Using Historical Charts for Future Trading

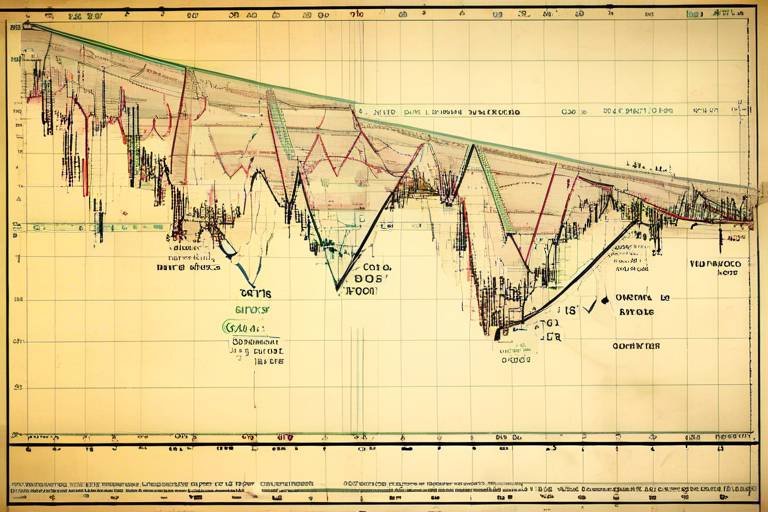

Trading in the financial markets can feel like navigating a vast ocean, filled with unpredictable waves and hidden currents. To successfully steer your ship, you need a reliable map. This is where historical charts come into play. They serve as a crucial tool for traders, providing a visual representation of past market behaviors that can illuminate potential future movements. By analyzing these charts, traders can identify trends, understand market sentiment, and refine their strategies, ultimately enhancing their decision-making processes.

Imagine you're a detective piecing together clues from a crime scene. Each data point on a historical chart is like a clue that tells a story about what has happened in the market. By studying these clues, traders can make educated guesses about what might happen next. This article delves into the significance of historical charts and how they can be leveraged to inform future trading strategies.

Understanding the value of historical data is crucial for traders. It provides context, reveals patterns, and helps in making informed predictions about future market movements. Just like a seasoned sailor uses past weather patterns to predict future storms, traders analyze historical data to forecast potential market shifts. The insights gained from this data can be the difference between a successful trade and a costly mistake.

Various types of historical charts exist, each serving different purposes. Familiarizing oneself with these can enhance analysis and improve trading strategies. Let's explore the three main types of charts:

Line charts offer a straightforward way to visualize price movements over time. They are particularly useful for identifying trends and long-term price movements. Think of them as a simple road map, showing the path the price has taken. By connecting the dots of closing prices, traders can easily spot upward or downward trends, which are essential for making informed trading decisions.

Bar charts provide more detailed information than line charts, displaying opening, closing, high, and low prices. This additional detail aids traders in making more nuanced decisions. Each bar represents a specific time frame and gives a complete picture of price action within that period. For traders looking for deeper insights, bar charts are invaluable.

Candlestick charts are popular among traders for their visual appeal and ability to convey market sentiment. They represent price movements and can indicate potential reversals. Each candlestick tells a story of price action within a specific time frame, with the body representing the open and close prices and the wicks showing the high and low prices. This rich visual data can help traders gauge market momentum and sentiment at a glance.

Trend analysis is a fundamental aspect of trading. Historical charts enable traders to identify upward, downward, and sideways trends, assisting in predicting future market behavior. Recognizing these trends is akin to reading the winds before setting sail; it helps traders determine the best course of action. By understanding current trends, traders can position themselves advantageously in the market.

Integrating technical indicators with historical charts can enhance trading strategies. Indicators like moving averages and the Relative Strength Index (RSI) help traders interpret price movements and make informed decisions. These tools act like compasses, guiding traders through the complexities of market analysis.

Moving averages smooth out price data to identify trends over specific periods. They are widely used to determine entry and exit points in trading. By filtering out the noise of daily price fluctuations, moving averages help traders see the bigger picture and make more strategic decisions.

The RSI is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions in the market. When the RSI indicates that an asset is overbought, it might be time to consider selling. Conversely, an oversold condition could signal a buying opportunity. This makes the RSI a valuable tool for timing trades effectively.

Backtesting involves applying trading strategies to historical data to evaluate their effectiveness. This process helps traders refine their approaches and increase the likelihood of future success. Think of backtesting as a rehearsal before the big performance; it allows traders to fine-tune their strategies based on past performances before risking real capital in the market.

Even experienced traders can make mistakes when interpreting historical charts. Recognizing common pitfalls can help traders avoid costly errors and improve their analysis. Here are a couple of common mistakes to watch out for:

While historical data is valuable, overreliance on it can lead to misguided decisions. Markets evolve, and past performance is not always indicative of future results. It's essential to use historical data as a guide, not a crutch. Just as a sailor must adapt to changing weather conditions, traders must be flexible and responsive to new information.

