The Importance of Understanding Trading Psychology

In the world of trading, it’s not just about numbers, charts, or market trends; it’s about the human element. Trading psychology plays a crucial role in determining whether you thrive or merely survive in the financial markets. Have you ever wondered why some traders seem to consistently outperform others, even with similar strategies? The answer often lies in their mental approach and emotional resilience. Understanding trading psychology can be the difference between making impulsive decisions that lead to losses and developing a disciplined strategy that enhances your chances of success.

At its core, trading psychology encompasses the emotional and mental factors that influence trading decisions. It’s about recognizing how feelings like fear, greed, and anxiety can cloud your judgment and lead to poor choices. For instance, when faced with a potential loss, a trader might panic and sell off assets prematurely, missing out on a potential rebound. Conversely, the thrill of a winning streak might lead to overconfidence, resulting in reckless trading behavior. Thus, mastering your emotions is not just beneficial; it’s essential.

Moreover, trading psychology isn’t just about avoiding negative emotions; it’s also about cultivating a positive mindset. A trader who approaches the market with confidence and clarity can make informed decisions rather than being swayed by fleeting emotions. This is where the concept of mental discipline comes into play. By developing habits that promote focus and resilience, you can navigate the inevitable ups and downs of trading with a level head. After all, the market is unpredictable, and the ability to remain calm under pressure can set successful traders apart from the rest.

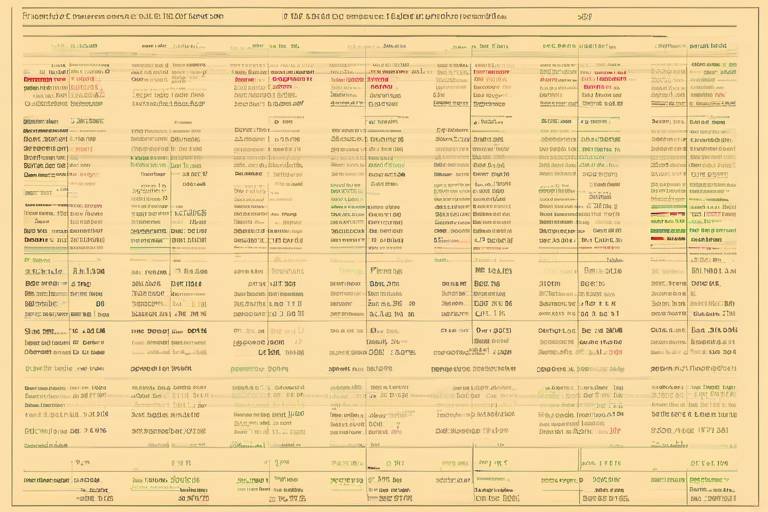

To illustrate the impact of trading psychology further, let’s consider a simple table that outlines some common emotional responses and their potential effects on trading behavior:

| Emotion | Potential Effect on Trading |

|---|---|

| Fear | May lead to hasty sell-offs and missed opportunities. |

| Greed | Can result in over-leveraging and taking excessive risks. |

| Anxiety | May cause indecision or second-guessing of strategies. |

| Overconfidence | Can lead to ignoring market signals and making impulsive trades. |

In conclusion, understanding trading psychology is not just an academic exercise; it’s a practical necessity for anyone looking to succeed in the financial markets. By recognizing the emotional factors that influence your trading decisions, you can develop a more strategic mindset, improve your decision-making skills, and ultimately enhance your trading performance. So, the next time you sit down to trade, take a moment to assess your mental state. Are you feeling confident, or are you letting fear dictate your actions? The answers to these questions could be the key to unlocking your trading potential.

- What is trading psychology?

Trading psychology refers to the emotional and mental factors that influence trading decisions and behaviors.

- Why is trading psychology important?

It helps traders understand how emotions like fear and greed can affect decision-making, leading to either success or failure in trading.

- How can I improve my trading psychology?

By developing mental discipline, creating a consistent trading routine, and employing mindfulness techniques to manage stress.

- What are common psychological traps in trading?

Common traps include overconfidence, fear of missing out (FOMO), and loss aversion, which can lead to poor trading decisions.

