How to Analyze Chart Patterns for Altcoin Trading

Welcome to the exciting world of altcoin trading! If you’re diving into this vibrant market, understanding how to analyze chart patterns is essential for making informed trading decisions. Chart patterns are like the fingerprints of the market—they reveal the unique behaviors, trends, and potential reversals in price movements. By mastering these patterns, you can not only anticipate market shifts but also position yourself to capitalize on them effectively.

In the realm of trading, chart patterns serve as powerful tools that help traders decipher the often chaotic price movements of altcoins. They provide visual cues that can indicate whether a trend is likely to continue or reverse. Think of it this way: if the market is a story, chart patterns are the chapters that tell you what might happen next. Understanding these patterns can give you a significant edge, allowing you to make strategic decisions rather than relying solely on gut feelings or random guesses.

So, what exactly are these chart patterns? They are formations created by the price movements of an asset, displayed on a chart over a specific period. Traders use these patterns to forecast future price movements based on historical data. The beauty of chart patterns lies in their ability to provide insights into market psychology—showing us where traders might be feeling bullish or bearish. By recognizing these patterns, you can better predict potential breakouts or reversals, which is crucial in the fast-paced world of altcoin trading.

But don’t just take my word for it! Let’s break down some of the most common chart patterns you’ll encounter. These include the head and shoulders, triangles, and flags. Each of these patterns has its own unique characteristics and implications for your trading strategy. For instance, the head and shoulders pattern is often seen as a strong indicator of a trend reversal, while triangles and flags typically suggest that the current trend is likely to continue. Understanding these patterns can be the difference between making a profitable trade and missing out on opportunities.

In the upcoming sections, we’ll dive deeper into each of these patterns, exploring their formations, significance, and the best practices for trading them effectively. Additionally, we’ll discuss how volume analysis can enhance the reliability of these patterns, ensuring that your trading decisions are based on solid data rather than mere speculation. And if you’re wondering about the tools available to assist in chart analysis, don’t worry—we’ve got you covered there too!

So, are you ready to unlock the secrets of chart patterns and take your altcoin trading to the next level? Let’s get started!

- What are chart patterns? Chart patterns are formations created by the price movements of an asset on a chart, used to forecast future price movements.

- Why are chart patterns important in altcoin trading? They help traders predict market trends and reversals, allowing for more informed trading decisions.

- What are some common chart patterns? Common patterns include head and shoulders, triangles, and flags.

- How does volume analysis enhance chart pattern analysis? Volume analysis confirms the strength of a pattern, ensuring that the observed movements are supported by sufficient trading activity.

- What tools can I use for chart analysis? There are various trading platforms and software that provide tools for effective chart analysis.

Understanding Chart Patterns

Chart patterns are the backbone of technical analysis in trading, particularly in the volatile world of altcoins. Imagine you’re trying to read a map; chart patterns serve as your compass, guiding you through the unpredictable terrain of cryptocurrency markets. These visual representations of price movements not only help traders identify potential trends but also forecast reversals, making them invaluable tools in a trader's toolkit.

The significance of chart patterns lies in their ability to reflect market psychology. When traders act on their emotions—fear, greed, excitement—they create recognizable patterns on charts. By analyzing these patterns, traders can gain insights into market sentiment and make informed decisions. For instance, when prices consistently form a specific pattern, it often indicates a collective belief among traders about the future direction of the asset. This is where the magic happens: understanding these patterns can mean the difference between a profitable trade and a costly mistake.

Chart patterns can be broadly categorized into two types: continuation patterns and reversal patterns. Continuation patterns suggest that the current trend will continue, while reversal patterns indicate a potential change in direction. Here are a few key patterns you should familiarize yourself with:

- Head and Shoulders: A classic reversal pattern that signals a change in trend direction.

- Triangles: These can be ascending, descending, or symmetrical, and typically indicate a continuation of the current trend.

- Flags: Short-term continuation patterns that resemble a flag on a pole, indicating a brief pause before the trend resumes.

By mastering these patterns, traders can better anticipate market movements and make strategic decisions. However, it's essential to remember that no pattern is foolproof. Market conditions can change rapidly, and external factors—like news events or regulatory changes—can influence price action. Thus, while chart patterns provide valuable insights, they should be used in conjunction with other analytical tools and techniques.