Failing to consider the broader market context can skew analysis. Economic indicators, news events, and market sentiment should also inform trading decisions alongside historical charts. A trader who ignores these factors might find themselves sailing into treacherous waters without a life jacket.

- What are historical charts? Historical charts are graphical representations of past market data, showing price movements over time.

- Why are historical charts important for trading? They help traders identify trends, patterns, and potential future market movements, enhancing decision-making.

- What types of historical charts should I use? The most common types are line charts, bar charts, and candlestick charts, each providing different insights.

- How can I improve my trading strategies using historical charts? By analyzing trends, integrating indicators, and backtesting strategies against historical data, traders can refine their approaches.

The Importance of Historical Data

This article explores the significance of historical charts in trading, providing insights into how they can inform future trading strategies and enhance decision-making processes for traders.

Understanding the value of historical data is crucial for traders. Think of historical data as a treasure map—it shows you where the pitfalls are and where the gold mines might be hidden. By analyzing past market movements, traders can uncover patterns that often repeat, giving them a competitive edge in making informed predictions about future market movements. Without this historical context, trading can feel like sailing without a compass; you might end up lost in the turbulent waters of the market.

One of the most significant benefits of using historical data is its ability to reveal trends. For example, when you look at a historical chart, you might notice that a particular stock tends to rise during certain months of the year. This seasonal trend can be a game-changer for your trading strategy. Moreover, historical data can help you understand the volatility of a stock or market. By examining how dramatically prices have fluctuated in the past, you can better anticipate potential risks and rewards in the future.

It's also important to recognize that historical data can provide insights into market sentiment. For instance, if a stock price has consistently dropped after a major economic event, such as a recession, this information can inform your decisions when similar situations arise. The psychology of trading often plays a critical role, and knowing how the market reacted in the past can give you a clearer picture of what might happen next.

In summary, leveraging historical data is not just about looking back; it's about arming yourself with the knowledge to make smarter, more strategic decisions moving forward. As the saying goes, "Those who cannot remember the past are condemned to repeat it." By utilizing historical charts, you can avoid the mistakes of the past and navigate the future with confidence.

Various types of historical charts exist, each serving different purposes. Familiarizing oneself with these can enhance analysis and improve trading strategies.

Line charts offer a straightforward way to visualize price movements over time. They are particularly useful for identifying trends and long-term price movements.

Bar charts provide more detailed information than line charts, displaying opening, closing, high, and low prices. This additional detail aids traders in making more nuanced decisions.

Candlestick charts are popular among traders for their visual appeal and ability to convey market sentiment. They represent price movements and can indicate potential reversals.

Trend analysis is a fundamental aspect of trading. Historical charts enable traders to identify upward, downward, and sideways trends, assisting in predicting future market behavior.

Integrating technical indicators with historical charts can enhance trading strategies. Indicators like moving averages and RSI help traders interpret price movements and make informed decisions.

Moving averages smooth out price data to identify trends over specific periods. They are widely used to determine entry and exit points in trading.

The RSI is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions in the market.

Backtesting involves applying trading strategies to historical data to evaluate their effectiveness. This process helps traders refine their approaches and increase the likelihood of future success.

Even experienced traders can make mistakes when interpreting historical charts. Recognizing common pitfalls can help traders avoid costly errors and improve their analysis.

While historical data is valuable, overreliance on it can lead to misguided decisions. Markets evolve, and past performance is not always indicative of future results.

Failing to consider the broader market context can skew analysis. Economic indicators, news events, and market sentiment should also inform trading decisions alongside historical charts.

- What is the main benefit of using historical charts in trading?

Historical charts help traders identify trends and patterns, enabling more informed decision-making. - How can I avoid common mistakes when using historical data?

Be mindful of overreliance on past data and always consider the current market context. - Are there different types of historical charts?

Yes, the most common types include line charts, bar charts, and candlestick charts, each serving unique purposes. - What role do technical indicators play in analyzing historical charts?

Technical indicators help traders interpret price movements and enhance their trading strategies.

Types of Historical Charts

When it comes to trading, the you use can significantly impact your analysis and decision-making process. Each chart type has its unique strengths and weaknesses, catering to different trading styles and strategies. Understanding these differences is crucial for any trader looking to enhance their market insights. Let’s dive into the three most common types of historical charts: line charts, bar charts, and candlestick charts. By familiarizing yourself with these tools, you can better interpret price movements and trends.

Line charts are perhaps the simplest and most straightforward type of historical chart. They plot a series of data points connected by straight lines, offering a clear view of price movements over time. This simplicity makes them particularly useful for identifying long-term trends. For instance, if you’re analyzing a stock’s performance over several months, a line chart can quickly reveal whether the price is generally trending upwards, downwards, or remaining stable. However, while line charts provide a great overview, they may lack the detail needed for more nuanced trading decisions.

