Strategies for Trading Low Market Cap Coins

Trading low market cap coins can feel like walking a tightrope—one wrong step, and you could plunge into chaos, but with the right strategies, you can soar to new heights. These cryptocurrencies, often flying under the radar, offer unique opportunities for those willing to embrace the thrill of high-risk, high-reward trading. In this article, we will explore effective strategies that can help you navigate this volatile market while maximizing your chances of success.

First off, it's essential to understand what low market cap coins are. Typically, these coins have a market capitalization of less than $1 billion, making them more susceptible to price fluctuations and market manipulation. However, their lower liquidity can also mean that a small amount of capital can lead to significant gains if you time your trades right. Think of it like mining for gold—while the stakes are high, so are the potential rewards. But beware, as the landscape can change rapidly, and what seems like a golden opportunity today might turn into a fool's errand tomorrow.

To effectively trade these coins, you need to adopt a multifaceted approach that combines research, analysis, and risk management. Start by identifying promising coins that catch your eye. This involves digging deeper than just the surface-level data. Look for indicators such as community engagement, project fundamentals, and historical price performance. It's like being a detective—putting together clues to form a complete picture of the coin's potential.

As you delve into your research, don't forget to analyze market trends. Understanding price movements and volume trends is crucial for making informed decisions. Low market cap coins can be particularly volatile, so keeping an eye on market sentiment can give you an edge. For instance, if you notice a spike in social media mentions or positive news coverage, it might indicate rising interest that could drive the price up.

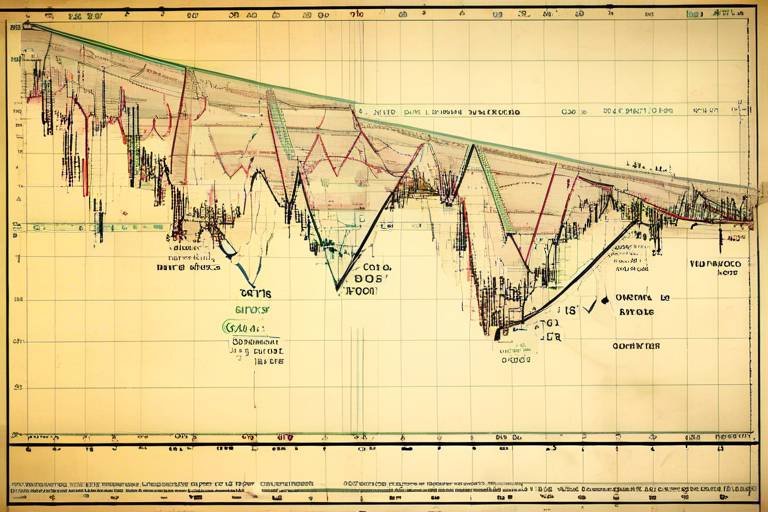

Another critical tool in your trading arsenal is technical analysis. By studying price charts, you can identify patterns and trends that may not be immediately obvious. Techniques such as moving averages, Relative Strength Index (RSI), and Fibonacci retracements can help you determine entry and exit points. Think of technical analysis as your roadmap; it guides you through the unpredictable terrain of low market cap trading.

Moreover, sentiment analysis plays a vital role in this game. By gauging the market mood through social media platforms and news articles, you can get a sense of how traders feel about a particular coin. Are they optimistic or pessimistic? This emotional aspect can significantly impact price movements, making it a valuable consideration in your trading strategy.

However, with great potential comes great risk. That's why implementing robust risk management strategies is essential when trading low market cap coins. Set stop-loss orders to protect your investments and never invest more than you can afford to lose. Diversifying your portfolio can also help mitigate risks. By spreading your investments across different coins, you can cushion the blow if one of your picks doesn’t perform as expected.

In summary, trading low market cap coins requires a blend of research, analysis, and risk management. By understanding the unique characteristics of these coins and employing effective strategies, you can navigate this exciting but treacherous market. Remember, the key is to stay informed, remain adaptable, and always be prepared for the unexpected.

- What are low market cap coins? Low market cap coins are cryptocurrencies with a market capitalization of less than $1 billion. They are often more volatile and can present both risks and opportunities for traders.