In conclusion, understanding chart patterns is a crucial aspect of altcoin trading. By recognizing these patterns and their implications, traders can navigate the complexities of the market with greater confidence, making informed decisions that align with their trading strategies.

Common Chart Patterns

When it comes to altcoin trading, understanding chart patterns is like having a treasure map in your pocket. These patterns are not just random squiggles on a graph; they are visual cues that can help you predict market movements. By recognizing these patterns, traders can make informed decisions that could lead to profitable trades. Let's dive into some of the most prevalent chart patterns that every trader should be aware of.

One of the most recognized patterns is the head and shoulders pattern, which serves as a strong indicator of potential trend reversals. Imagine a mountain range where the middle peak (the head) is higher than the two surrounding peaks (the shoulders). This formation typically suggests that a bullish trend is about to shift into a bearish one. Traders often look for this pattern to signal when to exit a long position or enter a short position. The inverse head and shoulders pattern, on the other hand, is like a phoenix rising from the ashes, indicating a potential bullish reversal. It's structured similarly but inverted, providing traders with a clear signal that it might be time to buy.

Next, we have triangles and flags, which are continuation patterns that suggest the market is likely to continue its current trend. Triangles can be ascending, descending, or symmetrical, each offering different implications for traders. For instance, an ascending triangle often indicates that buyers are gaining strength and a breakout to the upside is likely. On the flip side, flags are short-term patterns that resemble a flag on a pole and typically occur after a strong price movement. They suggest that, after a brief consolidation, the price is likely to continue in the direction of the previous trend.

Understanding these patterns is crucial, but it's equally important to recognize their implications for your trading strategy. For example, if you spot a head and shoulders pattern forming, you might want to consider setting your stop-loss orders just above the right shoulder to minimize risk. Similarly, with triangles, waiting for a breakout before entering a trade can help you capitalize on the momentum. By combining your knowledge of these patterns with sound risk management techniques, you can enhance your trading strategy significantly.

In summary, chart patterns are invaluable tools in the arsenal of any trader. By familiarizing yourself with these common patterns, you can better navigate the often tumultuous waters of altcoin trading. Remember, the key to successful trading lies not just in recognizing these patterns, but also in understanding how to apply them effectively in your trading decisions.

Head and Shoulders Pattern

The is one of the most recognizable and significant chart patterns in the world of trading. It serves as a powerful indicator that suggests a potential reversal in the current trend. Imagine a mountain range where the peaks represent price highs; the head and shoulders pattern is like the tallest peak surrounded by two shorter ones. This formation typically appears at the end of an uptrend, signaling that the price might soon start to decline.

To identify a head and shoulders pattern, look for three peaks: the first peak (left shoulder), the second and highest peak (head), and the third peak (right shoulder), which should be lower than the head but similar in height to the left shoulder. The valleys between these peaks form the neckline, which is crucial for determining entry and exit points. When the price breaks below this neckline, it confirms the reversal, and traders often see this as a signal to sell.

Understanding the significance of this pattern is essential for any trader. When you spot a head and shoulders formation, it’s like seeing a warning sign on the road ahead. Ignoring it could lead to steep losses, while acting on it could save your investment. This pattern not only indicates a reversal but also provides a potential profit target. The distance from the head to the neckline can be projected downwards from the breakout point, giving traders a clear idea of potential price movement.

Traders can leverage the head and shoulders pattern in various ways:

- Entry Points: Entering a trade when the price breaks below the neckline can maximize profit potential.

- Stop-Loss Placement: Placing a stop-loss just above the right shoulder can help manage risk.

- Target Pricing: Use the height of the head from the neckline to set profit targets.

In summary, the head and shoulders pattern is not just a random occurrence on a chart; it’s a critical tool that traders can use to make informed decisions. By recognizing this pattern and understanding its implications, traders can position themselves advantageously in the market. So, the next time you’re analyzing a chart, keep an eye out for this compelling formation—it could be the key to unlocking profitable trades!

