How to Use Technical Analysis to Improve Trade Execution

In the fast-paced world of trading, making informed decisions is crucial for success. This is where technical analysis comes into play, acting as a powerful tool for traders looking to enhance their trade execution. By analyzing past market data, particularly price and volume, traders can forecast future price movements and make more strategic decisions. But how exactly does one harness the power of technical analysis? In this article, we will explore the fundamentals of technical analysis and its application in improving trade execution, offering insights into various tools and strategies that can lead to better decision-making.

At its core, technical analysis is about understanding market behavior through data. It’s like being a detective, piecing together clues from price charts and trading volumes to predict future trends. The principles of technical analysis are grounded in the belief that all current market information is reflected in the price. Therefore, by studying historical price movements, traders can identify patterns and trends that may suggest where the market is headed next. This approach is essential because it helps traders avoid emotional decisions driven by fear or greed, allowing for a more systematic and analytical trading strategy.

Traders have a toolbox filled with various instruments to aid in their analysis. Among the most effective tools are charts, indicators, and oscillators. Each of these tools plays a unique role in helping traders interpret market conditions and make informed trading decisions. For instance, charts provide a visual representation of price movements over time, allowing traders to spot trends and reversals. Indicators, such as moving averages, help smooth out price data to identify the direction of the trend, while oscillators can signal overbought or oversold conditions. Understanding how to effectively use these tools can significantly enhance a trader's ability to execute trades successfully.

Recognizing chart patterns is a fundamental skill in technical analysis. Patterns like head and shoulders or triangles can provide critical insights into potential market movements. For example, a head and shoulders pattern often indicates a reversal in trend, while triangles can suggest a continuation. Learning to identify and interpret these patterns effectively can give traders a significant edge. It’s like learning to read the signs on the road; understanding these patterns can guide traders toward profitable decisions.

Support and resistance levels are pivotal in technical analysis. These levels act like invisible barriers that the price struggles to break through. Support is the price level where a downtrend can be expected to pause due to a concentration of demand, while resistance is where an uptrend can pause due to a concentration of supply. Determining these levels can be done through historical price data, and their significance in trade execution cannot be overstated. They help traders set entry and exit points, manage risk, and make more calculated decisions.

Another essential aspect of technical analysis is the use of trend lines. These lines help traders visualize market trends by connecting the high or low points on a chart. Drawing trend lines is relatively straightforward, yet they provide valuable insights into the market's direction. A well-drawn trend line can indicate potential entry and exit points, allowing traders to capitalize on price movements. It's akin to having a roadmap; it guides traders through the often-chaotic landscape of the market.

Technical indicators, such as moving averages and the Relative Strength Index (RSI), are essential tools for analyzing market trends. Moving averages help smooth out price fluctuations, making it easier to identify the overall direction of the market. On the other hand, the RSI measures the speed and change of price movements, helping traders identify overbought or oversold conditions. By incorporating these indicators into their trading strategies, traders can enhance their ability to make informed decisions, ultimately leading to improved trade execution.

While technical analysis is powerful, integrating it with fundamental analysis can significantly enhance trading effectiveness. Fundamental analysis focuses on the underlying factors that influence a market, such as economic indicators, earnings reports, and geopolitical events. By combining these two approaches, traders can gain a more comprehensive view of the market. For instance, if technical analysis indicates a bullish trend, but fundamental analysis reveals negative news about a company's earnings, a trader might reconsider their position. This hybrid approach allows for a more nuanced and informed trading strategy.

Understanding market sentiment is crucial for traders. Sentiment analysis involves gauging the mood of the market—whether traders are feeling optimistic or pessimistic. This can be assessed through various means, such as news articles, social media, and market indicators. When combined with technical analysis, sentiment can provide valuable context for price movements. For example, if technical indicators suggest a bullish trend but sentiment is predominantly negative, it may signal caution for traders. This holistic view can lead to better trade execution.

