Strategies for Trading During Economic Uncertainty

In today's fast-paced financial landscape, economic uncertainty can feel like a storm brewing on the horizon. Whether it's due to geopolitical tensions, fluctuating interest rates, or unexpected global events, the market can often seem unpredictable. But fear not! With the right strategies in place, traders can not only survive but thrive in these turbulent times. This article dives deep into effective trading strategies, exploring how to navigate the complexities of economic uncertainty while enhancing decision-making processes.

First off, it’s crucial to recognize that economic indicators serve as the compass guiding traders through the fog of uncertainty. These indicators, such as GDP growth rates, unemployment figures, and consumer confidence indexes, provide insights into the overall health of the economy. By keeping a close eye on these metrics, traders can anticipate market movements and adjust their strategies accordingly. For instance, a sudden rise in unemployment might signal a downturn, prompting traders to adopt a more defensive posture.

However, understanding indicators is just the tip of the iceberg. Implementing robust risk management techniques is essential for safeguarding investments. Think of risk management as your life jacket in the choppy waters of trading. It’s about ensuring that when the waves get rough, you don’t capsize. Techniques such as setting stop-loss orders, using position sizing, and regularly reviewing your portfolio can help minimize losses. These practices not only protect your capital but also provide a sense of security, allowing you to make more informed decisions without the paralyzing fear of losing everything.

One effective way to manage risk is through Diversification. By spreading investments across various asset classes—stocks, bonds, commodities, and even real estate—you can significantly reduce your exposure to any single investment. Imagine throwing all your eggs into one basket; if that basket falls, you’re in trouble. Instead, consider diversifying your investments across different sectors and geographic regions. This strategy can buffer against market volatility and provide more stable returns over time.

| Asset Class | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | Variable |

| Bonds | Moderate | Stable |

| Commodities | High | Variable |

| Real Estate | Moderate | Stable |

Another pivotal aspect of trading during uncertain times is asset allocation. This involves strategically distributing your investments among various asset classes based on your risk tolerance and investment goals. During economic uncertainty, you might want to lean towards more stable investments, such as bonds or dividend-paying stocks, while still maintaining a portion of your portfolio in higher-risk assets for growth potential. This balance can help you ride out the storm while still keeping an eye on future opportunities.

Moreover, sector rotation is a strategy that can be particularly effective during economic shifts. By shifting investments between sectors based on their performance relative to economic cycles, traders can capitalize on emerging trends. For example, during a recession, consumer staples and healthcare sectors often outperform others. By staying informed about these trends, traders can position themselves advantageously, maximizing their returns while minimizing risk.

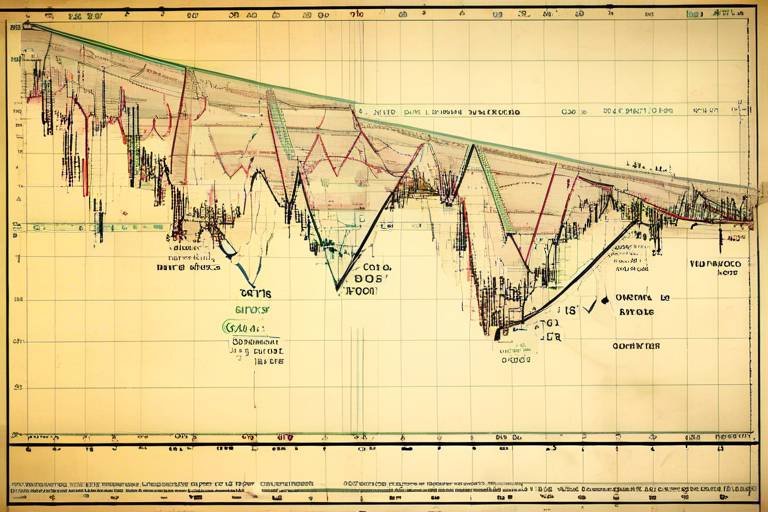

Lastly, employing technical analysis can provide valuable insights into market movements. By analyzing price charts and using indicators such as moving averages and relative strength index (RSI), traders can identify patterns and make informed predictions about future price movements. This analytical approach can serve as a guiding light, helping traders navigate through the uncertainties of the market.