Inverse Head and Shoulders

The inverse head and shoulders pattern is a powerful indicator that signals a potential bullish reversal in the market. This pattern typically forms after a downtrend, indicating that the price is about to change direction and move upwards. Imagine a person standing with their head slightly tilted to one side; this pattern resembles that posture, where the "head" is the lowest point, flanked by two "shoulders" that are higher. Understanding how to identify and trade this pattern can significantly enhance your altcoin trading strategy.

To spot an inverse head and shoulders pattern, look for the following characteristics:

- Left Shoulder: The price dips and then rises, creating the first shoulder.

- Head: The price then drops lower, forming the head, before rising again.

- Right Shoulder: Finally, the price dips again but not as low as the head, forming the right shoulder.

Once this pattern is recognized, traders often look for confirmation through a breakout above the neckline, which is drawn across the peaks of the left and right shoulders. This breakout is crucial as it indicates a shift in momentum and can be a strong signal to enter a long position. The volume during the breakout is also significant; ideally, you want to see an increase in volume to confirm the validity of the pattern.

To further illustrate the significance of the inverse head and shoulders, consider the following table that outlines the key elements of the pattern:

| Pattern Element | Description |

|---|---|

| Left Shoulder | First dip followed by a rise, marking the beginning of the reversal. |

| Head | Deepest dip in the pattern, indicating maximum selling pressure before reversal. |

| Right Shoulder | Shallower dip compared to the head, indicating diminishing selling pressure. |

| Neckline | Horizontal line drawn across the peaks of the shoulders, critical for breakout confirmation. |

Trading the inverse head and shoulders pattern involves a few best practices. First, ensure that you wait for a confirmed breakout above the neckline before entering a trade. This minimizes the risk of false signals. Additionally, consider setting a stop-loss order just below the right shoulder to protect your investment. The target price can be estimated by measuring the distance from the head to the neckline and projecting that distance upward from the breakout point.

In conclusion, the inverse head and shoulders pattern is not just a visual cue but a strategic tool that can help traders make informed decisions. By understanding its structure and implications, you can position yourself for potential gains in the altcoin market. Remember, like any trading strategy, it is essential to combine this pattern with other indicators and sound risk management practices for the best results.

Q: How reliable is the inverse head and shoulders pattern?

A: While no pattern is foolproof, the inverse head and shoulders is considered one of the more reliable reversal patterns, especially when confirmed by volume and other indicators.

Q: Can the inverse head and shoulders pattern appear on different time frames?

A: Yes, this pattern can be identified on various time frames, from minutes to daily charts. However, the reliability may vary based on the time frame you choose.

Q: What should I do if the price does not break the neckline?

A: If the price fails to break the neckline, it may indicate a false signal. In such cases, it’s wise to reassess your position and consider exiting to limit losses.

Trading Strategies for Head and Shoulders

The Head and Shoulders pattern is one of the most recognized formations in technical analysis, indicating a potential reversal in market trends. To effectively capitalize on this pattern, traders need to employ well-defined strategies that encompass entry and exit points, risk management, and confirmation signals. First and foremost, understanding the structure of the pattern is crucial. The head and shoulders consists of three peaks: the left shoulder, the head, and the right shoulder, with the neckline acting as a critical support or resistance level. Once traders spot this formation, they should prepare to act.

One effective strategy is to wait for a confirmed breakout below the neckline. This is where the magic happens—once the price breaks through the neckline, it often leads to a significant downward movement. Traders should place a sell order just below the neckline to maximize their potential profits. However, it’s essential to set a stop-loss order above the right shoulder to mitigate risks in case the market reverses unexpectedly. The distance from the head to the neckline can be used to set profit targets, allowing traders to calculate potential gains based on the height of the pattern.

Another critical aspect of trading the head and shoulders pattern is to monitor volume. A successful breakout should ideally be accompanied by increased volume. This serves as a confirmation signal that the trend is indeed reversing. If the breakout occurs with low volume, it might suggest a false signal, prompting traders to be cautious. To enhance decision-making, traders can utilize various indicators, such as the Relative Strength Index (RSI) or Moving Averages, to confirm the strength of the trend reversal.

Additionally, it’s beneficial to analyze the overall market sentiment and news events that could impact the altcoin market. For instance, if a significant announcement is made regarding a particular altcoin, it could influence the price action and the validity of the head and shoulders pattern. Keeping an eye on these external factors can provide traders with a more comprehensive view of the market landscape.