Effective risk management is vital in trading. It’s not just about making profits; it’s also about protecting your capital. Technical analysis can inform risk management strategies by helping traders identify potential stop-loss levels based on support and resistance. By setting these levels, traders can minimize potential losses while maximizing gains. Additionally, understanding volatility through technical indicators can help traders adjust their risk exposure according to market conditions. This approach ensures that traders can navigate the market with confidence and security.

- What is technical analysis? Technical analysis is the study of past market data, primarily price and volume, to forecast future price movements.

- How can I improve my trading using technical analysis? By utilizing tools such as charts, indicators, and understanding market patterns, traders can make more informed decisions.

- Is technical analysis better than fundamental analysis? Both analyses have their strengths and weaknesses; combining them often yields the best results.

- What are some common technical indicators? Common indicators include moving averages, RSI, MACD, and Bollinger Bands.

Understanding Technical Analysis

Technical analysis is a method used by traders to evaluate and forecast future price movements based on historical market data. At its core, it involves analyzing price charts and volume data to identify patterns and trends that can inform trading decisions. Think of it as a map for navigating the often chaotic waters of financial markets; just as a sailor uses navigational tools to find their way, traders utilize technical analysis to chart their course.

One of the fundamental principles of technical analysis is the belief that all available information is already reflected in the price of a security. This means that rather than focusing on the underlying fundamentals of a company—such as earnings reports or economic indicators—traders look to the price action itself to make decisions. As the famous saying goes, "Price is truth." This approach allows traders to react quickly to market movements and capitalize on potential opportunities.

Another important aspect of technical analysis is the concept of market psychology. Traders often make decisions based on emotions such as fear and greed, which can lead to predictable patterns in price movements. For instance, during a strong uptrend, traders may become overly optimistic, pushing prices higher even when they may be overvalued. Conversely, in a downtrend, fear can lead to panic selling, resulting in prices dropping more than they should. By understanding these psychological factors, traders can better anticipate market behavior and adjust their strategies accordingly.

Technical analysis also relies heavily on the use of charts. There are several types of charts that traders can use, including line charts, bar charts, and candlestick charts. Each type provides a different perspective on price action and can reveal unique insights. For example, candlestick charts not only show the opening and closing prices but also the highs and lows during a specific time frame, offering a more comprehensive view of market sentiment.

In summary, technical analysis is a powerful tool that equips traders with the ability to make informed decisions based on price movements and market psychology. By mastering its principles and techniques, traders can enhance their trade execution and increase their chances of success in the dynamic world of trading.

Key Tools of Technical Analysis

When diving into the world of trading, one of the most essential skills to develop is the ability to utilize technical analysis. This skill set can transform your trading game, enabling you to make informed decisions based on historical price movements and market behavior. So, what are the key tools that traders use to navigate this complex landscape? Let’s break it down.

At the heart of technical analysis are a variety of tools that help traders interpret market data. These tools can be broadly categorized into three main groups: charts, indicators, and oscillators. Each of these tools serves a specific purpose, and understanding how to effectively use them can significantly enhance your trade execution.

Charts are the most fundamental tools of technical analysis. They visually represent price movements over time, allowing traders to spot trends and patterns quickly. There are several types of charts, including line charts, bar charts, and candlestick charts. Among these, candlestick charts are particularly popular due to their ability to convey more information at a glance, such as opening, closing, high, and low prices within a specific time frame. This rich data presentation allows traders to make quick decisions based on visual cues.

Next, we have technical indicators, which are mathematical calculations based on price and volume. These indicators help traders identify market trends, momentum, and potential reversal points. Some of the most commonly used indicators include:

- Moving Averages: These smooth out price data to create a trend-following indicator, helping traders identify the direction of the trend.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, indicating overbought or oversold conditions.

- Bollinger Bands: These consist of a middle band (a moving average) and two outer bands that represent volatility, helping traders assess market conditions.

Additionally, oscillators are another crucial tool in technical analysis. Unlike indicators, oscillators fluctuate between a fixed range, providing insights into potential price reversals. They are particularly useful in sideways markets where price movements are less predictable. Examples of popular oscillators include the Stochastic Oscillator and the MACD (Moving Average Convergence Divergence).