- How can I identify promising low market cap coins? Look for strong community engagement, solid project fundamentals, and positive historical performance. Tools like social media sentiment analysis and market trend research can also help.

- What are some common risks associated with trading low market cap coins? Risks include high volatility, market manipulation, and lower liquidity, which can lead to significant price swings.

- How important is diversification in trading low market cap coins? Diversification is crucial as it helps mitigate risks. By spreading investments across various assets, you can protect yourself from the potential downturn of a single coin.

Understanding Low Market Cap Coins

Low market cap coins, often labeled as gem coins, are cryptocurrencies with a market capitalization of less than $100 million. These coins are typically in the early stages of development, making them an intriguing option for traders looking for high-risk, high-reward scenarios. But what exactly makes these coins stand out in the bustling world of cryptocurrency?

First and foremost, the characteristics of low market cap coins are what attract traders. Unlike established cryptocurrencies such as Bitcoin or Ethereum, these coins often have low liquidity and are subject to extreme price fluctuations. This volatility can be a double-edged sword: while it opens the door for substantial gains, it also poses significant risks. For those who thrive on excitement and are willing to take calculated risks, low market cap coins can be a playground.

One of the primary reasons traders are drawn to these coins is the potential for massive returns. Imagine discovering a coin that, due to its low market cap, has the potential to skyrocket in value if it gains traction in the market. Many success stories exist where early investors in low market cap coins turned modest investments into life-changing sums of money. However, it’s essential to approach these opportunities with caution and a well-thought-out strategy.

Moreover, low market cap coins often represent innovative projects or technologies that are not yet widely recognized. This can include everything from decentralized finance (DeFi) platforms to unique blockchain applications. By investing in these coins, traders can support groundbreaking ideas and potentially see their investments soar as these projects gain popularity.

However, not everything is sunshine and rainbows. The risks associated with low market cap coins are significant. The lack of established track records means that many of these projects could fail, leaving investors with worthless tokens. Additionally, the low liquidity can lead to price manipulation, where a few large trades can drastically affect the coin's value. Therefore, it’s crucial to conduct thorough research and due diligence before diving into this volatile space.

In summary, low market cap coins present a unique blend of opportunity and risk. They are often overlooked by mainstream investors, but for those willing to navigate the challenges, they can offer incredible potential. As the market continues to evolve, understanding these coins and their characteristics will be key to identifying promising investment opportunities.

Identifying Promising Coins

When diving into the world of low market cap coins, one of the most exhilarating yet daunting tasks is identifying which coins are worth your time and investment. The thrill of finding that hidden gem can feel like searching for gold in a vast ocean of digital assets. But how do you separate the wheat from the chaff? The key lies in thorough research and a keen eye for potential. You want to look for coins that not only have a unique proposition but also a strong community backing them. After all, a coin without a community is like a ship without a sail—it’s unlikely to go anywhere.

Start by examining the project's fundamentals. What problem is the coin trying to solve? Does it have a clear use case? A strong whitepaper can often provide insights into the project's vision and roadmap. Additionally, consider the development team behind the coin. Are they experienced? Have they delivered on their promises in the past? A team with a solid track record can be a good indicator of the project's potential success.

Another crucial aspect to consider is the coin's market activity. Look at the trading volume and price movements. A coin with consistent trading volume indicates interest and liquidity, which can be vital for entering and exiting positions without significant slippage. You can utilize various tools to analyze these metrics, such as CoinMarketCap or CoinGecko, which provide comprehensive data on market activity.

Moreover, social media sentiment plays a significant role in the crypto space. Platforms like Twitter and Reddit can provide real-time insights into community sentiment. A sudden spike in discussions or positive news can often precede price movements. Keep an eye on trends and conversations to gauge the mood around a particular coin. Remember, the market is influenced not just by fundamental factors but also by the collective psychology of its participants.