In summary, trading the head and shoulders pattern requires a blend of technical analysis, risk management, and market awareness. By waiting for confirmed breakouts, setting appropriate stop-loss orders, and analyzing volume and market sentiment, traders can enhance their chances of making profitable trades. Remember, patience is key—rushing into trades without proper analysis can lead to unnecessary losses. Always stay informed and adapt your strategies as the market evolves.

- What is the head and shoulders pattern?

The head and shoulders pattern is a chart formation that indicates a potential reversal in an upward trend, characterized by three peaks: the left shoulder, the head, and the right shoulder. - How do I identify a head and shoulders pattern?

Look for three peaks with the middle peak being the highest (the head) and the two outside peaks being lower (the shoulders). The neckline is formed by connecting the lowest points of the two troughs. - What should I do when I see a head and shoulders pattern?

Wait for a confirmed breakout below the neckline before entering a trade. Set a stop-loss above the right shoulder and use volume analysis to confirm the breakout. - Can the head and shoulders pattern fail?

Yes, like any trading strategy, the head and shoulders pattern can fail. It’s important to use risk management techniques and not rely solely on one pattern for trading decisions.

Triangles and Flags

When it comes to altcoin trading, understanding triangles and flags is crucial for any trader looking to capitalize on ongoing trends. These chart patterns are not just fancy shapes; they are powerful indicators that can help you predict future price movements. Think of them as road signs on your trading journey, guiding you toward potential profit opportunities. So, what exactly are these patterns, and how can you spot them?

Triangles are typically formed when the price action converges between two trend lines, creating a shape that resembles a triangle. There are three main types of triangles to keep an eye on:

- Ascending Triangle: This pattern indicates a bullish sentiment, where buyers are pushing prices upward while sellers are holding back.

- Descending Triangle: This pattern suggests a bearish outlook, as sellers are dominating the market while buyers struggle to keep prices stable.

- Symmetrical Triangle: This pattern reflects indecision in the market, with both buyers and sellers vying for control, often leading to a breakout in either direction.

Flags, on the other hand, are continuation patterns that form after a strong price movement. They look like small rectangles that slope against the prevailing trend. Think of a flag as a pause in the action, where traders take a breath before the market resumes its previous direction. There are two main types of flags:

- Bullish Flag: This occurs after a significant upward movement, indicating that the price is likely to continue rising after the consolidation period.

- Bearish Flag: This appears after a downward movement, suggesting that the price may continue to fall following the brief consolidation.

Recognizing these patterns is essential for making informed trading decisions. For example, if you spot a bullish flag forming after a strong upward trend, it might be a signal to enter a long position. Conversely, if you see a descending triangle, it could be wise to prepare for a potential downward breakout. The key is to combine these patterns with other indicators, such as volume analysis, to increase the reliability of your trading strategy.

In summary, triangles and flags are not just random patterns; they provide valuable insights into market sentiment and potential price movements. By mastering these patterns, you can enhance your trading strategy and make more informed decisions in the ever-evolving world of altcoin trading. So, keep your eyes peeled for these formations, and let them guide you toward your next trading opportunity!

Q1: How can I identify a triangle pattern on a chart?

A triangle pattern can be identified by drawing trend lines that connect the highs and lows of the price action. Look for converging lines that indicate a potential breakout.

Q2: What is the significance of volume in triangle and flag patterns?

Volume plays a critical role in confirming the validity of these patterns. An increase in volume during a breakout suggests a stronger move, while low volume may indicate a false breakout.

Q3: Can triangles and flags be used in any market?

Yes! While they are commonly used in altcoin trading, these patterns can be applied to any financial market, including stocks and forex.

