorable. A good rule of thumb is to aim for a risk-reward ratio of at least 1:2, meaning for every dollar you risk, you should aim to make two dollars.

Moreover, incorporating technical analysis can aid in determining realistic target prices. By analyzing charts and patterns, traders can identify key support and resistance levels, which can act as natural target points. For instance, if a cryptocurrency has historically struggled to break through a certain price level, that level can serve as a target price for taking profits. Conversely, if it has consistently bounced back from a lower price point, that could be a sensible stop-loss level.

To illustrate the concept further, here’s a simple table showing how to set target prices based on different scenarios:

| Scenario | Entry Price | Target Price | Stop-Loss Price | Risk-Reward Ratio |

|---|---|---|---|---|

| Scenario 1 | $100 | $120 | $90 | 2:1 |

| Scenario 2 | $50 | $70 | $45 | 2:1 |

| Scenario 3 | $200 | $250 | $180 | 3:1 |

By setting target prices, traders can maintain discipline and avoid emotional decision-making that often leads to losses. It’s like having a roadmap; it keeps you focused and on track, even when the market tries to throw you off course. Remember, the goal is not just to make a quick buck but to develop a sustainable trading strategy that can weather the storms of market volatility.

In conclusion, setting target prices is not merely about choosing arbitrary numbers; it’s about crafting a well-thought-out strategy that considers market conditions, personal goals, and risk management. By doing so, you empower yourself to make informed decisions that align with your trading philosophy and financial objectives.

Using Stop-Loss Orders

When it comes to navigating the tumultuous waters of cryptocurrency trading, stop-loss orders can be your lifebuoy. These orders are like a safety net that automatically sell your assets when they hit a specific price point. Imagine you're on a rollercoaster: the thrill is exhilarating, but you wouldn't want to plunge into the depths without a safety harness, right? That's exactly what stop-loss orders do for your investments—they help you manage risk while still allowing for potential gains.

Setting a stop-loss order is straightforward but requires careful thought. You need to decide at what price you want to exit a trade to limit your losses. This price should be based on your overall trading strategy and risk tolerance. For instance, if you buy Bitcoin at $40,000 and set a stop-loss order at $38,000, you're telling the market, "If my investment drops to $38,000, sell it." This way, you limit your loss to $2,000. However, it's crucial to choose your stop-loss level wisely, as setting it too close to your entry point may lead to premature sell-offs due to normal market fluctuations.

One of the common pitfalls is letting emotions dictate your trading decisions. Without a stop-loss order, you might find yourself holding onto a losing position, hoping it will bounce back. This is akin to watching a sinking ship and thinking, "Maybe it'll float again!" Instead, a stop-loss order allows you to cut your losses and reallocate your funds to more promising opportunities. In fact, many seasoned traders consider stop-loss orders as an essential part of their trading toolkit, emphasizing that they can help maintain discipline in an otherwise chaotic environment.

To illustrate the effectiveness of stop-loss orders, let’s look at a simple table comparing two trading scenarios: one with a stop-loss and one without.

| Scenario | Investment Price | Stop-Loss Price | Outcome |

|---|---|---|---|

| With Stop-Loss | $40,000 | $38,000 | Sold at $38,000, Loss: $2,000 |

| Without Stop-Loss | $40,000 | N/A | Price drops to $30,000, Loss: $10,000 |

As you can see from the table, using a stop-loss order can significantly reduce your potential losses. In the volatile world of crypto, where prices can swing dramatically in a matter of hours, having this safety mechanism in place is not just smart—it's essential.

In conclusion, incorporating stop-loss orders into your trading strategy is a proactive approach to risk management. They not only protect your investments but also empower you to make more rational decisions. Remember, the goal isn't just to make profits; it's also about preserving your capital for future opportunities. So, the next time you enter a trade, ask yourself: "Have I set my stop-loss?" If the answer is no, it might be time to reconsider your strategy.

- What is a stop-loss order?

A stop-loss order is an instruction to sell a security when it reaches a certain price, designed to limit an investor's loss on a position.

