How to Create a Crypto Trading Plan Based on Technical Analysis

In the dynamic world of cryptocurrency trading, having a solid plan can be the difference between success and failure. A well-crafted trading plan not only guides your decisions but also helps you stay disciplined amidst the market's chaos. But how do you create a trading plan that truly works? The answer lies in technical analysis.

Technical analysis is like the crystal ball of trading; it allows you to look into the future by analyzing past price movements and trading volumes. By studying these patterns, traders can forecast potential price trends. Imagine you’re a detective piecing together clues from a crime scene—each candle on a chart tells a story, revealing the market's behavior and hinting at possible entry and exit points. With technical analysis, you’re not just guessing; you’re making informed decisions based on data and trends.

Before diving into the charts, it’s essential to set clear trading goals. Think of your goals as the roadmap that will guide your trading journey. Using the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—ensures that your objectives are not just vague dreams but concrete targets. For instance, instead of saying, "I want to make money," you could set a goal like, "I want to achieve a 10% return on investment in the next three months." This clarity will help you stay focused and disciplined in your trading approach.

Now that you have your goals in place, it's time to choose the right technical indicators. Technical indicators are like the tools in a mechanic's toolbox; each one serves a specific purpose. Common indicators include:

- Moving Averages: Helps smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions.

By selecting the right mix of indicators, you can gain valuable insights into potential market movements and trends, enhancing your overall trading strategy.

Creating well-defined entry and exit strategies is crucial for capitalizing on market opportunities. Think of your entry strategy as the moment you decide to jump into a pool; you want to be sure the water is just right before you dive in. Similarly, your exit strategy should outline when to take profits or cut losses. This approach not only maximizes your gains but also minimizes emotional decision-making, keeping you grounded in your analysis.

In the world of crypto trading, risk management is your safety net. Implementing techniques like stop-loss orders and position sizing can protect your capital from the market's unpredictable swings. A stop-loss order acts like a parachute; it helps you avoid catastrophic losses by automatically selling your asset when it reaches a certain price. Position sizing, on the other hand, ensures you’re not overexposing your portfolio to any single trade, which is crucial in the volatile crypto landscape.

Once your plan is in place, backtesting becomes your best friend. This process involves applying your trading strategies to historical data to see how they would have performed. It’s like rehearsing for a play; you get to fine-tune your performance before the big show. By analyzing past data, you can refine your strategies, identify weaknesses, and improve your chances of success when you step into the real-time trading arena.

The crypto market is constantly evolving, and staying informed is key to making smart decisions. Keeping an eye on market news, regulatory changes, and technological advancements is like having a radar that alerts you to potential changes in the environment. This awareness allows you to adapt your strategies to the ever-changing market conditions, ensuring you’re always a step ahead.

Even the best-laid plans need adjustments. Regularly reviewing your trading plan based on performance metrics and market changes is crucial for continuous improvement. It’s like tuning a musical instrument; you need to make sure everything is in harmony to produce the best sound. By analyzing what works and what doesn’t, you can refine your approach and enhance your long-term success in crypto trading.

Finally, maintaining a trading journal is an invaluable tool for any trader. This journal helps you track your trades, emotions, and decisions, offering insights into your trading behavior. Think of it as your personal coach; it provides feedback and highlights areas for growth. By reflecting on your past trades, you can learn from your mistakes and successes, facilitating personal growth as a trader.

1. What is the importance of technical analysis in crypto trading?

Technical analysis helps traders predict future price movements based on past data, providing insights into potential entry and exit points.

2. How do I set realistic trading goals?

Use the SMART criteria to ensure your goals are specific, measurable, achievable, relevant, and time-bound.

3. What are some common technical indicators?

Popular indicators include moving averages and the Relative Strength Index (RSI), which help identify market trends and conditions.

4. Why is risk management important?

Risk management techniques protect your capital from significant losses and help maintain a sustainable trading strategy.

5. How can I improve my trading skills?

Regularly review your trading plan, backtest your strategies, and maintain a trading journal to learn from your experiences.

Understanding Technical Analysis

This article explores the essential components of a crypto trading plan, focusing on technical analysis to enhance trading strategies and decision-making for both novice and experienced traders.

Technical analysis is a critical tool for traders looking to navigate the often volatile waters of cryptocurrency markets. It involves evaluating price movements and trading volumes to make educated guesses about future price trends. Think of it as reading the pulse of the market; by analyzing historical data, traders can gain insights into market behavior, potential entry and exit points, and overall sentiment.