Volume Analysis in Chart Patterns

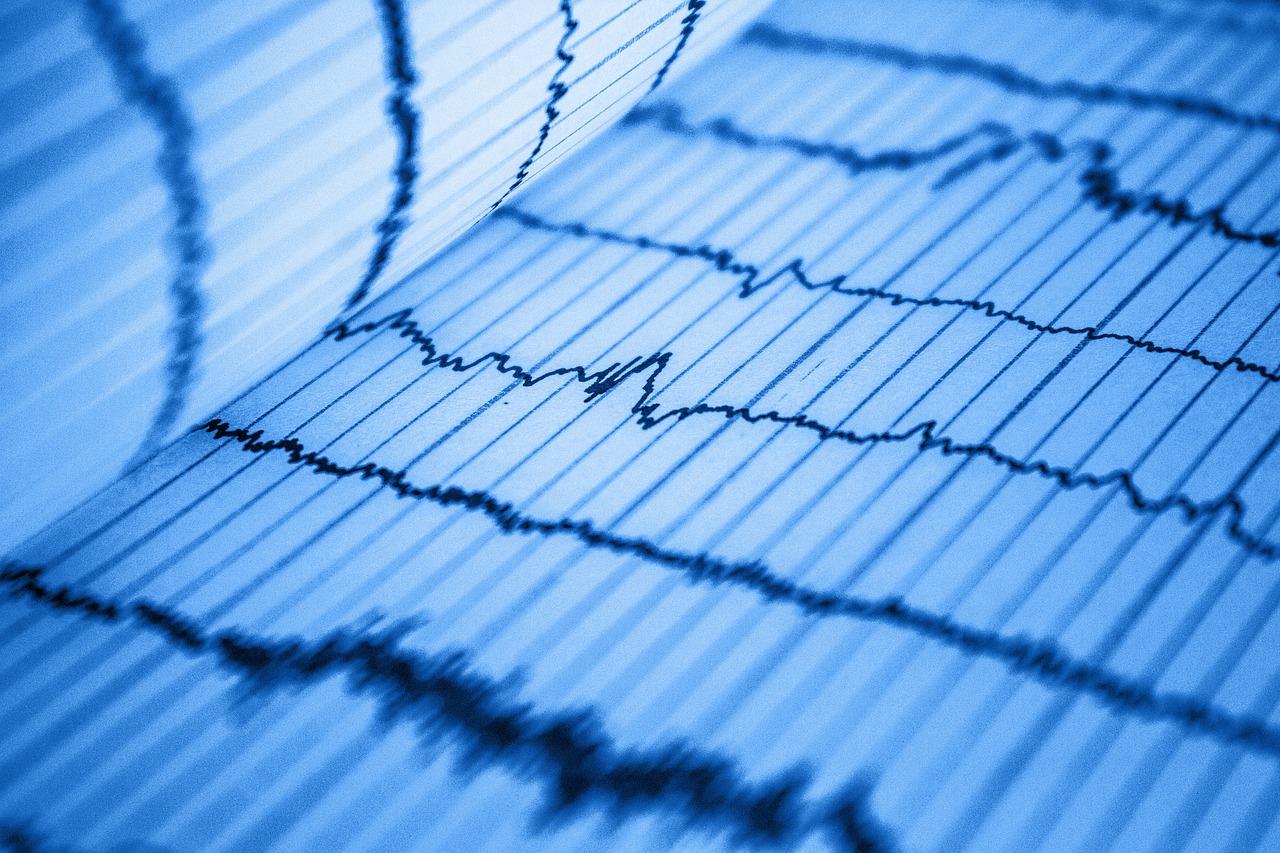

When it comes to trading altcoins, understanding volume analysis is like having a secret weapon in your trading arsenal. It’s not just about looking at price movements; volume analysis provides the context that can make or break your trading decisions. Think of volume as the heartbeat of the market—when it spikes, it often indicates that something significant is happening, whether it’s a potential breakout or a reversal. By analyzing volume alongside chart patterns, traders can gain deeper insights into market dynamics, allowing them to make more informed decisions.

Volume analysis enhances the reliability of chart patterns in several ways. First, it helps confirm the strength of a pattern. For example, if a head and shoulders pattern forms and is accompanied by increasing volume, it suggests that the trend reversal is more likely to happen. Conversely, if a pattern forms with low volume, it may indicate a lack of conviction among traders, and the pattern could fail. This is why it’s crucial to incorporate volume indicators when analyzing chart patterns.