In conclusion, while economic uncertainty can indeed be daunting, it's essential to remember that with the right strategies, traders can not only weather the storm but also find opportunities amidst the chaos. By understanding economic indicators, implementing risk management techniques, diversifying investments, and utilizing technical analysis, traders can enhance their decision-making processes and improve their chances of success.

- What are economic indicators? Economic indicators are statistics that provide insights into the economic performance of a country, influencing market trends.

- How can I manage risk while trading? By setting stop-loss orders, diversifying your portfolio, and using proper position sizing techniques.

- What is sector rotation? Sector rotation is a strategy that involves shifting investments between sectors based on their performance during different phases of the economic cycle.

- How does technical analysis help in trading? Technical analysis helps traders identify patterns and trends in price movements, enabling informed trading decisions.

Understanding Economic Indicators

When it comes to trading, understanding economic indicators is like having a compass in a stormy sea. These indicators are vital statistics that help traders gauge the overall health of an economy and predict future market movements. They can be a trader's best friend during periods of uncertainty, guiding decisions and strategies. So, what exactly should you be looking at? Let's break it down.

First up, we have the Gross Domestic Product (GDP). This measures the total economic output of a country and serves as a broad indicator of economic health. A rising GDP often indicates a growing economy, which can lead to increased consumer spending and, in turn, a bullish market. Conversely, a declining GDP might raise red flags, signaling potential market downturns.

Next, we can't overlook the unemployment rate. High unemployment rates can dampen consumer confidence, leading to decreased spending, which can negatively impact stock prices. On the flip side, low unemployment typically fuels spending and can lead to a thriving market. Keeping an eye on these figures can help traders anticipate shifts in market sentiment.

Another crucial indicator is the Consumer Price Index (CPI), which measures inflation. Inflation can erode purchasing power, and sudden spikes can lead to market volatility. Traders often watch for changes in CPI to adjust their strategies accordingly. For instance, if inflation is rising rapidly, traders might consider shifting their investments toward sectors that tend to perform well during inflationary periods, like commodities.

Additionally, interest rates play a significant role in trading strategies. Central banks, like the Federal Reserve, adjust interest rates to control economic growth. Lower interest rates can stimulate borrowing and investing, often leading to a bullish market. In contrast, higher rates might slow down the economy, prompting traders to be more cautious. Understanding the relationship between interest rates and market movements can provide traders with a tactical advantage.

To put it all together, here’s a quick summary of key economic indicators to monitor:

- Gross Domestic Product (GDP): Indicates overall economic health.

- Unemployment Rate: Reflects consumer confidence and spending.

- Consumer Price Index (CPI): Measures inflation and its impact on purchasing power.

- Interest Rates: Affect borrowing, spending, and overall market sentiment.

By keeping a close eye on these indicators, traders can better navigate the turbulent waters of economic uncertainty. Remember, it's not just about knowing these numbers; it's about understanding how they interconnect and influence market behavior. The more informed you are, the more confident you can be in your trading decisions.

Risk Management Techniques

When it comes to trading, especially during periods of economic uncertainty, having a solid risk management strategy is not just beneficial; it’s essential. Think of it like wearing a seatbelt in a car. You may not need it all the time, but when things go wrong, it can save your life—or in this case, your investment portfolio. Traders must recognize that markets can be unpredictable, and without a robust risk management plan, they could find themselves facing devastating losses.

One of the first steps in effective risk management is to establish a clear understanding of your risk tolerance. This means knowing how much risk you are willing to take on with each trade. Are you a conservative trader who prefers to play it safe, or are you more of a risk-taker looking for high rewards? Understanding your own risk profile will guide your trading decisions and help you set appropriate stop-loss orders to limit potential losses.

Another critical aspect of risk management is position sizing. This involves determining how much capital to allocate to a particular trade based on your overall portfolio size and risk tolerance. A common approach is the 1% rule, where you risk no more than 1% of your total trading capital on a single trade. For example, if your trading account has $10,000, you should limit your risk to $100 per trade. This strategy helps to ensure that even a series of losses won't wipe out your entire account, allowing you to stay in the game longer.