Lastly, don't overlook the importance of technical analysis. While it may sound complex, you don't need to be a seasoned trader to grasp the basics. Familiarize yourself with key indicators such as Moving Averages, Relative Strength Index (RSI), and support/resistance levels. These tools can help you make informed decisions about entry and exit points. To illustrate, here’s a simple table of some common technical indicators:

| Indicator | Description | Use Case |

|---|---|---|

| Moving Average (MA) | Averages the price over a specific period | Identifying trends |

| Relative Strength Index (RSI) | Measures speed and change of price movements | Identifying overbought or oversold conditions |

| Bollinger Bands | Volatility indicator that shows price levels | Identifying potential price reversals |

In conclusion, identifying promising low market cap coins requires a blend of fundamental analysis, community sentiment, and technical insights. By staying informed and using the right tools, you can navigate this exciting yet risky landscape with greater confidence. So, gear up, do your homework, and who knows? You might just discover the next big thing in the crypto world!

- What are low market cap coins? Low market cap coins are cryptocurrencies with a smaller total market capitalization, making them more volatile but potentially offering higher returns.

- How can I find promising low market cap coins? Research the project's fundamentals, analyze market activity, and gauge community sentiment on social media platforms.

- What tools can I use for analysis? Websites like CoinMarketCap and CoinGecko provide essential data, while technical analysis tools can help you understand price movements.

- Is trading low market cap coins risky? Yes, due to their volatility and lower liquidity, trading low market cap coins can be risky, so it's essential to have a solid risk management strategy.

Analyzing Market Trends

When it comes to trading low market cap coins, is like having a treasure map in a vast ocean of uncertainty. Without understanding the movements of the market, you might find yourself sailing into dangerous waters. Market trends can provide crucial insights into potential price movements, helping you make informed decisions. So, how do you start analyzing these trends effectively?

First, it’s essential to look at price movements. This means observing how the price of a coin changes over time. You can use various tools like candlestick charts, which not only show you the price but also the volume of trades occurring at different times. By examining these charts, you can spot patterns that might indicate whether a coin is gaining momentum or losing steam. For example, if you notice a series of higher highs and higher lows, it could suggest that the coin is on an upward trend.

In addition to price movements, volume trends are equally important. Volume refers to the number of coins traded during a specific period. A sudden spike in volume can indicate increased interest and potential price movement. If a low market cap coin experiences a significant rise in volume without a corresponding increase in price, it might suggest that big players are accumulating the coin, which could lead to a price surge later on.

Moreover, it’s vital to incorporate technical indicators into your analysis. These indicators are mathematical calculations based on price and volume, helping traders predict future movements. Some popular indicators include:

- Moving Averages: These help smooth out price data to identify trends over time.

- Relative Strength Index (RSI): This measures the speed and change of price movements, indicating whether a coin is overbought or oversold.

- Bollinger Bands: These consist of a middle band (moving average) and two outer bands that indicate volatility.

By combining these indicators with your price and volume analysis, you can create a more comprehensive view of the market trends surrounding low market cap coins. Remember, though, that no single indicator is foolproof. It’s often best to use a combination of tools to get a clearer picture.

Lastly, don't forget to stay flexible. The crypto market is notoriously volatile, and trends can shift rapidly. Regularly revisiting your analysis and adjusting your strategies based on new information is key to staying ahead of the curve. Think of it as dancing with the market; if you can anticipate its moves, you’ll find yourself in a much better position to capitalize on opportunities.

Q: How often should I analyze market trends?

A: It’s advisable to analyze market trends regularly, ideally daily or weekly, depending on your trading strategy. Keeping an eye on short-term and long-term trends can help you make timely decisions.

Q: What tools can I use for market trend analysis?

A: There are several tools available for market trend analysis, including trading platforms like TradingView, CoinMarketCap, and various crypto-specific apps that provide real-time data and charting capabilities.

Q: Can sentiment analysis affect market trends?

A: Absolutely! Market sentiment can heavily influence price movements. Positive news can drive prices up, while negative news can lead to declines. Always consider the broader context when analyzing trends.

Technical Analysis Techniques

When diving into the world of low market cap coins, mastering technical analysis can be your secret weapon. This approach involves studying price charts and volume patterns to forecast future movements. Think of it as reading the pulse of the market; it tells you when to buy, hold, or sell. So, how do you get started? Let’s break it down into some key techniques that can help you navigate this often turbulent sea of trading.