The Role of Emotions in Trading

When it comes to trading, emotions play a pivotal role in shaping our decisions. Imagine standing on the edge of a cliff, feeling the rush of wind and the thrill of the view. That’s akin to the emotional rollercoaster traders experience daily. Emotions like fear, greed, and anxiety can significantly influence trading performance, often leading to irrational decisions that can derail even the most meticulously crafted strategies. Understanding these emotions and their impact is essential for any trader looking to achieve long-term success.

Fear is perhaps the most powerful emotion in trading. It can manifest in various forms, from the fear of losing money to the fear of missing out on a lucrative opportunity. This fear can cause traders to hesitate, second-guess their strategies, or even abandon their trading plans altogether. On the other hand, greed can lead to overtrading or holding onto losing positions in the hope that they will turn around. Both fear and greed can cloud judgment, making it crucial for traders to recognize these feelings and develop strategies to manage them effectively.

Additionally, anxiety can creep in, especially during periods of market volatility. This anxiety can lead to impulsive decisions, such as entering or exiting trades prematurely. It's essential to acknowledge these emotions and understand how they can distort our perception of reality. For instance, when the market is in a downturn, fear may prompt a trader to sell off assets at a loss, while greed might encourage them to hold onto a losing position, hoping for a rebound. This tug-of-war between emotions can lead to poor decision-making, ultimately affecting the trader's bottom line.

To illustrate how emotions can impact trading, consider the following table:

| Emotion | Impact on Trading | Potential Outcome |

|---|---|---|

| Fear | Leads to hesitation and missed opportunities | Potential loss of profit |

| Greed | Encourages overtrading and holding onto losses | Increased risk of significant losses |

| Anxiety | Causes impulsive decisions | Erratic trading patterns and losses |

By recognizing these emotional influences, traders can take proactive steps to mitigate their effects. One effective strategy is to implement a solid trading plan that includes specific entry and exit points, as well as risk management techniques. This structured approach can help reduce the emotional burden of trading, allowing traders to focus on their strategies rather than their feelings.

Moreover, maintaining a trading journal can be incredibly beneficial. By documenting trades and the emotions experienced during each trade, traders can gain insights into their emotional triggers and patterns. This self-awareness is the first step toward developing a more disciplined trading approach. Just like a sports player reviews their performance to improve, traders can learn from their emotional experiences to enhance their decision-making processes.

In conclusion, understanding the role of emotions in trading is crucial for success. By acknowledging the impact of fear, greed, and anxiety, traders can develop strategies to manage these feelings effectively. Remember, trading is not just about numbers; it’s also about understanding yourself and your emotions. With the right mindset and tools, you can navigate the emotional landscape of trading and pave the way for a more successful trading journey.

- How can I manage my emotions while trading? Establish a trading plan, maintain a trading journal, and practice mindfulness techniques to help regulate your emotions.

- What are some common emotional pitfalls in trading? Common pitfalls include fear of missing out (FOMO), loss aversion, and overconfidence, all of which can lead to poor decision-making.

- Can mindfulness techniques really help with trading? Yes, mindfulness techniques can enhance emotional awareness and improve focus, leading to better trading performance.

Trading is not just about numbers and charts; it's also a mental game. Many traders find themselves caught in common psychological traps that can lead to poor decision-making and ultimately, financial losses. The market can be a tricky place, and understanding these traps is crucial for anyone looking to improve their trading performance. Identifying these pitfalls can help you navigate the emotional rollercoaster that trading often brings.

One of the most prevalent traps is overconfidence. When traders experience a streak of wins, they may start to believe they have the market figured out. This overestimation of one’s abilities can lead to taking excessive risks, ignoring established trading plans, and ultimately, suffering significant losses. It's like a poker player who wins a few hands and then starts betting everything without considering the odds. This trap can be particularly dangerous because it can create a false sense of security, making it difficult to recognize when to pull back.

Another psychological trap is loss aversion, where the fear of losing money can outweigh the potential for making gains. This bias often leads traders to hold onto losing positions for too long, hoping that the market will turn in their favor. Instead of cutting losses early, they cling to the hope that things will improve, which often results in even greater losses. Imagine a runner who refuses to stop despite an injury, thinking they’ll catch up to the pack; in trading, this can lead to disastrous results.