Bar charts take things a step further by providing more detailed information than line charts. Each bar represents a specific time interval (like a day or week) and displays the opening, closing, high, and low prices for that period. This additional detail can be invaluable for traders who want to understand market volatility and price fluctuations. For example, if a bar shows a wide range between the high and low prices, it indicates significant price movement during that time, which could be a signal for traders to take action. By analyzing these bars, traders can make more informed decisions based on the market’s behavior.

Candlestick charts have gained immense popularity among traders for their visual appeal and ability to convey market sentiment effectively. Each candlestick represents price movements within a specific time frame and is composed of a body and wicks. The body indicates the opening and closing prices, while the wicks show the high and low prices during that period. What makes candlestick charts particularly powerful is their ability to indicate potential market reversals and trends. For instance, a series of bullish candlesticks can suggest upward momentum, while bearish candlesticks can indicate a potential downturn. By analyzing patterns in candlestick formations, traders can gain insights into market psychology and make more strategic trading decisions.

In conclusion, understanding the different types of historical charts is essential for any trader looking to refine their strategies. Each chart type offers unique insights into price movements, and by leveraging these tools, you can enhance your trading analysis and decision-making process. Remember, the key to successful trading lies not just in the charts themselves, but in how you interpret and apply the information they provide.

Q1: What is the best type of chart for beginners?

A1: For beginners, line charts are often the easiest to understand as they provide a clear view of price trends over time without overwhelming details.

Q2: How do I choose which chart type to use?

A2: The choice of chart type depends on your trading style. If you prefer a long-term view, line charts may suffice. For more detailed analysis, consider bar or candlestick charts.

Q3: Can I use multiple chart types simultaneously?

A3: Absolutely! Many traders use a combination of chart types to get a well-rounded view of the market and validate their trading strategies.

Line Charts

Line charts are one of the most fundamental tools in a trader's toolbox, offering a clear and straightforward way to visualize price movements over time. Imagine tracing the ups and downs of a roller coaster; that’s what a line chart does for stock prices. Each point on the chart represents a price at a specific time, and when these points are connected, they create a line that illustrates the overall trend. This simplicity is what makes line charts particularly appealing to both novice and experienced traders.

One of the key benefits of using line charts is their ability to highlight trends. By observing the slope of the line, traders can quickly identify whether the price is generally moving up, down, or remaining stable. For instance, a steep upward slope signifies a bullish trend, where prices are increasing, while a downward slope indicates a bearish trend, where prices are falling. This visual clarity allows traders to make quicker decisions based on market conditions.

Furthermore, line charts can be customized to display price data over various time frames, ranging from minutes to years. This flexibility enables traders to zoom in on short-term fluctuations or zoom out to understand long-term movements. For example, a trader might examine a daily line chart to make quick trades, while also looking at a yearly chart to gauge the overall market sentiment.

However, while line charts are incredibly useful, they do have limitations. They only display closing prices, which means traders miss out on important information such as opening prices, highs, and lows. To address this, many traders complement line charts with other types of charts, like bar or candlestick charts, that provide more detailed information about price action. By combining these tools, traders can gain a more comprehensive view of market dynamics.

In summary, line charts serve as a vital starting point for traders seeking to understand market trends. Their straightforward nature allows for quick analysis, making them an indispensable part of any trading strategy. Whether you're a beginner just starting or a seasoned trader refining your approach, mastering line charts can significantly enhance your trading effectiveness.

- What are line charts used for in trading? Line charts are primarily used to visualize price movements over time, helping traders identify trends and make informed decisions.

- Why are line charts considered simple? They connect closing prices over time with a single line, making it easy to see overall price direction without clutter.

- Can line charts be used for short-term trading? Yes, line charts can be adjusted to display various time frames, making them suitable for both short-term and long-term trading strategies.

- What are the limitations of line charts? Line charts only show closing prices, which means they do not provide information about opening prices, highs, or lows during a trading session.

Bar Charts

Bar charts are an essential tool in the trader's arsenal, offering a wealth of information at a glance. Unlike line charts, which simply connect price points over time, bar charts provide a more detailed view of price action. Each bar on the chart represents a specific time period (which can range from minutes to days, depending on the trader's strategy) and displays four key price points: the opening price, closing price, highest price, and lowest price. This detailed representation allows traders to see not just where the price has been, but also how it got there.

Imagine you're reading a story where every chapter reveals not just the events, but also the emotions and motivations of the characters involved. Bar charts do exactly that for price movements. They tell the story of market sentiment—was there buying pressure? Did sellers dominate the session? By examining the length and position of the bars, traders can gauge the strength of the market's movements. For instance, a long bar with a close near its high indicates strong buying interest, while a long bar closing near its low suggests selling pressure.