- How do I set a stop-loss order?

You can set a stop-loss order through your trading platform by specifying the price at which you want to sell your asset.

- Can stop-loss orders guarantee profits?

No, stop-loss orders are designed to limit losses, not guarantee profits. Market conditions can lead to slippage, where the order may execute at a different price.

- Should I use a stop-loss order for every trade?

While it's not mandatory, using stop-loss orders for every trade is recommended as a risk management strategy.

Market Analysis Techniques

When it comes to navigating the often-turbulent waters of cryptocurrency trading, understanding is crucial. These techniques are like the compass and map for traders, guiding them through the unpredictable landscape of digital currencies. Essentially, market analysis can be divided into two primary categories: fundamental analysis and technical analysis.

Fundamental analysis involves evaluating the intrinsic value of a cryptocurrency by examining various factors, such as its technology, team, market demand, and overall economic environment. For example, if you’re looking at a new coin, you might want to consider questions like: What problem does it solve? Who is behind it? How does it compare to competitors? By answering these questions, traders can gain insights into whether a coin is undervalued or overvalued in the current market.

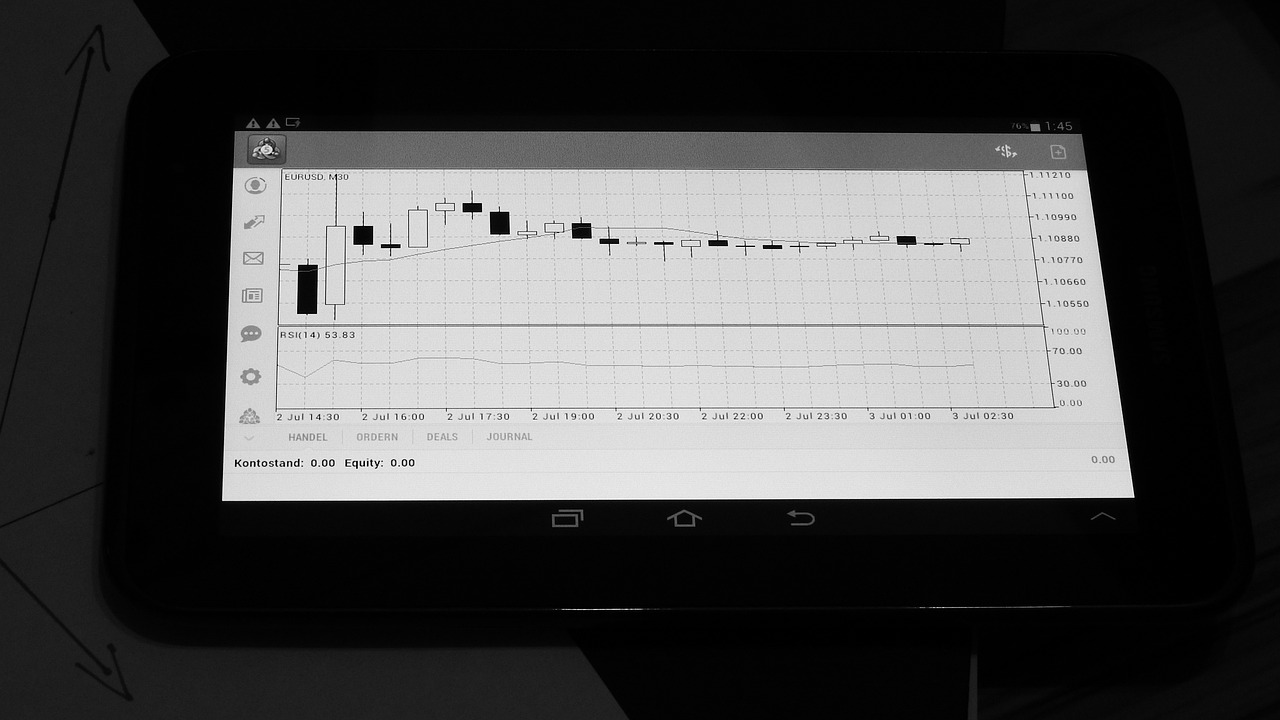

On the other hand, technical analysis relies on statistical trends and historical price movements to forecast future price behavior. This method is akin to looking at a weather pattern to predict tomorrow’s forecast. Traders often use charts and indicators, like moving averages or Relative Strength Index (RSI), to identify potential entry and exit points. For instance, if a coin has consistently bounced off a particular price level, traders might view that level as a support line, indicating a potential buying opportunity.