One of the most fundamental tools in technical analysis is the trend line. By connecting the highs or lows of price movements, you can visualize the direction in which the coin is heading. For instance, if you see a series of higher highs and higher lows, that’s a bullish trend, suggesting it might be a good time to enter. Conversely, if the trend shows lower highs and lower lows, it could be a warning sign that it’s time to exit. This simple technique can be incredibly powerful when trading low market cap coins, where volatility is the name of the game.

Another essential technique is the use of moving averages. These indicators smooth out price data to identify trends over a specific period. For example, a 50-day moving average can help you see the overall direction of a coin’s price. When the price crosses above the moving average, it may indicate a buying opportunity, while crossing below can signal a sell. This method is particularly useful in low market cap trading, where prices can swing wildly, and a little clarity goes a long way.

Don’t forget about volume analysis. Understanding the volume behind price movements can give you insight into the strength of a trend. If a coin's price is increasing but the volume is low, it might not be sustainable. On the other hand, a price increase accompanied by high volume is often a strong signal that the trend will continue. This is crucial for low market cap coins, as they can be easily manipulated, so having volume as a supporting factor can help you make more informed decisions.

Lastly, consider employing candlestick patterns. These visual representations of price movements can reveal a lot about market sentiment. For instance, a doji candle indicates indecision in the market, while a hammer candle could suggest a potential reversal. Learning to read these patterns can provide you with valuable insights and help you anticipate market shifts.

In conclusion, mastering these technical analysis techniques can significantly enhance your trading strategy for low market cap coins. By combining trend lines, moving averages, volume analysis, and candlestick patterns, you can create a comprehensive approach to trading that not only helps you make informed decisions but also boosts your confidence in this unpredictable market.

- What is technical analysis? Technical analysis is a method used to evaluate and predict the future price movements of assets based on historical price patterns and trading volumes.

- Why is it important for low market cap coins? Low market cap coins are often more volatile, making technical analysis crucial for identifying trends and making informed trading decisions.

- How can I learn more about technical analysis? There are numerous online resources, courses, and books dedicated to technical analysis that can help you get started.

- Can technical analysis guarantee profits? While it can improve your chances of making informed trades, no method can guarantee profits due to the unpredictable nature of the market.

Sentiment Analysis

When diving into the world of low market cap coins, becomes an invaluable tool. It’s not just about numbers and charts; it’s about understanding the mood of the market. Think of it like reading the room before making a big decision. If you can sense excitement or fear among investors, you can adjust your strategy accordingly. Social media platforms like Twitter and Reddit are buzzing with discussions about cryptocurrencies, and these conversations can provide insights into what traders are thinking.

For instance, a sudden spike in positive mentions of a particular coin on social media might indicate growing interest, potentially leading to a price increase. Conversely, if a coin is getting a lot of negative press or complaints, it could signal a downturn. By monitoring these trends, traders can make more informed decisions. But it’s not just about quantity; the quality of sentiment matters too. Analyzing the context of discussions is crucial—are people excited about a new feature, or are they just jumping on a bandwagon?

To effectively gauge sentiment, consider using tools and platforms that aggregate social media data. Websites like Santiment or CryptoSlate can provide valuable insights. They track mentions, engagement, and overall sentiment, giving traders a clearer picture of market dynamics. Additionally, news outlets and specialized cryptocurrency blogs can also influence sentiment. A positive article about a low market cap coin can lead to increased buying pressure, while negative news can trigger panic selling.

In the end, sentiment analysis is about being in tune with the market's heartbeat. It’s not a crystal ball, but it can certainly help you make more educated guesses about where a coin might be headed. By combining sentiment analysis with technical indicators and fundamental research, traders can develop a well-rounded approach to investing in low market cap coins.

- What is sentiment analysis in cryptocurrency trading?

Sentiment analysis involves gauging the mood and opinions of traders and investors regarding a specific cryptocurrency, often using social media and news outlets to assess potential price movements. - How can I perform sentiment analysis?

