Creating a Trading Plan - Step-by-Step Guide

Creating a trading plan is like crafting a roadmap for your financial journey. Without it, you’re just driving through the market blindfolded, hoping to stumble upon success. A well-thought-out trading plan not only provides structure but also empowers you with the discipline needed to navigate the often turbulent waters of trading. Think of it as your personal guide that keeps you focused on your goals while helping you manage risks effectively.

In this guide, we’ll take you through the essential components of a trading plan, offering strategies and tips that will help you trade with confidence. Whether you’re a novice looking to dip your toes into the trading pool or a seasoned trader seeking to refine your approach, this comprehensive guide will equip you with the knowledge you need to succeed. So, buckle up and let’s dive into the world of trading plans!

A trading plan is crucial for success in the financial markets. Imagine trying to build a house without a blueprint. It would be chaotic, right? Similarly, a trading plan provides the necessary structure and discipline to keep your trading activities organized. It acts as a compass, guiding you through the complexities of market analysis and helping you make informed decisions based on your goals.

Moreover, having a solid trading plan allows you to manage risks effectively. By outlining your strategies and expectations, you can minimize emotional trading and avoid impulsive decisions that often lead to losses. In essence, a trading plan is not just a document; it’s your ticket to navigating the markets with confidence and clarity.

A well-structured trading plan includes several key components that are vital for guiding your trading decisions. These components typically encompass:

- Trading Goals: Clearly defined objectives that align with your financial aspirations.

- Risk Management Strategies: Techniques to protect your capital and mitigate potential losses.

- Entry and Exit Criteria: Specific rules that dictate when to enter or exit trades.

- Performance Evaluation Metrics: Tools for assessing your trading effectiveness and making necessary adjustments.

By incorporating these elements, you can create a robust trading plan that serves as a reliable guide in your trading journey. Each component plays a crucial role in ensuring that your trading activities are not only organized but also strategically aligned with your financial goals.

Establishing clear and achievable trading goals is essential for maintaining focus and motivation. Think of your goals as the destination on your trading journey. If you don’t know where you’re headed, how can you get there? Goals should be specific, measurable, attainable, relevant, and time-bound (SMART) to ensure you can track your progress effectively.

Differentiating between short-term and long-term goals allows traders to align their strategies with their overall investment objectives. Short-term goals may focus on immediate gains, such as making a profit within weeks, while long-term goals emphasize sustained growth and portfolio development over months or years. Understanding this distinction can help you tailor your trading plan to suit your needs.

As market conditions and personal circumstances change, it’s important for traders to periodically reassess and adjust their goals. This flexibility can help maintain relevance and effectiveness in a dynamic trading environment. Just like a ship adjusts its sails to navigate changing winds, your trading goals should evolve to reflect your current situation and market conditions.

Effective risk management is the cornerstone of any trading plan. By identifying potential risks and establishing strategies to mitigate them, traders can protect their capital and reduce the likelihood of significant losses. This could involve setting stop-loss orders, diversifying your portfolio, or only risking a small percentage of your capital on any single trade. Remember, it’s not about avoiding risks altogether but managing them wisely.

Defining clear entry and exit criteria is essential for executing trades with confidence. This involves analyzing market signals and establishing rules that dictate when to enter or exit a position based on predetermined conditions. By having these criteria in place, you can avoid emotional decisions and stick to your trading plan.

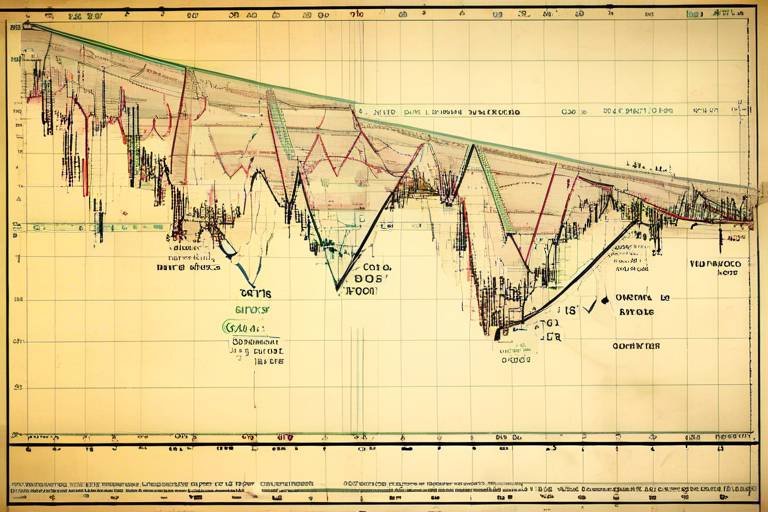

Technical analysis helps traders identify optimal entry points by examining price charts and patterns. Utilizing indicators and trend lines can enhance decision-making and improve the timing of trades. It’s like having a magnifying glass that helps you spot the right opportunities amidst the noise of the market.