At its core, technical analysis is built on the premise that all relevant information is already reflected in the price of an asset. This means that instead of getting bogged down by news articles or social media chatter, traders can focus on the hard data presented in charts. By looking at patterns and trends, traders can identify support and resistance levels, which are crucial for making informed trading decisions.

One of the most appealing aspects of technical analysis is that it can be applied to any market, including cryptocurrencies. However, it’s essential to choose the right tools and indicators to enhance your analysis. Here are some of the most commonly used elements:

- Price Charts: These visual representations of price movements over time are foundational to technical analysis. Candlestick charts, for instance, provide a wealth of information at a glance.

- Volume Indicators: Trading volume can indicate the strength of a price movement. High volume during an upward trend may suggest a strong bullish sentiment.

- Technical Indicators: Tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands help traders identify trends and potential reversal points.

For instance, let's take a look at a simple table that outlines some popular technical indicators and their purposes:

| Indicator | Purpose |

|---|---|

| Moving Averages | Smooth out price data to identify trends over specific periods. |

| RSI (Relative Strength Index) | Measures the speed and change of price movements to identify overbought or oversold conditions. |

| Bollinger Bands | Indicates volatility and potential price reversals by showing the range of price movements. |

By using these indicators, traders can create a more comprehensive view of market dynamics. However, it's crucial to remember that no single indicator is foolproof. The best approach is to use a combination of tools to corroborate findings and enhance decision-making.

In summary, understanding technical analysis is akin to learning a new language—the language of the market. By mastering this language, traders can better communicate with the market, anticipate movements, and make strategic decisions that align with their trading goals. So, are you ready to dive deeper into the world of technical analysis and enhance your trading game?

Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals is crucial for maintaining focus and discipline in trading, ensuring that your strategies align with your overall financial objectives.

Selecting appropriate technical indicators, such as moving averages and RSI, can significantly enhance your trading strategy by providing valuable signals for potential market movements and trends.

Creating well-defined entry and exit strategies helps traders capitalize on market opportunities while managing risks effectively, ensuring that decisions are based on analysis rather than emotions.

Implementing risk management techniques, such as stop-loss orders and position sizing, is essential to protect your capital and minimize potential losses in volatile crypto markets.

Backtesting involves applying your trading strategies to historical data to evaluate their effectiveness, allowing traders to refine their approaches and improve their chances of success in real-time trading.

Keeping abreast of market news, regulatory changes, and technological advancements is vital for making informed trading decisions and adapting strategies to evolving market conditions.

Regularly reviewing and adjusting your trading plan based on performance metrics and market changes is crucial for continuous improvement and long-term success in crypto trading.

Maintaining a trading journal helps track your trades, emotions, and decisions, providing valuable insights into your trading behavior and facilitating personal growth as a trader.

Q: What is the best technical indicator for crypto trading?

A: There isn't a one-size-fits-all answer. It's best to use a combination of indicators to get a clearer picture of market conditions.

Q: How often should I review my trading plan?

A: Regular reviews, ideally weekly or monthly, help you stay aligned with your goals and adapt to market changes.

Q: Can I rely solely on technical analysis for trading?

A: While technical analysis is powerful, it's wise to combine it with fundamental analysis and market news for the best results.

Setting Clear Trading Goals

When it comes to trading cryptocurrencies, setting clear trading goals is like having a map for your journey. Without a map, you might find yourself lost in the vast and often chaotic world of crypto trading. So, what exactly do we mean by "clear trading goals"? In essence, these are specific, measurable, achievable, relevant, and time-bound (SMART) objectives that guide your trading activities. Think of them as the North Star that keeps you on track, even when the market's waves threaten to toss you off course.

To make your trading goals truly effective, start by defining what you want to achieve. Are you looking to make a specific profit within a certain timeframe? Or perhaps you're aiming to develop your trading skills to become a more proficient trader? Whatever your goals are, it's essential that they are realistic and aligned with your overall financial objectives. For instance, if you're a novice trader, setting a goal to double your investment in a month might lead to reckless decisions. Instead, focus on smaller, incremental gains that build your confidence and knowledge over time.

Moreover, writing down your goals can be incredibly powerful. It not only solidifies your intentions but also serves as a reminder of what you're working towards. You might want to categorize your goals into short-term and long-term objectives. Short-term goals could include learning a new trading strategy or mastering a specific technical indicator, while long-term goals might involve achieving a certain percentage return on your investments over the year.