In summary, mastering these key tools of technical analysis can significantly enhance your trading strategy. By effectively utilizing charts, indicators, and oscillators, traders can gain a deeper understanding of market dynamics, leading to more informed and confident trading decisions. Remember, the goal is not just to use these tools but to integrate them into a cohesive strategy that aligns with your trading style and objectives.

Chart Patterns

Chart patterns are the bread and butter of technical analysis, acting as visual cues that traders use to predict future price movements. Imagine you're a detective, and each pattern is a clue that helps you piece together the bigger picture of market behavior. By recognizing these patterns, you can make more informed trading decisions and potentially increase your profitability. Some of the most commonly recognized patterns include head and shoulders, double tops and bottoms, and triangles. Each of these patterns tells a story about the market's sentiment and the possible direction of price action.

For instance, the head and shoulders pattern is often seen as a reversal signal, indicating that a bullish trend may be coming to an end. Conversely, the inverse head and shoulders pattern can signal a bullish reversal after a downtrend. To identify these patterns effectively, traders should look for specific formations on the chart:

- Head and Shoulders: This pattern consists of three peaks, with the middle peak (the head) being the highest and the two outer peaks (the shoulders) being lower.

- Double Tops and Bottoms: These patterns appear as two peaks or two troughs, suggesting a potential reversal in the current trend.

- Triangles: These can be ascending, descending, or symmetrical, indicating a period of consolidation before a potential breakout.

Understanding how to interpret these patterns can significantly enhance your trading strategy. For example, when you spot a double top, it might be wise to consider selling, as it suggests that the price is likely to reverse downward. On the other hand, a double bottom could be a signal to buy, indicating a potential upward movement. The key is to look for confirmation through other indicators or price action before making a trade.

Moreover, it’s essential to remember that chart patterns are not foolproof. They are best used in conjunction with other technical analysis tools, such as support and resistance levels and trend lines. By combining these elements, you can create a more robust trading strategy that minimizes risks and maximizes potential rewards.

In conclusion, mastering chart patterns is an invaluable skill for any trader. They provide insights into market psychology and help you anticipate price movements. So, the next time you look at a chart, take a moment to identify the patterns present, and let them guide your trading decisions. After all, in the world of trading, knowledge is power, and recognizing chart patterns can give you the edge you need to succeed.

Q: How reliable are chart patterns in predicting price movements?

A: While chart patterns can provide valuable insights, they are not always reliable. It's essential to use them alongside other technical indicators and market analysis.

Q: Can I use chart patterns in all markets?

A: Yes, chart patterns can be applied to various markets, including stocks, forex, and cryptocurrencies. However, each market may have its characteristics, so adjustments might be necessary.

Q: How can I practice identifying chart patterns?

A: You can practice by analyzing historical charts and using demo trading platforms to simulate real trading scenarios without risking actual capital.

Support and Resistance

When diving into the world of technical analysis, levels serve as the backbone of your trading strategy. Think of them as the invisible walls that dictate the ebb and flow of market prices. Support is akin to a safety net, where the price tends to stop falling and may even bounce back up, while resistance acts like a ceiling, preventing prices from rising beyond a certain point. Understanding these levels is crucial for traders who want to enhance their execution and make informed decisions.

Identifying support and resistance levels can sometimes feel like deciphering a secret code. Traders often look at historical price data to pinpoint where these levels might be. For instance, if a stock has consistently bounced back at a price of $50, that price is likely a strong support level. Conversely, if it has repeatedly failed to break above $70, that price is a resistance level. These levels can be identified using various methods, including:

- Historical Price Points: Analyzing past price movements to find where the stock has reversed direction.

- Moving Averages: Using averages like the 50-day or 200-day moving average can help identify dynamic support and resistance levels.

- Fibonacci Retracement Levels: Utilizing Fibonacci levels to predict potential reversal points based on the golden ratio.

Once you have identified these levels, the next step is to monitor how the price reacts as it approaches them. A price that bounces off a support level can signal a buying opportunity, while a price that fails to break through a resistance level might indicate a good time to sell. However, it’s essential to keep in mind that these levels are not set in stone; they can change based on market conditions and trader sentiment.