You can perform sentiment analysis by monitoring social media platforms, using specialized tools that aggregate data, and keeping an eye on news articles related to the cryptocurrency market. - Why is sentiment analysis important for low market cap coins?

Low market cap coins are often more volatile, making sentiment analysis crucial for understanding market trends and potential price fluctuations.

Risk Management Strategies

Trading low market cap coins can be thrilling, but it also comes with its fair share of risks. It's like riding a roller coaster: the highs can be exhilarating, but the drops can leave your stomach in knots. To navigate this volatile environment successfully, having effective is essential. These strategies are not just about protecting your investments; they’re about creating a sustainable trading approach that allows you to capitalize on opportunities while minimizing potential losses.

One of the first steps in managing risk is to set clear stop-loss orders. A stop-loss order automatically sells a coin when it reaches a specified price, helping you limit your losses. For instance, if you purchase a coin at $1 and set a stop-loss at $0.80, your potential loss is capped at 20%. This strategy can save you from emotional decision-making during market downturns. Remember, in the world of low market cap coins, prices can swing wildly, so having a plan in place is crucial.

Furthermore, it’s important to adopt a well-defined position sizing strategy. This means determining how much of your total capital you are willing to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your total portfolio on any one trade. By doing this, you ensure that even if a trade goes south, your overall portfolio won’t take a devastating hit. For example, if your total capital is $10,000, risking 2% means you would only expose $200 to a single trade.

Another effective strategy is to diversify your portfolio. While it might be tempting to put all your eggs in one basket, especially with a coin that seems to be skyrocketing, diversification can be a lifesaver. By spreading your investments across various low market cap coins and even including some higher market cap assets, you can reduce the impact of any single coin's poor performance on your overall portfolio. Think of it as a safety net; if one coin falls, others might rise, balancing your overall gains and losses.

Additionally, staying informed about market trends and news is vital. Low market cap coins are often influenced by news, social media sentiment, and market trends more than established coins. Regularly checking platforms like Twitter, Reddit, or specialized crypto news websites can provide insights into potential price movements. For instance, if a particular coin is mentioned in a positive light by a well-known influencer, it might see a surge in interest and price. Conversely, negative news can lead to rapid declines. Being aware of these factors can help you make timely decisions about when to enter or exit a trade.

In conclusion, while trading low market cap coins can be highly rewarding, it’s essential to approach it with a solid risk management strategy. Implementing stop-loss orders, practicing prudent position sizing, diversifying your portfolio, and staying updated on market trends are all effective ways to manage risk. By doing so, you can enjoy the thrill of trading while safeguarding your investments. Remember, the goal is not just to make profits but to protect your capital so you can continue trading in this exciting market.

- What is a low market cap coin? Low market cap coins are cryptocurrencies with a relatively small market capitalization, often making them more volatile and risky but potentially offering higher rewards.

- How can I find promising low market cap coins? Research is key. Look for coins with strong fundamentals, active communities, and positive news coverage.

- Is it safe to invest in low market cap coins? While they can offer high returns, they also come with significant risks. It's important to use risk management strategies.

- What role does market sentiment play in trading? Market sentiment can heavily influence price movements, especially for low market cap coins. Monitoring social media and news can provide valuable insights.

- How often should I review my portfolio? Regular reviews are essential, ideally on a monthly basis, to ensure your strategy aligns with market conditions.

Building a Diversified Portfolio

When it comes to trading low market cap coins, diversification is not just a buzzword; it’s a survival strategy. Think of your investment portfolio like a garden. If you only plant one type of flower, a sudden frost could wipe out your entire garden. However, if you plant a variety of flowers, some may thrive even in adverse conditions. This analogy holds true in the world of cryptocurrency trading. By spreading your investments across various low and high market cap coins, you create a safety net that can help mitigate risks and enhance potential returns.

Creating a balanced portfolio means you’re not putting all your eggs in one basket. In the volatile world of low market cap coins, where price swings can be dramatic, it’s essential to have a mix of assets. For instance, while you might invest in a promising low cap coin that has just launched, it’s wise to pair that with some established high cap coins. This strategy not only stabilizes your portfolio but also allows you to take advantage of the explosive growth potential that low market cap coins can offer.