Additionally, diversifying your investments is a powerful way to mitigate risk. By spreading your investments across different asset classes—such as stocks, bonds, commodities, and real estate—you can reduce the impact of a poor-performing asset on your overall portfolio. For instance, if the stock market takes a downturn, your bonds or real estate investments may still perform well, balancing out your losses. Here’s a simple table to illustrate how diversification works:

| Asset Class | Example Investments | Risk Level |

|---|---|---|

| Stocks | Technology, Healthcare | High |

| Bonds | Government, Corporate | Low to Medium |

| Commodities | Gold, Oil | Medium |

| Real Estate | REITs, Rental Properties | Medium |

Moreover, using stop-loss orders is a practical technique that every trader should employ. A stop-loss order automatically sells your asset when it reaches a predetermined price, effectively limiting your losses. For example, if you buy a stock at $50 and set a stop-loss order at $45, the stock will automatically sell if it drops to that price. It’s like having a safety net—if you fall, you won’t hit the ground hard.

Lastly, let’s not forget about the psychological side of trading. Emotional decision-making can lead to significant losses. Maintaining discipline and sticking to your risk management plan, even when the market is volatile, is crucial. Consider keeping a trading journal where you document your trades, emotions, and decision-making processes. This can help you identify patterns in your behavior and improve your trading strategy over time.

In summary, effective risk management techniques are the backbone of successful trading, especially in uncertain economic times. By understanding your risk tolerance, employing proper position sizing, diversifying your investments, using stop-loss orders, and maintaining emotional discipline, you can protect your capital and make informed decisions. Remember, it’s not just about how much you can gain; it’s about how much you can afford to lose.

- What is risk management in trading? Risk management in trading refers to the strategies and techniques used to minimize potential losses and protect investments.

- How can I determine my risk tolerance? Your risk tolerance can be determined by assessing your financial situation, investment goals, and emotional comfort with risk.

- What is the 1% rule in trading? The 1% rule suggests that traders should risk no more than 1% of their total trading capital on a single trade to protect their portfolio.

- Why is diversification important? Diversification is important because it helps spread risk across different asset classes, reducing the impact of poor performance in any one area.

- What are stop-loss orders? Stop-loss orders are automated trades that sell an asset when it reaches a specified price, helping to limit losses.

Diversification Strategies

Diversification is like a safety net for your investment portfolio, especially during times of economic uncertainty. Imagine you're a tightrope walker, balancing high above the ground. If you only have one safety net, the risk of falling is enormous. However, if you have multiple nets spread out below, your chances of landing safely increase significantly. This analogy perfectly encapsulates the essence of diversification. By spreading your investments across various asset classes, you can reduce the overall risk and enhance potential returns. But how do you effectively diversify in a turbulent market?

First and foremost, consider the different types of assets you can include in your portfolio. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and perhaps even commodities like gold or oil. Each of these asset classes behaves differently under varying economic conditions. For instance, when stocks are soaring, bonds may lag, but during a downturn, bonds often hold their value better than stocks. This inverse relationship can provide a cushion for your investments.

Another effective strategy for diversification is to invest in different sectors of the economy. Not every sector reacts the same way to economic changes. For example, consumer staples tend to be more stable during recessions, while technology stocks may experience higher volatility. By investing across sectors such as healthcare, technology, consumer goods, and energy, you can better position your portfolio to weather economic storms. Here’s a quick look at some sectors to consider:

| Sector | Characteristics | Example Investments |

|---|---|---|

| Healthcare | Generally stable, less affected by economic downturns | Pharmaceutical companies, biotech firms |

| Technology | High growth potential, but volatile | Software companies, hardware manufacturers |

| Consumer Goods | Essential products, stable demand | Food and beverage companies, household goods |

| Energy | Subject to geopolitical influences, can be volatile | Oil companies, renewable energy firms |

Additionally, consider geographical diversification. Investing in international markets can provide exposure to growth opportunities that may not be available domestically. For instance, emerging markets may offer higher growth potential, albeit with increased risk. By including international assets in your portfolio, you can further buffer against local economic downturns.

Lastly, don't forget about the importance of rebalancing. As the market fluctuates, the allocation of your investments will change. Regularly reviewing and adjusting your portfolio ensures that you maintain your desired level of risk and return. Think of it as tuning a musical instrument; periodic adjustments keep everything in harmony.