Moreover, the significance of support and resistance levels can vary depending on the timeframe you are analyzing. For example, a resistance level on a daily chart may hold more weight than one on a 5-minute chart. This is where understanding the context of your trades becomes vital. Always consider the broader market trends and how they might affect these levels.

In summary, mastering the concept of support and resistance can significantly enhance your trading execution. By recognizing these critical levels and understanding their implications, you can make more informed decisions, ultimately leading to better trading outcomes. Just remember, in the world of trading, patience and practice are key. The more you familiarize yourself with these concepts, the more adept you will become at navigating the market's twists and turns.

- What is the difference between support and resistance? Support is the price level where a stock tends to stop falling and may bounce back up, while resistance is the price level where a stock tends to stop rising and may fall back down.

- How can I identify support and resistance levels? You can identify these levels by analyzing historical price data, using moving averages, or applying Fibonacci retracement levels.

- Do support and resistance levels change? Yes, support and resistance levels can change based on market conditions, news, and trader sentiment.

Trend Lines

Trend lines are essential tools in the arsenal of any trader looking to navigate the often turbulent waters of financial markets. They act as visual guides, helping traders identify the direction of price movements over a specified period. By connecting significant price points on a chart, trend lines can reveal whether a market is in an uptrend, downtrend, or moving sideways. Think of them as the roadmap to your trading journey, indicating where you might want to enter or exit trades.

To draw a trend line, you need to connect at least two price points. In an uptrend, you would connect the lows, creating a line that slopes upward. Conversely, in a downtrend, you connect the highs, resulting in a downward slope. The more times a trend line is tested (price touches it), the stronger it is considered. This strength is crucial because it can indicate potential reversal points, where the price may change direction.

One of the most significant advantages of using trend lines is their ability to provide traders with clear entry and exit signals. For instance, if the price approaches a trend line and bounces back, it may suggest that the trend is still intact, offering a potential buying opportunity. On the other hand, if the price breaks through a trend line, it could signal a reversal or a change in market sentiment, prompting traders to reconsider their positions.

Moreover, trend lines can be used in conjunction with other technical analysis tools for even greater effectiveness. For example, when a trend line aligns with a key support or resistance level, it can create a powerful trading signal. This intersection of multiple indicators strengthens the validity of the trade, making it more likely to succeed. Here’s a quick table summarizing the different types of trend lines:

| Trend Line Type | Description |

|---|---|

| Uptrend | Connects higher lows, indicating bullish market sentiment. |

| Downtrend | Connects lower highs, indicating bearish market sentiment. |

| Horizontal | Indicates a period of consolidation, where price moves sideways. |

In conclusion, mastering the art of drawing and interpreting trend lines can significantly enhance your trading strategy. They not only provide visual cues but also help in making informed decisions based on market behavior. So, the next time you're analyzing a chart, take a moment to draw those lines and see how they can guide your trading journey.

- What is a trend line? A trend line is a straight line that connects significant price points on a chart, indicating the direction of the market.

- How do I draw a trend line? Connect at least two significant price points, using lows for an uptrend and highs for a downtrend.

- How can trend lines improve my trading? They provide visual cues for potential entry and exit points, helping you make informed trading decisions.

- What should I do if the price breaks a trend line? A break can signal a potential reversal or change in market sentiment, prompting you to reassess your position.

Technical Indicators

Technical indicators are essential tools in the trader's toolkit, providing valuable insights into market trends and potential price movements. They are like the compass for a sailor, helping you navigate through the turbulent waters of the financial markets. By analyzing historical price data, these indicators can help traders make informed decisions and optimize their trade execution. Some of the most widely used indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands, each serving a unique purpose in the trading strategy.

Moving averages, for instance, smooth out price data to identify trends over a specific period. They can be categorized into two main types: simple moving averages (SMA) and exponential moving averages (EMA). The SMA calculates the average price over a set number of periods, while the EMA gives more weight to recent prices, making it more responsive to new information. Traders often use these moving averages to determine potential support and resistance levels, as well as to identify the overall direction of the market.