Here's a quick example of how you can structure your trading goals:

| Goal Type | Specific Goal | Timeframe |

|---|---|---|

| Short-term | Learn to use moving averages for trading | 1 month |

| Long-term | Achieve a 20% return on investment | 1 year |

In addition to defining your goals, it's crucial to regularly assess your progress. Are you on track to meet your objectives? If not, what adjustments can you make to get back on course? This reflective practice not only keeps you accountable but also allows you to adapt your strategies based on what you learn along the way. Remember, the crypto market is dynamic, and staying flexible is key to navigating its twists and turns.

Finally, don't forget to celebrate your achievements, no matter how small. Each milestone you reach is a stepping stone toward becoming a successful trader. By setting clear trading goals and following through on them, you're not just trading; you're building a sustainable trading practice that can weather the storms of the crypto market.

Choosing the Right Indicators

When it comes to trading cryptocurrencies, the right indicators can be your best friends. Think of them as the compass guiding you through the often turbulent waters of the crypto market. But with so many indicators available, how do you choose the ones that will truly enhance your trading strategy? It's all about understanding what each indicator does and how it can fit into your overall trading plan.

One of the most popular indicators among traders is the Moving Average (MA). This tool smooths out price data to create a trend-following indicator that shows the average price over a specific period. For example, the 50-day moving average can help you identify whether the market is in an uptrend or downtrend. If the price is above the moving average, it often signals a bullish trend, while a price below indicates a bearish trend. However, relying solely on MAs can be misleading, especially in volatile markets. That's why combining them with other indicators can provide a clearer picture.

Another essential indicator is the Relative Strength Index (RSI). This momentum oscillator measures the speed and change of price movements on a scale of 0 to 100. Typically, an RSI above 70 indicates that an asset may be overbought, while an RSI below 30 suggests it might be oversold. This information can be invaluable in making decisions about when to enter or exit a trade. However, like all indicators, it should not be used in isolation. Instead, consider it as part of a broader toolbox.

For a more comprehensive view, many traders also use Volume Indicators. Volume is a critical factor in confirming trends. For instance, if a price movement is accompanied by high volume, it’s more likely to be sustainable. Conversely, a price change with low volume may not indicate a strong trend. Tools like the On-Balance Volume (OBV) or the Accumulation/Distribution Line can help you gauge whether the market is accumulating or distributing assets.

To sum it up, the key to choosing the right indicators lies in understanding their unique functions and how they can complement each other. A well-rounded approach might include:

- Moving Averages: For trend direction.

- Relative Strength Index: For momentum and potential reversals.

- Volume Indicators: For confirming trends.

Ultimately, the indicators you choose should align with your trading style and goals. Take the time to experiment with different combinations and find what works best for you. Remember, the goal is not just to have a collection of indicators but to create a cohesive strategy that enhances your decision-making process.

1. How many indicators should I use in my trading strategy?

While there's no one-size-fits-all answer, it's generally advisable to use 2-3 indicators that complement each other. This helps avoid analysis paralysis while providing a well-rounded view of the market.

2. Can I rely solely on indicators for trading decisions?

Indicators are tools to help inform your decisions, but they should not be the sole basis for your trades. Always consider market news, trends, and your own risk tolerance.

3. How do I know if an indicator is effective?

The effectiveness of an indicator can vary based on market conditions. Backtesting your strategy using historical data can help you gauge how well an indicator performs in different scenarios.

Developing Entry and Exit Strategies

When it comes to trading in the volatile world of cryptocurrencies, having a solid plan for entry and exit strategies is not just beneficial—it's essential. Think of it like a roadmap on a long journey; without it, you might find yourself lost in a maze of price fluctuations and market noise. So, how do you craft a strategy that not only helps you enter the market at the right time but also ensures you exit with profits or minimal losses?

First, let’s talk about entry strategies. An effective entry strategy is about timing and market conditions. One common method is to use technical indicators like the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI). These indicators can help you identify when a cryptocurrency is oversold or overbought, signaling potential entry points. For example, if the RSI drops below 30, it might indicate a good buying opportunity as the asset could be undervalued. However, remember that no indicator is foolproof; they should be used in conjunction with your overall analysis.