To better illustrate the usefulness of bar charts, consider the following table that outlines the information conveyed by each component of a bar:

| Component | Description |

|---|---|

| Open | The price at which the asset started trading during the time period. |

| Close | The price at which the asset finished trading during the time period. |

| High | The highest price reached during the time period. |

| Low | The lowest price reached during the time period. |

Understanding bar charts is crucial for effective trading. They can help identify potential reversal points, as well as confirm existing trends. For example, if you notice a series of bars that are consistently closing higher, it might indicate a bullish trend. Conversely, if the bars are closing lower, it could signal a bearish trend. Moreover, bar charts can be used in conjunction with other technical analysis tools to enhance trading strategies. By analyzing the patterns created by these bars, traders can make more informed decisions about when to enter or exit a trade.

However, like any tool, bar charts have their limitations. Traders should avoid making decisions based solely on one type of chart. Instead, they should integrate insights from various chart types and indicators to develop a more comprehensive understanding of market dynamics. By doing so, they can mitigate risks and improve their chances of success in the trading arena.

- What is the main advantage of using bar charts?

Bar charts provide a detailed view of price action, showing opening, closing, high, and low prices, which helps traders make informed decisions. - How can I use bar charts effectively?

Combine bar charts with other technical indicators and chart types to gain a comprehensive understanding of market trends. - Are bar charts suitable for all trading strategies?

Yes, bar charts can be used across various trading strategies, but they should not be the sole basis for trading decisions.

Candlestick Charts

Candlestick charts have become a favorite among traders, and for good reason! They not only present price movements in a visually appealing way but also convey a wealth of information about market sentiment. Each "candlestick" represents a specific time period—be it minutes, hours, or days—and provides four critical data points: the opening price, closing price, highest price, and lowest price during that period. This rich tapestry of information allows traders to quickly assess the market's behavior and make informed decisions.

What makes candlestick charts particularly powerful is their ability to illustrate potential market reversals. For instance, a candlestick with a long lower shadow and a small body can indicate that buyers are stepping in after a price drop, suggesting a potential bullish reversal. Conversely, a long upper shadow with a small body can signal that sellers are pushing the price down after a rally, indicating a possible bearish reversal. These visual cues are essential for traders looking to capitalize on short-term price movements.

Moreover, candlestick patterns—such as doji, hammer, and engulfing—can provide insights into market psychology. These patterns emerge from the interaction of buyers and sellers and can indicate whether the market is likely to continue in its current direction or reverse. For example, a "doji" candlestick, which has a very small body, suggests indecision in the market, while a "hammer" pattern might signal a potential bullish reversal after a downtrend.

Incorporating candlestick charts into your trading strategy can enhance your analysis significantly. By observing these patterns alongside other technical indicators, traders can confirm signals and improve their decision-making processes. For instance, if a bullish engulfing pattern appears in conjunction with a rising moving average, it may strengthen the case for a potential upward price movement.

To illustrate the importance of candlestick charts, consider the following table that highlights some common candlestick patterns and their implications:

| Pattern | Description | Implication |

|---|---|---|

| Doji | A candlestick with a small body | Indecision in the market |

| Hammer | A candlestick with a long lower shadow | Potential bullish reversal |

| Engulfing | A larger candle that engulfs the previous one | Possible trend reversal |

In summary, candlestick charts are not just tools for visualization; they are a gateway to understanding market dynamics and trader psychology. By mastering these charts, traders can enhance their strategies and improve their chances of success in the ever-evolving world of trading.

Analyzing Trends with Historical Charts

When it comes to trading, understanding trends is like having a compass in a vast ocean. Historical charts serve as that compass, guiding traders through the unpredictable waters of the market. By analyzing these charts, traders can uncover hidden patterns and make educated predictions about future price movements. But how exactly do we analyze trends using historical charts? Let's dive in!

First off, it’s essential to recognize that trends can be categorized into three main types: upward trends, downward trends, and sideways trends. Each trend tells a different story about market sentiment and potential future movements. For instance:

- Upward Trends: Characterized by higher highs and higher lows, indicating a bullish market where prices are expected to rise.

- Downward Trends: Defined by lower highs and lower lows, hinting at a bearish market where prices are likely to fall.

- Sideways Trends: When prices move within a horizontal range, suggesting market indecision and potential consolidation before a breakout.

Analyzing these trends requires a keen eye for detail. Traders often look for key indicators such as support and resistance levels, which are critical in understanding where prices might reverse or continue their trajectory. Support levels are like a safety net, providing a cushion for prices, while resistance levels act as ceilings that prices struggle to break through. By marking these levels on historical charts, traders can visualize potential entry and exit points.

Moreover, the timeframe you choose to analyze can significantly impact your trend analysis. Short-term traders might focus on minute or hourly charts, while long-term investors often look at daily or weekly charts. Each timeframe provides a different perspective on market trends, allowing traders to tailor their strategies accordingly. For example, a trader might notice an upward trend on a daily chart but see a downward trend when zooming into an hourly chart. This discrepancy highlights the importance of context in trend analysis.