Creating effective exit strategies is crucial for maximizing profits and minimizing losses. Traders should establish profit targets and stop-loss levels to ensure disciplined exits based on market movements and risk tolerance. Think of your exit strategy as the safety net that catches you if the market takes an unexpected turn.

Regular performance evaluation allows traders to assess the effectiveness of their trading plan. By analyzing results and making necessary adjustments, traders can continuously improve their strategies and achieve better outcomes in the market. It’s like tuning a musical instrument; regular checks ensure that your trading approach remains harmonious with the market’s rhythm.

1. What is the most important element of a trading plan?

The most important element is arguably the risk management strategy. Without it, you could face significant losses that could derail your trading journey.

2. How often should I review my trading plan?

It’s advisable to review your trading plan regularly, especially after significant market changes or personal life events that may affect your trading strategy.

3. Can I trade successfully without a trading plan?

While some traders may have occasional success without a plan, having a well-structured trading plan significantly increases your chances of long-term success.

Understanding the Importance of a Trading Plan

A trading plan is not just a piece of paper; it’s your **roadmap** to success in the financial markets. Imagine setting out on a road trip without a map or GPS. You might get somewhere, but chances are you’ll take a few wrong turns and waste a lot of time. Similarly, without a trading plan, you’re navigating the complex world of trading blindly, which can lead to poor decisions and unnecessary losses.

At its core, a trading plan provides the **structure** and **discipline** necessary to make informed decisions. It outlines your trading goals, strategies, and risk management techniques, allowing you to approach the markets with confidence. By having a clear plan in place, you can avoid emotional trading, which often leads to impulsive decisions driven by fear or greed. Instead, you can rely on your carefully crafted strategies to guide you through the ups and downs of the market.

Furthermore, a well-defined trading plan helps you manage risk effectively. In the world of trading, risk is an inevitable companion. However, it’s how you handle that risk that will determine your success. A trading plan allows you to identify potential risks and develop strategies to mitigate them. For instance, you can set specific stop-loss levels to limit potential losses on each trade, ensuring that no single trade can significantly harm your overall capital.

Additionally, a trading plan serves as a **benchmark** for evaluating your performance. By regularly assessing your trades against your plan, you can identify what works and what doesn’t. This reflective practice is crucial for continuous improvement. You may find that certain strategies yield better results than others, or that your risk management techniques need adjustment. Whatever the case may be, having a plan allows you to make data-driven decisions rather than relying on gut feelings.

In summary, the importance of a trading plan cannot be overstated. It acts as your guiding star in the often turbulent seas of trading. Without it, you risk losing your way and, ultimately, your investment. So, before you dive into the markets, take the time to create a comprehensive trading plan that addresses your goals, strategies, and risk management. Your future self will thank you for it!

- What is a trading plan? A trading plan is a documented strategy that outlines your trading goals, risk management techniques, and specific entry and exit criteria.

- Why is a trading plan important? A trading plan provides structure, discipline, and a clear strategy, helping traders manage risk and make informed decisions.

- How often should I update my trading plan? It’s advisable to review and update your trading plan regularly, especially when market conditions change or if you experience significant gains or losses.

Key Components of a Trading Plan

When it comes to trading, having a well-structured plan is like having a roadmap on a long journey. It guides you through the twists and turns of the financial markets, ensuring you don’t veer off course. A comprehensive trading plan should encompass several key components that work together to provide clarity and direction. These components are not just formalities; they are critical elements that can determine your success or failure in trading.

First up, we have trading goals. Setting specific, measurable, attainable, relevant, and time-bound (SMART) goals is essential. Think of your goals as the destination of your journey. Without a clear destination, how can you know which path to take? For instance, a goal might be to achieve a 10% return on investment within six months. This gives you a concrete target to aim for.