In conclusion, diversification strategies are essential for navigating the complexities of economic uncertainty. By spreading your investments across various asset classes, sectors, and geographical regions, you can significantly mitigate risk and enhance your chances of achieving favorable returns. Remember, it's not just about having a variety of investments, but also about managing them wisely to adapt to changing market conditions.

- What is diversification? Diversification is the practice of spreading investments across various asset classes and sectors to reduce risk.

- Why is diversification important during economic uncertainty? It helps mitigate losses by ensuring that not all investments are affected negatively at the same time.

- How often should I rebalance my portfolio? It's advisable to review and rebalance your portfolio at least once a year or whenever there are significant market changes.

- Can I diversify too much? Yes, over-diversification can lead to diminished returns and complexity in managing your portfolio.

Asset Allocation

When it comes to navigating the stormy seas of economic uncertainty, serves as your trusty compass. It’s not just about throwing your money at random investments; it’s about strategically distributing your assets across various categories to balance risk and reward. Think of it like a well-balanced diet: you wouldn’t want to eat only one type of food, right? Similarly, a well-diversified portfolio can help you weather the economic storms that come your way.

At its core, asset allocation involves dividing your investments among different asset categories, such as stocks, bonds, real estate, and cash. The goal is to maximize returns while minimizing risk, especially during turbulent times. For instance, when the stock market is volatile, having bonds in your portfolio can help cushion the blow. But how do you determine the right mix? It often comes down to your risk tolerance, investment goals, and time horizon.

To make this concept clearer, let’s consider a simple table that illustrates a potential asset allocation strategy:

| Asset Class | Percentage Allocation |

|---|---|

| Stocks | 60% |

| Bonds | 30% |

| Real Estate | 5% |

| Cash | 5% |

In this example, an investor who is willing to accept a higher level of risk might allocate 60% of their portfolio to stocks, which can provide higher returns but also come with greater volatility. On the other hand, a more conservative investor might prefer a heavier allocation to bonds and cash to safeguard their capital. The key is to regularly review and adjust your asset allocation based on changing market conditions and personal circumstances.

Moreover, understanding your investment horizon is crucial. If you’re investing for a short-term goal, like buying a house in a couple of years, a conservative allocation might be more appropriate. Conversely, if you’re in it for the long haul, you can afford to take on more risk with a larger stock allocation. This adaptability is what makes asset allocation a dynamic strategy rather than a one-size-fits-all solution.

In summary, effective asset allocation is not just about choosing where to invest; it’s about crafting a strategy that aligns with your financial goals and risk tolerance. Regularly revisiting your asset allocation can help you stay on track, especially when the economic landscape shifts unexpectedly. So, as you navigate through uncertain times, remember that a well-thought-out asset allocation can be your best ally in achieving financial stability.

- What is asset allocation? Asset allocation is the process of distributing your investments among different asset categories to balance risk and returns.

- How often should I review my asset allocation? It's advisable to review your asset allocation at least annually or whenever there are significant changes in your financial situation or market conditions.

- Can asset allocation guarantee profits? No, while a good asset allocation strategy can help mitigate risks, it cannot guarantee profits due to the inherent volatility of markets.

Sector Rotation

Sector rotation is a strategic investment approach that involves shifting your portfolio's focus among different sectors of the economy based on their performance relative to the overall market. Think of it as a game of musical chairs; as the music plays, some sectors thrive while others falter. This method allows traders to capitalize on economic cycles and trends, optimizing their returns even during periods of uncertainty.

Understanding which sectors are likely to outperform can be a game changer. For instance, during economic expansions, sectors such as technology and consumer discretionary may lead the charge, while in downturns, defensive sectors like utilities and healthcare often show resilience. By staying attuned to these shifts, traders can position themselves to ride the waves of market fluctuations.

To effectively implement sector rotation, it’s essential to monitor key economic indicators that signal changes in the economic cycle. Some of these include:

- Gross Domestic Product (GDP): A growing GDP usually points to a thriving economy, favoring cyclical sectors.

- Unemployment Rates: Low unemployment can signal a strong economy, benefiting sectors like consumer discretionary.