Additionally, the Fear of Missing Out (FOMO) is a significant emotional challenge that many traders face. When traders see others making profits, they may jump into trades without proper analysis, driven by the anxiety of missing out on potential gains. This impulsive behavior can lead to entering trades at the wrong time, often resulting in losses. The key here is to recognize that the market will always present new opportunities; being patient and sticking to your strategy is essential.

To further illustrate these psychological traps, consider the following table that summarizes some common traps and their potential consequences:

| Psychological Trap | Description | Potential Consequences |

|---|---|---|

| Overconfidence | Believing you know the market inside and out after a few wins. | Increased risk-taking and eventual significant losses. |

| Loss Aversion | Fearing losses more than valuing potential gains. | Holding onto losing trades too long, leading to larger losses. |

| FOMO | Feeling anxious about missing profitable trades. | Entering trades impulsively without proper analysis. |

Understanding these common psychological traps is the first step in overcoming them. By being aware of how emotions can cloud judgment, traders can develop a more disciplined approach. This involves creating a solid trading plan and sticking to it, regardless of market conditions or emotional impulses. Remember, trading is a marathon, not a sprint. It requires patience, strategy, and a clear mind.

The Fear of Missing Out, commonly referred to as FOMO, is a powerful emotional driver that can wreak havoc on a trader's decision-making process. Imagine standing at the edge of a bustling party, where everyone seems to be having the time of their lives, and you feel that nagging urge to join in, even if it means abandoning your carefully laid plans. This analogy perfectly captures the essence of FOMO in trading. When traders see others profiting from a surge in market activity, the instinctual urge to jump in can lead to impulsive decisions that often result in losses.

FOMO can manifest in various ways, such as entering trades without conducting thorough analysis or chasing after stocks that have already skyrocketed in price. This behavior is akin to a moth drawn to a flame; the initial excitement can quickly turn into regret as the reality of the situation sets in. Traders who succumb to FOMO often overlook their trading strategies, risking their hard-earned capital for the sake of momentary excitement. Recognizing this emotional response is the first step in mitigating its effects.

To better understand how FOMO impacts trading decisions, consider the following common scenarios:

- Seeing a stock surge in price and feeling compelled to buy in, even if it contradicts your analysis.

- Feeling anxious when you hear about a profitable trade that you missed, leading to rash decisions in future trades.

- Constantly checking market news and social media for updates, which can create a sense of urgency to act.

These scenarios illustrate how FOMO can cloud judgment and lead to poor trading outcomes. Traders may find themselves in a cycle of emotional trading, where fear and excitement dictate their actions rather than a well-thought-out strategy. This emotional rollercoaster can be exhausting and can undermine a trader's confidence over time.

So, how can traders combat FOMO and regain control over their trading decisions? The key lies in developing a robust trading plan that includes clear entry and exit strategies, as well as risk management principles. By setting specific goals and sticking to them, traders can create a framework that minimizes the influence of emotional impulses. Additionally, it’s essential to cultivate self-awareness and recognize when FOMO begins to creep in. Taking a step back to reassess the situation can help traders avoid hasty decisions that could lead to significant losses.

In conclusion, FOMO is a formidable foe in the world of trading. Acknowledging its presence and implementing strategies to manage it can pave the way for a more disciplined and successful trading experience. Remember, the market will always be there, and the key to long-term success lies in making informed decisions rather than succumbing to fleeting emotions.

This article explores the crucial role of trading psychology in financial success, highlighting how emotional and mental factors influence trading decisions and strategies.

Emotions can significantly impact trading performance. Understanding how fear, greed, and anxiety affect decision-making is essential for developing a disciplined trading approach.

Traders often fall into psychological traps that can lead to poor decisions. Identifying these traps, such as overconfidence and loss aversion, is vital for improving trading outcomes.

FOMO can drive traders to make impulsive decisions, leading to potential losses. Recognizing this feeling and implementing strategies to manage it is crucial for long-term success.

The consequences of FOMO can be quite severe and often lead traders down a slippery slope of emotional decision-making. When traders succumb to the fear of missing out, they may:

- Enter trades without conducting thorough analysis, relying instead on market hype.

- Overtrade, resulting in excessive transaction costs and lower overall profitability.

- Neglect their trading plans, straying from well-thought-out strategies.