The Relative Strength Index (RSI), on the other hand, measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. When the RSI is above 70, it indicates that the asset may be overbought, while an RSI below 30 suggests it may be oversold. This can signal potential reversal points, allowing traders to capitalize on price corrections.

Bollinger Bands add another layer of analysis by providing a visual representation of price volatility. They consist of a middle band (the SMA) and two outer bands that are standard deviations away from the SMA. When the price moves closer to the upper band, it indicates that the market may be overbought, while a price near the lower band suggests oversold conditions. This dynamic can help traders identify potential entry and exit points, enhancing their overall trade execution.

It's important to note that while technical indicators are powerful tools, they should not be used in isolation. Combining different indicators can provide a more comprehensive view of market conditions. For instance, a trader might use the RSI to identify overbought conditions and then confirm this with a moving average crossover. This layered approach can significantly increase the probability of successful trades.

To further illustrate the effectiveness of technical indicators, consider the following table that summarizes some popular indicators along with their primary functions:

| Indicator | Type | Primary Use |

|---|---|---|

| Moving Averages | Trend Indicator | Identifying trends and potential support/resistance levels |

| Relative Strength Index (RSI) | Momentum Indicator | Identifying overbought or oversold conditions |

| Bollinger Bands | Volatility Indicator | Assessing price volatility and potential reversal points |

In conclusion, technical indicators are invaluable for traders aiming to enhance their trade execution. By understanding and applying these tools effectively, traders can gain a competitive edge in the market. The key lies in not only knowing how to use these indicators but also in integrating them into a broader trading strategy that includes risk management and market sentiment analysis.

- What are technical indicators? Technical indicators are mathematical calculations based on historical price and volume data that help traders analyze market trends and make informed trading decisions.

- How do I choose the right technical indicators? The choice of indicators depends on your trading strategy, market conditions, and personal preferences. It's often beneficial to use a combination of indicators for a more comprehensive analysis.

- Can technical indicators guarantee successful trades? No, while technical indicators can enhance your trading decisions, they do not guarantee success. It's essential to use them in conjunction with other analysis methods and risk management strategies.

Combining Technical Analysis with Fundamental Analysis

When it comes to trading, relying solely on one type of analysis can be like trying to navigate a ship without a compass. While technical analysis provides a detailed view of price movements and market trends, fundamental analysis offers a broader perspective by examining the underlying factors that drive those price movements. By merging these two approaches, traders can create a more robust trading strategy that helps them make informed decisions.

So, why should you consider combining these analyses? Think of it as having a two-eyed perspective—one eye focuses on the immediate market trends and patterns, while the other looks at the bigger picture, including economic indicators, company performance, and geopolitical events. This dual approach can significantly enhance your trading effectiveness. For instance, if technical analysis indicates a bullish trend in a stock, but fundamental analysis reveals that the company is facing a major lawsuit, it might be wise to reconsider your entry point.

To effectively combine these analyses, consider the following strategies:

- Use Technical Analysis for Entry and Exit Points: Identify optimal points to enter or exit trades based on chart patterns, support and resistance levels, and technical indicators.

- Employ Fundamental Analysis for Context: Stay informed about economic news, earnings reports, and other fundamental factors that could influence market sentiment.

- Adjust Your Strategy Based on Market Conditions: In a strong bullish market, technical indicators may provide clearer signals, whereas fundamental analysis may play a more significant role in volatile or uncertain markets.

By integrating these two forms of analysis, you can develop a more comprehensive view of the market. For example, suppose you’re interested in a tech stock that has shown a consistent upward trend on the charts. However, after reviewing fundamental data, you discover that the company has been overvalued based on its earnings potential. This insight could lead you to either wait for a better entry point or reconsider the trade altogether, thereby avoiding potential losses.

Moreover, understanding market sentiment can further enhance your combined analysis. Sentiment often drives price movements in the short term, and being aware of the general market mood can help you make better trading decisions. For instance, if technical indicators suggest a price drop but fundamental news indicates strong earnings, the market sentiment might still be bullish, leading to a potential price recovery. This is where a hybrid approach shines, allowing you to capitalize on both short-term trends and long-term fundamentals.