- Inflation Rates: Rising inflation may lead to a shift toward commodities and energy sectors.

One effective way to track sector performance is through sector ETFs (Exchange-Traded Funds), which allow traders to invest in a basket of stocks within a specific sector. By analyzing the performance of these ETFs, traders can identify which sectors are gaining momentum and make informed decisions about where to allocate their resources.

Additionally, utilizing technical analysis can enhance your sector rotation strategy. By examining chart patterns and trends, traders can spot potential entry and exit points for sector investments. For example, if a particular sector ETF shows consistent upward movement with increasing volume, it may indicate a strong buying opportunity. Conversely, if the ETF is experiencing declining prices and low volume, it could be wise to shift investments elsewhere.

In conclusion, mastering sector rotation requires a keen understanding of economic indicators, market trends, and technical analysis. By staying agile and informed, traders can navigate the complexities of economic uncertainty and position themselves for success. Remember, the key is to be proactive rather than reactive—anticipate the shifts, and you'll be one step ahead in the trading game.

- What is sector rotation? Sector rotation is the practice of shifting investments among different sectors of the economy based on their expected performance in various economic conditions.

- How can I identify which sector to invest in? Monitoring economic indicators, market trends, and using technical analysis can help identify which sectors are likely to perform well.

- Are sector ETFs a good investment? Yes, sector ETFs can provide diversified exposure to specific sectors, making them a useful tool for implementing a sector rotation strategy.

Using Technical Analysis

When it comes to trading during economic uncertainty, technical analysis emerges as a powerful tool in a trader's arsenal. Think of it as a compass that helps you navigate the unpredictable waters of the financial markets. By analyzing historical price data and trading volumes, you can uncover patterns and trends that might not be immediately evident. This approach allows you to make informed decisions based on market behavior rather than emotions or speculation.

One of the key components of technical analysis is the use of charts. These visual representations of price movements over time can reveal a lot about market sentiment. For instance, if you see a stock consistently bouncing off a particular price level, that could indicate strong support. Conversely, if it repeatedly fails to break through a certain price, that might signal resistance. By recognizing these patterns, traders can make more strategic entry and exit decisions.

Moreover, there are several technical indicators that traders frequently utilize to analyze price movements. Some of the most popular indicators include:

- Moving Averages: These smooth out price data to identify trends over a specific period. A simple moving average (SMA) can help you see the overall direction of a stock.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

- Bollinger Bands: These bands expand and contract based on market volatility, providing insights into potential price breakouts or reversals.

In addition to these indicators, chart patterns play a crucial role in technical analysis. Patterns like head and shoulders, double tops, and triangles can signal potential market reversals or continuations. By learning to recognize these formations, traders can anticipate future price movements and position themselves accordingly.

However, it’s important to remember that technical analysis is not foolproof. Just like a weather forecast, it provides probabilities rather than certainties. Market conditions can change rapidly, and unexpected news can disrupt even the most well-planned strategies. Therefore, combining technical analysis with other forms of analysis, like fundamental analysis or sentiment analysis, can provide a more comprehensive view of the market.

In conclusion, using technical analysis during times of economic uncertainty can significantly enhance your trading strategy. By focusing on price movements, patterns, and indicators, you can make more informed decisions that align with the current market conditions. So, the next time you find yourself in a volatile market, remember to pull out your technical analysis toolkit and let it guide you through the storm.

Q: What is technical analysis?

A: Technical analysis is the study of past market data, primarily price and volume, to forecast future price movements.

Q: How do I get started with technical analysis?

A: Begin by learning about different chart types, indicators, and patterns. Practice analyzing charts using historical data.

Q: Can technical analysis guarantee profits?

A: No, while it can improve your decision-making, there are no guarantees in trading. It's essential to manage risk and combine analysis methods.

Staying Informed on Global Events

In the world of trading, knowledge is power, and when it comes to economic uncertainty, staying informed about global events is absolutely crucial. Think of it as having a compass in a dense forest; without it, you might wander aimlessly, unsure of your direction. Global events, whether they’re political upheavals, natural disasters, or economic shifts, can send shockwaves through the financial markets, affecting everything from stock prices to currency values. So, how do you keep your finger on the pulse of the world?