This impulsivity can lead to a cycle of regret and further emotional trading, where one bad decision leads to another. For instance, imagine a trader who sees a stock skyrocketing and jumps in without proper research. If the stock then plummets, not only does the trader face a financial loss, but they also experience emotional turmoil, which can cloud their judgment in future trades.

Understanding these risks is key to developing a more strategic mindset. By recognizing that FOMO can lead to irrational behavior, traders can take steps to mitigate its effects. This may involve setting clear criteria for entering trades, maintaining a disciplined approach, and reminding themselves that opportunities will always arise in the market.

Mental discipline is key to successful trading. Developing habits that promote focus and resilience can enhance a trader's ability to navigate market fluctuations effectively.

A consistent trading routine can help cultivate mental discipline. Establishing daily practices for analysis and reflection can improve decision-making and emotional regulation.

Incorporating mindfulness techniques can help traders manage stress and maintain focus. Practices such as meditation can enhance emotional awareness and improve overall trading performance.

- What is trading psychology? Trading psychology refers to the emotional and mental factors that influence a trader's decisions and behavior in the financial markets.

- How can I improve my trading psychology? You can improve your trading psychology by developing mental discipline, establishing a trading routine, and utilizing mindfulness techniques.

- What are common psychological traps in trading? Common psychological traps include overconfidence, loss aversion, and fear of missing out (FOMO).

- How does FOMO impact trading decisions? FOMO can lead to impulsive trading decisions, resulting in losses and emotional turmoil, which can further impair judgment.

Fear of Missing Out, or FOMO, can be a trader's worst enemy. It can lead to hasty decisions that often result in significant financial losses. So, how do we combat this insidious feeling? The first step is to establish a clear trading plan. This plan should outline your trading goals, entry and exit strategies, and risk management protocols. By having a structured approach, you create a roadmap that helps you stay focused, reducing the chances of being swayed by the latest market hype.

Another effective strategy is to set specific goals for your trading activities. For instance, rather than aiming to make a quick profit on every trade, consider setting a target that focuses on your overall performance over a longer period. This can help shift your mindset from short-term gains to long-term success. Additionally, adhering to risk management principles is crucial. Always know how much capital you're willing to risk on any given trade and stick to that limit. This way, even if you miss out on a potential opportunity, your financial health remains intact.

Moreover, it’s essential to regularly review your trades. This practice not only helps you learn from your mistakes but also reinforces your trading strategy. By analyzing past decisions, you can identify patterns in your behavior and adjust accordingly. You might find that many of your impulsive trades were driven by FOMO. Acknowledging this can empower you to make more informed choices in the future.

Incorporating mindfulness techniques can also be a game-changer. Techniques such as meditation or deep-breathing exercises can help you manage the anxiety that often accompanies FOMO. When you feel that urge to jump into a trade, take a moment to pause and breathe. This simple act can provide clarity, allowing you to assess whether the trade aligns with your established plan.

Lastly, consider joining a trading community or finding a mentor. Having a support system can provide you with valuable insights and different perspectives on trading. Engaging with others can help you feel less isolated in your trading journey and can serve as a reminder that missing out on a trade isn't the end of the world. Remember, there will always be new opportunities, and the market is continuously evolving.

By implementing these strategies, you can effectively manage FOMO and enhance your trading performance. It’s all about creating a disciplined approach that prioritizes your long-term goals over short-term temptations. Stay focused, stay informed, and most importantly, stay patient.

- What is FOMO in trading?

FOMO, or Fear of Missing Out, is the anxiety that traders feel when they believe they might miss out on a profitable opportunity, leading them to make impulsive trading decisions. - How can I create a trading plan?

A trading plan should include your trading goals, strategies for entering and exiting trades, and risk management rules. Be specific and realistic about what you want to achieve. - Why is risk management important?

Risk management helps protect your capital by ensuring that you do not risk more than you can afford to lose on any single trade. - What mindfulness techniques can I use?

Practices such as meditation, deep breathing, and visualization can help manage stress and keep you focused during trading.