To enhance your trend analysis further, integrating various tools and techniques can be beneficial. For instance, using trend lines can help in visually identifying the direction of the market. A simple trend line drawn along the lows in an upward trend can act as a dynamic support level, while a downward trend line can signify resistance. Additionally, incorporating moving averages can smooth out price fluctuations, making it easier to spot prevailing trends.

In conclusion, analyzing trends with historical charts is an art that combines observation, interpretation, and strategy. By understanding the different types of trends, recognizing key levels of support and resistance, and utilizing various tools, traders can make more informed decisions. Remember, the market is a living entity, constantly changing, and your ability to adapt your analysis will be key to your trading success.

Q: How can I identify an upward trend using historical charts?

A: Look for a series of higher highs and higher lows on the chart. Drawing a trend line along the lows can also help visualize this trend.

Q: What is the significance of support and resistance levels?

A: Support levels indicate where prices may stop falling and bounce back, while resistance levels show where prices might struggle to rise above. These levels are crucial for making trading decisions.

Q: How often should I analyze historical charts?

A: It depends on your trading style. Day traders may analyze charts multiple times a day, while long-term investors might check them weekly or monthly.

Using Indicators with Historical Charts

Integrating technical indicators with historical charts is like adding spices to a dish; it enhances the flavor and complexity of your trading strategy. When traders look at historical charts, they often see raw data points that tell a story. However, by overlaying indicators, they can gain deeper insights and make more informed decisions. Indicators serve as tools that help traders interpret price movements, identify trends, and forecast future market behavior. For instance, moving averages can smooth out price fluctuations, making it easier to spot the underlying trend. Meanwhile, the Relative Strength Index (RSI) can indicate whether a market is overbought or oversold, providing crucial signals for potential entry or exit points.

One of the most popular indicators, the Moving Average, calculates the average price of a security over a specific period. This helps traders to filter out the "noise" from random price fluctuations and focus on the overall trend direction. For example, a simple moving average (SMA) over 50 days can reveal whether the market is generally moving up or down. When combined with historical charts, traders can effectively identify key support and resistance levels, which are essential for making strategic decisions.

On the other hand, the Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions. An RSI above 70 often indicates that a security is overbought, which could suggest a price correction is imminent, while an RSI below 30 signals that a security is oversold, hinting at a potential price increase. When traders analyze historical charts alongside the RSI, they can better gauge market sentiment and make timely trading decisions.

By combining these indicators with historical charts, traders can create a more robust trading strategy. However, it's important to remember that no single indicator is foolproof. Each indicator has its strengths and weaknesses, and they should be used in conjunction with one another for the best results. For example, a trader might use moving averages to identify the trend and the RSI to confirm entry points. This multi-faceted approach can significantly enhance trading accuracy and effectiveness.

To illustrate the power of indicators, consider the following table that summarizes some common indicators and their functions:

| Indicator | Function |

|---|---|

| Moving Average (MA) | Smooths price data to identify trends over specific periods. |

| Relative Strength Index (RSI) | Measures momentum to identify overbought or oversold conditions. |

| Bollinger Bands | Indicates volatility and potential price reversals. |

| MACD (Moving Average Convergence Divergence) | Shows the relationship between two moving averages and helps identify momentum changes. |

In conclusion, using indicators with historical charts is not just about crunching numbers; it's about understanding the market's rhythm and flow. Just as a musician relies on their instruments to create beautiful melodies, traders depend on indicators to fine-tune their strategies. By embracing a combination of historical data and technical indicators, traders can significantly improve their decision-making process, leading to a more successful trading experience.

Q: How do I choose the right indicator for my trading strategy?

A: The right indicator depends on your trading style and objectives. Experiment with different indicators and see which ones resonate with your trading approach.

Q: Can I rely solely on indicators for my trading decisions?

A: While indicators are helpful, it's essential to consider other factors like market context, news events, and your own risk tolerance.

Q: How often should I adjust my indicators?

A: Regularly reviewing and adjusting your indicators based on market conditions is crucial. Markets change, and so should your approach.

Moving Averages

When it comes to trading, understanding the concept of is like having a trusty compass in the vast sea of market fluctuations. A moving average is essentially a calculation that helps traders smooth out price data by creating a constantly updated average price. This technique is invaluable because it allows traders to identify the direction of the trend without the noise of daily price fluctuations. Imagine trying to spot a clear path through a dense forest; moving averages help cut through the underbrush, providing a clearer view of where the market might be headed.

There are two primary types of moving averages that traders often use: the simple moving average (SMA) and the exponential moving average (EMA). The SMA calculates the average of a set of prices over a specific number of periods, giving equal weight to all prices in that period. On the other hand, the EMA gives more weight to recent prices, making it more responsive to new information. This responsiveness can be crucial, especially in fast-moving markets where conditions can change in a heartbeat.