Next, we have exit strategies, which are just as critical. You might be wondering, "When should I sell?" The answer isn’t always straightforward. One popular approach is to set profit targets based on your risk-reward ratio. A common strategy is to aim for a 2:1 ratio, meaning for every dollar you're willing to risk, you should aim to make two dollars. This helps keep your losses manageable while maximizing your gains. Additionally, consider implementing trailing stops. This technique allows you to lock in profits by setting a stop-loss order at a certain percentage below the market price as it rises. This way, you can ride the upward trend while protecting your capital.

It’s also important to think about the emotional aspect of trading. Emotions can lead to impulsive decisions, which is why having a predefined entry and exit strategy can help you stick to your plan. For instance, if you’ve set a target price and it hits that mark, resist the urge to hold on for “just a little longer” in hopes of further gains. Trust your strategy. After all, trading is much like fishing; patience and discipline are key components of success.

To sum it up, developing effective entry and exit strategies involves a mix of technical analysis, emotional control, and clear goal-setting. Here’s a quick recap of some essential points:

| Strategy Type | Description |

|---|---|

| Entry Strategy | Using indicators like MACD and RSI to identify potential buying opportunities. |

| Exit Strategy | Setting profit targets and using trailing stops to lock in gains. |

| Emotional Control | Sticking to your predefined strategies to avoid impulsive decisions. |

By following these guidelines, you can develop a trading plan that not only enhances your chances of success but also helps you navigate the unpredictable waters of cryptocurrency trading with confidence and clarity.

- What is the best time to enter a trade? The best time to enter a trade varies by market conditions and individual strategies. Using technical indicators can help identify optimal entry points.

- How do I know when to exit a trade? Setting clear profit targets and using trailing stops are effective ways to determine when to exit a trade.

- Can emotions affect my trading decisions? Yes, emotions can lead to impulsive decisions. Having a solid trading plan can help mitigate this risk.

Risk Management Techniques

When it comes to crypto trading, the thrill of the market can sometimes overshadow the importance of risk management. Think of it as your safety net in a high-flying circus act; without it, one misstep can lead to disastrous consequences. So, how do we ensure that our trading journey remains exciting yet controlled? Here are some effective techniques you can implement to safeguard your investments.

First and foremost, stop-loss orders are a trader's best friend. This tool allows you to set a predetermined price at which your asset will automatically sell, limiting your losses. Imagine you bought Bitcoin at $50,000, but you’re not comfortable losing more than 10%. By placing a stop-loss order at $45,000, you effectively cap your potential loss. This way, you can sleep soundly at night without worrying about market fluctuations.

Next up is position sizing. This technique involves determining how much of your capital you should risk on a single trade. A common rule of thumb is to risk only 1-2% of your total trading capital on any given trade. For instance, if you have a $10,000 trading account, risking 2% means you should only risk $200 on a single trade. This approach helps you stay in the game longer, even when the market throws curveballs your way.

Another vital aspect of risk management is diversification. Just like you wouldn’t put all your eggs in one basket, you shouldn’t invest all your capital in a single cryptocurrency. By spreading your investments across various assets, you reduce the risk of a significant loss if one of them plummets. For example, you might consider allocating your funds among Bitcoin, Ethereum, and a few altcoins. This strategy not only minimizes risk but also opens up opportunities for gains across different markets.

Additionally, keeping an eye on market volatility is crucial. The crypto market is notorious for its wild price swings, and understanding when to trade can make a world of difference. Tools like the Average True Range (ATR) can help gauge volatility and inform your trading decisions. When the ATR is high, it might be wise to tighten your stop-loss orders or reduce your position size, while a low ATR might signal a more stable environment for trading.

Lastly, emotional discipline plays a significant role in risk management. It’s easy to let emotions dictate your trading decisions, especially during periods of high volatility. Establishing a clear trading plan and sticking to it, regardless of market conditions, can help mitigate emotional trading. Consider keeping a trading journal to document your trades, thoughts, and feelings. This practice not only helps you reflect on your decisions but also reinforces your commitment to your risk management strategies.

In summary, effective risk management techniques are essential for navigating the volatile world of crypto trading. By employing tools like stop-loss orders, position sizing, diversification, and maintaining emotional discipline, you can protect your capital and enhance your trading performance. Remember, it’s not just about making profits; it’s also about how well you can manage your risks to stay in the game.

- What is a stop-loss order? A stop-loss order is a predetermined price point at which a trader's asset will automatically sell to limit losses.