First and foremost, it's essential to establish a routine for consuming news. Many traders start their day by checking reliable financial news websites, subscribing to newsletters, or using dedicated financial apps. This way, they can get a quick overview of the latest developments. But remember, not all news is created equal. It’s vital to differentiate between sensational headlines and substantial reports that provide real insights into market movements. For example, a tweet from a prominent political figure may cause immediate fluctuations, but a detailed economic report from a government agency often has a more lasting impact.

Moreover, utilizing social media platforms can be a double-edged sword. On one hand, they provide real-time updates and diverse perspectives; on the other, they can spread misinformation. Follow credible analysts and financial experts on platforms like Twitter or LinkedIn, but always cross-reference the information you receive. In this fast-paced world, being a well-informed trader means not just knowing what’s happening, but understanding how it affects your trading strategy.

Another key aspect of staying informed is to pay attention to economic calendars. These calendars outline important upcoming events such as economic releases, earnings reports, and central bank meetings. By being aware of these dates, you can prepare for potential market volatility. For instance, if you know that a major economic report is due, you might choose to adjust your positions or implement tighter risk management strategies to safeguard your investments.

To illustrate the importance of staying informed, consider the following table that highlights some significant global events and their potential impacts on trading:

| Event | Potential Impact |

|---|---|

| Federal Reserve Interest Rate Decision | Can lead to volatility in the stock and currency markets as traders react to changes in monetary policy. |

| Geopolitical Tensions | May cause spikes in commodity prices, particularly oil, as concerns about supply disruptions arise. |

| Natural Disasters | Can affect local economies and industries, leading to stock price fluctuations in affected sectors. |

| Major Trade Agreements | Can influence currency valuations and the stock prices of companies involved in international trade. |

Finally, it’s crucial to not only gather information but also to analyze it critically. Ask yourself questions like: How does this news affect my current positions? What are the broader implications for the market? By cultivating a habit of critical thinking, you can transform raw data into actionable insights, allowing you to navigate the complexities of trading during uncertain times with confidence.

- How often should I check global news as a trader? It's beneficial to check news multiple times a day, especially before making significant trading decisions.

- What are some reliable sources for financial news? Reputable sources include Bloomberg, Reuters, and CNBC, along with economic calendars from financial institutions.

- How can I avoid misinformation on social media? Always verify information from multiple credible sources before acting on it.

News Impact on Markets

In the fast-paced world of trading, news plays a pivotal role in shaping market sentiment and influencing price movements. Whether it's a sudden geopolitical event, an unexpected economic report, or corporate earnings announcements, the news can create waves of volatility that traders must navigate. Understanding how to interpret and react to news is crucial for anyone looking to succeed in uncertain economic times.

When significant news breaks, the market often reacts swiftly, and this reaction can be both immediate and profound. For instance, a positive jobs report might lead to an uptick in stock prices, while news of a potential trade war could send markets plummeting. Traders need to be agile, ready to adapt their strategies based on the latest information. This adaptability can be the difference between profit and loss.

To effectively manage the impact of news on trading decisions, it's essential to consider the following factors:

- Timing: The timing of news releases can significantly affect market reactions. Economic indicators are often released at specific times, and traders should be prepared for increased volatility during these periods.

- Market Sentiment: How the market perceives news can vary. Positive news may not always lead to positive outcomes if the market has already priced in expectations.

- Volume and Liquidity: High trading volume during news events can lead to rapid price changes. Traders should be aware of liquidity conditions, as they can affect order execution.

Moreover, analyzing the context of the news is vital. For example, while a central bank's decision to lower interest rates may typically be seen as bullish for stocks, if the market believes this action is a response to a looming recession, the reaction could be negative. Therefore, contextual analysis is key to making informed trading decisions.

To illustrate the impact of news on market movements, consider the following table that highlights how different types of news can influence stock prices:

| Type of News | Typical Market Reaction |

|---|---|

| Positive Economic Data | Increase in stock prices |

| Negative Economic Data | Decrease in stock prices |

| Geopolitical Tensions | Increased volatility, potential sell-off |

| Corporate Earnings Surprises | Sharp price movements based on results |

In conclusion, the impact of news on markets is both significant and complex. Traders must stay informed and be prepared to adjust their strategies in response to new information. By understanding the nuances of how news affects market behavior, traders can enhance their decision-making processes and improve their chances of success in uncertain economic landscapes.