Let’s take a closer look at how these moving averages can be utilized effectively:

| Type of Moving Average | Description | Best Used For |

|---|---|---|

| Simple Moving Average (SMA) | Averages prices over a specific number of periods. | Identifying long-term trends. |

| Exponential Moving Average (EMA) | Gives more weight to recent prices for quicker signals. | Spotting short-term trends and reversals. |

In practical terms, traders often use moving averages to determine entry and exit points in the market. For example, when the price crosses above the moving average, it can signal a potential buying opportunity, while a price crossing below can indicate a selling opportunity. This crossover strategy is one of the most popular methods among traders because it combines simplicity with effectiveness. However, like any tool, it’s essential to use moving averages in conjunction with other indicators to avoid false signals.

Moreover, moving averages can also act as dynamic support and resistance levels. When the price approaches a moving average, it may bounce off it, indicating a strong trend. Conversely, if the price breaks through a moving average, it can signal a change in market sentiment. This dual function of moving averages adds another layer of depth to a trader's strategy, allowing for more informed decision-making.

In conclusion, moving averages are a fundamental aspect of technical analysis that every trader should grasp. They not only provide clarity in the often chaotic world of trading but also empower traders to make more informed decisions. By incorporating moving averages into your trading strategy, you can enhance your ability to predict market movements and improve your overall trading performance.

- What is the main purpose of using moving averages? The main purpose is to smooth out price data to identify trends and make informed trading decisions.

- How do I choose between SMA and EMA? Choose SMA for long-term trends and EMA for short-term trading signals.

- Can moving averages guarantee profits? No, while they are useful tools, they do not guarantee profits and should be used in conjunction with other indicators.

Relative Strength Index (RSI)

The is a powerful momentum oscillator that traders often use to gauge the speed and change of price movements in the market. Developed by J. Welles Wilder Jr., this indicator ranges from 0 to 100 and is primarily utilized to identify overbought or oversold conditions. But what does that really mean? Well, think of the RSI as a temperature gauge for the market; just as a thermometer tells you whether it's too hot or too cold, the RSI helps traders determine whether a security is potentially overvalued or undervalued.

When the RSI is above 70, it typically signals that the asset might be overbought, suggesting a potential price correction could be on the horizon. Conversely, if the RSI falls below 30, it indicates that the asset may be oversold, hinting at a possible price reversal to the upside. This makes the RSI an invaluable tool for traders looking to make informed decisions about their entry and exit points. However, like any tool, it’s essential to use the RSI in conjunction with other indicators and analysis methods to enhance its effectiveness.

To illustrate how the RSI works, here’s a simple breakdown of its calculation:

| Step | Calculation |

|---|---|

| 1 | Calculate the average gain and average loss over a specified period (commonly 14 days). |

| 2 | Calculate the Relative Strength (RS) by dividing the average gain by the average loss. |

| 3 | Calculate the RSI using the formula: RSI 100 - (100 / (1 + RS)). |

While the RSI is an excellent tool, it’s crucial to remember that it’s not foolproof. Traders should be aware of potential pitfalls, such as relying solely on the RSI without considering other market factors. For instance, during strong trends, the RSI can remain overbought or oversold for extended periods, leading to false signals. Therefore, integrating the RSI with other indicators, like moving averages or trend lines, can provide a more comprehensive view of market conditions.

In summary, the Relative Strength Index is a valuable asset for any trader's toolkit. By understanding how to interpret its signals and applying it alongside other analytical tools, traders can enhance their decision-making process and improve their chances of success in the ever-fluctuating world of trading.

- What is the best period to use for RSI? Most traders use a 14-day period, but this can be adjusted based on trading style and market conditions.

- Can RSI be used for all types of assets? Yes, RSI can be applied to stocks, commodities, forex, and other financial instruments.

- Is RSI a leading or lagging indicator? RSI is considered a lagging indicator because it is based on past price movements, but it can provide leading signals in terms of potential reversals.

Backtesting Trading Strategies

Backtesting is like having a time machine for traders. It allows you to take your trading strategies and apply them to historical data to see how they would have performed in the past. This process is incredibly valuable because it provides insights into the potential effectiveness of your strategies without risking any real money. Imagine being able to test your ideas against various market conditions before putting them into action! It's a way to refine your approach, enhance your decision-making, and ultimately increase your chances of success in the unpredictable world of trading.

When backtesting, traders typically follow a systematic approach. Here’s a quick breakdown of the steps involved in the backtesting process:

- Define Your Strategy: Clearly outline the rules for your trading strategy. This includes entry and exit points, risk management, and any indicators you plan to use.

- Gather Historical Data: Collect relevant historical data that covers a sufficient time frame. This data should include price movements, volume, and any other variables that might affect your strategy.

- Simulate Trades: Apply your strategy to the historical data. For each trade signal generated by your strategy, simulate the trade as if you were executing it in real-time.