- How much should I risk on each trade? It's generally advised to risk only 1-2% of your total trading capital on a single trade to manage risk effectively.

- Why is diversification important? Diversification helps spread risk across different assets, reducing the impact of a loss in any single investment.

- How can I maintain emotional discipline in trading? Keeping a trading journal and sticking to a well-defined trading plan can help you manage emotions and make rational decisions.

Backtesting Your Trading Plan

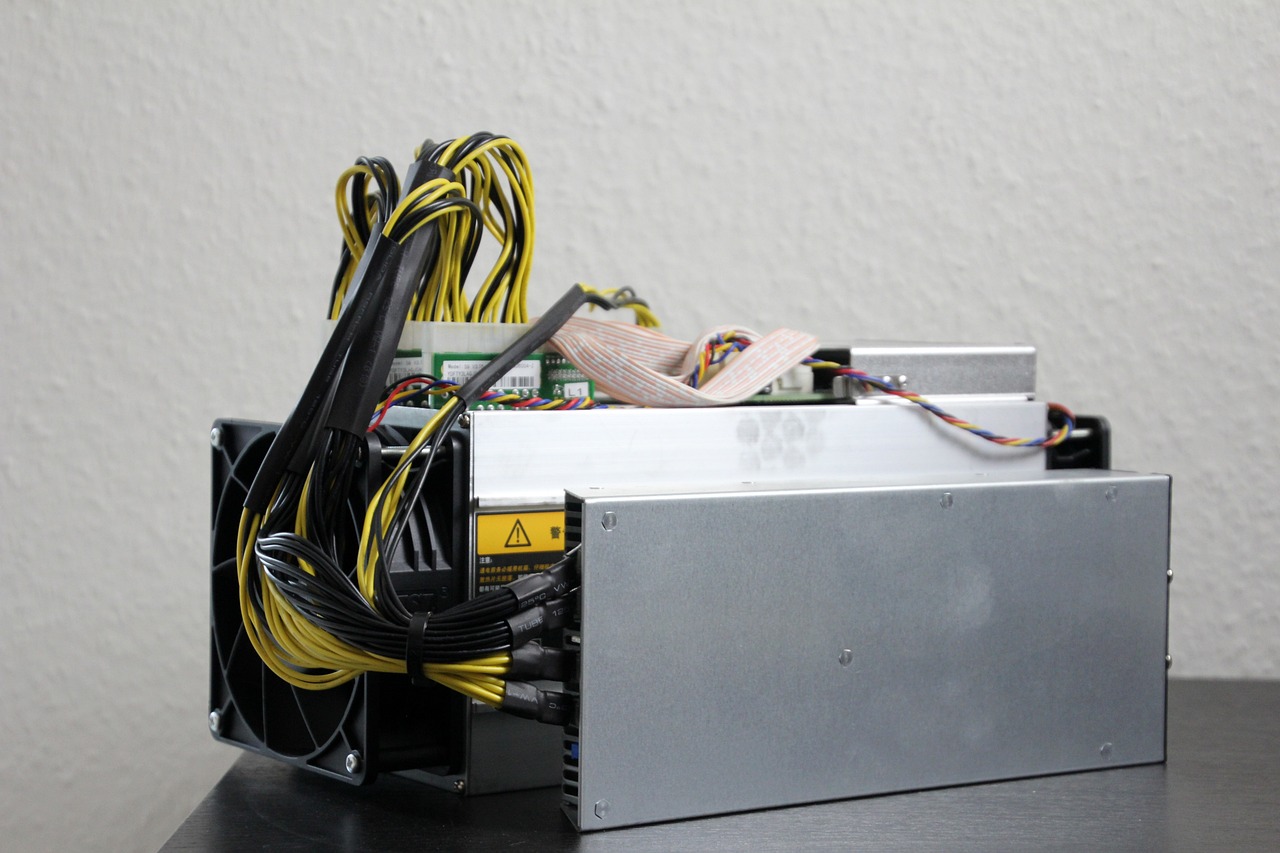

Backtesting is an essential step in developing a successful crypto trading plan. It involves applying your trading strategies to historical market data to see how they would have performed in the past. This process is crucial because it allows traders to evaluate the effectiveness of their strategies without risking real money. Imagine trying to navigate a new city without a map; backtesting acts as your GPS, guiding you through the twists and turns of the market.