Q: How can I stay updated on the latest news that impacts the markets?

A: You can stay updated by following financial news websites, subscribing to market newsletters, and utilizing financial apps that provide real-time news alerts.

Q: Should I react immediately to breaking news?

A: While it's important to be aware of breaking news, immediate reactions can sometimes lead to impulsive decisions. It's crucial to analyze the news in context before making any trades.

Q: How can I manage risk when trading based on news events?

A: Implementing stop-loss orders, diversifying your portfolio, and only risking a small percentage of your capital on any single trade can help manage risk effectively.

Utilizing Economic Reports

Economic reports are like the treasure maps of the trading world. They provide crucial insights into the health of an economy and can significantly influence market movements. For traders, understanding how to utilize these reports effectively can be the difference between a profitable trade and a costly mistake. So, what exactly should you look for in these reports, and how can they shape your trading strategies during uncertain times?

First off, it's essential to know the types of economic reports that can impact your trading decisions. Some of the most significant reports include:

- Gross Domestic Product (GDP): This measures the overall economic output and growth of a country. A higher GDP often signals a strong economy, while a decline might indicate trouble ahead.

- Unemployment Rate: A high unemployment rate can suggest economic weakness, while a lower rate indicates a robust job market.

- Consumer Price Index (CPI): This report measures inflation and can influence central bank policies, affecting interest rates and, consequently, market movements.

- Retail Sales: This report provides insights into consumer spending, which is a significant driver of economic growth.

These reports are typically released on a regular schedule, and savvy traders keep an eye on the calendar to anticipate their impact. For instance, if you know that the CPI report is due to be released, you might want to adjust your positions accordingly. This is where the art of timing comes into play. By being proactive and understanding the implications of these reports, you can make informed decisions that align with market expectations.

Moreover, interpreting the data is just as important as knowing when it’s released. For example, if the unemployment rate drops, but the GDP growth is stagnant, it could indicate that the job market is not as strong as it seems. This juxtaposition can lead to market volatility, and being aware of such nuances allows you to navigate your trades more effectively.

Another critical aspect is the reaction of the market to these reports. Sometimes, a report might come out better than expected, but the market could still react negatively due to other underlying factors. Understanding market sentiment and how it correlates with economic data is vital. This is where technical analysis can complement your economic report insights, helping to identify potential entry and exit points based on market behavior.

In addition, it’s wise to keep a journal of how various reports have affected the market in the past. This can serve as a reference guide, allowing you to identify patterns and trends that could inform your future trading strategies. By analyzing historical data, you can better predict how the market might respond to similar reports in the future.

In conclusion, utilizing economic reports is an essential strategy for traders looking to thrive in uncertain economic conditions. By understanding the types of reports, their implications, and the market's reaction to them, you can enhance your decision-making process. Remember, in the world of trading, knowledge is power, and staying informed is your best defense against the unpredictability of the markets.

1. What are economic reports?

Economic reports are documents released by government agencies or financial institutions that provide data on various aspects of the economy, such as employment, inflation, and economic growth.

2. How often are economic reports released?

Economic reports are released on a regular basis, with some monthly, quarterly, or annually, depending on the type of data being reported.

3. Why are economic reports important for traders?

Economic reports help traders gauge the health of the economy, which can influence market trends and investment decisions.

4. How can I stay updated on upcoming economic reports?

You can stay updated by following financial news websites, subscribing to economic calendars, or using trading platforms that provide alerts for upcoming reports.

Psychological Aspects of Trading

Trading is not just about numbers and charts; it’s also a mental game. The psychological aspects of trading can make or break your success in the markets. When economic uncertainty looms, emotions can run high, leading to impulsive decisions that may not align with your trading strategy. Have you ever found yourself second-guessing your trades or feeling overwhelmed by market fluctuations? You're not alone. Many traders grapple with the psychological pressures that come with trading, especially during turbulent times.