- Analyze Results: After running your backtest, analyze the results. Look for key metrics such as win rate, average profit/loss, maximum drawdown, and overall profitability.

- Refine Your Strategy: Based on your analysis, tweak your strategy. This could mean adjusting parameters, changing indicators, or even rethinking your entry and exit points.

However, while backtesting can provide valuable insights, it’s important to remember that it is not foolproof. There are common pitfalls that traders should be aware of:

- Data Snooping: This occurs when traders tweak their strategies to fit historical data too closely, leading to a strategy that may not perform well in the future.

- Overfitting: Similar to data snooping, overfitting happens when a strategy is too complex and tailored to past data, making it less adaptable to changing market conditions.

- Ignoring Market Changes: Historical data may not account for current market dynamics, regulations, or economic factors that could affect future performance.

In essence, backtesting is a powerful tool that, when used wisely, can help traders refine their strategies and boost their confidence. It’s like practicing for a big game—by simulating the conditions you’ll face, you can better prepare yourself for success when it counts. Just remember, while past performance can provide guidance, it’s not a guarantee of future success. The markets are constantly evolving, and adaptability is key.

What is backtesting?

Backtesting is the process of testing a trading strategy on historical data to evaluate its effectiveness and potential profitability.

How do I perform backtesting?

To perform backtesting, define your strategy, gather historical data, simulate trades based on your strategy, analyze the results, and refine your approach as necessary.

What are some common mistakes in backtesting?

Common mistakes include data snooping, overfitting, and ignoring current market conditions. These can lead to misleading results and poor decision-making.

Can backtesting guarantee future success?

No, backtesting cannot guarantee future success. It can provide insights and help refine strategies, but market conditions can change, and past performance is not always indicative of future results.

Common Mistakes in Using Historical Charts

Even seasoned traders can stumble when interpreting historical charts. It's almost like navigating a maze; one wrong turn can lead you astray. Recognizing common pitfalls is essential to avoid costly errors and enhance your trading analysis. One major mistake is overreliance on past data. While historical data is undoubtedly valuable, it’s crucial to remember that the markets are dynamic and ever-evolving. Just because a stock performed well in the past doesn't guarantee it will do the same in the future. Think of it like using a map from last year to navigate a city that has changed significantly; the landmarks may no longer be relevant.

Another common error is ignoring market context. Traders often focus solely on the charts without considering external factors that influence market behavior. Economic indicators, news events, and overall market sentiment play a significant role in price movements. For instance, a sudden economic downturn can drastically affect a stock's performance, regardless of its historical trends. It's like trying to predict the weather based solely on last week's forecast; you need to account for current conditions to make an accurate prediction.

Additionally, many traders fall into the trap of chasing trends without a solid strategy. They might see a stock price rising and jump on the bandwagon, hoping for quick profits. However, this can lead to impulsive decisions that lack proper analysis. Instead, traders should develop a structured approach that takes into account various indicators and market conditions. This way, they can make informed decisions rather than emotional ones.

Lastly, it’s important to note that neglecting to update analysis regularly can also be detrimental. Markets change, and so should your analysis. Regularly revisiting and adjusting your strategies based on the latest data can help you stay ahead of the game. Just like a gardener must tend to their plants regularly to ensure they thrive, traders must continuously nurture their strategies to adapt to the market's ever-changing landscape.

- What is the most common mistake traders make with historical charts?

Overreliance on past data is the most common mistake, as it can lead to misguided decisions. - How can I avoid ignoring market context?

Stay updated on economic indicators and news events that may impact market sentiment. - Why is it important to regularly update my analysis?

Markets are dynamic, and regular updates ensure your strategies remain relevant and effective.

Overreliance on Past Data

When it comes to trading, the allure of historical data is undeniable. It’s like having a treasure map that shows where the gold was buried in the past. However, while these charts can provide valuable insights, can lead traders down a perilous path. Imagine trying to drive a car by only looking in the rearview mirror; it’s not just impractical, it’s downright dangerous!

The first pitfall of leaning too heavily on historical data is the assumption that the past will repeat itself. Sure, certain patterns may have emerged over time, but markets are influenced by a myriad of factors. Economic conditions, political events, and even social trends can dramatically shift the landscape. For instance, a stock that consistently rose during a particular economic boom may not perform the same way during a recession. It's essential to remember that while history can offer clues, it does not guarantee future performance.

Moreover, traders often fall into the trap of confirmation bias, where they only seek out historical data that supports their preconceived notions. This can cloud judgment and lead to poor decision-making. To illustrate, consider a trader who believes a specific stock is destined for a rebound because it has done so in the past. If they ignore current market indicators or news that contradicts this belief, they may end up holding onto a losing position far too long.

Another factor to consider is the evolution of market dynamics. The trading environment is constantly changing, with new technologies, regulations, and market participants altering the way assets behave. For example, the rise of algorithmic trading has introduced a level of speed and complexity that historical data alone cannot account for. Relying solely on the past without acknowledging these shifts can lead to significant miscalculations.