Combining both fundamental and technical analysis can create a more comprehensive trading strategy. For example, a trader might identify a promising cryptocurrency through fundamental analysis, then use technical indicators to determine the best time to buy in. This dual approach enhances the likelihood of making informed decisions rather than relying on gut feelings or market hype.

Moreover, it’s essential to stay updated with news and trends that can affect the market. Events such as regulatory changes, technological advancements, or significant partnerships can lead to rapid price shifts. Therefore, being proactive in gathering information and analyzing market sentiment is vital. Social media platforms, crypto news websites, and forums can be valuable resources for gauging market sentiment and spotting emerging trends.

In conclusion, mastering market analysis techniques is not just about crunching numbers or reading charts; it’s about understanding the broader context of the cryptocurrency market. By blending fundamental and technical analysis, traders can equip themselves with a robust toolkit for making smarter trading decisions. Remember, in the world of crypto, knowledge is power, and the more informed you are, the better your chances of balancing risk and reward effectively.

- What is the difference between fundamental and technical analysis?

Fundamental analysis focuses on the intrinsic value of a cryptocurrency, while technical analysis uses price movements and statistical data to predict future trends. - How can I stay updated on market trends?

Follow reputable crypto news websites, engage in social media discussions, and participate in online forums to keep abreast of the latest developments. - Is it necessary to use both analysis techniques?

While it’s not mandatory, using both fundamental and technical analysis can provide a more comprehensive understanding of the market and improve trading decisions.

Diversification Strategies

Diversification is not just a fancy finance term; it's a powerful strategy that can make or break your crypto trading experience. Imagine you're at a buffet filled with delicious dishes. If you only pick one item, you might miss out on the flavors of the others, right? Similarly, spreading your investments across various cryptocurrencies can help you manage risk while enhancing your potential rewards. This approach allows you to cushion your portfolio against the unpredictable nature of the crypto market.

When we talk about diversification, we're really discussing the art of not putting all your eggs in one basket. In the world of cryptocurrency, this means investing in a mix of established coins like Bitcoin and Ethereum, alongside promising altcoins that might have a higher risk but also higher reward potential. By balancing your investments, you're less likely to suffer catastrophic losses if one asset dramatically underperforms.

One effective method for achieving diversification is to consider the correlation between different cryptocurrencies. Some coins move together, while others may behave independently. For instance, Bitcoin often sets the tone for the market, but altcoins can react differently to market changes. By analyzing these correlations, you can create a portfolio that minimizes risk. To illustrate this, here's a simple table that shows how different cryptocurrencies have performed in relation to Bitcoin:

| Cryptocurrency | Correlation with Bitcoin | Risk Level |

|---|---|---|

| Ethereum (ETH) | 0.85 | Medium |

| Litecoin (LTC) | 0.75 | Medium |

| Ripple (XRP) | 0.60 | High |

| Cardano (ADA) | 0.50 | Medium |

Incorporating a variety of cryptocurrencies into your portfolio can also help you take advantage of different market cycles. Some coins may thrive in bullish markets, while others might perform well during bearish trends. This is where understanding market conditions becomes crucial. For example, during a market downturn, stablecoins can provide a safe haven, preserving your capital until the market rebounds.

Furthermore, diversification isn't just limited to different cryptocurrencies. You can also explore various investment vehicles such as crypto ETFs or indices that offer exposure to a basket of cryptocurrencies. This method can simplify the diversification process while still allowing you to benefit from the growth of the crypto market.