Loss aversion is a psychological phenomenon that can have a profound impact on traders' decision-making processes. At its core, it refers to the tendency for individuals to prefer avoiding losses rather than acquiring equivalent gains. In simpler terms, the pain of losing $100 feels significantly more intense than the pleasure of gaining $100. This inherent bias can lead traders to make irrational decisions, often causing them to hold onto losing trades for too long in the hope of breaking even, rather than cutting their losses and moving on.

Understanding loss aversion is crucial for developing a successful trading strategy. It can create a vicious cycle where the fear of loss leads to inaction or poor decision-making. When faced with potential losses, traders might become overly cautious, missing out on profitable opportunities. Conversely, they might chase after losses, hoping to recover what they’ve lost, which can result in even more significant financial damage. This behavior can be likened to a hamster running on a wheel, expending energy but going nowhere.

To illustrate the impact of loss aversion, consider the following table that compares the psychological effects of gains and losses:

| Outcome | Emotional Response |

|---|---|

| Gain of $100 | Moderate Happiness |

| Loss of $100 | Intense Disappointment |

As shown in the table, the emotional response to a loss is far more intense than that of a gain, highlighting why traders often find themselves paralyzed by fear. To combat loss aversion, it’s essential for traders to develop a more rational approach to decision-making. One effective strategy is to set predefined stop-loss levels before entering a trade. This way, traders can limit their losses without the emotional turmoil that often accompanies the decision to exit a losing position.

Additionally, traders can benefit from maintaining a trading journal. By documenting their trades, including the reasons behind their decisions, they can gain valuable insights into their emotional responses and patterns of behavior. This practice not only fosters self-awareness but also encourages a disciplined approach to trading, minimizing the influence of loss aversion on their strategies.

Ultimately, recognizing and addressing loss aversion is a critical step toward becoming a successful trader. By understanding this psychological barrier, traders can take proactive measures to mitigate its effects, enabling them to make more informed, rational decisions that align with their trading goals.

- What is loss aversion? - Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains, which can lead to irrational trading decisions.

- How can I overcome loss aversion in trading? - Setting stop-loss orders and maintaining a trading journal can help mitigate the effects of loss aversion.

- Why is understanding trading psychology important? - It helps traders recognize emotional influences on their decisions, leading to more disciplined and rational trading strategies.

This article explores the crucial role of trading psychology in financial success, highlighting how emotional and mental factors influence trading decisions and strategies.

Emotions can significantly impact trading performance. Understanding how fear, greed, and anxiety affect decision-making is essential for developing a disciplined trading approach.

Traders often fall into psychological traps that can lead to poor decisions. Identifying these traps, such as overconfidence and loss aversion, is vital for improving trading outcomes.

FOMO can drive traders to make impulsive decisions, leading to potential losses. Recognizing this feeling and implementing strategies to manage it is crucial for long-term success.

The consequences of FOMO include entering trades without proper analysis and risking capital unnecessarily. Understanding these risks helps traders develop a more strategic mindset.

Traders can overcome FOMO by establishing clear trading plans and sticking to them. Setting specific goals and adhering to risk management principles is essential.

Loss aversion is a common psychological phenomenon where the fear of losing outweighs the potential for gains. Understanding this bias can help traders make more rational decisions.