In conclusion, the fusion of technical and fundamental analysis not only provides a more nuanced understanding of the market but also equips you with the tools to navigate its complexities. By leveraging the strengths of both approaches, you can enhance your trade execution, minimize risks, and ultimately achieve better trading outcomes.

Q1: Can I rely solely on technical analysis for trading?

A1: While technical analysis can provide valuable insights, combining it with fundamental analysis often leads to more informed decisions and better outcomes.

Q2: How do I know when to use technical versus fundamental analysis?

A2: Use technical analysis for timing your trades and identifying entry/exit points, while fundamental analysis can help assess the overall market conditions and long-term trends.

Q3: What are some key indicators to look for in fundamental analysis?

A3: Key indicators include earnings reports, economic data releases, interest rates, and other macroeconomic factors that can influence market performance.

Market Sentiment

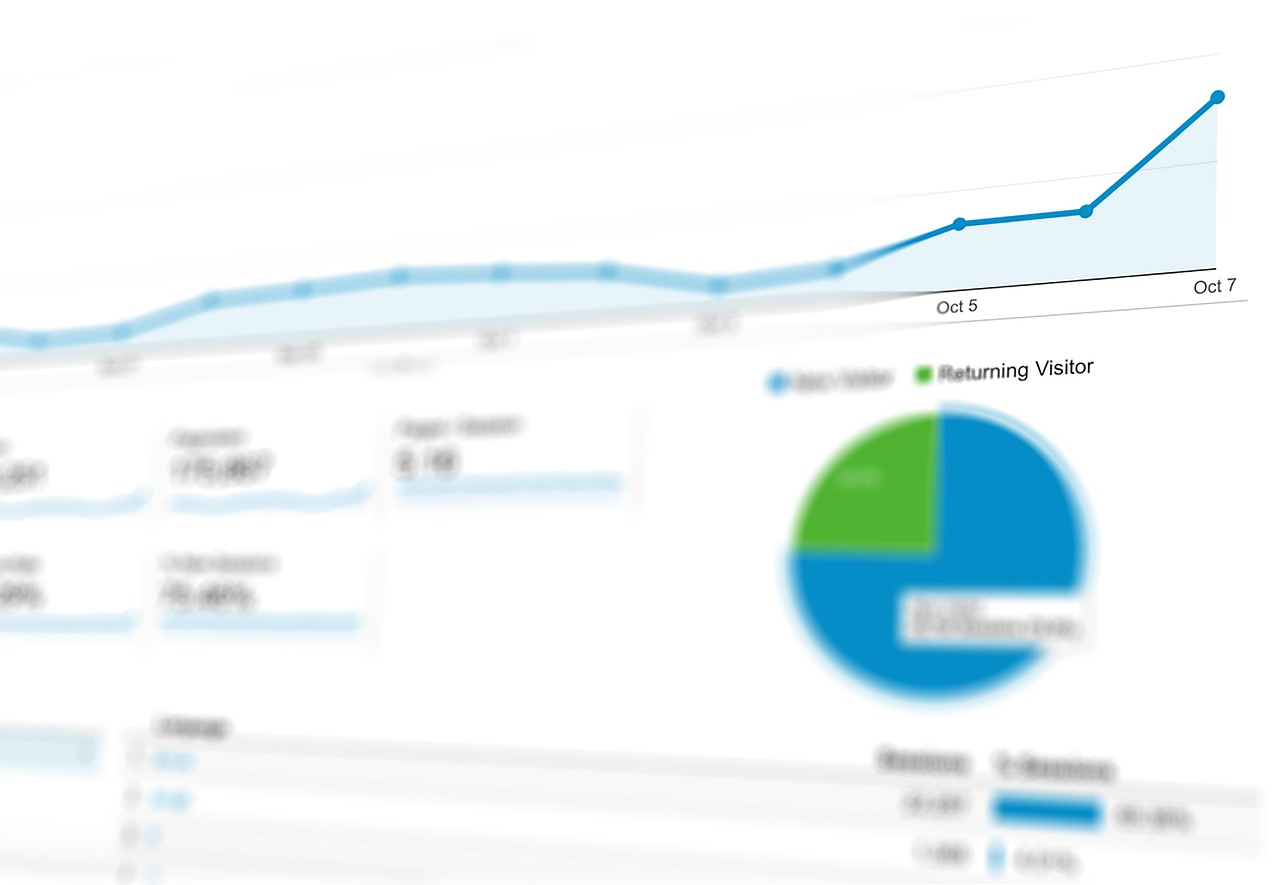

Market sentiment is like the heartbeat of the trading world; it reflects the collective emotions and attitudes of investors toward a particular asset or market. Understanding this sentiment can be a game-changer for traders looking to improve their execution. But what exactly is market sentiment? Simply put, it’s the overall feeling or tone that traders and investors have about a market or a specific security. This feeling can swing from extreme optimism, often referred to as a "bullish" sentiment, to extreme pessimism, known as "bearish" sentiment. Just like a weather forecast, market sentiment can change rapidly, and being able to read these changes can help you make more informed trading decisions.

So, how do you gauge market sentiment? There are several indicators and tools that traders can use to measure this elusive concept. One popular method is through sentiment indicators, which can provide insights into whether the market is leaning towards optimism or pessimism. For example, the Fear and Greed Index is a well-known tool that quantifies market sentiment by analyzing various factors, including volatility, market momentum, and social media trends. By keeping an eye on this index, traders can better understand whether they should be buying or selling.

Another way to assess market sentiment is through social media analysis. Platforms like Twitter and Reddit can give traders a pulse on what the crowd is thinking. If you notice a surge in positive discussions about a particular stock, it might indicate a bullish sentiment. Conversely, if negativity reigns, it could be a sign to tread carefully. This is akin to listening to a crowd at a concert; if they’re cheering and singing along, it’s a good vibe. But if they’re booing, it’s time to reconsider your position.