Moreover, volume can also signal potential price movements. Traders often look for volume spikes that coincide with chart patterns. For instance, if a triangle pattern is forming and suddenly there’s a surge in volume, it could indicate that the price is about to break out of the pattern. This is where traders need to be alert and ready to act. By keeping an eye on volume, you can better gauge whether to enter or exit a trade.

To illustrate the relationship between volume and chart patterns, let’s take a look at the following table:

| Chart Pattern | Volume Trend | Implication |

|---|---|---|

| Head and Shoulders | Increasing volume on the right shoulder | Higher likelihood of a trend reversal |

| Inverse Head and Shoulders | Increasing volume on breakout | Confirming bullish reversal |

| Triangles | Decreasing volume as the pattern develops | Potential breakout in either direction |

| Flags | Volume increase during breakout | Continuation of the prevailing trend |

In summary, volume analysis is not just an optional add-on; it’s a crucial component of effective chart pattern analysis. By understanding how volume interacts with chart patterns, traders can enhance their decision-making process and improve their overall trading performance. So, the next time you’re analyzing a chart, remember to keep an eye on the volume—it might just give you the edge you need to succeed in the altcoin market.

- What is the significance of volume in trading? Volume indicates the strength of a price movement. High volume often confirms the validity of a price trend or reversal.

- How do I calculate volume? Volume is typically provided by trading platforms and represents the total number of shares or contracts traded in a specific period.

- Can volume analysis predict price movements? While volume can provide insights into potential price movements, it is not a guarantee. It should be used in conjunction with other analysis techniques.

- What tools can help with volume analysis? Many trading platforms offer built-in volume indicators, and there are also specialized software tools designed for comprehensive volume analysis.

Volume Confirmation Techniques

When it comes to trading altcoins, volume confirmation is a crucial aspect that can significantly enhance the reliability of the chart patterns you observe. Think of volume as the fuel that powers the price movement; without it, even the most promising patterns can fizzle out. So, how do you incorporate volume into your trading strategy? Let’s dive into some effective techniques that can help you validate chart patterns and make more informed trading decisions.

One of the primary methods for volume confirmation is to look for volume spikes that accompany price movements. For instance, if you spot a breakout from a head and shoulders pattern, the ideal scenario would be for the breakout to occur alongside a notable increase in volume. This surge indicates that there’s strong interest in the asset, lending credibility to the breakout. Conversely, if the breakout happens on low volume, it might be a false signal, akin to a firework that goes off with a whimper instead of a bang.

Another effective technique is to analyze the volume trend. This involves looking at the volume over a specific period and identifying whether it is increasing or decreasing. A rising volume trend during an uptrend can confirm the strength of the move, while decreasing volume during a downtrend may suggest a lack of commitment from sellers. In this way, volume can act as a barometer, helping you gauge the strength of price movements. To visualize this, consider the following table:

| Price Movement | Volume Trend | Interpretation |

|---|---|---|

| Price Increasing | Volume Increasing | Strong bullish momentum |

| Price Increasing | Volume Decreasing | Potential weakness in trend |

| Price Decreasing | Volume Increasing | Strong bearish momentum |

| Price Decreasing | Volume Decreasing | Potential reversal or consolidation |

Additionally, you can use the concept of volume oscillators to confirm your patterns. Tools like the Accumulation/Distribution Line or the On-Balance Volume (OBV) can provide insights into whether the price movements are supported by sufficient buying or selling pressure. For example, if the price of an altcoin is rising but the OBV is falling, it suggests that the rally may not be sustainable, as it lacks the necessary volume support.

Finally, it’s essential to combine volume analysis with other indicators for a more comprehensive view. For instance, using moving averages alongside volume can help you identify trends more effectively. When the price crosses above a moving average with a corresponding volume spike, it can serve as a strong buy signal. On the flip side, if the price drops below a moving average on high volume, it may indicate a strong sell signal.

In summary, volume confirmation techniques are vital for validating chart patterns in altcoin trading. By observing volume spikes, analyzing volume trends, utilizing volume oscillators, and combining these insights with other indicators, you can bolster your trading strategy and increase your chances of success. Remember, in the world of trading, knowledge is power, and understanding volume can be your secret weapon!