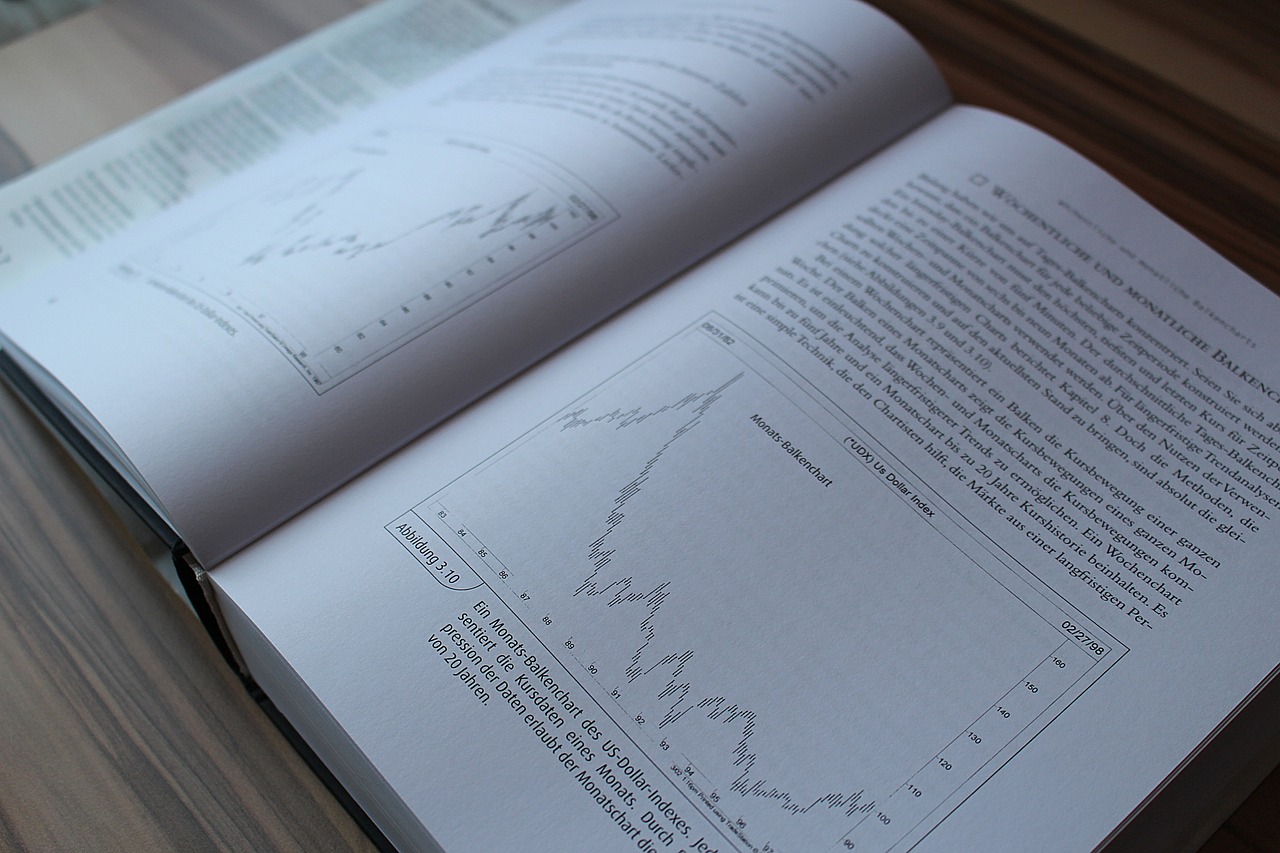

Mental discipline is key to successful trading. Just like an athlete trains their body for peak performance, traders must cultivate a strong mental framework to navigate the unpredictable nature of the financial markets. The ability to maintain focus and resilience amidst market fluctuations can be the difference between a successful trade and a costly mistake. Think of mental discipline as the sturdy foundation of a house; without it, everything else is at risk of collapsing.

Developing habits that promote mental discipline isn't just about willpower; it involves creating a structured approach to trading. A consistent trading routine can help cultivate this discipline. For instance, establishing daily practices for analysis and reflection allows traders to assess their performance critically and learn from their experiences. This routine acts as a safety net, helping traders avoid impulsive decisions driven by emotions.

Incorporating mindfulness techniques can further enhance mental discipline. Mindfulness practices, such as meditation, can help traders manage stress and maintain focus. By fostering emotional awareness, traders can recognize when their feelings might be clouding their judgment. Imagine being in a stormy sea; mindfulness is your lighthouse guiding you safely to shore, helping you avoid the rocky cliffs of rash decisions.

Here are some effective strategies to enhance mental discipline:

- Set Clear Goals: Define what you want to achieve in your trading journey. This gives you a target to work towards.

- Maintain a Trading Journal: Documenting your trades and emotions can provide valuable insights into your decision-making process.

- Practice Regular Reflection: Take time to review your trades, assess what worked, and identify areas for improvement.

- Limit Distractions: Create an environment conducive to focus, free from unnecessary interruptions.

By integrating these strategies into your trading routine, you can significantly enhance your mental discipline, leading to improved trading performance. Remember, trading is not just about numbers; it's about managing your mind and emotions effectively.

1. What is trading psychology?

Trading psychology refers to the emotional and mental aspects that influence trading decisions. It encompasses how emotions like fear and greed can affect a trader's actions.