Ultimately, the key to successful diversification lies in regularly reviewing and adjusting your portfolio. As the crypto landscape evolves, so too should your investment strategy. Keeping an eye on market trends, news, and technological advancements ensures that your portfolio remains balanced and aligned with your risk tolerance and investment goals.

- What is diversification in crypto trading? Diversification in crypto trading refers to spreading investments across various cryptocurrencies to reduce risk and enhance potential rewards.

- How can I effectively diversify my crypto portfolio? You can diversify by investing in a mix of established coins and promising altcoins, considering their correlation and market behavior.

- Are stablecoins a good option for diversification? Yes, stablecoins can provide stability during market fluctuations, acting as a buffer against volatility while still offering growth potential.

- How often should I review my diversified portfolio? It's advisable to review your portfolio regularly, especially when there are significant market changes or news that could affect your investments.

Asset Allocation Principles

When it comes to crypto trading, understanding is essential for creating a robust portfolio that can weather the storm of market volatility. Think of asset allocation as the foundation of your trading strategy—much like a well-built house needs a strong base to stand tall against the elements. By distributing your investments across various cryptocurrencies, you can not only mitigate risks but also enhance your potential for rewards.

One key aspect of asset allocation is recognizing your risk tolerance. Are you a conservative investor who prefers stability, or are you more aggressive, willing to embrace the highs and lows of the market? Your risk tolerance will significantly influence how you allocate your assets. For instance, if you're risk-averse, you might consider allocating a larger portion of your portfolio to more stable cryptocurrencies, like Bitcoin or Ethereum, while limiting exposure to smaller, more volatile altcoins.

Another important factor to consider is the current market conditions. The cryptocurrency landscape is ever-changing, and what works today might not work tomorrow. Regularly assessing market trends and adjusting your allocations accordingly can help you stay ahead of the curve. For example, during a bullish market, you might want to increase your stake in high-growth altcoins, while in a bearish market, shifting towards stablecoins or established cryptocurrencies can offer protection against losses.

To illustrate these principles, let’s look at a theoretical asset allocation for a balanced crypto portfolio:

| Asset Type | Percentage Allocation |

|---|---|

| Bitcoin | 40% |

| Ethereum | 30% |

| Stablecoins | 20% |

| Altcoins | 10% |

This allocation allows for growth through Bitcoin and Ethereum while providing safety with stablecoins. The small allocation to altcoins gives you exposure to potential high returns without overexposing your portfolio to risk.

As you develop your asset allocation strategy, keep in mind that diversification is not just about spreading your investments; it's about finding the right balance that aligns with your investment goals and risk appetite. By regularly reviewing and adjusting your allocations, you can create a dynamic strategy that adapts to the ever-evolving crypto market.

- What is asset allocation? - Asset allocation refers to the strategy of distributing investments among various asset categories to manage risk and achieve desired returns.

- Why is asset allocation important in crypto trading? - It helps in balancing potential risks and rewards, ensuring that your portfolio is not overly exposed to any single asset.

- How often should I review my asset allocation? - Regular reviews, at least quarterly, are recommended to adjust for market conditions and personal financial changes.

- Can I change my asset allocation strategy? - Absolutely! Your asset allocation should evolve based on your risk tolerance, market trends, and investment goals.

Incorporating Stablecoins

When it comes to navigating the tumultuous waters of cryptocurrency trading, stablecoins can serve as a reliable life raft. These digital currencies are designed to maintain a stable value by pegging them to a reserve of assets, such as fiat currency or commodities. This stability can be particularly beneficial during periods of market volatility, where traditional cryptocurrencies can experience wild price swings. By incorporating stablecoins into your trading strategy, you can effectively mitigate risks while still capitalizing on growth opportunities.

One of the primary advantages of stablecoins is their ability to provide liquidity. Imagine you’ve just made a profitable trade in Bitcoin, but you’re worried about a potential downturn. Instead of holding onto your Bitcoin, you can quickly convert it into a stablecoin, locking in your profits while waiting for the right moment to reinvest. This flexibility allows traders to remain agile in a fast-paced market, ensuring that they can respond to changing conditions without being caught off guard.