One of the most significant challenges traders face is fear and greed. Fear can cause you to exit a position too early or hesitate to enter a potentially lucrative trade, while greed can lead to overtrading or holding onto losing positions in hopes of a rebound. This emotional tug-of-war can cloud your judgment and lead to poor decision-making. To combat these feelings, it’s essential to establish a trading plan that includes clear entry and exit strategies. By having a plan, you can reduce the impact of emotions on your trading decisions and stick to your strategy even when the market gets rocky.

Another psychological hurdle is loss aversion. Studies have shown that the pain of losing is often felt more intensely than the pleasure of winning. This can lead to a reluctance to cut losses, causing traders to hold onto losing positions longer than they should. To manage this, consider setting predetermined stop-loss levels. By knowing when to exit a trade before entering it, you can take some of the emotional weight off your shoulders, allowing you to focus on executing your strategy rather than worrying about potential losses.

Additionally, maintaining discipline is crucial. It’s easy to get caught up in the excitement of trading, especially when you see others making significant profits. However, chasing after quick gains can lead to reckless behavior. Instead, remind yourself of your overall trading goals and the importance of sticking to your strategy. One effective way to reinforce discipline is by keeping a trading journal. Documenting your trades, including your thought process and emotional state at the time, can provide valuable insights into your trading behavior and help you identify patterns that may need adjustment.

Lastly, don’t underestimate the power of mindfulness in trading. Practicing mindfulness can help you stay grounded and maintain a clear perspective, especially during stressful market conditions. Techniques such as deep breathing, meditation, or even short breaks away from the screen can help you regain focus. By cultivating a mindful approach, you’ll be better equipped to handle the emotional ups and downs of trading, allowing you to make more rational decisions.

- How can I improve my trading psychology? Start by creating a solid trading plan, practicing discipline, and keeping a trading journal to track your emotions and decisions.

- What is loss aversion, and how does it affect trading? Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains. It can lead to holding onto losing trades longer than necessary.

- Why is discipline important in trading? Discipline helps you stick to your trading plan and avoid impulsive decisions driven by emotions.

- Can mindfulness help with trading? Yes, mindfulness practices can enhance focus and reduce stress, helping you maintain a clear perspective during volatile market conditions.

Frequently Asked Questions

- What are economic indicators, and why are they important for traders?

Economic indicators are statistics that provide insight into the health of an economy. For traders, these indicators are vital as they help predict market trends and inform trading strategies during uncertain times. By keeping an eye on indicators like GDP, unemployment rates, and inflation, traders can make more informed decisions and adjust their strategies accordingly.

- How can I effectively manage risk when trading?

Managing risk is crucial for trading success, especially in volatile markets. Some effective risk management techniques include setting stop-loss orders, diversifying your portfolio, and only risking a small percentage of your capital on any single trade. By implementing these strategies, you can protect your investments and minimize potential losses.

- What is diversification, and how can it help during economic uncertainty?

Diversification involves spreading your investments across various asset classes to reduce risk. During economic uncertainty, diversification can protect your portfolio from significant losses by ensuring that not all your investments are affected by the same market movements. This strategy allows traders to capture gains from different sectors while mitigating potential downturns.

- What role does technical analysis play in trading?

Technical analysis involves studying price movements and trading volumes to forecast future market behavior. By using charts and key indicators, traders can identify trends and make informed decisions. During uncertain times, technical analysis can provide valuable insights that help traders react quickly to market changes.

- Why is it important to stay informed about global events?

Staying updated on global events is essential because they can significantly impact market volatility. Economic reports, geopolitical developments, and major news events can create rapid changes in market conditions. By being informed, traders can adjust their strategies and make timely decisions that align with current market dynamics.

- How can news impact my trading strategy?

News can create both opportunities and risks in the market. Positive news can drive prices up, while negative news can lead to declines. Traders need to interpret the news effectively and understand its potential impact on their trades. By incorporating news analysis into their strategies, traders can capitalize on market movements driven by current events.

- What psychological challenges do traders face during economic uncertainty?

Traders often experience heightened emotions like fear and greed during uncertain times, which can lead to impulsive decisions. Common psychological challenges include overtrading, loss aversion, and difficulty sticking to a trading plan. Recognizing these challenges and developing strategies to maintain discipline can help traders navigate the emotional landscape of trading more effectively.