When backtesting, it's vital to use reliable historical data. This data should include price movements, trading volumes, and other relevant metrics. The more comprehensive your data, the more accurate your backtest will be. You can obtain historical data from various sources, including cryptocurrency exchanges and financial data providers. The quality of your data is like the foundation of a house; without a solid base, everything else is at risk of collapsing.

To effectively backtest your trading plan, follow these key steps:

- Define Your Strategy: Clearly outline your entry and exit criteria, as well as your risk management rules. This clarity will help you stay focused during the backtesting process.

- Select a Time Frame: Choose the time frame for your backtest. Whether you focus on daily, weekly, or hourly data, consistency is key.

- Run the Backtest: Use trading software or platforms that allow you to simulate trades based on your strategy. This step will show you how your strategy would have performed over time.

- Analyze the Results: Look at key performance metrics such as win rate, profit factor, and drawdown. This analysis will help you understand the strengths and weaknesses of your strategy.

- Refine Your Approach: Based on your findings, adjust your strategy as necessary. This iterative process is crucial for honing your trading plan.

For example, let's say you backtested a strategy based on moving averages. You might find that it performed well during trending markets but struggled during sideways movements. This insight allows you to tweak your strategy to include additional indicators that can help you identify market conditions better.

Moreover, it's important to remember that past performance does not guarantee future results. While backtesting provides valuable insights, the crypto market is notoriously volatile, and conditions can change rapidly. Therefore, always remain adaptable and ready to modify your approach as new information becomes available.

In conclusion, backtesting your trading plan is not just a helpful exercise; it's a vital component of a successful trading strategy. By rigorously testing your strategies against historical data, you can gain confidence in your decision-making and improve your chances of success in the unpredictable world of crypto trading.

- What is backtesting? Backtesting is the process of applying a trading strategy to historical data to evaluate its effectiveness.

- Why is backtesting important? It helps traders understand how their strategies would have performed in the past, allowing for adjustments and improvements before risking real capital.

- How do I perform a backtest? Define your strategy, select a time frame, run the backtest using trading software, analyze the results, and refine your strategy based on your findings.

- Can I rely solely on backtesting results? No, while backtesting is valuable, it's crucial to remain adaptable and consider current market conditions, as they can differ significantly from historical data.

Staying Informed About Market Trends

In the fast-paced world of cryptocurrency trading, staying informed about market trends is not just an option; it's a necessity. Imagine trying to navigate a stormy sea without a compass—it's chaotic, and you're likely to get lost. Similarly, without up-to-date information, your trading decisions can become erratic and ungrounded. To sail smoothly through the crypto waters, you need to keep your finger on the pulse of the market. This means regularly consuming news, analyzing reports, and understanding the broader economic context that influences price movements.

One effective way to stay informed is by following reputable news sources and platforms dedicated to cryptocurrency. Websites like CoinDesk, CoinTelegraph, and CryptoSlate provide daily updates, insightful articles, and expert opinions that can help you grasp the latest trends. Additionally, consider subscribing to newsletters that summarize market activities. These can be a great way to receive curated content directly in your inbox, saving you time and ensuring you don’t miss out on critical information.

Moreover, social media platforms can be treasure troves of information. Following influential figures in the crypto space on Twitter or joining relevant groups on Reddit can expose you to grassroots discussions and emerging trends. Just remember, while social media can be informative, it can also be a breeding ground for misinformation. Always cross-reference the information you gather to ensure its accuracy.

Another crucial aspect of staying informed is understanding the impact of regulatory changes. Governments around the world are constantly evolving their stance on cryptocurrencies, and these regulations can significantly affect market dynamics. For instance, a sudden announcement from the SEC regarding Bitcoin ETFs or changes in tax regulations can lead to rapid price fluctuations. By keeping an eye on regulatory news, you can anticipate market movements and adjust your trading strategies accordingly.

To help you visualize the importance of staying informed, consider the following table that outlines various sources of market information and their benefits:

| Source | Benefits |

|---|---|

| News Websites | Timely updates and in-depth analysis |

| Social Media | Real-time discussions and grassroots insights |

| Newsletters | Curated content delivered directly to you |

| Forums | Community-driven insights and diverse opinions |

Lastly, don’t forget to engage with your own data. Analyzing your trading performance can provide insights into how market trends have affected your decisions and outcomes. Regularly reviewing your trades and correlating them with market movements can help you identify patterns and refine your strategies. This practice not only helps you stay informed but also empowers you to make better, data-driven decisions in the future.