Next, let’s talk about risk management strategies. This is the safety net that protects your capital from unexpected market downturns. You wouldn’t jump out of an airplane without a parachute, right? Similarly, in trading, you need to identify potential risks and establish strategies to mitigate them. This could involve setting stop-loss orders or diversifying your portfolio to spread out risk. The key is to be proactive rather than reactive.

Another important component is entry and exit criteria. These are your rules for when to jump into a trade and when to gracefully exit. Imagine you’re a chef; you wouldn’t just throw ingredients together without a recipe. In trading, you analyze market signals and establish clear conditions that dictate your entry and exit points. This might include technical indicators or specific price levels that trigger your trades.

Finally, let’s not forget about performance evaluation metrics. This is where the magic happens after your trades are executed. Regularly assessing your performance allows you to see what’s working and what’s not. It’s like reviewing the footage of a game to understand your strengths and weaknesses. By analyzing your results, you can make necessary adjustments to your trading plan to continuously improve your strategies.

To summarize, a successful trading plan is built on:

- Trading Goals: Clear and measurable objectives

- Risk Management Strategies: Plans to safeguard your capital

- Entry and Exit Criteria: Defined rules for trading

- Performance Evaluation Metrics: Regular assessments to improve

By integrating these components into your trading plan, you’ll be well-equipped to navigate the markets with confidence. Remember, a trading plan is not static; it should evolve as you gain more experience and as market conditions change. Stay flexible, stay informed, and keep refining your approach!

What is the purpose of a trading plan?

A trading plan serves as a guideline that helps traders make informed decisions, manage risks, and stay focused on their goals.

How often should I review my trading plan?

It’s advisable to review your trading plan regularly—at least once a month or after significant market events—to ensure it remains relevant and effective.

Can I change my trading goals?

Absolutely! As market conditions and personal circumstances change, it’s important to reassess and adjust your trading goals accordingly.

Setting Clear Trading Goals

When it comes to trading, having a roadmap is essential. Just like you wouldn’t embark on a cross-country road trip without a map or GPS, you shouldn’t dive into the financial markets without clear trading goals. Setting these goals is like laying down the foundation for a sturdy house; it gives you a structure to build upon and helps you stay focused on your journey. But what does it mean to set clear trading goals? Well, it’s all about defining what you want to achieve in a way that is specific, measurable, attainable, relevant, and time-bound—commonly known as the SMART criteria.

Imagine you’re an athlete training for a marathon. You wouldn’t just say, “I want to run a marathon someday.” Instead, you’d set specific goals: “I want to run 5 kilometers in under 30 minutes by the end of the month.” This level of specificity not only clarifies what you’re aiming for but also allows you to track your progress. Similarly, in trading, your goals should be clear and actionable. For instance, you might set a goal to achieve a 10% return on your investment within six months. This is a clear target that you can measure and adjust as needed.

However, it’s not just about setting any goals; it’s about ensuring they align with your overall trading strategy and personal circumstances. Are you a conservative investor looking to build wealth over time, or are you a risk-taker looking for quick gains? Your goals should reflect your trading style and risk tolerance. Furthermore, it’s crucial to periodically reassess these goals. Just as an athlete might adjust their training regimen based on performance, you should be flexible enough to tweak your trading goals in response to market changes or personal life events.

To help you visualize this, consider the following table that outlines different types of trading goals:

| Goal Type | Description | Example |

|---|---|---|

| Short-term Goals | Focus on immediate gains or specific trades. | Achieve a 5% return in the next month. |

| Long-term Goals | Emphasize sustained growth and overall portfolio development. | Grow the investment portfolio by 50% over five years. |

| Performance Goals | Target specific metrics to improve trading skills. | Reduce the average loss per trade by 20% within three months. |

In conclusion, setting clear trading goals is not just a task; it’s a vital part of your trading journey. It keeps you focused, motivated, and aligned with your overall strategy. Remember, the clearer your goals, the easier it will be to navigate the often tumultuous waters of the trading world. So, take the time to define your goals today, and watch how they guide your trading decisions tomorrow!

- What are SMART goals in trading? SMART goals are specific, measurable, attainable, relevant, and time-bound objectives that help traders define their trading ambitions clearly.

- How often should I reassess my trading goals? It’s advisable to review your goals periodically, especially after significant market changes or personal life events.