Moreover, sentiment can also be derived from trading volume and price movements. For instance, if a stock's price is rising along with high trading volume, it suggests strong bullish sentiment. On the flip side, if prices are falling with increasing volume, it may indicate a bearish outlook. This relationship between price and volume is crucial; it’s like a dance where one often leads the other. By analyzing these patterns, traders can better position themselves in the market.

Incorporating market sentiment into your trading strategy can significantly enhance your decision-making process. When combined with technical analysis, you have a more robust framework for executing trades. For example, if technical indicators suggest a buy signal but market sentiment is overwhelmingly negative, it might be wise to hold off until the sentiment shifts. On the other hand, if sentiment is bullish and technical analysis supports it, the time may be right to jump in.

To summarize, market sentiment is a vital component of trading that should not be overlooked. By staying attuned to the emotional currents of the market, you can better navigate the complexities of trading. Remember, trading is not just about numbers; it’s about understanding the psychology behind those numbers. So, keep your finger on the pulse of market sentiment, and you might just find yourself executing trades with greater confidence and success!

- What is market sentiment? Market sentiment refers to the overall attitude of investors towards a particular security or financial market, often driven by emotions and psychological factors.

- How can I measure market sentiment? You can measure market sentiment using various tools such as sentiment indicators, social media analysis, and observing trading volume and price movements.

- Why is market sentiment important in trading? Understanding market sentiment can help traders make more informed decisions, allowing them to better time their entries and exits in the market.

Risk Management Strategies

When it comes to trading, the phrase "don't put all your eggs in one basket" couldn't be more relevant. Effective are essential for protecting your capital and ensuring long-term success in the market. Without a solid plan in place, even the most skilled traders can find themselves on the losing end of a trade. So, how do we navigate the often-turbulent waters of trading while minimizing our risks? Let's dive in!

First and foremost, one of the most fundamental strategies is to determine your risk tolerance. This involves understanding how much of your capital you are willing to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your total trading account on any given trade. By adhering to this guideline, you can ensure that a series of losses won't wipe out your entire trading capital. For example, if you have a trading account of $10,000, risking just 2% means you would only risk $200 on a single trade.