In conclusion, staying informed about market trends is essential for any crypto trader looking to succeed. By leveraging multiple sources of information, being aware of regulatory changes, and analyzing your own data, you position yourself to navigate the complexities of the crypto market with confidence and skill.

- What are the best sources for crypto news? Look for reputable sites like CoinDesk, CoinTelegraph, and CryptoSlate, and consider following crypto influencers on social media.

- How can I effectively analyze market trends? Use a combination of news analysis, technical indicators, and historical data to understand market movements.

- Why is it important to follow regulatory news? Regulatory changes can have a significant impact on the crypto market, affecting prices and trading strategies.

- What role does social media play in staying informed? Social media can provide real-time insights and discussions, but always verify information from multiple sources.

Monitoring and Adjusting Your Plan

When it comes to crypto trading, monitoring and adjusting your trading plan is not just a good practice; it's a necessity. Imagine you’re sailing a ship. If you don’t regularly check your compass and adjust your course, you might end up far from your intended destination. The same principle applies to trading. Regular reviews of your trading plan help you stay on track and adapt to the ever-changing market landscape.

One of the first steps in this process is to establish a routine for reviewing your performance. This could be daily, weekly, or monthly, depending on your trading style. During these reviews, you should analyze your trades, looking for patterns in your successes and failures. Ask yourself questions like: What trades went well? What didn’t? Were there any emotional triggers that influenced my decisions? This self-reflection is crucial for growth.

Moreover, it’s essential to keep an eye on the market conditions. The crypto market is notoriously volatile, and what worked yesterday may not work today. For instance, if you notice a significant shift in trading volume or price trends, it might be time to tweak your strategies. Utilizing technical analysis tools can aid in this process, helping you identify new opportunities or potential risks.

In addition to regular performance reviews, consider maintaining a trading journal. This journal should not only document your trades but also your thoughts and feelings during the trading process. By keeping track of your emotions, you can identify patterns that may affect your trading decisions. For example, if you notice that you tend to make impulsive trades after a loss, you can work on strategies to manage that emotional response.

Another critical aspect of monitoring your plan is to set specific metrics to measure your success. These metrics could include your win/loss ratio, average profit per trade, or the percentage of trades that align with your initial plan. By quantifying your performance, you can make more informed decisions about what adjustments are necessary. Here’s a simple table to illustrate some potential metrics you might track:

| Metric | Current Value | Target Value |

|---|---|---|

| Win/Loss Ratio | 3:1 | 4:1 |

| Average Profit per Trade | $200 | $250 |

| Percentage of Trades Following Plan | 70% | 80% |

Lastly, it’s important to stay flexible. The crypto landscape is continuously evolving, and your strategies should evolve with it. Don’t be afraid to make bold changes if the data suggests that your current approach isn’t yielding the desired results. Remember, trading isn’t just about sticking to a plan; it’s about adapting and evolving to become a better trader.

- How often should I review my trading plan? It's recommended to review your trading plan at least once a month, but more frequent reviews can be beneficial, especially in a volatile market.

- What should I include in my trading journal? Your trading journal should include details about each trade, your emotional state during the trade, and any lessons learned.

- How do I know when to adjust my trading plan? Monitor your performance metrics regularly. If you notice consistent underperformance or significant market changes, it may be time to adjust your plan.

Building a Trading Journal

Creating a trading journal is one of the most effective ways to enhance your trading skills and make informed decisions in the fast-paced world of cryptocurrency. Think of it as your personal roadmap, guiding you through the twists and turns of the market. A well-maintained journal not only tracks your trades but also captures your emotions, thoughts, and strategies, providing you with invaluable insights over time. By documenting your trading journey, you can identify patterns in your behavior, recognize what works, and pinpoint areas that need improvement.

So, how do you go about building an effective trading journal? First, you need to decide on the format that works best for you. Some traders prefer a digital format, using spreadsheets or specialized trading software, while others might lean towards a traditional pen-and-paper approach. Regardless of the medium, your journal should consistently include specific key elements:

- Date and Time: Record when each trade was executed to analyze trends over time.

- Asset Traded: Note which cryptocurrency you traded, as different assets can behave differently.

- Entry and Exit Points: Document the price at which you entered and exited the trade to evaluate your timing.

- Position Size: Indicate how much of the asset you traded, which is crucial for risk management.