Moreover, when building your portfolio, consider incorporating various sectors within the cryptocurrency space. For example, you might include:

- DeFi (Decentralized Finance) projects that aim to disrupt traditional financial systems.

- Gaming and NFT tokens that are gaining traction in the digital art and gaming communities.

- Blockchain infrastructure coins that support the underlying technology.

This variety not only enhances your portfolio’s resilience but also positions you to capitalize on emerging trends. Remember, the cryptocurrency market is constantly evolving, and being adaptable is key to long-term success.

Another crucial aspect of diversification is fund allocation. You don’t want to invest all your capital into a single coin, no matter how promising it seems. Instead, allocate your funds wisely across different coins based on their market cap, potential for growth, and your risk tolerance. For example, you might decide to allocate:

| Coin Type | Allocation Percentage |

|---|---|

| Low Market Cap Coins | 40% |

| Mid Market Cap Coins | 30% |

| High Market Cap Coins | 30% |

This allocation strategy allows you to enjoy the high-risk, high-reward nature of low market cap coins while still having a safety net provided by more stable investments.

Lastly, it’s essential to regularly review and adjust your portfolio. The cryptocurrency market is dynamic, and what seems like a good investment today may not hold the same value tomorrow. By keeping a close eye on your portfolio’s performance and the overall market conditions, you can make informed decisions about when to buy, hold, or sell. This proactive approach not only helps in maximizing your returns but also ensures that you are not caught off guard by sudden market shifts.

In conclusion, building a diversified portfolio is a fundamental strategy for anyone looking to trade low market cap coins. By spreading your investments across various assets, sectors, and market caps, you can navigate the turbulent waters of cryptocurrency trading with greater confidence and security.

Q: Why is diversification important in cryptocurrency trading?

A: Diversification helps mitigate risks by spreading investments across different assets, reducing the impact of a poor-performing coin on your overall portfolio.

Q: How often should I review my portfolio?

A: It’s advisable to review your portfolio regularly, at least once a month, or whenever there are significant market changes that could affect your investments.

Q: Can I still invest heavily in low market cap coins?

A: Absolutely, but it’s crucial to balance those investments with more stable assets to protect against the high volatility associated with low market cap coins.

Allocating Funds Wisely

When it comes to trading low market cap coins, is like being the captain of a ship navigating through unpredictable waters. You wouldn't want to put all your treasure in one chest, right? The same principle applies here. Diversifying your investments across various coins can help cushion the blow if one of them capsizes. But how do you determine the right allocation? It requires a blend of research, intuition, and a dash of strategy.

First off, consider the overall market conditions. Are we in a bullish phase where the market is trending up, or is it a bearish phase where caution is key? This can significantly influence how you allocate your funds. For instance, in a bullish market, you might want to allocate a larger percentage to high-potential, low market cap coins that are gaining traction. Conversely, in a bearish market, it might be wise to shift your focus towards more stable coins.

Moreover, it's crucial to assess the potential of each coin. Not all low market cap coins are created equal. Some may have innovative technology or a strong community backing them, while others might just be riding the hype wave. A good practice is to allocate funds based on a combination of factors such as market cap, trading volume, and the project's fundamentals. For example, you might decide on a tiered allocation strategy:

| Coin Type | Allocation Percentage | Rationale |

|---|---|---|

| High-Potential Coins | 50% | These coins show strong fundamentals and community support. |

| Moderate-Potential Coins | 30% | These have potential but require more monitoring. |

| Speculative Coins | 20% | High risk but potentially high reward; only a small portion. |

This tiered approach allows you to capitalize on potential gains while still managing your risk. Remember, the goal is not to eliminate risk entirely but to find a balance that suits your trading style and comfort level.

Another critical aspect of fund allocation is setting clear investment goals. Are you looking for short-term gains, or are you in for the long haul? Your objectives should dictate how you allocate your funds. For short-term traders, a more aggressive allocation towards volatile coins might be appropriate, whereas long-term investors might prefer a steadier approach with a focus on coins that are likely to appreciate over time.