2. Why is mental discipline important in trading?

Mental discipline helps traders remain focused and make rational decisions, especially during volatile market conditions. It acts as a safeguard against impulsive actions driven by emotions.

3. How can I improve my trading psychology?

Improving trading psychology involves recognizing and managing your emotions, establishing a consistent trading routine, and practicing mindfulness techniques to enhance emotional awareness.

4. What are some common psychological traps in trading?

Common psychological traps include overconfidence, loss aversion, and the fear of missing out (FOMO). Being aware of these traps can help traders make better decisions.

5. Can mindfulness techniques really help with trading?

Yes! Mindfulness techniques can help traders manage stress and maintain focus, which is essential for making sound trading decisions.

This article explores the crucial role of trading psychology in financial success, highlighting how emotional and mental factors influence trading decisions and strategies.

Emotions can significantly impact trading performance. Understanding how fear, greed, and anxiety affect decision-making is essential for developing a disciplined trading approach.

Traders often fall into psychological traps that can lead to poor decisions. Identifying these traps, such as overconfidence and loss aversion, is vital for improving trading outcomes.

FOMO can drive traders to make impulsive decisions, leading to potential losses. Recognizing this feeling and implementing strategies to manage it is crucial for long-term success.

The consequences of FOMO include entering trades without proper analysis and risking capital unnecessarily. Understanding these risks helps traders develop a more strategic mindset.

Traders can overcome FOMO by establishing clear trading plans and sticking to them. Setting specific goals and adhering to risk management principles is essential.

Loss aversion is a common psychological phenomenon where the fear of losing outweighs the potential for gains. Understanding this bias can help traders make more rational decisions.

Mental discipline is key to successful trading. Developing habits that promote focus and resilience can enhance a trader's ability to navigate market fluctuations effectively.

Building a solid trading routine is akin to laying the foundation of a house; without it, everything else might crumble. A consistent routine not only fosters mental discipline but also equips traders with the tools they need to make informed decisions. By setting aside specific times for market analysis, traders can immerse themselves in the data and trends without the distraction of impulsive trading. Think of it this way: just like an athlete practices daily to hone their skills, traders too must engage in regular practice to refine their strategies and emotional regulation.

Moreover, a trading routine can include a variety of components that cater to both analysis and emotional well-being. For instance, traders can incorporate:

- Market Analysis: Dedicate time to review charts, news, and economic indicators.

- Reflection: Assess past trades to identify strengths and weaknesses.

- Goal Setting: Establish daily, weekly, and monthly trading goals.

- Emotional Check-ins: Evaluate emotional state before and after trading sessions.

By integrating these elements into their routine, traders can create a structured environment that encourages consistency and focus. This structure not only mitigates the influence of emotions but also enhances overall performance. A well-defined routine acts as a safety net, catching traders before they fall into the traps of impulsivity and emotional decision-making.

Q1: How long does it take to build a trading routine?

A: Building a trading routine can take anywhere from a few weeks to a few months, depending on individual commitment and adaptability. The key is consistency.

Q2: What should I include in my trading routine?

A: Your routine should include market analysis, reflection on past trades, goal setting, and emotional check-ins to ensure you remain focused and disciplined.

Q3: Can a trading routine help with emotional trading?

A: Yes! A trading routine provides structure and helps mitigate emotional responses, allowing for more rational decision-making.

This article explores the crucial role of trading psychology in financial success, highlighting how emotional and mental factors influence trading decisions and strategies.

Emotions can significantly impact trading performance. Understanding how fear, greed, and anxiety affect decision-making is essential for developing a disciplined trading approach.

Traders often fall into psychological traps that can lead to poor decisions. Identifying these traps, such as overconfidence and loss aversion, is vital for improving trading outcomes.

FOMO can drive traders to make impulsive decisions, leading to potential losses. Recognizing this feeling and implementing strategies to manage it is crucial for long-term success.

The consequences of FOMO include entering trades without proper analysis and risking capital unnecessarily. Understanding these risks helps traders develop a more strategic mindset.

Traders can overcome FOMO by establishing clear trading plans and sticking to them. Setting specific goals and adhering to risk management principles is essential.

Loss aversion is a common psychological phenomenon where the fear of losing outweighs the potential for gains. Understanding this bias can help traders make more rational decisions.