- Can I have both short-term and long-term trading goals? Absolutely! Having a mix of both can help you balance immediate gains with sustained growth.

Short-term vs. Long-term Goals

When it comes to trading, understanding the difference between short-term and long-term goals can be the difference between thriving in the market and merely surviving. Think of your trading journey as a road trip: while you can make quick stops along the way (short-term goals), it's the ultimate destination (long-term goals) that gives your journey purpose and direction. Short-term goals typically focus on immediate gains, often involving quick trades that capitalize on market fluctuations. For example, a trader might aim to make a certain percentage profit within a week or a month. This approach requires a keen eye on market trends and the ability to react swiftly to changes.

On the other hand, long-term goals are more about sustained growth and overall portfolio development. These goals might include building a retirement fund or increasing your investment over several years. It's like planting a tree; you nurture it over time, and while you may not see immediate results, the eventual growth can be substantial. Long-term trading strategies often involve less frequent trading, focusing instead on the overall trajectory of investments.

To illustrate the differences further, let’s look at a quick comparison:

| Aspect | Short-term Goals | Long-term Goals |

|---|---|---|

| Time Frame | Days to Weeks | Months to Years |

| Risk Level | Higher | Lower |

| Focus | Quick Profits | Sustained Growth |

| Strategy | Frequent Trading | Buy and Hold |

As you set your trading goals, it's crucial to strike a balance between short-term and long-term objectives. This balance allows you to enjoy the thrill of quick wins while still keeping an eye on the bigger picture. Moreover, as market conditions and personal circumstances change, you should not hesitate to reassess and adjust your goals accordingly. This flexibility can help maintain relevance and effectiveness in a dynamic trading environment, ensuring that both your short-term and long-term strategies work in harmony towards your financial success.

- What are short-term trading goals? Short-term trading goals typically involve making profits quickly, often within days or weeks, by capitalizing on market fluctuations.

- How do I set long-term trading goals? Long-term trading goals should focus on sustained growth and can include objectives like retirement savings or significant portfolio growth over several years.

- Can I have both short-term and long-term goals? Absolutely! A balanced approach that incorporates both types of goals can provide motivation and help you navigate different market conditions effectively.

Adjusting Goals Over Time

In the ever-evolving landscape of trading, adjusting your goals over time is not just a suggestion; it's a necessity. Imagine setting out on a road trip without a map. You might start off with a clear destination, but what happens when you hit a detour? Similarly, as market conditions shift and your personal circumstances change, your trading goals should be flexible enough to adapt. This flexibility is crucial for maintaining relevance and effectiveness in a dynamic trading environment.

To effectively adjust your goals, start by regularly reviewing your trading performance. Are you consistently hitting your targets? If not, it might be time to reassess what you want to achieve. Setting aside time each month or quarter to evaluate your progress can provide valuable insights. You might find that certain goals are too ambitious, while others may not challenge you enough. Here’s a simple framework to guide you through the adjustment process:

- Review Performance: Analyze your trades and outcomes to understand what worked and what didn’t.

- Market Conditions: Stay informed about market trends and economic indicators that could impact your trading.

- Personal Circumstances: Consider any changes in your life that might affect your trading capacity, such as job changes, financial situations, or time availability.

- Set New Goals: Based on your review, adjust your goals to align with your current situation and market conditions.

For instance, if you initially aimed for a 20% return on investment but found the market to be particularly volatile, you might want to adjust your goal to a more realistic 10%. This doesn’t mean you’re giving up; it means you’re being pragmatic. Just like a sailor adjusting their sails in response to changing winds, you too must be willing to pivot and adapt.

Moreover, keeping a trading journal can be a game-changer in this process. Documenting your trades, the rationale behind your decisions, and the outcomes allows you to reflect on your trading journey. Over time, patterns will emerge, making it easier to identify when it's time to adjust your goals. Remember, trading is not just about making money; it's about learning and evolving as a trader.

Ultimately, the goal of adjusting your trading objectives is to ensure that they remain aligned with your overall vision and strategy. Think of it as tuning a musical instrument; the better the tuning, the more harmonious the performance. By staying adaptable and open to change, you can navigate the markets with greater confidence and clarity.

- Why is it important to adjust trading goals? Adjusting goals helps traders stay relevant and effective in changing market conditions and personal circumstances.