Lastly, don't forget to regularly reassess your allocations. The crypto market is dynamic, and what works today might not work tomorrow. By staying flexible and adjusting your strategy based on market trends and personal performance, you can optimize your investment potential. In summary, wise fund allocation is about understanding your risk tolerance, market conditions, and investment goals, all while keeping an eye on the ever-changing landscape of low market cap coins.

- What is a low market cap coin? Low market cap coins are cryptocurrencies with a smaller total market capitalization, often considered more volatile and risky.

- How can I find promising low market cap coins? Research is key! Look for coins with strong fundamentals, active communities, and innovative technology.

- What is the best strategy for allocating funds? A tiered approach based on potential and market conditions can help manage risk while maximizing returns.

- How often should I review my portfolio? Regular reviews are essential, especially in the fast-paced crypto market. Adjust your allocations based on performance and market changes.

Regular Portfolio Review

Regularly reviewing your portfolio is like checking the pulse of your investments; it keeps you in tune with how your assets are performing and helps you make informed decisions. In the fast-paced world of low market cap coins, where volatility can swing prices dramatically, this practice becomes even more crucial. You wouldn’t drive a car without checking the fuel gauge, right? Similarly, you shouldn't let your portfolio sit without scrutiny.

When you conduct a portfolio review, it’s essential to assess not just the performance of individual coins but also how they fit into your overall strategy. Are they meeting your expectations? Are there any underperformers that might be dragging down your returns? This evaluation can help you identify which assets are worth holding onto and which ones might need to be swapped out for better options. To make this process effective, consider the following steps:

- Performance Analysis: Look at how each coin has performed over a set period. Compare it to market benchmarks to see if it’s underperforming or outperforming.

- Market Conditions: Evaluate the current market conditions and trends. Are there new developments that could affect your holdings? For instance, a sudden surge in interest for a particular sector could indicate a shift in market dynamics.

- Rebalancing Needs: As some coins grow and others shrink, your portfolio may become unbalanced. Regular reviews allow you to rebalance your investments to maintain your desired risk level.

Additionally, documenting your findings can provide valuable insights over time. Create a simple table to track the performance of your investments, noting down key metrics such as:

| Coin Name | Initial Investment | Current Value | Percentage Change | Notes |

|---|---|---|---|---|

| Coin A | $100 | $150 | +50% | Strong community support |

| Coin B | $100 | $80 | -20% | Consider selling |

| Coin C | $100 | $120 | +20% | Monitor for further growth |

Incorporating these practices into your routine can significantly enhance your trading strategy. Just like a gardener tends to their plants, nurturing them to flourish, you should nurture your investments. Regular portfolio reviews not only help in optimizing returns but also instill a sense of discipline in your trading approach.

So, set a schedule for your portfolio reviews—whether it's weekly, monthly, or quarterly—and stick to it. Remember, the market doesn't wait for anyone, and staying proactive can be the difference between a thriving portfolio and missed opportunities.

- How often should I review my portfolio? It's generally recommended to review your portfolio at least once a month, but more frequent reviews may be beneficial, especially in volatile markets.

- What should I do if I find underperforming assets? Depending on your strategy, you may consider selling underperforming assets to reinvest in more promising opportunities.

- How can I stay informed about market changes? Follow cryptocurrency news websites, join forums, and engage with social media channels dedicated to crypto trading.

Staying Informed About Market Changes

In the fast-paced world of low market cap coins, staying informed is not just a luxury; it's a necessity. The cryptocurrency market can change in the blink of an eye, and being on top of the latest developments can mean the difference between a profitable trade and a substantial loss. So, how can you ensure that you're always in the loop? Here are some effective strategies:

First and foremost, follow reputable news sources. Websites like CoinDesk, CoinTelegraph, and CryptoSlate provide timely updates on market trends, regulatory changes, and significant events that can influence the prices of low market cap coins. Subscribing to newsletters or setting up alerts for specific keywords related to your investments can also keep you informed without having to scour the internet constantly.

Moreover, social media platforms have become essential tools for traders. Twitter, Reddit, and Telegram channels are buzzing with discussions about emerging coins and market sentiment. By engaging with these communities, you can gain insights into what other traders are thinking and identify potential trends before they become mainstream. Just remember to approach information with a critical eye—rumors can spread like wildfire!