Moreover, stablecoins can act as a buffer against market fluctuations. For instance, during a market crash, while many cryptocurrencies plummet in value, stablecoins can retain their worth. This characteristic makes them an excellent tool for risk management. By allocating a portion of your portfolio to stablecoins, you can create a safety net that cushions the blow of inevitable market dips.

Incorporating stablecoins into your portfolio can also enhance your trading strategies. Here’s how:

- Hedging Against Volatility: Use stablecoins to hedge your positions. If you anticipate a drop in the market, converting some of your holdings into stablecoins can protect your investment.

- Facilitating Quick Trades: Stablecoins allow you to execute trades without the need to convert back to fiat currency, saving you time and transaction fees.

- Accessing DeFi Opportunities: Many decentralized finance (DeFi) platforms offer attractive interest rates for stablecoin deposits, providing an additional revenue stream.

However, it’s essential to choose the right stablecoin. Not all stablecoins are created equal, and some may carry more risk than others. Look for stablecoins that are backed by reputable reserves and have a transparent operational model. Popular options include Tether (USDT), USD Coin (USDC), and Dai (DAI). Each of these stablecoins has its unique features and benefits, so do your research to find the one that aligns best with your trading goals.

In summary, incorporating stablecoins into your trading strategy can provide significant advantages, including enhanced liquidity, risk management, and the ability to capitalize on market opportunities. As you build your crypto portfolio, consider allocating a portion to stablecoins to create a more balanced approach that withstands the volatility of the crypto landscape.

- What are stablecoins? Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve of assets, such as fiat currency.

- How do stablecoins help in trading? They provide liquidity, act as a buffer against market volatility, and allow for quick trades without converting back to fiat.

- Which stablecoins are the best to use? Popular options include Tether (USDT), USD Coin (USDC), and Dai (DAI), each with different features and benefits.

- Can I lose money with stablecoins? While stablecoins are designed to maintain value, risks can still arise from regulatory changes or issues with the underlying assets.

Psychological Aspects of Trading

When it comes to trading, especially in the volatile world of cryptocurrencies, the psychological aspects play an incredibly significant role. It’s not just about numbers, graphs, and market trends; it’s about how you react to them. Have you ever felt that rush of excitement when a trade goes your way, or the sinking feeling in your stomach when it doesn’t? These emotions are part of the trading game, and managing them can be the difference between success and failure.

One of the most common emotional pitfalls traders face is the age-old battle between fear and greed. Fear can lead to hesitation, causing you to miss out on potential profits or exit trades too early. On the flip side, greed can push you to hold onto a position for too long, hoping for that next big jump, only to watch your gains evaporate. It’s like walking a tightrope; one misstep can send you tumbling down. Recognizing these emotions is the first step toward mastering them. Regularly asking yourself questions such as, “Am I acting out of fear?” or “Is my greed clouding my judgment?” can help keep your trading decisions grounded.

Moreover, developing a well-structured trading plan is crucial. A trading plan is like a roadmap that guides you through the unpredictable terrain of the crypto market. It should outline your strategies, goals, and risk management techniques. Think of it as your personal trading GPS. Without it, you might find yourself lost in the chaos, making impulsive decisions based on fleeting emotions rather than informed strategies.

Consider incorporating the following elements into your trading plan:

- Entry and Exit Strategies: Define when to enter and exit trades based on your analysis.

- Risk Management Techniques: Set clear rules for how much you’re willing to lose on any given trade.

- Performance Review: Regularly assess your trades to learn from both victories and mistakes.

In addition to having a trading plan, maintaining a disciplined mindset is essential. This discipline is what separates successful traders from those who struggle. It’s easy to get swept up in the excitement of a market rally or panic during a downturn, but sticking to your plan helps you remain level-headed. Just like a marathon runner who trains for months, you must prepare mentally and emotionally for the ups and downs of trading.

Lastly, it’s important to remember that trading is not just about making money; it’s also about self-improvement. Every trade offers a lesson, whether you win or lose. Embrace the journey of becoming a better trader by reflecting on your experiences and adjusting your strategies accordingly. The psychological aspects of trading are not just hurdles to overcome; they are opportunities for growth. So, the next time you find yourself in a trading frenzy, take a step back, breathe, and remind yourself of the bigger picture.