- How often should I review my trading goals? It's advisable to review your trading goals monthly or quarterly to ensure they align with your performance and market trends.

- What should I do if I consistently miss my trading goals? If you're consistently missing your goals, reassess them to ensure they are realistic and achievable based on your current trading strategy and market conditions.

Risk Management Strategies

Effective risk management is the backbone of any successful trading plan. Think of it as your safety net in the high-flying circus of the financial markets. Without a solid plan in place, even the most skilled traders can find themselves tumbling into the depths of significant losses. So, how do we create this safety net? It starts with identifying potential risks and establishing robust strategies to mitigate them. This proactive approach enables traders to protect their capital while navigating the unpredictable waters of trading.

One of the first steps in risk management is to determine your risk tolerance. This involves assessing how much of your capital you are willing to risk on a single trade. A good rule of thumb is to risk only a small percentage of your total trading capital—typically around 1% to 2%. By doing this, even a series of unfortunate trades won't wipe out your entire account. It’s like having a cushion that absorbs the shocks of market volatility.

Another essential component of risk management is setting stop-loss orders. These are predetermined price levels where you will exit a trade to limit your losses. For example, if you buy a stock at $50 and set a stop-loss at $48, your maximum loss will be limited to $2 per share. This strategy not only protects your capital but also removes the emotional aspect of trading decisions, allowing you to stick to your plan even when the market gets turbulent.

In addition to stop-loss orders, you should also consider using position sizing techniques. Position sizing helps you determine how many shares or contracts to buy based on your risk tolerance and the distance of your stop-loss order. For instance, if you have a $10,000 trading account and are willing to risk 1% on a trade, you would risk $100. If your stop-loss is $2 away from your entry point, you could purchase 50 shares. This method ensures that your potential losses remain within your predetermined risk level.

Lastly, regularly reviewing and adjusting your risk management strategies is crucial. As market conditions change, so should your approach. For example, during periods of high volatility, you might want to tighten your stop-loss orders or reduce your position sizes to protect against sudden market swings. By staying flexible and responsive to market dynamics, you can enhance your risk management framework and improve your overall trading performance.

In summary, effective risk management strategies are vital for navigating the trading landscape. By understanding your risk tolerance, utilizing stop-loss orders, employing position sizing techniques, and regularly reviewing your strategies, you can create a robust safety net that allows you to trade with confidence and peace of mind.

- What is risk tolerance? Risk tolerance refers to the amount of risk an individual is willing to take when investing or trading. It varies from person to person based on financial goals, experience, and psychological factors.

- How do stop-loss orders work? Stop-loss orders automatically sell a security when it reaches a certain price, helping to limit potential losses.

- Why is position sizing important? Position sizing helps traders determine how much capital to allocate to each trade, ensuring that they do not risk more than they can afford to lose.

- Can I adjust my risk management strategies? Yes! It’s essential to regularly review and adjust your risk management strategies based on market conditions and personal circumstances.

Developing Entry and Exit Criteria

Defining clear entry and exit criteria is essential for executing trades with confidence. Think of your trading plan as a roadmap; without specific directions, you might find yourself lost in the vast landscape of the financial markets. Entry and exit criteria serve as your guiding stars, illuminating the path you should take when making trading decisions. This involves analyzing market signals and establishing rules that dictate when to enter or exit a position based on predetermined conditions. The more specific your criteria, the easier it will be to stick to your plan and avoid emotional trading.

To develop effective entry criteria, traders often rely on technical analysis. This involves examining price charts and patterns to identify optimal entry points. For instance, you might look for specific patterns, such as head and shoulders or double bottoms, which can indicate potential price movements. Additionally, utilizing indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands can enhance your decision-making process. These tools can help you gauge market momentum and determine whether it’s the right time to make your move.

On the flip side, exit strategies are equally crucial for maximizing profits and minimizing losses. Imagine you’re on a roller coaster; you want to enjoy the thrill but also know when it’s time to get off before things get out of control. Traders should establish profit targets and stop-loss levels to ensure disciplined exits based on market movements and risk tolerance. For example, if you enter a trade at $100 with a profit target of $120 and a stop-loss set at $95, you’re effectively managing your risk while aiming for a reward. This balance is vital in maintaining a sustainable trading strategy.