Mental discipline is key to successful trading. Developing habits that promote focus and resilience can enhance a trader's ability to navigate market fluctuations effectively.

A consistent trading routine can help cultivate mental discipline. Establishing daily practices for analysis and reflection can improve decision-making and emotional regulation.

In the fast-paced world of trading, maintaining a calm and focused mind is essential for making sound decisions. Mindfulness techniques provide traders with tools to manage stress and enhance emotional awareness. One effective method is meditation, which allows traders to center their thoughts and reduce anxiety. By dedicating just a few minutes each day to meditation, traders can cultivate a sense of peace that translates into their trading activities.

Another beneficial practice is deep breathing exercises. When faced with market volatility, taking a moment to breathe deeply can help lower heart rates and clear the mind. This simple yet powerful technique can be done anywhere, making it a practical tool for traders on the go. For instance, when feeling overwhelmed, a trader can pause and take a series of deep breaths, inhaling through the nose and exhaling through the mouth, which can help restore focus.

Additionally, journaling can be an effective mindfulness technique. By keeping a trading journal, traders can reflect on their emotions and decisions, identifying patterns that may influence their trading behavior. This practice not only fosters self-awareness but also aids in developing a more disciplined approach to trading. A typical entry might include thoughts on a recent trade, emotional responses, and lessons learned, which can be invaluable for future decisions.

Incorporating these mindfulness techniques into a trader's daily routine can significantly enhance performance. By fostering a greater awareness of emotional states and reactions, traders can navigate the psychological challenges of trading with greater ease. Remember, the goal is not to eliminate emotions completely but to understand and manage them effectively.

- What is trading psychology? Trading psychology refers to the emotional and mental aspects that influence a trader's decision-making process.

- How can I improve my trading psychology? You can improve your trading psychology by practicing mindfulness techniques, maintaining a trading journal, and developing a consistent trading routine.

- Why is mental discipline important in trading? Mental discipline helps traders remain focused and resilient, enabling them to make better decisions, especially during market fluctuations.

Frequently Asked Questions

- What is trading psychology?

Trading psychology refers to the emotional and mental aspects that influence a trader's decisions and strategies in the financial markets. It encompasses how emotions like fear, greed, and anxiety can impact trading performance, often leading to impulsive or irrational decisions.

- How do emotions affect trading?

Emotions play a significant role in trading. When traders experience fear, they may hesitate to make decisions, potentially missing out on profitable opportunities. Conversely, greed can push traders to take excessive risks. Understanding these emotional triggers is essential for developing a disciplined trading approach.

- What are some common psychological traps in trading?

Traders often fall into traps such as overconfidence, where they believe they can predict market movements perfectly, and loss aversion, where the fear of losing money leads to poor decision-making. Recognizing these traps can help traders avoid costly mistakes.

- What is FOMO and how does it impact trading?

FOMO, or the Fear of Missing Out, can drive traders to make hasty decisions without proper analysis. This impulsive behavior often results in entering trades at the wrong time, leading to potential losses. It's crucial for traders to recognize FOMO and implement strategies to manage it effectively.

- What strategies can help overcome FOMO?

To combat FOMO, traders should establish clear trading plans and stick to them. Setting specific goals and adhering to risk management principles can help maintain focus and avoid impulsive decisions driven by emotional responses.

- What is loss aversion in trading?

Loss aversion is a psychological phenomenon where the fear of losing money outweighs the potential for gains. This bias can lead traders to hold onto losing positions for too long or avoid taking necessary risks, ultimately hindering their trading success.

- How can mental discipline improve trading performance?

Mental discipline is key to navigating market fluctuations effectively. By developing habits that promote focus and resilience, traders can enhance their decision-making processes and emotional regulation, leading to improved trading outcomes.

- What role does a trading routine play in mental discipline?

A consistent trading routine helps cultivate mental discipline by establishing daily practices for analysis and reflection. This structure can improve decision-making and emotional control, allowing traders to respond to market changes more effectively.

- Can mindfulness techniques help traders?

Yes! Incorporating mindfulness techniques, such as meditation, can significantly help traders manage stress and maintain focus. These practices enhance emotional awareness and can lead to better overall trading performance.