Q: How can I manage my emotions while trading?

A: Managing emotions involves self-awareness and discipline. Create a trading plan, set clear goals, and stick to your strategies to help mitigate emotional decision-making.

Q: What should I include in my trading plan?

A: Your trading plan should include entry and exit strategies, risk management rules, and a performance review process to analyze your trades.

Q: How can I learn from my trading mistakes?

A: Keep a trading journal to document your trades, including the reasons for entering and exiting. Review this journal regularly to identify patterns and areas for improvement.

Managing Fear and Greed

In the thrilling world of crypto trading, emotions can often run high. Two of the most powerful emotions that traders face are fear and greed. These feelings can significantly impact decision-making, leading to impulsive actions that can result in substantial losses. Imagine standing on the edge of a cliff, looking down at the swirling waters below. The fear of falling can paralyze you, while the desire to leap for a thrill can push you to take unnecessary risks. In trading, this metaphorical cliff represents the volatile nature of the market, where the stakes are high, and the potential for profit is alluring.

Fear often manifests when traders witness sudden market declines, leading to panic selling. This reaction can be detrimental, as it may cause traders to exit positions prematurely, missing out on potential recoveries. Conversely, greed can lead to overconfidence, where traders hold onto their assets for too long, hoping for an unrealistic price surge. The key to navigating these emotional waters is self-awareness. Recognizing when fear or greed is influencing your decisions is the first step towards maintaining a balanced approach.

To effectively manage these emotions, consider implementing the following strategies:

- Set Clear Goals: Define what success looks like for you in trading. Having specific, measurable goals can help anchor your decisions and reduce the influence of emotions.

- Practice Mindfulness: Techniques such as meditation or deep-breathing exercises can help calm your mind, allowing you to think more clearly when making trading decisions.

- Limit Exposure: By only investing what you can afford to lose, you can mitigate the fear of losing significant amounts of money. This can create a more relaxed trading environment.

- Review Past Trades: Analyzing previous trades can provide valuable insights into your emotional responses and help you identify patterns that may lead to fear or greed.

Additionally, creating a trading journal can be a game-changer. Documenting your thoughts, feelings, and the rationale behind each trade allows you to reflect on your emotional state over time. This practice not only enhances self-awareness but also helps you develop a more disciplined approach to trading.

Ultimately, the goal is to cultivate a mindset that embraces rationality over emotion. By acknowledging the psychological aspects of trading, you can make more informed decisions that align with your trading strategy rather than being swayed by fleeting feelings. Just as a skilled sailor learns to navigate through storms, a successful trader learns to sail through the turbulent waters of fear and greed.

Q: How can I recognize when fear or greed is affecting my trading decisions?

A: Pay attention to your emotional responses during trading. If you find yourself making impulsive decisions, such as selling in a panic or holding onto a losing position due to hope of recovery, these are signs that your emotions may be influencing your actions.

Q: What are some practical steps to reduce emotional trading?

A: Setting clear trading goals, practicing mindfulness, limiting your investment exposure, and maintaining a trading journal are effective strategies to help you stay disciplined and focused.

Q: Is it possible to completely eliminate fear and greed from trading?

A: While it may not be possible to eliminate these emotions entirely, you can learn to manage them effectively. Developing self-awareness and implementing strategies to counteract emotional responses can lead to more rational trading decisions.

Developing a Trading Plan

Creating a robust trading plan is akin to drawing a roadmap before embarking on a journey. Without it, you might find yourself lost in the chaotic world of cryptocurrency trading, where emotions and market fluctuations can lead to poor decision-making. A well-structured trading plan not only outlines your strategies and goals but also serves as a framework for managing risk effectively. It’s essential to include specific elements that cater to your trading style, risk tolerance, and market conditions.