Consider implementing a table to visualize your entry and exit criteria. Here’s a simple example:

| Criteria Type | Entry Criteria | Exit Criteria |

|---|---|---|

| Price Action | Break above resistance level | Break below support level |

| Indicators | RSI below 30 (oversold) | RSI above 70 (overbought) |

| Chart Patterns | Formation of a bullish engulfing pattern | Formation of a bearish engulfing pattern |

By creating such a table, you provide a visual reference that can aid in quick decision-making during trading sessions. Remember, the goal is to remove ambiguity from your trading approach. The clearer your entry and exit criteria, the less likely you are to second-guess your decisions when the market gets turbulent.

In conclusion, developing robust entry and exit criteria is not just about having rules; it's about having a framework that keeps you disciplined and focused on your trading goals. As you refine your criteria, keep in mind that the market is ever-changing. Regularly revisiting and adjusting these criteria based on your experiences and market conditions will lead to a more effective trading strategy in the long run.

- What is the importance of having entry and exit criteria? Having clear criteria helps traders make informed decisions and stick to their trading plans, reducing emotional trading.

- How often should I review my entry and exit criteria? It's advisable to review them periodically, especially after significant market changes or personal trading experiences.

- Can technical analysis guarantee successful trades? While technical analysis can improve your chances of success, no method can guarantee profits due to the unpredictable nature of the markets.

Technical Analysis for Entry Points

This article outlines a comprehensive approach to developing a trading plan, including essential components, strategies, and tips for successful trading, ensuring that traders can navigate the markets with confidence.

A trading plan is crucial for success in the financial markets. It provides structure, discipline, and a clear strategy, helping traders manage risk and make informed decisions based on their goals and market analysis.

A well-structured trading plan includes several key components, such as trading goals, risk management strategies, entry and exit criteria, and performance evaluation metrics. Each element plays a vital role in guiding trading decisions and actions.

Establishing clear and achievable trading goals is essential for maintaining focus and motivation. Goals should be specific, measurable, attainable, relevant, and time-bound (SMART) to ensure traders can track their progress effectively.

Differentiating between short-term and long-term goals allows traders to align their strategies with their overall investment objectives. Short-term goals may focus on immediate gains, while long-term goals emphasize sustained growth and portfolio development.

As market conditions and personal circumstances change, it's important for traders to periodically reassess and adjust their goals. This flexibility can help maintain relevance and effectiveness in a dynamic trading environment.

Effective risk management is a cornerstone of any trading plan. By identifying potential risks and establishing strategies to mitigate them, traders can protect their capital and reduce the likelihood of significant losses.

Defining clear entry and exit criteria is essential for executing trades with confidence. This involves analyzing market signals and establishing rules that dictate when to enter or exit a position based on predetermined conditions.

Technical analysis is a powerful tool that traders use to identify optimal entry points in the market. By examining price charts and patterns, traders can gain insights into potential future price movements. This analysis involves studying various indicators, such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels, which can guide traders in making informed decisions.

For instance, moving averages help smooth out price data to identify trends over a specific period. When the short-term moving average crosses above the long-term moving average, it can signal a potential buying opportunity. Similarly, the Relative Strength Index (RSI) measures the speed and change of price movements, indicating whether a stock is overbought or oversold. A reading below 30 may suggest that a stock is oversold and could be a good entry point.

In addition to these indicators, traders often look for chart patterns, such as head and shoulders or double tops, which can provide hints about market reversals. Understanding these patterns can be likened to reading a map; they give traders direction and help them navigate through the complexities of the market.

Moreover, it's essential to combine technical analysis with other forms of analysis, such as fundamental analysis, to create a more comprehensive trading strategy. This approach ensures that traders are not solely reliant on past price movements but are also considering the underlying factors that can influence market behavior.

To illustrate the effectiveness of technical analysis, consider the following table that summarizes some common technical indicators and their purposes:

| Indicator | Purpose |

|---|---|

| Moving Average | Identifies trends by smoothing price data over a specific period. |

| Relative Strength Index (RSI) | Measures price momentum to identify overbought or oversold conditions. |

| Fibonacci Retracement | Identifies potential support and resistance levels based on the Fibonacci sequence. |

By effectively utilizing technical analysis, traders can enhance their ability to pinpoint entry points, leading to more successful trades. Remember, the goal is not just to enter the market but to do so at the right time, maximizing potential gains while minimizing risks.