To mitigate the risks associated with overreliance on past data, traders should adopt a more holistic approach. This includes incorporating real-time data, understanding market sentiment, and staying informed about global economic events. By combining historical analysis with current information, traders can develop a more nuanced understanding of the market, enhancing their decision-making processes.

In summary, while historical charts are an invaluable tool in a trader's arsenal, it’s crucial to use them judiciously. Instead of viewing the past as a crystal ball, traders should treat it as one piece of a larger puzzle. By maintaining a balanced perspective and integrating various sources of information, they can navigate the complexities of trading more effectively.

- Why is historical data important in trading? Historical data helps traders identify patterns, trends, and potential future movements in the market.

- What are the risks of relying too much on past performance? Overreliance can lead to misguided decisions, as markets are influenced by many changing factors.

- How can I effectively use historical data in my trading strategy? Combine historical analysis with current market conditions, news events, and technical indicators for a well-rounded approach.

Ignoring Market Context

When it comes to trading, one of the most crucial yet often overlooked aspects is the market context. Imagine trying to navigate through a dense fog without a compass; that’s what it feels like for traders who ignore the broader market landscape. Historical charts are undoubtedly valuable, but they should never be the sole focus of your trading strategy. Why? Because the market is a living entity, constantly influenced by a myriad of factors including economic indicators, geopolitical events, and even market sentiment. Ignoring these elements can lead to misguided decisions that could cost traders dearly.

For instance, consider a scenario where a trader solely relies on a historical chart showing a consistent upward trend for a particular stock. If an unexpected economic downturn occurs, the trader might find themselves holding onto a position that is rapidly losing value, simply because they failed to account for the larger economic picture. This is where the importance of context comes into play. It’s essential to ask yourself: What external factors could impact this trend? Are there upcoming earnings reports, regulatory changes, or global events that could shift market dynamics?

Furthermore, integrating market context into your analysis can significantly enhance your decision-making process. This means not only looking at the numbers on a chart but also considering the narrative behind those numbers. For example, if you notice a stock has been on a downward trend, it’s vital to investigate the reasons behind it. Is it due to poor earnings reports, changes in management, or broader market trends? Understanding the context allows traders to make more informed predictions about future movements.

To illustrate the importance of market context, let’s look at a simple table comparing two hypothetical trading scenarios:

| Scenario | Market Context Considered | Outcome |

|---|---|---|

| Scenario A | No context considered; only historical chart analysis | Trader loses significant capital as the stock plummets due to unexpected news |

| Scenario B | Market context analyzed; economic indicators and news events evaluated | Trader anticipates market shift and exits position before losses occur |

Clearly, Scenario B demonstrates the power of integrating market context into trading strategies. By understanding the surrounding environment, traders can better navigate the complexities of the market and avoid pitfalls that come from a narrow focus on historical data alone. So, the next time you analyze a chart, remember to step back and consider the bigger picture. It could be the difference between a successful trade and a costly mistake.

- What is market context in trading? Market context refers to the broader economic, political, and social factors that can influence market movements, beyond just historical price data.

- How can I analyze market context effectively? You can analyze market context by staying informed about economic indicators, news events, and overall market sentiment, and integrating this information into your trading strategy.

- Why is it risky to rely solely on historical charts? Relying solely on historical charts can lead to misguided decisions, as past performance does not always predict future results, especially in a changing market environment.

Frequently Asked Questions

-

What are historical charts and why are they important for trading?

Historical charts are graphical representations of past market data, showing price movements over time. They are crucial for traders because they provide insights into market trends, help identify patterns, and inform predictions about future price movements. By analyzing these charts, traders can make more informed decisions and develop effective trading strategies.

-

What types of historical charts should I be familiar with?

There are several types of historical charts that traders commonly use. The most popular ones include:

- Line Charts: Simple and effective for visualizing price trends over time.

- Bar Charts: Provide detailed information about opening, closing, high, and low prices.

- Candlestick Charts: Offer a visually appealing way to understand market sentiment and potential reversals.

-

How can I analyze trends using historical charts?

Analyzing trends with historical charts involves looking for upward, downward, or sideways movements in price data. By recognizing these patterns, traders can make educated guesses about future market behavior. It's like reading the story of the market's past to predict its future chapters!

-

What are some common mistakes when using historical charts?

Even seasoned traders can stumble when interpreting historical charts. Some common pitfalls include:

- Overreliance on Past Data: Just because something happened before doesn't mean it will happen again. Markets change!

- Ignoring Market Context: Focusing solely on charts without considering broader economic indicators or news events can lead to poor decisions.

-

How do I backtest my trading strategies using historical data?

Backtesting involves applying your trading strategies to historical data to see how they would have performed. This process allows you to refine your approach, identify strengths and weaknesses, and increase your chances of success in real-time trading.