- Trade Rationale: Write down your reasons for entering the trade, including any technical indicators or news events that influenced your decision.

- Outcome: Record whether the trade was profitable or not, along with the percentage gain or loss.

- Emotional State: Reflect on how you felt during the trade, as emotions can significantly impact decision-making.

- Lessons Learned: Conclude with a brief summary of what you learned from each trade, which can help you refine your strategies.

Let’s break this down a bit more. For instance, when you note your emotional state, you might discover that fear often led you to exit trades too early, or perhaps overconfidence caused you to take on larger positions than you should have. By recognizing these patterns, you can work on strategies to manage your emotions better, leading to more disciplined trading.

Moreover, you can enhance your trading journal by incorporating charts and graphs that visualize your performance over time. This could be as simple as a line graph showing your cumulative gains or losses, or more complex analytics that break down your performance by asset type or trading strategy. Visual aids can often highlight trends that numbers alone might obscure.

Ultimately, the goal of your trading journal is to create a feedback loop that fosters continuous improvement. Regularly reviewing your past trades allows you to see how your strategies evolve and adapt based on market conditions. It’s like having a mirror that reflects not just your successes but also your failures, helping you to grow as a trader.

In conclusion, building a trading journal is not just about tracking your trades; it's about fostering a mindset of growth and learning. By dedicating time to this practice, you’re investing in your future as a trader. Remember, every expert was once a beginner, and the path to mastery is paved with thoughtful reflection and analysis of past experiences.

1. How often should I update my trading journal?

It's best to update your journal after every trade. This ensures that your reflections and insights are fresh and accurate.

2. What should I do if I miss a trade in my journal?

Don’t worry! Simply add it in as soon as you remember. The goal is to maintain accuracy, but it’s also important not to let missed entries discourage you.

3. Can I use apps for my trading journal?

Absolutely! There are many apps designed specifically for trading journals that can automate some of the tracking and analysis processes.

4. Is it necessary to track my emotions in the journal?

While it’s not mandatory, tracking your emotions can provide insight into your trading psychology, which is crucial for long-term success.

5. How can I analyze my trading journal effectively?

Set aside regular time to review your journal entries. Look for patterns in your successes and failures, and adjust your strategies accordingly.

Frequently Asked Questions

- What is technical analysis in crypto trading?

Technical analysis is the study of price movements and trading volumes to predict future price trends in the cryptocurrency market. By analyzing historical data, traders can identify patterns and potential entry and exit points, helping them make informed trading decisions.

- How do I set clear trading goals?

Setting clear trading goals involves using the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. This means defining what you want to achieve in your trading journey, how you'll measure success, ensuring your goals are realistic, making them relevant to your overall financial strategy, and setting a timeline for achieving them.

- What indicators should I use for trading?

Choosing the right indicators can significantly enhance your trading strategy. Commonly used indicators include Moving Averages, Relative Strength Index (RSI), and MACD. Each of these provides different insights into market trends and can help you make better trading decisions.

- How do I develop entry and exit strategies?

To create effective entry and exit strategies, start by identifying your trading signals based on technical indicators. Define your criteria for entering a trade, such as a specific price level or indicator crossover, and establish exit points, including profit targets and stop-loss levels, to manage risks effectively.

- What are some risk management techniques?

Risk management is crucial in crypto trading. Techniques include using stop-loss orders to limit potential losses, position sizing to manage how much capital you risk on each trade, and diversifying your portfolio to spread risk across different assets.

- Why is backtesting important?

Backtesting allows traders to apply their strategies to historical data to see how they would have performed in the past. This process helps you refine your strategies, identify potential weaknesses, and improve your chances of success in real-time trading.

- How can I stay informed about market trends?

Staying informed involves regularly checking cryptocurrency news, following market analysts, and keeping an eye on regulatory changes and technological advancements. This knowledge helps you adapt your trading strategies to the ever-changing market conditions.

- Why should I monitor and adjust my trading plan?

Regularly reviewing and adjusting your trading plan based on performance metrics and market changes is essential for continuous improvement. This ensures that your strategies remain relevant and effective over time, helping you achieve long-term success in your trading journey.

- What is a trading journal and why is it important?

A trading journal is a record of your trades, emotions, and decision-making processes. Keeping a journal helps you track your performance, identify patterns in your trading behavior, and facilitate personal growth as a trader by learning from both successes and mistakes.