Regular performance evaluation allows traders to assess the effectiveness of their trading plan. By analyzing results and making necessary adjustments, traders can continuously improve their strategies and achieve better outcomes in the market.

- What is a trading plan? A trading plan is a comprehensive strategy that outlines how a trader will operate in the financial markets, including goals, risk management, and entry/exit criteria.

- Why is risk management important? Risk management is essential to protect capital and minimize losses, ensuring that traders can sustain their trading activities over time.

- How often should I evaluate my trading performance? It’s advisable to evaluate your trading performance regularly, such as weekly or monthly, to identify strengths and weaknesses in your strategy.

Exit Strategies to Maximize Profits

This article outlines a comprehensive approach to developing a trading plan, including essential components, strategies, and tips for successful trading, ensuring that traders can navigate the markets with confidence.

A trading plan is crucial for success in the financial markets. It provides structure, discipline, and a clear strategy, helping traders manage risk and make informed decisions based on their goals and market analysis.

A well-structured trading plan includes several key components, such as trading goals, risk management strategies, entry and exit criteria, and performance evaluation metrics. Each element plays a vital role in guiding trading decisions and actions.

Establishing clear and achievable trading goals is essential for maintaining focus and motivation. Goals should be specific, measurable, attainable, relevant, and time-bound (SMART) to ensure traders can track their progress effectively.

Differentiating between short-term and long-term goals allows traders to align their strategies with their overall investment objectives. Short-term goals may focus on immediate gains, while long-term goals emphasize sustained growth and portfolio development.

As market conditions and personal circumstances change, it's important for traders to periodically reassess and adjust their goals. This flexibility can help maintain relevance and effectiveness in a dynamic trading environment.

Effective risk management is a cornerstone of any trading plan. By identifying potential risks and establishing strategies to mitigate them, traders can protect their capital and reduce the likelihood of significant losses.

Defining clear entry and exit criteria is essential for executing trades with confidence. This involves analyzing market signals and establishing rules that dictate when to enter or exit a position based on predetermined conditions.

Technical analysis helps traders identify optimal entry points by examining price charts and patterns. Utilizing indicators and trend lines can enhance decision-making and improve the timing of trades.

Creating effective exit strategies is crucial for maximizing profits and minimizing losses. Think of your trading journey like a thrilling roller coaster; you want to enjoy the ride but also ensure you get off at the right moment! This is where exit strategies come into play. Traders should establish profit targets and stop-loss levels to ensure disciplined exits based on market movements and risk tolerance.

One effective approach is to use a combination of trailing stops and fixed profit targets. A trailing stop allows you to lock in profits while still giving your trade room to grow. For instance, if a stock price rises, you can adjust your stop-loss order upwards, ensuring that if the price reverses, you exit with a profit rather than a loss.

Moreover, it's essential to regularly review your exit strategies. Markets are dynamic, and what worked yesterday may not work today. By analyzing your trades and understanding the reasons behind your exits, you can refine your strategies for future trades.

Consider the following table as a quick reference for exit strategies:

| Exit Strategy | Description | Best Used For |

|---|---|---|

| Profit Target | Setting a specific price level to take profits. | Clear profit goals |

| Stop-Loss Order | Automatically selling a position at a predetermined price to limit losses. | Risk management |

| Trailing Stop | A stop-loss order that moves with the market price. | Maximizing profits in trending markets |

| Time-Based Exit | Exiting a position after a certain period, regardless of price. | Short-term trades |

Ultimately, the key to successful trading lies in having a well-thought-out exit strategy. It's not just about when to enter a trade but knowing when to exit and secure your profits. So, next time you're in a trade, ask yourself: "Am I ready to get off this ride?"

Regular performance evaluation allows traders to assess the effectiveness of their trading plan. By analyzing results and making necessary adjustments, traders can continuously improve their strategies and achieve better outcomes in the market.

- What is a trading plan? A trading plan is a comprehensive strategy that outlines your trading goals, risk management strategies, and criteria for entering and exiting trades.

- Why is risk management important? Effective risk management helps protect your capital and minimizes the likelihood of significant losses, allowing for long-term success in trading.

- How often should I evaluate my trading performance? Regularly evaluating your trading performance—ideally after every trade or at least weekly—can help you identify areas for improvement and adjust your strategies accordingly.