First and foremost, define your trading goals. Are you looking to make quick profits through day trading, or are you in it for the long haul with a focus on long-term investments? By establishing clear objectives, you can tailor your trading strategies accordingly. For instance, if your goal is to accumulate wealth over time, you might focus on fundamental analysis and long-term holds rather than short-term market movements.

Next, consider your risk management strategies. This involves determining how much of your capital you are willing to risk on a single trade. Many traders follow the 1% rule, which suggests that you should never risk more than 1% of your total trading capital on any given trade. This approach helps protect your portfolio from significant losses and allows you to stay in the game longer. You could also incorporate a risk-reward ratio into your plan, ensuring that potential rewards outweigh the risks you are taking.

Another critical component of your trading plan should be your entry and exit strategies. Define specific criteria for entering a trade, such as technical indicators or market news. Similarly, set concrete exit points to lock in profits or minimize losses. For example, if you enter a position based on a breakout pattern, you might decide to exit once the price hits a certain target or if it falls below a predetermined support level.

Moreover, it’s vital to include a section for reviewing and adjusting your plan. The crypto market is dynamic, and what works today may not work tomorrow. Regularly reviewing your trading performance allows you to identify patterns, learn from your mistakes, and refine your strategies. You might find it helpful to maintain a trading journal, documenting your trades, the rationale behind your decisions, and the outcomes. This practice not only enhances your self-awareness but also helps you develop a more disciplined approach over time.

In conclusion, developing a trading plan is not just a one-time task but an ongoing process that evolves with your trading experience and market conditions. By establishing clear goals, implementing risk management strategies, defining entry and exit points, and committing to regular reviews, you can navigate the turbulent waters of crypto trading with greater confidence and success.

- What is a trading plan? A trading plan is a comprehensive guide that outlines your trading strategies, goals, risk management techniques, and criteria for entering and exiting trades.

- Why is a trading plan important? A trading plan helps you stay disciplined, manage risk effectively, and make informed decisions, reducing the likelihood of emotional trading.

- How often should I review my trading plan? It's advisable to review your trading plan regularly, at least monthly, to ensure it remains relevant and effective in changing market conditions.

Frequently Asked Questions

- What is the risk-reward ratio in crypto trading?

The risk-reward ratio is a crucial metric that helps traders evaluate the potential profit against the possible loss of a trade. For instance, if a trader risks $100 to potentially gain $300, the risk-reward ratio is 1:3. Understanding this ratio aids traders in making informed decisions and managing their trades more effectively.

- How can I set target prices for my trades?

Setting target prices involves determining specific price points at which you will take profits or cut losses. This strategy helps maintain discipline by preventing emotional decision-making. Traders often analyze market trends and historical price data to establish realistic target prices that align with their trading strategies.

- What are stop-loss orders and why are they important?

Stop-loss orders are automated trading tools that sell an asset when it reaches a predetermined price, effectively limiting potential losses. They are vital in volatile markets like crypto, as they help traders protect their investments from significant downturns and maintain a disciplined trading approach.

- How can diversification help in crypto trading?

Diversification is a risk management strategy that involves spreading investments across various cryptocurrencies. By doing so, traders can mitigate risks associated with market volatility, as poor performance in one asset may be offset by better performance in another. This balanced approach enhances the potential for overall portfolio growth.

- What role do stablecoins play in a crypto portfolio?

Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to traditional currencies like the US dollar. Incorporating stablecoins into a crypto portfolio can provide a buffer against market fluctuations, offering stability during volatile periods while still allowing for growth potential when invested wisely.

- How can I manage emotions like fear and greed in trading?

Managing emotions is crucial for successful trading. Traders should recognize when fear or greed influences their decisions and develop strategies to counteract these feelings. Maintaining a disciplined approach, sticking to a trading plan, and focusing on long-term goals can help mitigate the impact of these emotions on trading outcomes.

- Why is having a trading plan important?

A well-defined trading plan outlines your strategies, goals, and risk management techniques. It serves as a roadmap for navigating the complexities of crypto trading, helping you stay focused and disciplined. Without a plan, traders may be more susceptible to emotional decisions that can lead to losses.