Next, employing stop-loss orders is a game-changer in managing risk. A stop-loss order is an instruction to sell a security when it reaches a certain price. This tool acts as a safety net, limiting potential losses and helping to preserve your capital. For instance, if you enter a trade at $50 and set a stop-loss at $48, your maximum loss would be capped at $2 per share. This way, you can trade with confidence, knowing that you have a plan in place to mitigate losses.

Additionally, diversifying your portfolio is another key strategy in risk management. Just like investing in different sectors can reduce exposure to any single economic event, spreading your trades across various instruments can help cushion against market volatility. Consider diversifying not only by asset class but also by geographical regions and sectors. This approach can help balance out the risks associated with individual trades.

Lastly, let’s not forget the importance of position sizing. This involves determining how many shares or contracts to buy based on your risk tolerance and the distance to your stop-loss. For example, if you are willing to risk $200 on a trade and your stop-loss is set to limit loss to $2 per share, you would buy 100 shares. This way, you’re not only controlling your risk but also aligning your position size with your overall trading strategy.

Incorporating these strategies into your trading plan can significantly enhance your ability to manage risk effectively. Remember, trading is not just about making profits; it's also about protecting your capital. By understanding your risk tolerance, using stop-loss orders, diversifying your portfolio, and carefully sizing your positions, you can create a robust framework that supports your trading goals.

- What is risk management in trading? Risk management in trading refers to the strategies and techniques used to minimize potential losses while maximizing returns. It involves assessing risk tolerance, setting stop-loss orders, diversifying investments, and determining appropriate position sizes.

- Why is risk management important? Effective risk management is crucial because it helps traders protect their capital, avoid significant losses, and maintain a sustainable trading approach. Without proper risk management, even profitable strategies can lead to financial ruin.

- How can I determine my risk tolerance? To determine your risk tolerance, consider factors such as your financial situation, trading experience, and emotional resilience. Assess how much you can afford to lose without impacting your lifestyle or long-term financial goals.

- What is a stop-loss order? A stop-loss order is a predetermined price at which an investor will sell a security to prevent further losses. It acts as a safety mechanism to limit potential losses on a trade.

Frequently Asked Questions

- What is technical analysis?

Technical analysis is a method used by traders to evaluate market data, primarily focusing on price and volume, to forecast future price movements. It helps traders make informed decisions based on historical price patterns and market trends.

- How can I improve my trade execution using technical analysis?

Improving trade execution involves utilizing various tools of technical analysis such as charts, indicators, and recognizing patterns. By understanding these elements, traders can identify optimal entry and exit points, enhancing their overall trading performance.

- What are some key tools used in technical analysis?

Key tools include chart patterns (like head and shoulders or triangles), support and resistance levels, trend lines, and technical indicators such as moving averages and RSI. Each of these tools serves a unique purpose in helping traders analyze market conditions.

- How do I identify support and resistance levels?

Support and resistance levels can be identified by analyzing historical price data. Support is typically found at price levels where buying interest is strong enough to overcome selling pressure, while resistance is where selling interest is strong enough to overcome buying pressure.

- What are trend lines and how do I use them?

Trend lines are straight lines that connect price points on a chart, helping traders visualize the direction of the market. To use them, draw a line connecting at least two significant price points, which can indicate potential entry and exit points based on the trend.

- Can I combine technical analysis with fundamental analysis?

Absolutely! Combining technical and fundamental analysis can enhance your trading effectiveness. While technical analysis focuses on price movements, fundamental analysis looks at economic indicators. Together, they provide a more comprehensive view of market conditions.

- What is market sentiment and why is it important?

Market sentiment refers to the overall attitude of traders towards a particular market or asset. Understanding sentiment can help you gauge potential price movements and make more informed trading decisions, especially when combined with technical analysis.

- How does technical analysis help with risk management?

Technical analysis can inform risk management strategies by helping traders identify potential price reversals and volatility. By understanding market trends and patterns, traders can set appropriate stop-loss orders and position sizes to protect their capital.