Performance Evaluation and Adjustment

Regular performance evaluation is not just a suggestion; it’s a necessity for anyone serious about trading. Think of it as your personal trading health check-up. Just like you wouldn’t ignore a persistent cough, you shouldn’t overlook the importance of reviewing your trades and overall strategy. By taking the time to analyze your performance, you can identify what's working, what isn't, and where adjustments need to be made. This process helps ensure that you’re not just trading on autopilot but are actively engaging with the market and your own strategies.

So, how do you go about evaluating your trading performance? Start by keeping a detailed trading journal. This journal should include:

- Trade Details: Date, time, asset traded, entry and exit points.

- Rationale: Why you entered the trade and what indicators you used.

- Outcome: Profit or loss, and any emotions felt during the trade.

Once you have this data, it’s time to analyze it. Look for patterns in your trading behavior. Are you consistently losing on certain types of trades? Maybe you're too quick to exit or too slow to pull the trigger. A performance table can be incredibly helpful here. Here’s a simple example:

| Trade Number | Asset | Entry Price | Exit Price | Outcome | Notes |

|---|---|---|---|---|---|

| 1 | XYZ | $100 | $110 | Profit | Followed plan |

| 2 | ABC | $50 | $45 | Loss | Ignored stop-loss |

| 3 | LMN | $75 | $80 | Profit | Market conditions favorable |

By reviewing your trades in this format, you can easily spot trends and make informed decisions about your future trading strategies. Are you taking too much risk? Are you not leveraging your winning trades effectively? These insights can lead to actionable changes that can significantly improve your trading outcomes.

Moreover, remember that the market is dynamic. What worked last month might not work today. Therefore, it’s essential to be flexible and willing to adjust your trading plan as necessary. This might mean recalibrating your risk management strategies, modifying your entry and exit criteria, or even setting new trading goals based on your recent performance. The key is to remain proactive rather than reactive.

Q: How often should I evaluate my trading performance?

A: It's advisable to review your performance at least monthly. However, if you're actively trading, a weekly review can provide valuable insights.

Q: What should I focus on during my performance evaluation?

A: Concentrate on your profit-loss ratio, adherence to your trading plan, emotional responses during trades, and any patterns in your successes and failures.

Q: Can I use trading software for performance evaluation?

A: Absolutely! Many trading platforms offer built-in analytics tools that can simplify the evaluation process and provide deeper insights into your trading habits.

In conclusion, performance evaluation and adjustment are not just tasks to check off your list; they are integral parts of your trading journey. By committing to regular reviews and being open to change, you can enhance your trading skills and increase your chances of success in the ever-evolving financial markets.

Frequently Asked Questions

- What is a trading plan and why do I need one?

A trading plan is essentially your roadmap for trading. It outlines your goals, strategies, and rules for entering and exiting trades. Think of it as a GPS for your trading journey—without it, you might get lost in the market's twists and turns. Having a well-structured trading plan helps you stay disciplined and focused, reducing the emotional rollercoaster that often comes with trading.

- How do I set realistic trading goals?

Setting realistic trading goals is like setting a fitness routine; you want them to be challenging yet achievable. Use the SMART criteria—Specific, Measurable, Attainable, Relevant, and Time-bound—to define your objectives. For instance, instead of saying "I want to make money," try "I aim to achieve a 10% return on my investment within six months." This specificity allows you to track your progress and stay motivated.

- What are some effective risk management strategies?

Risk management is your safety net in trading. It involves identifying potential risks and implementing strategies to minimize them. Some effective methods include setting stop-loss orders to limit losses, diversifying your portfolio to spread risk, and only risking a small percentage of your capital on any single trade. Remember, the goal is to protect your capital while still allowing for growth!

- How do I develop entry and exit criteria?

Developing entry and exit criteria is like creating a game plan before a big match. You need to analyze market signals and decide the conditions that trigger your trades. For entry points, you might look at technical indicators or price patterns. For exits, set profit targets and stop-loss levels to ensure you stick to your plan, even when emotions run high. This structure will help you trade with confidence.

- How often should I evaluate my trading performance?

Regular performance evaluation is key to improving your trading skills. Think of it as a check-up for your trading health! Ideally, you should review your performance monthly or quarterly. Analyze your wins and losses, identify patterns, and adjust your strategies accordingly. This practice will help you stay on track and make informed decisions moving forward.