Using Tools for Chart Analysis

In the fast-paced world of altcoin trading, having the right tools at your disposal can make all the difference. Just like a chef needs quality knives to create a culinary masterpiece, traders require effective chart analysis tools to navigate the volatile waters of cryptocurrency markets. These tools not only help in identifying chart patterns but also enhance your overall trading strategy, allowing you to make informed decisions that could lead to profitable outcomes.

One of the most popular tools for chart analysis is trading platforms like TradingView or Coinigy. These platforms offer a user-friendly interface and a plethora of features that cater to both novice and experienced traders. With customizable charting options, you can easily visualize price movements and apply various indicators to enhance your analysis. Additionally, these platforms often provide access to a community of traders, allowing for the sharing of insights and strategies.

Another essential tool is the use of technical indicators. Indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can provide valuable insights into market trends and potential reversals. For instance, the RSI can help you determine whether an altcoin is overbought or oversold, giving you a clearer picture of when to enter or exit a trade. By integrating these indicators into your chart analysis, you can add layers of confirmation to the patterns you observe.

Furthermore, chart pattern recognition software can be a game-changer for traders. Tools like PatternSmart or ChartPattern.com utilize algorithms to automatically identify patterns on your charts. This can save you time and help you spot opportunities that you might have missed otherwise. However, it’s crucial to remember that while these tools can enhance your trading, they should not replace your own analysis and intuition.

When choosing tools for chart analysis, consider the following factors:

- User Interface: Is the tool easy to navigate? A cluttered interface can lead to mistakes.

- Customization Options: Can you tailor the charts and indicators to fit your trading style?

- Community Support: Does the platform have a vibrant community for sharing insights and strategies?

- Cost: Are the tools within your budget? Many platforms offer free trials, so take advantage of those before committing.

In conclusion, utilizing the right tools for chart analysis can significantly improve your trading performance. By combining different resources, such as trading platforms, technical indicators, and pattern recognition software, you can develop a robust trading strategy that enhances your ability to analyze market movements effectively. Remember, the goal is not just to identify patterns but to understand their implications and make informed decisions based on comprehensive analysis.

Q1: What are the best tools for chart analysis in altcoin trading?

A1: Some of the best tools include TradingView, Coinigy, and various technical indicators like RSI and Moving Averages. Additionally, pattern recognition software can be beneficial.

Q2: How can I ensure the reliability of chart patterns?

A2: Incorporating volume analysis and using multiple indicators to confirm patterns can greatly enhance their reliability.

Q3: Is it necessary to pay for chart analysis tools?

A3: While many effective tools are available for free, premium tools often offer advanced features that can provide a competitive edge. It’s worth exploring free trials before making a commitment.

Frequently Asked Questions

- What are chart patterns in altcoin trading?

Chart patterns are visual representations of price movements that help traders identify potential market trends and reversals. By analyzing these patterns, traders can make informed decisions about when to enter or exit trades.

- How do I identify a head and shoulders pattern?

The head and shoulders pattern consists of three peaks: a higher peak (head) between two lower peaks (shoulders). To identify it, look for a distinct upward trend followed by the formation of this pattern, signaling a potential trend reversal.

- What does an inverse head and shoulders pattern indicate?

An inverse head and shoulders pattern suggests a bullish reversal. It features three troughs, with the middle trough (head) being the lowest. Recognizing this pattern can be crucial for traders looking to capitalize on upward price movements.

- Can volume analysis improve my trading decisions?

Absolutely! Volume analysis adds an extra layer of confirmation to chart patterns. By observing trading volume, you can validate whether a pattern is strong enough to support a potential price movement, making your trading decisions more reliable.

- What tools can I use for chart analysis?

There are numerous tools available for chart analysis, including trading platforms like TradingView, MetaTrader, and various charting software. These tools provide features such as technical indicators, drawing tools, and customizable charts to enhance your analysis capabilities.

- Are triangles and flags important in altcoin trading?

Yes! Triangles and flags are continuation patterns that indicate a pause in price action before the trend resumes. Recognizing these patterns can help traders anticipate future price movements and make strategic trading decisions.

- How can I manage risk while trading chart patterns?

Risk management is vital in trading. You can manage risk by setting stop-loss orders, determining position sizes based on your trading capital, and diversifying your investments. This way, you can protect your capital while taking advantage of chart patterns.