Another critical aspect is market analysis tools. Websites like CoinMarketCap and CoinGecko offer comprehensive data on price movements, trading volumes, and market capitalizations. Utilizing these tools can help you spot patterns and make informed decisions. For instance, if you notice a sudden spike in trading volume for a particular low market cap coin, it might be worth investigating further to understand the cause—could it be a new partnership, or perhaps a major influencer has endorsed it?

Additionally, consider setting up price alerts. Many trading platforms allow you to set notifications for specific price points or percentage changes. This way, you won't miss out on significant market movements, even if you're not actively monitoring the charts. Think of it as having a personal assistant who nudges you when something important happens!

Lastly, don't underestimate the power of continuous education. The cryptocurrency landscape is ever-evolving, and keeping yourself educated about new technologies, trading strategies, and market dynamics can give you an edge. Online courses, webinars, and podcasts can be fantastic resources to expand your knowledge and refine your trading skills.

In summary, staying informed about market changes involves a combination of following news sources, engaging with social media, utilizing market analysis tools, setting price alerts, and committing to continuous education. By adopting these strategies, you'll be better equipped to navigate the volatile waters of low market cap coins and make more informed trading decisions.

- What are low market cap coins? Low market cap coins are cryptocurrencies with a smaller market capitalization, often considered riskier but potentially offering higher rewards.

- How can I find promising low market cap coins? Researching market trends, analyzing price movements, and utilizing tools like CoinMarketCap can help identify promising investment opportunities.

- Is trading low market cap coins safe? Trading low market cap coins involves significant risks due to their volatility, so proper risk management strategies are essential.

- How often should I review my portfolio? Regular reviews are crucial, ideally on a monthly basis, to adjust your strategies based on market conditions.

Frequently Asked Questions

- What are low market cap coins?

Low market cap coins are cryptocurrencies with a smaller market capitalization compared to more established coins like Bitcoin or Ethereum. They often have a market cap under $1 billion, making them more volatile and potentially offering higher returns for traders willing to take on the risk.

- Why should I consider trading low market cap coins?

Trading low market cap coins can be enticing due to the potential for significant gains. These coins may be undervalued or have unique use cases that can lead to rapid price increases. However, it's crucial to recognize the higher risks involved, as these coins can also experience extreme price fluctuations.

- How can I identify promising low market cap coins?

To identify promising low market cap coins, you should conduct thorough research. Look for indicators such as project fundamentals, active development teams, community engagement, and market trends. Tools like CoinMarketCap or CoinGecko can help you analyze these factors effectively.

- What role does technical analysis play in trading?

Technical analysis is vital for trading low market cap coins as it helps you understand price movements and market trends. By analyzing charts, patterns, and volume, traders can make informed decisions about when to buy or sell based on historical data.

- How can sentiment analysis impact my trading decisions?

Sentiment analysis involves gauging the mood of the market, often through social media and news outlets. By understanding the general sentiment around a coin, traders can predict potential price movements. Positive sentiment can lead to price surges, while negative sentiment might indicate a downturn.

- What are some effective risk management strategies?

Effective risk management strategies include setting stop-loss orders, diversifying your portfolio, and only investing what you can afford to lose. By implementing these strategies, you can protect your investments from significant losses in the volatile low market cap sector.

- How should I allocate funds across different coins?

Proper fund allocation is essential for managing risk. A common approach is to allocate a smaller percentage of your total investment to low market cap coins while keeping a larger portion in more stable, higher market cap assets. This balance allows for potential high returns while minimizing overall risk.

- Why is it important to regularly review my portfolio?

Regularly reviewing your portfolio is crucial because it allows you to adjust your strategies based on market conditions. By monitoring performance and staying informed about market changes, you can make necessary adjustments to optimize returns and manage risks effectively.

- How can I stay informed about market changes?

Staying informed about market changes involves following news outlets, cryptocurrency forums, and social media channels. Subscribing to newsletters or using market analysis platforms can also help you keep up with the latest trends and developments that may impact low market cap coins.